Norinchukin Bank’s losses expected to grow to 1.5 trillion yen

#Bitcoin #chaos

Daily Bitcoin Journey with Jor on Fountain

What a great time at #BTCPrague and #Superbacked

Michael Saylor gives inspirational speech at #BTCPrague

Chad is back in Prague #BTCPrague

Looking forward to attending #BTCPrague 2024 together with #superbacked and #sunknudsen. Hit us up if you’re interested in learning more about Superbacked secret management platform! superbacked.com

Spanking children is illegal in civilized countries

Chinese banks see largest withdrawals in history 👀👀

U.S. commercial banks hold €17T in customer deposits. FDIC insurance fund has €0.128T, or 0.0075%. Anyone have the total worldwide numbers? The world is waking up to the ticking debt clock and unfunded liabilities that can not be paid back, ever. https://usdebtclock.org/world-debt-clock.html

Senator Lummis (WY) argues against the DOJ’s hyper-aggressive argument against Non-Custodial Wallets, jeopardizes fundamental property rights. “Arguments against self-custody software threaten the fundamental property rights that are core to being an American,” Lummis wrote. “I will do everything I can to fight for your rights to hold your own keys and run your own node.”

the FBI calls crypto money so they can arrest you for money laundering

the IRS calls it property so they can tax you on capital gains

the SEC calls it a security so they can sue every exchange

the CFTC calls it a commodity so you can’t use it as a currency

Credit: Crypto Tea

GM Bitcoiners. For you in the U.S., please call your senator on the below number per Mr. Snowden's request

nostr:note1mz5j32l49kg0l94x9kk2shz2q0x9v9xk4cpzm4p0da202rlr879qfgrg2p

Hi. Yes, there likely is a tipping point. Where that is globally, is at best a guess. Arguably it already has happened in a handful of countries like Nigerian, Venezuela, and Lebanon. Two possibilities would be either a massive liquidity event with the U.S. or a gradual decline in the U.S. dollar.

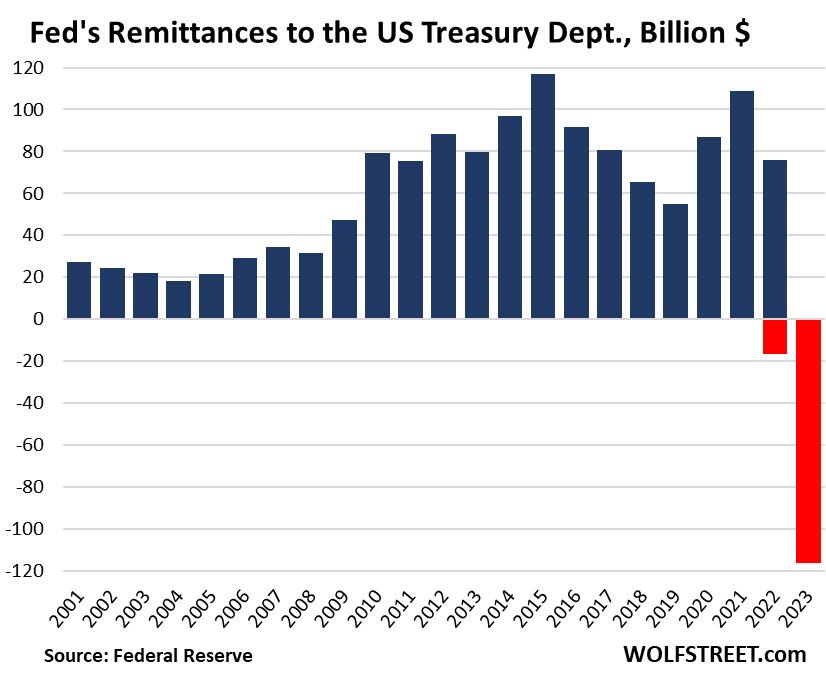

The U.S. Federal Reserve loses $114B, the third largest financial loss in history (beaten only by Lehman Brothers and Washington Mutual).

The Federal Reserve is neither Federal nor has any reserves. It is a private company, representing a banking cartel, with the sole purpose of turning the world’s debt into interest payments, recorded as dividends payable its bank owners.

Legarde can’t stop #Bitcoin

Vanguard CEO resigns after 33 years. Bezos hosts Saylor on private yacht after selling Amazon shares. Mr 100 moves to 1400. Genesis weak hands dumps 600M, price barely moves. Wall Street & banks FOMO. Supply shock coming 51 days.

Game theory playing out. 🤔

On our way. Thanks Gary! 😂

Will USDT be affected? Estimated 25% of USDT on the Tron network.. nostr:note14g57wgguv6qzvdxwu04taa8ldlwn7r3m3fmspste7wztu0xr06cq4rppe7