Ask ChatGPT : "Is silver a money in the past?"

----------

Yes, silver has historically been used as money. Throughout history, many civilizations have utilized silver as a form of currency due to its intrinsic value, durability, and divisibility. Some key points about silver's role as money include:

1. **Ancient Civilizations**:

- The use of silver dates back to ancient civilizations such as the Egyptians, Greeks, and Romans, who used silver coins for trade and commerce.

2. **The Greek and Roman Empires**:

- Both the Greeks and Romans minted silver coins. The Greek drachma and the Roman denarius were standard currencies made from silver.

3. **Middle Ages**:

- During the medieval period, silver continued to be a primary medium of exchange in Europe. The silver penny, for instance, was widely used in England.

4. **Spanish Empire**:

- In the 16th century, the Spanish Empire mined vast quantities of silver from the Americas, particularly from the Potosí mines in present-day Bolivia. This silver was used to mint coins and became a global currency.

5. **The Silver Standard**:

- Several countries adopted the silver standard in the 19th century, where the value of their currency was based on a fixed amount of silver.

6. **Transition to Fiat Money**:

- The use of silver as a primary form of money began to decline with the advent of fiat money systems and the move towards the gold standard in the late 19th and early 20th centuries.

Today, while silver is no longer used as everyday currency, it remains valuable as a precious metal and is still used in coinage, investment, and industrial applications.

Ask ChatGPT : "What is debt based monetary system and what is its advantage and disadvantage?"

----------

A debt-based monetary system, also known as a fiat monetary system, is a financial structure where money is created through the issuance of debt. In this system, central banks (like the Federal Reserve in the United States) and commercial banks play a central role in money creation.

Here's how it works:

1. **Central Bank Actions**: The central bank controls the supply of money primarily through open market operations, setting reserve requirements, and adjusting the interest rates. When the central bank buys government securities, it increases the money supply by crediting the accounts of the banks that sold the securities.

2. **Commercial Bank Lending**: Commercial banks create money through the lending process. When a bank issues a loan, it credits the borrower’s account with a deposit, effectively creating new money. This newly created money is backed by the borrower's promise to repay the loan.

### Advantages of a Debt-Based Monetary System

1. **Economic Growth**: By facilitating borrowing and lending, this system can promote economic growth. Businesses can obtain loans to invest in new projects, and consumers can borrow to purchase goods and services, stimulating demand.

2. **Monetary Policy Flexibility**: Central banks can adjust interest rates and conduct open market operations to influence the economy. This flexibility helps manage inflation, control unemployment, and respond to economic crises.

3. **Financial Innovation**: The system encourages financial innovation, as banks and financial institutions develop new products and services to meet the borrowing needs of businesses and consumers.

4. **Liquidity Provision**: It provides liquidity to the economy, allowing for smoother financial transactions and operations.

### Disadvantages of a Debt-Based Monetary System

1. **Debt Accumulation**: Continuous money creation through debt can lead to high levels of debt for consumers, businesses, and governments, increasing the risk of default and financial instability.

2. **Inflation**: If not managed properly, excessive money creation can lead to inflation, eroding the purchasing power of money.

3. **Economic Cycles**: The system can contribute to economic cycles of boom and bust. Easy credit conditions can lead to economic bubbles, while tightened credit can exacerbate economic downturns.

4. **Interest Payments**: Borrowers must pay interest on the debt, which can be a burden for consumers and businesses and can also lead to significant portions of government budgets being devoted to interest payments rather than productive investments.

5. **Wealth Inequality**: The system can exacerbate wealth inequality, as those with better access to credit (typically the wealthy) can leverage their borrowing to accumulate more assets, while those without such access can fall behind.

I think it is time to exit Japanese Yen or Yen-dominated asset.

I will decrease all of my Yen-dominated asset or asset in Japanese financial institution.

If you know what I mean, just be prepared.

I also heard from my relative in Thailand that inflation in Thailand is ridiculous.

Living in Thailand is like keep getting fucked by the system.

Living in Japan is like keep getting fucked by Boomers

Srsly?

When you're expat and living in the country where its currency is going to failed 😅

In the worst cast scenario, I just go back to Thailand but if Japanese Yen failed, I think Thai Baht also not going to survive

"It's time to choose"

https://finance.yahoo.com/news/ueda-longest-silence-period-keeps-045431453.html

โดยส่วนตัว นี่น่าจะเป็นสัญญาณ Brace for impact แฮะ

"It's time to choose"

https://finance.yahoo.com/news/ueda-longest-silence-period-keeps-045431453.html

บางทีก็คิดนะว่า Kishida นี่มันเป็น Tyranny หรือเปล่า

คะแนนนิยมต่ำเตี้ยเรี่ยดินขนาดนี้ มันยังทำหน้ายิ้ม จะขึ้นภาษีรัวๆ

ถึงก่อนหน้านี้จะมีนโยบายลดภาษีไปนิดหน่อยก็เถอะ เหอะๆ

มองหน้าแล้วไม่ค่อยน่าไว้ใจ

Ueda นี่ ได้แต่ทำตัวเหงียมๆ

Yes, Japan economy is totally destroyed and already shifted to neo-socialism.

With money printer, yield curve control and a lot of subsidies.

https://www.youtube.com/watch?v=Tv2T0BMHlLQ

Looks like Japan government let Bitcoin ATM back.

Maybe KYC is required. 「ガイアのサービス利用者としてログインした後に本人確認をする」

Max 100K JPY per time, and 10% fee (This is ridiculous...)

I will check if have time.

https://www.nikkei.com/article/DGXZQOUB1212Z0S4A710C2000000/

Okay, KYC is required for sure...

Looks like Japan government let Bitcoin ATM back.

Maybe KYC is required. 「ガイアのサービス利用者としてログインした後に本人確認をする」

Max 100K JPY per time, and 10% fee (This is ridiculous...)

I will check if have time.

https://www.nikkei.com/article/DGXZQOUB1212Z0S4A710C2000000/

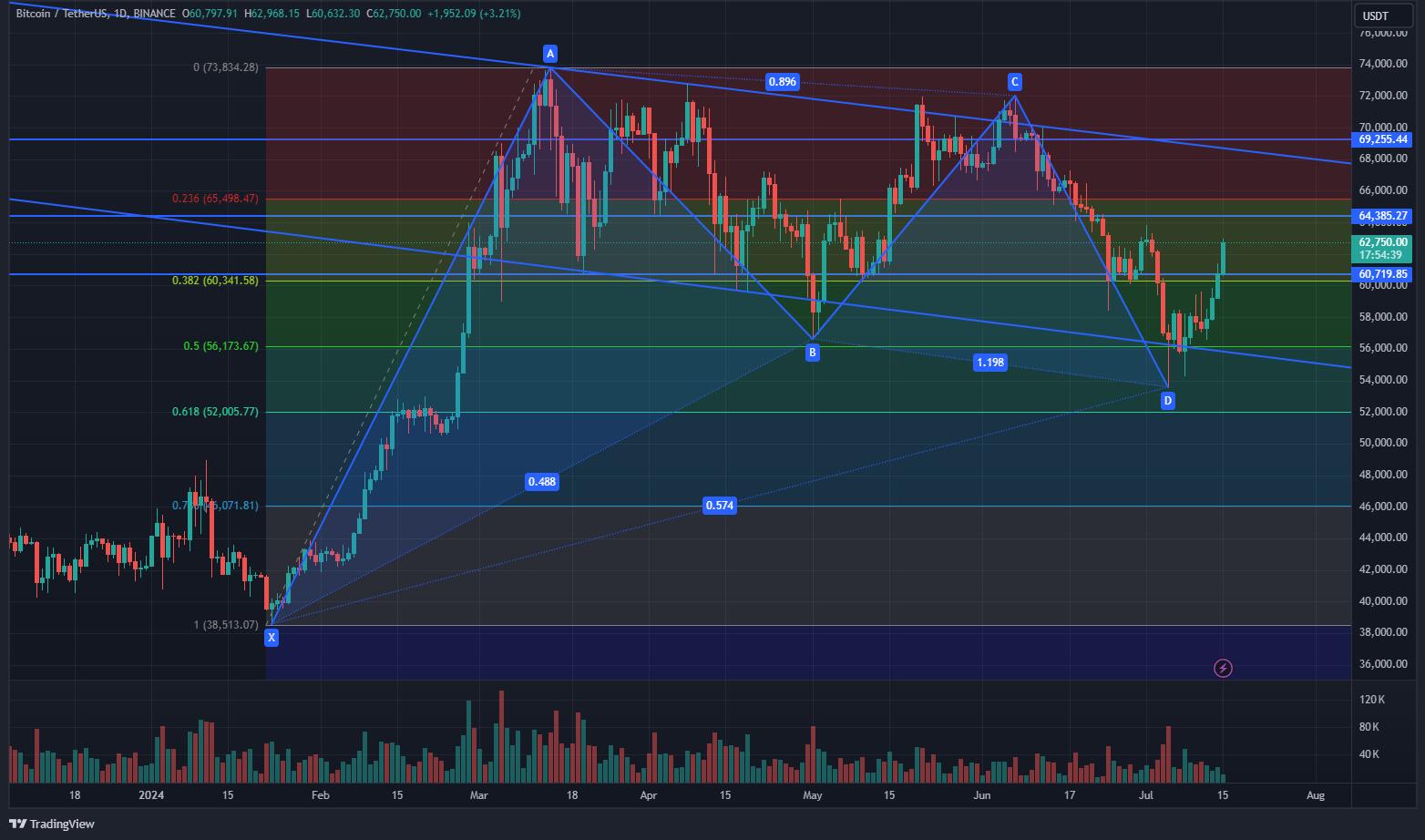

Bullish Gartley

For those who want to know that economic background in Japan for last 30 years, I recommend you guys to watch this.