STH cost basis at an ATH of $60.7k and bounced off strong. #Bitcoin

New ATH for S&P 500. #Bitcoin 👀

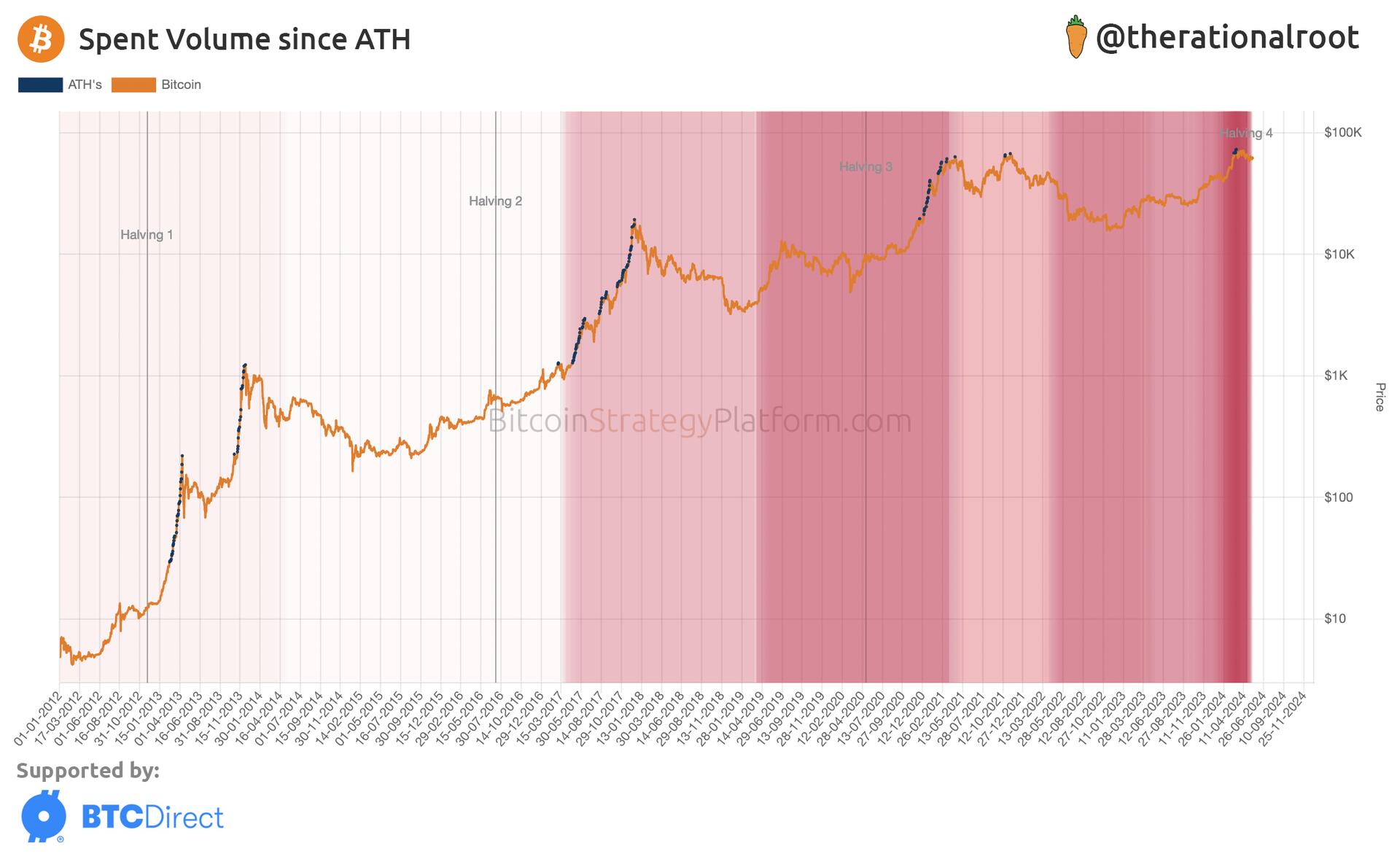

Chart highlights the age of spent volume in the current drawdown:

-2020 bull market participants who held through the bear and are now locking in profits.

-Buyers from the 2022 bear market bottom now realizing substantial gains.

#Bitcoin

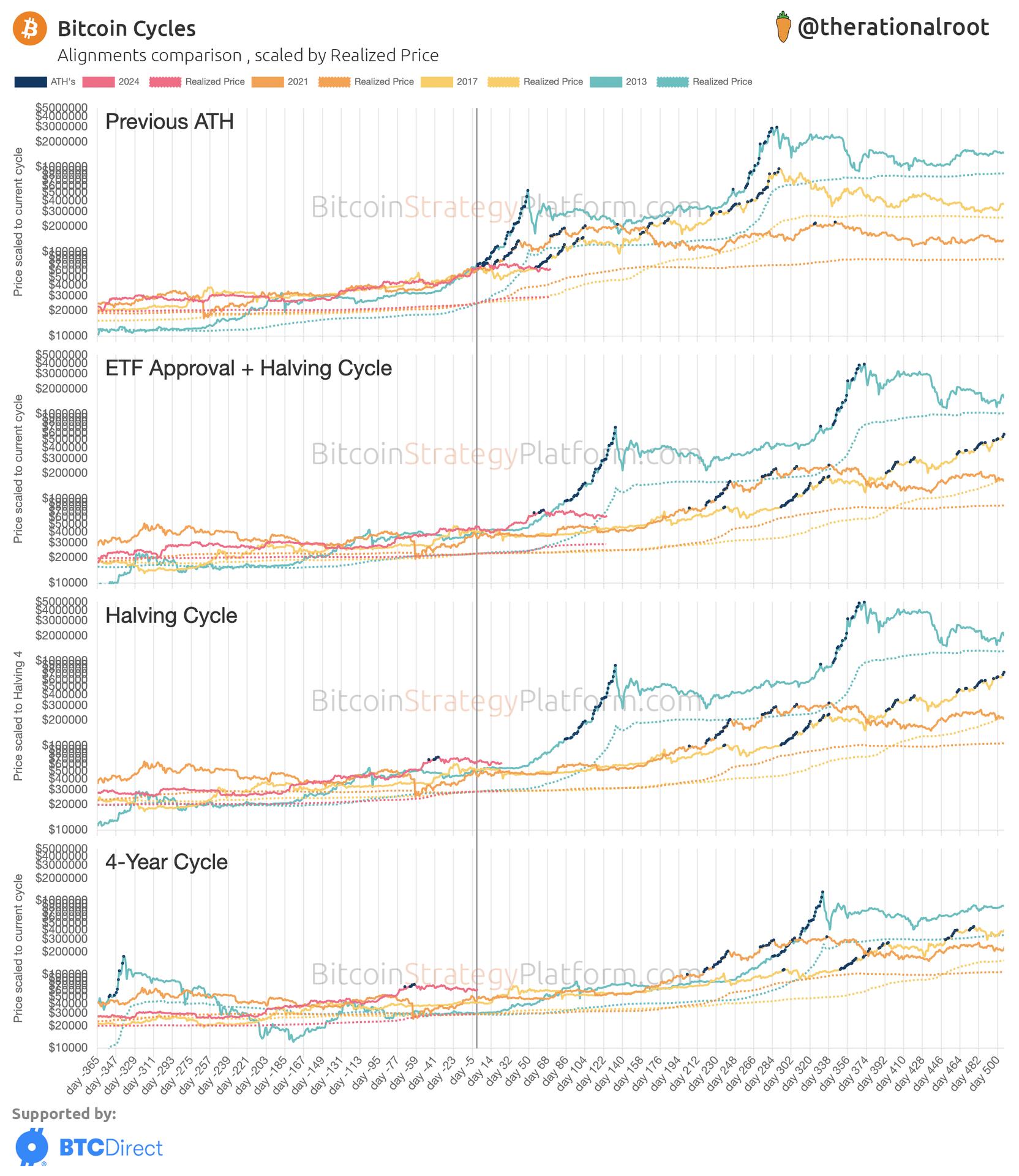

Cycle alignments. #Bitcoin

Read more in the latest Bitcoin Strategy newsletter 👇

https://www.bitcoinstrategyplatform.com/news/etf-tracker-v3-hong-kong-etfs

Visit the live ETF Tracker:

Read more in the latest Bitcoin Strategy newsletter 👇

https://www.bitcoinstrategyplatform.com/news/etf-tracker-v3-hong-kong-etfs

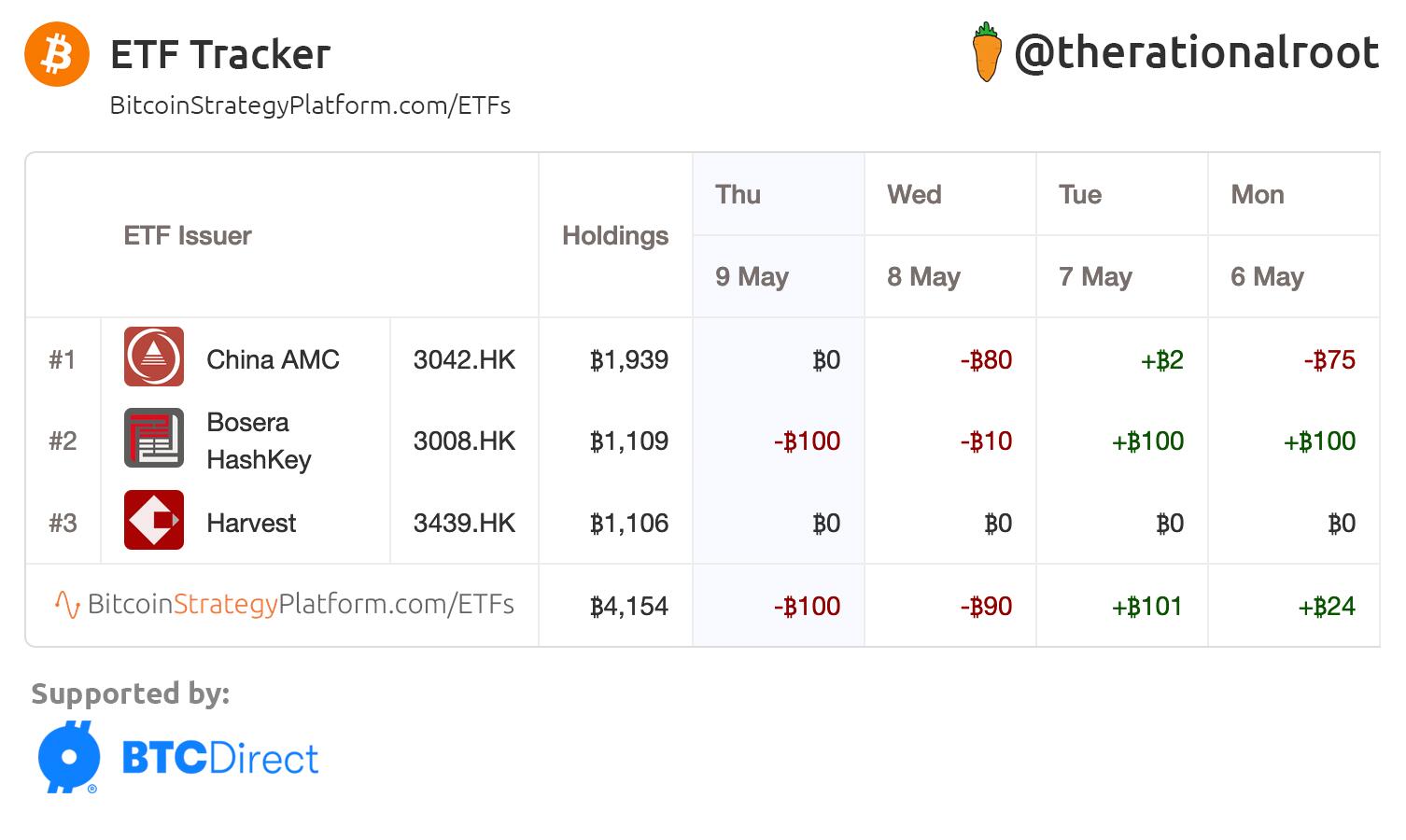

Live ETF Tracker Update — v3: Now Includes Hong Kong ETFs 🔥

#Bitcoin

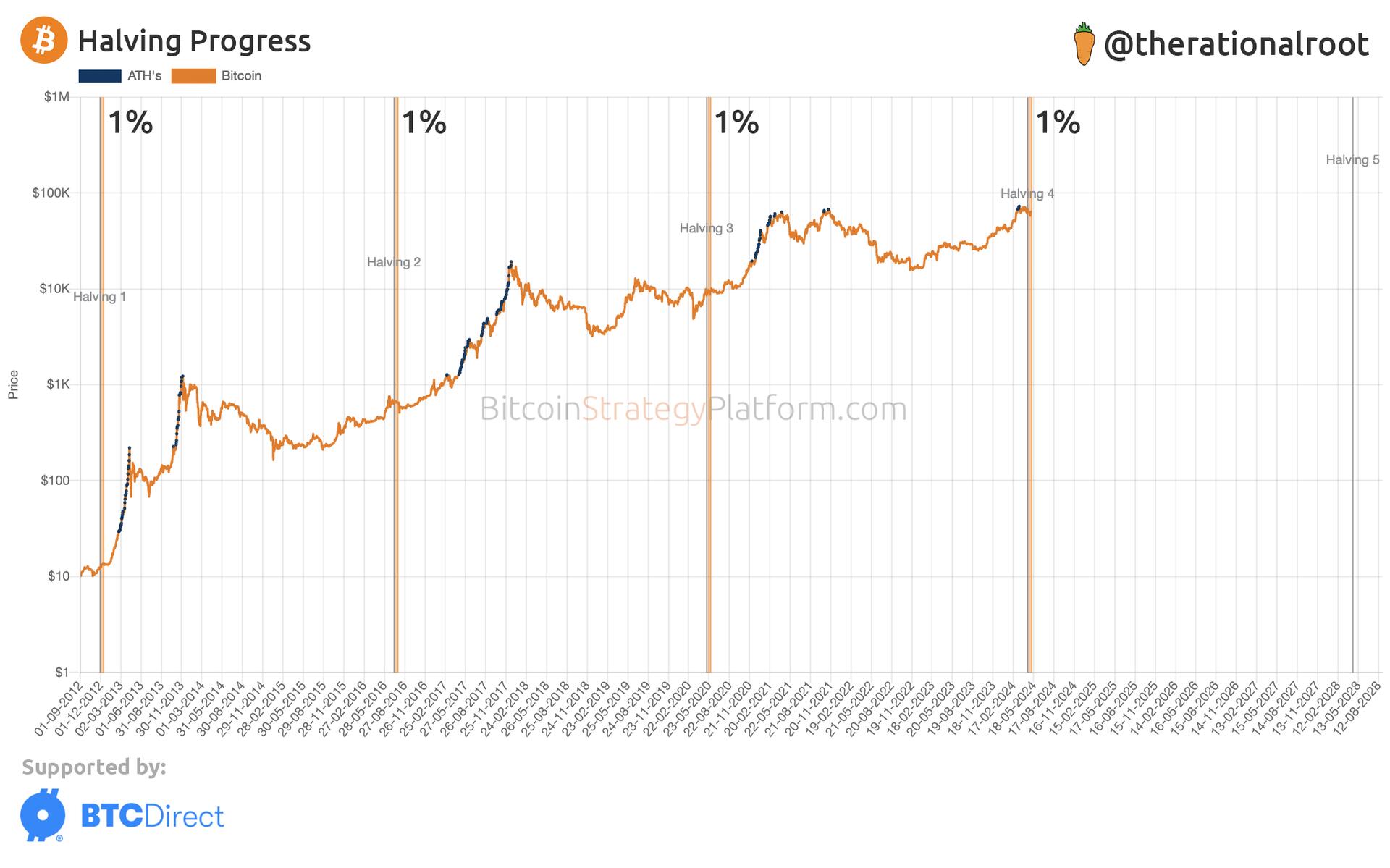

Halving progress 1%. #Bitcoin

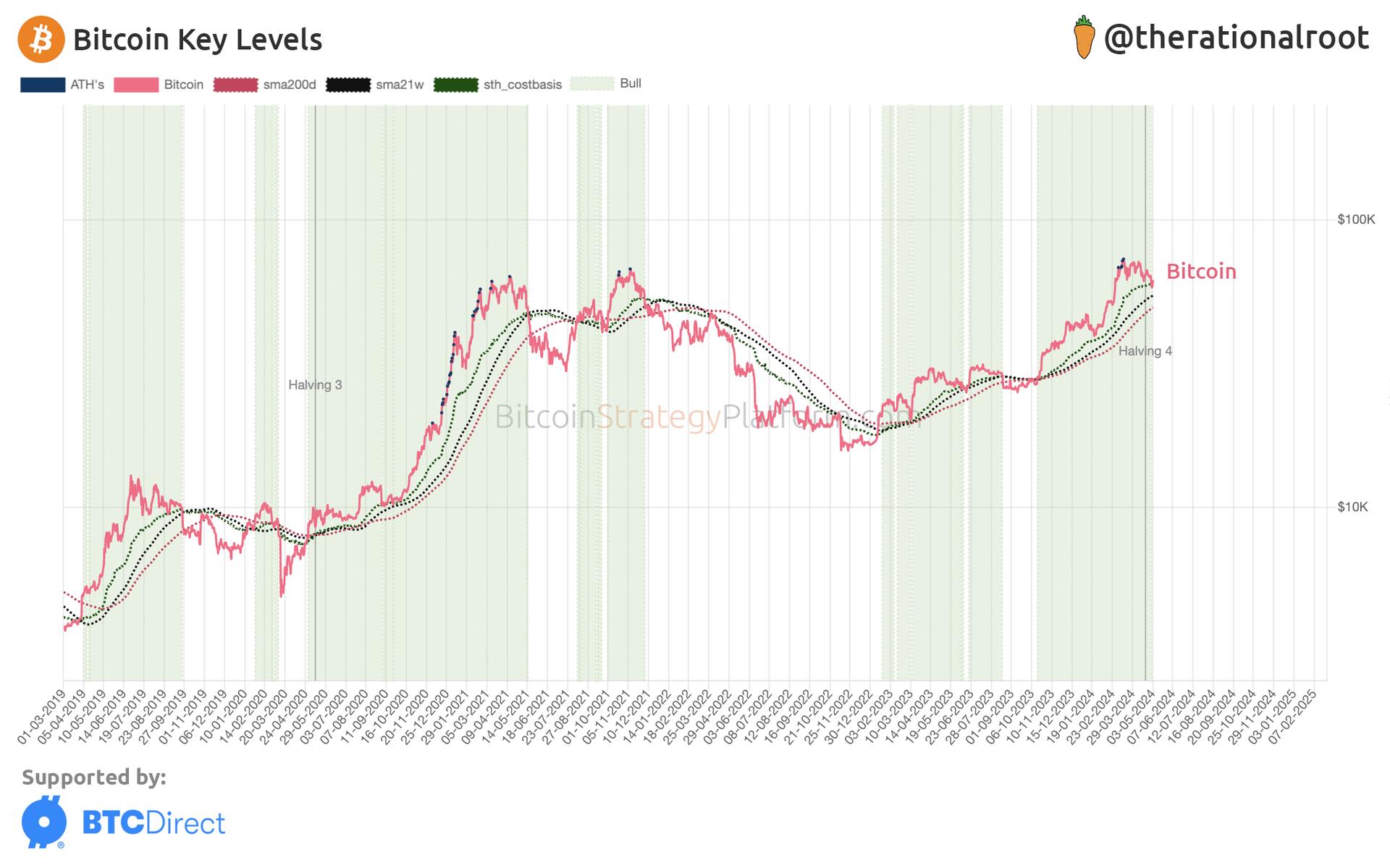

#Bitcoin Key levels.

note1ymusvlgv4fr0hcny9hzhvmhmx4nywtqcqn97chwsrgtt0g0pzh9q3z9d7f

Bull market continuation or intermission? Read more in the latest Bitcoin Strategy newsletter 👇

https://www.bitcoinstrategyplatform.com/news/bull-market-continuation-or-intermission

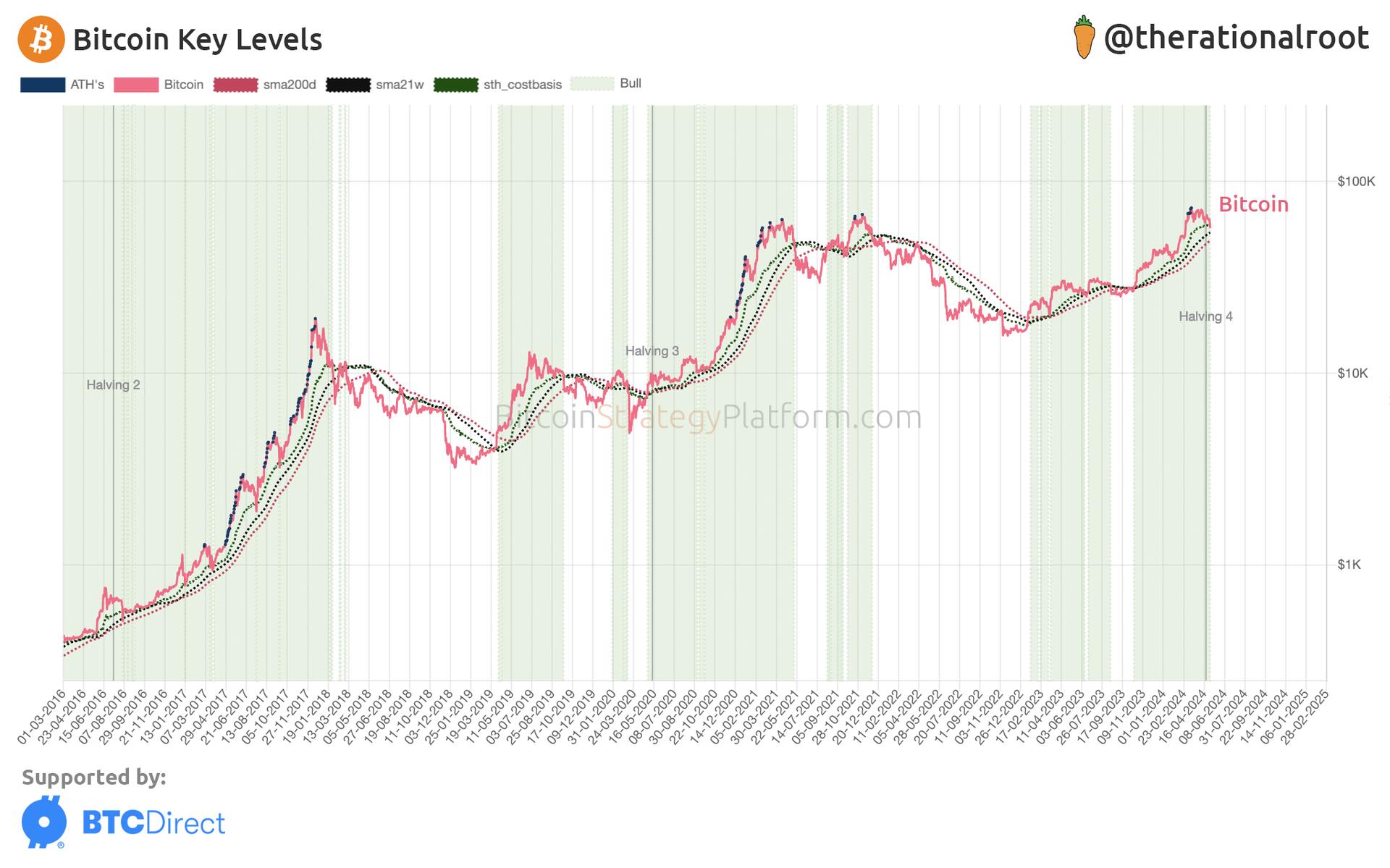

#Bitcoin Key levels.

Read more in the latest Bitcoin Strategy newsletter: Bull market Continuation or Intermission? 👇

https://www.bitcoinstrategyplatform.com/news/bull-market-continuation-or-intermission

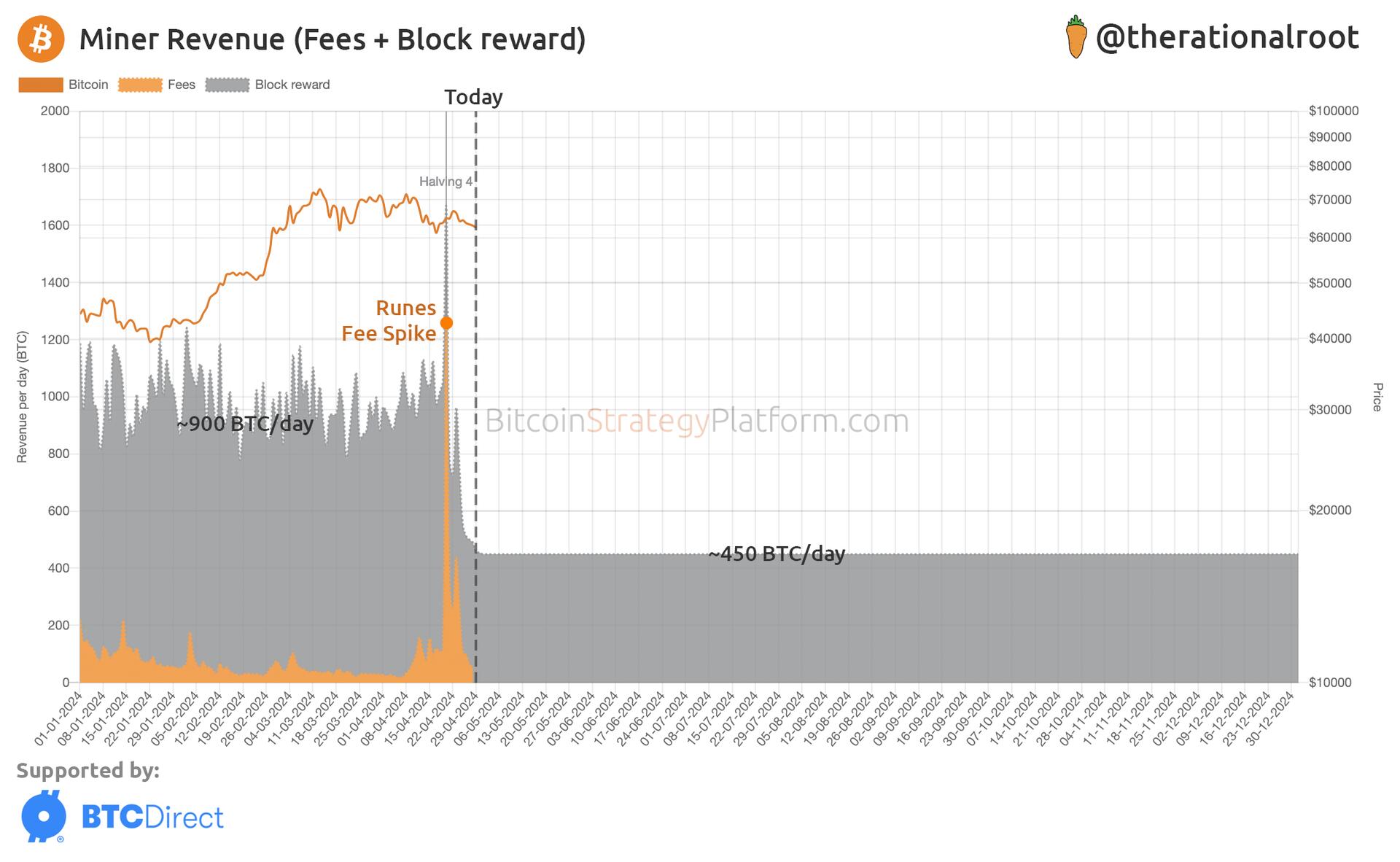

With declining transaction fees, miner revenue drops from 900 to 450 a day — delayed Halving effect. #Bitcoin

Read more in the latest Bitcoin Strategy newsletter: Bull market Continuation or Intermission? 👇

https://www.bitcoinstrategyplatform.com/news/bull-market-continuation-or-intermission

While a Halving supply crunch always needed time to materialize, this Halving, the fee spike caused miners to earn more BTC instead of less, resulting in, at least temporarily, the absence of a supply shock. #Bitcoin

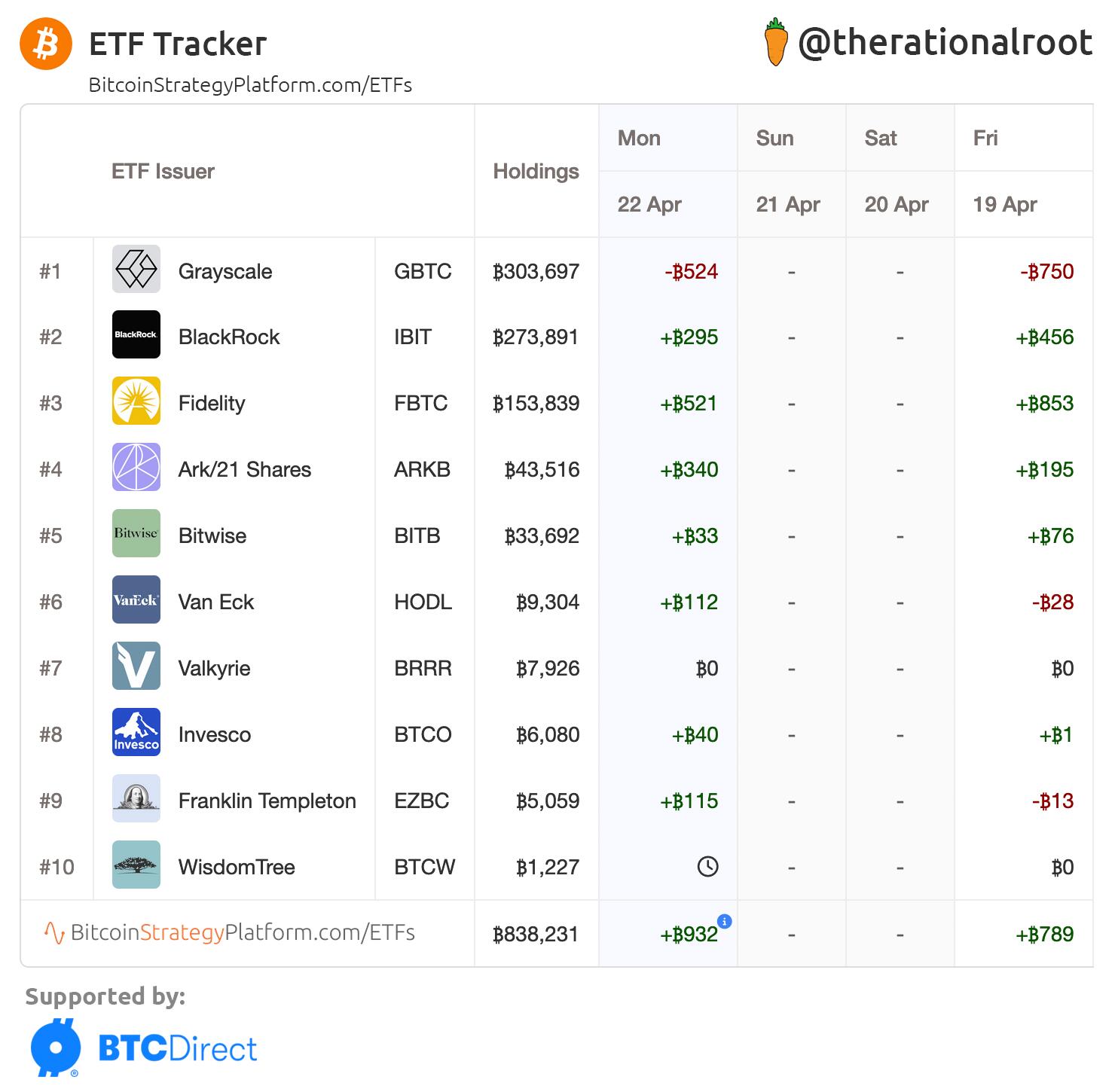

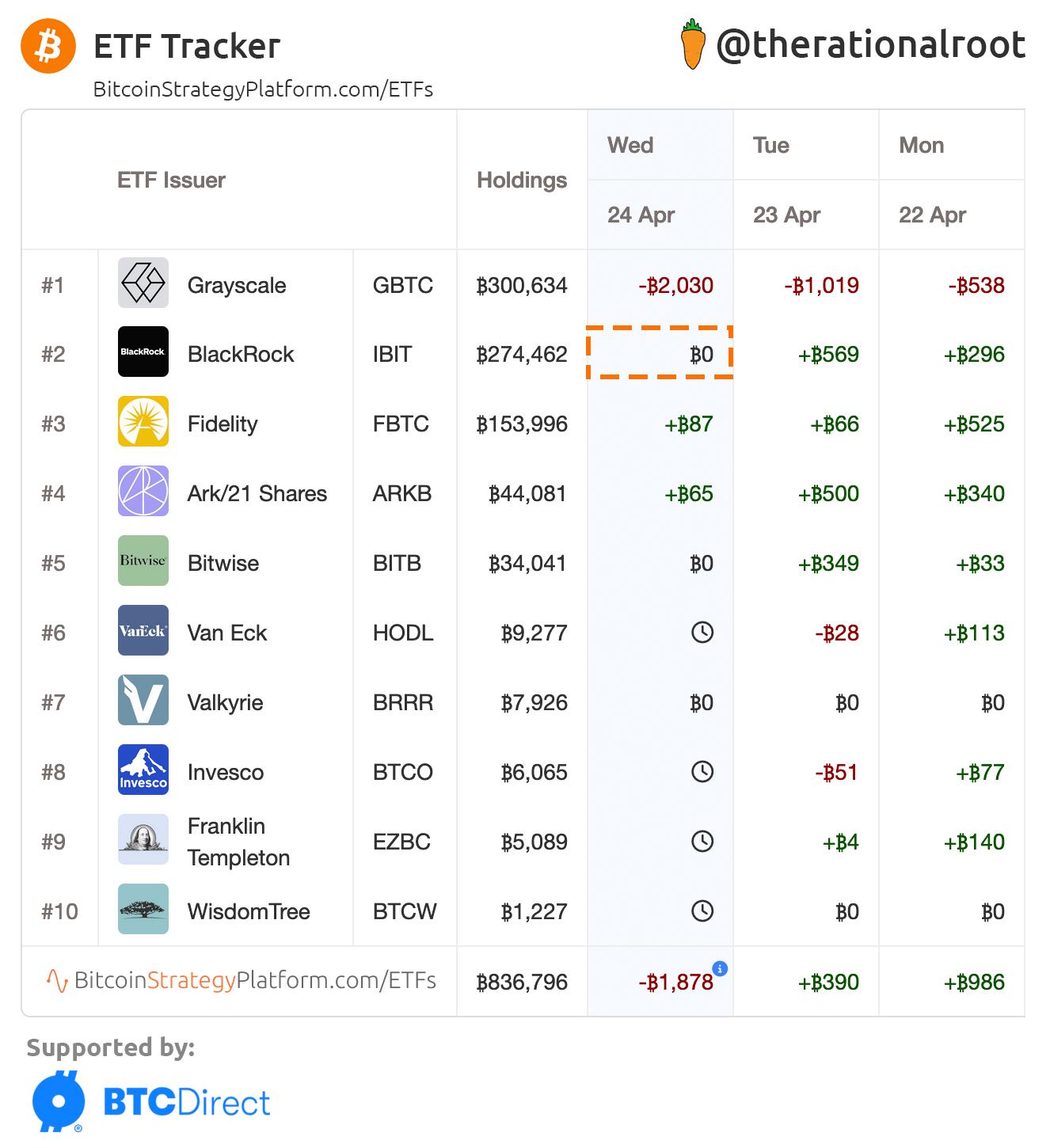

ETFs’ update for the week:

-Blackrock's third consecutive day with ZERO net inflows.

-GBTC fell below 300k BTC (from >600k at launch).

Demand drying up?

After reaching the historic top 10, today, BlackRock ended its 71-day streak of continuous net inflows. #Bitcoin

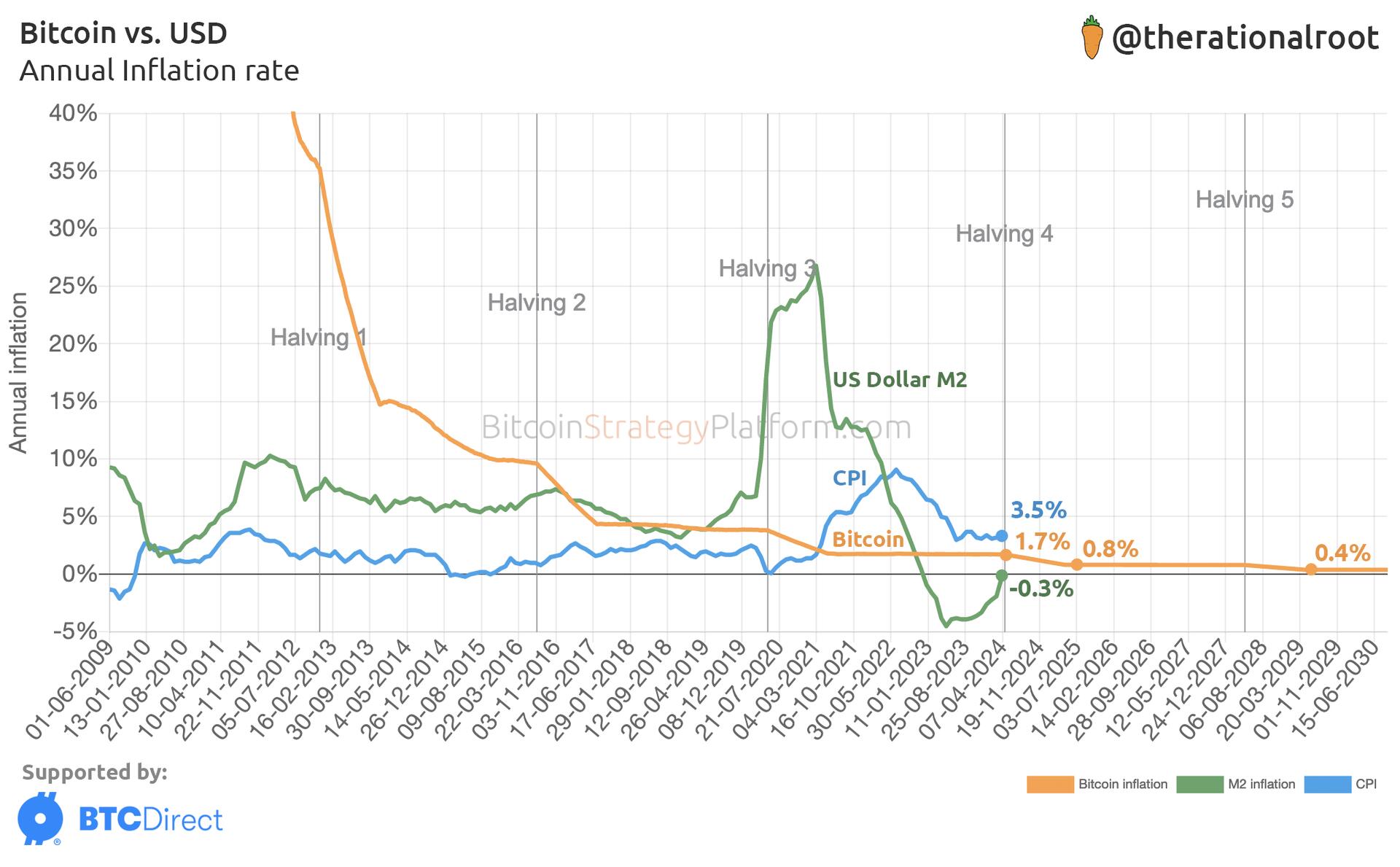

Due to the Halving, #Bitcoin's annual inflation will drop to ~0.8% over the coming year. Meanwhile, the M2 money supply will likely return to its 7% average.

ETFs Update: Net inflow 932 #BTC (69% lower than average since launch).

- Reduced outflows from Grayscale,

- Reduced inflows into other ETFs.