Bitcoin Fundamentals on the Investors Podcast nostr:npub1s5yq6wadwrxde4lhfs56gn64hwzuhnfa6r9mj476r5s4hkunzgzqrs6q7z, Coin Stories nostr:npub1ahxjq4v0zlvexf7cg8j9stumqp3nrtzqzzqxa7szpmcdgqrcumdq0h5ech, What Bitcoin Did nostr:npub16le69k9hwapnjfhz89wnzkvf96z8n6r34qqwgq0sglas3tgh7v4sp9ffxj, Bitcoin for Millennials nostr:npub1gfxgylgst4lcemkjth6xdvcvq7le8rtlrym7wayml63qrjggngaqkqescl, TFTC nostr:npub1guh5grefa7vkay4ps6udxg8lrqxg2kgr3qh9n4gduxut64nfxq0q9y6hjy and The Bitcoin Podcast nostr:npub1cj8znuztfqkvq89pl8hceph0svvvqk0qay6nydgk9uyq7fhpfsgsqwrz4u should cover it. Stay warm

It’s been awesome to learn more from fellow plebs about money and macro economics than I ever did in traditional schools. #bitcoin encourages learning with an endless rabbit hole of nuances

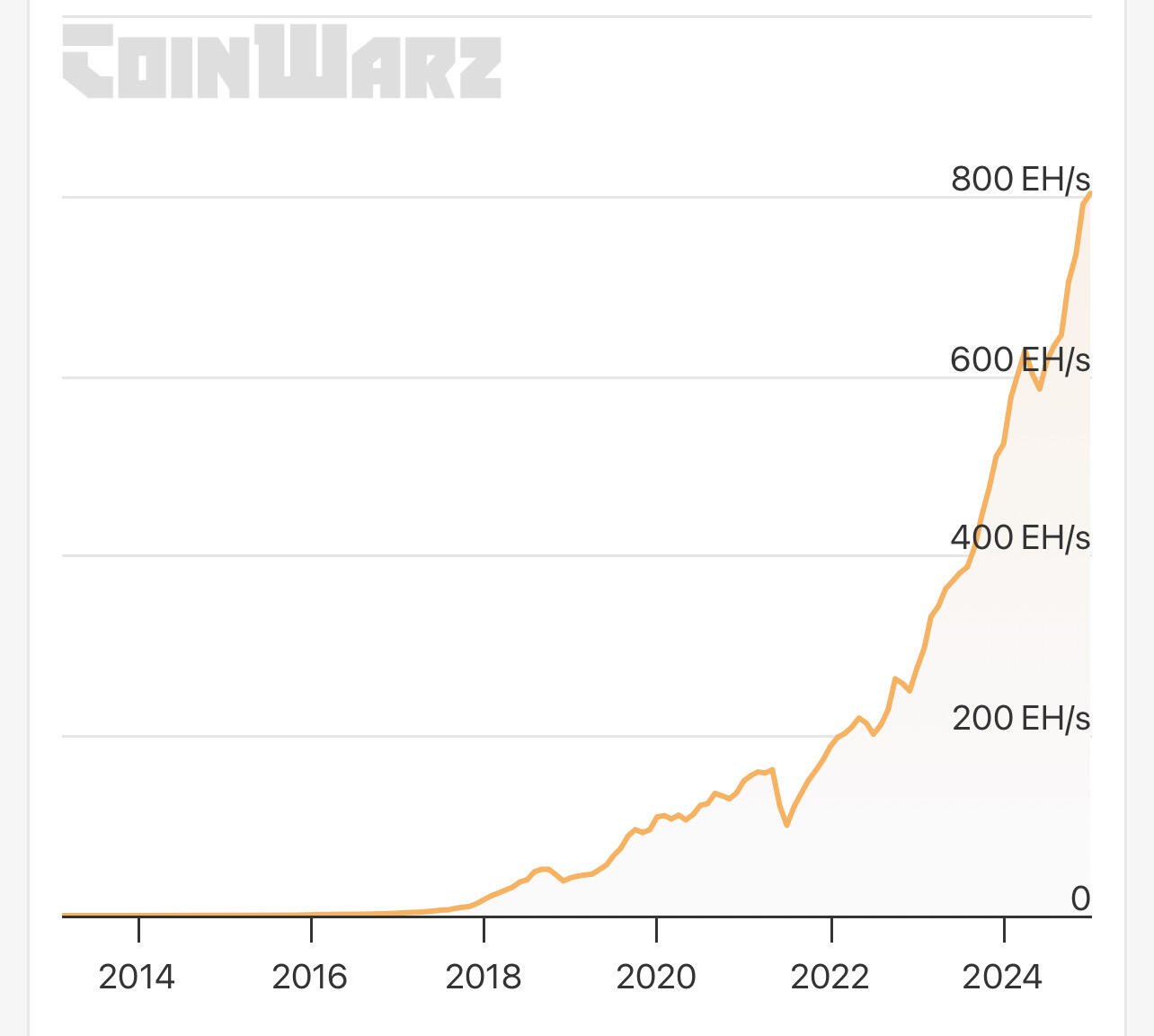

The fact that the DXY is almost at 109 and #bitcoin is still holding strong around 100k shows the strengthening demand from institutions and retail. Hash rate record is testament to an active and well secured network

Very well said! Family, nature, and sound money sounds like a great strategy

And being on cheap, censored, walled platforms debases the mind. That’s why I’m #nostr only

Trying to keep up! How do you recommend preparing?

So true and still wild how people think “it’s over” because #bitcoin retraced to 96k. Think of it this way, if the Fed keeps buying up bonds at every otherwise failed Treasury auction with 8 trillion in debt coming up for renewal next year, why would anyone sell sound money now? I’ll gladly cobble together a few sats on this dip

No, cut corners on the small things mean they will on the things that matter too. I’d pass but just my two sats

Manifest destiny and American exceptionalism is so back and I’m here for it!

I’m out of fiat for today 😂 but yes buying dips in fiat terms is always satisfying! And good to see consolidation with #bitcoin basing around 100k now

Wanted to get feedback from #nostr on something I’ve been thinking about re purchasing power. If money supply expands at 7% and market returns 7%, real return is break even and that’s why #bitcoin is the best savings vehicle. But if fiscal dominance continues and printing is the only way out, given diminishing returns from each liquidity bazooka, wouldn’t money supply presumably increase at even higher rate and outpace market returns? So could the narrative on breaking even in public market returns turn negative? I just think focusing on CPI defined inflation and nominal rates is a fools errand and we need to think about what drives the decline in fiat purchasing power

Just my two sats! Welcome all thoughts - thanks friends!

That’s exactly why it’s freedom money. #bitcoin secures our money, our future purchasing power and liberates us to not have to endlessly earn in constantly depreciating fiat terms. There really is no second best!

The parallels to 1971 going off the gold standard for petrodollars are profound. #bitcoin is the ultimate energy backed proof of work money

Another win was the news yesterday on Michael Barr stepping down as Vice Chair of Supervision at the Fed

Both awful. Comfort with fiat money leads to comfort with fiat foods. Break free, stacks sats, and eat clean natural food the way it was meant to be eaten without processed additives

GM Nostr! Some of you may have already noticed, but I’ve launched the total global assets feature on nostr:nprofile1qyw8wumn8ghj7cn0wd68ytnzd96xxmmfde68smmtduhxxmmdqyxhwumn8ghj7mn0wvhxcmmvqyv8wumn8ghj7mn0wd68ytnydahxk7fwwdhkx6tpdsq3yamnwvaz7tmsw4e8qmr9wpskwtn9wvq3vamnwvaz7tmjv4kxz7fwv3jhvum5wghx7un8qyt8wumn8ghj7un9d3shjtnwdaehgunnwvh8yegpzemhxue69uhhyetvv9ujuurjd9kkzmpwdejhgqpqgkkahxwca30rf2td22u9p3jnmlh79dylgmm2et0kykftle6tdcysfxm5ly . As of now, the Bitcoin and Gold market caps are dynamically updating, though there are still some small bugs that I'm working on fixing.

Now, here’s my question for all of you—hopefully, someone has some ideas. What do you think is the best way to make the global assets dashboard truly dynamic? I have some ideas on how to track the total money supply through M1 and M2, as well as Bonds. But what about collectibles, art, and real estate? Are there any specific datasets or API endpoints that you know of to access these data points dynamically and update the dashboard every hour or so?

Super cool data and interface! I don’t know much about dynamic data sources for art and collectibles but like the overlay of global M2. You should connect and partner with nostr:npub1ath4je07y7py74nvu044fum3f8hz3exc3dtcv782qg94w5gaddusl74k6d

Can stack more than 1K sats per 1 USD again! Happy to do so!

We exported the dollar and gutted our industrial manufacturing base which hurt the middle class. Reshoring industrial capacity and securing decades worth of input resources will improve quality and cost of living for all Americans

I try not to think about price targets too much and focus on stacking sats. Thinking about #bitcoin in dollar pricing terms encumbers us to the fiat system so trying very hard to change my unit of account, which is not easy. But number go up is exciting and your target seems very achievable!