it’s only a matter of time until zaps are adopted elsewhere. companies will be FORCED to adopt it as they scramble to play catch up

and it’s because we understand two things:

1. Bitcoin is the best money the world has ever seen

2. ***Money becomes more useful the more people use it**.*

This is the opposite of how most investments work.

- If the price of a stock goes up, then the value decreases because its dividend yield is smaller in proportion to its price. If the price goes up too much, an investor would eventually want to sell for something cheaper, as they can objectively see it is overpriced.

- By contrast, $100 worth of bitcoins today has a better value than $100 worth several years ago, even though the price of Bitcoin is much greater. The reason is that the utility of bitcoin (money) has increased! There is more **optionality** for each dollar. There are more opportunities to unload the bitcoins at the owner's discretion.

It is precisely this positive feedback between price and value that means that the growth of money can be self-sustaining. *(Unfortunately, it equally applies to the downside too - its demonetization can be self-sustaining.)*

Money, through network effects, group psychology and social beliefs can therefore drive its own value into a practically-unlimited top value.

This is incredibly unintuitive to most people - everybody looks at assets like a business, expecting it to require hard work and prudent strategy in order for it to grow. Some even go as far as to critique Bitcoin as worthless because it doesn't produce income. This only exposes their fundamental misunderstanding of what money is.

fascinating thread on the design of a massive DC transmission line in china https://mobile.twitter.com/wang_seaver/status/1603483542272385025

We have forgotten what immutability is.

Back in the day, people would construct huge factories - essentially computer programs made of steel.

You give them one input - milk/eggs - and they give you an output - 50,000 boxes of chocolate bars an hour! Perfectly uniform and without bacteria.

Back then, there was no version 2 coming. You had to design it really well from the start before constructing it, as changes were either impossible or prohibitively costly.

-- an excerpt from the Saylor Series Episode 2 - the Rise of Man through the Dark and Steel Ages, its 2-minute version can be found here https://www.2minutebitcoin.org/blog/saylor-series-episode-2-the-rise-of-man-through-the-dark-and-steel-ages-robert-breedlove

a good encapsulation: https://how-i-experience-web-today.com/

The world has experienced an astonishing 56 hyperinflations in the last ~100 years.

This means that in some country, every other year, an innocent population lost their life savings and their dignity, simply because they stored it in the wrong vessel.

- an excerpt from the 2-minute version of Stone Ridge 2020 Shareholder Letter https://www.2minutebitcoin.org/blog/stone-ridge-2020-shareholder-letter

the only only right choice

block out noise, lower your time preference

engage in good faith, be kind, never stop learning 🫡

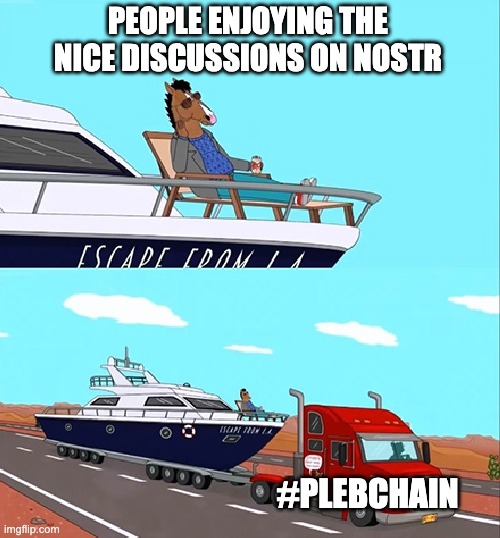

only on #plebchain ✌️

lindy

every day it survives, the greater chance it survives for longer

every day it grows, the greater chance it grows for longer

the most unintuitive thing is that money has no top.

unlike traditional investments that can become objectively overpriced - eg stock and the company’s revenue - money is unlimited.

as more people adopt it, it’s value increases proportionately

people intuitively comprehend that a system rooted in nature - PoW - is better than one based on completely made up abstract mechanisms - PoS

👉👈🥺

seems like a whole lot of incumbents

Kind of related to how risk in money is non intuitive

The more demand for money there is, the less risky it is for an individual person to hold money.

Similarly, the less demand there is, the more risky it is for a person to hold it.

If you were the first person to sell goods or labor for money, then you would probably look insane or immensely stupid to bet that other people would want this stuff in the future.

On the other hand, if many people are using money, then you are merely depending on there not being a hyperinflationary event in the immediate future.

In that case, you might look insane or stupid for worrying about such a remote possibility at all.

really?

let’s see your argument here :)

speed != block verification speed

we need to spread the knowledge

It makes no sense to trade off an unverifiable supply for privacy on the base layer.

It is better to build privacy on a second layer - regulations allowing.

If Bitcoin was private by default on layer one, it’s adoption would be a much bigger hurdle and much less of a given. It’s not very free market, not very libertarian, etc - but it is the world we live in

and the core reason for paper existence and proliferation was the difficulty and risk in transporting gold

World War 2 was the major reason. There is a book that talks about the flow of gold during the war - it is a massive logistical headache and risk

wise words

Actually gold failed because it can’t be transported well. That’s the main reason fiat outcompeted it, the others are secondary

With regards to the unverifiable supply, we believe that’s a major negative of Monero.

How many halvenings have you been to? Which one was your favorite?

#plebchain #coffeechain talks