Canada struggling right now. Capital finding a new home. The Bitcoin free market continues uninterrupted of course.

Weird to see things play out almost exactly as you expect them.

And Canada has so much potential and so much to offer the world. Rough to watch.

Here's the source: https://financialpost.com/news/foreign-investors-canada-missing-in-action

UPDATE 🚨: Canada is at it again ... the latest M2 Money Supply data from Stats Canada is out and it ain't pretty.

Canada hit another all-time high in M2 at 2.715 Trillion. The debasement of Canadian dollars continues at 8.48% CAGR from 1968 to today.

Party on Canada (or print on!). Check out Bitcoin fellow plebs.

That is a 🔥 nostr:npub1s05p3ha7en49dv8429tkk07nnfa9pcwczkf5x5qrdraqshxdje9sq6eyhe line.

“8 billion people in service of 8 billion people.” Is one that gets me fired up.

Oh yeah. That’s a great one too!!

Something happened to me a little while back and I fully blame @`Jeff Booth` for this (in the best way possible Jeff!! 🙌 ) ... once you fully understand that "the natural state of the free market is deflation" everything clicks ... the fiat chaos in housing, politics, salaries, careers, almost everything.

The madness of a dying system's last throes? It all makes brutal, logical sense - wrong and often horrible, but understandable.

And the beauty that is emerging (slowly but surely) from a new free market is completely mind blowing.

Blessed to witness this historic shift with each of you. Grateful for the perspective. What a time to be alive. Onward!! 🚀

AI, Bitcoin, & The Collapse Of The Fiat Economy with nostr:nprofile1qy2hwumn8ghj7etyv4hzumn0wd68ytnvv9hxgqgdwaehxw309ahx7uewd3hkcqpqs05p3ha7en49dv8429tkk07nnfa9pcwczkf5x5qrdraqshxdje9sgew2ua

We discuss:

- AI's Impact on the Economy

- The Illusion Of Prosperity

- Deflation & Abundance

- The Return of Free Markets

Watch it here: https://youtu.be/VRA8VIsO-rQ

Sharing this one far and wide with friends. Always appreciate these episodes gentlemen. Thank you nostr:nprofile1qqsd0uazmzmhwseeym3rjhf3txyjapreapc6sq8yq8cy07cg45tlx2cpzemhxue69uhk2er9dchxummnw3ezumrpdejz7qgdwaehxw309a38yc3wd9hj7lhaadh nostr:nprofile1qqsg86qcm7lve6jkkr64z4mt8lfe57jsu8vpty6r2qpk37sgtnxevjcpr4mhxue69uhkummnw3ez6ur4vgh8wetvd3hhyer9wghxuet5qyxhwumn8ghj7mn0wvhxcmmvfym9kz 🙏💯👊

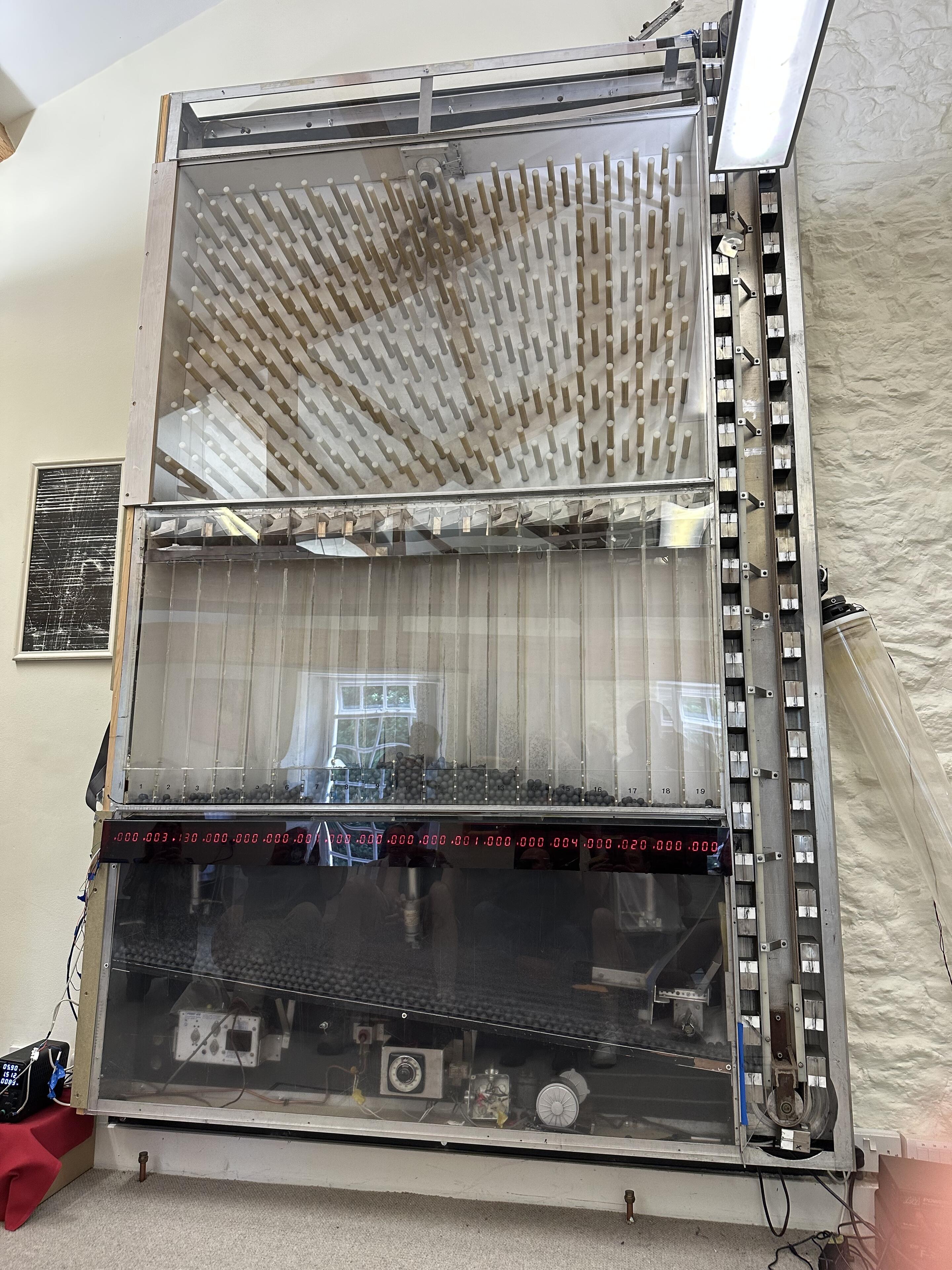

Spent the last 3 days at https://broughtonsanctuary.co.uk with a group of people at the leading edge of consciousness, AI research, and global affairs and also got to experience many of the early research technologies used by PEAR to try to measure the effect of consciousness on outcomes. (The Princeton Engineering Anomalies Research Lab)

This must have been amazing Jeff! What a great opportunity! 👊💯🔥

I think you're right to be cautious here. I'm just going off of exactly what you stated ... M2 is going higher (mandatory) so therefore scarcer hard assets go up in dollar price. Doesn't mean they trend down for a little longer here etc. Unlike the 2010 which was a steady rise in prices, this decade real estate will continue to be much more volatile as the fiat system unwinds.

I feel for the first time homebuyers as well. Hope some of them are spending the time to understand Bitcoin.

Tough to call. So much nuance here ... property type, location etc. etc. Just interviewed Brent Johnson (dollar milkshake theory) and this came up. I think the team will release it next week. He's negative on Canadian real estate but when I pushed a bit he admitted that it can go higher in nominal terms from here, especially in response to any economic crisis.

My bet here is prices go UP on Canadian real estate over the next few years. The banks and the gov need real estate to go higher ... so they will. I don't agree with this approach but that's the game.

Think of it this way. What will lose value faster? The Canadian dollar or a good hard asset property and then place your bet accordingly.

But in BTC terms real estate just continues to get obliterated.

Bottom line: Up in fiat terms, down in BTC.

What an amazing conversation. Must listen stuff. 👊💯

nevent1qqsps6359ayuu0lmz9smsv02vtvcyn7gycyy24tv36qa332ntj8xwjcpyfmhxue69uhkummnw3ez6an9wf5kv6t9vsh8wetvd3hhyer9wghxuet5x3ked8

Absolute epic rip. Loved that you guys got into the weeds of what this transition looks like in more detail. Really appreciate these chats. 🙏

Awesome. Thanks for sharing. 👊

Suddenly NOSTR feels much more important and valuable to me.

Agreed. What a beautiful message and wonderful time in history.

Maybe one of the best episodes I've recently listened to, particularly clear perhaps for someone new.

Why #bitcoin is your ultimate retirement asset with nostr:nprofile1qqsqmsf8pxrztsvas7nz08gvglheg84w4kxcl5fee6u2mhm5lg3d5scpremhxue69uhkummnw3ez6ur4vgh8wetvd3hhyer9wghxuet59uq36amnwvaz7tmwdaehgu3dwfjkccte9emkcann9eehqctrv5hsz8thwden5te0dehhxarj9e3xjarrda5kuetj9eek7cmfv9kz7nfwsry and nostr:nprofile1qqsyynyz05g96luvamf9marxkvxq00un34l3jdl8wjdlagspeyyf5wspr9mhxue69uhhyetvv9ujuumwdae8gtnnda3kjctv9uwt3fjq

--

#BitcoinForMillennials #podcast #studyBitcoin

Appreciate the kind words 🙏 , Bram does an incredible job with these!!

We cannot wait to unleash you in front of the group!! 👊🔥🙏

Totally!! 😂 It’s wild that in an attempt to make people take a look at it I used the historic low.

We've been banging the table for our real estate clients to add BTC to their lives for years now. And as we all know it's tough to get people to understand Bitcoin initially.

Anyway we may have cracked this a tad by using what they understand.

We started to share this example and the feedback has been good.

Let's say you have a rental property worth about $750K (yes, that's really a standard CAD fiat price for one in the Greater Toronto Area) that generates $475 in positive cash flow.

Now remember, these investors do not want to sell their real estate (yet!) .... they consider it risky. So we're presenting this:

Take the $475 in cash flow and use it to get a credit line secured against the rental. At 5.7% rate here in Canada that gets you $100K, then buy Bitcoin with it.

You now have a $750K property.

And $100K in BTC.

After 10 years:

Property Value at 7% CAGR (historic rate) = $1,378,844

Bitcoin value at 24% CAGR (low 4-year rolling CAGR) = $693,098

Combined Value = $2,071,943

After 20 years:

Property Value = $2,712,395

Bitcoin Value = $5,956,786

Combined Value = $8,669,181

So for $475/month that they property paid for they totally changed the return on the one rental property.

You almost double the CAGR of property from 7% to 13.75% over 20 years with a simple $475/month credit line payment invested in BTC.

The feedback by some of our most serious investors has been instantly profound, almost like they finally "get it".

Anyway just sharing in case this is useful. nostr:nprofile1qysqjamnwvaz7tmjv4kxz7fwwdhhvetjv45kwm3dwd6xzcmt9ehhyecpz3mkzue69uhhyetvv9ujuerpd46hxtnfduqzqefdtzk2lgg947z8ts87sq562tnam0pn0v4anjvtk9apz8wyehnqweuq9q it's basically a take on what you've been presenting just reworked a tad for a smaller single family home rental that is kicking off some positive cash flow. So thank you for the inspiration here.

We'll have 1,100 investors or so out to a client event in April so we'll test out the messaging further there.

I should have tagged nostr:nprofile1qyvhwue69uhkyat8d4skutndva6hjtnwv46r5dpcxsuqz9nhwden5te0vfjhgcfwdehhxarjd9kzucmpd5qzqxvfqd89dw8kqmrjfaz6zt8gfggcg93p4tm3s2slv4jrszuugfmt74rjkj nostr:nprofile1qyx8wumn8ghj7cnjvghxjmcpz4mhxue69uhk2er9dchxummnw3ezumrpdejqqgr3t0cvv7u0yl8wkvp056ug628ahq407gnqwnhcdf7u4jlp2tu4nvuhevmn nostr:nprofile1qqsyynyz05g96luvamf9marxkvxq00un34l3jdl8wjdlagspeyyf5ws6m5g3a

Newbie NOSTR question...

I'm using Primal on the mobile app and Primal's wallet. It's great.

Can I use also use the Primal wallet when sending Zaps from a browser on my Mac desktop ??

I seem to be locked into using my Alby wallet. Thanks!!

I think it took my two full years to fully digest all of what you share and now my world will never be the same. This is gonna sound wild to some but to me Bitcoin is almost like a form of consciousness that is bringing information order to a complex system that was corrupted. That corruption kicked off poor quality signal and global human consciousness could not progress because of it ... Bitcoin solves for this. I'm not claiming to be the first to have such thoughts but it has become obvious to me that Bitcoin is more than the best money humanity has ever seen, much more. Wild times. Luv it all. So thanks for kicking off this exploration for me Jeff.