During this re-accumulation phase, nearly a quarter of Bitcoin’s supply nestled within the consolidation range before Bitcoin took off.

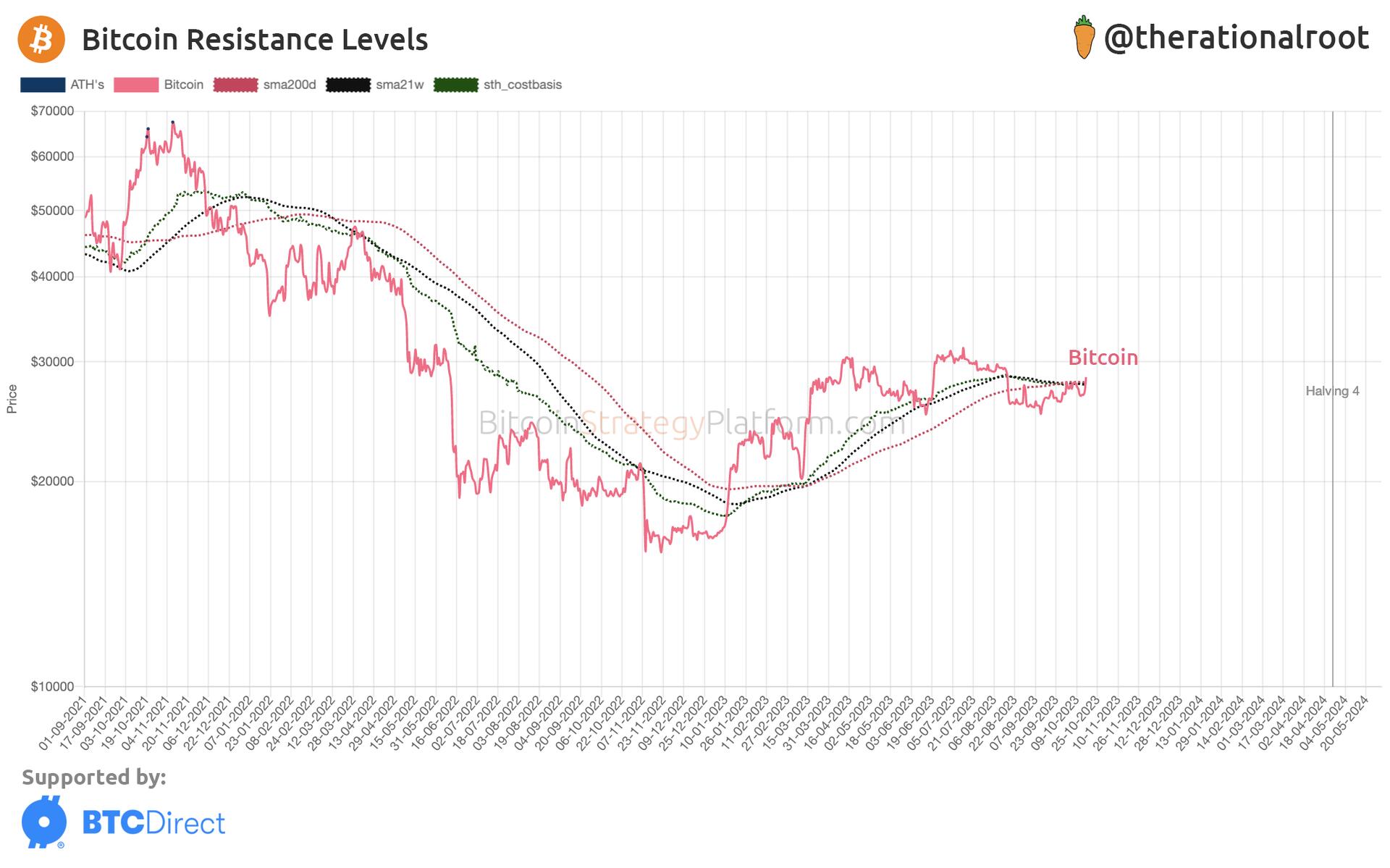

Above the Short-Term Holder cost basis! #Bitcoin

Read about Bitcoin's Supply Distribution in this week's report.

https://www.bitcoinstrategyplatform.com/news/bitcoins-money-map

Ever wondered where and when people buy their Bitcoin?

Around 24% of Bitcoin’s supply has been traded proximate to current price levels.

Predominant psychological intervals are apparent at approximately 10k steps: 17k, 27k, 38k, 47k, and 57k. Those seem like key milestones for a lot of buyers.

Read more in this week's report.

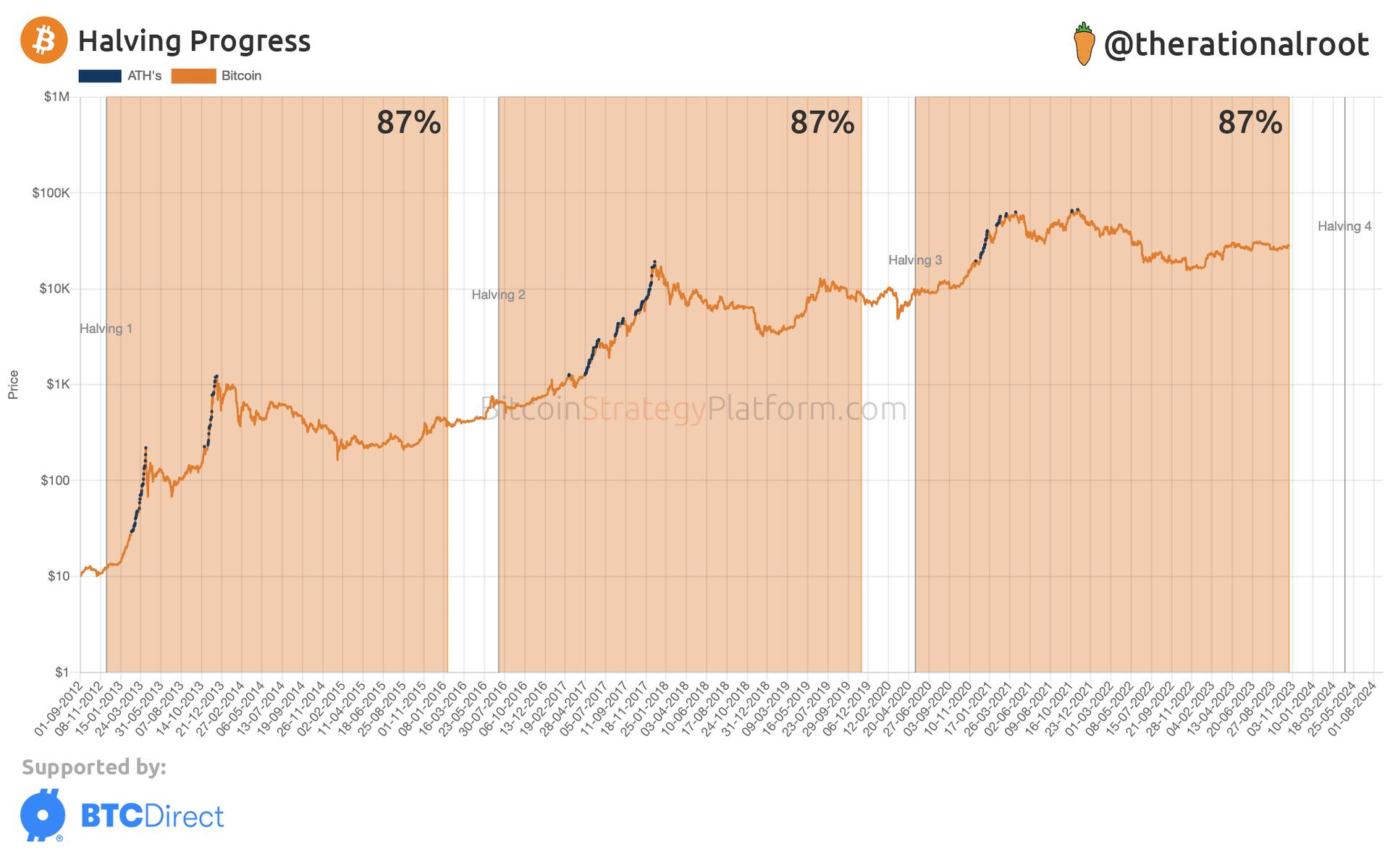

Halving progress 87%. #Bitcoin

Bitcoin 4-Year Cycle.

A fake spot ETF pump was just what we needed for Bitcoin to break back above the 200d, 21w and STH cost basis.

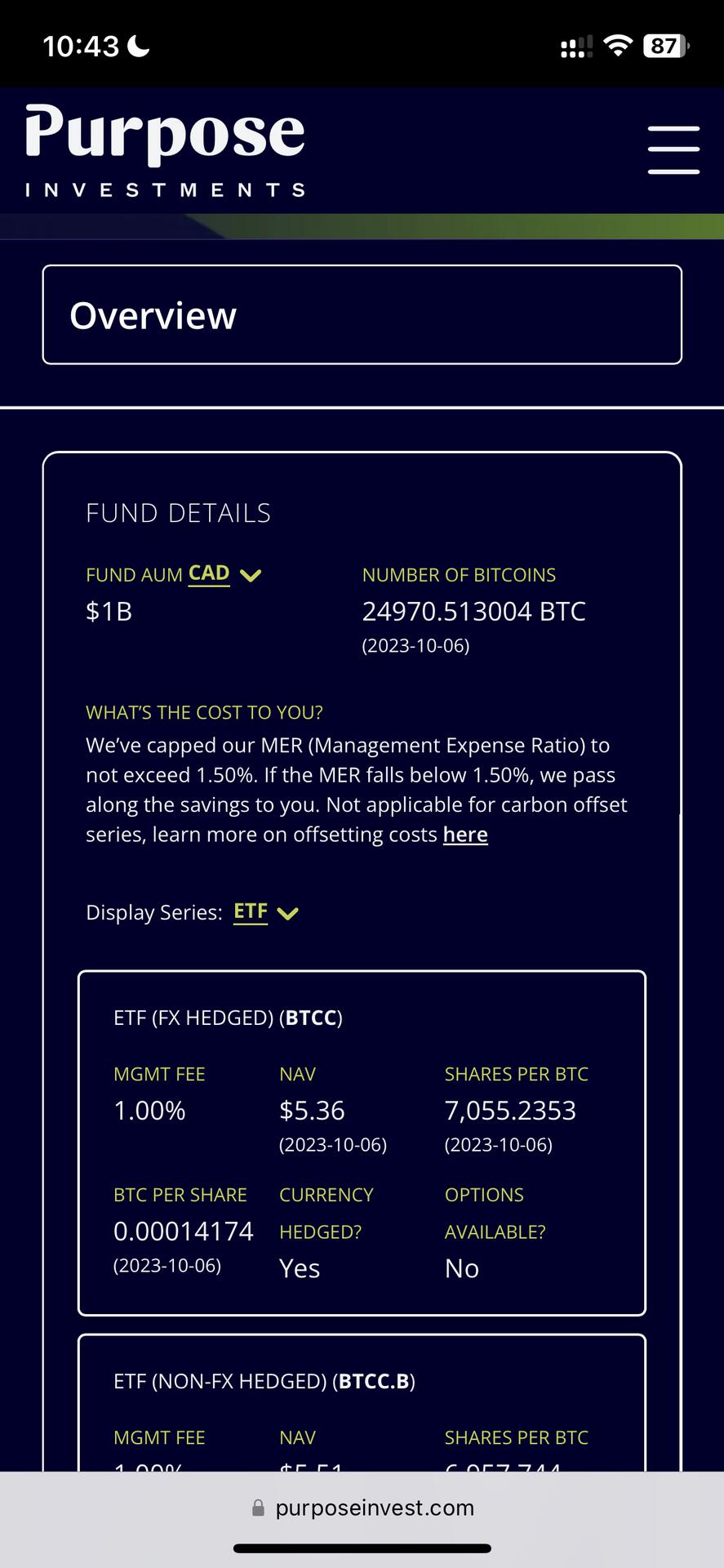

Interesting, nearly 25k btc. Do they have proof of reserves? Will look into it.

Indeed, like FTX.

Read more about Paper Bitcoin in the Bitcoin Strategy Newsletter: https://www.bitcoinstrategyplatform.com/news/paper-bitcoin-unraveled

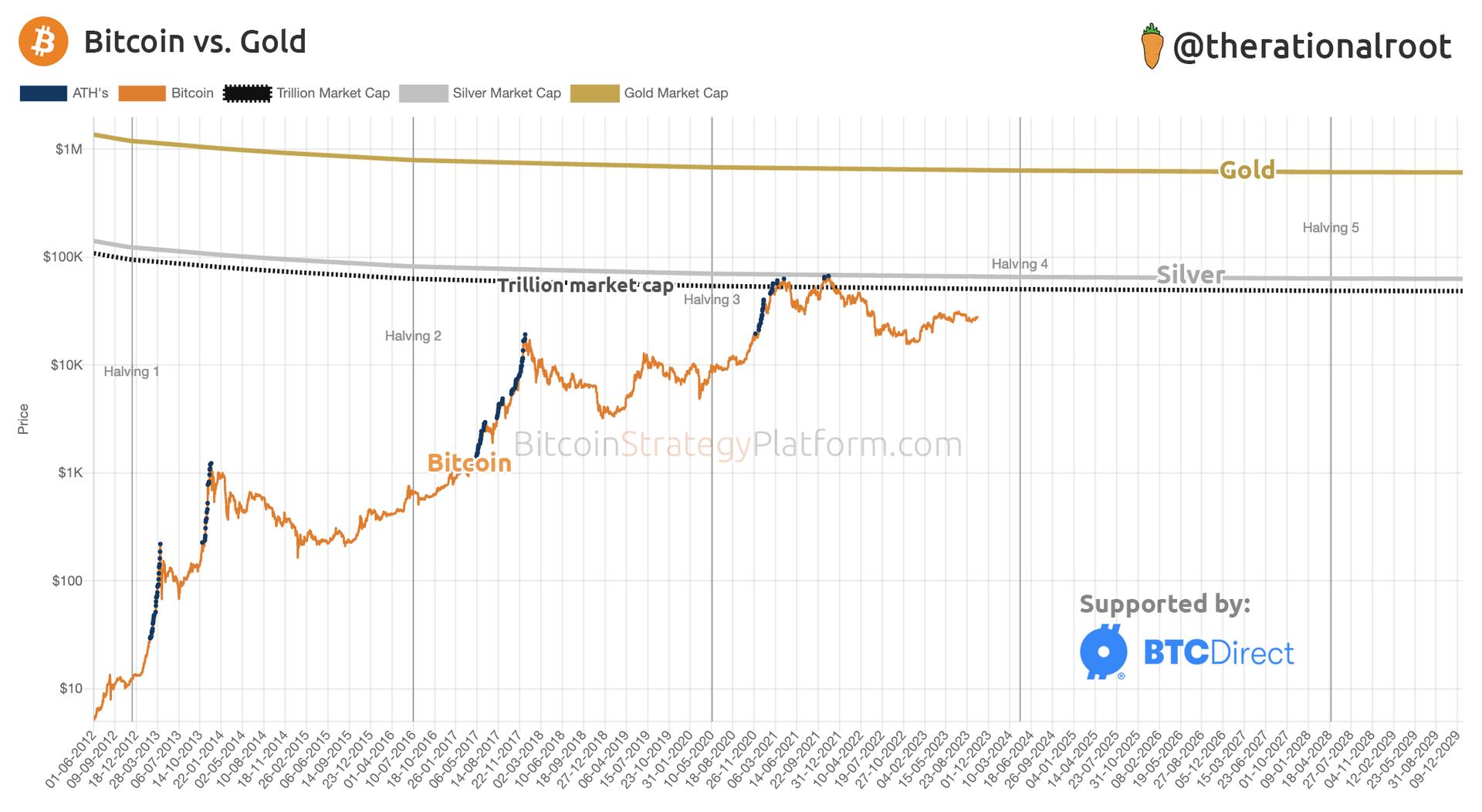

Bitcoin vs. Gold

In both gold and Bitcoin, the concept of paper or synthetic assets affecting the spot price is a concern. However, a critical distinction between the two lies in the area of verifiability. While both futures and spot ETFs for Bitcoin and gold share the common feature of often lacking an actual underlying asset, the two diverge significantly when it comes to the capability for transparent verification of those assets.

In the world of gold, the lack of easy verifiability tends to make spot ETFs more susceptible to becoming fractional reserves. That is, the real, physical gold that's supposed to back the paper might not fully exist, making the system less transparent and reliable.

Bitcoin, by contrast, offers the benefit of higher verifiability and proof of reserves, which substantially mitigates the risk of fractional reserve practices.

Halving progress 86%. #Bitcoin

Tickets available here: https://b.tc/conference/amsterdam/registration

I will be speaking at Bitcoin Amsterdam next week!

Ticket prices increase tomorrow — use code ROOT for 10% off! 🥕

Hope to see you there! 👊

Read more about UTXO Price here 👇

Avg. Exchange Price vs. UTXO Price

Bitcoin's price using only on-chain data, eliminating the need for third-party involvement.

UTXOracle by Steve

Possibly, coming from below acts as resistance as short-term holders are break-even. Nonetheless, indicative moment for near-term price action.

Bitcoin is at the average purchase price of short-term holders. A level that functions as resistance when approaching from below. This is because short-term holders that were at a loss are now break even.

Bitcoin making a move for the STH cost basis.