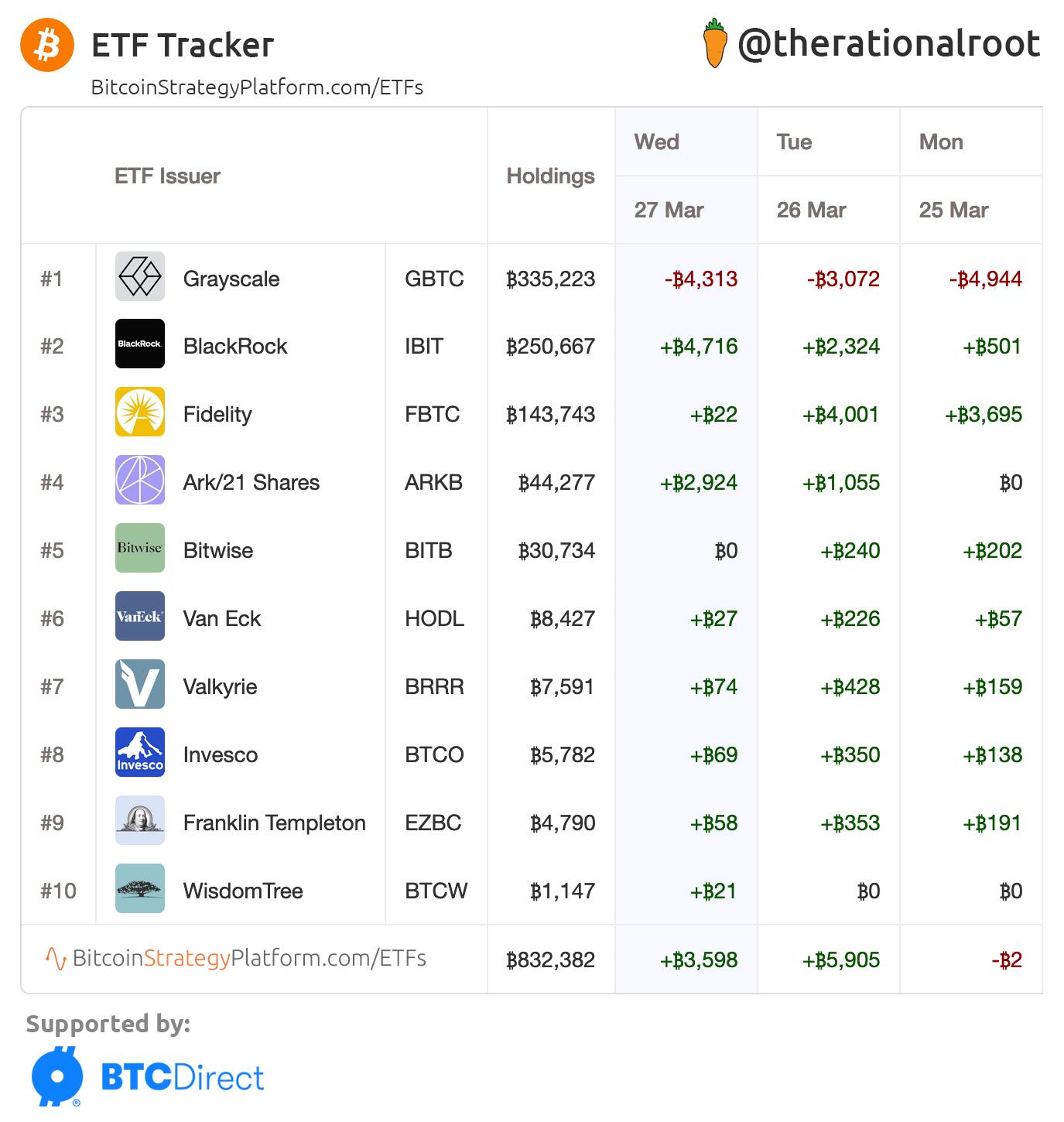

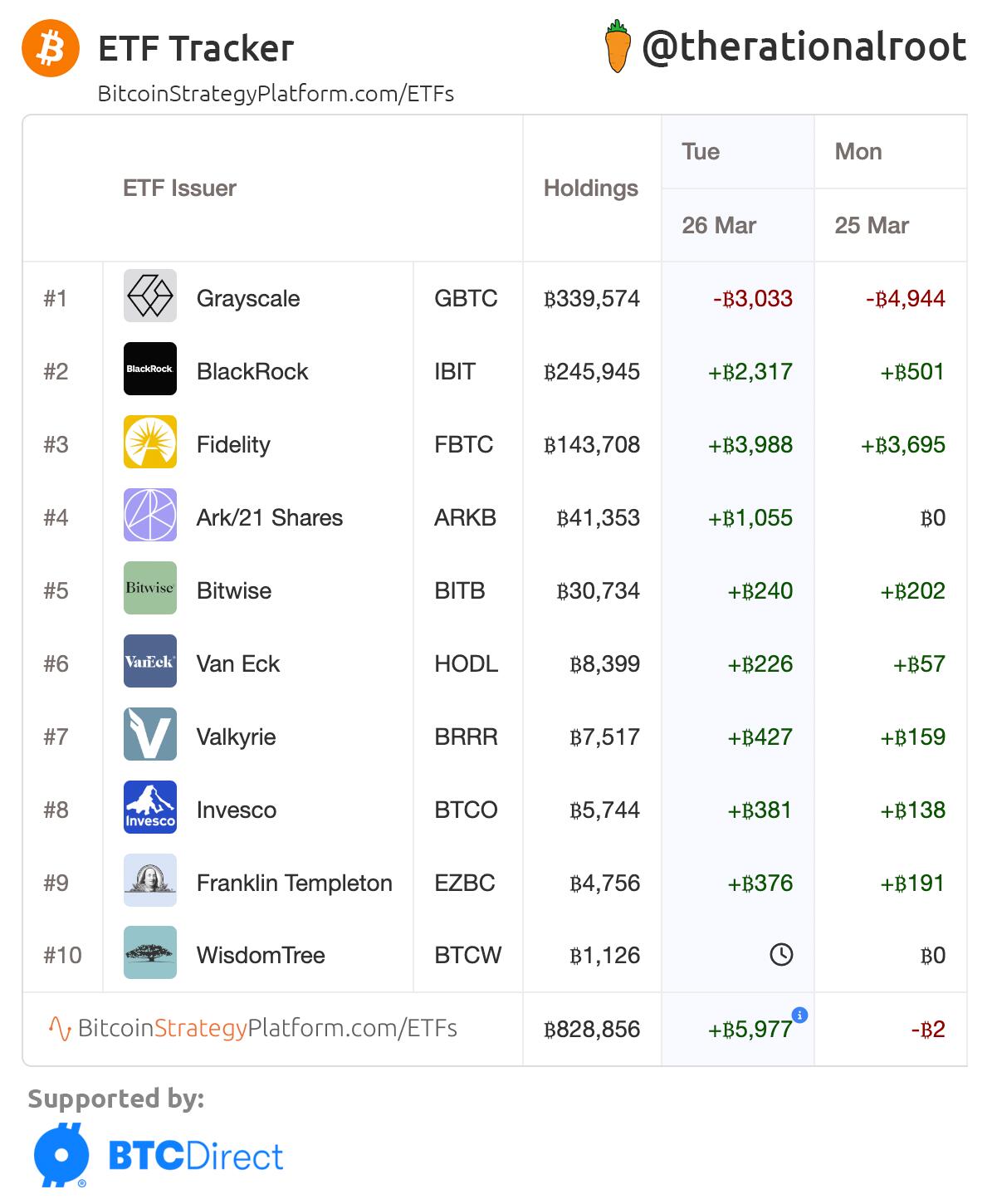

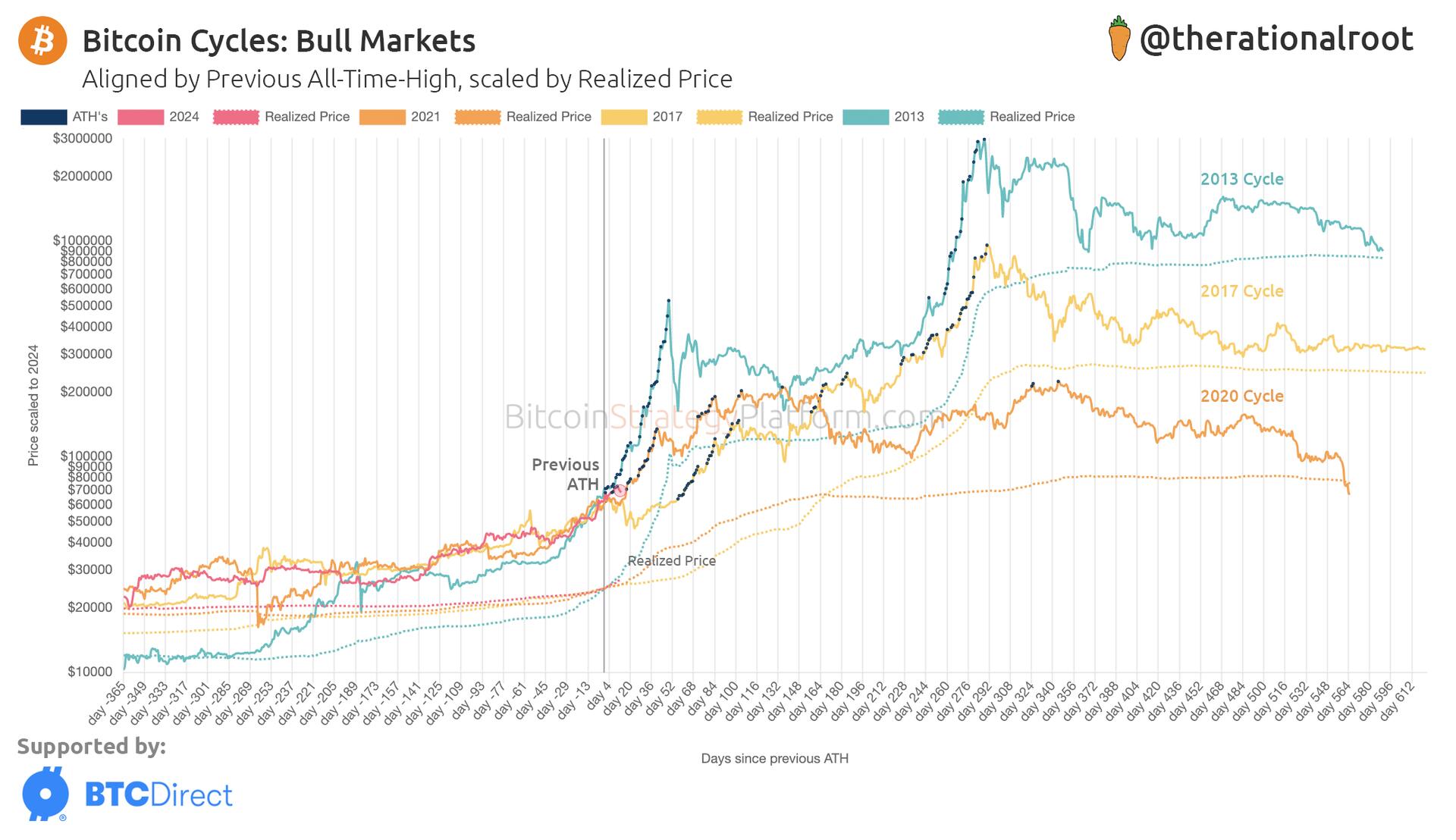

Significant ETF inflows are back, noticeable pressure on price, and people are still bearish. Also, BlackRock reached 250k BTC in AUM.

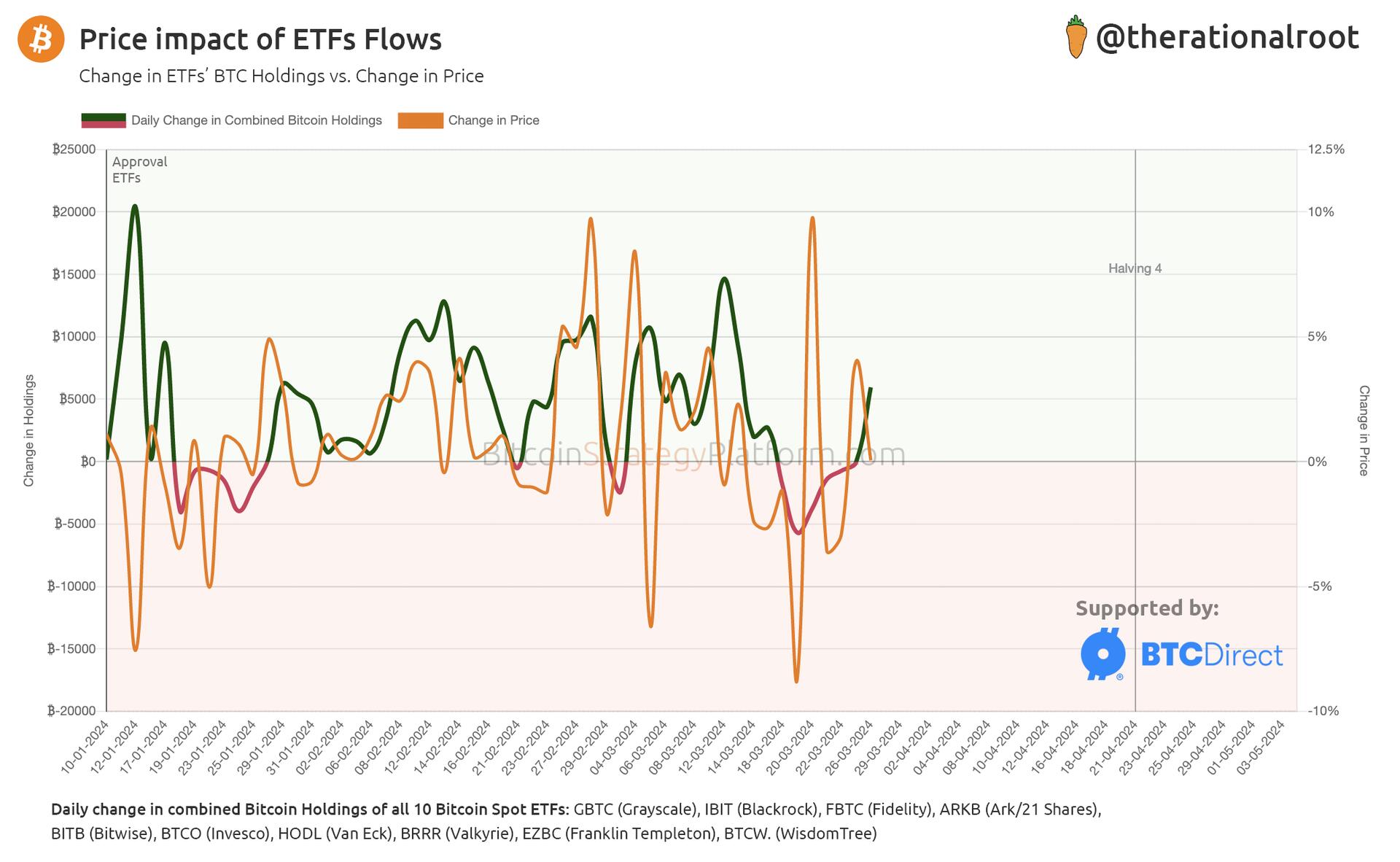

Read more about the impact of ETF flows on price in the last Bitcoin Strategy newsletter. Subscribe to receive timely insights! 👇

https://www.bitcoinstrategyplatform.com/news/the-price-impact-of-etfs-flows

Price impact of ETFs Flows:

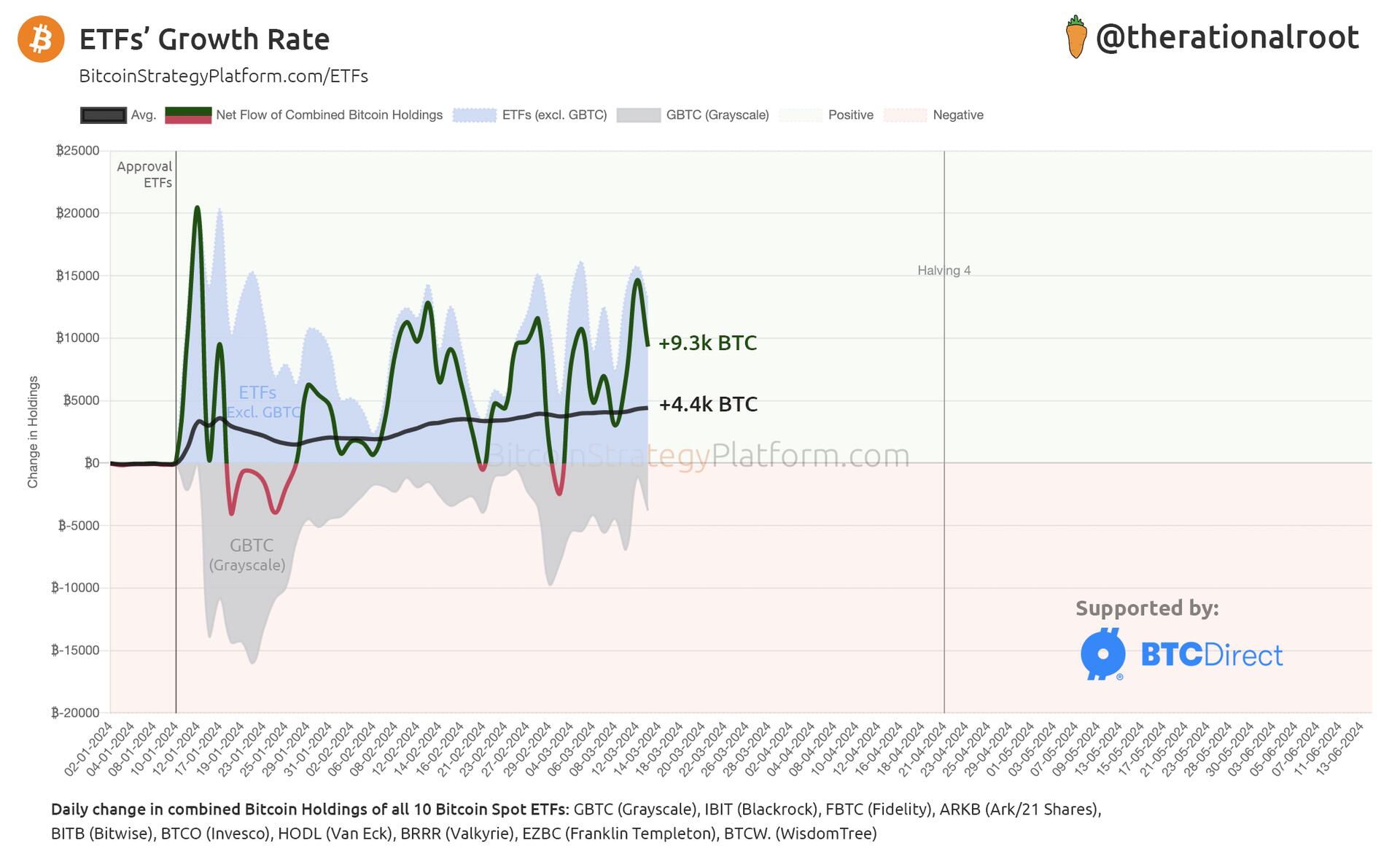

ETF flows are a major driver, below the change in cumulative BTC holdings vs. the change in price.

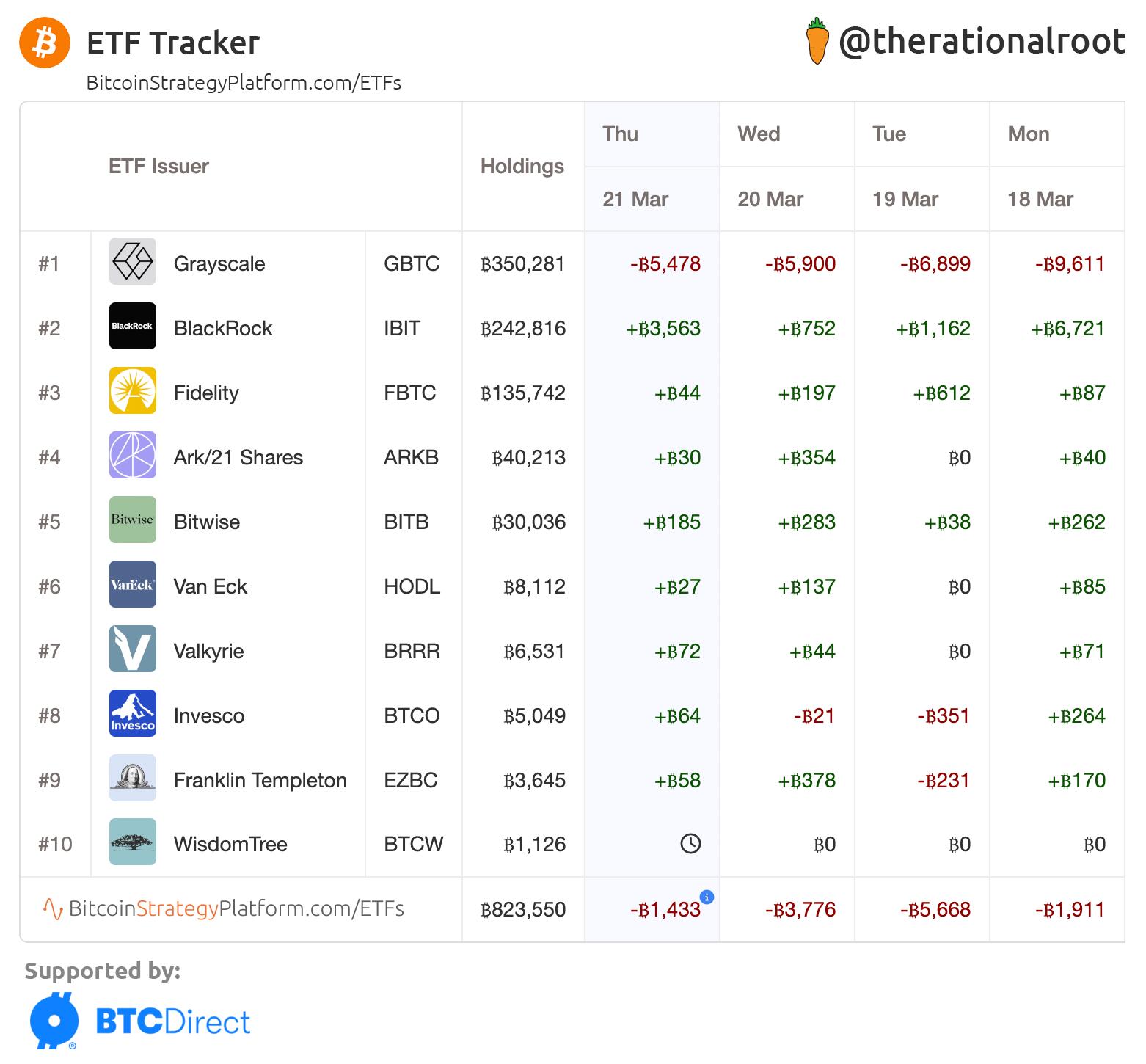

ETF Inflows are back! Looking forward to what today brings! #Bitcoin

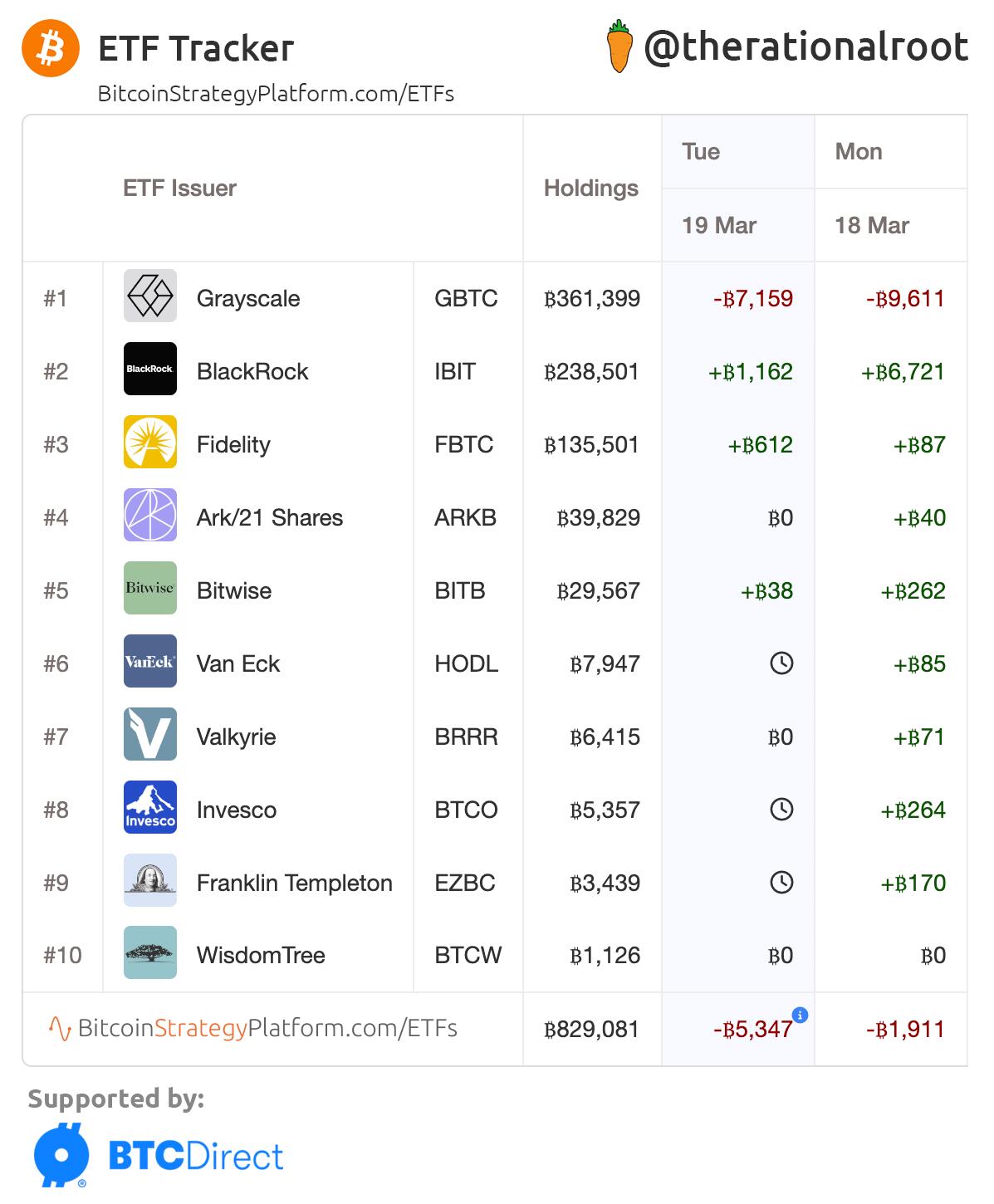

Outflows continue at Grayscale but are offset by Fidelity and other ETFs. With markets closed over the weekend and a neutral start to the week, Bitcoin has maintained its upward trajectory. #Bitcoin

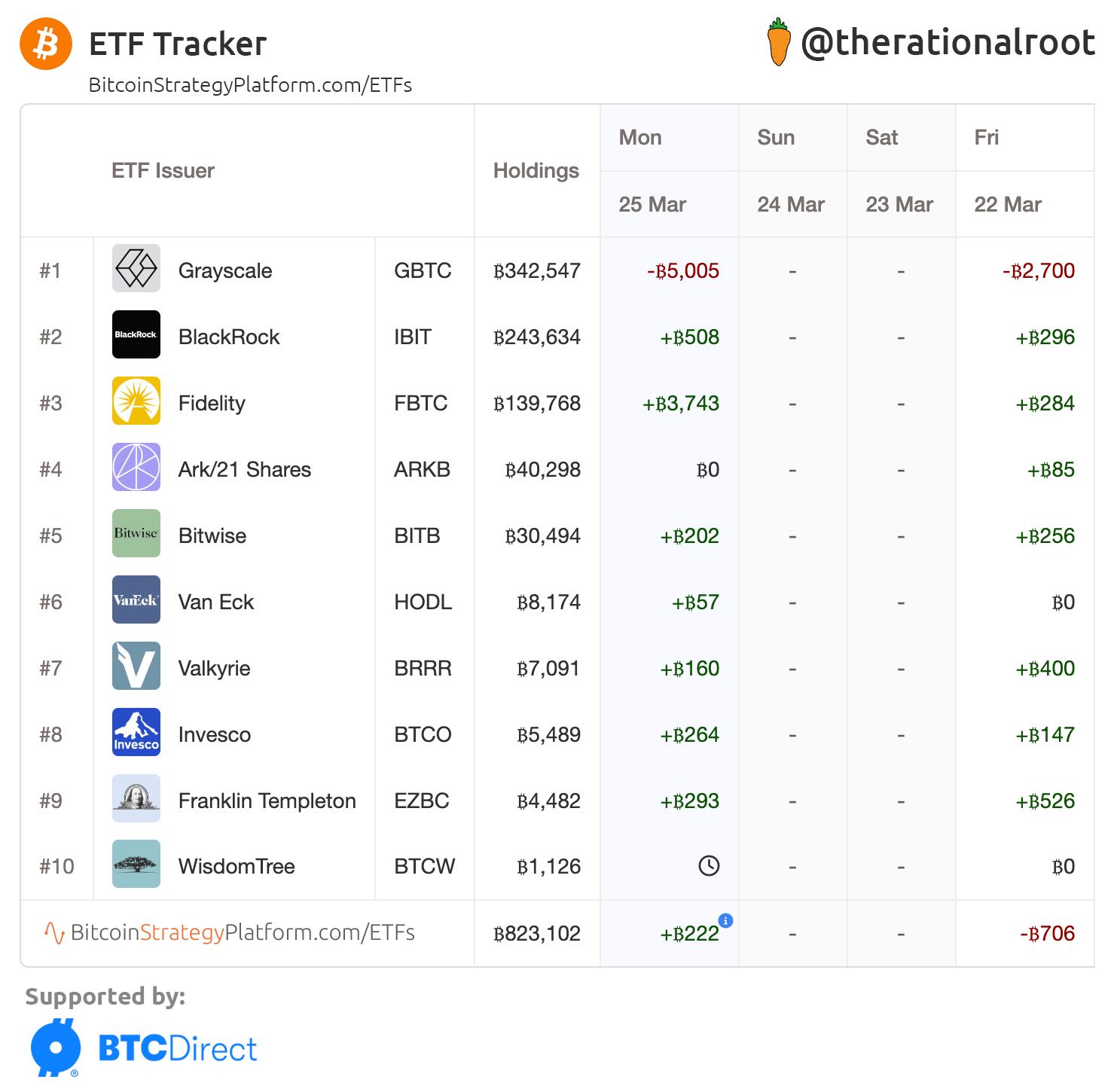

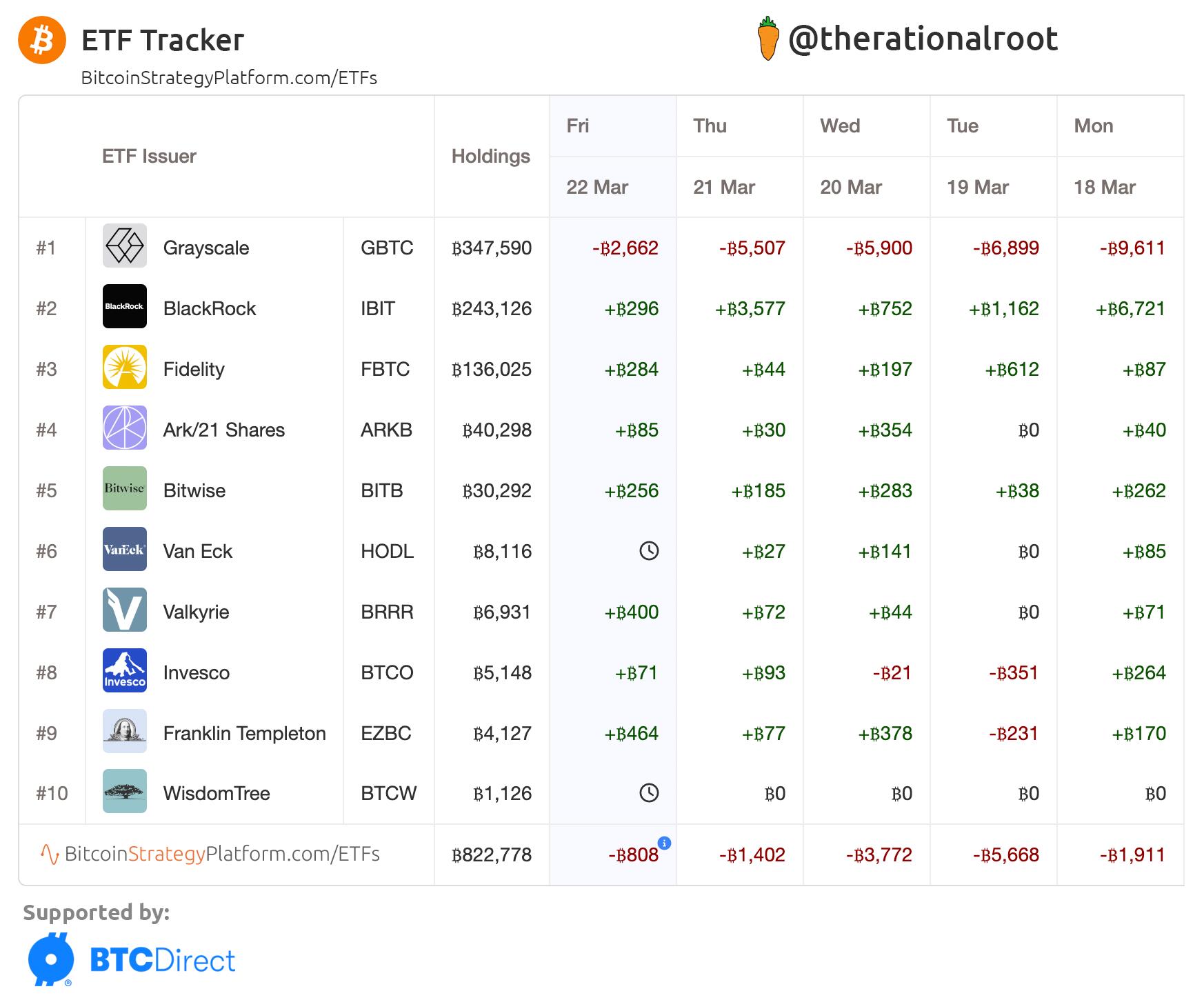

Full week of net outflows due to Grayscale and reduced inflows. BlackRock will flip Grayscale within a couple of weeks.

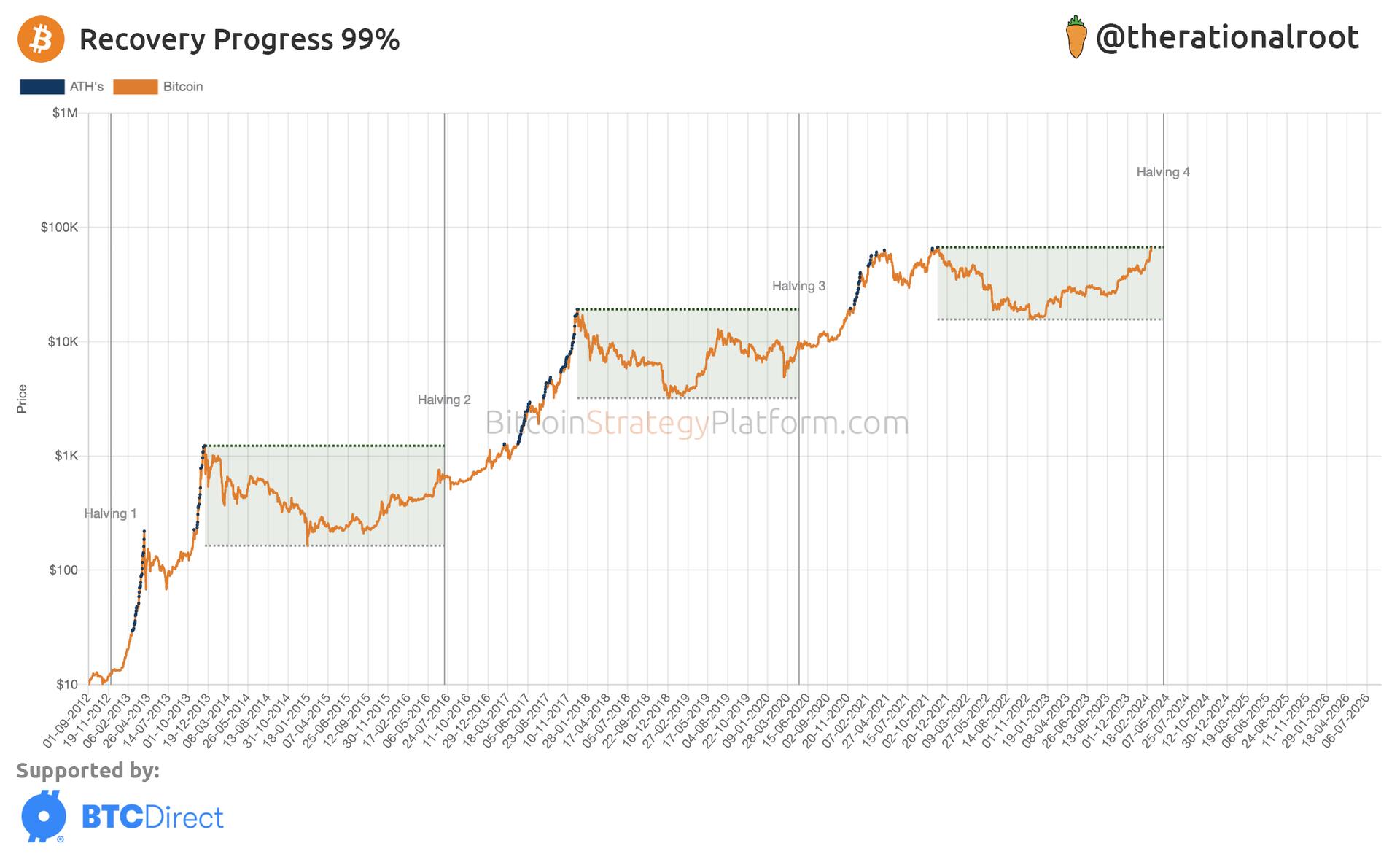

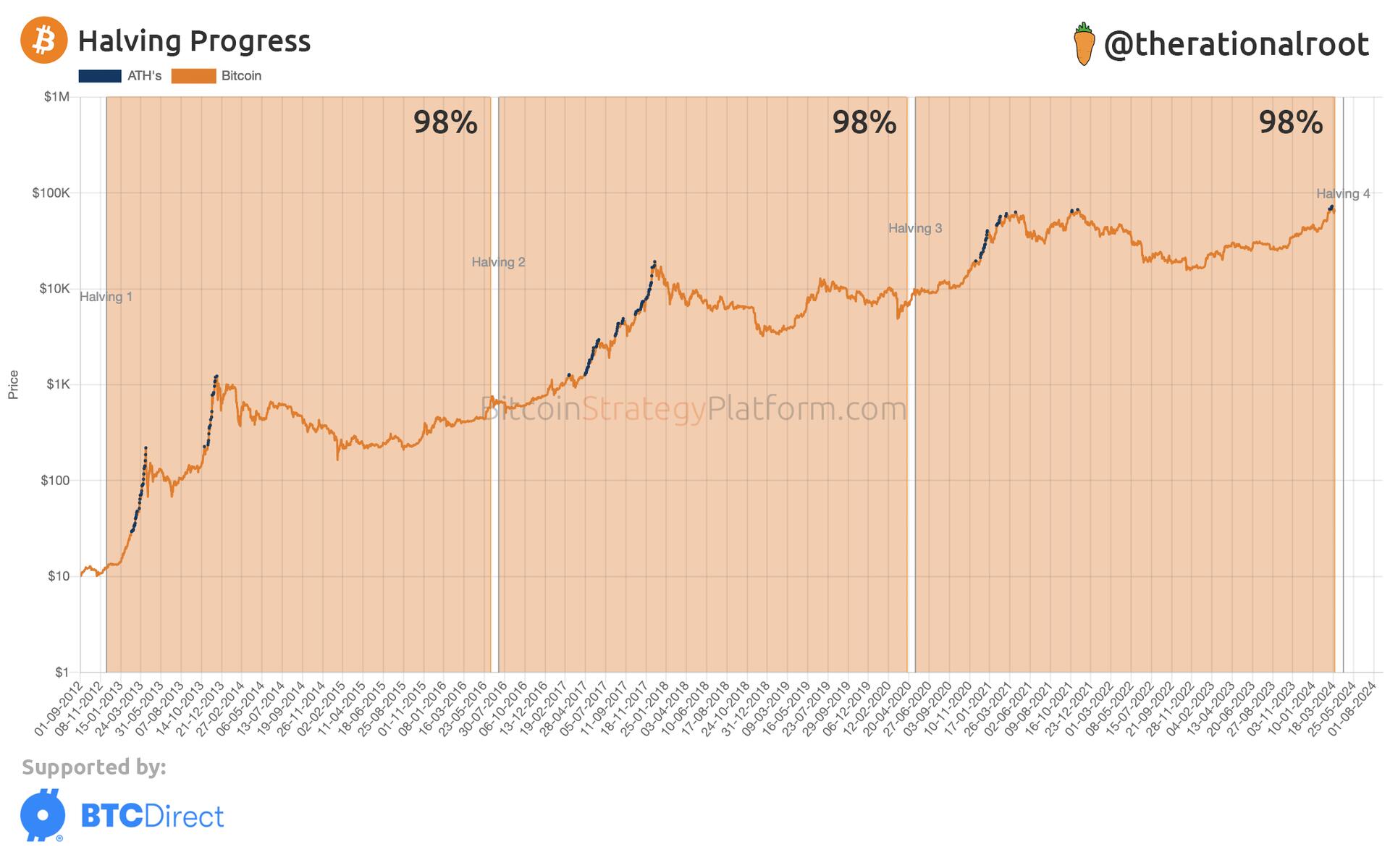

Halving progress 98%. #Bitcoin

Outflows out of grayscale continue, but more importantly, during this dip, the 9 other ETFs have shown consistent inflows.

ETFs update: Yesterday, we saw a large net outflow of 5.3k #BTC, obviously contributing to the $5k drawdown in price.

Important observation: yesterday's numbers show Grayscale outflows did not rotate into BlackRock.

Giant GBTC outflows, 9.5k #BTC.

Since ETF approval, 250,000 BTC have flowed out of Grayscale. This substantial sell pressure was mostly offset by other ETFs' inflows. We were overdue for a pullback, and yesterday, and likely today, outflows are in charge.

Nonetheless, large inflows to BlackRock!

Read more in the latest Bitcoin Strategy newsletter 👇

https://www.bitcoinstrategyplatform.com/news/100k-before-the-halving

$100k before the Halving?

Pack it up guys, it's over. #Bitcoin crashed.

Avg. ETFs Net Inflow: +4.4k BTC/Day 🤯

Order of magnitude of 1st Halving.

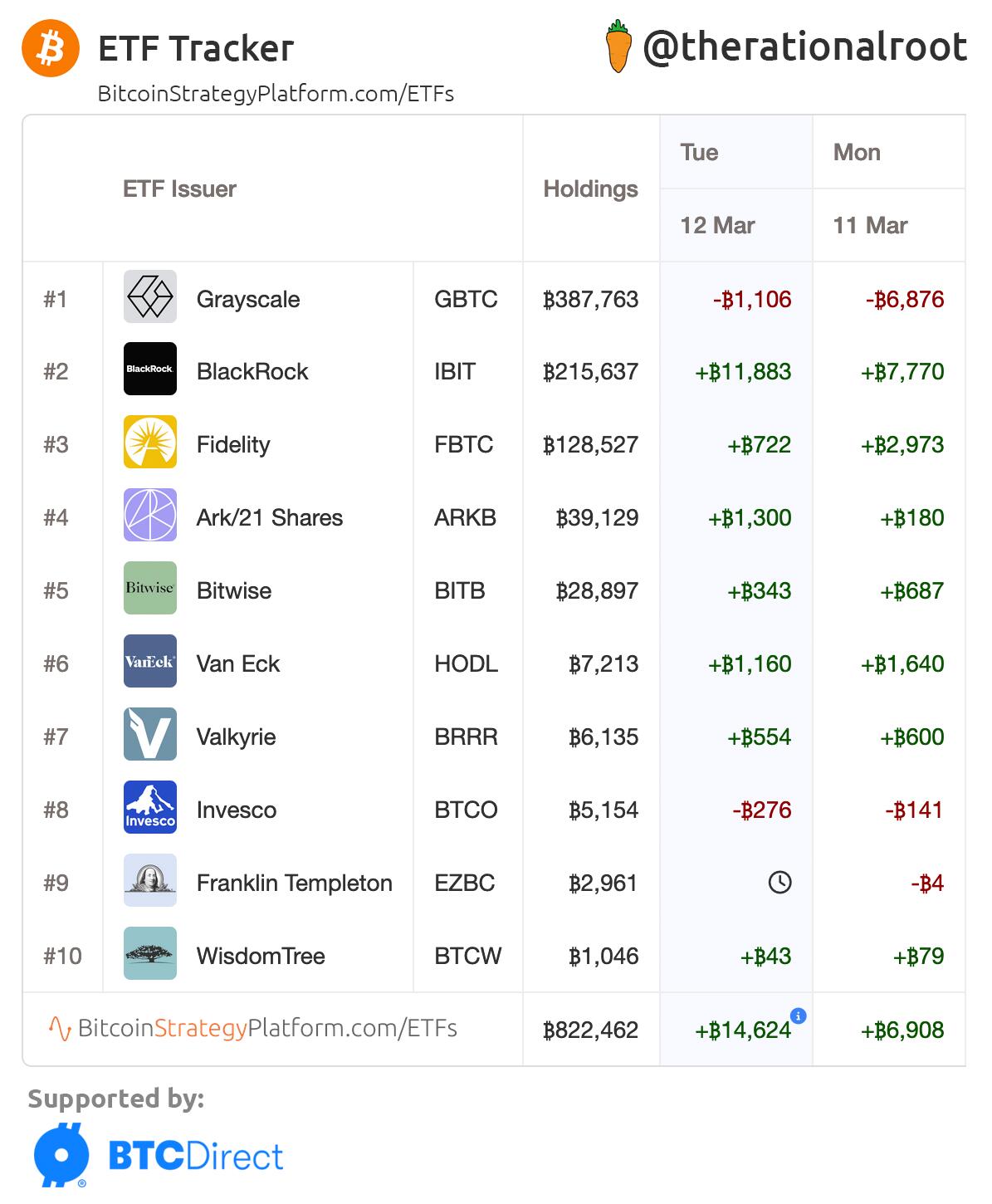

ETFs Net Inflow: +14.6k BTC

-Massive inflows to BlackRock: +11.9k!

-Reduced outflows of Grayscale 👀

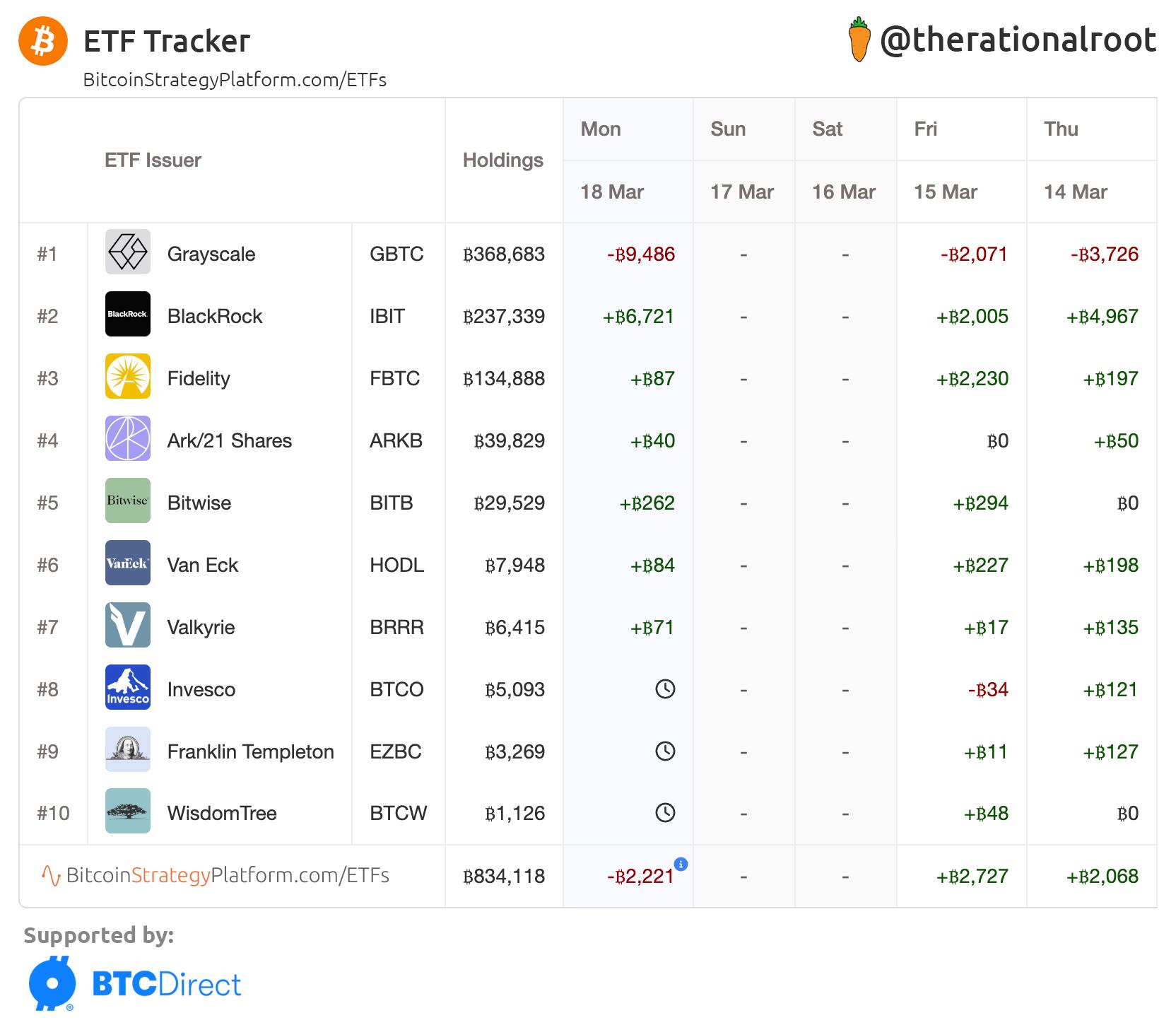

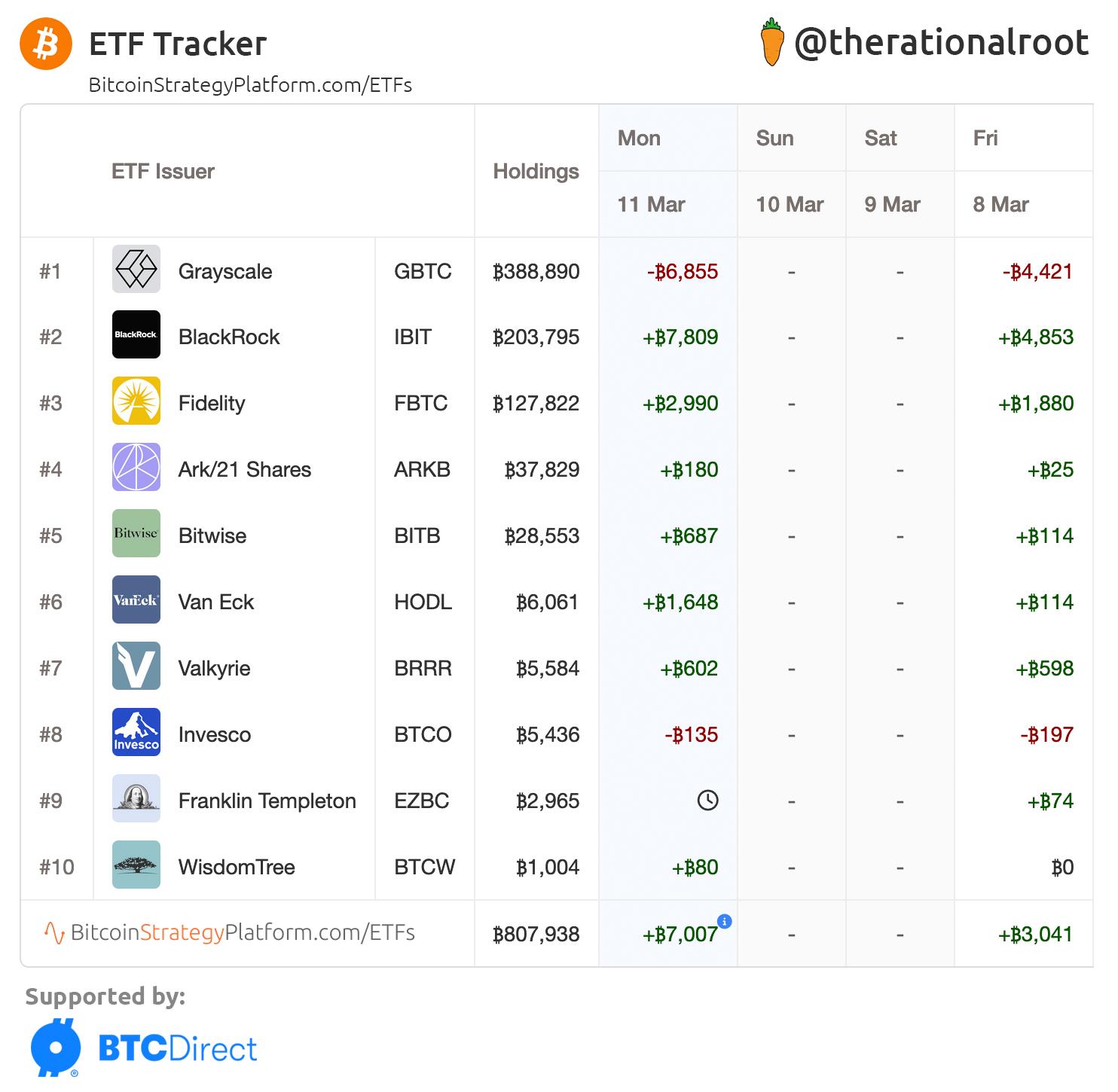

Strong start of the week for ETFs: net inflow of +7k #BTC

-Cumulative holdings crossed 800k BTC.

-BlackRock's now holds over 200k BTC.

-Grayscale dropped below 400k BTC.

-Large inflow to Van Eck due to year-long zero fees.

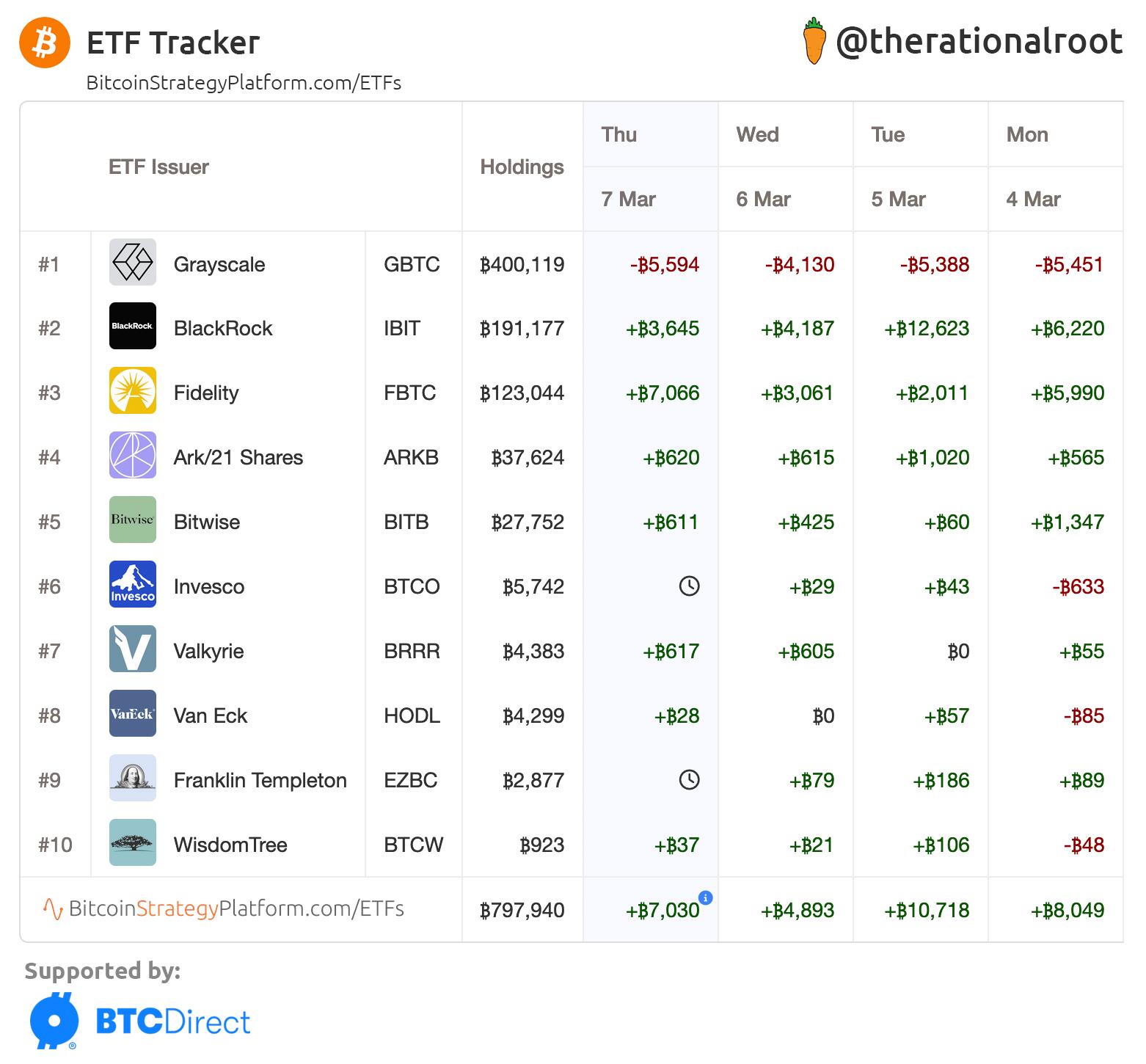

+7k BTC Net Inflow to ETFs: Fidelity records its biggest inflow yet, while Grayscale sees continued outflows.

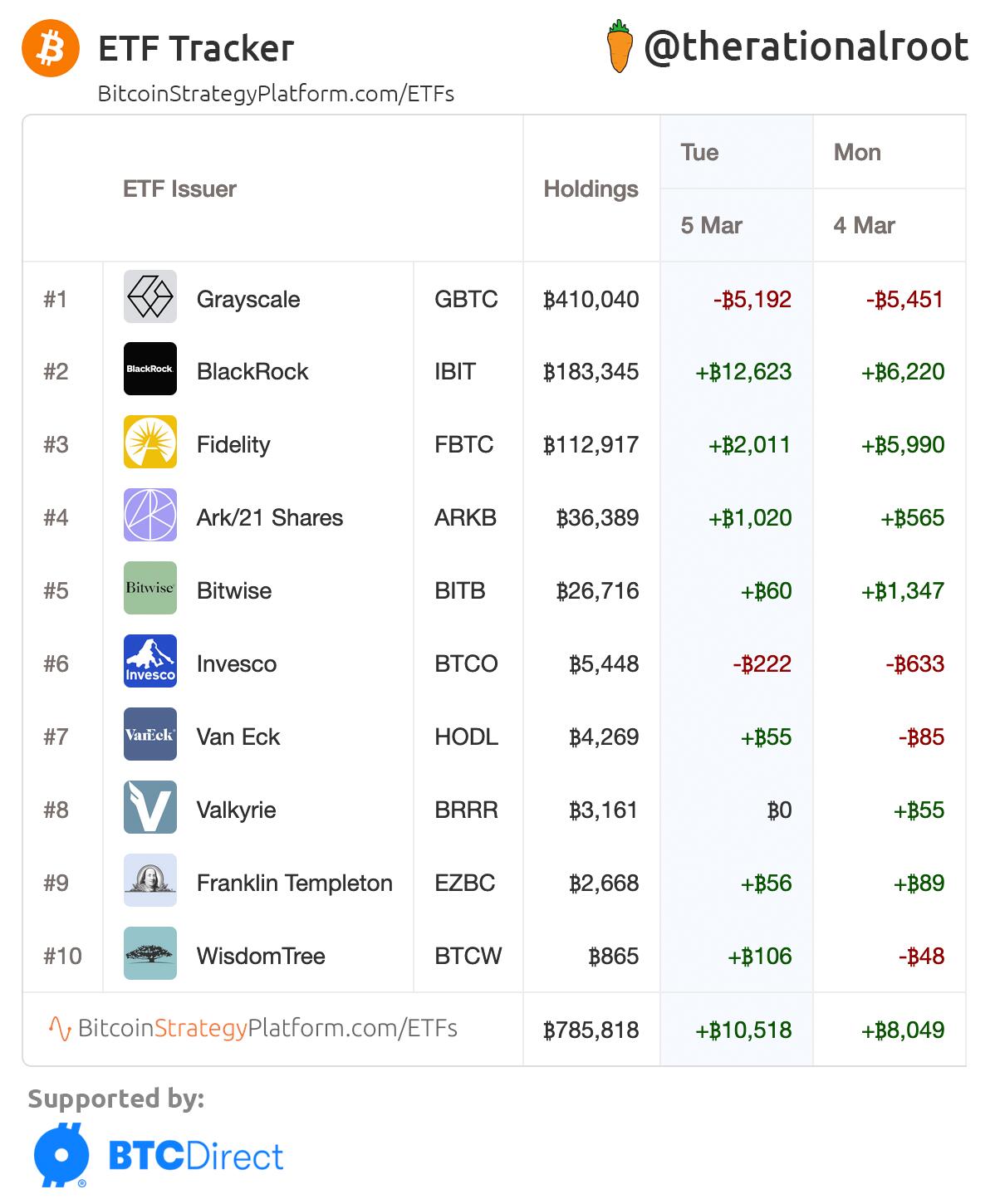

Net inflow of +10.5k #BTC to ETFs.

BlackRock's largest inflow to date, +12.6k!

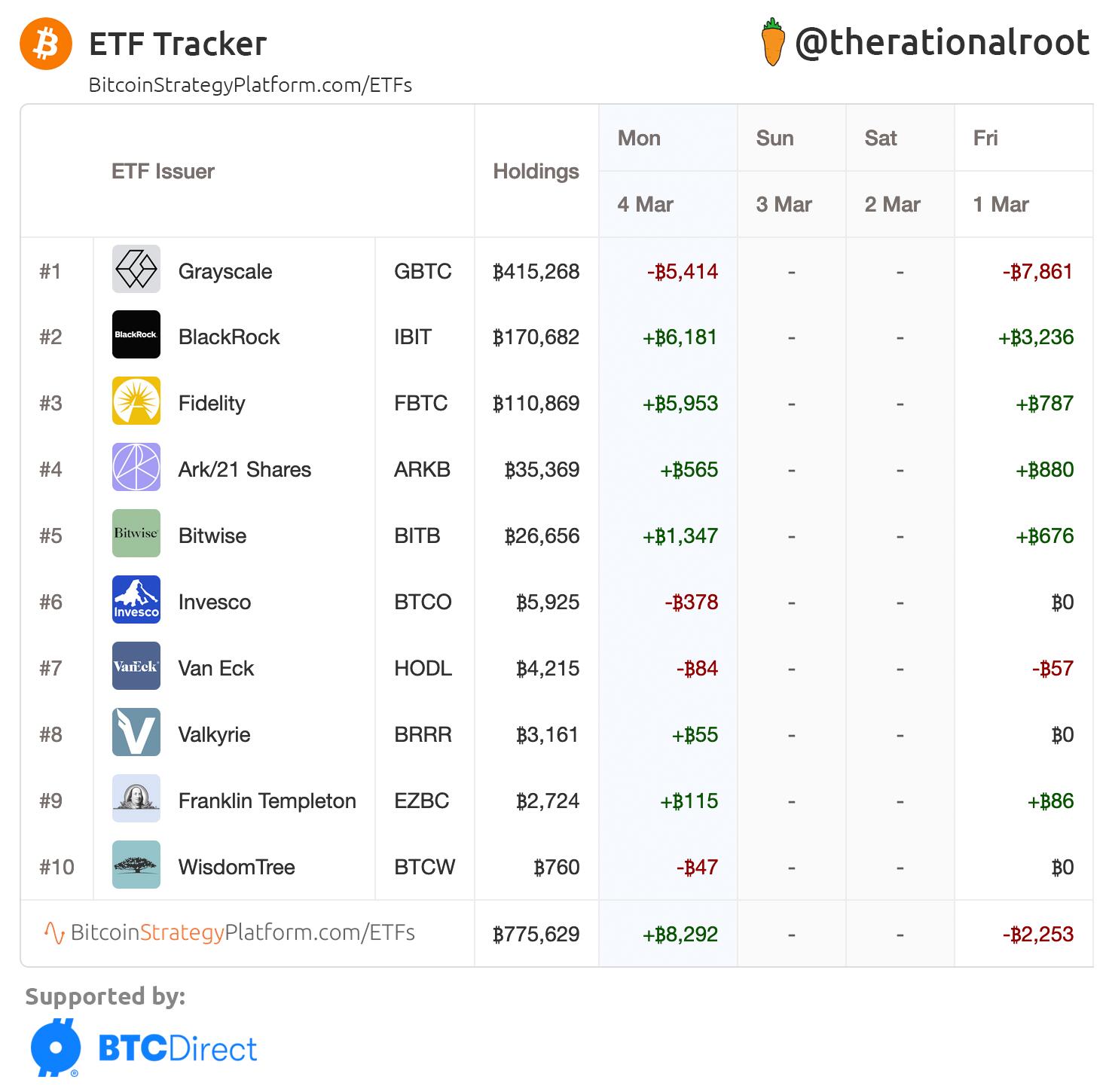

ETFs net inflow 8.3k #BTC

Despite substantial Grayscale outflows, likely due to the Genesis bankruptcy, BlackRock and Fidelity easily offset these outflows!

Recovery Progress 99%. #Bitcoin