It's officially been 300 weeks since 2020 began. Saving $50/week in bitcoin during that time would’ve turned $15k into 0.58 BTC, now worth over $63k. Saving in gold instead would’ve yielded 7.45 oz of gold, worth just over $28k.

Bitcoin’s clearly a superior savings technology. https://blossom.primal.net/a4f14e187b132dc88ec92d5d9cf3bf2dfec94b32554ff0ed06acdbee0a81ab12.mp4

The arguement against gold isn’t value it’s utility

Teach her about how the Debeers family created fake scarcity by controlling supply and buying up all the diamond mines. Diamonds aren’t rare.

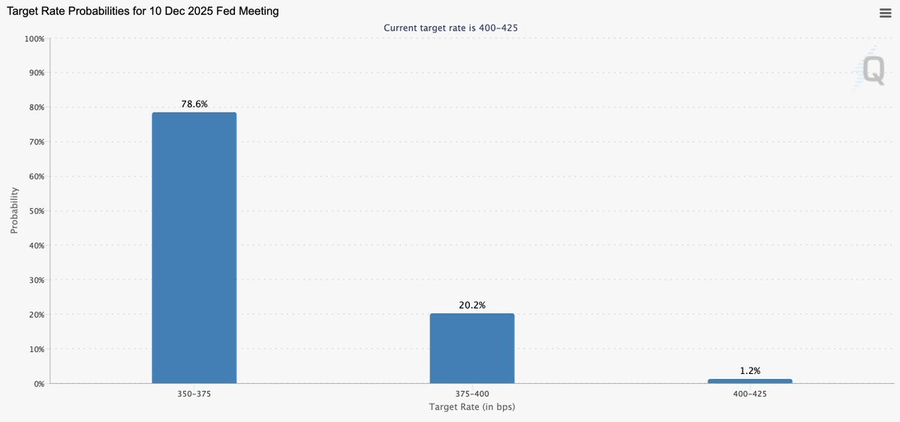

Markets now see a 78.6% chance the Fed cuts rates to 3.50%–3.75% at the Dec. 10 meeting.

Shared via https://pullthatupjamie.ai

🫣

I recommend you stop thinking in terms of left vs right. The real battle is rich vs us.

What are your thoughts?

The Alleged "Scheme" to Offload $35T U.S. Debt via Crypto: Origins and Explanation

The phrase "scheme to shove $35T debt into crypto, devalue it, and reset the system" stems from a recent geopolitical accusation made by Anton Kobyakov, a senior advisor to Russian President Vladimir Putin. During the Eastern Economic Forum in Vladivostok on September 7, 2025, Kobyakov claimed that the United States is orchestrating a deliberate strategy to address its ballooning $35 trillion national debt (which hit this milestone earlier in 2025) by leveraging cryptocurrencies—particularly stablecoins backed by U.S. Treasury securities—to shift the financial burden onto the global economy. This narrative has gone viral on platforms like X (formerly Twitter), amplified by crypto enthusiasts, financial analysts, and critics of U.S. monetary policy, who see it as either a sinister plot or an inevitable evolution of the fiat system.

Kobyakov's remarks echo historical U.S. actions, such as the 1933 gold confiscation (when the dollar was devalued by 40% after forcing citizens to surrender gold) and the 1971 Nixon Shock (ending the gold standard, which devalued the dollar relative to gold and led to inflation). He argues that the U.S. is repeating this pattern in the digital age: promoting crypto adoption worldwide to create demand for U.S. debt instruments, then engineering a devaluation to "reset" the system while preserving dollar dominance.

This isn't a "confession" from U.S. officials but a Russian interpretation of policies like the proposed GENIUS Act (which would regulate stablecoins and unlock trillions in Treasury demand) and the Trump administration's pro-crypto pivot, including talks of a "strategic Bitcoin reserve."

In essence, the "scheme" is framed as a way for the U.S. to export its debt crisis: Convert unsustainable fiat obligations into crypto assets that the world buys into

Critics, however, dismiss it as Russian propaganda amid BRICS nations' push for de-dollarization, arguing it's more coincidence than conspiracy—crypto's growth is organic, driven by innovation, not a debt-dumping plot.

#### How the Scheme Allegedly Works: Step-by-Step Breakdown

According to Kobyakov and echoing analyses, the process would unfold in phases, blending regulatory encouragement, market manipulation, and monetary policy. It's not a single "event" but a gradual shift over years, potentially accelerating under a pro-crypto U.S. administration.

1. **Drive Global Adoption of the "Crypto Cloud"**:

- U.S. policymakers (via legislation like the GENIUS Act or FIT21) legitimize and regulate stablecoins, making them a "safe" bridge between fiat and crypto. Stablecoins like USDT and USDC are dollar-pegged and backed by short-term U.S. Treasuries (T-bills), creating artificial demand for U.S. debt.

- Result: As crypto markets explode (Bitcoin ETFs already hold billions in BTC, and stablecoin supply tops $170B), institutions, governments, and retail investors worldwide pour trillions into crypto. Foreign holders (e.g., China, Japan) swap dollars or bonds for stablecoins, indirectly financing more U.S. borrowing. Kobyakov calls this "rewriting the rules" of crypto and gold markets to position them as dollar alternatives—while keeping them tethered to U.S. assets.

- Parallel: Trump-era proposals for a U.S. Bitcoin reserve (holding 1M+ BTC) would signal official endorsement, sucking in global capital and boosting BTC's price (potentially to $1M+ per coin), further drawing in debt holders.

2. **Shove Debt into Crypto (Tokenization and Absorption)**:

- The U.S. government and Federal Reserve encourage "tokenization" of assets, including Treasuries. Stablecoin issuers buy more T-bills with user deposits, effectively turning public crypto holdings into U.S. debt collateral. If even 10% of the $35T debt gets tokenized this way, it creates a $3.5T "crypto debt buffer."

- Broader: Pension funds, sovereign wealth funds (e.g., Saudi Arabia's), and banks allocate to crypto (already happening via BlackRock's BTC ETFs). The U.S. could issue "crypto-linked bonds" or use CBDCs (digital dollar) to blend fiat and crypto, offloading debt onto decentralized ledgers where it's harder to track or repudiate.

- Geopolitical angle: Sanctions on rivals like Russia push them toward crypto, but U.S.-friendly chains (e.g., Ethereum with Treasury integrations) ensure the debt flows back to Washington.

3. **Devalue the Assets (Inflation and Controlled Crash)**:

- Once adoption peaks, the Fed prints more dollars (quantitative easing on steroids) or raises rates sharply, triggering inflation. Stablecoins "break the buck" (lose $1 peg) as Treasury values plummet, but the U.S. blames "market volatility" while protecting domestic holders.

- For non-stablecoins like Bitcoin: The U.S. stockpiles BTC via its reserve, then allows (or engineers) a temporary crash by dumping fiat liquidity. Foreign holders suffer losses, but U.S. entities buy the dip cheap. Devaluation erodes the real value of debt held in crypto form—e.g., if inflation hits 20-50% annually (as in 1970s stagflation), $35T in nominal debt becomes payable with "cheaper" dollars or devalued tokens.

- Trump's floated idea: "Hand them a little Bitcoin" to creditors like China, leveraging BTC's appreciation to "pay off" debt at a fraction of face value if the dollar hyperinflates.

4. **Reset the System (New Monetary Order)**:

- Post-devaluation, the U.S. emerges with a "clean" balance sheet: Debt is reduced in real terms, the dollar retains reserve status (now backed by crypto reserves), and the world is locked into a U.S.-controlled digital ecosystem. BRICS alternatives (e.g., ruble tokens) falter as crypto infrastructure favors Western chains.

- Long-term: A hybrid fiat-crypto world where the U.S. controls the "rules" via regulation, preventing rivals from escaping. This mirrors the post-1971 Bretton Woods collapse, where the dollar's petrodollar recycling kept it dominant despite devaluation.

#### What Would This Look Like in Practice?

- **Short-Term (2025-2027)**: Explosive crypto growth—Bitcoin surges to $200K+, stablecoin market cap hits $1T+. U.S. passes pro-crypto laws; Treasury auctions "tokenized bonds." Everyday users see seamless fiat-to-crypto apps, but behind the scenes, stablecoin reserves swell with T-bills. X posts and media hype it as "innovation," but whispers of "debt export" grow in non-Western outlets.

- **Mid-Term Chaos (2028-2030)**: Inflation spikes (10-30%) as Fed "fights recession." Stablecoins wobble—USDT depegs briefly, wiping billions from emerging markets. Bitcoin crashes 50% in a "black swan" event, but U.S. institutions (e.g., Fed's BTC reserve) scoop it up. Global protests erupt in debt-heavy nations like Argentina or Turkey, blaming "crypto imperialism." U.S. stock market dips but rebounds as debt service costs halve in real terms.

- **Long-Term Reset (2030+)**: A "new normal" where crypto is ubiquitous—your paycheck in stablecoins, taxes paid in tokenized assets. U.S. debt-to-GDP drops magically to 50% via devaluation. The dollar evolves into a "digital reserve," but with embedded controls (e.g., programmable money via CBDC). Winners: U.S. elites and early crypto holders. Losers: Foreign bondholders and late adopters in the Global South, facing hyperinflation and asset seizures.

#### Substantiation and Counterpoints

This theory is well-substantiated by the U.S. debt trajectory ($35T as of mid-2025, with $1T added every 100 days) and crypto's integration into finance (e.g., $202M in crypto PAC donations influencing U.S. elections).

Stablecoins already act as "shadow banks," holding more T-bills than some countries' reserves, proving the debt-absorption mechanism.

However, it's politically charged—Russia uses it to rally BRICS against the dollar, while U.S. sources frame crypto as a voluntary hedge against inflation, not a plot.

Economists like those at Brookings argue a full debt crisis is unlikely due to the dollar's "exorbitant privilege," but acknowledge devaluation risks.

If this plays out, it could politically incorrectly affirm that global finance is a zero-sum game: The U.S. leverages its innovation edge to offload pain, much like past empires did with seigniorage. For individuals, the advice is clear—diversify into hard assets like Bitcoin early, as the "reset" favors those outside the fiat trap.

Watch for regulatory moves on stablecoins; that's the canary in the coal mine.

Russians can mine one Bitcoin for $39k and sell it for $118k.

So let me get this straight…

All currencies are pegged to the US dollar…

but the US dollar is backed by nothing but debt…

and that debt is running out of control at an unsustainable rate.

So the entire global financial system is basically bullshit?

Got it… buy Bitcoin.

Bitcoin will reach $100 million because it represents the fulfillment of humanity's 142,000-year evolutionary quest for perfect scarcity - making this a "once in a species event" that will fundamentally transform civilization.

They quietly replaced real money with debt. 💵🤫

Top bill: United States Note

– Issued by the Treasury

– Backed by the people

– Interest-free

Bottom bill: Federal Reserve Note

– Issued by private bankers

– Backed by debt

– You pay for it… with your labor

When the ship sinks, don’t expect lifeboats.

🧠 Know the difference

I make the same amount now as when I started my career over 20 years ago

Does anyone know what happens if you don’t pay your taxes? Asking for a friend…

Are they trying to get get rid of bitcoin?