Kaching - thanks for playing. 🎰💸

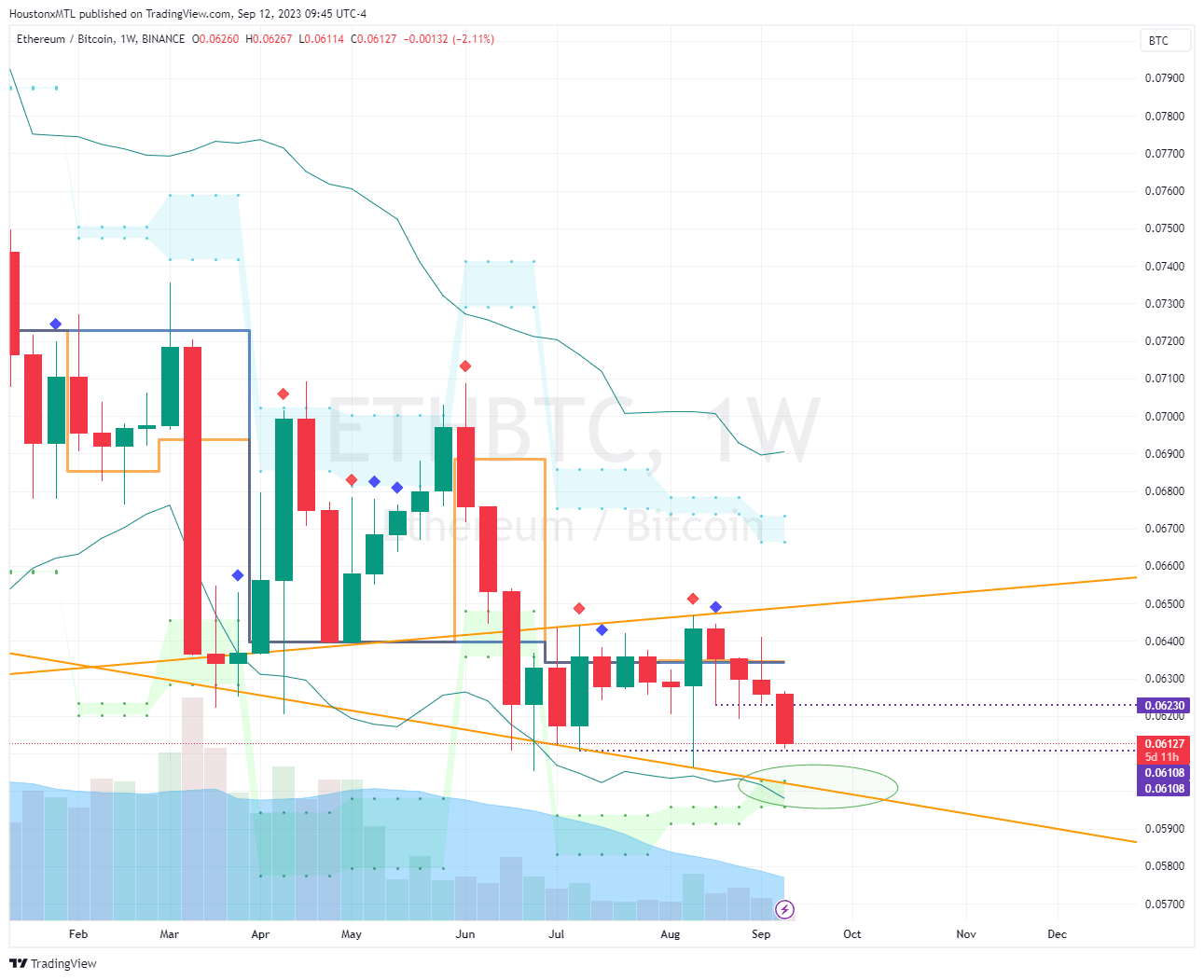

Taking some profits here on the $ETHBTC trade before FOMC this afternoon.

There's more downside possible but taking some chips off the table.

#trading #btc #eth

$ETHBTC update.

The long $BTC, short $ETH trade continues to play out. 💸

https://iris.to/note1gwqn2qc5tkl7v50wmw7ej6v6tlwj9crzw8uhlh95ntjl6prxxp4q4y9v0m

Markets always move slower than you want, but faster than you expect.

Top of the morning. ☕

1370 here we come.

Currently short a bunch of shitcoins and waiting to see how the market reacts to the macro news on Wednesday and Thursday as well as the potential supply coming from FTX.

Pay attention.

The USDJPY and USDCNH are on the verge of new cycle highs.

Say hello to the USD wrecking ball. 💣

I'm pointing out the next significant pivot.

17.30 marks the outside bar high.

Outside bars are fractal broadening formations .

So that pivot both attracts and repels - if we trade close we will likely trade to and through that pivot.

Not enough people are talking about it.

The high-yield bond ETFs $JNK and $HYG are both trading outside-inside on the monthly chart and consolidating at the precipice.

If we see a break of last month's outside bar to the downside, watch out. 👀

This means that the market is expecting more defaults or lower recoveries from junk bonds, which could be caused by factors such as higher interest rates, a worsening economy, lower earnings, or more volatility, and drive investors into safer risk assets. 📈📉

Alright $VIX reclaimed the 15.45 level.

Now watch to see if we reclaim the 17.30 pivots.

A truly fascinating sequence of price action is unfolding.

On the daily chart we are trading within the range defined by the big down bar that was formed on August 17th.

To the layman's eye, it looks like we are just chopping around, but we are actually trading at an inflection point that is precipitating a big price move.

One way the chop is expressed in the price action is as a series of widening formations with higher highs and lower lows, which is kryptonite for traders using horizontal levels or previous pivots for stop losses.

What usually precedes big moves are choppy periods that chop up the majority of traders who are jockeying for the next move but eventually capitulate before the big move happens. Once the move is finally underway, those left behind are forced to chase the price or fear missing out on the price action they so desperately wanted to be ahead of.

Finally, take a look at the 1628 pivot. Notice how we've been chopping around this level?

Zoom out to the 3M chart and you can see that 1628 is the reversal pivot on the quarterly chart - which has become a battleground for buyers and sellers.

When the 1628 pivot gives way, we should see much lower prices.

The major timeframes are all trading 🔴 so my expectation is that this period of consolidation will eventually resolve to the downside and we visit the 1370 pivot as I have noted previously on my feed.

$BTC is trading in a very similar structure to $ETH, so I expect both $BTC and $ETH to resolve the consolidation in a similar manner.

#BTC #ETH #trading #plebchain

As noted last week, the $VIX reversed and is now inching its way back up and tagged the 15 handle.

Expect some more volatility ahead as we come back through the range.

https://iris.to/note1g08rd2q7wfeeas99mqjuclry8qn4m8ngg8rqx4xqyyjyraw6s64q6kf6yp

The $VIX is setting up for a snapback rally and could be setting the stage for a volatile September.

#trading #plebchain

Looks like Ideogram has made some serious progress in cracking the AI text-generating code.

https://ideogram.ai/api/images/direct/ZexKKAgiTRqX_gt89btqfg

If the US 10 YY breaks over yesterday's high then the 4.206 is the next likely pivot in play.

Pay attention to what this could mean for the broader market if the market follows this pivot.

So how did buying that local top on $BTC go? 🤣

Now home gamers - just imagine if you had gone short.

https://iris.to/note1ftwzst0h9hm2fmtnv2dnlffcr4ck9x00v97k4q2urkxzjdw47vfq3vueks

#Bitcoin #Trading #BTC #plebchain

All eyes on the #jobs report tomorrow. 👀

The US 2 and 10-year yields have retraced their recent upward thrust and this could be the moment buyers step back in.

If the jobs report comes in strong, we could see yields push back up. #economy #trading #plebchain

This is the way.

Call it a slow-motion rug pull. 🦥🐌

Over 170 years ago in January of 1862, United States representative from Ohio, George Pendleton, took the floor and declared that if the members of Congress were to disengage money’s material moorings in gold and silver, they would -

From "The Money Plot" by F. Kaufman (2020)

I’m about half way through The Money Plot from F. Kaufman.

So far it’s been pretty wide recounting of the history and use case of money and has some novel stories I haven’t read elsewhere.

I will post a thorough review when I’m done.