Useful new #bitcoin dashboard from new hedge https://newhedge.io/terminal/bitcoin

Not really nostr specific, but the amount of folks still not using password managers to ensure a strong unique password for every service is shocking

Now I really feel old. Where is the history of major FIAT failures documented? It will be just a submenu item on the future history of #Bitcoin site somewhere like:

home->history of money->major failures->barter->seashells ->yap rai stones->precious metals->fiat

And after fiat came the age of Bitcoin, all that was known for generations.

"We're buying it to hold it 100 years...that $66K to $16K crash. That shook out the tourists. That shook out the non-believers. When it was 16K, we were all ready to ride it to zero. And that's what you'll find w/the #Bitcoin maximalists." - nostr:npub15dqlghlewk84wz3pkqqvzl2w2w36f97g89ljds8x6c094nlu02vqjllm5m 🔥🔥🔥

Grayscale plans to spin off spot #bitcoin ETF https://www.reuters.com/technology/grayscale-pursues-spin-off-spot-bitcoin-etf-2024-03-12/

People like calculators and visuals for planning. For those wanting to try to figure out how much Bitcoin they will need, you can reverse out from converting the fiat equivalent along the way.

Take for example this calculator

https://www.nerdwallet.com/calculator/retirement-calculator

For a hypothetical 25 year old that wants to retire at age 50, plug in these values...

* Age: 25

* Pre-tax income: 500,000 (no, you aren't expected to be earning this, but another field depends on this field, so just set it high. we ignore it otherwise)

* Current Retirement Savings: 0

* Monthly Contribution: 1055

* Monthly Budget in Retirement: 12935

* Other retirement income: 0 (dont rely on social security, pensions, etc)

Expand advanced details and plug in the following

* Retirement age: 50

* Life Expectancy: 95

* Pre-retirement rate of return: 15% (this isn't tradfi, and we'll assume this as our low CAGR for Bitcoin appreciation in fiat terms)

* Post-retirement rate of return: 15%

* Inflation rate: 3%

* Annual income increase: 0 (yes, super conservative)

This should produce a chart that looks something like the following

Now, begin tweaking the individual inputs to get a better feel for your personal situation. The key takeaways and notes here are as follows...

1) The earlier you begin saving, the better.

2) Stack hard, rediculously hard, the earlier you can, as compounded will pay off much better then a gradual DCA.

3) To clarify point #2, you need to be making sacrifices. Invest any tax refunds, bonuses, windfalls as a lump sum buy. Limit frivolous purchases. It's not the $5 coffees. Its the outsized purchases (new cars, leases, bigger then necessary housing in high tax districts) that will eat up your savings potential.

4) The amount invested each month in the chart should be to buy Bitcoin building your stack. Whatever amount of bitcoin you can get.

5) This assumes you are eventually spending your Bitcoin. If you plan to never spend your bitcoin you could get a loan against it, assuming you have some other cash flow coming in to service the loan.

6) The older you are when you first start saving, the harder it is to get to your goal amount.

Here's a common diagram denoting the importance of starting early.

While I agree with he jist of what you are saying that calculator is totally broken. Put in whatever you want for current savings, say 10 million, you still can’t make it.

And after reading what just I wrote, maybe it’s not broken; money printer go brrrrrr

Wealth is defined as having an abundance of valuable possessions, the real value is in the experience that wealth can create.

I mean it’s pretty much a statistical guarantee. How about you pick a 30 minute window?

Do they keep the physical coin, like you have a bunch of them, or is it just symbolic and you get it back to give again next time?

Proof of Work is absolutely necessary ti not have any trusted third parties. #bitcoin #satoshi nostr:npub1cn4t4cd78nm900qc2hhqte5aa8c9njm6qkfzw95tszufwcwtcnsq7g3vle nostr:note1tzxca8rjftn5gcc2l2z4lf9yf50cqj9s6sxgalsv3aqdzrg2dn6qk9a3q6

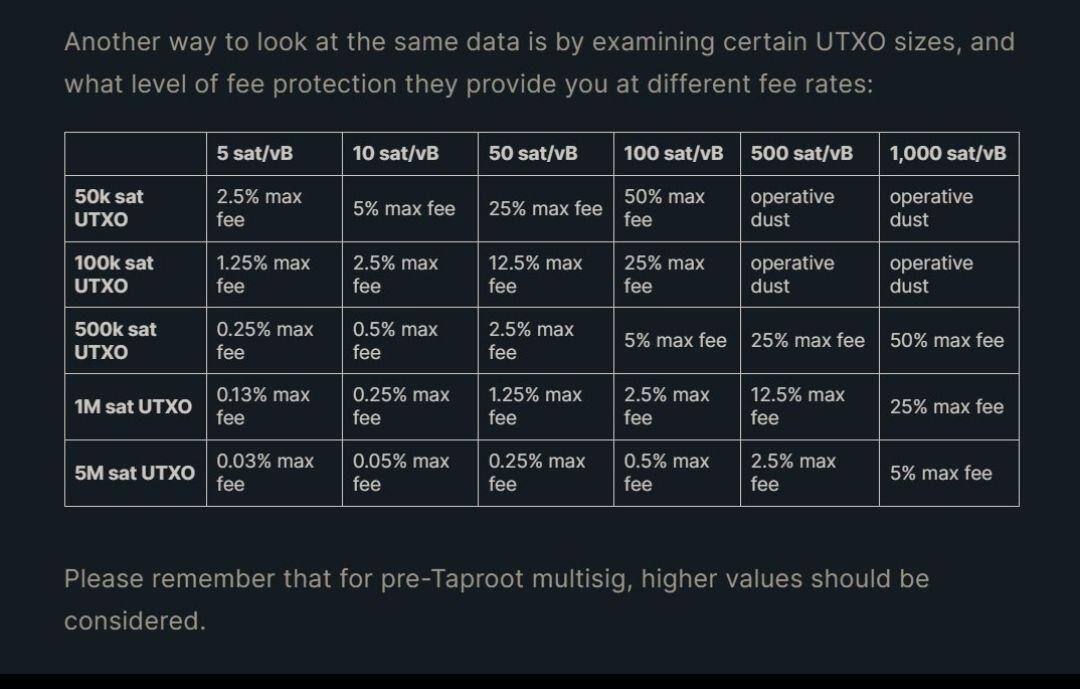

Well this chart from nostr:npub1xkere5pd94672h8w8r77uf4ustcazhfujkqgqzcykrdzakm4zl4qeud0en is a ₿anger

Valuable chart in terms of protecting your UTXOs. In the past when massive amounts of dust transactions have belonged to a single entity they have worked with miners to run large consolidation transactions that would otherwise not make it into the mempool.

Batteries and #bitcoin are great stores of energy! nostr:note1rz4ypfk8fv8uzjatufuu08ulyhh2vjlysmem2gua8nvc0hmecyyqns6pyw

At least you did not try X.

The problem with hyperinflation is it happens slowly, then all at once. It's too late for these folks to use #bitcoin to protect their wealth. Our best hope is to hodl them up as another example of the inevitable systemic failure of central banking.

In case you did not know.... #bitcoin

I feel ya... and once we hit 100k we are not even 2x previous ATH.

@npub1teawtzxh6y02cnp9jphxm2q8u6xxfx85nguwg6ftuksgjctvavvqnsgq5u Verifying My Public Key: "LearnBitcoincom"

nostr:note1fquvmzzgal5vzsygu6flmzqaaqe0k5v0nf7e4x3ghy45epl2kkes9fc827

nostr:note1fquvmzzgal5vzsygu6flmzqaaqe0k5v0nf7e4x3ghy45epl2kkes9fc827