The #Euro reached a new low.

1 Euro still buys you 1670 Sats, on the way to 1000 Sats.

#Bitcoin

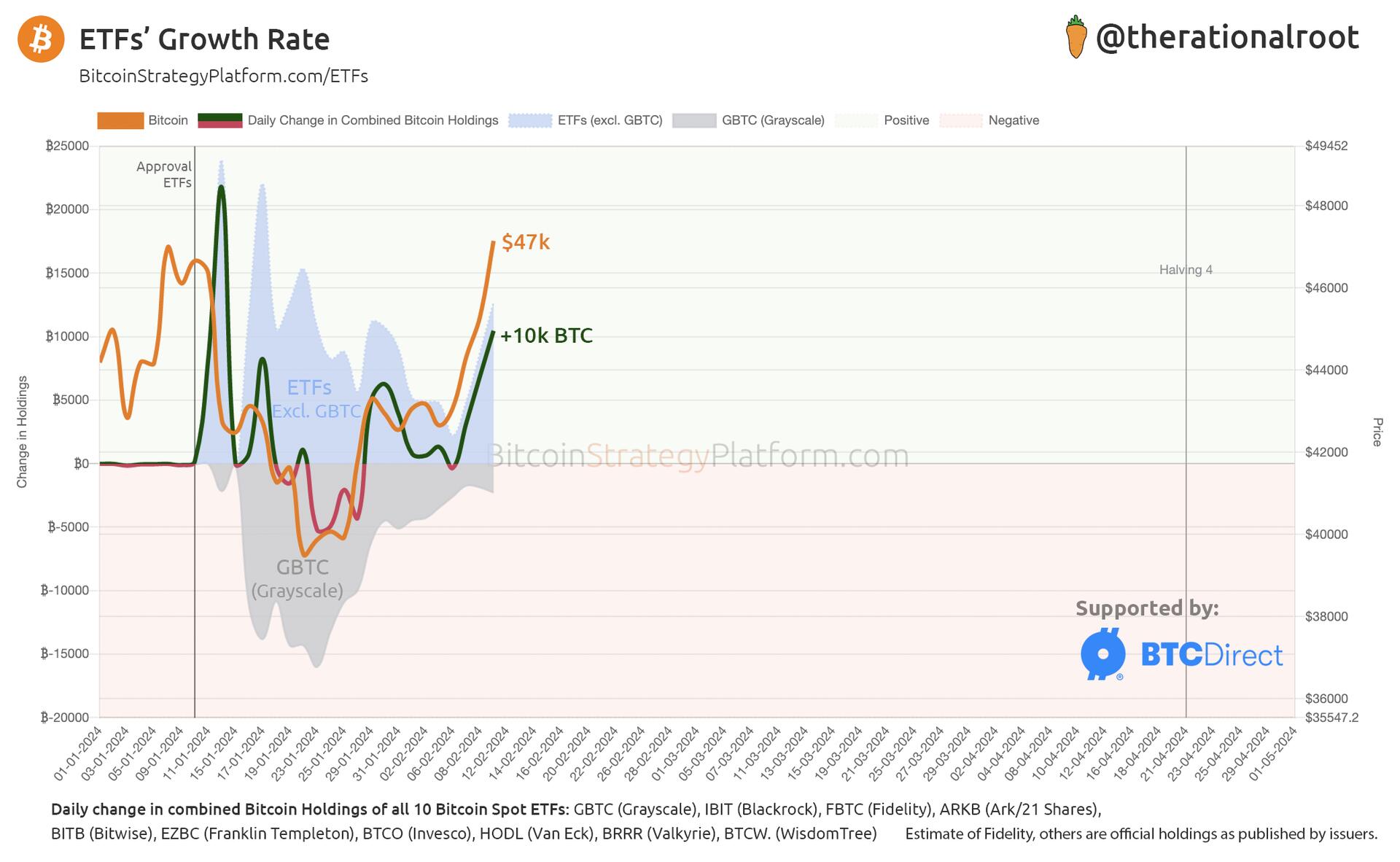

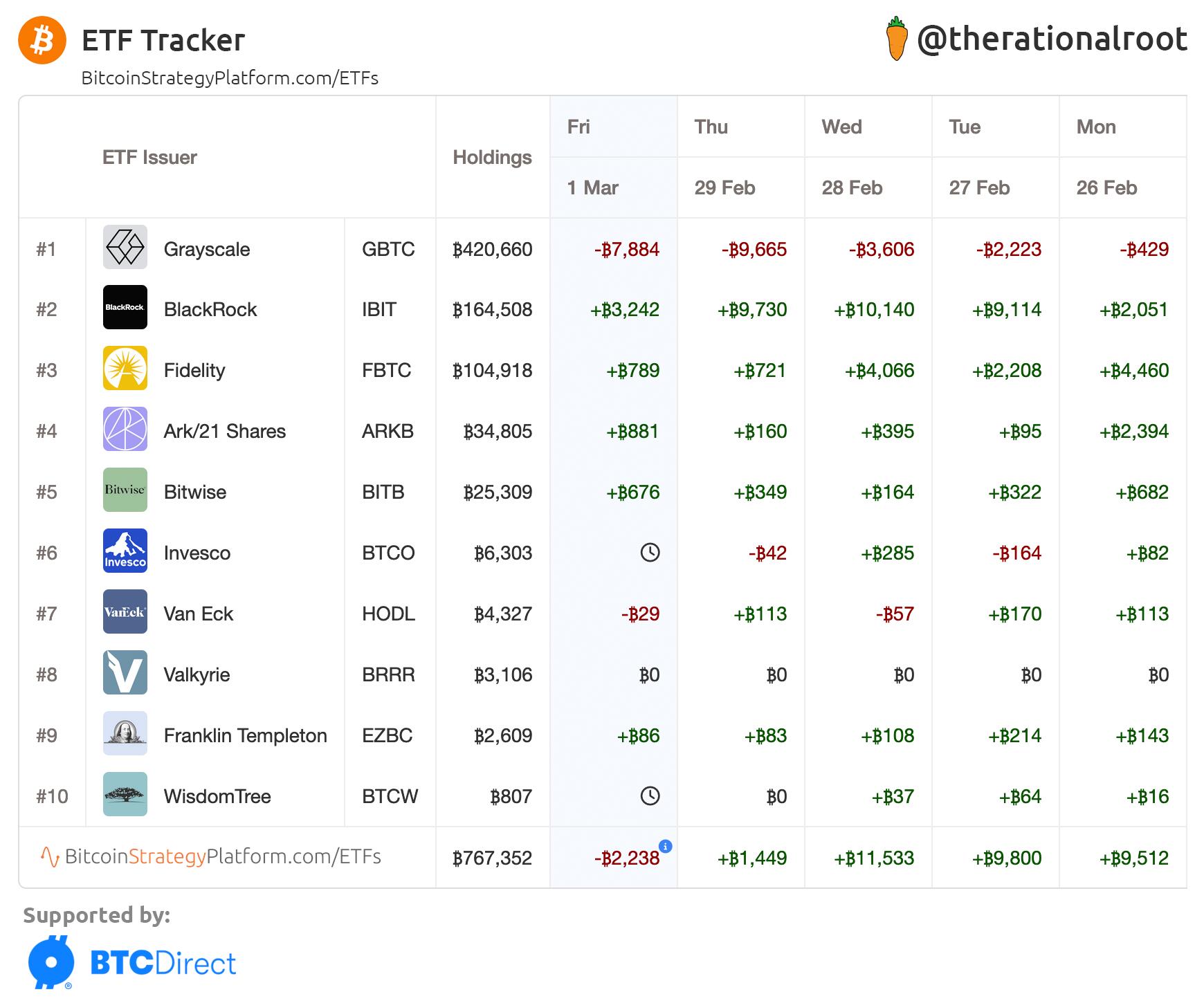

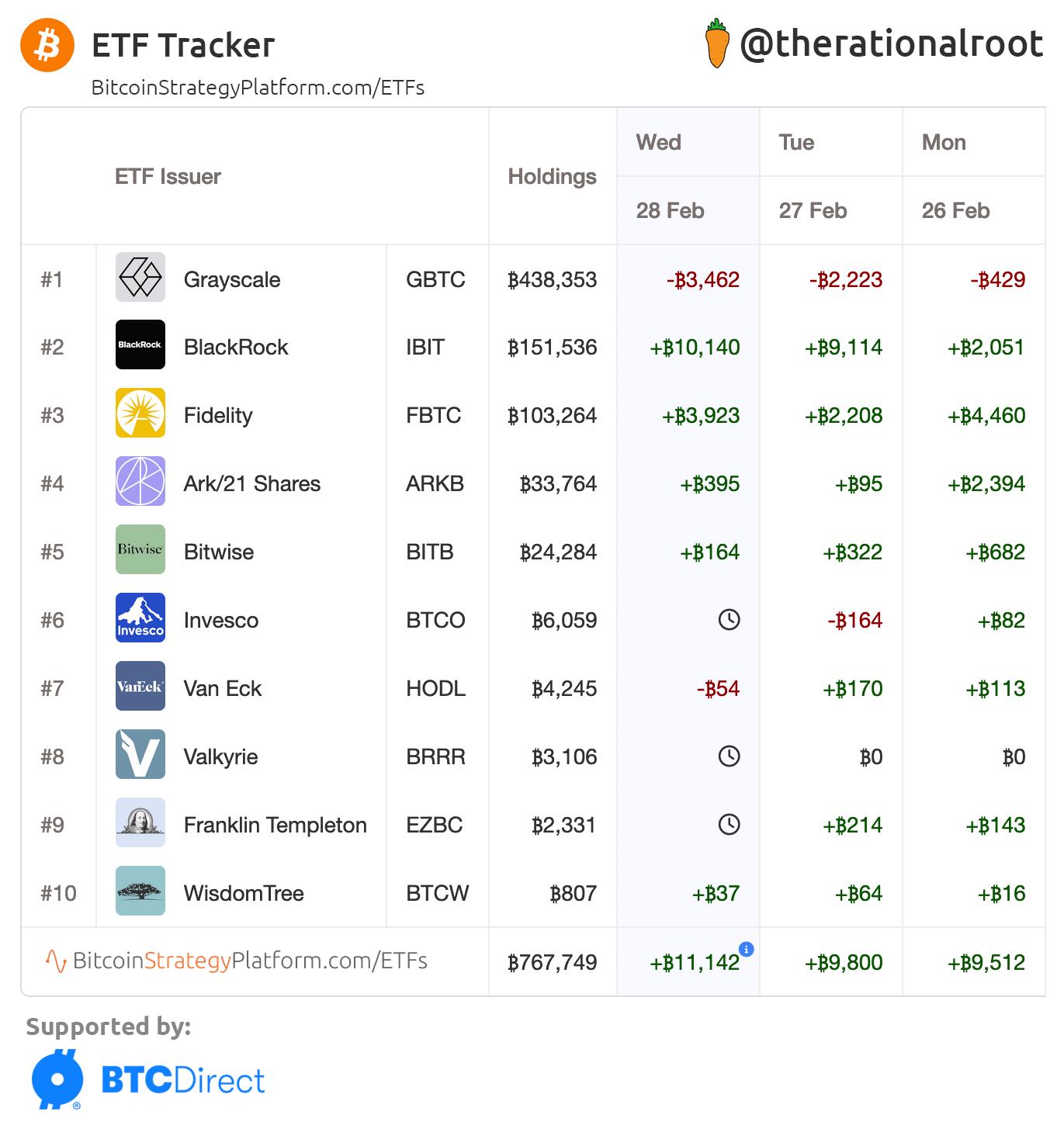

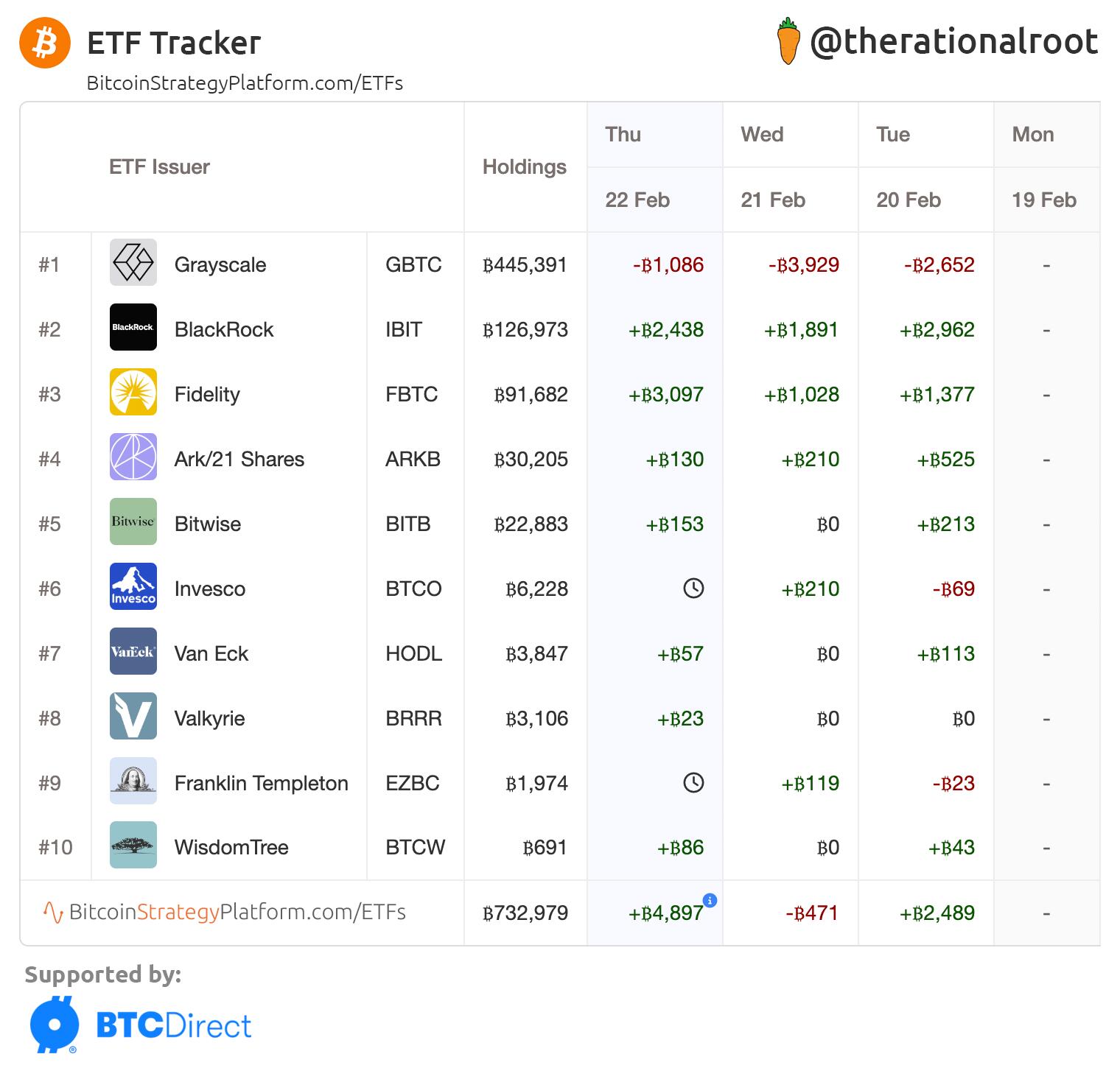

Final day of the week sees a net -2.2k outflow due to heavy GBTC outflows, possibly linked to the Genesis bankruptcy. Reasonable amount of inflows mainly by BlackRock.

Wonder why price plateaued the past 24 hours?

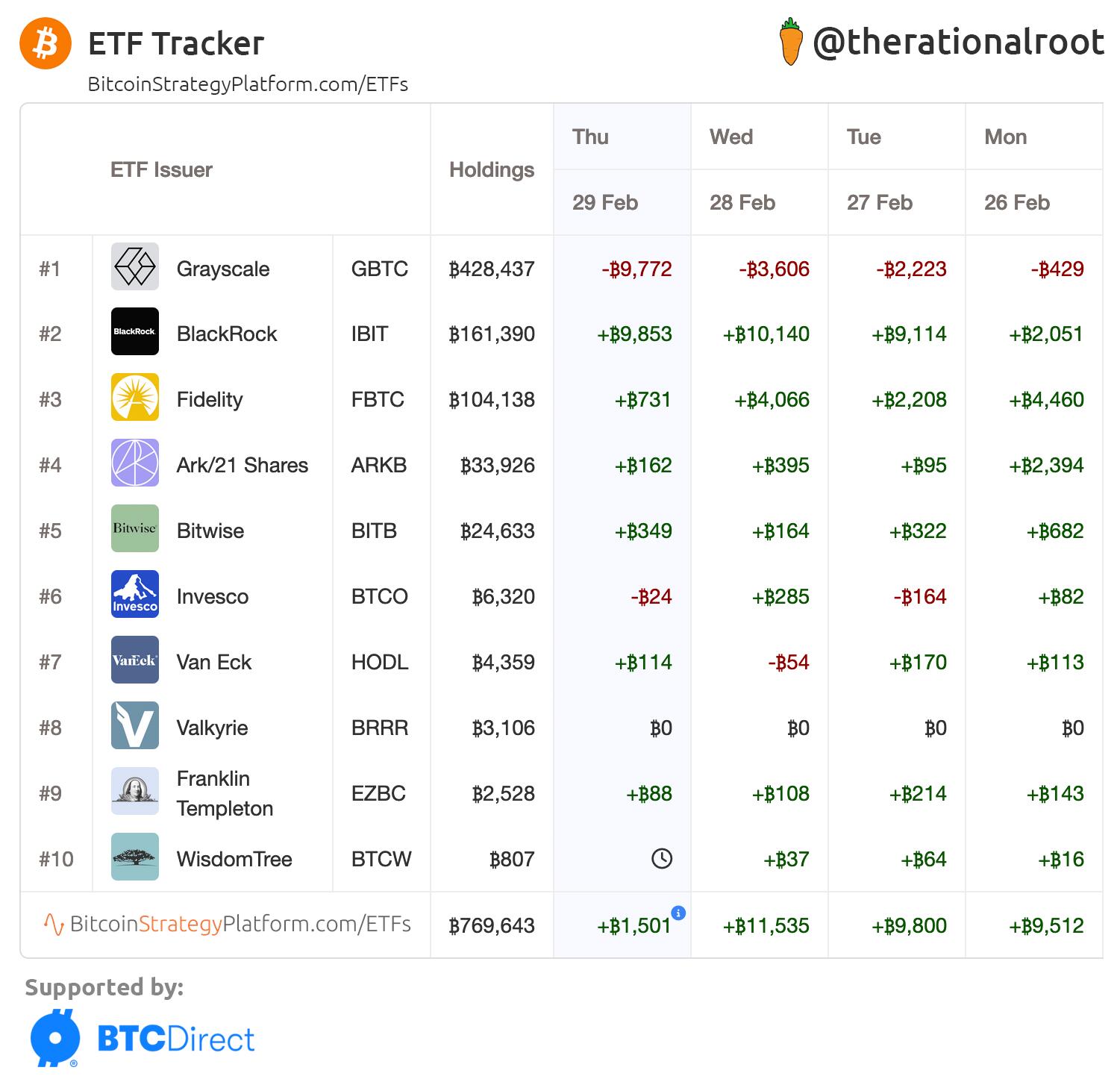

Nearly 10k BTC outflows of Grayscale.

This was offset by mainly BlackRock inflows,

resulting in (only) a net +1.5k BTC inflow.

Outflows of Grayscale are possibly due to the Genesis Bankruptcy (a total of ~25k BTC).

Follow my ETF Tracker for live updates.

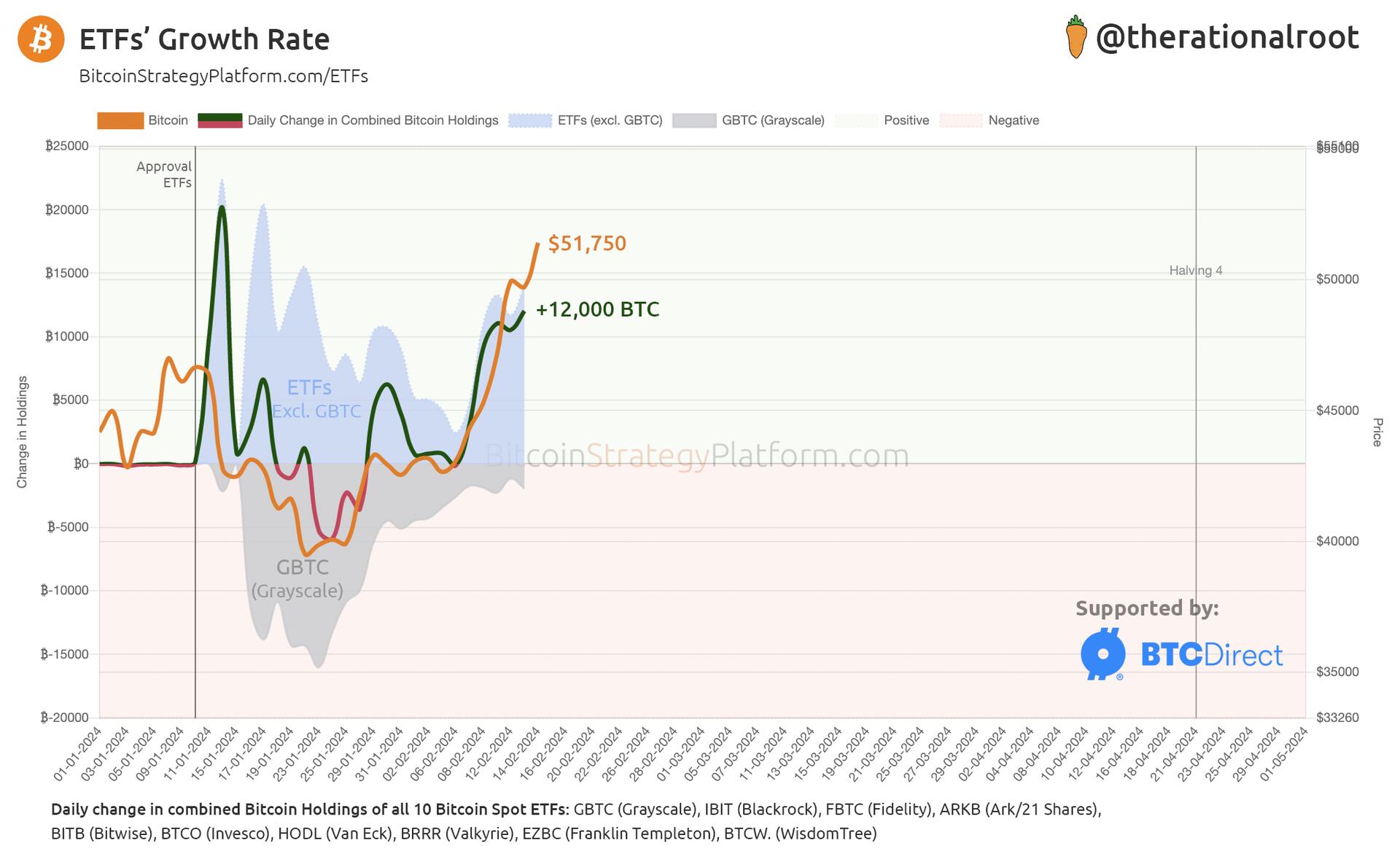

...and another one: +11k #BTC net inflow to ETFs!

-Record-breaking daily inflow to BlackRock: over 10k.

-BlackRock now holds over 150k.

-Fidelity now holds over 100k.

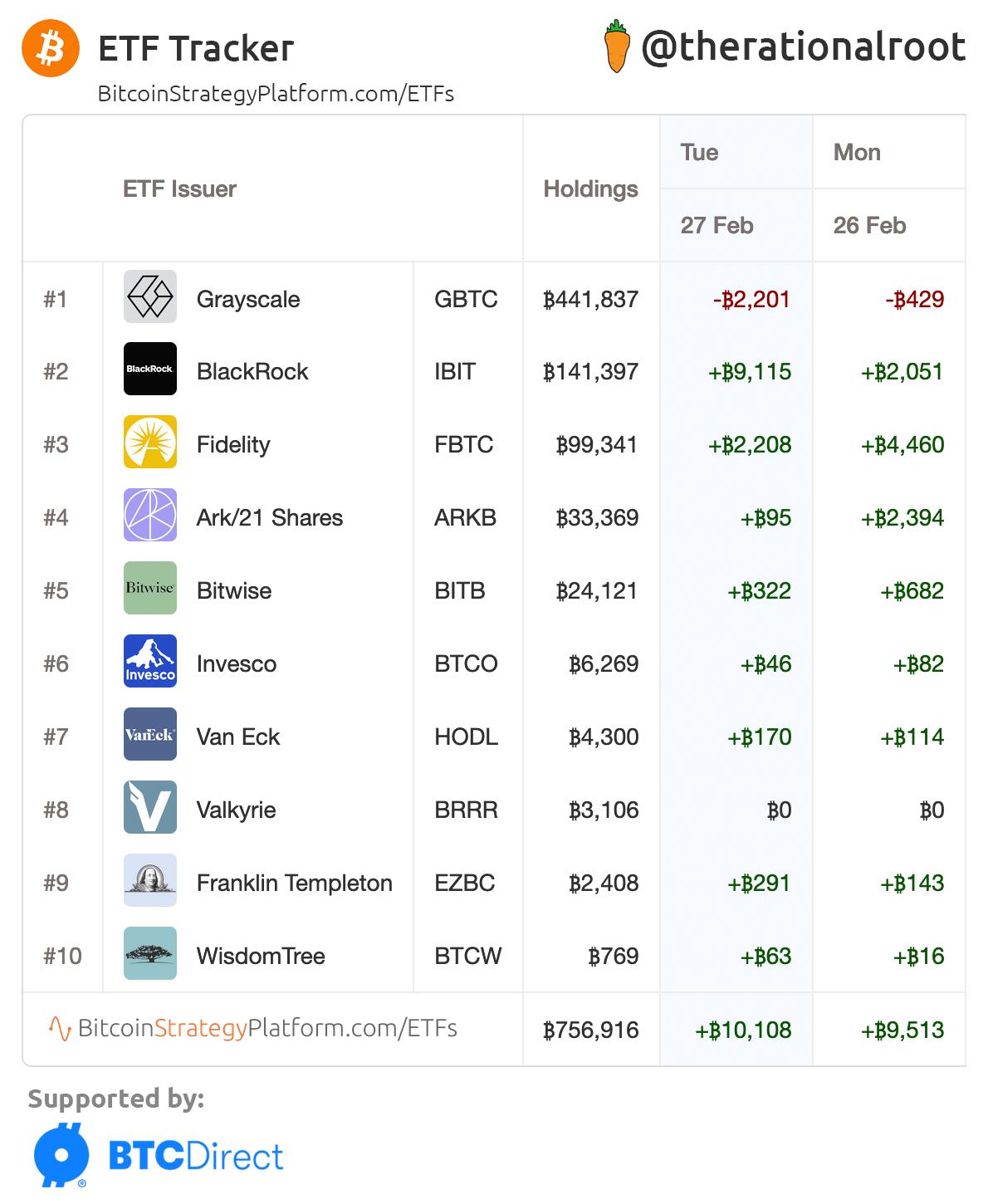

The supply crunch continues: +10k net inflows to ETFs!

#Bitcoin

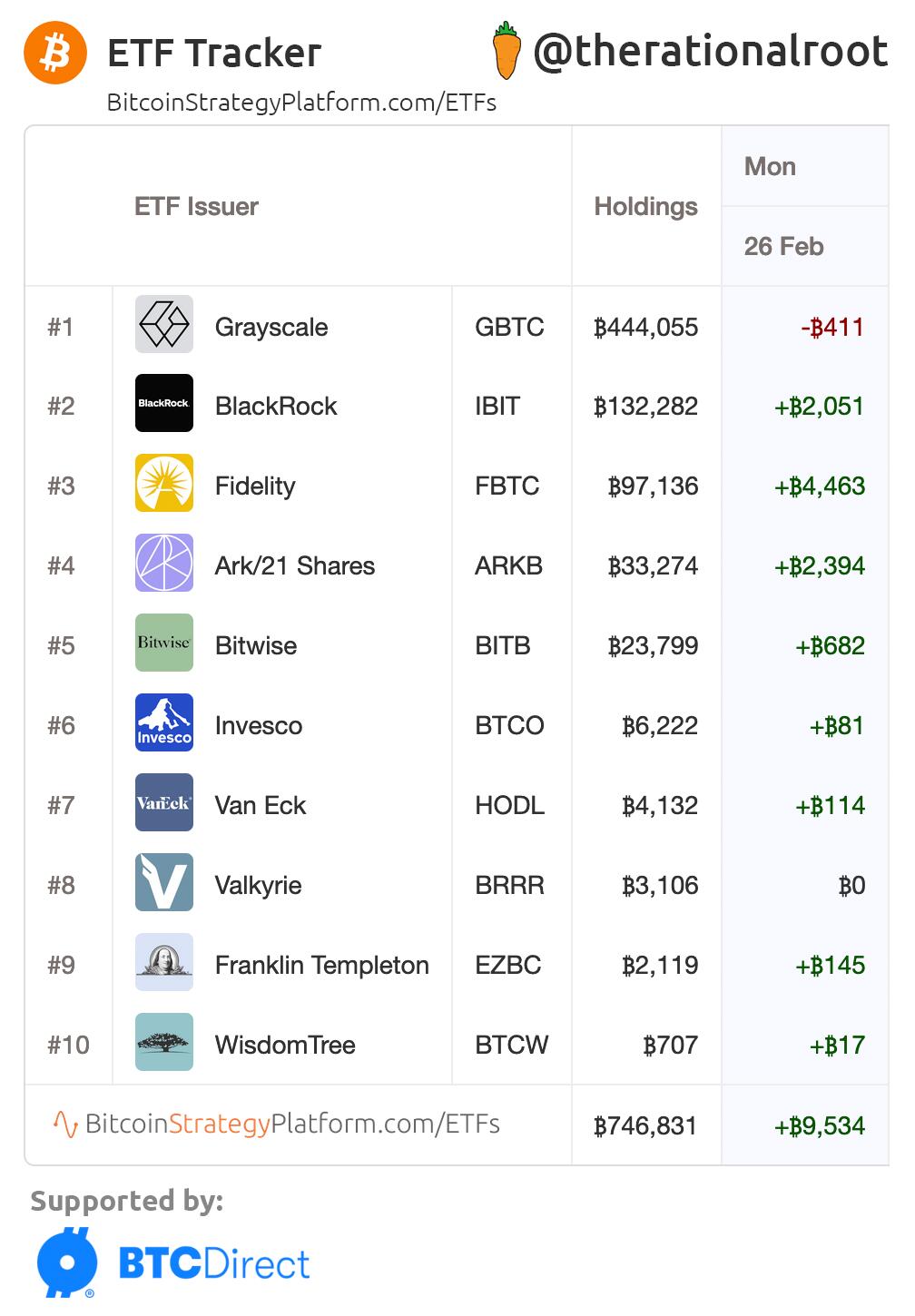

ETFs waking up to digital scarcity, massive day with +9.5k #BTC added to holdings. That is 10x the issuance, and soon Halving coming up. 🤯

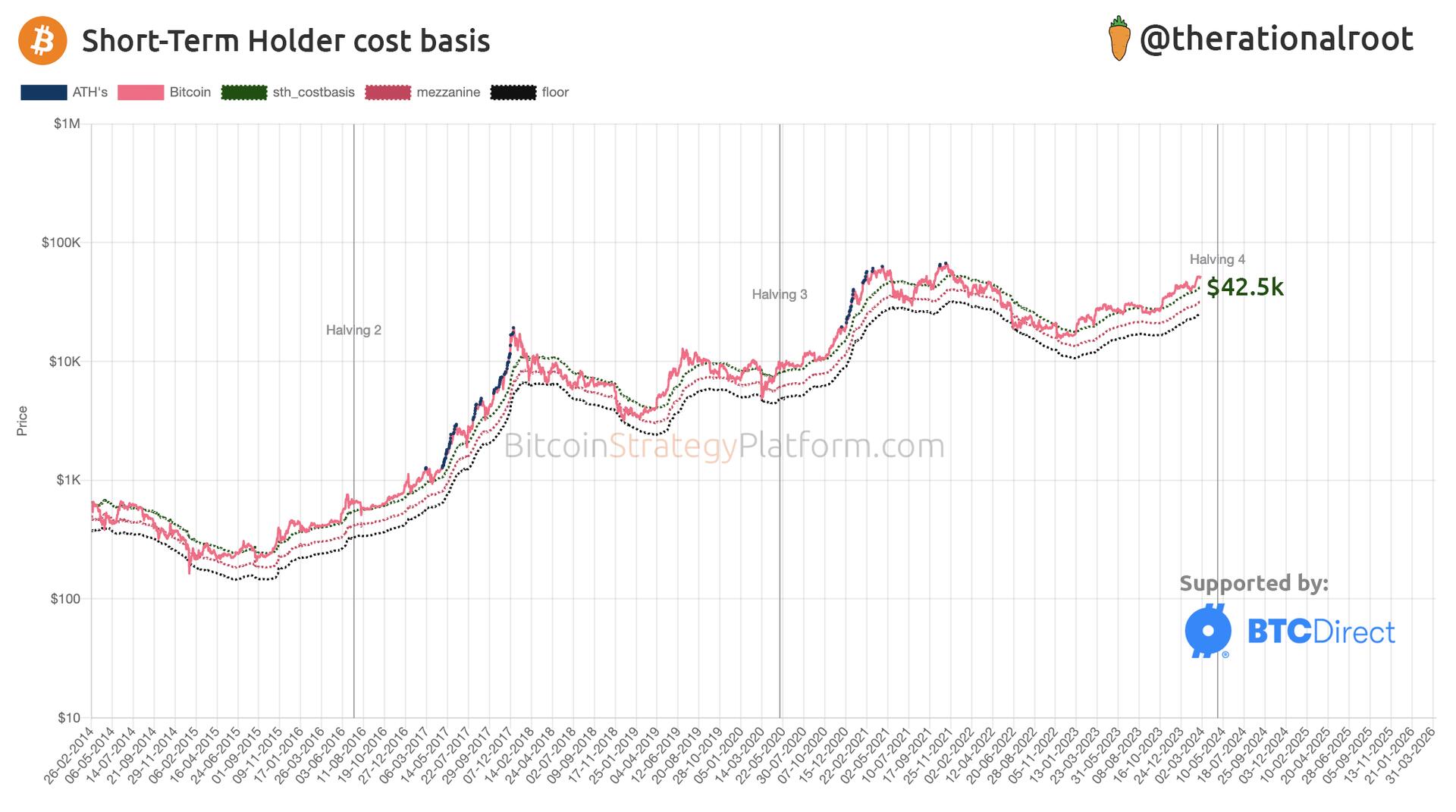

Short-Term Holder cost basis at $42.5k and rising!

#Bitcoin

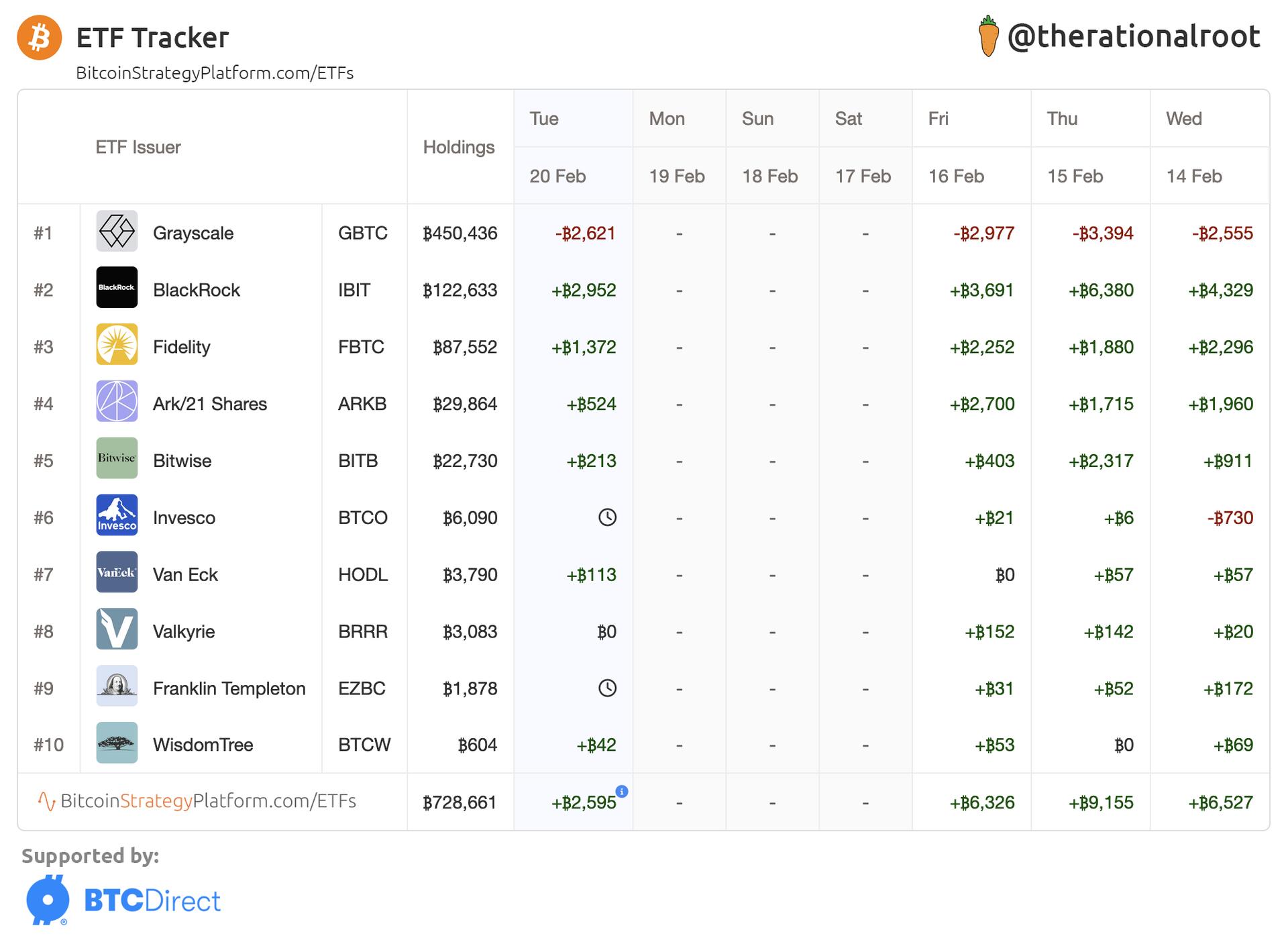

The Bitcoin Strategy ETF Tracker:

We finished the week strong!

ETFs Net Flow, Friday: +4.5k #BTC

+3.2k BlackRock

+1k Fidelity

-0.9k Grayscale

Fastest updates of ETF Holdings at Bitcoin Strategy.

Another massive day for the ETFs:

-Fidelity bigger inflows than BlackRock.

-Reduced outflows of Grayscale.

#Bitcoin

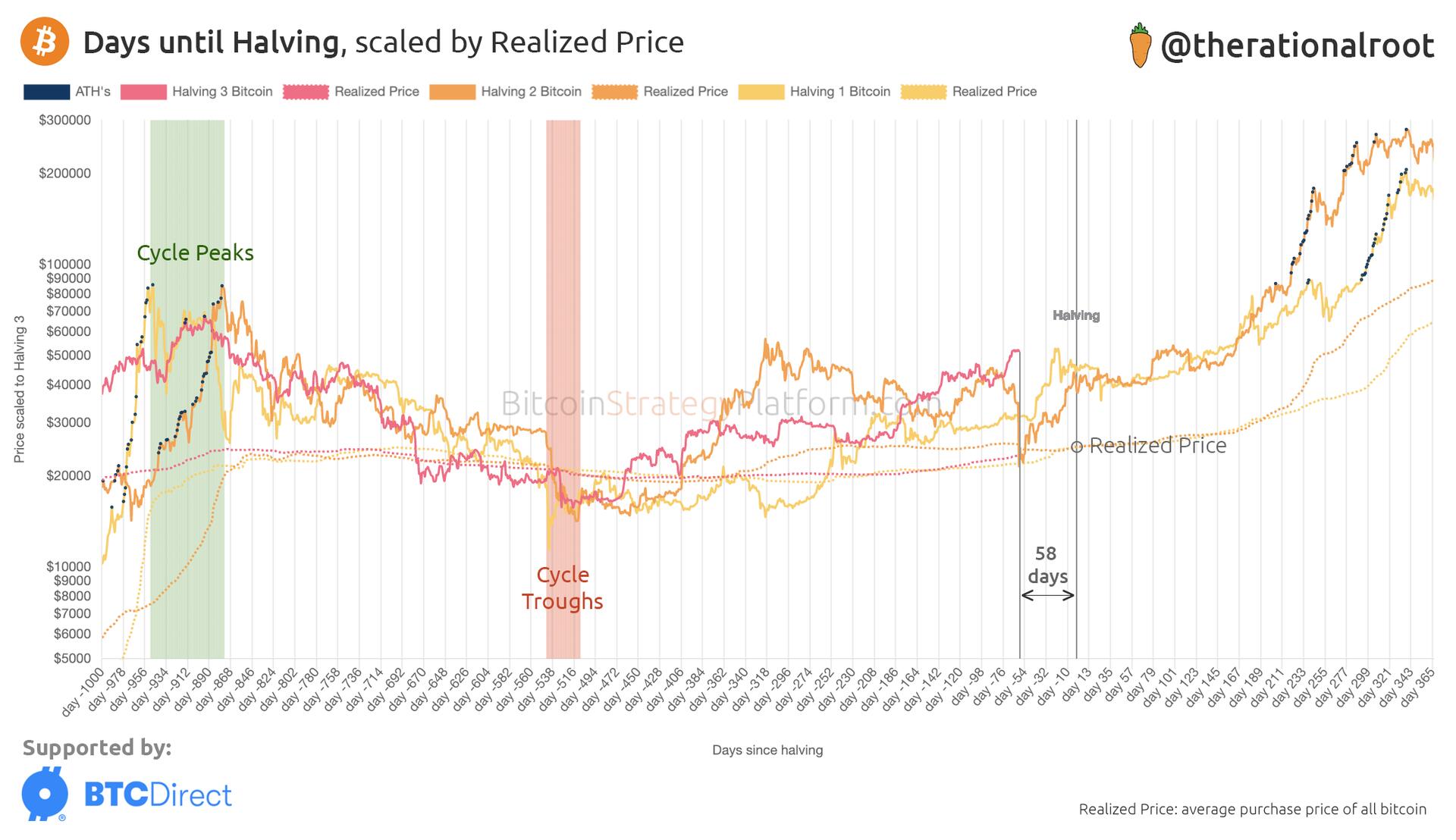

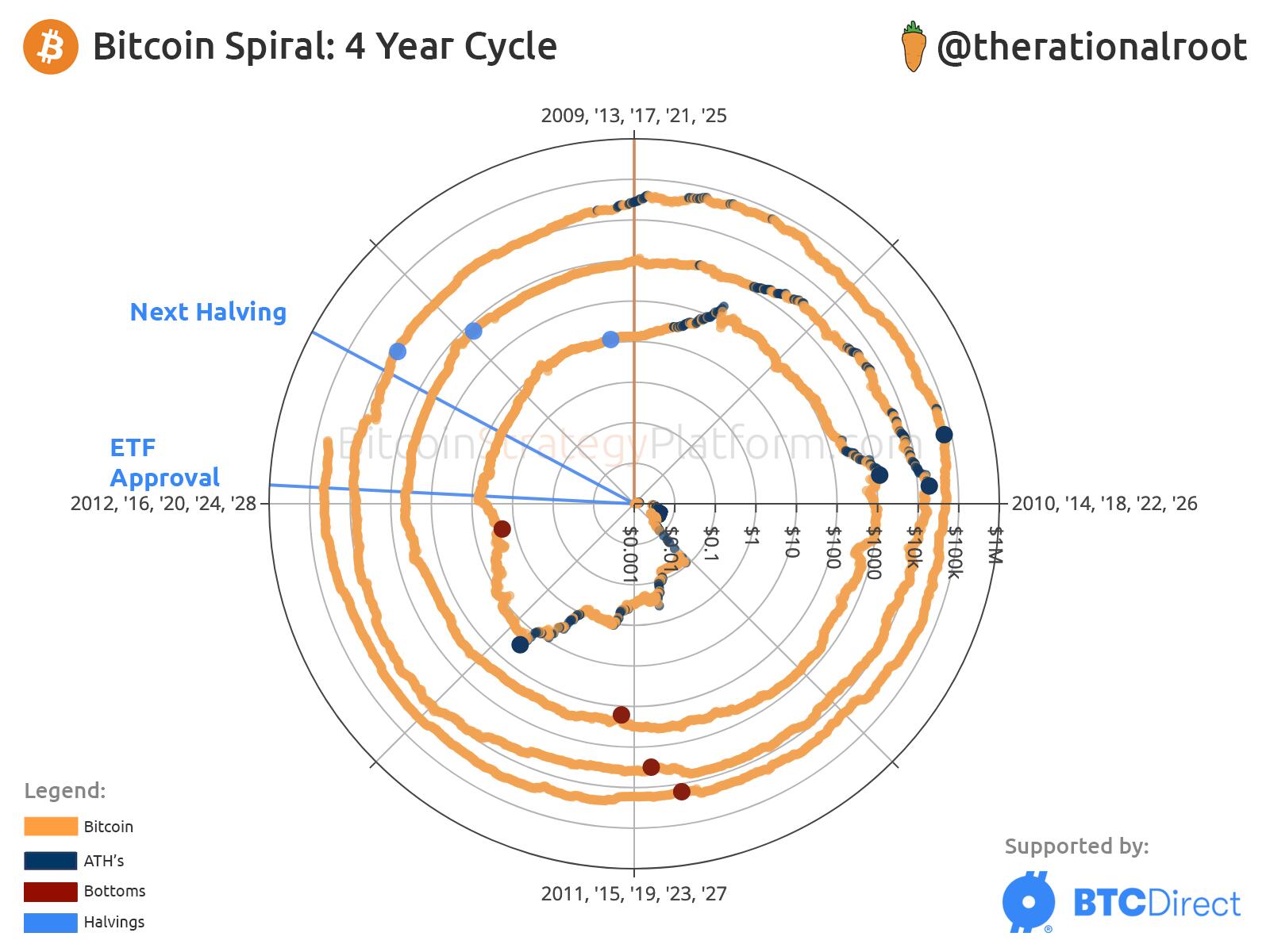

Bitcoin cycle comparison: 58 days until the Halving.

Latest ETF results:

+2.6k BTC added to holdings (half of last Friday)

#Bitcoin

Less than 9k blocks until the next Halving. #Bitcoin

The ETFs are putting us into the next gear, read the latest Bitcoin Strategy newsletter for detailed insight into the effects that can be observed across multiple indicators. 👇

UPDATE: Live ETF Tracker — v2.0 🔥

This week’s data is in:

- ETF Net In-Flows consistently over +6K BTC this week

- Cumulative holdings at All-Time-High of 726K BTC

- Cumulative holdings up 100k BTC since launch

- Blackrock alone added over 30k BTC this week

- Grayscale down 166k since launch

New in ETF tracker v2.0:

✅ Faster availability of data

✅ BTC focused, presenting data that affects the underlying Bitcoin market

✅ Detailed overview + Charts of Holdings + Growth Rate

🥕 Follow the Bitcoin Strategy ETF Tracker for Live Updates, more is coming!

🥕 Check the latest Bitcoin Strategy newsletter below.

#Bitcoin

The Bitcoin Strategy ETF Tracker, no signup needed, though recommended 👇

Enormous ETF inflows, net +12k #BTC were added yesterday.

- BlackRock alone saw a 10k btc inflow, and now surpassed 100k btc in holdings 🤯.

- Biggest outflows were from Grayscale (1.9k) and Invesco (~500 btc).

- Three consecutive days over +10k net inflows.

Follow me for more ETF news 👊

Wall Street waking up to the curve of this line. #Bitcoin

Read more in today's Bitcoin Strategy newsletter:

-Bitcoin toolset

-ETFs’ inflows

-Resistance levels

-Genesis 1.2B in GBTC shares

https://www.bitcoinstrategyplatform.com/news/correlation-etfs-flows