🚨 Charlie Munger’s "Three L’s"—Ladies, Liquor, and Leverage—are as relevant to Bitcoin as they are to life. 🚨

While personal distractions and vices can be costly, Leverage is the real portfolio killer in the crypto space. Every cycle, we see traders overextending, taking on excessive risk, and getting wiped out when the market moves against them.

When #Bitcoin dips, diamond hands buy. Weak hands? They get liquidated. Dips don’t kill portfolios—margin calls do.

Bitcoin is volatile, but its long-term trajectory remains up. Why risk it all for short-term greed when patience and discipline win in the end?

Stay solvent. Stay patient. Stack sats. Survive the game.

Dips exist to transfer #Bitcoin from paper hands to diamond hands

#Bitcoin’s volatility is the ultimate opportunity—institutions are riding this wave, yield farming premiums with delta-neutral plays. Over 50% of ETF inflows are fueling markets, not just HODLing.

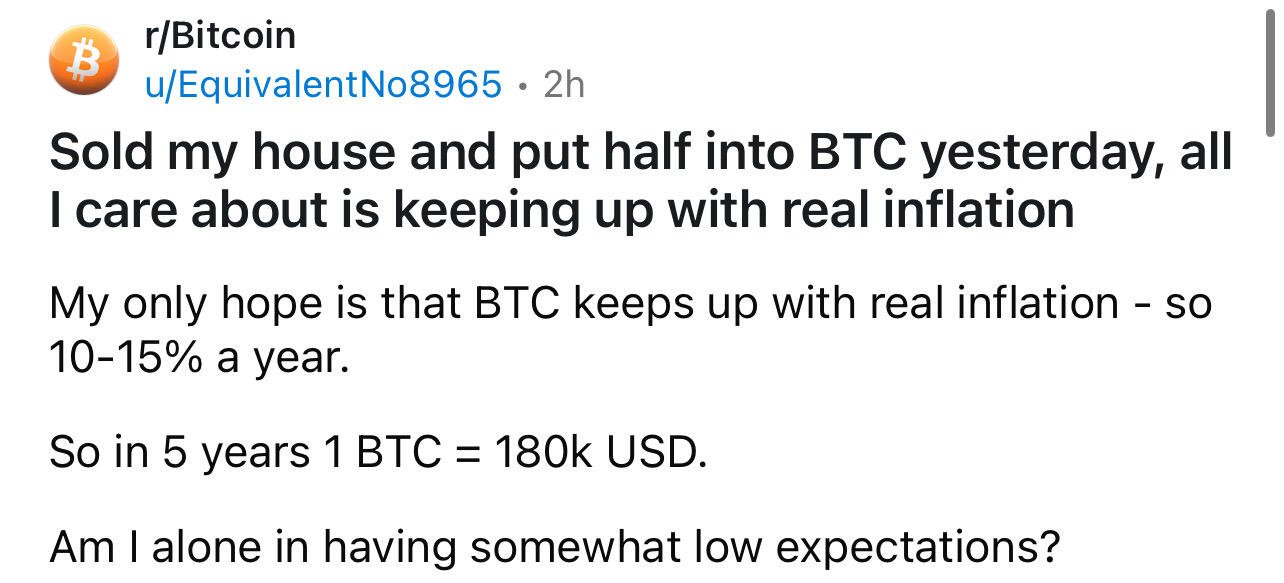

good luck with the house sale

Short-term bearish: #Bitcoin has broken below the 0.382 Fibonacci level ($93,163) and is nearing 0.5 Fib ($88,143) support. Further downside may target $83,124 (0.618 Fib).

Moving averages: Short-term MAs are turning bearish, but the 200-day MA ($64K) suggests a long-term uptrend is intact.

Volume: Selling pressure is increasing, confirming the downtrend.

Key levels: Support at $88K and $83K, resistance at $93K and $99K.

Overall: A short-term correction, but a bounce from key support levels could revive bullish momentum.

With the SEC now fully embracing #Bitcoin, it's hard to imagine how Bitcoin will remain depressed for long.

“The 21st century is going to be a billion AIs thinking a million times a second, and what are they going to be using to move their money around? They’re going to use digital money because they can’t get a bank account,” Michael Saylor #Bitcoin

"Bitcoin's days are numbered," said Michael Saylor in 2013.

Fast forward to today, and his company holds billions in BTC. A tale of skepticism turned into conviction. Never doubt the potential for change. #Bitcoin

If you're still focused solely on #Bitcoin's volatility, you're missing the bigger picture:

we're in an era where governments are on a spending spree, printing cash like there's no tomorrow, driving inflation sky-high. Your "safe" dollars are losing purchasing power by the day, yet the elephant in the room—reckless, unchecked government expenditure—gets a pass.

#Bitcoin might be a rollercoaster, but at least it's not being devalued by inflation or mismanaged by those in power. It's time to question what real financial security looks like in this landscape of fiscal irresponsibility.

#Inflation #GovernmentSpending

You can work ten times harder, master your craft, and even carry a lucky rabbit’s foot—yet still fail spectacularly. Why? 🤔

Because if you don’t understand monetary economics, #Bitcoin, and the devastating effects of an exponentially inflating currency, you’re basically rearranging deck chairs on the Titanic.

Do yourself a favour: study Austrian economics, learn why Bitcoin matters, and hedge accordingly—before your savings evaporate faster than a politician’s promise!

#Bitcoin #MSTR #Microstrategy

#Bitcoin: A Solution to the UK’s Costly Financial Regulation

The FCA’s increasing regulatory burden lacks empirical proof of economic benefits but raises costs, limits access to advice, and reduces competitiveness. Bitcoin offers a transparent, decentralised, and low-cost alternative that could:

✅ Eliminate intermediaries, reducing compliance costs

✅ Increase transparency, removing the need for costly audits

✅ Enable self-custody, reducing complex custody regulations

✅ Lower investment costs, closing the "advice gap"

✅ Minimise FCA overreach, replacing bureaucracy with cryptographic proof

By embracing Bitcoin, the UK could cut financial red tape, empower investors, and create a more competitive economy.

The FCA’s ban on #Bitcoin ETFs is inconsistent and overly cautious, especially when compared to its approval of other high-risk investments like AIM stocks and leveraged ETFs. If the FCA's primary concern were true investor protection, it would either apply stricter rules across all high-risk assets or allow Bitcoin ETFs within a regulated framework.

At its core, the FCA’s stance appears less about risk management and more about controlling Bitcoin’s financial integration, even if that means contradicting global financial trends and harming UK investors.

I expect Trump’s pro-crypto stance will lead to favorable IRS rulings including no tax on unrealized #Bitcoin gains. This will also be a very welcome relief for Microstrategy shareholders.

Legally, you don’t even own the money in your bank account. Seriously. I’m not making this up.

When you stick your cash in the bank, you’re not "saving" it. You’re lending it to them. For free. At 0% interest. How generous of you, eh?

It’s theirs now. They own it. You? You’re just a creditor – fancy word for "waiting in line if they mess up."

And that’s why people love #Bitcoin. No middlemen. No dodgy deals. It’s actually yours. Unless you forget your seed code, in which case, good luck with that.

Zoom out. If #Bitcoin’s market cap reached 1% of total global assets, it would be worth $450k. Matching gold’s market cap today, Bitcoin would be worth $900k. If Bitcoin captures 5% of the global bond market, it would soar to $1.6m.

The cryptocurrency market now commands $3.5 trillion in value, with over 15 million daily active users across all decentralised networks. Yet many people are still puzzled by what Bitcoin and other cryptocurrencies actually are, and some people still can't see past all the speculation and scams to understand the real use cases driving this ecosystem.

Was a good flush out of all the excess leverage and paper hands

Hey, I'm Jordan. I published a free fiction book on #nostr called Guidestone! It's a Bitcoin parable—the first of many in the Pleb Tales series. I'll link the original post here (https://primal.net/e/note1dg7uu7wkga3vkeeffkrp33e2wlv96x8ps0pm4stqaa8lnwkkzursqn6vtn , follow the comments to read the story, like a thread). It's also in my nostr read but the images are only available on Primal in a browser if you want to read it there. I'm also working on a novel version and screenplay that should come out this year.

I just got my first paperbacks, and even though #nip-15 was too hard for me to figure out 😆, I want to sell my book here until I can get a nostr store up and running! Send a message if you want one (or a few). $15usd if you are in the US! Just send me a message with the shipping address and zap this post. I'll send tracking the next day. I'm hoping to make my first few sales today!

#poetry #writing #bitcoin #literature #story #stories #mythology #books #readstr #grownostr #bookstr #fantasy #plebstr #readstr #philosophy #art #artst #family #parenting #plebianmarket #market #zap #diy #nostrart #hodl #proofofwork #craft #artisans #nashville #market #olas #artwork #digitalart #buyintoart #dadlife #smallbusiness #education #kidsbook #gift #gm #artist #introductions #wisdom

good work