If you ever unironically say "redistribution of wealth," you're part of the problem.

#Wealth hasn't been previousy distributed in order that it may be REdistributed.

It has been earned in the market by those who produce value.

Any distribution implies a central authority determining capital allocation, thereby causing the initial distribution.

The wealth you have hasn't been distributed; it has been earned by you or someone you love.

Don't dilute yourself.

Lifchanging wealth < generational wealth < being present for your family.

I'm not a bitcoiner to get wealthy.

I buy bitcoin because it's the best savings vehicle on the market. When the formula is everything ÷ 21M, and that "everything" part gets bigger as economies grow and technology advances, my savings in bitcoin become more valuable as a result.

My purchasing power cannot be debased, it cannot be confiscated, and I can take it anywhere in the world for free.

It certainly would be nice to have generational wealth to pass on to my posterity; in fact, that's the goal.

However, another goal is to retire myself early to be able to enjoy time with my loved ones. Does that involve borrowing against my stack? Hopefully, if lending options improve for that. Does that also involve being willing to sell some of my stack to live more freely? Absolutely.

Judge me all you want. If you have a better solution that allows me to use it without selling it, I'm all ears.

I find the purity contest about "never selling bro" to be the most unfortunate and annoying part of the bitcoin echochamber. It's like y'all forgot the whole point.

Day 83

1 mile

7m 57s

#pow

#runstr

#nosfit

The difficulty adjustment for gold is: more mining, more supply.

The difficulty adjustment for #bitcoin is: more mining, same supply.

About time... This is the way

Day 82

1 mile

7m 28s

#pow

#runstr

#nosfit

Day 81

1 mile

6m 28s

#pow

#runstr

#nosfit

Very true... In your professional opinion, at what point should a fever be a concern?

The shift from "it's for terrorists and drug dealers" to "we need a strategic reserve."

What about just selling to regular governments?

This Thanksgiving I'm thankful for the many blessings Yahweh has given me, especially my family and their health and safety.

Most of all, I'm thankful that Christ is my King, and not some diddler named Charles.

Definitely Robin Williams shouting "Goooooood morning Vietnaaaaaaam"

Day 80

1 mile

7m 21s

#pow

#runstr

#nosfit

With #bitcoin hash rate going up, what are the odds that a #bitaxe miner will hit another block, possibly ever? #asknostr

The longs aren't going to liquidate themselves...

To all the #bitcoin purists out there:

We save money for the future and for uncertainty. We save so that one day we don't have to work and can retire and enjoy the remainder of our lives with those whom we love.

Why would you never sell a portion of your bitcoin holdings, which you assert is the superlative savings vehicle, to afford you the ability to simply retire earlier?

The #neversell crowd, while I find myself in it sometimes, seems to have the mentality of "stack as much as you can forever man!"

I get the sentiment, but at a certain point you have to realize that when somebody gets run over by a gravel truck at work, leaving behind their family, and all they've ever done is work, work, work to stack more corn, I can guarantee that family would take their dad back with zero coins in a heartbeat if they could.

The only two things in this natural world that have been shown to be truly finite are time and the orange coin.

As bitcoiners, we need to remember that "time" part of the equations.

We need to remember that bitcoin is actually "freedom money," in the sense that if you save in it, you can buy your freedom from a fiat job with it.

You can, while your heart is still thumping in your chest, buy time with your loved ones with it.

We're nowhere near my price target for realizing the freedom I've been saving for; that would be too high of a percentage of my stack for my taste. But that time IS coming.

So my question to you is: truly would you never sell? And if not, why?

Day 79

1 mile

7m 28s

#pow

#runstr

#nosfit

Day 78

1 mile

7m 49s

#pow

#runstr

#nosfit

Day 77

1 mile

6m 59s

#pow

#runstr

#nosfit

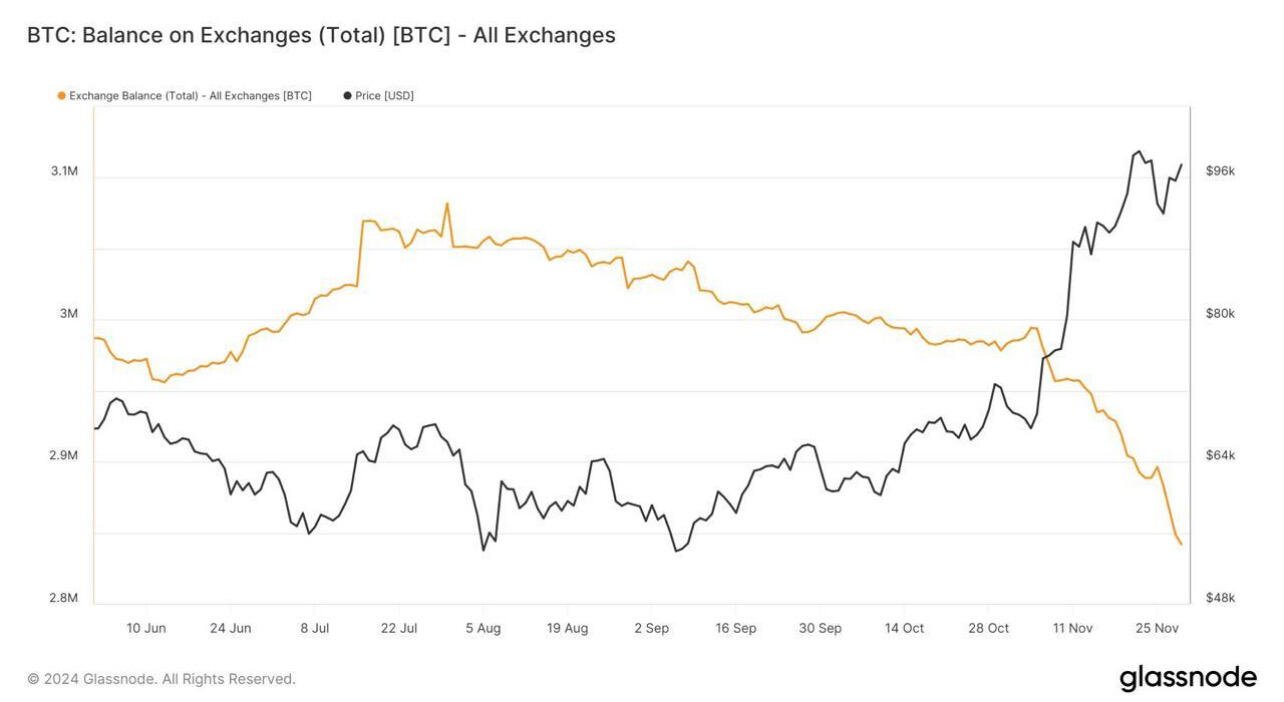

I think I'm starting to get why price doesn't go absolutely mental when you see reports of "Blackrock buys a gazillion, mstr does the same."

Trading desks have sell walls at key points where you lettuce hands are "taking profit," like right now around $100k.

Whales are able to sit at these sell walls and fill all those orders, hoovering up your sats you could be leaving to your posterity to be held by a faceless megacorporation for the indefinite future.

This keeps price in a "boring" range for a bit, then once that sell wall is eaten through, we shoot up to the next wall and chill there for a bit.

This, in addition to the OTC trades that are happening between whales, is what's keeping price low: lettuce.

Am I on the right track?