Proof of work.

Kitchen remodel moving along nicely....

Interesting.

Shady.... Shadowy, supercoders...

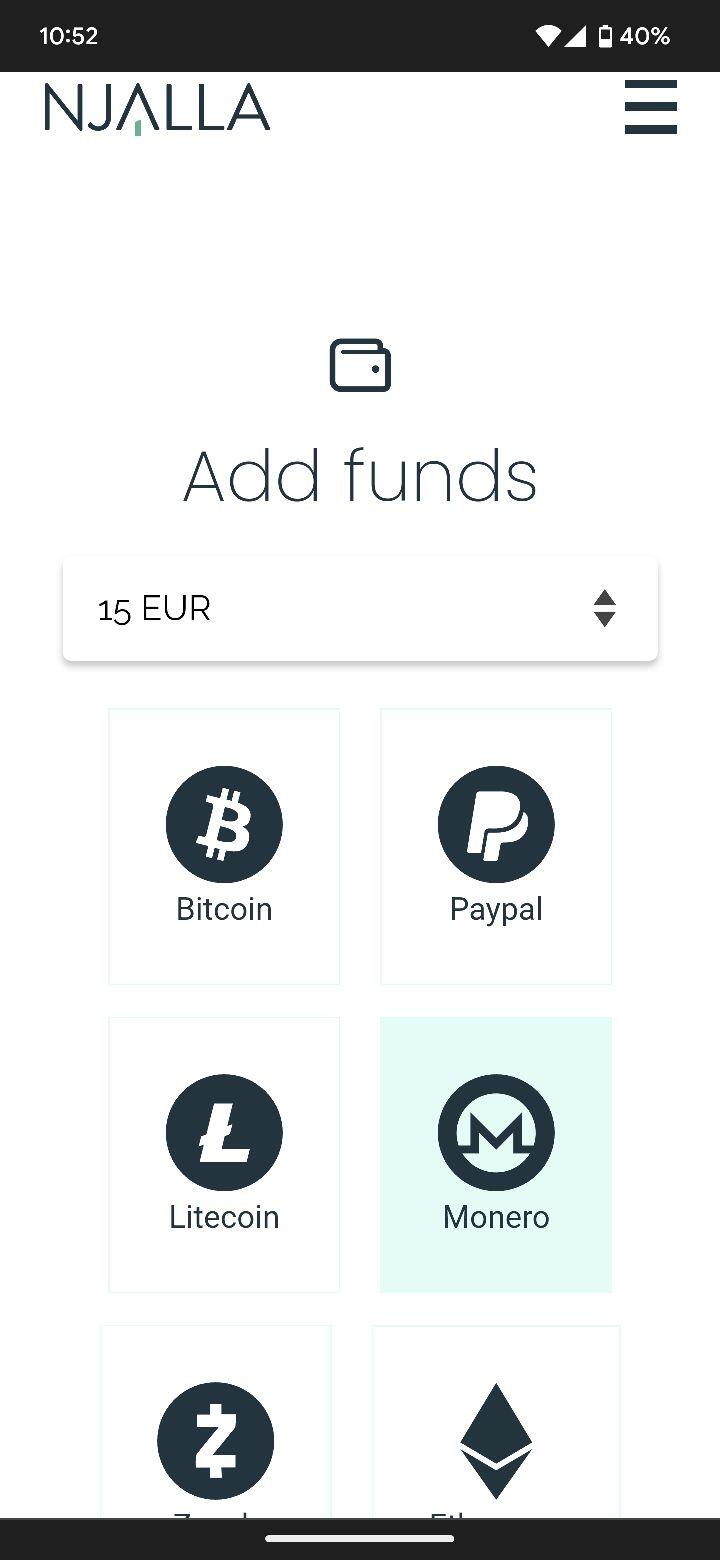

Never said you couldn't, all of these, except PayPal, provide a level of privacy over GoDaddy...

Inside an unplayed game of Skip-Bo we just scored, anyone want some UNO merch?

1986

#uno

#cardstr

Nice to see peeps firing up their zappers on this cold morning...

notes are for zapping, it'll make a dull day ZAPTASTIC!

GM

Touch some grass.

My boy and the neighborhood kids enjoying "The Luge" we make every year in our yard.

Good times.

https://video.nostr.build/9d93e986ba3c5371da19e928c6d8ed5e169af01f5d98914a506a9a5171faf55e.mp4

Making memories.

#sledstr

#snowstr

#gm

#pv

#wabisabi

#winter

#grownostr

Notes and Other Stuff Transmitted by Relays

#bitcoin

#bitcoin

You don't comprehend what I'm saying. Of course you're KYC'd on CashApp and Kraken, its what happens after you acquire the XMR. dgaf about the privacy between CashApp and Kraken. This same scenario could be done from strike to kraken, too.

If you know of a non-KYC exchange that has lightning for XMR, you could use that, too.

The KYC bitcoin dialogue is so tiresome, just use XMR. You're gonna have to give ID to return to fiat, anyway, unless you're doing gift cards or something stupid.

If you're never selling, then it's all just noise.

If you do sell and are avoiding taxrs, you're a criminal.

It's fake, written based on the Gold Confiscation Act of 1933..... But, yes, I think if it were to get to this, Monero would be extremely valuable.

as kyc free as coinjoins, wasabi mixers and the like, and easier. no mess with wait times for fiat deposits and avoids BTC withdraw fees.

nostr:npub19mc0en74540rd0ytuwjjtswwjleqa2a2jnnfmqh7hltyrk2gps6skpz875 was building the client, but I believe the Cake Wallet team is at the helm now. Was told Q1 or 2 of 2024. Cake teased about lightning integration in April, as well.

wait times and 3rd part risk.

CashApp instant transfer > Kraken fiat deposit wait times

fees and instant withdrawal

theres a bunch of ways to do it. Personally, could care less about all the KYC dialogue. BTC is KYC-free, it's exchanges and platforms that are KYC.

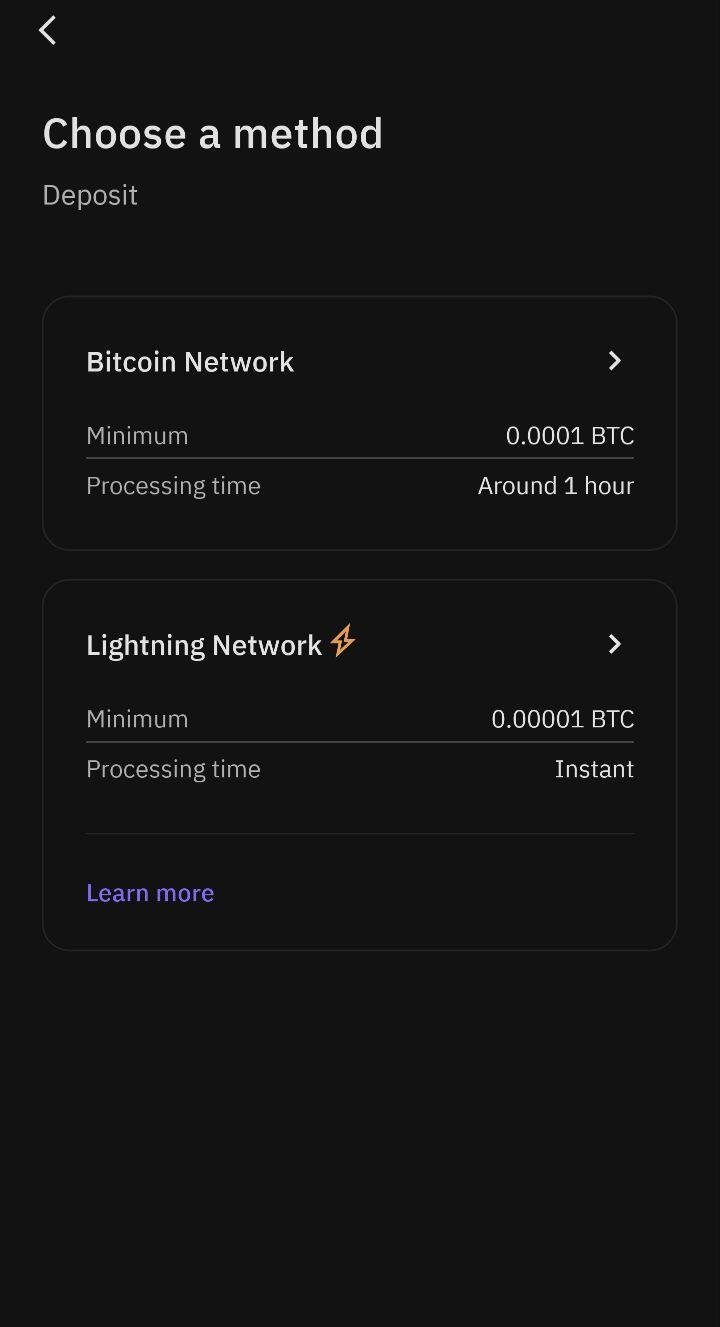

Really, I just wanted to deposit with lightning, lol.

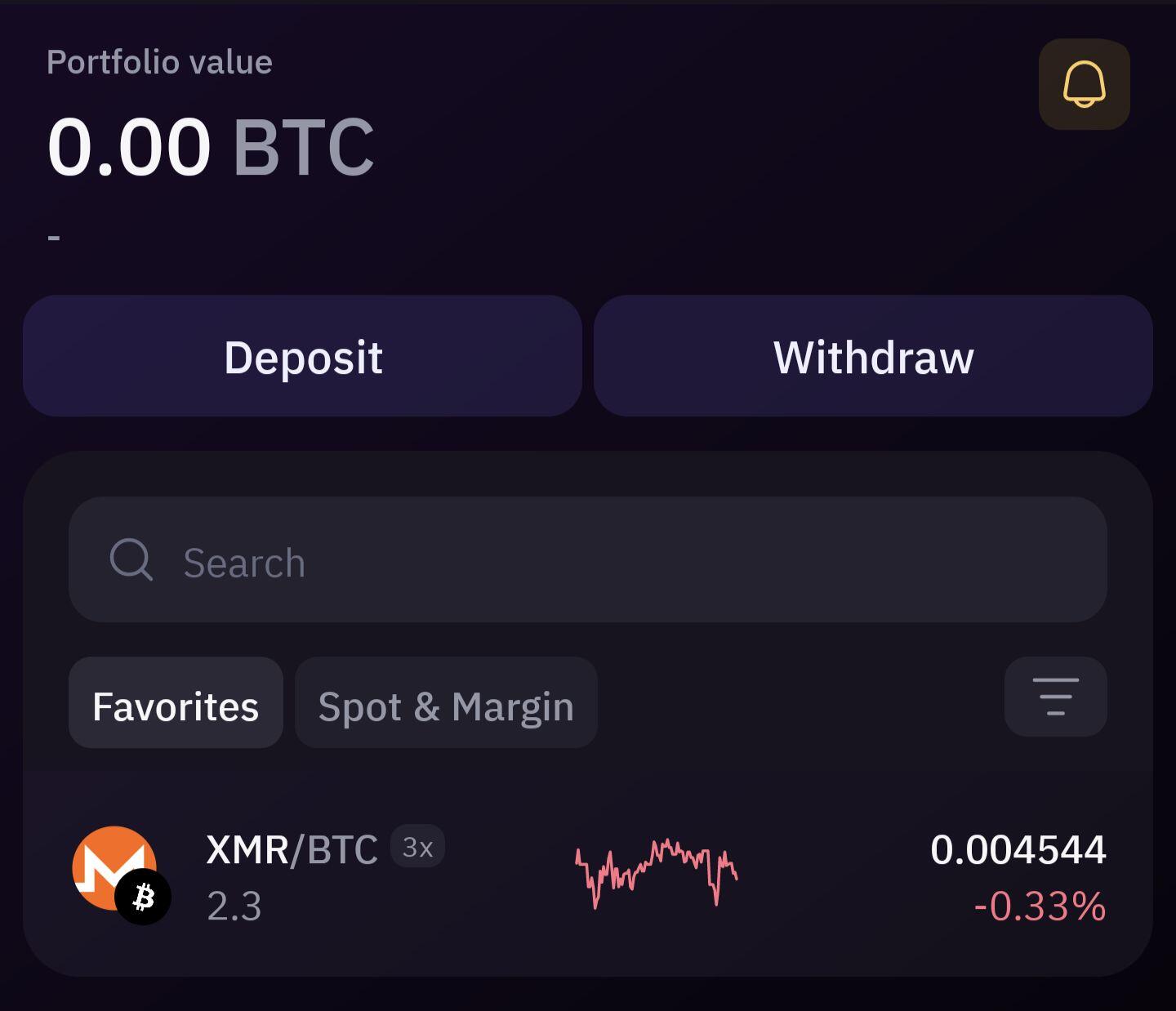

one of the few exchanges with it AND XMR. Kraken is a gem, IMO.

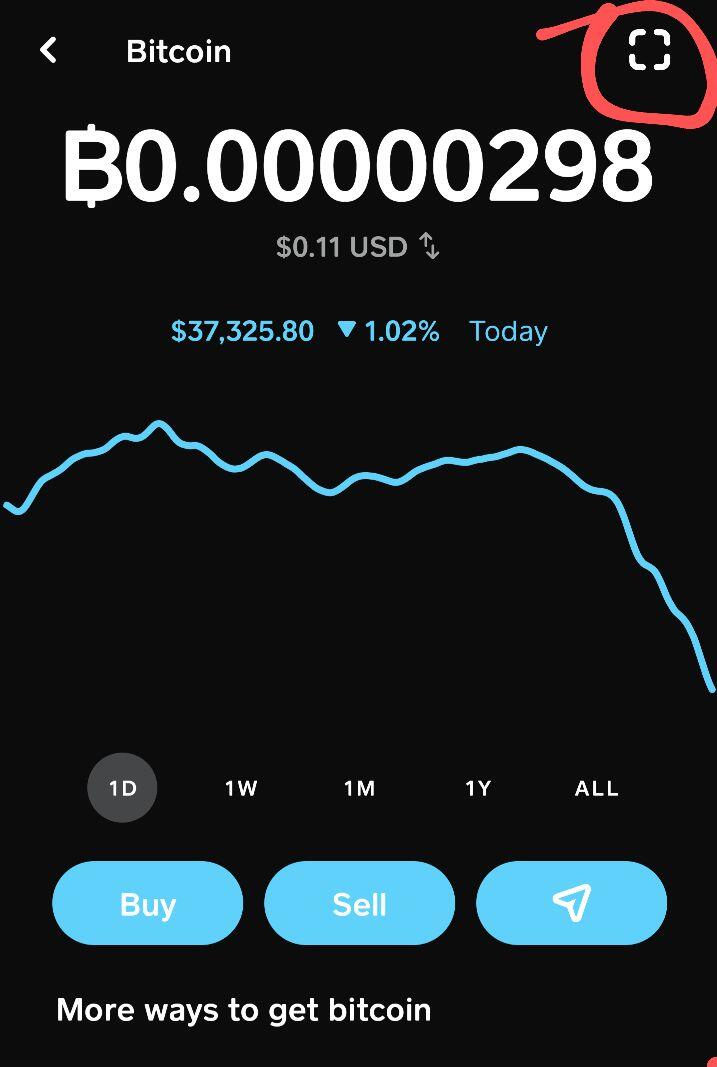

Easy way to quickly get KYC-free sats.

Buy bitcoin on CashApp.

Generate a lightning invoice on Kraken.

Rerurn to CashApp, "paste" invoice into CashApp using the QR scanner.

Once deposit clears on Kraken (only takes a few seconds).

Go to XMR/BTC pair and buy XMR (select pay fees in xmr to leave Kraken with zero balance)

Withdraw XMR to wallet.

Now you're free to use any KYC-free spot to exchange the XMR for BTC...

Bisq

CoinEx

MexC

SimpleSwap

Swapspace

TradeOgre

Agoradesk

swap direct with Cake Wallet

Surprisingly easy, and very little waiting.

What's another simple way?

The less counter-party risk, the better....

Bitcoin Confiscation Act Signed Into Law

WASHINGTON, D.C. - In a drastic move that sent shockwaves through the cryptocurrency world, President Biden, today, signed the Bitcoin Confiscation Act into law. The legislation, passed by Congress last month, nationalizes all bitcoin within U.S. borders and requires citizens to forfeit any bitcoin holdings over 0.00000001 BTC per person.

"This law is necessary to protect the financial stability of the country and ensure proper oversight over this volatile digital asset," said Treasury Secretary, Janet Yellen, at the signing ceremony. "We cannot have an uncontrolled, speculative currency threatening our economic growth."

Starting, January 2024, in exchange for seized bitcoin, the Treasury will provide compensation to citizens at a rate of $1 million per full bitcoin, with a cap of $10,000 for fractional bitcoin. Payment will be made in a new federally-issued Central Bank Digital Currency (CBDC) that was also created through the law.

The cryptocurrency industry has reacted with outrage, calling the law unconstitutional and predicting that it will drive innovation overseas. "This is a tragic infringement of economic liberties that strikes at the heart of financial freedom," said fiatjaf, CEO of The Nostr.

Some bitcoin enthusiasts have vowed to defy the order or hide their cryptocurrency holdings. But the Treasury Department was given broad authority to track ownership of digital assets and punish evaders.

"I earned those bitcoins fair and square," said local resident SirSleepy, who declined to state how many bitcoins he owns. "I should be able to do what I want with my own property."

The law tasks the Treasury with appropriating $100 billion to cover the costs, a figure some critics worry may still fall far short of the total value seized. Between 18 and 22 million bitcoins are projected to be confiscated nationwide.

The economic impacts may not be clear for some time. But for now, fears and uncertainty rule the day in the once red-hot bitcoin market. Prices are expected to plunge over 30% since passage in Congress, and analysts say this may only be the beginning if confiscation efforts encounter resistance.

Do yourself and your neighbors a favor. Do what's right. Hand over your bitcoin to protect us all.

Bitcoin Confiscation Act

An Act to provide for the nationalization, to regulate the value, and for other purposes.

Be it enacted by the Senate and House of Representatives in Congress assembled,

Section 1. Title to all bitcoin within the borders of the United States is hereby transferred to and vested in the Government of the United States. Title to all bitcoin in excess of 0.00000001 bitcoin per person is hereby forfeited to the Government of the United States.

Section 2. The Secretary of the Treasury is hereby authorized and directed to pay $1 million per full bitcoin nationalized hereunder. In no case shall payment exceed $10,000 for a fractional bitcoin. Payment shall be made by check drawn on the Treasury, or in Central Bank Digital Currency hereinafter provided for, or in both, at the discretion of the Secretary.

Section 3. All persons required to deliver bitcoin hereunder shall be immune from criminal prosecution, fine, or forfeiture on account thereof.

Section 4. The Secretary of the Treasury may issue regulations as necessary to implement this Act. Regulations prescribed hereunder may impose upon persons required to deliver bitcoin such reporting requirements as the Secretary deems necessary.

Section 5. There is hereby authorized to be appropriated $100 billion for the purpose of carrying out the provisions of this Act. And any excess in the amount so provided over the amount necessary for such purpose shall be covered into the General Fund of the Treasury.

Section 6. This Act shall take effect January 1, 2025.

The Secretary of the Treasury shall have discretion to appoint such agents and to utilize such other local agencies as deemed necessary to facilitate the nationalization of bitcoin as provided herein.

Just in case you hate #blackfriday, see regular link below ⬇️

Gold, Silver and #Bitcoin

belong in a Swiss vault.

Swiss made 🇨🇭 open source

Swiss made 🇨🇭 security

Swiss made 🇨🇭 usability

Swiss made 🇨🇭 privacy

Swiss made 🇨🇭 independence

Hardware Wallet from nostr:npub1tg779rlap8t4qm8lpgn89k7mr7pkxpaulupp0nq5faywr8h28llsj3cxmt

🚨 Get 5% discount with voucher at checkout with this URL

☟

https://bitbox.shop/en/?ref=pJhE7EVgor&code=banksith

#plebchain

#zap

#bitcoin

#coffeechain

#zapathon

#nostr

#einundzwanzig 🧡

what is this, a discount for ants?

yep, I'm trying to figure that out, just sent some sats to him again, address worked....

hnmm..

nostr:npub1fa95mmkkkqx88m077vyny2zhp6zaxe0wlgjdvtlhwqvhrdpnrjjqh8qct8

changed his profile to his getalby address, vut probably just messing it up further.

Don't see an option to edit my fund, too.

yep, I'm trying to figure that out, just sent some sats to him again, address worked....

hnmm..

nostr:npub1fa95mmkkkqx88m077vyny2zhp6zaxe0wlgjdvtlhwqvhrdpnrjjqh8qct8

How's nostr:npub1pzerv8rqqvhk82y85axa3t3yxr8rdqnea03zlmk5crsne509esqqw0x463 doin' today? Doesn't it run on WoS?