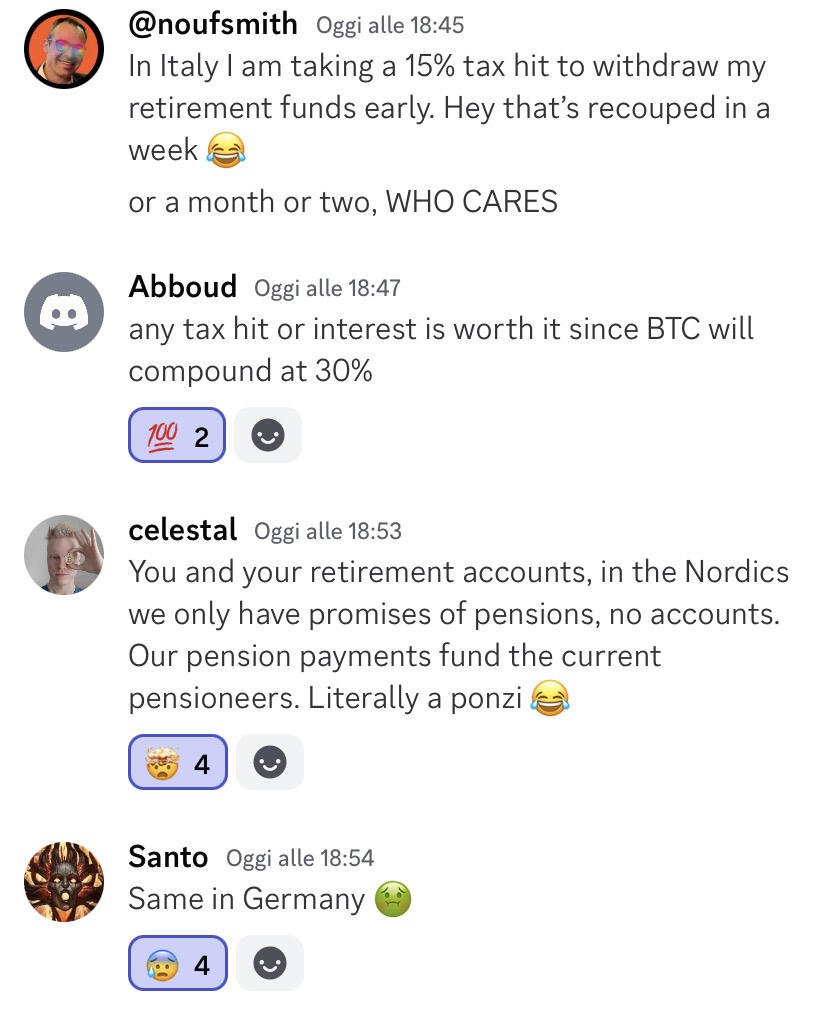

Can your PENSION go into #Bitcoin?

It looks like you can in some countries, not in others such as the Northern European vIrTuOuS countries 🤯

Study fiat to learn what #Bitcoin fixes.

Cats meaning videos and things

Although one could argue cats are manmade bird extinguishers

Byzantine-resilient peer-to-peer replication.

Few.

#Bitcoin?

DIP & RIP

Perfection.

#Bitcoin maxis can be viewed as narrow minded by (fill in the blank).

But if it’s true that #Bitcoin fixes the money, any wannabe store of value and medium of exchange is detrimental for humanity.

Do you like cats?

Fiat is the matrix dystopian SciFi movie. Bitcoin takes us back to reality. The bad trip ends ☀️

#Bitcoin paradox: it makes you realize time is your scarcest resource, and it expands it.

Stay nimble, stack sats

Hey by the way,

There is no “they”.

@JeffBooth about corn.

Thank you for being a Bitcoiner 💜

h/t @parman_the

Bro! You don’t have a Lightning wallet. Zapping is tempe fun part of nostr!

“One day, interest will be the only thing we will be able to pay.”

Elon is correct.

Please share with your ETH acquaintances

If you still have #ETH and decided to forgive yourself and join #Bitcoin

Go to www.sideshift.ai/eth/btc.

It’s just one transaction with a ~2% fee and no account creation.

Steps:

1. Create variable rate order

2. Provide BTC address

3. Send ETH (max ~23ETH) with sufficient gas

4. Wait for confirmation

https://x.com/noufsmith/status/1833388769904382123?s=46&t=NdgatoeC0GKWNjC0JfOXVQ

You’re welcome and Welcome 🤗 🧡 ( 💜 is a different nostry topic)