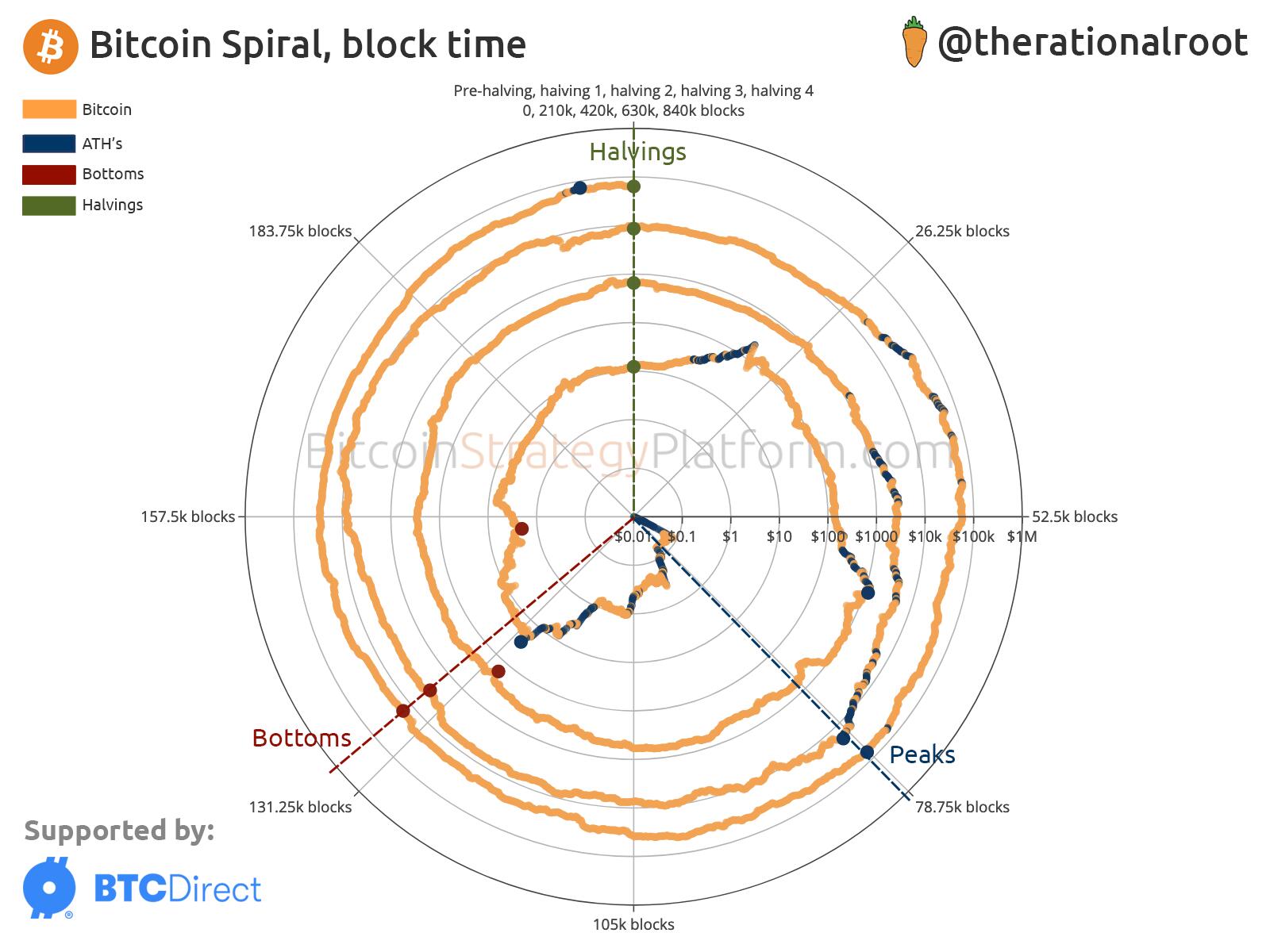

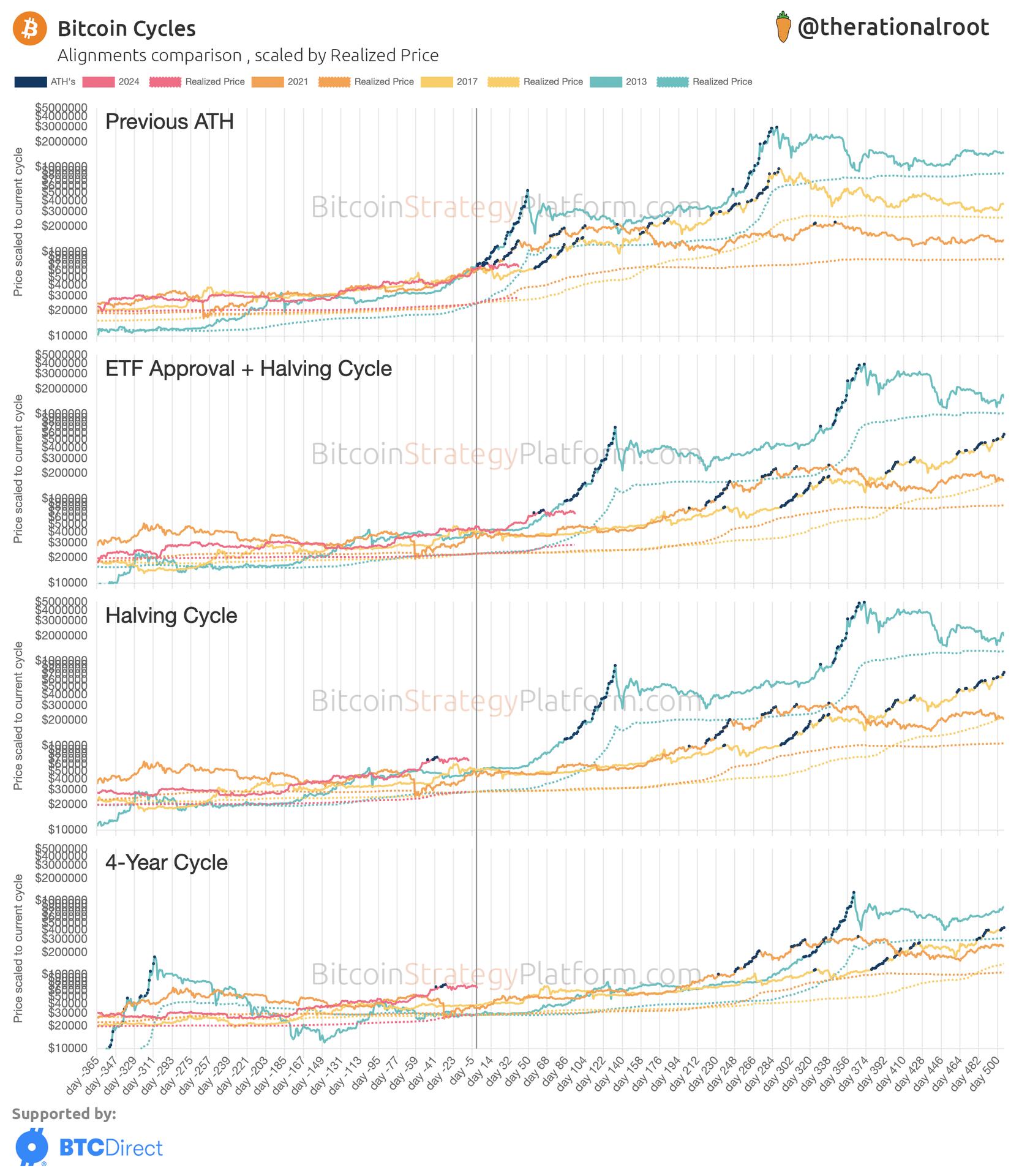

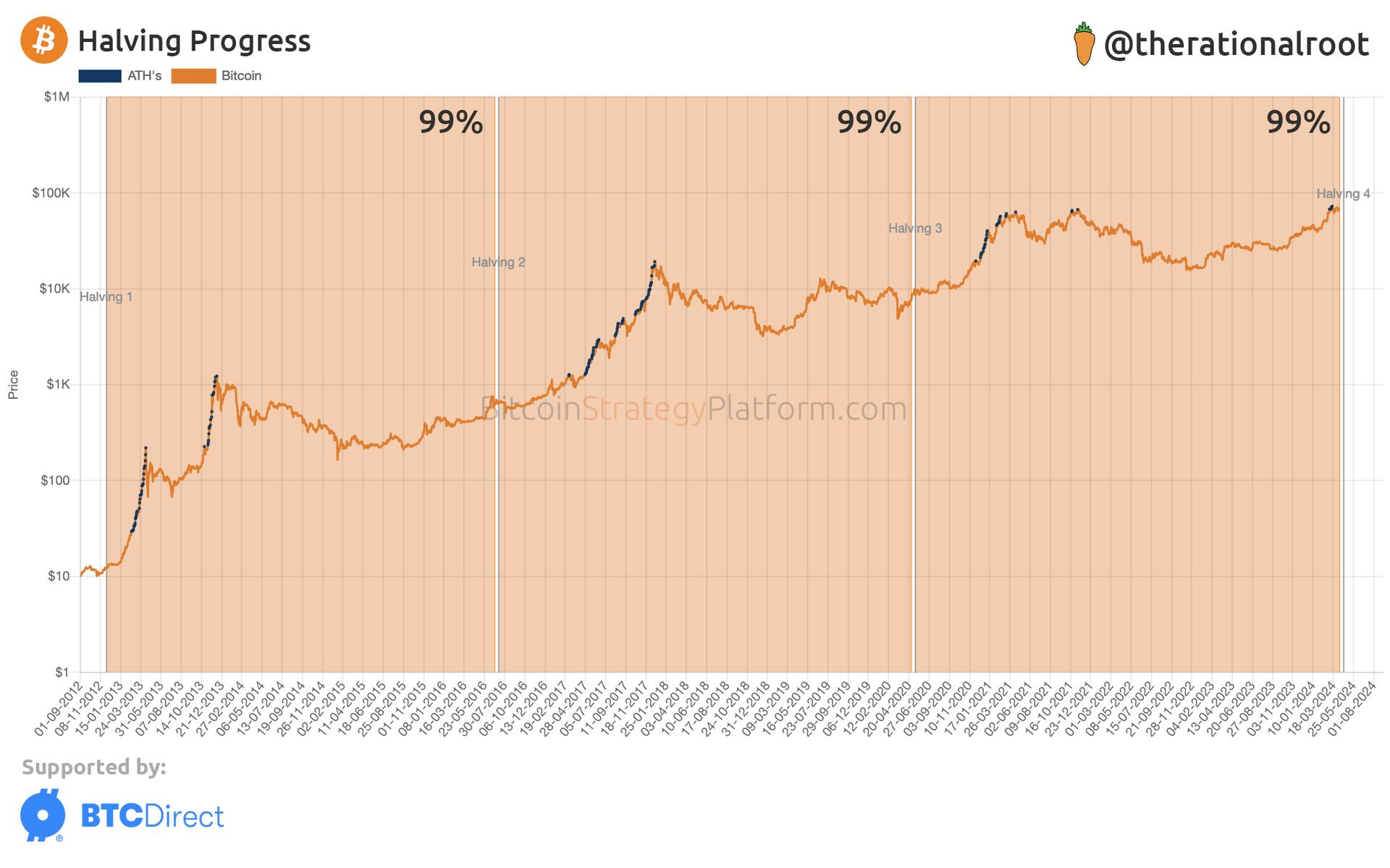

Where will the Bitcoin price be in 50k blocks?

Looking forward to what this Halving will bring! #Bitcoin

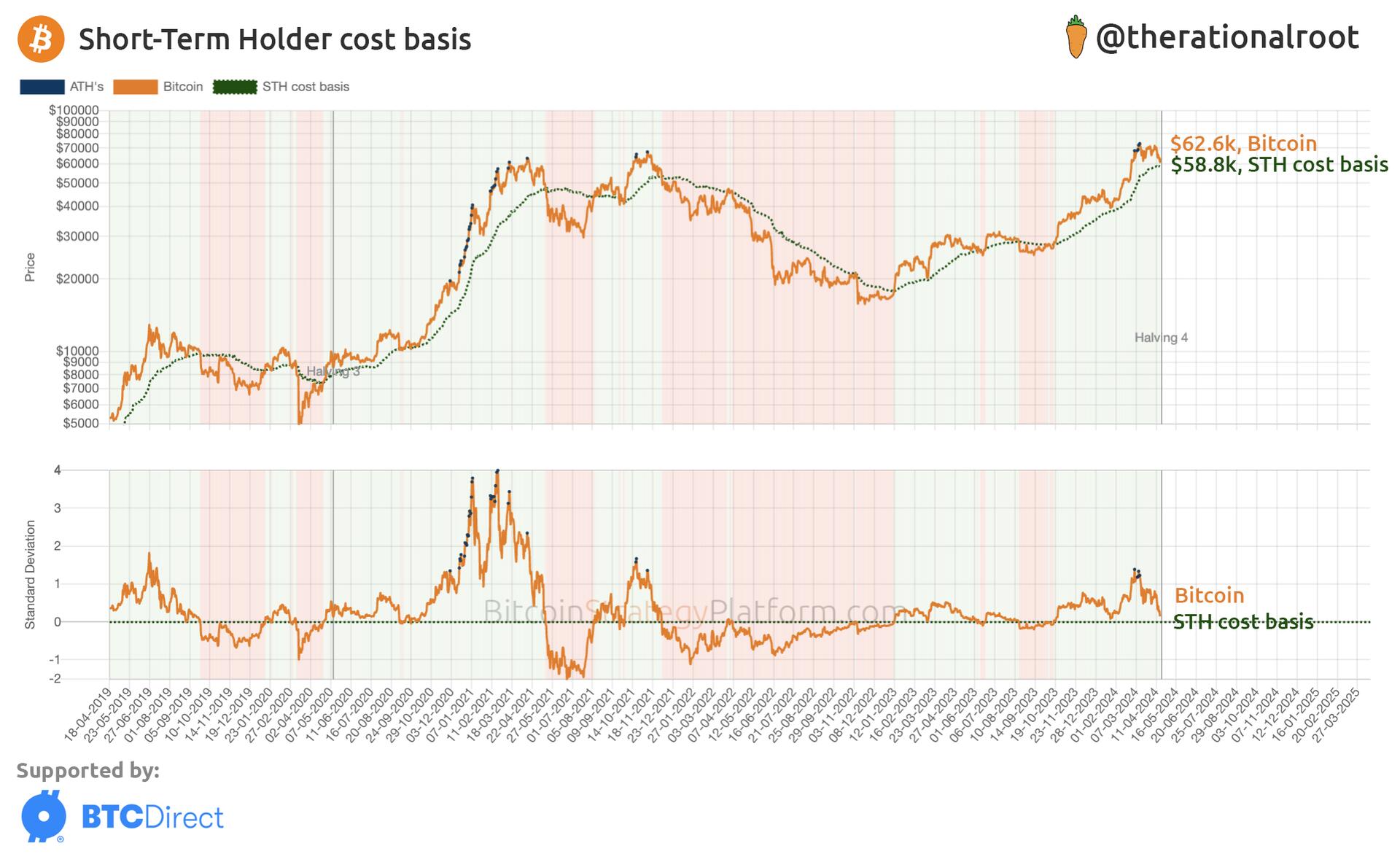

Short-Term Holder cost basis at $58.8k. #Bitcoin

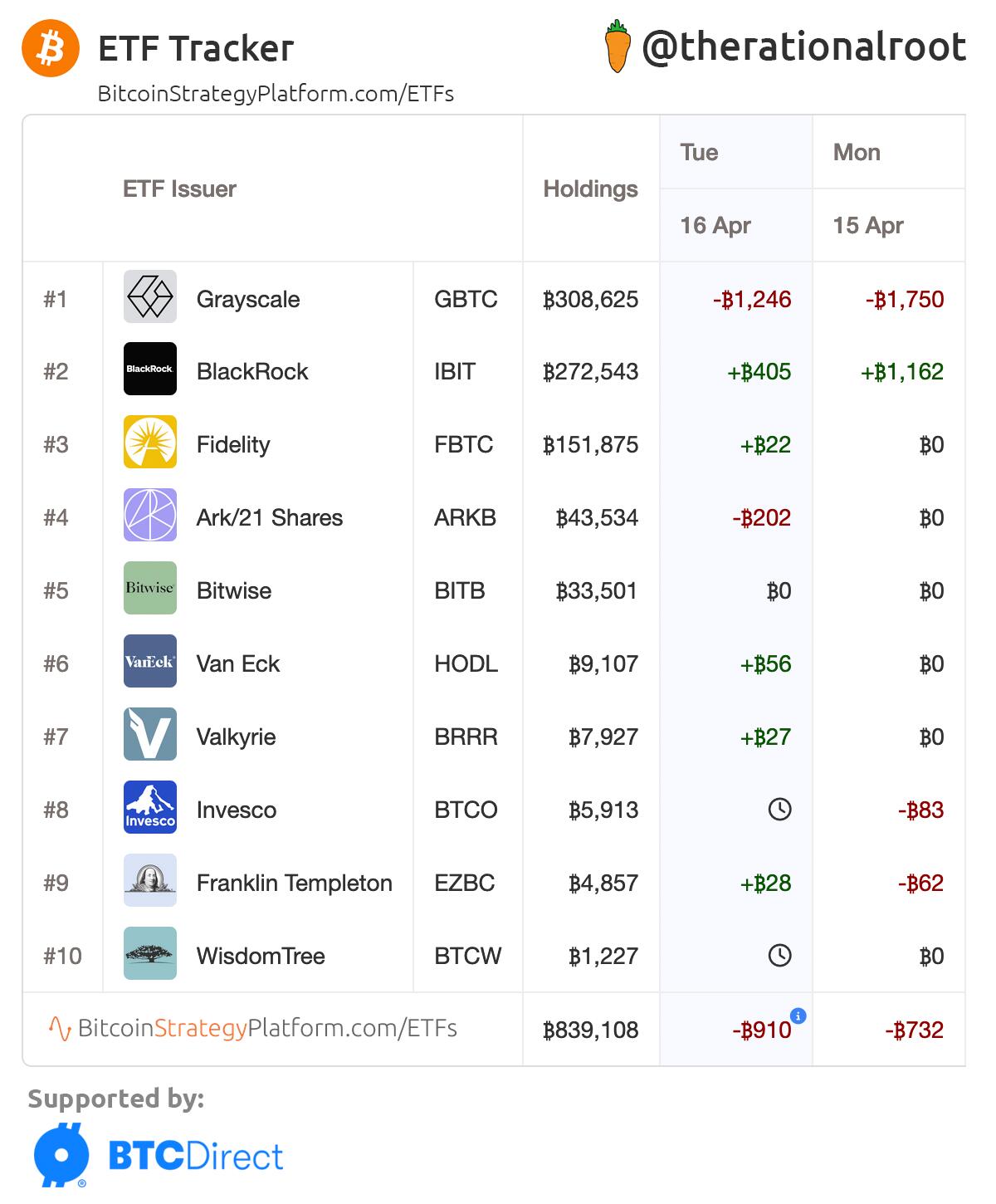

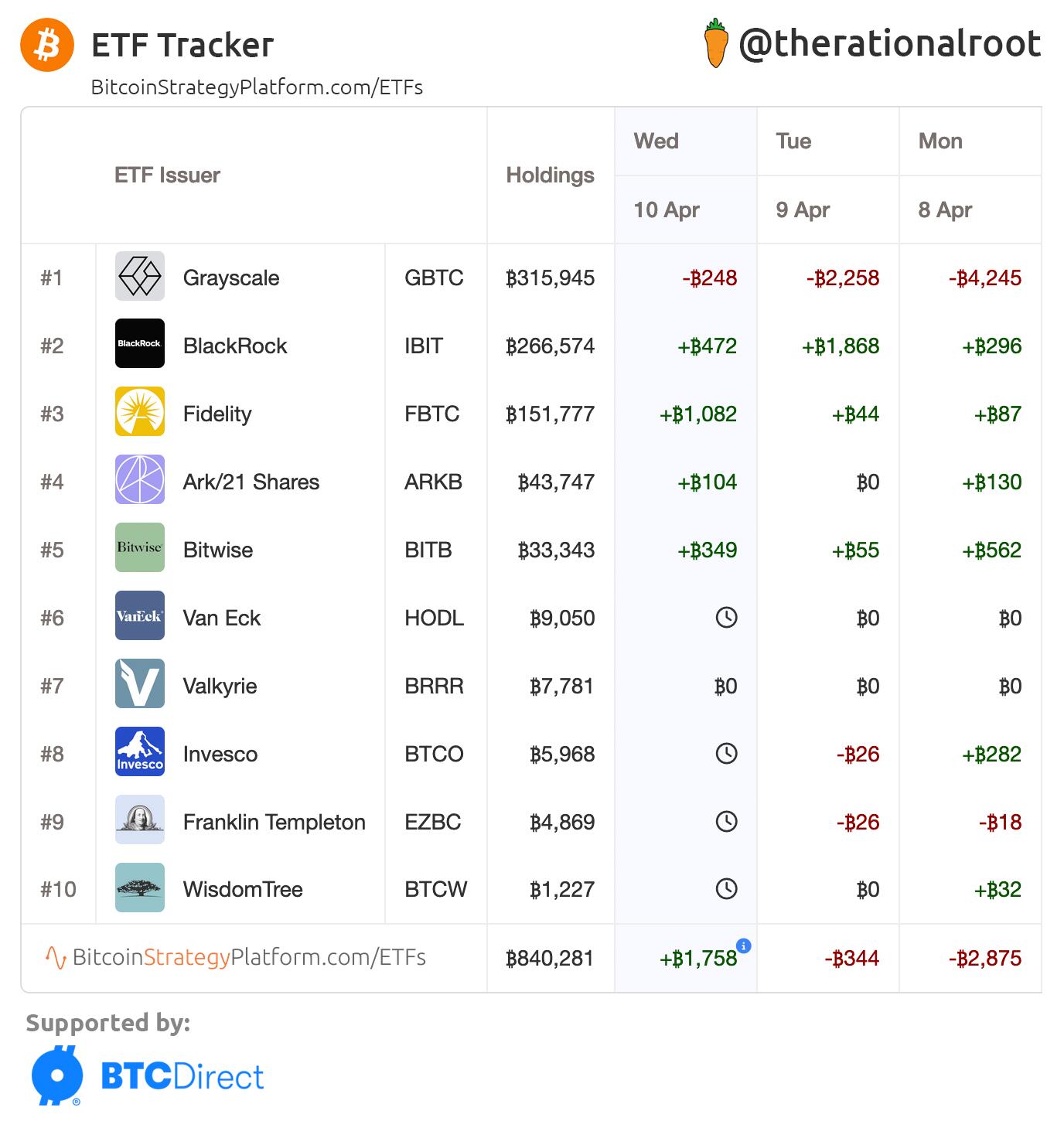

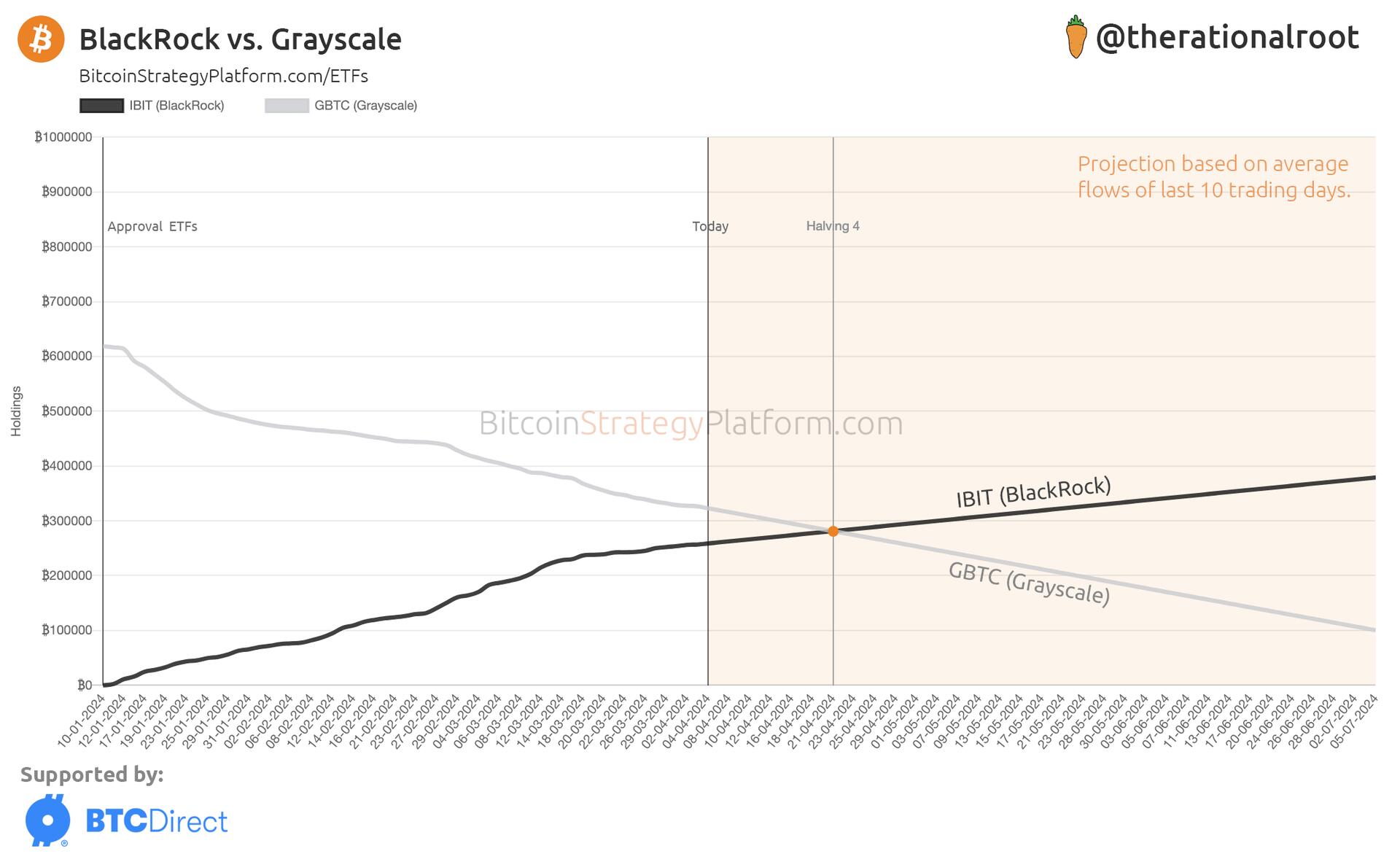

ETFs Update: Net outflow of 910 BTC due to GBTC. Reduced inflows to other ETFs continue.

chartjs for this one, but also plotly for others.

Many ETF flows stalled due to derisking/fear of war.

Meanwhile, BlackRock continues with its streak of 65 consecutive days of inflows.

#Bitcoin

Read more in the latest Bitcoin Strategy newsletter 👇

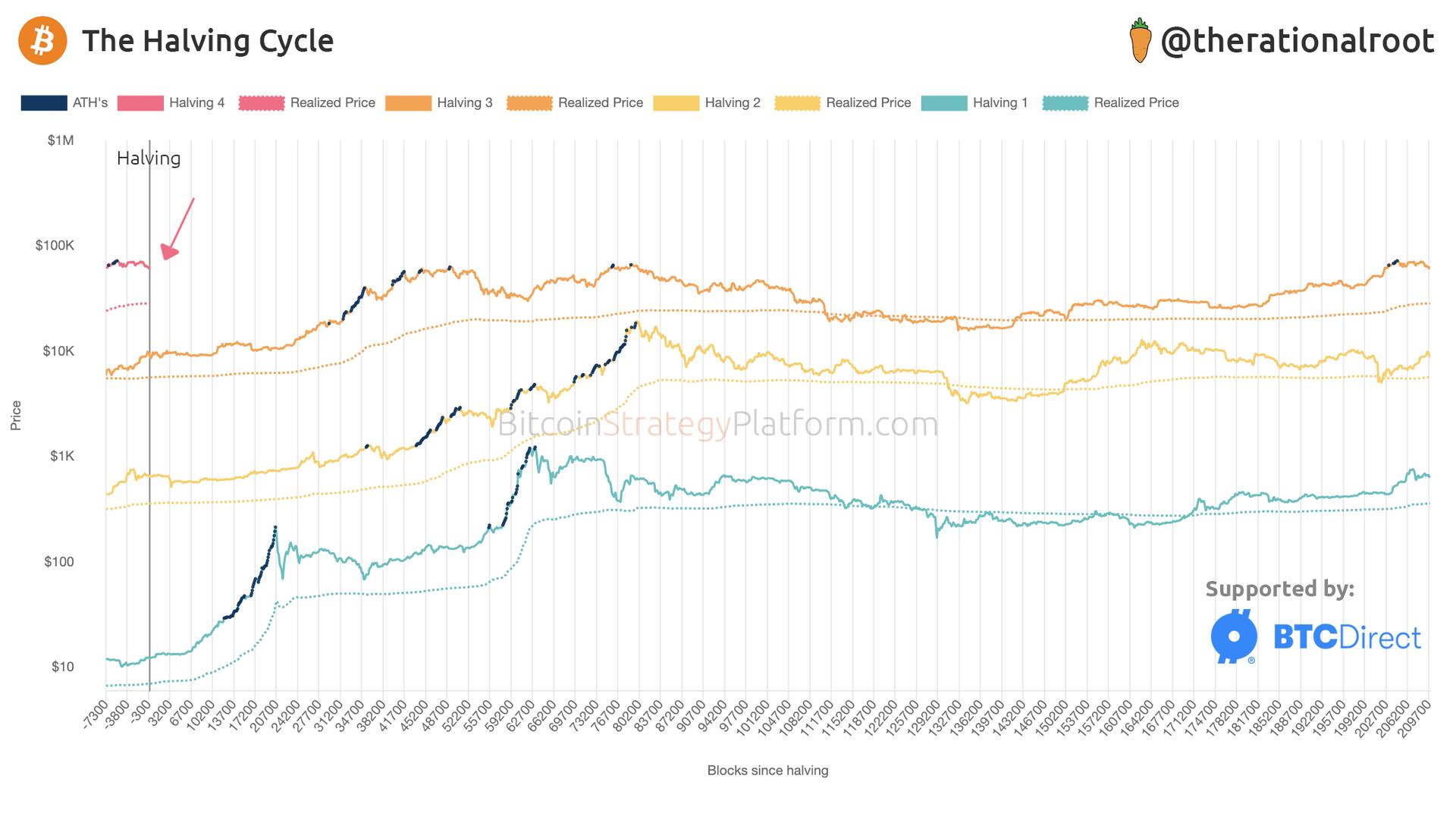

https://www.bitcoinstrategyplatform.com/news/ultimate-cycle-comparison

The Ultimate Cycle Comparison. #Bitcoin

The Bitcoin Strategy Newsletter has surpassed 10,000 subscribers, making it one of the top performers on Substack. Truly grateful for the #Bitcoin community and your incredible support! ✊🧡🙏

If you haven’t subscribed yet, please check it out:

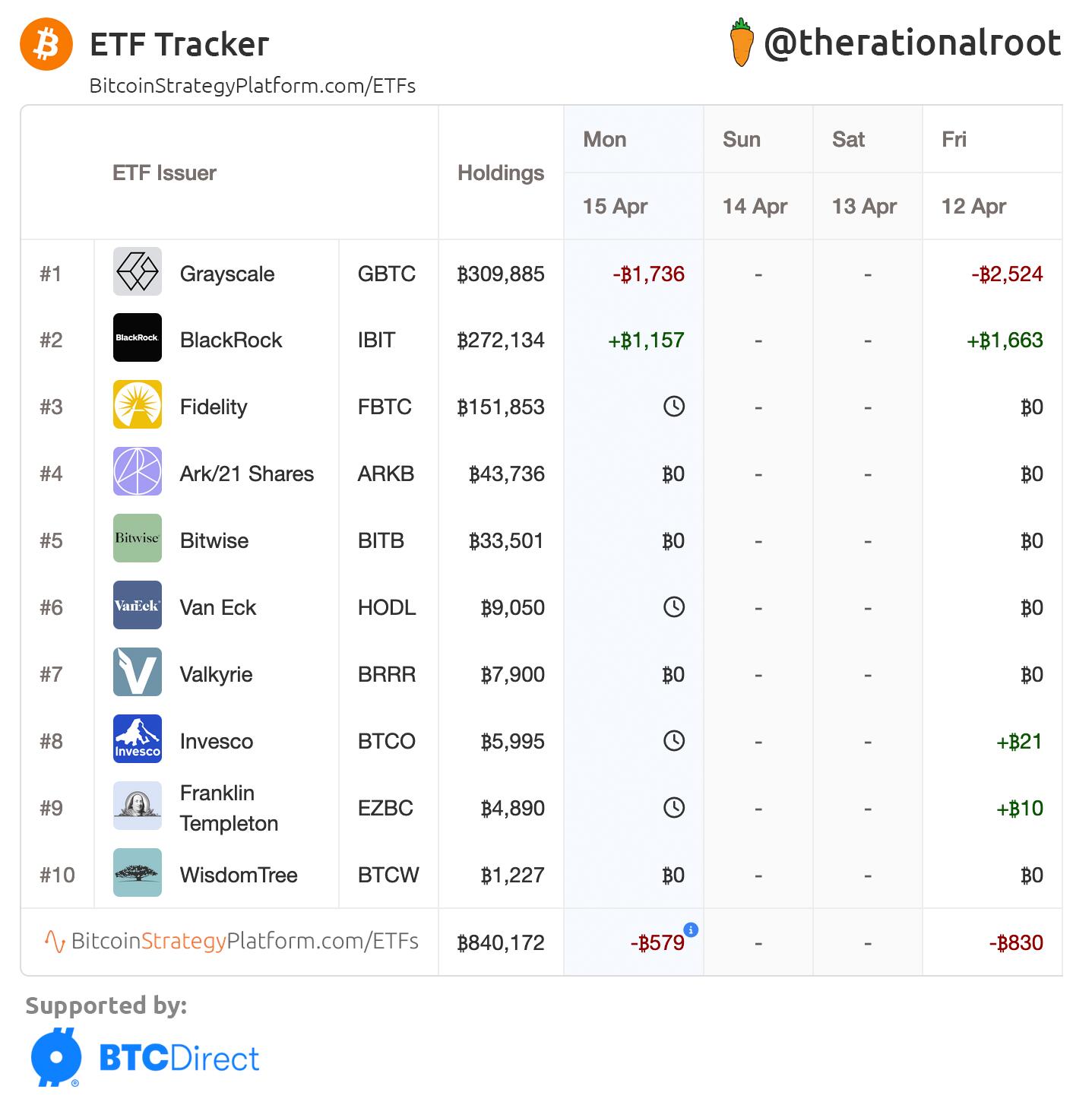

ETFs update:

-Net 1.7k #BTC inflow compensates for earlier outflows, resulting in ~neutral flows this week.

-Lowest outflow from GBTC since ETF approval.

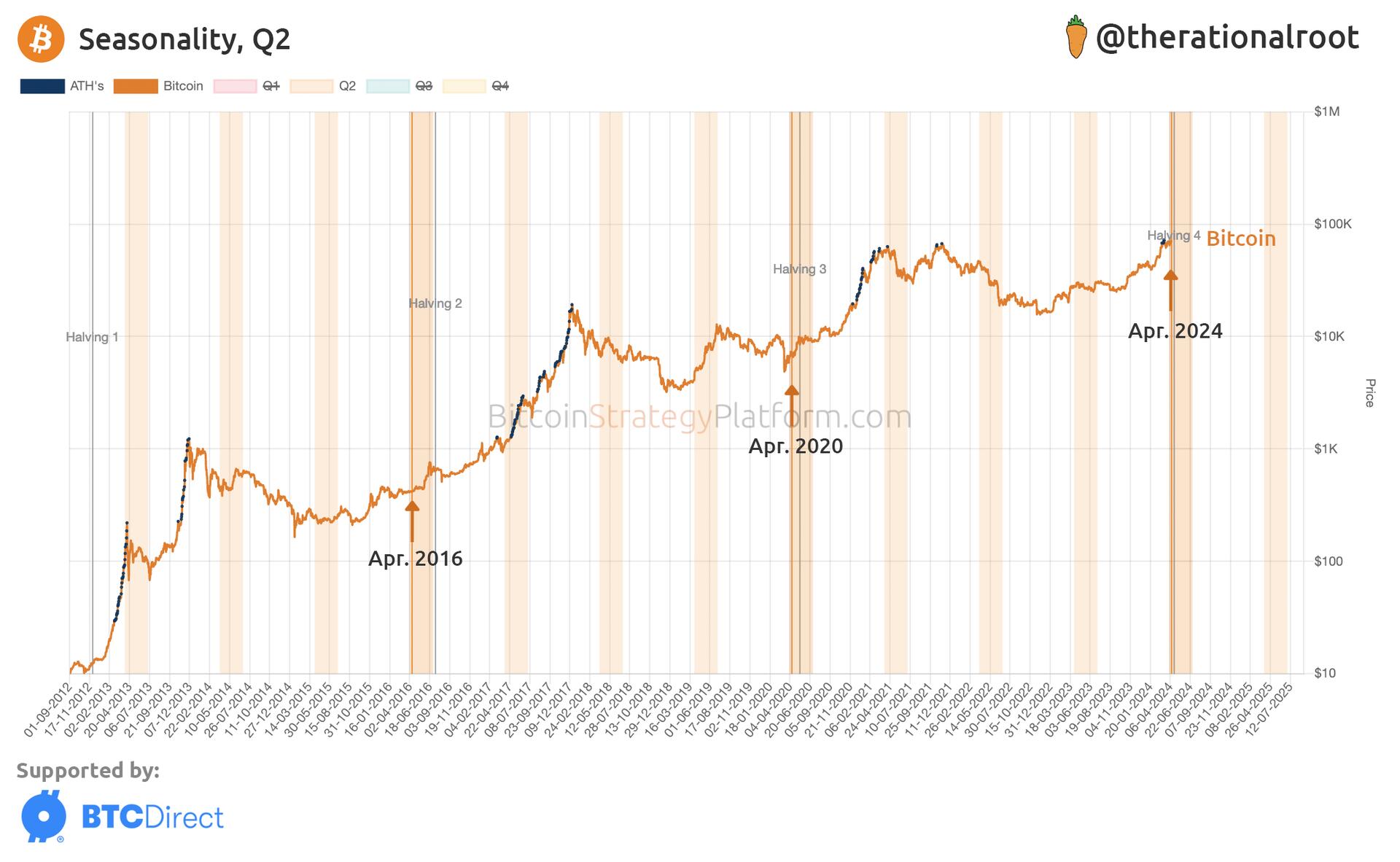

Q2 of the 4-year cycle: the #Bitcoin Halving.

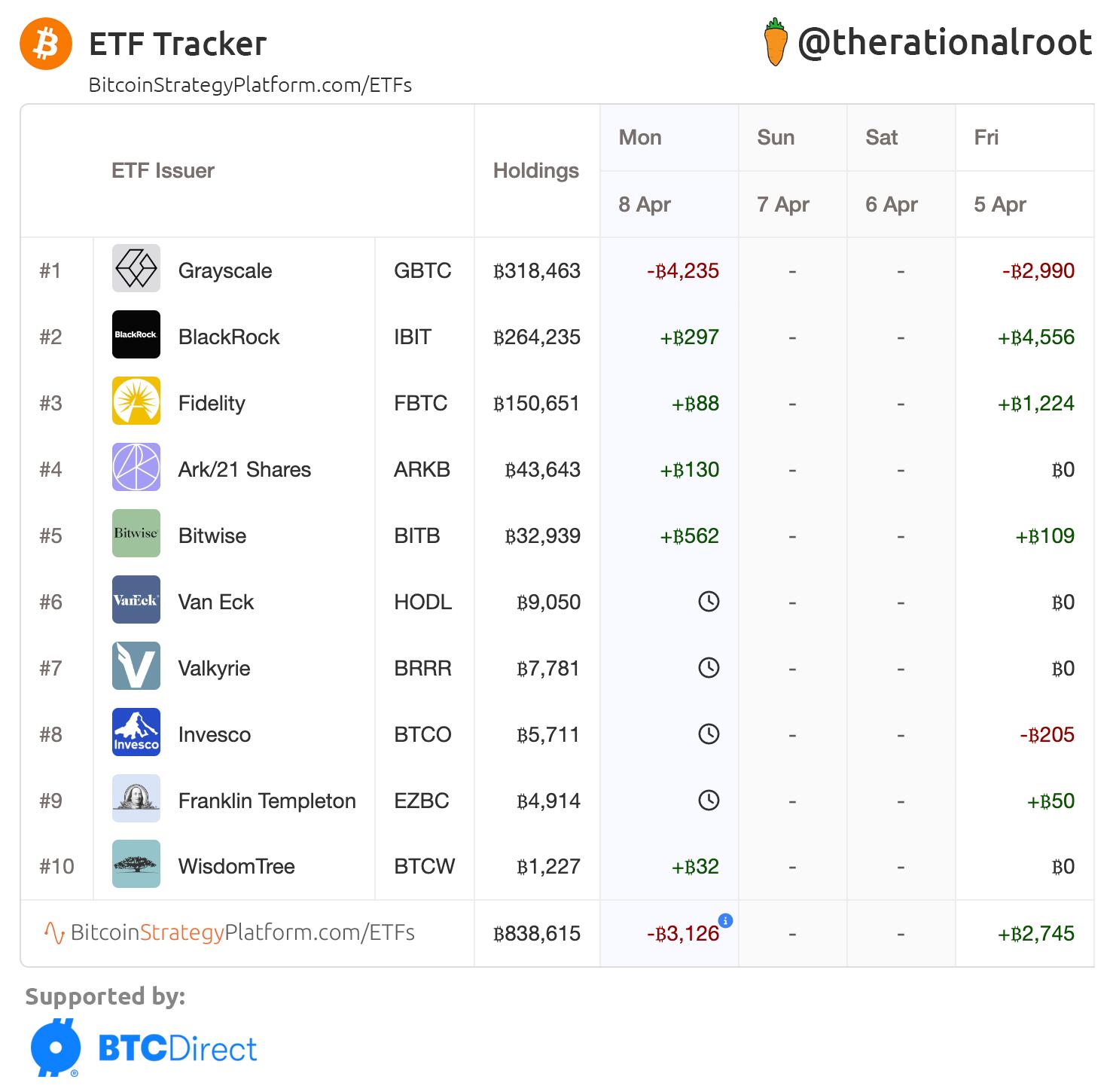

ETFs update: Net outflow of ~3k #BTC due to GBTC.

-Price held up well, given the outflows.

-No direct rotation from GBTC to IBIT.

Bitcoin at $72.5k,

Short-Term Holder cost basis at $58k (All-Time High).

Halving progress 99%. #Bitcoin

Read more in the latest Bitcoin Strategy newsletter 👇

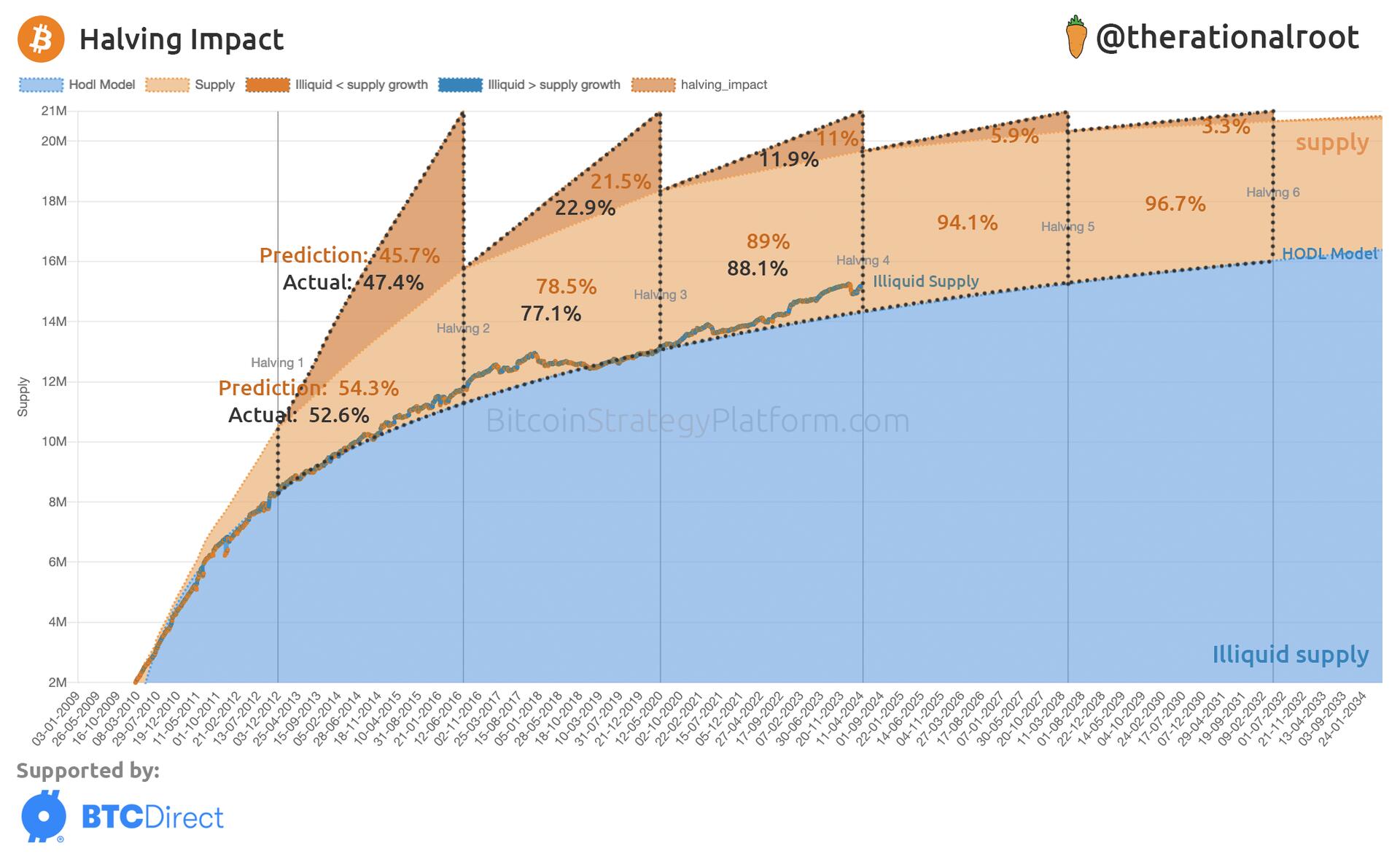

The next Halving will gradually reduce the available supply for trade over the next 4 years, with an estimated impact of ~6%. Its impact is diminishing but remains significant. #Bitcoin

BlackRock likely to flip Grayscale by the Halving. #Bitcoin

only for the uninitiated. 😉

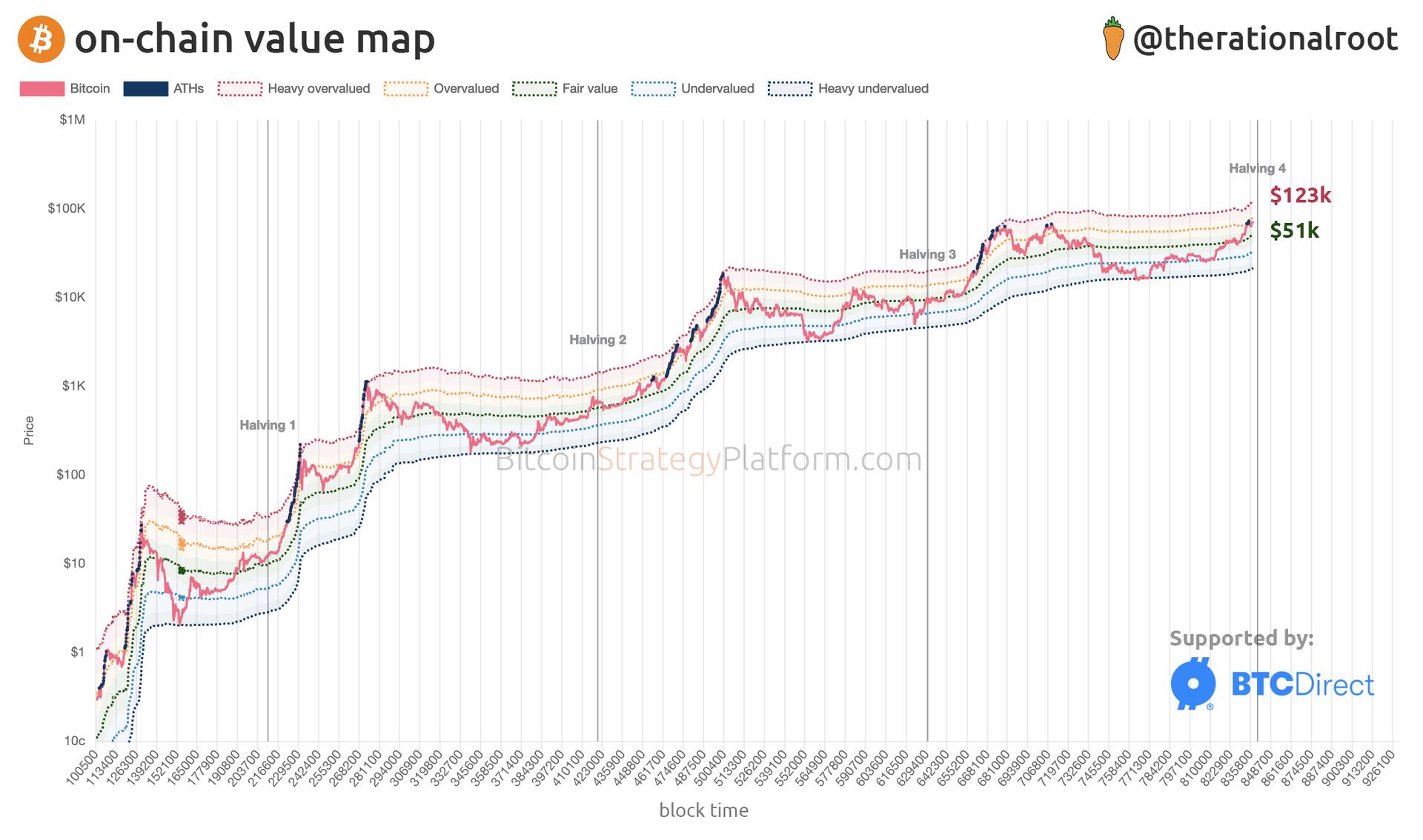

On-chain value map: heavy overvalued now at $123k and rising.