🚨 I’ve been been preparing for these times for over a decade and one of the reasons I retired from professional hockey.

Financial storms are brewing, and the bond market's collapse is harbinger for things to come.

Just wrote about it on my blog and what I’m doing to prepare for the times ahead.

Would love to get your feedback and learn from things you might be doing to prepare as well…

Community is BIGGEST driver for weathering the storm.

Just landed and got to Airbnb in LA for PB. Who’s ready to roll??

Cameron Macgregor is someone everyone should get used to seeing and hearing.

Thank you for coming on the show & providing a MUCH needed view on #men & #bitcoin that is shunned in culture to explain what's going on in our world & how to drive meaningful change.

Everyone needs to hear your message, you are one sharp dude. 🫡

Proud to know you.

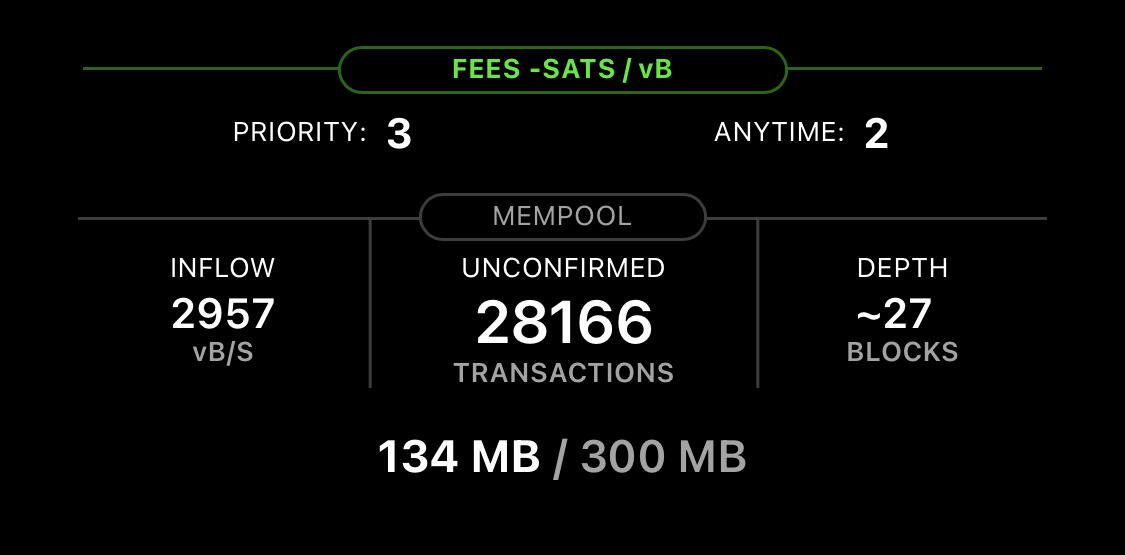

Bro! I almost fell out of my chair yesterday when I looked at the mempool. Hadn’t looked in a number of days and could not believe my eyes at how few TXs were in there!!! 🤪🤪

So, if the government shut down and 4 million government workers, the nations largest employer, aren’t working does that mean they are nonessential?

Asking for a friend.

When you can endlessly steal wealth from your citizens through inflation, enrich yourself and your cronies in the process through illicit accounting, and beat these same citizens over the head using the same wealth you just stole from them through unlimited propaganda, how do you expect to "out-educate" or "out-propagandize" the state?

You cannot.

#bitcoin fixes this.

Note to self, Brandon:

Listening and hearing are two very different and distinct things.

Will report back later with results. 👀

“The fruit of the Spirit is love, joy, peace, patience, kindness, generosity, faithfulness, gentleness, self-control.”

- Galatians 5: 22-23

“If you want to be a great investor then you have to get good at philosophy and history.” - Jim Rogers

I think this is something that #Bitcoin helps you understand at deeper levels than you could have imagined. #Bitcoiners have an innate sense of this.

#Nostr is the place where this flourishes.

Join @BJdichter me & the gang in a few minutes on X spaces going over:

- EU trying to track all crypto

- @theRealKiyosaki & @jordanbpeterson say BUY #BITCOIN

- Top mockingbird assets say @JoeBiden is done

- @laurenboebert proves something u didn’t expect

Thank you nostr:npub10vlhsqm4qar0g42p8g3plqyktmktd8hnprew45w638xzezgja95qapsp42 for coming on the show & being a playable character in this world.

We get deep in to the reason the culture has shifted & psychology behind this that goes back a century +.

You can't put bandaids on bullet holes.

#Bitcoin & Freedom

"Paper is poverty... it is only the ghost of money, and not money itself."

Thomas Jefferson on #bitcoin

What you are about to read may alarm you…

Profiting off chaos, sickness, and death.

In a world driven by financial incentives, it's crucial for the modern man to understand the intricate connections between our monetary system and industries that, at first glance, might seem unrelated.

As we unpack this complex web of interests, it becomes evident how our current fiat-based monetary system can incentivize certain industries to thrive on chaos, war, sickness, and death.

We have talked ad-nauseam how a broken money system perpetuates these trends.

When you lay this all out things start to come in to focus.

It becomes clear how all of this chaos landed on our doorstep and the actions we must take to confront it and succeed.

This list may provide a wake up call to some, shocks to others, and confirm others suspicions but is by no means comprehensive:

1. Weapons Manufacturers: The arms industry benefits from conflicts, as governments with failing currencies can resort to war to stimulate their economies. War becomes a means of profit as more weapons are produced and sold.

2. Private Military Contractors: With governments and corporations seeking outsourced military operations, private military contractors seize opportunities in times of war or geopolitical instability to maximize their gains.

3. Pharmaceuticals and Medical Companies: Sickness and suffering can lead to increased demand for pharmaceutical products and medical services, boosting revenues for these industries.

4. Funeral Services: Death is a solemn reality, but funeral services can profit from rising mortality rates, offering their services during times of increased uncertainty.

5. Disaster Relief Companies: Disasters and emergencies generate demand for disaster relief services, providing opportunities for companies operating in this sector.

6. Hospitals and Healthcare Providers: Financial incentives within the healthcare industry can lead to overdiagnosis, overtreatment, and prolonged procedures to maximize profits.

7. Life Settlement Companies: These companies profit by purchasing life insurance policies from individuals in challenging circumstances, capitalizing on financial distress.

8. Media and News Outlets: Sensationalism and the coverage of chaos and crises can drive higher viewer engagement, leading to increased advertising revenue for media companies

9. Psychological Services and Counseling: Mental health challenges may lead to increased demand for psychological services, which can be driven by distressing situations.

10. Security and Surveillance Industries: In a climate of uncertainty, the security industry thrives as governments and organizations invest in surveillance technologies and solutions.

Profiteering chaos:

The common thread among these industries is that our current monetary system, built on fiat currency, incentivizes growth at any cost.

As governments print more currency, the value of it erodes, prompting businesses and individuals to seek more profits to compensate for this loss.

This drives industries to capitalize on unfortunate situations that generate revenue, further perpetuating cycles of chaos and instability.

Now, imagine a paradigm shift:

Enter Bitcoin – a neutral digital currency with deflationary properties that work to realign incentives and break this cycle.

In a Bitcoin-based world, the game changes.

With a capped supply and an inherent deflationary nature, Bitcoin prevents value erosion over time.

This means that companies are no longer forced to constantly churn out more products or services just to survive the erosion of their earnings.

In a Bitcoin world, companies can focus on innovation, quality, and true value creation.

Bitcoin's deflationary mechanism captures the productivity gains, and these gains are redistributed to companies and individuals alike.

Companies that provide genuine value will naturally prosper, and individuals will witness their wealth grow over time, without the need for constant consumption.

Ultimately, the power of a neutral deflationary currency like Bitcoin lies in its ability to reshape incentives across industries.

As we understand the dynamics of our current monetary system and the potential of Bitcoin to transform it, we can collectively work towards a more sustainable, ethical, and prosperous future for all.

Stay strong.

Hyperbitcoinization will certainly be worth it. For all.

Thanks for all the hard work 💪🏻💯⚡️

I remember these calculations during the last financial crisis in 2008. They were insurmountable then…let alone now.

Haha clown world.