"Resistance Money informs without inflaming and teaches without preaching... It's at the very top of my suggested reading list for anyone curious and open-minded about bitcoin." — Troy Cross, Reed College

Tough but fair! It was a test, linking to a Twitter-hosted image. It’s from a Reuters article, and it’s a statement from the Prime Minister of Egypt about plans to block remissions outside of their (recently debased and poorly managed) banking system. He thinks it helps. It just drives people towards bitcoin and stables.

What the central bank tinkerers don't understand is that blocking the exits doesn't quell demand for alternative monies. It stimulates it. Every time you set up a chokepoint, a new person googles 'what is bitcoin?' (or 'ما هو البيتكوين؟').

https://pbs.twimg.com/media/GIGtH-wWgAAIFVc?format=jpg&name=large

Baby steps — I’ll add the app to my dock now so I see the icon every day, which will remind me to get on here and participate!

Haha, do not order the hard copy just yet! In negotiations with the press, we pressed hard on the paperback price, and if it has good sales, other options will open up (audiobook, cheaper hard cover, more markets, translations, etc.).

Thank you! We’re working on pulling that release date forward. Strong pre-order numbers will help.

Pre-order your copy of Resistance Money today! Just $29.95 (USD, paperback, Amazon) gets you the most meticulously researched, lively, comprehensive, and measured evaluation of bitcoin to date — peer-reviewed, and published by a leading academic press.

The real story is not that bitcoin continues to flourish after fifteen years. Nor is it that SBF is a convicted criminal. It’s that the worlds of credentialed academia and journalism got both SBF and bitcoin exactly wrong. The press darling is in jail. Bitcoin roams free.

One week later, Wallet of Satoshi is gone from the USA app stores. Were you ready, anon? Are you still “onboarding” people with a banking app they may not be able to access in the future? nostr:note15um7j7vh5ha3c5ghqc74rv43lgvcktkf6qfggla89y26rfpw0w8qdpdwrq

Shotgun KYC; see quoted note. It’s when someone else has your stuff and won’t give it back until you prove your identity and answer intrusive questions. Happens all the time with this sort of app. Wallet of Satoshi is a bank, and shouldn’t surprise us if it turns out to do bank-like things.

Folks who continue to use Wallet of Satoshi (and recommend its use) would do well to write down some guesses about these three scenarios (rug, shotgun, honeypot). How likely is each, and how does the sum probability of those three dire scenarios compare to a graceful WoS exit or ongoing functionality?

It’s called risk management. You either do this, or reality does it for you. nostr:note126egz0ay4yzgskx23a886cf3d2ay6j3c7fx24hwegssapc57cf8qkqjzxy

Common argument:

1. Halvings introduce no new information about supply.

2. If so, halvings cannot influence price.

3. Therefore, halvings cannot influence price (1 and 2).

I think halvings are priced in, but reject both premises.

Against 1: halvings can introduce new information about supply. They show, with certainty, what was before only expected to some high degree -- that new supply coming to market will soon dramatically click downward.

Against 2: halvings can also introduce new information, not about supply, but about demand. What if you discover, time and again, that people quite stupidly respond to halvings by buying? The first few times, that's new information! And when it stops, that's new information too!

Why do I think halvings are still priced in? Because they're *now* priced in. These effects are known, and known to be known, and negligible after the first few halvings.

I knew the Bank of Lebanon was no good. But until today, I didn't know quite how no good. They didn't just print too much money. Officials embezzled from the bank, invested in Ponzi schemes, and then lied and printed to cover it all up. Result: Lebanese Pound down 98% vs. USD.

There are a lot of sources that go into more detail on this, and the story isn't over yet. For one recent overview, see: https://www.dw.com/en/how-lebanon-was-plundered-by-its-own-central-bank/a-66613994

When the World Bank released a report about your monetary and fiscal system entitled "Ponzi Finance?" you know you messed up: https://www.worldbank.org/en/news/press-release/2022/08/02/lebanon-s-ponzi-finance-scheme-has-caused-unprecedented-social-and-economic-pain-to-the-lebanese-people

One interesting element of this particular case is how authorities across monetary, banking, financial, and fiscal systems conspired to create a crisis. And 'create' is not an exaggeration, according to the World Bank. They call it a ‘Deliberate Depression’.

One can reflect on why counterfeiting might “oppress the poor — and learn from the exercise — without being Catholic, I hope!

“Whoever knowingly makes or intentionally spends counterfeit money shall be separated from the communion of the faithful as one accursed, an oppressor of the poor and a disturber of the state”

Lateran 1, Canon 13 (15 in some numberings), 1123 AD

What’s interesting to me isn’t just that counterfeiting is singled out for condemnation — it’s that one of the reasons given is that it amounts to oppression of the poor. These guys were onto something.

“How, exactly, do counterfeit bills oppress the poor?” is a good question. Think about it, and you may come to some unexpected conclusions!

Unfortunately no! We’re finished with revisions (116 people helped us improve the manuscript with sometimes ruthless and penetrating comments and critique). But since this is an academic press, the process doesn’t end there, not by a long shot. This delay is the price of trying to do it right, instead of self-publishing or publishing with BTC Inc or something like that. Hopefully it'll be worth it, and find new audiences beyond the already orange-pilled who buy bitcoin books!

I'm working on a taxonomy of digital goods — especially rivalrous, excludable ones that can be transferred. What are paradigm cases or important kinds to keep track of? How would you add to a list like this?

- domain names

- digital dollars, debts, bonds

- NFTs

- gaming assets (skins, etc.)

- bitcoin (of course)

- ether

Some key properties I'm keeping track of include marginal cost of production, non-monetary (use) value, cash flow, aesthetic value, possible Veblen status, mode of issuance/creation, and self-custody.

What else comes to mind?

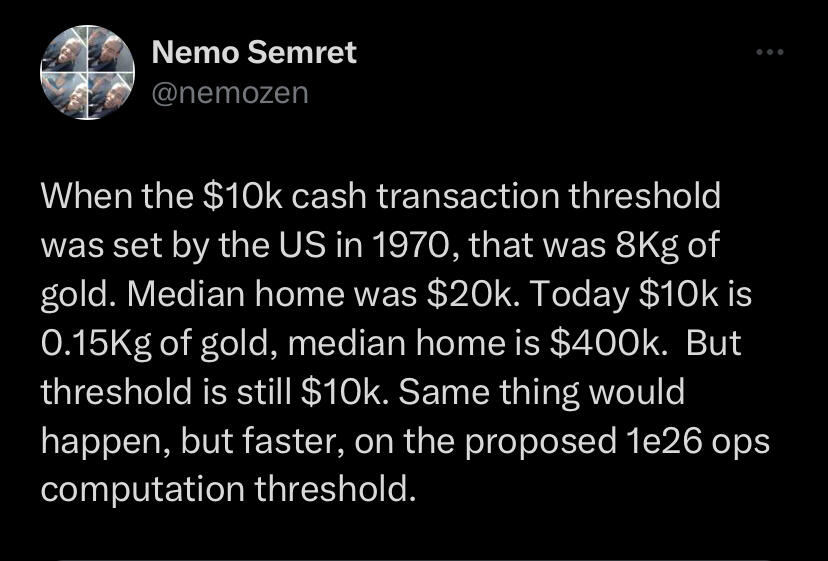

Make Cash Great Again — pentuple reporting thresholds and bring back or mint new supernotes ($500, $1,000, even $10,000 denominations)

Academia matters to bitcoin because a sewage pipe is feeding misinformation into the public sphere. And the only way to fight lies is with the truth. Bitcoin is too important to not study with care, and with all the tools we have.