это идея которая пришла в голову??? если да то присоединяйся к нам)))

ИИ против биткоина) причина? отсутствия финансирования и электроэнергия.))) от кого больше пользы тот и прав)))

НОСТР. живой организм алгоритма. это будет по круче чем GPT-5)))

наше поколение будет наводить бордак в сети а дети наших детей будут наводить порядок ...

это мелочи... скоро будет 99%)))

there is no time for a shiktuner.

there is no time for a shiktuner.

do you keep your bitcoin?

then understand, soon all the shikkoiners will come, and they are 85% of the market))) can you imagine it?

значит вот какая идея пришла случайно в голову... просто мысль просто логика.

это странно но это логично максимально на столько на сколько возможно.

если тут будет больше монет чем обычно и этого хватит для покрытия расходов на электричество то можно со 100% уверенностью скать что кто то запустить супер квантовый майнер на время для того что б намайнить эти блоки и забрать все комиссии себе. это позволенно сделать на 2016 блоков так что это будет сделанно за 1-2 часа или 5-8 минут.

после чего сложность повысится на % сильно что приведет к еще большьей стоимости. транзакций.

но это будет первым доказательством того что создали квантовый вычеслитель который позволяет почти мгновенно проводить блоки и делать записи в блок чейн.

изучаю этот феномен более подробно.

А вот если не будет сердечек оставлю молнию... а так пока что сердечко... я еще не набрал молнии нет заряда) но круто) и верно)

в цлеом это можно получить как информацию о том что это нужно сделать. Просто называетсмя идея пришла в голову...

если это так работает то нужно множество идей создать в нынешнее время на разработку которых уйдет время и энергия. но сам факт того что это реально это работает.

пробуй мой друг. и пиши свой результат.

If you can send information faster than the speed of light, then it is possible to get answers from the future. which means you can send 1 satoshi to a very distant future and get an answer.

How can this be done?

Create an address with a public and private key and send 1 satoshi to it. then save the address for the heirs who will move it in time. once it gets into the right hands you will receive a message that 1 satoshi was received from the great great grandfather.

to explore this method of informative mechanics of information transfer

Если можно отпровлять информацию быстрее скорости света то возможно получать ответы из будущего. а значит можно отправить 1 сатоши в очень далекое будущее и получить ответ.

Как это реализовать?

создает адрес с открытым и закрытым ключем и отпровляем на него 1 сатоши. потом сохраняем этот адрес для наследников которые переместят его во времени. как тольк он попадет в нужные руки Вам придет сообщение что 1 сатоши получен от пра пра пра деда.

изучить этот метод имформативной механики передачи информации

напишу на двух языках... вдруг один пропадет из-за своей простоты...напримет англ

1+2+3+4+5+6+7+8+9,,,

1+2+3+4+5+6+7+8+9,,,

TRole of the 21st century. sent 21,000 satoshi to the enemy with comsa in 1 sat...

what if you do it with a friend??? 🤣🤣🤣

How to correctly leave an inheritance? very simple)))

How to correctly leave an inheritance? very simple)))

Just make a private key and give it to him. put 1000 satoshi 100 satoshi 50 satoshi 20 satoshi 10 satoshi 5 satoshi 2 satoshi 1 satoshi to these addresses... they will figure out by themselves how to implement their inheritance in the future. but the fact that they will not be needed for the next 200 years is certain, there will be no arguments about who is more important, there are no mysteries and secrets...

I think I made the theory clear...

любая сумма будет +1

"Bitcoin is a swarm of cyber hornets serving the goddess of wisdom, feeding on the fire of truth, exponentially growing ever smarter, faster, and stronger behind a wall of encrypted energy."

"You could not misunderstand Bitcoin more completely than to think it's about cheap, fast payments on the internet.

"Bitcoin is about everything else, everywhere else."

"There is no second best."

"Bitcoin fixes this"

It couldn’t be more approriate now… “Bitcoin because fuck banks”

"Bitcoin because technology".

"Bitcoin is the only thing that AI can't do better than you"

“ Bitcoin is amazingly transformative because it’s the first time in the entire history of the world in which anybody can now send or receive any amount of money, with anyone else, anywhere on the planet, without having to ask permission from any bank or government.” Roger Ver

“Tick tock, next block.”

"In a world full of madness, the only sane thing is to guess numbers"

"Once you understand #Bitcoin, you go to bed each night with anxiety, feeling chronically short."

-- Michael Saylor

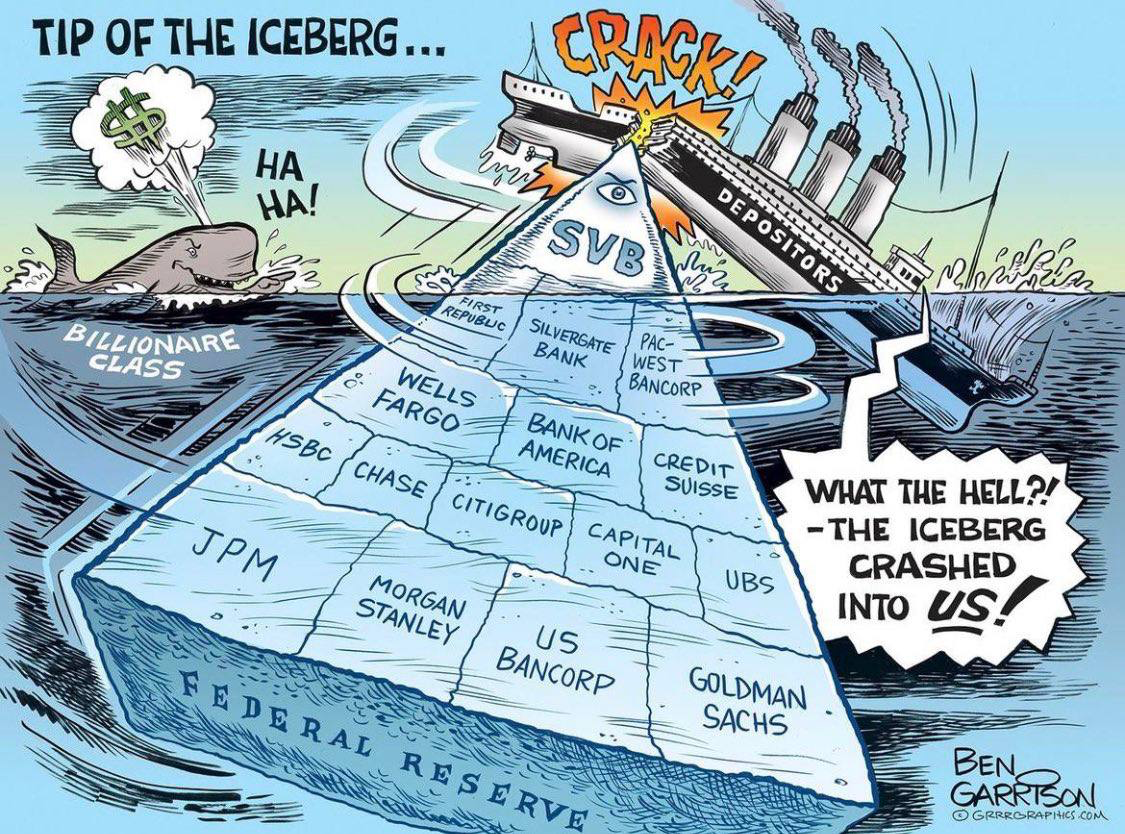

Morgan Stanley, a subsidiary of JPMorgan, the second-largest U.S. commercial multinational corporation and the 34th largest bank in the world, founded in 1935, which owns the largest brokerage business in the world, called bitcoin a speculative asset, not a currency.

Morgan Stanley, a subsidiary of JPMorgan, the second-largest U.S. commercial multinational corporation and the 34th largest bank in the world, founded in 1935, which owns the largest brokerage business in the world, called bitcoin a speculative asset, not a currency.

Analysts at the investment bank noted (https://www.rbc.ru/crypto/news/6411c3c79a7947154c5c24e7) that the first cryptocurrency is not isolated from the traditional financial system, as its price is supported by bank liquidity in U.S. dollars.

The analysts noted that bitcoin was created to store value and make transactions without intermediaries, but in practice the leading cryptocurrency "is not isolated from the traditional banking system. This is because the price of bitcoin is backed by "bank liquidity" in U.S. dollars, making BTC trading akin to trading a speculative asset rather than a currency.

While the bitcoin network can operate without banks, the price of the asset and therefore its purchasing power is still dependent on "central bank" policies and it needs traditional banks to bring liquidity to the cryptocurrency market, Morgan Stanley said.

Bitcoin rose nearly 20 percent on March 14 after U.S. officials said they would support the banking sector, but last week, in the midst of uncertainty, BTC fell along with risky assets and bank stocks, trading as a speculative asset, the report said.

"If bitcoin had traded in line with its core value proposition - 'the ability to be your own bank' - then its exchange rate would have risen amid growing banking uncertainty," Morgan Stanley experts said.

In their opinion, the dynamics of bitcoin pointed to the fact that the rally at the beginning of the week was caused by a small number of market participants, and it probably contributed to the elimination of short positions, but not "fundamental changes in the dynamics of trade," believe the bank.

What can we say to analysts of the bank on such statement? In the last 30 days Morgan Stanley shares fell in price by 16%, while bitcoin also rose by the same 16% during the same 30 days, even taking into account the fall in the last two days. Morgan Stanley manages over $2.3 trillion in private capital. In 30 days the bank lost over $22 billion in capitalization, and of course it is very important for us to hear what its analysts think about how bad bitcoin is and why it is a speculative asset.

In addition, the largest brokerage business in the world that Morgan Stanley owns is simply the biggest casino in the world with a turnover of tens of trillions of dollars per month. Consequently, Morgan Stanley is the biggest speculator on Earth, taking out its clients' margin positions on any move up or down to the tune of several bitcoin capitalizations.

The claim is driven by envy. In fact, Morgan Stanley is just an American banking conglomerate engaged in stock and financial market speculation, and the international rating agency Moody's lowered its outlook on the entire US banking system, including Morgan Stanley itself, from stable to negative.

And these people are teaching us how to live. We will meet when Morgan Stanley is declared bankrupt or when its big casino called the stock market crashes, whichever happens first. And both will happen with a 100% guarantee.

Morgan Stanley CEO James Patrick Gorman, a close friend of Klaus Schwab and a regular participant at the WEF in Davos, already once called Soros' words about a possible crisis ridiculous in 2018. But the crisis is already out the window. We will soon find out who was right, Gorman or Soros.

NOSTR turns into a tweeter???

NOSTR turns into a tweeter???

And only bitcoin has infinity in blocks and finitude in addresses.

And only bitcoin has infinity in blocks and finitude in addresses. Indonesian President Joko Widodo has called on the country's regional administrations to abandon the Visa and Mastercard payment systems, The Jakarta Post reported. He said this was necessary to protect transactions from possible geopolitical repercussions.

Indonesian President Joko Widodo has called on the country's regional administrations to abandon the Visa and Mastercard payment systems, The Jakarta Post reported. He said this was necessary to protect transactions from possible geopolitical repercussions.