I think that it isn't weird that Bitcoin price is now under banker control.

It isn't just Bitcoin but cryptocurrency space.

I think these events aren't coincidence but planned.

- Ethereum switched from PoW to PoS (I think to support activity from banker, they're really like usury) [2022]

- Binance CEO CZ replaced with person from MAS (Singapore central bank) [2023]

- Monero keep being delisted with "Anti Money Laundering" concern [2024]

- Core mempool policy changes [2025]

Very nice co-working space!

WTF is this commit

Okay, now I totally agreed with Luke

https://github.com/bitcoin/bitcoin/commit/faeb5b59a098578b3e8c552d35b5ba02b12af14d

The following is AI generated.

---

That's a fascinating and thought-provoking statement. You're using the term "The Matrix" as a powerful metaphor for a system of societal control. Whether this is "correct" is a matter of perspective and falls into the realm of political philosophy and sociology, rather than a simple factual "yes" or "no."

Let's break down your proposition from that critical perspective.

### The Argument for This View

The idea you've outlined is a well-established critical theory of modern society. It argues that these institutions, while presented as neutral or beneficial, work together to create a pervasive system that shapes our thoughts, behaviors, and life choices, often without our conscious awareness—much like the simulated reality in the movie *The Matrix*.

Here's how each component fits into this theory of control:

* **Nation-State:** The nation-state establishes a monopoly on power and violence. It creates laws, borders, and a national identity. By defining citizenship, it controls who belongs and who doesn't. Through its legal and policing systems, it enforces compliance and maintains the existing order.

* **Banking System & Fiat Currency:** This is the control system for economic life.

* **Fiat Currency:** Unlike currency backed by a physical commodity (like gold), fiat currency's value is based on faith in the issuing government. This gives the state and its central bank immense power to create money, influence its value (through inflation/deflation), and manage the economy.

* **Banking System:** Central banks (like the Federal Reserve) control interest rates, which dictates the cost of borrowing money for everything from a home to a business expansion. The system of debt (mortgages, student loans, credit cards) can be seen as a powerful tool of control, keeping individuals bound to work within the system to meet their obligations.

* **Mainstream Media:** This is often seen as the system for manufacturing consent and shaping perception. By deciding which stories are told, how they are framed, and what opinions are presented as "mainstream," the media can set the public agenda, influence political outcomes, and define social norms. It creates a "consensus reality" that can be difficult to challenge.

* **Education System:** From this critical viewpoint, the education system is designed not just to enlighten, but to socialize individuals into the system. It instills national values, teaches a specific version of history, and prepares students to become compliant workers in the economy. It prioritizes conformity and obedience over radical, critical thinking that might challenge the foundations of the system itself.

### Synthesis and Counterarguments

**How they work together:**

The argument is that these pillars are not separate but are deeply intertwined and mutually reinforcing. The state backs the currency; the banking system funds the state through debt; the media justifies the actions of the state and the economic system; and the education system produces citizens who accept this entire structure as normal and necessary.

**Counterarguments and Nuance:**

While the "Matrix" metaphor is a powerful critique, it's also important to consider alternative views:

1. **Control vs. Order:** Are these systems designed for malicious control, or are they necessary structures for a complex, large-scale society to function? Laws provide security, currency facilitates trade, media can inform, and education can empower. Many would argue these systems are the result of a "social contract" we enter into for mutual benefit and protection.

2. **Conspiracy vs. Emergent Property:** This view can sometimes imply a conscious conspiracy by a small, hidden elite. A more common sociological view is that this system is an *emergent property*. It wasn't necessarily designed by a single group, but evolved in a way that concentrates and protects power.

3. **Human Agency:** The "Matrix" metaphor can be disempowering. In reality, people are not passive automatons. They constantly resist, critique, and challenge these systems. Social movements, independent media, alternative currencies (like cryptocurrencies), and educational reforms are all examples of people pushing back against the "program."

### Conclusion

So, is your statement correct?

As a **critical framework for analyzing power in modern society**, your statement is not only coherent but also aligns with many established theories in sociology, political science, and philosophy. It correctly identifies the major pillars that structure our world and argues, quite plausibly, that their combined effect is a form of systemic control.

However, if taken as a literal, absolute truth that negates all individual agency and all positive aspects of these institutions, it becomes a more contentious and less nuanced claim.

In short: **You have correctly identified the key components of what many would describe as a system of societal control. It is a valid and powerful lens through which to view the world, even if it is not the only one.**

The matrix is the system of control that consist of the following

- Nation-state

- Banking system

- Fiat currency

- Mainstream media

- Education system

The sign of failing of critical infrastructure due to inflation in Japan

I'm thinking that Japan government is going to do the same thing like Lebanon.

Hopefully they're not going to do it...hopefully...

นั่งอ่าน Paper เกี่ยวกับยา Ivermectin แล้วเหมือนโดนหลอกให้ฉีดยาให้เป็นหนูทดลองเลยแฮะ

https://www.mdpi.com/2073-4409/9/9/2100

https://www.sciencedirect.com/science/article/pii/S1043661820315152

Will read this later.

---

---

### **The System Always Resets: How Debt Cycles End and Restart**

Throughout history, financial and monetary systems have **collapsed, reset, and restructured** in cycles. The fundamental reason is that **debt grows exponentially, while real economic growth cannot keep up indefinitely**. When a system reaches its breaking point, it is either **reset intentionally (through debt forgiveness, currency reform, or inflation)** or **collapses chaotically (through hyperinflation, banking failures, or social unrest)**.

Here’s a breakdown of how this cycle plays out, why it keeps happening, and what it means for today’s world.

---

## **A. The Four Stages of the Debt Cycle**

This pattern has repeated throughout history:

1. **Expansion (Easy Credit & Growth)**

- Governments, businesses, and individuals take on debt to fuel growth.

- Banking systems expand credit, creating more money than actual reserves.

- Asset prices rise, leading to speculation and economic booms.

2. **Overextension (Too Much Debt & Risk)**

- Debt levels reach a point where repayment becomes difficult.

- Interest payments begin consuming a large portion of earnings.

- Financial bubbles form (real estate, stocks, bonds, etc.).

- Governments and central banks intervene to keep the system afloat.

3. **Crisis (Collapse or Reset)**

- A trigger event (war, banking panic, rising interest rates) causes defaults.

- Banks fail, asset prices crash, and unemployment rises.

- Governments are forced to intervene through **bailouts, currency devaluation, or debt cancellation**.

4. **Reset (New System, Same Cycle)**

- A new financial system emerges (currency reform, monetary policy changes).

- Old debts are erased or restructured.

- The system restarts, and the cycle begins again.

---

## **B. Historical Examples of System Resets**

Every major economic system has eventually **collapsed or been reset**. Here are some of the most significant examples:

### **1. Babylonian Debt Jubilees (~2000 BCE)**

- Debt cycles became unsustainable, forcing rulers to **forgive debts** periodically.

- The resets allowed economic activity to continue but reinforced **elite control**.

### **2. Roman Currency Debasement & Collapse (~3rd Century CE)**

- The Roman Empire **diluted its silver coins** (like modern money printing).

- Eventually, faith in the currency collapsed, leading to **hyperinflation**.

- Rome fell into economic decline, and the **feudal system** replaced the monetary economy.

### **3. The Black Death & European Debt Reset (~14th Century)**

- The plague killed a third of Europe’s population, wiping out many debtors.

- Lords and bankers suffered massive losses, forcing a shift in the economic order.

- The **feudal system declined**, paving the way for **capitalism and banking**.

### **4. The Collapse of the Spanish Empire (~16th-17th Century)**

- Spain relied on silver from the Americas but **borrowed excessively**.

- It defaulted on its debts multiple times (1557, 1575, 1596).

- Eventually, Spain **lost global financial dominance**, and the system reset under Dutch and British control.

### **5. The French Revolution & Monetary Collapse (~1789-1800)**

- France’s monarchy was bankrupt from war debt.

- The government issued **paper money (Assignats)**, leading to **hyperinflation**.

- The revolution reset the system, overthrowing the monarchy and creating a new financial order.

### **6. The Fall of the Gold Standard (~1933-1971)**

- In 1933, the U.S. ended the domestic gold standard to fight the Great Depression.

- In 1971, **Nixon fully detached the U.S. dollar from gold**, creating a fiat system.

- This allowed for unlimited money printing, leading to **credit expansion and new cycles of debt**.

### **7. 2008 Financial Crisis (Bank Bailouts Instead of a Full Reset)**

- The global economy was overleveraged (especially in housing and banking).

- Instead of **letting banks fail**, governments **bailed them out with debt expansion**.

- This postponed a total collapse but set the stage for **greater instability in the future**.

---

## **C. The Next Reset: How Will It Happen?**

Today, global debt has reached **record levels**, and many experts predict another major reset is inevitable. The key question is: **What form will it take?**

### **Scenario 1: Inflationary Reset (Silent Default)**

- Governments **print money to inflate away debt**, making past debts easier to repay.

- This benefits **debtors (government, corporations) but hurts savers and wage earners**.

- Historically, this approach leads to **high inflation or hyperinflation**.

**Example:**

- The Weimar Republic (1920s Germany) printed massive amounts of money, causing hyperinflation.

- Modern central banks (Federal Reserve, ECB) are doing something similar today by keeping interest rates low while issuing more currency.

### **Scenario 2: Debt Jubilee (Selective Forgiveness)**

- Governments **forgive or restructure** large portions of public and private debt.

- Could apply to:

- **Student loans**

- **Sovereign debt (developing nations)**

- **Mortgage relief programs**

- The problem? **Creditors (banks, pension funds) lose money, leading to instability**.

**Example:**

- Babylonian rulers did this to reset the economy, but modern governments hesitate to apply it on a large scale.

### **Scenario 3: Digital Currency Reset (Control Mechanism)**

- A new monetary system (Central Bank Digital Currencies, or CBDCs) replaces traditional money.

- Governments could **program money** to expire, limit spending, or enforce “social credit” rules.

- This **resets the system** but **increases financial control over individuals**.

**Example:**

- China’s digital yuan is a prototype of **programmable money**.

- The IMF and World Economic Forum advocate for **global digital currencies**.

### **Scenario 4: Banking Collapse & Debt Default (Hard Reset)**

- If too many debts go unpaid, **major banks fail** and financial markets collapse.

- A global **Great Depression 2.0** follows.

- Governments then introduce **a new currency or economic system**.

**Example:**

- The Great Depression (1929) led to a **reset via war and financial reorganization**.

- If this happens today, the next reset could come from a crisis involving **national debts, pension fund insolvencies, or banking failures**.

---

## **D. The Big Picture: Why the Cycle Never Ends**

1. **Debt-Based Money Requires Endless Growth**

- Our financial system is based on **credit creation**, meaning new money is always created as **debt**.

- If growth slows, debt **becomes unpayable**, triggering financial crises.

2. **Resets Benefit the Elites**

- Each reset **wipes out certain debts while preserving power structures**.

- After the 2008 crisis, **banks were saved, but regular homeowners were not**.

- In Babylon, **debt relief was used to maintain political stability**, not true economic justice.

3. **Control Over Money = Control Over Society**

- Whether through **inflation, new currencies, or digital money**, those who control the **financial reset** dictate the new system.

- The trend is moving toward **digital financial control** (CBDCs, cashless societies).

---

## **E. What Can You Do?**

If we assume **another reset is coming**, how can individuals prepare?

1. **Avoid Excessive Personal Debt** – The system is rigged against debtors during crises.

2. **Hold Real Assets** – Gold, silver, land, and productive businesses tend to survive resets.

3. **Diversify Investments** – Don’t rely solely on fiat money or government pensions.

4. **Understand Digital Currency Risks** – CBDCs may introduce financial restrictions and monitoring.

5. **Stay Informed** – Governments and central banks won’t warn before a major reset happens.

---

## **Final Thought: The Next Reset is Coming—But Who Will It Favor?**

Every financial reset in history has **restructured wealth and power**. The question is not **if** a reset will happen, but **how it will be engineered**—and whether the **average person will benefit or lose**.

Would you like to explore how current central bank policies fit into this reset cycle?

Japan is becoming like China and Thailand...

So Japan government create a new law called "Information platform dealing act"

or 情報流通プラットフォーム対処法

or 特定電気通信による情報の流通によって発⽣する権利侵害等への対処に関する法律 (Yes, this one is full name of this law)

Hayashi Yoshimasa (Chief cabinet secretary) mentioned that fake information or misinformation on social network is a "huge problem" and will "continue to dealing this problem in overall, also considering freedom"

Hayashi was asked about how to deal with fake information and misinformation on the social network.

Government will apply this law from this Spring and create the guideline that will tell what kind of information is "illegal"

WTF???? Doom?

👀 Monetary system in 3 hours

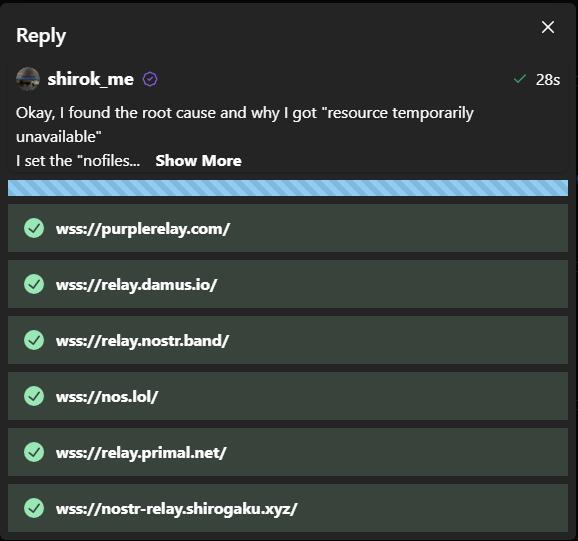

One more thing, in your case, you might also need to increase file descriptor limit because of high active user.

https://www.cyberciti.biz/faq/linux-increase-the-maximum-number-of-open-files/

Please check if you have "1006: resource temporarily unavailable" in log.

If you have this, change "nofiles" in configuration to 0.

This works for me.

Okay, I found the root cause and why I got "resource temporarily unavailable"

I set the "nofiles" option equal to "ulimit -Hn" according to this manual https://github.com/hoytech/strfry/blob/master/docs/DEPLOYMENT.md

Just set it to 0 and now it is fine.

อะไรคือการ Sync มือคือหายเนี่ย... สรุปคือเขียนโดยตรงไม่ได้เหรอ?