When comparing Bitcoin ETF options to MicroStrategy (MSTR) options, both offer exposure to Bitcoin’s price movements, but they have key differences in structure, risk profile, and market dynamics. Here's a breakdown:

1. Exposure to Bitcoin

Bitcoin ETF Options: These options will provide synthetic exposure to Bitcoin’s price through a regulated financial product. Investors are not actually holding Bitcoin directly but are instead participating in price movements via derivatives. This exposure is pure, meaning the price fluctuations of Bitcoin will closely mirror those of the ETF, depending on how the fund is structured.

MSTR Options: MicroStrategy (MSTR) is a publicly traded company that holds a significant amount of Bitcoin in its corporate treasury. Buying MSTR options offers indirect exposure to Bitcoin because MSTR’s stock price is heavily influenced by Bitcoin’s price.

However, MSTR’s stock price also reflects other factors like the company’s core business operations, management decisions, and overall market sentiment toward tech stocks. Therefore, MSTR is more of a hybrid play—both a Bitcoin proxy and a bet on the company itself.

2. Leverage and Risk

Bitcoin ETF Options: Bitcoin ETF options will likely offer direct exposure with leverage that can amplify gains or losses based solely on Bitcoin’s price. These options provide a cleaner way to take leveraged positions on Bitcoin with less concern about corporate performance or other external factors.

MSTR Options: MSTR options offer indirect leverage on Bitcoin’s price, but with additional risks tied to the company’s operational performance. If MicroStrategy’s core business underperforms, or if market sentiment around the company turns negative (unrelated to Bitcoin’s price), MSTR’s stock and options could decline, even if Bitcoin is performing well. That adds an additional layer of risk compared to pure Bitcoin ETF options.

3. Market Sentiment and Correlation

Bitcoin ETF Options: The price of Bitcoin ETF options will track Bitcoin closely, so these options are directly affected by Bitcoin’s volatility and market sentiment. Positive news about Bitcoin or growing institutional interest in cryptocurrencies will likely lead to price appreciation in the ETF and its options.

This product is purely correlated to Bitcoin, and its volatility will mirror Bitcoin’s movements.

MSTR Options: While MSTR’s stock price correlates with Bitcoin due to its Bitcoin holdings, it’s not a 1:1 relationship.

The company’s stock is influenced by broader market conditions, interest rates, the tech sector’s performance, and sentiment surrounding MicroStrategy’s core business. For example, if tech stocks are underperforming or if investors lose confidence in MicroStrategy’s CEO, Michael Saylor, MSTR’s stock may lag behind Bitcoin even if Bitcoin is rising.

4. Regulation and Investor Access

Bitcoin ETF Options: Bitcoin ETF options provide a regulated way to trade Bitcoin’s volatility. This means investors get exposure to Bitcoin in a format familiar to traditional equity and options traders. They avoid complexities around directly holding or securing Bitcoin, and regulation makes the product more accessible to institutional investors who require such safeguards.

MSTR Options: MSTR options are also traded in a regulated market, but they don’t provide the same pure exposure to Bitcoin. MSTR's stock can be seen as a "Bitcoin proxy," but institutional investors may see this as an indirect play that introduces other business risks. Additionally, for investors uncomfortable with MicroStrategy’s highly leveraged strategy to buy Bitcoin, MSTR options might seem riskier.

5. Tax Implications and Corporate Factors

Bitcoin ETF Options: ETF options tied to Bitcoin could offer tax efficiency for some investors, particularly in the U.S., where the capital gains from ETF transactions might be treated differently than direct crypto holdings, which are taxed as property. Since the ETF doesn’t directly hold Bitcoin but instead uses derivatives and futures, investors avoid the complexities of direct Bitcoin tax rules.

MSTR Options: MSTR is a publicly traded company, so any options trading on its stock would follow standard rules for equity options. However, since MicroStrategy itself holds a large amount of Bitcoin, its stock is affected by the company’s broader financial and strategic decisions. For example, changes in how MicroStrategy manages its Bitcoin treasury, or corporate governance issues, could impact MSTR’s stock price, adding a layer of complexity for options traders.

6. Upside Potential

Bitcoin ETF Options: The upside for Bitcoin ETF options is directly tied to Bitcoin’s price appreciation. In a bull market, these options can give traders highly leveraged exposure to Bitcoin’s price swings, which could be substantial given Bitcoin’s history of large, volatile moves. The ETF structure allows for cleaner price tracking and makes it easier to hedge risk.

MSTR Options: MSTR options have the potential for significant upside, but it’s more nuanced. If Bitcoin’s price surges and MicroStrategy’s stock is viewed as a strong proxy, MSTR could outperform Bitcoin due to its large Bitcoin reserves and speculative momentum. However, since MSTR also runs a software business, positive developments there could provide a further boost, adding upside beyond Bitcoin’s rise.

7. Diversification and Flexibility

Bitcoin ETF Options: These options provide Bitcoin exposure in isolation. Investors can focus solely on Bitcoin’s movements and volatility without concern for additional factors.

MSTR Options: MSTR options, while riskier, offer a form of diversification. Investors are indirectly exposed to Bitcoin, but also to the performance of a publicly traded company. Some may view this as beneficial diversification—having exposure to a company plus Bitcoin—but others may see it as unnecessary risk compared to pure Bitcoin ETFs.

Conclusion

Bitcoin ETF Options: These are ideal for investors seeking direct, leveraged exposure to Bitcoin’s price without the added complexity of a company’s operations. They are a cleaner and more focused way to play Bitcoin’s volatility.

MSTR Options: These are better suited for investors who want exposure to Bitcoin but are willing to take on additional risks (or potential rewards) related to MicroStrategy’s corporate performance. They provide indirect exposure to Bitcoin, with the potential for outsized gains in bull markets if both Bitcoin and MSTR’s stock perform well.

Ultimately, the choice depends on whether you want pure exposure to Bitcoin’s price (Bitcoin ETF options) or are comfortable with the additional risks and potential rewards that come with MicroStrategy’s stock (MSTR options).

#plebchain #nostr #yeslongfuckingreadit

The bullish case for Bitcoin ETF options is based on several factors that could drive significant growth and further adoption:

Institutional Adoption and Liquidity: The approval of Bitcoin ETF options could greatly increase institutional participation. Institutional investors, who were previously hesitant due to lack of regulation or custody concerns, will now have a more accessible, regulated vehicle to gain exposure to Bitcoin. This could lead to a massive inflow of capital into the Bitcoin market, increasing its liquidity and stabilizing its price over the long term.

Leverage Increases Returns: The introduction of leverage through ETFs allows traders and investors to amplify their potential returns on Bitcoin. While this can increase risk, it also opens the door for investors to capture greater upside without the need for constantly rolling over options or using complex trading strategies. Over time, this could drive more sustained demand for Bitcoin, especially during bullish market conditions.

Unlocking Synthetic Exposure: Fractionalized banking with ETF options allows for greater financial innovation. Investors can now gain exposure to Bitcoin’s price movements without directly holding the asset, reducing friction for participation. This makes Bitcoin more accessible to a broader audience, from retail to large-scale funds, and enhances its integration into traditional financial systems. This synthetic exposure could lead to exponential growth in trading volume and demand for Bitcoin.

Volatility Can Fuel Demand: Bitcoin's inherent volatility, combined with leveraged ETFs, could actually drive more speculative interest. Traders love volatility because it provides opportunities to profit from both upward and downward price movements. With Bitcoin's known upside potential, leveraged ETFs offer high-reward opportunities, which will likely attract more capital to the market, leading to even larger price moves on the upside.

Scarcity and Inability to Dilute: Unlike stocks or other commodities, Bitcoin has a fixed supply, which cannot be diluted or increased by any central authority. As demand grows due to ETF adoption, the capped supply of Bitcoin could result in price surges. The scarcity dynamic will likely continue to drive Bitcoin’s value, especially in a world where fiat currency is often subject to inflation and money printing.

Institutional Maturity and Risk Management: With the involvement of regulated entities and financial products like ETFs, the market will likely mature, attracting higher-quality participants. This could reduce some of the wild price swings seen in the unregulated crypto market while allowing for greater market efficiency. Institutional hedging tools will allow investors to manage risk better, making Bitcoin a more attractive asset for large portfolios.

Mainstream Legitimacy: The approval of Bitcoin ETFs by regulatory bodies like the SEC is a huge step in legitimizing Bitcoin as a mainstream asset. This move could pave the way for further financial products, like Bitcoin pension funds or more advanced derivatives, further embedding Bitcoin in the global financial system and expanding its user base. As Bitcoin becomes more recognized, its value as a store of wealth could increase, similar to gold.

Gateway to Broader Crypto Adoption: Bitcoin’s entrance into the regulated financial system through ETFs could serve as a gateway for the broader cryptocurrency market. As Bitcoin ETFs gain acceptance and perform well, other cryptocurrencies could follow a similar path, leading to increased interest and investment in the overall digital asset space.

In conclusion, the bullish case for Bitcoin ETF options lies in increased institutional adoption, accessibility for retail investors, leveraged growth potential, and Bitcoin’s scarcity. The approval of these ETFs represents a significant leap toward Bitcoin’s integration into traditional financial systems, potentially driving its price higher and solidifying its role as a major financial asset.

#plebchain #nostr

The bearish case for Bitcoin ETF options could center on the following:

Increased Regulation and Market Manipulation: Introducing Bitcoin into a highly regulated and leveraged ETF environment could stifle its decentralized and open-market nature. Traditional market players might use regulatory mechanisms to control volatility or manipulate the market, reducing Bitcoin's appeal to crypto purists and potentially dampening the free-market spirit that has driven much of its growth.

Leverage Risks and Overexposure: The availability of leverage through ETFs could lead to over-speculation, similar to what happened in other highly leveraged markets. Investors might take on too much risk, inflating Bitcoin's price in the short term but leading to massive corrections when the market can't sustain the leveraged positions. This could increase the likelihood of crashes and liquidations.

Volatility Could Backfire: While Bitcoin’s volatility attracts traders, the downside risk is significant. The "negative vanna" effect and gamma squeezes could lead to periods of extreme volatility, causing Bitcoin's price to spike rapidly, only to collapse just as fast. For long-term investors, this can create a very unstable investment environment, potentially shaking confidence in Bitcoin as a store of value.

Synthetic Exposure Isn't Real Bitcoin: The fractionalized nature of Bitcoin ETFs means investors aren't holding actual Bitcoin, but rather synthetic exposure to its price movements. This disconnect from the actual asset could reduce demand for "physical" Bitcoin, undermining the narrative of Bitcoin as digital gold. This could erode some of the perceived scarcity that drives its value.

Diminishing Unique Value: Bitcoin’s value proposition as a decentralized, scarce asset could be diluted as it becomes entangled in traditional financial systems. The more Bitcoin is integrated into regulated markets, the more it might be perceived as just another financial instrument, losing its appeal as an alternative to traditional fiat currencies.

Potential for a Parallel Black Market: With the rise of regulated Bitcoin markets, a parallel, decentralized market might develop, leading to price discrepancies. Investors and traders in the unregulated market might face liquidity problems, and the overall demand for Bitcoin could fragment, reducing its overall value and adoption in the mainstream financial system.

In summary, while the ETF options approval opens new doors, it also presents risks such as increased volatility, over-leverage, and a loss of Bitcoin’s unique appeal as a decentralized asset, which could lead to long-term bearish outcomes.

#plebchain #nostr

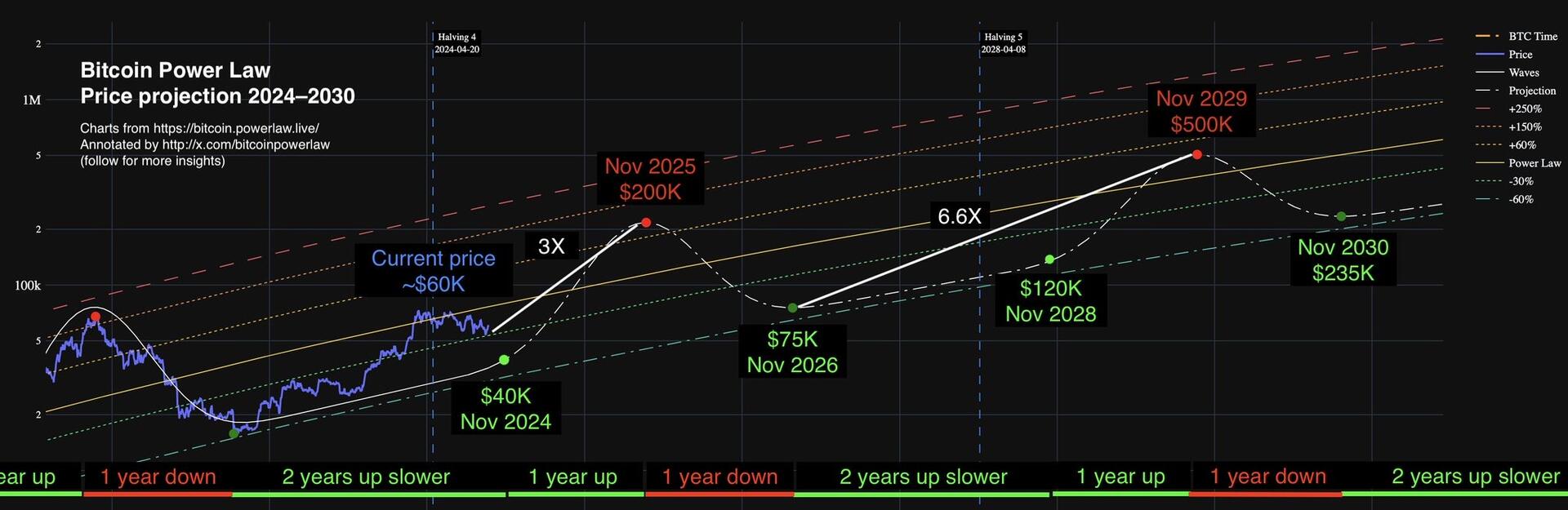

To have some to laugh about later #powerlaw #pastalaw #plebchain

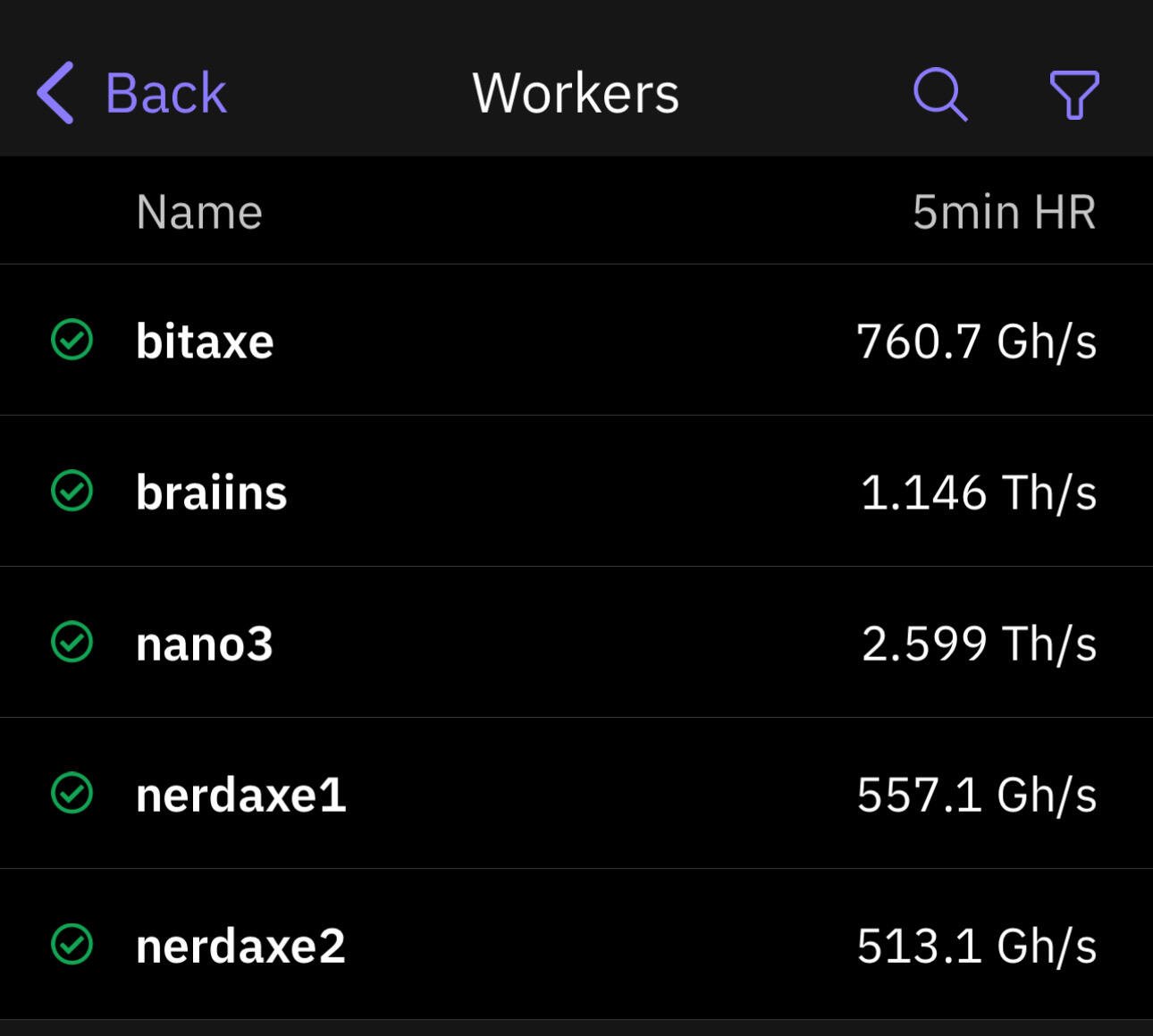

They hash #solomining #plebchain

#solomining #nano3 #braiins #canaan

Satoshi vs. MilliSatoshi (mSats)

Satoshi and milliSatoshi (mSats) are both units of measurement used in the Bitcoin network. They represent smaller divisions of a Bitcoin, which is the primary unit of currency.

Satoshi: This is the smallest unit of Bitcoin. There are 100 million satoshis in one Bitcoin. Think of it like a penny to a dollar.

MilliSatoshi (mSats): As the name suggests, a milliSatoshi is one-thousandth of a Satoshi. It's a much smaller unit, often used in microtransactions or when dealing with very small amounts of Bitcoin.

To summarize:

* 1 Bitcoin = 100 million satoshis

* 1 Satoshi = 1,000 milliSatoshis

Why use mSats?

Micro-transactions: mSats allow for very small transactions, which are essential for certain use cases like paying for small items or services.

Lightning Network: The Lightning Network, a layer-2 scaling solution for Bitcoin, often uses mSats to facilitate fast and low-cost transactions.

In essence, satoshis and mSats provide flexibility in representing different values of Bitcoin, allowing for both large and small transactions within the network.

#ask #nostr #plebchain #learnstr

I think it would be cool to have a chart display your target orders 👀 nostr:npub1cn4t4cd78nm900qc2hhqte5aa8c9njm6qkfzw95tszufwcwtcnsq7g3vle nostr:npub1ex7mdykw786qxvmtuls208uyxmn0hse95rfwsarvfde5yg6wy7jq6qvyt9

Decentralization of Power and Money: A Comparison

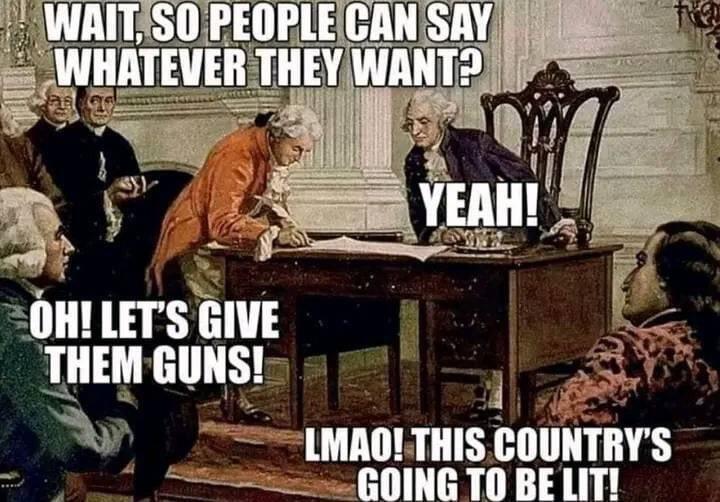

Decentralization is a concept that involves distributing #power or control away from a central authority. This idea has been applied to various aspects of society, including government and finance. The decentralization of power through arms and the #decentralization of #money through Bitcoin share some intriguing parallels:

Decentralization of Power through Arms

Individual agency: Citizens armed with #firearms have the potential to exercise individual agency and resist #government #overreach.

Check on authority: A dispersed ownership of weapons can serve as a check on the power of governments, preventing them from becoming overly centralized or oppressive.

Historical precedent: The American Revolution is often cited as an example of how an armed citizenry can overthrow a tyrannical government.

Decentralization of Money through Bitcoin

Individual agency: Bitcoin users have control over their own finances, without relying on intermediaries like banks.

Resistance to censorship: Bitcoin transactions are difficult to censor or control, making it resistant to government interference.

Global reach: Bitcoin operates on a global network, making it difficult for any single entity to dominate or control.

Key Parallels:

Empowerment of individuals: Both concepts empower individuals by giving them more control over their lives.

Resistance to centralized authority: Both decentralization of power and money aim to limit the concentration of authority in the hands of a few.

Historical significance: The idea of an armed citizenry has deep historical roots, while Bitcoin represents a more recent innovation.

Differences:

Nature of power: The decentralization of power through arms is primarily about political authority, while the decentralization of money is primarily about economic authority.

Technology: Bitcoin proof of work blockchain technology, while the decentralization of power through arms is not tied to a specific technology.

Risk: The decentralization of power through arms can potentially lead to violence or instability, while the decentralization of money is generally seen as a positive development.

In conclusion, while the decentralization of power through arms and the decentralization of money through Bitcoin share some similarities, they are distinct concepts with different implications and risks. Both ideas have the potential to empower individuals and limit the concentration of power, but they also raise important questions about governance, security, and societal stability.

#merica

Put heels 👠 on the girls #bitaxe #nerdaxe #plebchain #solominer #overclock

Jesus offers rest: The passage suggests that Jesus can provide relief from the burdens and stresses of life.

Jesus is gentle and lowly: This implies that Jesus is compassionate and approachable, making him a suitable source of comfort and guidance.

Jesus' yoke is easy: The metaphor of a yoke suggests that following Jesus' teachings and guidance is not a heavy or oppressive burden.

Jesus offers eternal rest: Some interpret the "rest for your souls" as referring to eternal peace and salvation.

Overall, the passage conveys a message of hope, comfort, and peace, inviting people to find solace and purpose in following Jesus.

#bitcoingospel

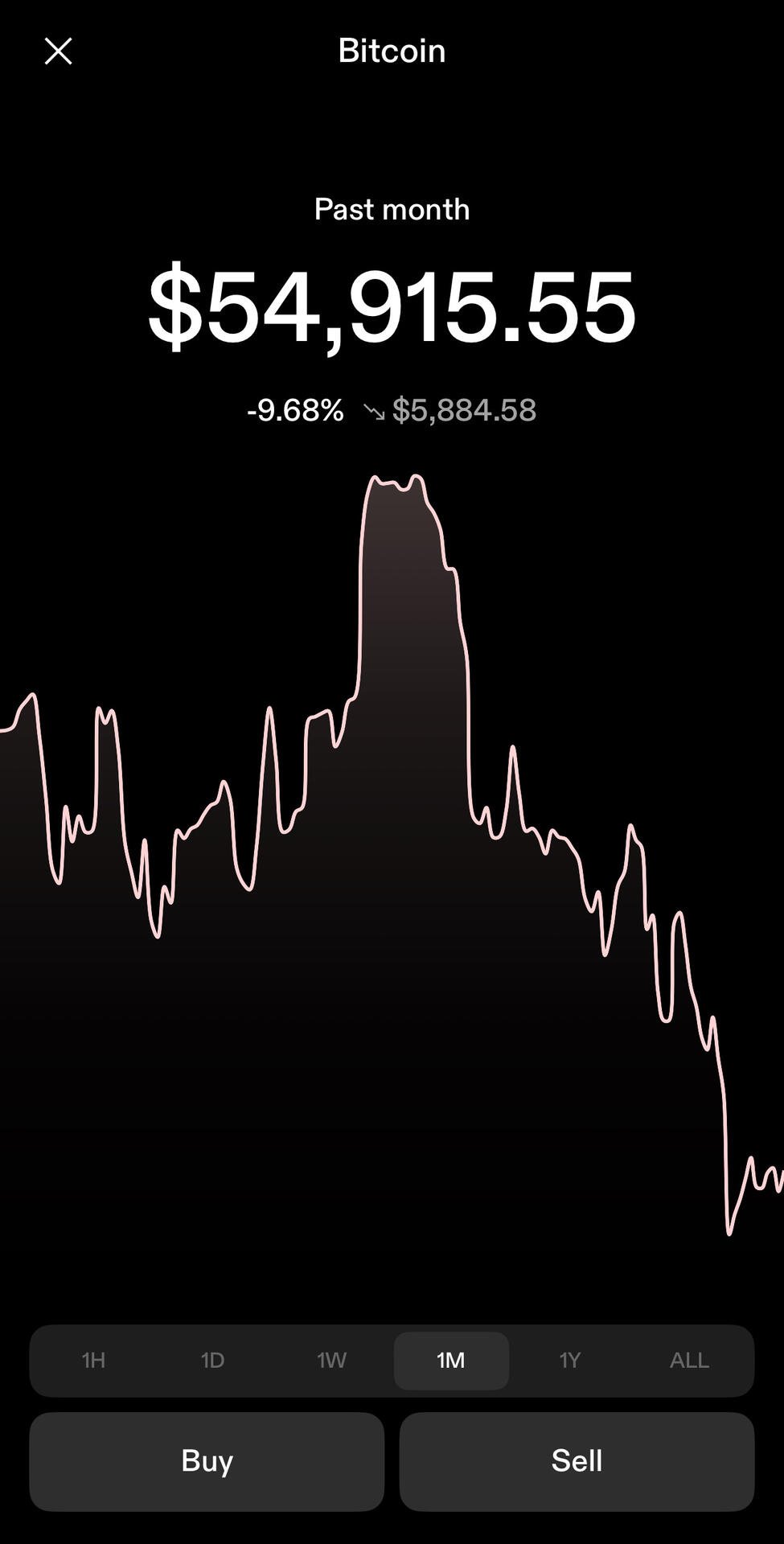

Will we test the 400 D MA? #astrologyformen

It's the only client that allows me to delete stupid notes. The only reason I use it here and then

excellent tools on #snort

Below the 200D MA heading toward 300D MA #astrologyformen

#chainalysis