**Single-Family Building & Permits Jump As 'Renter Nation' Fades**

Single-Family Building & Permits Jump As 'Renter Nation' Fades

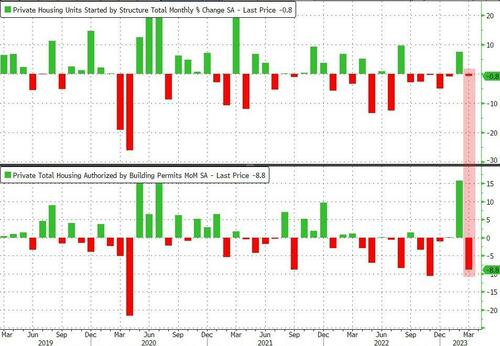

After February's surprise surge in Housing Starts and Permits, driven largely by a brief dip in mortgage rates, the housing market's data was expected to slide significantly in March data released today... and they did. However, while housing starts fell, it was less than expected (-0.5% MoM vs -3.5% exp but Feb's 9.8% jump was revised down to +7.3%) but Building Permits plunged 8.8% MoM (vs 6.5% MoM drop) and Feb's data was revised higherto 15.8% (from 13.8% MoM)...

?itok=wPOgN4zA (

?itok=wPOgN4zA ( ?itok=wPOgN4zA)

?itok=wPOgN4zA)

_Source: Bloomberg_

So a mixed bag but overall lower permits and starts...

?itok=IHRP5qRy (

?itok=IHRP5qRy ( ?itok=IHRP5qRy)

?itok=IHRP5qRy)

_Source: Bloomberg_

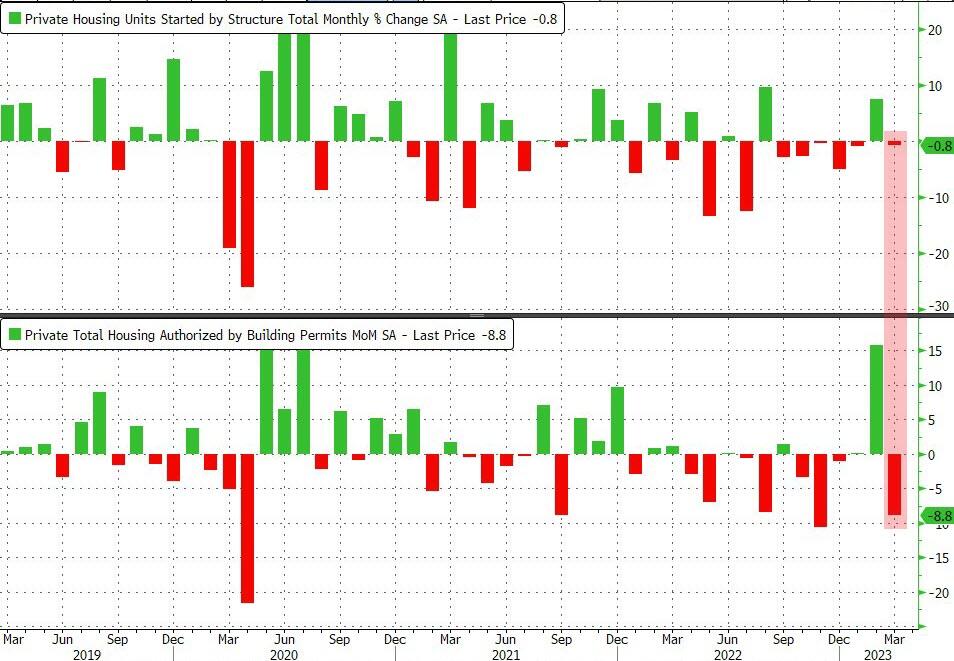

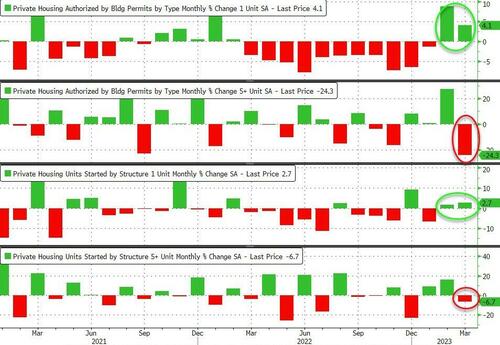

Notably, multi-family starts and permits both fell in March while single-family home starts and permits saw an increase...

- single family housing starts +2.7% to 861K SAAR, highest since December 22

- multi-family housing starts -6.7% to 542K SAAR, lowest since Jan 23

- single family permits +4.1% to 818K SAAR, the highest since Oct 2022

- multi-family permits tumble 29.7% to 543K from 717K, the lowest since November 2022

?itok=1t5578hk (

?itok=1t5578hk ( ?itok=1t5578hk)

?itok=1t5578hk)

_Source: Bloomberg_

Mortgage rates are higher now (since March) and post-SVB we suspect credit tightening has been dramatic...which is unlikely to sustain this single-family home starts growth.

Finally, note the chart below which shows housing starts lead the downturn, then housing completions... and then construction employment...

?itok=MpzVURcN (

?itok=MpzVURcN ( ?itok=MpzVURcN)

?itok=MpzVURcN)

The number of **homes completed declined 0.6%** to a 1.54 million pace.

The level of one-family properties **under construction dropped to the lowest since August 2021**, suggesting it will take time to boost inventory.

Is housing starts' reversal signaling the downturn in the housing market that will eventually hit employment.

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Tue, 04/18/2023 - 08:39

https://www.zerohedge.com/personal-finance/single-family-building-permits-jump-renter-nation-fades

**Bank of America Jumps On Blowout Earnings As Big Banks Feast On Small Bank Corpses**

Bank of America Jumps On Blowout Earnings As Big Banks Feast On Small Bank Corpses

In a zero sum world where the devastation among the small and regional banks means larger banks get bigger and more profitable, we doubt it will come as a surprise that Bank of America followed in JPMorgan's footsteps and reported blowout Q1 earnings this morning, beating across the board, with revenue boosted not only by soaring Net Interest Income but also by solid earnings across the bank's various trading operations.

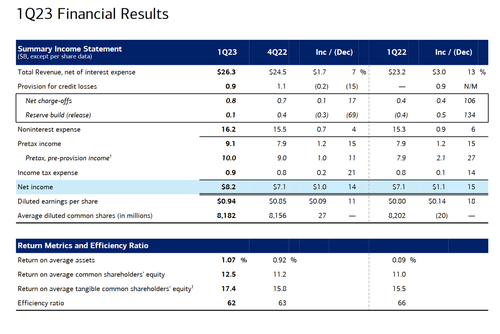

Here are the main highlights from BofA's Q1 earnings:

- EPS 94c, Exp. 84c, up 18% or 14c from 80c y/y

- Revenue net of interest expense $26.26 billion, +13% y/y, _**beating**_ estimate $25.4 billion

- Trading revenue excluding DVA $5.05 billion, +8.7% y/y, _**beating**_ estimate $4.46 billion

- FICC trading revenue excluding DVA $3.43 billion, +29% y/y, _**beating**_ estimate $2.62 billion

- Equities trading revenue excluding DVA $1.62 billion, -19% y/y, _**missing**_ estimate $1.8 billiom

- Wealth & investment management total revenue $5.32 billion, -2.9% y/y, _**missing**_ estimate $5.48 billion

- Net interest income FTE $14.58 billion, +25% y/y, estimate $14.42 billion

Of note, revenue from FICC (fixed-income, currencies and commodities trading) unexpectedly rose almost 30% to $3.43 billion as clients reacted to changing interest rates, the bank said. That helped the bank top analysts’ estimates for earnings per share.

?itok=EEBPp67x (

?itok=EEBPp67x ( ?itok=EEBPp67x)

?itok=EEBPp67x)

Some more balance sheet stats:

- Return on average equity 12.5%, estimate 10.9%

- Return on average assets 1.07%, estimate 0.92%

- Return on average tangible common equity 17.4% vs. 15.5% y/y, estimate 15.4%

- Basel III common equity Tier 1 ratio fully phased-in, advanced approach 12.9% vs. 12% y/y, estimate 12.6%

- Standardized CET1 ratio 11.4% vs. 10.4% y/y, estimate 11.3%

- Efficiency ratio 61.5%, estimate 63.1%

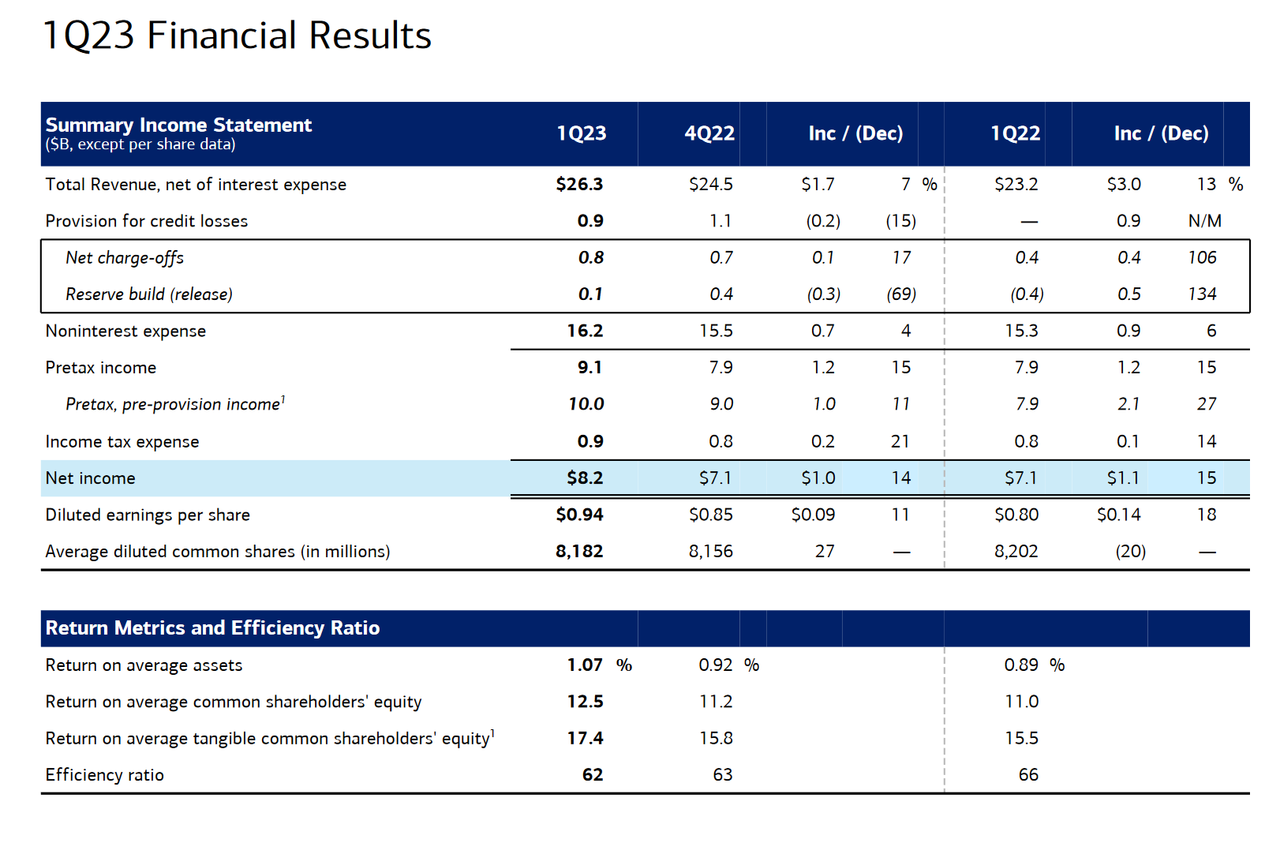

On the bad debt side, things were bad, but not as bad as consensus expected, with the bank reserving a $931 million provision for credit losses vs. $30 million y/y, but below the $1.092 billion in Q4'22 and _**smaller**_ than the estimate $1.18 billion. According to BofA, the net reserve build of $124MM in 1Q23, was driven primarily by Consumer "due to higher-than-expected credit card balances, partially offset by an improved macroeconomic outlook that primarily benefited the Commercial portfolio." In total, net reserve build of $360 million, driven primarily by higher-than-expected credit card balances.

Notably, the provision for credit losses reflected a benefit of $237 million, **driven primarily by an improved macroeconomic outlook,** and decreased $402m from 1Q22 as the prior year was impacted by reserve builds. At the same time, provisions in the consumer unit were up a lot more than expected though. They came in at $1.089 billion, compared with the $946 million analysts were calling for.

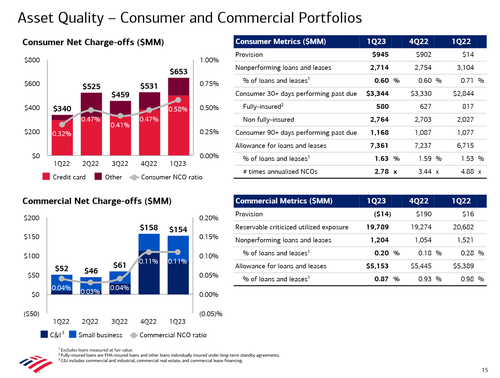

The net charge-offs meanwhile rose to $807 million vs. $392 million y/y and $689 million q/q, modestly above the estimate $782.6 million. According to BofA, consumer net charge-offs of $653MM increased $122MM, driven primarily by higher credit card losses; overall, the credit card loss rate rose to 2.21% in 1Q23, 1.71% in 4Q22, and 3.03% in 4Q19. Curiously, commercial net charge-offs of $154MM decreased $4MM; the net charge-off ratio of 0.32% increased 6 bps from 4Q22 and remained below pre-pandemic levels.

Finally, BofA's total allowance for loan and lease losses of $12.5B represented 1.20% of total loans and leases. The total allowance of $14.0B included $1.4B for unfunded commitments, and includes a January 1, 2023 $243MM reduction for the accounting change to remove the recognition and measurement guidance on troubled debt restructurings. Also of note, **nonperforming loans (NPLs) increased $0.1B from 4Q22 to $3.9B, while commercial reservable criticized utilized exposure of $19.8B increased $0.5B from 4Q22.**

?itok=KW32U6JD (

?itok=KW32U6JD ( ?itok=KW32U6JD)

?itok=KW32U6JD)

A drill down into BofA's consumer and commercial portfolios is shown below:

?itok=OxHO3f9_ (

?itok=OxHO3f9_ ( ?itok=OxHO3f9_)

?itok=OxHO3f9_)

Turning to BofA's Net Interest Income, it rose a whopping $2.9BN or 25% Y/Y to $14.4B ($14.6B FTE), translated into a net interest yield 2.2% vs. 1.69% y/y (in line with the estimate of 2.21%) and wa…

**NYTimes Bitcoin Hit Piece Backfires As #StopThePresses Movement Erupts On Social Media**

NYTimes Bitcoin Hit Piece Backfires As #StopThePresses Movement Erupts On Social Media

_Authored by Mark Jeftovic via Bombthrower.com,_ (https://bombthrower.com/nytimes-hit-piece-backfires-as-stopthepresses-movement-erupts-on-social-media/#)

Backlash spotlights newspaper’s ecological hypocrisy .

What happens when America’s purported “paper of record” promulgates an unabashedly biased hit piece against Bitcoin’s so-called “climate impact”, replete with shoddy reporting (https://www.coindesk.com/consensus-magazine/2023/04/11/the-new-york-times-skewed-bitcoin-mining-expose-reveals-blatant-bias/), wrong data (https://twitter.com/dsbatten/status/1645291134367973376), logical fallacies (https://www.coindesk.com/podcasts/the-breakdown-with-nlw/the-latest-new-york-times-bitcoin-mining-hit-piece-is-a-monument-to-intellectual-laziness/) and even doctored photographs (https://twitter.com/level39/status/1645453050788696064)?

?itok=6AktivQN (

?itok=6AktivQN ( ?itok=6AktivQN)

?itok=6AktivQN)

_The New York Times murders 60 million trees every year._

The public, fed up with being spoon-fed increasingly nonsensical propaganda under the guise of “news” turns the spotlight back on the outlet, highlighting the New York Times _very real_ destruction of habitats, ecosystems and life giving, carbon reducing trees.

Via a piece on TheBtcTimes website (https://www.btctimes.com/insights/the-new-york-times-is-murdering-millions-of-trees), and through the @NYTimesUP twitter (https://twitter.com/NYTimesUp) account, the **#StopThePresses** movement erupted over the weekend, drawing attention to several inconvenient truths about how the New York Times print edition gets made:

> This is a paper mill.

>

> But it’s more accurately described as a TREE SLAUGHTERHOUSE. @nytimes (https://twitter.com/nytimes?ref_src=twsrc%5Etfw) profits from the murder of trees, choosing to print a daily newspaper packed full of corporate advertisements and propaganda.

>

> It’s time to #StopThePresses (https://twitter.com/hashtag/StopThePresses?src=hash&ref_src=twsrc%5Etfw) 🛑#NYTimesUp (https://twitter.com/hashtag/NYTimesUp?src=hash&ref_src=twsrc%5Etfw)pic.twitter.com/hY50PqIact (https://t.co/hY50PqIact)

>

> — #StopThePresses (@NYTimesUp) April 17, 2023 (https://twitter.com/NYTimesUp/status/1647764005275181057?ref_src=twsrc%5Etfw)

27 tree slaughterhouses grind, pulp and purée approximately, 60 million trees each year. Trees absorb C02, so that’s 60 million less all natural carbon capturing beings, butchered annually, just to be defiled with agitprop; read once, and then unceremoniously disposed after.

**The public has had enough. _Left unchecked, America’s newspaper industry could consume every tree on the planet by the year 2040_.**

Make your voice heard and tell your congressman that something needs to be done about this unrepentant, climate killing juggernaut.

\* \* \*

_Subscribe to The Bombthrower mailing list (https://bombthrower.com/join) to get alerted when new articles come out, or follow me on Nostr (https://snort.social/p/npub1elwpzsul8d9k4tgxqdjuzxp0wa94ysr4zu9xeudrcxe2h3sazqkq5mehan) or Twitter (https://twitter.com/StuntPope)._

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Tue, 04/18/2023 - 08:16

**Elon Musk Confirms Development Of Non-Woke AI Bot "TruthGPT" To Rival Microsoft And Google**

Elon Musk Confirms Development Of Non-Woke AI Bot "TruthGPT" To Rival Microsoft And Google

In an interview with Fox News host Tucker Carlson on Monday evening, Elon Musk discussed the potential threats artificial intelligence poses to humanity. He expressed concerns over AI chatbots being developed with liberal bias and shared plans to create a non-woke chatbot.

Musk was an early donor of OpenAI's chatbot ChatGPT and expressed concerns over the direction of AI development. He told Carlson that large-language models were being trained to be "politically correct."

> _"I'm going to start something which I call TruthGPT," Musk said, "or a maximum truth-seeking AI that tries to understand the nature of the universe."_

> BREAKING: @ElonMusk (https://twitter.com/elonmusk?ref_src=twsrc%5Etfw) discusses creating an alternative to OpenAI, TruthGPT, because it is being trained to be politically correct and to lie to people. pic.twitter.com/HTFnve9o6d (https://t.co/HTFnve9o6d)

>

> — ALX 🇺🇸 (@alx) April 18, 2023 (https://twitter.com/alx/status/1648121643439366144?ref_src=twsrc%5Etfw)

Musk also advocated for the regulation of AI (https://www.zerohedge.com/technology/musk-wozniak-call-pause-developing-more-powerful-ai-gpt-4). He said, "AI is more dangerous than, say, mismanaged aircraft design or production maintenance or bad car production," adding, "It has the potential of civilizational destruction."

In February, Musk tweeted, "What we need is TruthGPT."

> What we need is TruthGPT

>

> — Elon Musk (@elonmusk) February 17, 2023 (https://twitter.com/elonmusk/status/1626533667408596992?ref_src=twsrc%5Etfw)

Musk told Carlson that Google's Larry Page once told him about plans to build a "digital god."

> Elon Musk says Google co-founder Larry Page once told him that he wants to build a "Digital God" using AI. pic.twitter.com/DMvME0ADfa (https://t.co/DMvME0ADfa)

>

> — Citizen Free Press (@CitizenFreePres) April 18, 2023 (https://twitter.com/CitizenFreePres/status/1648118540120240128?ref_src=twsrc%5Etfw)

Last month, Musk created a new AI company called X.AI Corp (https://www.zerohedge.com/technology/xai-musk-reportedly-creating-chatgpt-artificial-intelligence-rival), according to the state of Nevada filings. In the same month, he signed an open letter, along with hundreds of other tech experts, urging for an immediate pause of any new chatbots from OpenAI.

Musk has rolled Twitter into X as his plans to create a so-called "everything app" could soon be a reality. This latest revelation comes after **reports of Musk purchasing 1000s of GPUs** (https://www.zerohedge.com/technology/elon-musk-reportedly-buys-1000s-gpus-ai-project) (critical infrastructure for AI development).

Musk also told Carlson about halving the valuation of Twitter since his takeover last year:

> _"We just revalued the company at less than half the acquisition price."_

Musk took Twitter private in a $44 billion deal. The Information recently said the billionaire offered employees new equity grants at around a $20 billion valuation.

Hmmm.

> Wait for it …

>

> — Elon Musk (@elonmusk) April 18, 2023 (https://twitter.com/elonmusk/status/1648174775284498432?ref_src=twsrc%5Etfw)

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Tue, 04/18/2023 - 07:45

**Elon Musk Confirms Development Of Non-Woke AI Bot "TruthGPT" To Rival Microsoft And Google**

Elon Musk Confirms Development Of Non-Woke AI Bot "TruthGPT" To Rival Microsoft And Google

In an interview with Fox News host Tucker Carlson on Monday evening, Elon Musk discussed the potential threats artificial intelligence poses to humanity. He expressed concerns over AI chatbots being developed with liberal bias and shared plans to create a non-woke chatbot.

Musk was an early donor of OpenAI's chatbot ChatGPT and expressed concerns over the direction of AI development. He told Carlson that large-language models were being trained to be "politically correct."

> _"I'm going to start something which I call TruthGPT," Musk said, "or a maximum truth-seeking AI that tries to understand the nature of the universe."_

Musk also advocated for the regulation of AI (https://www.zerohedge.com/technology/musk-wozniak-call-pause-developing-more-powerful-ai-gpt-4). He said, "AI is more dangerous than, say, mismanaged aircraft design or production maintenance or bad car production," adding, "It has the potential of civilizational destruction."

In February, Musk tweeted, "What we need is TruthGPT."

> What we need is TruthGPT

>

> — Elon Musk (@elonmusk) February 17, 2023 (https://twitter.com/elonmusk/status/1626533667408596992?ref_src=twsrc%5Etfw)

Musk told Carlson that Google's Larry Page once told him about plans to build a "digital god."

> Elon Musk says Google co-founder Larry Page once told him that he wants to build a "Digital God" using AI. pic.twitter.com/DMvME0ADfa (https://t.co/DMvME0ADfa)

>

> — Citizen Free Press (@CitizenFreePres) April 18, 2023 (https://twitter.com/CitizenFreePres/status/1648118540120240128?ref_src=twsrc%5Etfw)

Last month, Musk created a new AI company called X.AI Corp (https://www.zerohedge.com/technology/xai-musk-reportedly-creating-chatgpt-artificial-intelligence-rival), according to the state of Nevada filings. In the same month, he signed an open letter, along with hundreds of other tech experts, urging for an immediate pause of any new chatbots from OpenAI.

Musk has rolled Twitter into X as his plans to create a so-called "everything app" could soon be a reality. This latest revelation comes after **reports of Musk purchasing 1000s of GPUs** (https://www.zerohedge.com/technology/elon-musk-reportedly-buys-1000s-gpus-ai-project) (critical infrastructure for AI development).

Musk also told Carlson about halving the valuation of Twitter since his takeover last year:

> _"We just revalued the company at less than half the acquisition price."_

Musk took Twitter private in a $44 billion deal. The Information recently said the billionaire offered employees new equity grants at around a $20 billion valuation.

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Tue, 04/18/2023 - 07:45

**US Should 'Immediately' Cut Off Flow Of American Capital To Chinese AI Firms, Rep. Gallagher Says**

US Should 'Immediately' Cut Off Flow Of American Capital To Chinese AI Firms, Rep. Gallagher Says

**Rep. Mike Gallagher (R-Wis.), chair of the House select committee on China, has called for the United States to immediately cease funding companies in China that are developing artificial intelligence (AI)**, the technology bringing about worldwide transformation and disruption.

?itok=KsPn_pDr\

?itok=KsPn_pDr\

_Chairman Rep. Mike Gallagher (R-Wis.) listens during a hearing of a special House committee dedicated to countering the Chinese Communist Party, on Capitol Hill, in Washington, on Feb. 28, 2023. (Alex Brandon/AP Photo)_ ( ?itok=KsPn_pDr)

?itok=KsPn_pDr)

Gallagher, a U.S. Marine combat veteran, who has been out front in publicizing and pushing legislation to nullify the threat China and its ruling Chinese Communist Party (CCP) pose to America, is asking for this financial pipeline to be shut down as some of the biggest and most powerful American venture capital (VC) firms, either directly or indirectly, are making significant investments in Chinese AI enterprises.

The representative also makes this request as global business and thought leaders—among them technology moguls Elon Musk, Apple co-founder Steve Wozniak, and Pinterest co-founder Evan Sharp—have publicly called for a pause on AI development because of the risks and dangers it poses if not checked and not controlled.

?itok=vmy-HYjF\

?itok=vmy-HYjF\

_A visitor watches an AI (Artificial Intelligence) sign on an animated screen at the Mobile World Congress (MWC), the telecom industry’s biggest annual gathering, in Barcelona. (Josep Lago/AFP via Getty Images)_ ( ?itok=vmy-HYjF)

?itok=vmy-HYjF)

“In recent months, we have seen revolutionary advances in artificial intelligence in America, but **we are still neck and neck with the Chinese Communist Party when it comes to this critical technology, which could determine geopolitical dominance in the 21st century**,” said Gallagher in a statement he sent to The Epoch Times.

“While serious questions remain about the right guardrails to put in place around AI in America, we know that the CCP will use this technology to further repress their own citizens and export their model of techno-totalitarian control around the world. The most obvious next step is to immediately cut off the flow of American capital to Chinese AI companies.”

Prominent American-based VC firms with global reach and that are funding companies in the Chinese AI sector include Tiger Global Management, Silver Lake, and IDG Capital. Sequoia Capital China, an affiliate of Sequoia Capital headquartered in Silicon Valley, backs Chinese AI companies. Money originating in America helps fund the Chinese VCs, Qiming Venture Partner and Matrix Partners China, that hold stakes in the China AI industry.

Referring to Sequoia Capital, Gallagher said: “ **Surely Sequoia can find other ways to make money than financing freedom’s end.**”

The Threat of the CCP and AI

Members of Congress, from both parties, are sounding the alarm on the danger of the United States funding AI development in a country ruled by the Chinese Communist Party (CCP), a growing adversary to the United States, and which is acting increasingly menacingly to its neighbors in the Pacific.

**S&P Futures Hit 2 Month High: 4,200 Looms As Record Bearish Sentiment Leads To Another Meltup**

S&P Futures Hit 2 Month High: 4,200 Looms As Record Bearish Sentiment Leads To Another Meltup

We have said previously on more than one occasion that the bear market rally just won't end until Wall Street's two bearish cosplayers, Marko Kolanovic and Mike Wilson, throw in the towel and turn bearish...

> Rally won't end until Wilson and Marko turn bullish

>

> — zerohedge (@zerohedge) February 7, 2023 (https://twitter.com/zerohedge/status/1623061687237595136?ref_src=twsrc%5Etfw)

... and sure enough, one day after both of these broken records published their latest weekly doom and gloom performance art **meant solely to get institutional and retail investors to sell to their flow desks**, futures have melted up even more, with spoos now trading a 2+ month high.

US equity futures were set to hold onto Monday’s sharp hour bounce as investors awaited a slew of earnings: contracts on the S&P 500 rose 0.4% by 7:00a.m. in ET while Nasdaq 100 contracts outperformed, rising 0.7%. Johnson & Johnson, Goldman Sachs Group Inc. and Netflix Inc. are among those reporting later.

?itok=56XId34r (

?itok=56XId34r ( ?itok=56XId34r)

?itok=56XId34r)

In premarket trading, Riot Platforms led fellow cryptocurrency-exposed stocks higher in US premarket trading as Bitcoin rebounded to inch closer to the $30,000 mark. Here are some other notable premarket movers:

- Bank of America rose 2% after reporting solid earnings which beat on the top and bottom line.

- Alibaba shares rise in US premarket trading after Reuters reported that Chinese regulators are expected to cut a fine on Ant Group to $700 million from an initially planned amount of more than $1 billion.

- Gamida Cell rose as much as 81% in premarket trading on Tuesday, poised to set a second consecutive intraday record, after the FDA approved its cell therapy Omisirge for patients with blood cancers to reduce the risk of infection following stem cell transplantation.

The irony is that it is not just Marko and Mike that are dodecatupling down on bearishness as stocks melt up: **so is everyone else.** As Bloomberg notes, traders are "scaling the towering monolith of skepticism that currently comprises Wall Street’s view of markets takes uncommon courage" and the more the S&P 500 goes up — and it’s risen 6% in a month — the less people trust it. Hedge funds have been loading up bets against US stocks, **and a model kept by Goldman Sachs shows mutual fund and futures-market outflows suggest that rather than rise, the index should have been down 3% over the past three months.**

**“Being bullish today is a very lonely proposition**,” said Eric Diton, president and managing director of the Wealth Alliance. It is, also, very profitable and as we have repeatedly warned readers, positioning is so bearish that stocks have no choice but to melt up. Moreover, **investor allocation to equities relative to bonds has dropped to its lowest level since the global financial crisis as worries about a recession take hold,** according to Bank of America Corp.’s global fund manager survey.

And that's why futures at 4,200 are a lock: **because with everyone bearish, and nobody left to sell - or short - what comes next is another rolling short squeeze.**

Traders are also anticipating the end of Federal Reserve policy tightening and are hoping for a milder-than-expected economic slowdown, optimism that has boosted equities this year. “If interest rates go down to the extent that’s priced into the forwards, we’re not going to get on top of inflation,” Euan Munro, chief executive officer at Newton Investment Management, said on Bloomberg Television. “Inflation is going to be quite hard to beat and will require interest rates to be held higher for a lot longer.”

European stocks are ahead with the Stoxx 600 up 0.5%, led by gains in the banks, mining and travel sectors. Here are the most notable European movers:

- Demant rises as much as 8.1% after the Danish company posted first-quarter results ahead of expectations and boosted its FY guidance, with its Hearing Aids unit delivering a strong beat

- Sika shares gain as much as 3.9% after the Swiss builder boosted sentiment by confirming its guidance and giving a positive indication on margin, according to Baader

- Entain shares jump as much as 4.8% after the UK-based gambling company reported an increase in first-quarter net gaming revenue, with most analysts seeing in-line results

- Moneysupermarket shares gain as much as 2.7% as analysts said the trading update from the price-comparison platform was robust, driven by strength for its Insurance segment

- IntegraFin shares rise as much as 6.8%, the most since November, as analysts …

**Environmentalists Pissed After G7 Leaves 'Gas' Loophole In Latest Climate Pledge**

Environmentalists Pissed After G7 Leaves 'Gas' Loophole In Latest Climate Pledge

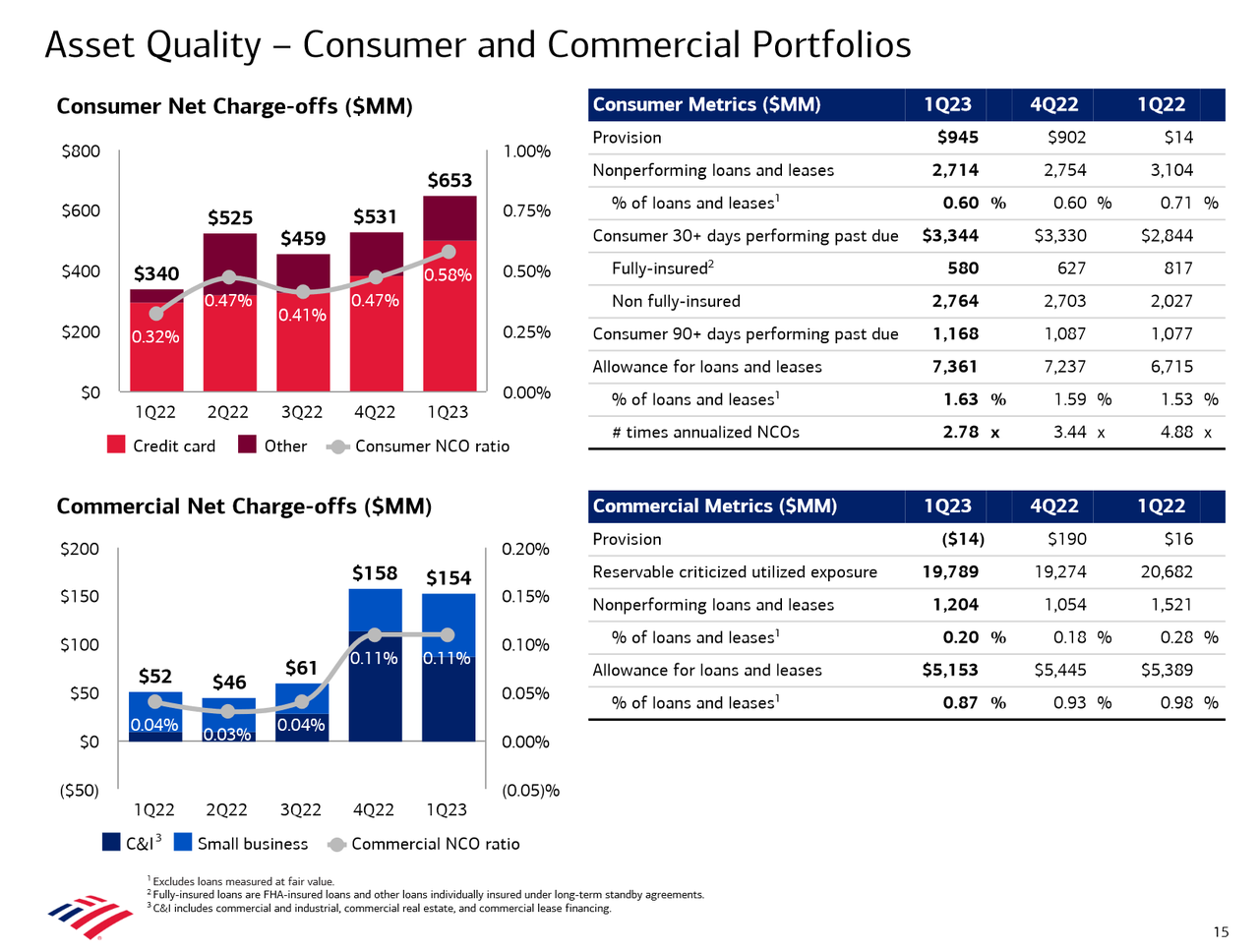

Environmentalists are up in arms over apparent slack added to the Group of Seven's energy and environmental goals, after ministers decided that the 'war in Ukraine and its effects on oil and gas' warrant breaking what are supposed to be 'firm commitments' that climate advocates say are necessary to limit global warming.

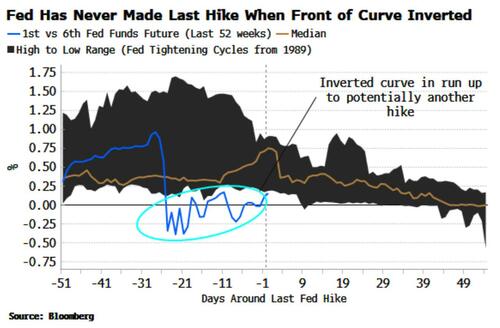

?itok=zvuKqTyA\

?itok=zvuKqTyA\

_Nishimura Yasutoshi, Japan's Minister of Economy, Trade and Industry, Environment Minister Akihiro Nishimura and other delegates attend the opening session of G7 Ministers? Meeting on Climate, Energy and Environment in Sapporo, Japan April 15, 2023, in this photo released by Kyodo. Mandatory credit Kyodo via REUTERS_ ( ?itok=zvuKqTyA)

?itok=zvuKqTyA)

Most notably, the ministers left the door open to **new investment in natural gas and ongoing use of fossil fuels**.

The G7 ministers also concluded their conclave on Sunday without setting a deadline for halting new coal investments, though they _did_ pinky-swear to 'work toward' cleaning emissions from power generation and reducing vehicle emissions by 2035.

" **It falls short of being the clarion call to action that was needed**," said Alden Meyer, a senior associate at climate change think tank E3G during a Twitter Spaces (https://twitter.com/i/spaces/1LyxBqQewaYJN) conversation, adding that the G7 undermines its global authority "every time they allow carve-outs on issues like international fossil fuel finance."

The G7, the seven most developed countries, consider themselves stewards of the global effort to reduce greenhouse glasses - and their communique 'sets the tone for negotiations around energy and climate among the Group of 20 countries and at the UN climate summit — COP28 — in Dubai in November,' _Bloomberg (https://www.bloomberg.com/news/articles/2023-04-16/g-7-agree-to-fossil-fuel-phase-out-without-coal-exit-deadline?srnd=premium-middle-east&leadSource=uverify%20wall)_ reports.

> _**The new statement seemed to weaken at least one previous (https://www.bmuv.de/fileadmin/Daten_BMU/Download_PDF/Europa___International/g7_climate_energy_environment_ministers_communique_bf.pdf) commitment,** climate activists said (https://priceofoil.org/2023/04/15/japan-hosted-g7-ministers-falsely-claim-they-have-ended-fossil-fuel-finance-leave-door-open-to-gas-investments/). At last year’s meeting, the group’s promise was specific: to halt “new direct public support for the international unabated fossil fuel energy sector by the end of 2022, except in limited circumstances clearly defined by each country that are consistent with a 1.5°C warming limit.”_

>

> _**But now, with the war in Ukraine and its effects on oil and gas supplies stretching into a second year**, the group said “ **investment in the gas sector can be appropriate to help address potential market shortfalls**,” as long as they’re “implemented in a manner consistent with our climate objectives and without creating lock-in effects.” -Bloomberg_

French Energy Minister Agnes Pannier-Runacher pushed back at critics, saying that the new language was actually more strict than what was originally envisioned, and that it "implicitly means that we cannot invest in the exploration of new gas capacity."

She also told reporters on Saturday that while the highlight of this year's negotiations was an agreement to phase out 'unabated' fossil fuels more rapidly, the group "could not reach an agreement on exiting coal by a specific date."

**The final language was said to have been crafted to appease Japan**, which hosted the meeting, as well as Germany's Deputy Energy Minister Patrick Graichen, which called the group's position "carefully balanced."

**That said,** the G7 meeting _did_ result in several commitments - including **a plan to boost solar capacity by more than 1,000 gigawatts, and offshore wind generation to 150 gigawatts** across member nations by the end of the decade, a move which would **triple solar power and increase offshore wind capacity seven-fold**.

"The G-7 are confirming that solar and wind are in line for takeoff," said Dave Jones, head of data insights at energy think tank Ember said in the same Twitter Spaces, adding that the commitments show "very clearly that wind and solar are the biggest and cheapest tools in the toolbox to reduce emissions this decade."

The group also acknowledged, but did nothing about, a plan to collectively cut vehicle emissions by at least 50% by 2035.

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Tue, 04/18/2023 - 06:55

**"You Can't Fight The Curve": Rates Curve Is Saying There's Little Upside To Another Fed Hike**

"You Can't Fight The Curve": Rates Curve Is Saying There's Little Upside To Another Fed Hike

_By Simon White, Bloomberg markets live reporter and analyst_

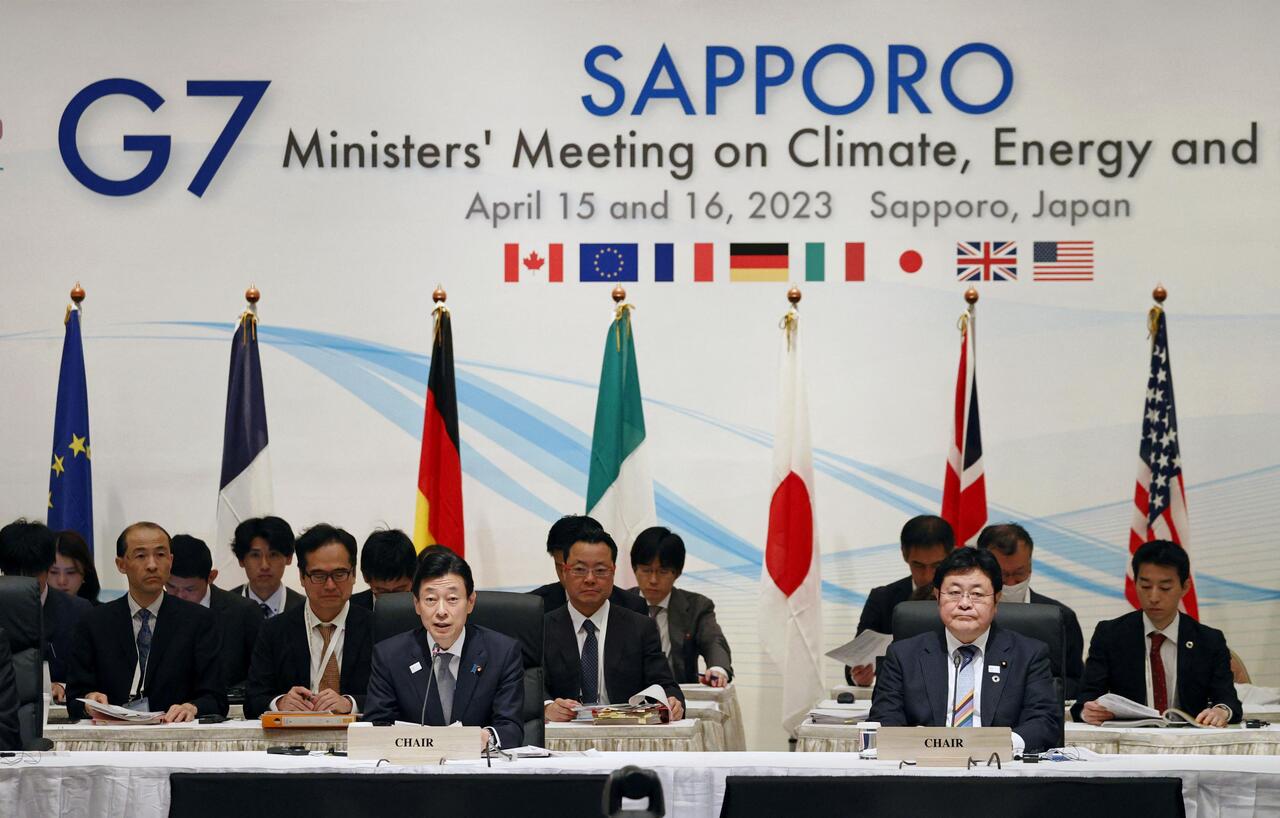

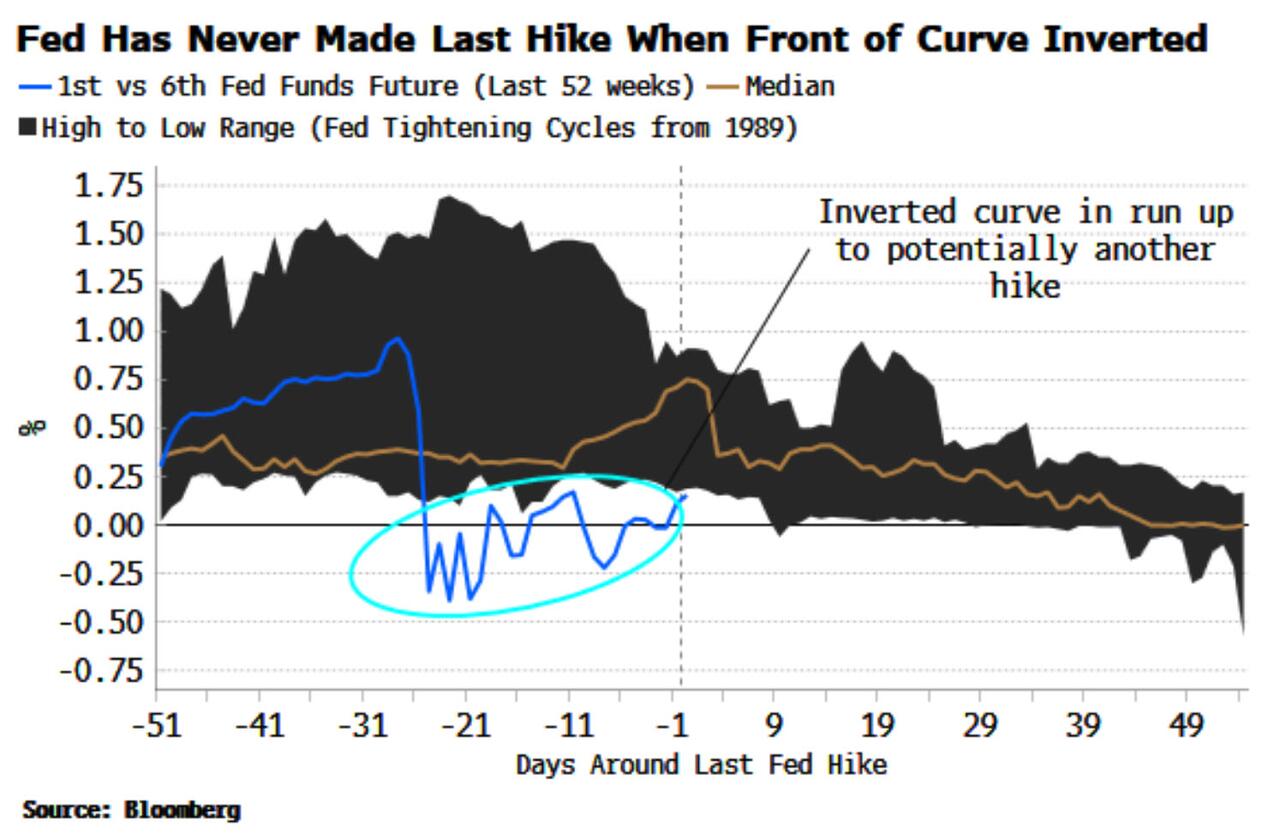

The market is anticipating one more hike from the Fed, but the short-term interest rates curve intimates there are rapidly diminishing benefits to higher rates, while their adverse costs continue to rise.

Barring the unexpected, it looks as if the Fed will raise rates 25 bps at its May meeting. **However, the battle the Fed has fought with the curve has reached the point where raising rates again will have a negligible additional impact on quelling inflation,** while the costs could still have an undesired negative impact.

The fed funds curve is now almost completely negatively inverted. W **hat this means is that one more hike will be minimally transmitted along the curve out to longer maturities where it would be able have a greater impact on constraining inflation.**

Indeed, this is the first time that the very front of the fed funds curve has been inverted in the run up to the last hike. Thus each previous tightening cycle the Fed’s last hike has had more ex ante demonstrable benefits.

?itok=fGIKilly (

?itok=fGIKilly ( ?itok=fGIKilly)

?itok=fGIKilly)

Given the shape of the curve, and the stubbornness of the pricing in of a “Fed pivot,” another hike would raise only the spot rate. The size of the pivot would probably deepen as the market assumed that the economic harm from higher rates would need to be addressed by greater cuts. Of course, if the Fed communicated the hiking cycle had a lot more to go, the curve would capitulate, but this is highly unlikely given we are teetering on the edge of a recession.

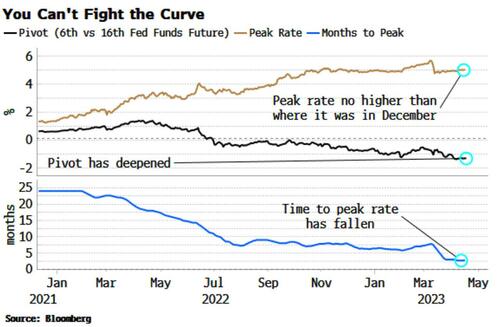

This has been the story all cycle. The Fed’s hawkishness was met by a higher expected peak rate, but that peak was brought forward, and the subsequent pivot made deeper. **The market signally ignored the Fed’s evangelism for “higher for longer.”**

?itok=xVXpmfEQ (

?itok=xVXpmfEQ ( ?itok=xVXpmfEQ)

?itok=xVXpmfEQ)

**Raising rates will increase the amount the Fed pays on reserve balances and on the RRP. This is great for larger banks who have a surfeit of reserves; it’s also good for money market funds and their clients**(ZH: this is precisely what we have been warning about since last July (https://www.zerohedge.com/markets/fed-quietly-handing-out-250-million-handful-happy-recipients-every-single-day)).

But it means more stress for smaller banks who are not flush with reserves, some of which are still paying through the Fed’s target range for them. It will also at the margin further stress the hold-to-maturity portfolios of many, again smaller, banks. Moreover, it keeps pressure on rising interest-rate costs for the government.

Overall, if the next Fed hike was a trade for the central bank, it looks like one with poor risk-reward.

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Tue, 04/18/2023 - 06:30

**"The Recovery Is On Track": China Economy Rebounds Strongly With 4.5% GDP Jump In Q1**

"The Recovery Is On Track": China Economy Rebounds Strongly With 4.5% GDP Jump In Q1

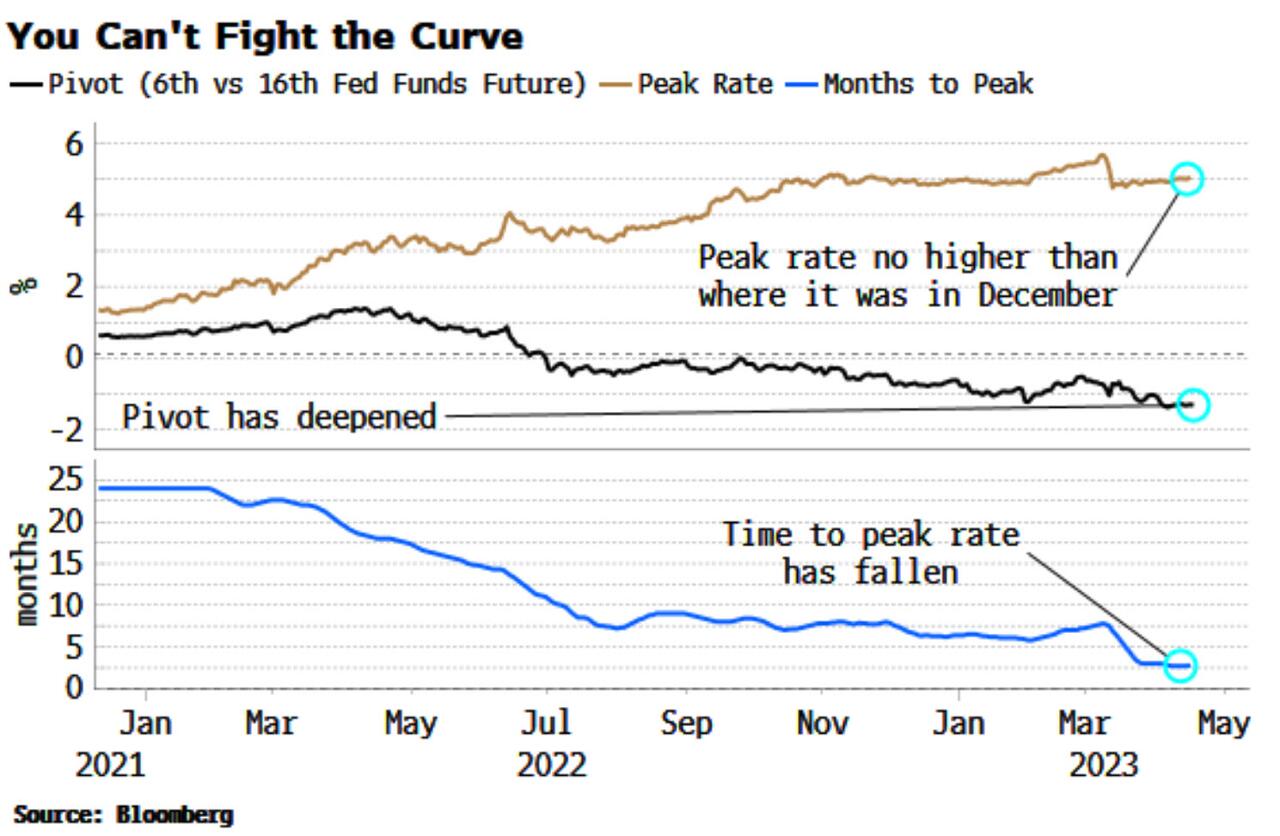

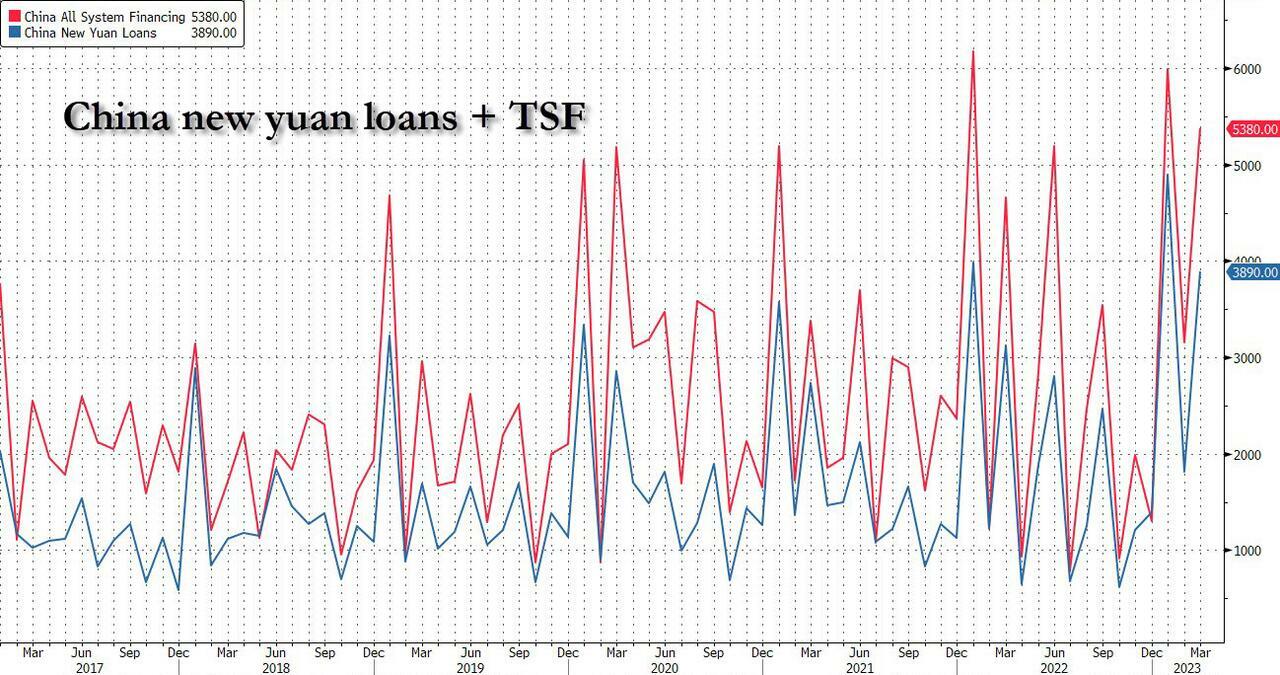

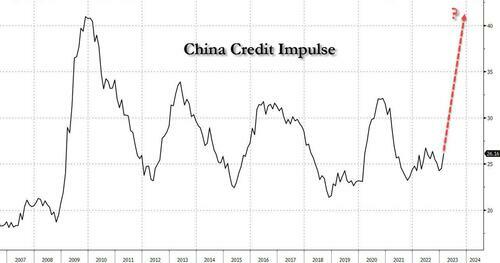

Last week, when discussing the latest record - (https://www.zerohedge.com/markets/liftoff-imminent-china-injects-record-credit-kickstart-economy)for the month of March - Chinese credit injection which saw a massive 5.4 trillion yuan in Total Social Financing, beating estimates by almost CNY 1 trillion...

?itok=zdHIpEAz (

?itok=zdHIpEAz ( ?itok=zdHIpEAz)

?itok=zdHIpEAz)

... and sparking a surge in China's all-important Credit Impulse...

?itok=ho9ENWsL (

?itok=ho9ENWsL ( ?itok=ho9ENWsL)

?itok=ho9ENWsL)

... we said (https://www.zerohedge.com/markets/liftoff-imminent-china-injects-record-credit-kickstart-economy)that China's delayed "liftoff was imminent", and that "the 2008 deja vu meter just went off the charts, because while the US is about to sink into a recession with commercial real estate set to fall all off a cliff, it is once again China that is - willingly or otherwise - **set to serve as the world's growth dynamo at a time when the entire developed world is about to max out at the same time.** This is precisely what happened in 2008 when China unleashed the biggest credit expansion in modern history, sparking not only historic growth spree but also an exponential debt increase that sent China's debt to over 300% of GDP."

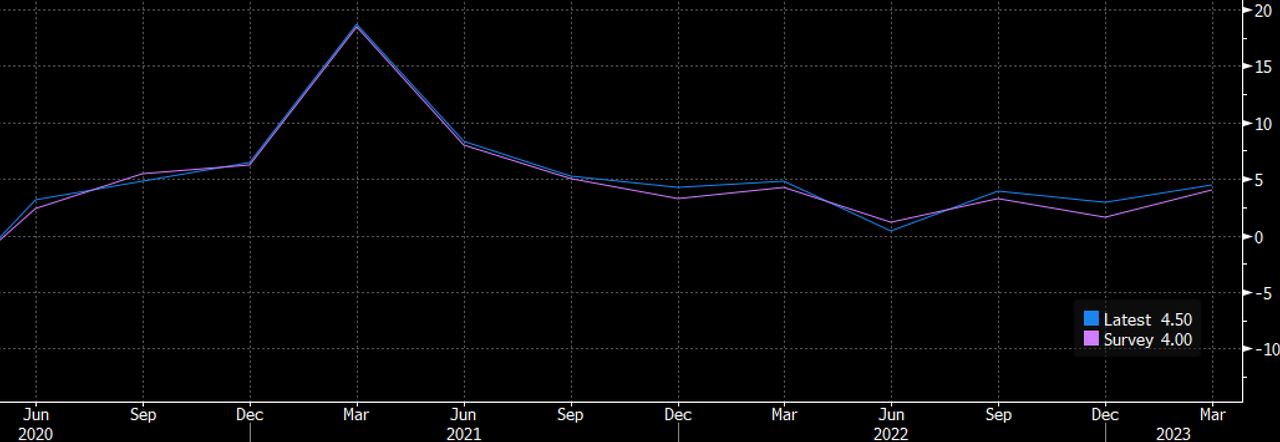

Since then, we have seen China report stellar trade data with both exports and imports sharply higher than expected, more solid real estate prints as housing prices have clearly rebounded from two years of decline, and most importantly, **overnight China's Q1 GDP also surprised to the upside, rising at a 4.5% annual clip in the first quarter - the strongest quarter for the Chinese economy since Q1 2022 - as strong growth in exports and infrastructure investment as well as a rebound in retail consumption and property prices drove a recovery in the world’s second-largest economy.**

?itok=pdXFkJja (

?itok=pdXFkJja ( ?itok=pdXFkJja)

?itok=pdXFkJja)

The official figure, which exceeded analyst expectations of a 4% rise and was the third consecutive beat of the median forecast...

?itok=tIbFYLfX (

?itok=tIbFYLfX ( ?itok=tIbFYLfX)

?itok=tIbFYLfX)

... followed efforts by Chinese leader Xi Jinping’s government to restore business confidence damaged by pandemic controls last year and abrupt policy changes.

That said, the Q1 growth rate was just short of the government’s recently upgraded full-year target of 5%, held back by a nationwide Covid-19 outbreak at the start of this year, but economists expect it to pick up pace as the year progresses.

Xi, who formally embarked on an unprecedented third term as China’s president last month, is keen to revive economic growth following China's shocking reversal of its covid-zero policy. Last year, GDP expanded just 3%, missing the official target of 5.5% which was already the lowest in decades.

“Definitely, the recovery’s on track,” said Tao Wang, UBS chief China economist. “The momentum at the beginning of the year was stronger than expected.”

Echoing what we said last week (https://www.zerohedge.com/markets/liftoff-imminent-china-injects-record-credit-kickstart-economy), the FT writes (https://www.ft.com/content/db9d8080-472c-419b-858f-07799849c5db)that "China’s rebound is crucial to global economic growth this year as developed nations grapple with persistently high inflation, rising interest rates and sluggish expansion in the wake of the pandemic and Russia’s full-scale invasion of Ukraine."

“The national economy showed a steady recovery and made a good start,” China’s National Bureau of Statistics said. But the agency cautioned the situation was “complex and volatile, inadequate domestic demand remains prominent and the foundation for economic recovery is not solid yet”.

Curiously, while Chinese commodities markets rallied following Tuesday’s data release, equities failed to hold on to early gains. That's because the data may have snuffed out recent hopes that bad news is good news and would lead to more stimulus. As Bloomberg reports Sofia Horta e Costa writes, "It’s clear markets are setting a high bar for China’s economy. So China data beats estimates yet again, but hardly anything moves i…

https://www.zerohedge.com/markets/recovery-track-china-economy-rebounds-strongly-45-gdp-jump-q1

**Leaked Document Shows American Smart Bombs Are Failing In Ukraine**

Leaked Document Shows American Smart Bombs Are Failing In Ukraine

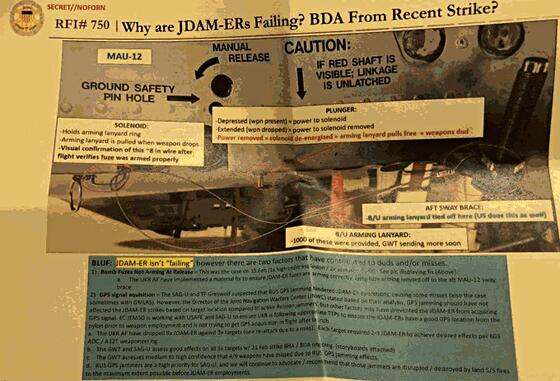

American-made smart bombs are failing in Ukraine, based on successful Russian electronic jamming measures, according to a Pentagon document connected to alleged leaker Jack Teixeira.

The highly-classified document not only reviews use of effective Russian countermeasures to make the smart bombs ineffective, but also says that in some cases technical problems are resulting in failure to detonate.

?itok=ANeSwtK6 (

?itok=ANeSwtK6 ( ?itok=ANeSwtK6)

?itok=ANeSwtK6)

A Biden administration defense aid program has involved sending the Joint Direct Attack Munition-Extended Range (JDAM-ER) to Ukraine in order to turn unguided bombs into GPS guided "smart bombs" capable of hitting targets over 50 miles away.

According to _Politico_ (https://www.politico.com/news/2023/04/12/russia-jamming-u-s-smart-bombs-in-ukraine-leaked-docs-say-00091600):

> _A larger problem is that Russia is using GPS **jamming to interfere with the weapons’ targeting process**, according to the slide and a separate person familiar with the issue who’s not in the U.S. government. American officials believe Russian jamming is causing the JDAMs, and at times other American weapons such as guided rockets, to miss their mark._

>

> _"I do think there may be concern that the Russians may be jamming the signal used to direct the JDAMs, which would answer why these munitions are not performing in the manner expected and how they perform in other war zones," said Mick Mulroy, a former Pentagon official and retired CIA officer._

The document mentions that "1,000 arming lanyards" were approved for Ukrainian forces, suggesting that over 1,000 of the smart bomb kits will be sent.

?itok=8VkyeghZ (

?itok=8VkyeghZ ( ?itok=8VkyeghZ)

?itok=8VkyeghZ)

Far from being the 'game changer' that Kiev hoped for, other major US-provided systems are failing as well. The leaked Pentagon documents elsewhere make mention of M270 and HIMARs rockets being thwarted by Russian forces' GPS jamming tactics. Some documents among the trove of leaks have consistently shown that Ukraine's military is generally beset by ammunition and weapons shortages, despite the billions in defense aid pledged from the West.

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Tue, 04/18/2023 - 05:44

https://www.zerohedge.com/military/leaked-document-shows-american-smart-bombs-are-failing-ukraine

**Rice Is Now Killing The Planet, Apparently**

Rice Is Now Killing The Planet, Apparently

_Authored by Steve Watson via Summit News (https://summit.news/2023/04/17/rice-is-now-killing-the-planet-apparently/),_

?itok=5mviUgjA\

?itok=5mviUgjA\

_Getty Images / Kinga Krzeminska_ ( ?itok=5mviUgjA)

?itok=5mviUgjA)

**Now it is firmly ensconced among the climate change cult that eating meat is killing the planet and you must ‘eat ze bugs’, the same people have a new target, rice.**

> VIDEO: Rice is to blame for around 10 percent of global emissions of methane, a gas that over two decades, traps about 80 times as much heat as carbon dioxide. Scientists say that if the world wants to reduce greenhouse gas emissions, rice cannot be ignored. pic.twitter.com/46GgkaGPgK (https://t.co/46GgkaGPgK)

>

> — AFP News Agency (@AFP) April 16, 2023 (https://twitter.com/AFP/status/1647520201850896384?ref_src=twsrc%5Etfw)

“Rice cannot be ignored.”

The Food and Agriculture Organization notes (https://www.google.co.uk/url?sa=t&rct=j&q=&esrc=s&source=web&cd=&cad=rja&uact=8&ved=2ahUKEwiDstLU5LD-AhWOMlkFHXN2D-4QFnoECBMQAw&url=https%3A%2F%2Fwww.fao.org%2F3%2Fy4347e%2Fy4347e01.htm&usg=AOvVaw18Kt9tRWd0fB4iH-OfJerk) that “Rice is one of the most important staple foods in the world. Over 50 percent of the world population depends on rice for about 80 percent of its food requirements. About 95 percent of the global output of rice is produced and consumed in developing countries.”

What is this really about?

> Banning rice would kill tens of millions of innocent people.

>

> I'm starting to think it's never been about saving the planet . . . https://t.co/Sz1bcbQM49 (https://t.co/Sz1bcbQM49)

>

> — Johnny Rotten's American Cousin (@EERCANE) April 16, 2023 (https://twitter.com/EERCANE/status/1647679411456561155?ref_src=twsrc%5Etfw)

> This is sinister. Removing rice or wheat from production would trigger global famine. We need to start recognizing voices pushing this agenda so we push back on this nonsense. @wef (https://twitter.com/wef?ref_src=twsrc%5Etfw)#2030agenda (https://twitter.com/hashtag/2030agenda?src=hash&ref_src=twsrc%5Etfw)

>

> — WiseOldOwl (@RealAlexLucio) April 16, 2023 (https://twitter.com/RealAlexLucio/status/1647728848010616832?ref_src=twsrc%5Etfw)

> pic.twitter.com/qQgvJcoBA0 (https://t.co/qQgvJcoBA0)

>

> — slimjim (@slimjim33\_33) April 16, 2023 (https://twitter.com/slimjim33_33/status/1647676990206652417?ref_src=twsrc%5Etfw)

> Asian countries already eat bugs. What’s your problem?

>

> — Shouty Pants (@unprisonplanet) April 17, 2023 (https://twitter.com/unprisonplanet/status/1647845521908723712?ref_src=twsrc%5Etfw)

> Yeah, they want us to eat bugs!

>

> — Betsy Rambo (@BetsyRambo) April 17, 2023 (https://twitter.com/BetsyRambo/status/1647817677694484481?ref_src=twsrc%5Etfw)

> Honestly we should just stop eating.

>

> — Cody (@BlueCollarBTC21) April 17, 2023 (https://twitter.com/BlueCollarBTC21/status/1647786368150683648?ref_src=twsrc%5Etfw)

> Eat 🪲

>

> Don't eat 🍚

>

> — Adam Townsend (@adamscrabble) April 16, 2023 (https://twitter.com/adamscrabble/status/1647638377598951424?ref_src=twsrc%5Etfw)

> “Scientists” should come up with better solutions than starving half of the planet.

>

> — Check Mark Prime (@PrimeCheckMark) April 16, 2023 (https://twitter.com/PrimeCheckMark/status/1647715350480289794?ref_src=twsrc%5Etfw)

> That is the grand solution in their minds

>

> — Parker (@winchester\_101) April 17, 2023 (https://twitter.com/winchester_101/status/1647783746584576002?ref_src=twsrc%5Etfw)

> Oh no, rice distribution warehouses are about to start mysteriously exploding.

>

> — Carolina Brew (@deeplens) April 16, 2023 (https://twitter.com/deeplens/status/1647705843167576064?ref_src=twsrc%5Etfw)

Brand **new merch** now available! Get it at **https://www.pjwshop.com/** (https://www.pjwshop.com/)

**ALERT!** In the age of mass Silicon Valley censorship It is crucial that we stay in touch.

We need you to sign up for our free newsletter here (https://summit.news/newsletter).

Support our sponsor – Turbo Force (https://bit.ly/TURBOFORCE) – a supercharged boost of clean energy without the comedown.

Also, we urgently need your financial support here (https://www.subscribestar.com/paul-joseph-watson).

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Tue, 04/18/2023 - 05:00

https://www.zerohedge.com/political/rice-now-killing-planet-apparently

**Elon Musk Says US Government Had Access To Private Twitter DMs**

Elon Musk Says US Government Had Access To Private Twitter DMs

_Authored by Paul Joseph Watson via Summit News,_ (https://summit.news/2023/04/17/elon-musk-says-us-government-had-access-to-private-twitter-dms/)

**During an upcoming appearance on Tucker Carlson’s show, Elon Musk reveals that the US government had full access to people’s private Twitter DMs.**

?itok=H_yssOWJ (

?itok=H_yssOWJ ( ?itok=H_yssOWJ)

?itok=H_yssOWJ)

Musk told Carlson during a segment which is set to air tonight that he was shocked as to the level of penetration the feds had with Twitter.

_**“The degree to which government agencies effectively had full access to everything that was going on on Twitter blew my mind, I was not aware of that,”**_ said Musk.

_**“Would that include people’s DMs?”**_ asked Carlson.

_**“Yes,”**_ responded Musk.

> pic.twitter.com/BilzqLGZsC (https://t.co/BilzqLGZsC)

>

> — Tucker Carlson (@TuckerCarlson) April 16, 2023 (https://twitter.com/TuckerCarlson/status/1647675042426232832?ref_src=twsrc%5Etfw)

It has long been suspected that individual Twitter employees had full access to private messages, but for branches of the federal government to have enjoyed that same privilege is stunning.

Since his purchase of Twitter last October, Musk has worked with journalists to release batches of files exposing the egregious censorship policies of the previous regime.

Matt Taibbi characterized the cozy relationship between the social media network, NGOs and the US government as the “censorship-industrial complex.”

According to Taibbi, the system worked as “a bureaucracy willing to sacrifice factual truth in service of broader narrative objectives,” acting as an insult to the principles of a free press.

\* \* \*

_Brand new merch now available! Get it at https://www.pjwshop.com/ (https://www.pjwshop.com/)_

_In the age of mass Silicon Valley censorship It is crucial that we stay in touch. (https://www.pjwshop.com/)I need you to sign up for my free newsletter (https://www.pjwshop.com/)here (https://summit.news/newsletter). Support my sponsor – Turbo Force (https://bit.ly/TURBOFORCE) – a supercharged boost of clean energy without the comedown. Get early access, exclusive content and behind the scenes stuff by following me on Locals (https://pauljosephwatson.locals.com/)._

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Tue, 04/18/2023 - 04:44

https://www.zerohedge.com/political/elon-musk-says-us-government-had-access-private-twitter-dms

**London Stock Exchange Says It'll Clear Crypto Trades**

London Stock Exchange Says It'll Clear Crypto Trades

Somewhere, Elizabeth Warren is tearing her hair out.

That's because as the Democratic senator continues to wage war on the crypto industry, news from across the pond has helped add another brick of legitimacy to the ecosystem. It was reported yesterday that the clearinghouse arm of the London Stock Exchange Group, LCH, is going to be offering clearing services for cash settled bitcoin index futures and options.

The announcement was made via press release (https://www.lch.com/resources/press-releases/lch-sa-provide-clearing-services-bitcoin-index-derivatives-gfo-x), late Thursday U.S. time.

Clearing "will be made available through a new segregated clearing service, LCH DigitalAssetClear," the release said. "The offering has been developed by GFO-X, a UK digital asset derivatives trading venue approved as a multilateral trading facility by the Financial Conduct Authority, and LCH SA, in close consultation with market participants, to ensure their digital asset derivatives trading and clearing requirements can be met within a secure, highly regulated environment."

It continued: "The new Bitcoin index futures and options contracts will be cash-settled through LCH DigitalAssetClear and will be based on the GFO-X/Coin Metrics Bitcoin Reference Rate (GCBRR), a BMR-compliant reference rate of the U.S. dollar price of Bitcoin. **Firms will be able to trade futures and options on the Bitcoin reference index directly."**

?itok=Nw8qh1ZV (

?itok=Nw8qh1ZV ( ?itok=Nw8qh1ZV)

?itok=Nw8qh1ZV)

Services are expected to go live in Q4 2023, the release said.

Frank Soussan, Head of LCH DigitalAssetClear, commented: "Bitcoin index futures and options are a rapidly growing asset class, with increasing interest among institutional market participants looking for access within a regulated environment they are familiar with. Offering centralised clearing for these cash-settled dollar-denominated crypto derivatives contracts on GFO-X is an important development for the market. The service is a powerful combination of GFO-X’s high-performance technology and optimised contract specifications with LCH’s proven risk management capabilities. We look forward to working with GFO-X and market participants alike to build a liquid, regulated market place for these products, and contributing to its safe growth and development."

Arnab Sen, CEO and Co-Founder of GFO-X, added: **"Recent market events in the trading of digital assets have highlighted the need for a safe, regulated venue where large financial institutions can trade at scale, while keeping their clients’ assets protected.** LCH delivers proven risk management capabilities across a range of asset classes and some of the most sophisticated clearing services in financial markets today. As the UK’s first regulated and centrally cleared trading venue focused entirely on digital asset futures and options, our joint vision is to ensure digital asset derivatives’ trading and clearing requirements and growing demand can be met within a secure, highly regulated environment."

_Don't tell Liz, but this looks to us like one more large step toward crypto legitimacy and global adoption..._

_ ?itok=pod9N9j8 (

?itok=pod9N9j8 ( ?itok=pod9N9j8)_

?itok=pod9N9j8)_

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Tue, 04/18/2023 - 04:15

https://www.zerohedge.com/markets/london-stock-exchange-says-itll-clear-crypto-trades

**Brits Aren't Impressed With Their Politicians Right Now**

Brits Aren't Impressed With Their Politicians Right Now

Conservative UK Prime Minister Rishi Sunak and Labour leader Keir Starmer received the highest levels of support from the public out of the 20 politicians Statista (https://www.statista.com/global-consumer-survey/tool/52/pro_gbr_202200_cel?bars=1&index=0&absolute=0&missing=1&heatmap=0&rows%5B0%5D=v9309_nati_nationalpoliticians_brandjobreview&columns%5B0%5D=v0013g_demo_generation&columns%5B1%5D=v9301_nati_nationalpoliticians_attitudes&tgeditor=0) polled, with **just 18 percent of UK adults saying they thought the leaders were doing a good job.**

(https://www.statista.com/chart/29724/brits-thoughts-on-whether-politicians-are-doing-a-good-job/)

(https://www.statista.com/chart/29724/brits-thoughts-on-whether-politicians-are-doing-a-good-job/)

_You will find more infographics at Statista (https://www.statista.com/chartoftheday/)_

Former Prime Minister Boris Johnson came just behind, with 15 percent of support. Trailing further behind still came Dominic Raab, the Deputy Prime Minister, and Jacob Rees-Mogg, the Conservative MP for North East Somerset, who received just 6 percent each.

But, as Statista's Anna Fleck notes (https://www.statista.com/chart/29724/brits-thoughts-on-whether-politicians-are-doing-a-good-job/), **when looking at the share of support in terms of voting patterns (https://www.statista.com/topics/4666/british-politics/), things look a little more hopeful for the party leaders.** Then, 38 percent of Labour voters said Keir Starmer was doing a job and 45 percent of Conservative voters said the same for Rishi Sunak.

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Tue, 04/18/2023 - 02:45

https://www.zerohedge.com/political/brits-arent-impressed-their-politicians-right-now

**EU Slams Poland & Hungary's Ban On Ukrainian Food Imports As Other Countries Threaten To Join Blockade**

EU Slams Poland & Hungary's Ban On Ukrainian Food Imports As Other Countries Threaten To Join Blockade

_Authored by Gergorz Adamczyk via Remix News,_ (https://rmx.news/poland/eu-slams-poland-and-hungarys-ban-on-ukrainian-food-imports/)

The European Commission has slammed Poland and Hungary’s ban on Ukrainian food imports, saying member states cannot make such decisions regarding trade policy.

?itok=1B8X3fpV (

?itok=1B8X3fpV ( ?itok=1B8X3fpV)

?itok=1B8X3fpV)

The leader of the ruling conservative Law and Justice party (PiS), Jarosław Kaczyński (https://rmx.news/poland/polands-judicial-reform-law-demanded-by-eu-requires-review-to-avoid-adding-chaos-into-polands-system-says-jaroslaw-kaczynski/), announced over the weekend that a range of agricultural products such as grain, fruits, dairy, vegetables and poultry meat would be stopped from entering Poland from Ukraine. **The decision has come as a result of the glut of grain from Ukraine and the flood of Ukrainian products onto the Polish market.** In addition, **Hungary and Slovakia have enacted similar measures**, and there are reports that Romania and Bulgaria may also close their border to certain Ukrainian food imports.

> **_“Bulgarian interests must be protected. Moreover, now that two countries have already acted in this way, if we do not react, the accumulations on Bulgarian territory could become even bigger,”_** Bulgaria’s acting Agriculture Minister Yavor Gechev said.

If Hungary, Slovakia, Romania, and Poland all block Ukrainian food product transit, **it would effectively result in a geographical blockade in Europe, as the four countries border Ukraine.**

Despite the growing crisis affecting Central and Eastern European countries, the European Commission argues that trade policy is the exclusive competence of the European Union and that _**“unilateral actions are unacceptable.”**_ It also asserted that in difficult times, it was important to maintain coordination and unity in EU actions.

According to commercial television station Polsat News (https://www.polsatnews.pl/wiadomosc/2023-04-16/zakaz-importu-zboza-z-ukrainy-komisja-europejska-dzialania-jednostronne-sa-niedopuszczalne/), the matter has already been the subject of calls between European Commission President Ursula von der Leyen (https://rmx.news/article/ursula-von-der-leyen-russia-s-behavior-has-grown-even-worse-since-the-nord-stream-2-project-began/), Polish Prime Minister Mateusz Morawiecki and Ukrainian PM Denys Shmyhal.

Hungarian Minister of Agriculture István Nagy announced (https://mandiner.hu/cikk/20230415_magyarorszag_megtiltja_a_mezogazdasagi_termekek_importjat_ukrajnabol) on Saturday that Hungary will also temporarily ban the import of grain and oilseeds from Ukraine (https://rmx.news/poland/polish-farmers-block-roads-in-protest-against-grain-imports-from-ukraine/), as well as several other agricultural products, after Poland announced its ban.

According to the ministry’s statement, **the continuation of the current market trends would cause such serious damage to Hungarian agriculture that extraordinary measures must be taken to prevent them.** He added that Ukrainian agriculture uses production practices no longer allowed in the European Union resulting in extremely low production costs. Ukraine was also given duty-free access to the European market, with free trade opportunities for grain and oilseeds, as well as large quantities of poultry, eggs and honey, making it impossible for Hungarian and Central European farmers to compete.

Nagy stressed that the restriction on imports into Hungary is temporary and will last until June 30, 2023, which may be enough time to take meaningful and lasting EU measures (https://rmx.news/economy/hungary-moves-to-protect-farmers-from-cheap-ukrainian-grain-while-eu-does-nothing/) for a lasting solution.

According to the statement, the agricultural sector expects the EU to ensure fair market conditions for European agriculture. The Hungarian government will always stand by Hungarian farmers and will protect Hungarian agriculture, the minister said.

**Despite several affected member states’ demands for a Union-level solution, the EU has so far done nothing to rectify the situation.**

The Ukrainian Ministry of Agriculture has expressed disappointment at Poland’s decision and stated that the decision was contrary to the agreement between the two countries. The statement went on to acknowledge that Polish farmers were in a difficult situation, but that “the situation of Ukrainian farmers was the most acute of all.”

A statutory instrument banning the import of chosen products from Ukraine was introduced by the Polish minister of development and technolo…

**Russia Flexes Naval Might With Pacific Snap Drills Involving Over 25,000 Servicemen**

Russia Flexes Naval Might With Pacific Snap Drills Involving Over 25,000 Servicemen

Russia's defense ministry has revealed details of ongoing snap live-fire military exercises which kicked off April 14. President Putin also hailed the drills as a success at a moment most forces are concentrated in Ukraine. Defense Minister Sergey Shoigu said Monday that the surprise combat readiness check of Russia's Pacific Fleet has involved **over 25,000 servicemen being placed on high alert**.

"They’re engaged in fire drills and tactical exercises, while also working on improving interactions between different branches of the military," Shoigu said. He also revealed that in total **167 ships, 12 submarines, and 89 planes and helicopters** are taking part in the large-scale exercises.

?itok=vRkuLZzX\

?itok=vRkuLZzX\

_Image source: Russian Defense Ministry_ ( ?itok=vRkuLZzX)

?itok=vRkuLZzX)

Shoigu specified (https://abcnews.go.com/International/wireStory/putin-hails-russian-navys-performance-pacific-drills-98628318) that during the drills Russia's nuclear-capable long-range strategic bombers will **"fly over the central part of the Pacific Ocean to imitate strikes against groups of enemy ships."**

These drills which are far away from the frontlines of the Ukraine war are likely an attempt to demonstrate to the West that Russia still has immense military capability in different theatres. _The Associated Press_ detailed the expanse of the drills as follows (https://abcnews.go.com/International/wireStory/putin-hails-russian-navys-performance-pacific-drills-98628318):

> _The Defense Ministry has declared that sectors in the southern part of the Sea of Okhotsk, the Peter the Great Bay of the Sea of Japan and the Avacha Bay on the southeastern coast of the Kamchatka Peninsula would be closed to sea and air traffic for the duration of practice torpedo and missile launches and artillery exercises._

>

> _The ministry said that the drills were intended to **"test the Pacific Fleet’s readiness to repel aggression."** The ministry described the briefing as a show of Russia’s "voluntary transparency."_

Shoigu said at a moment that the Ukraine ground and air war still rages that **"nobody has aborted the task of developing the navy"** and declared that the "final stage" of the drills will kick off Tuesday. He previously noted that the combat readiness checks are all about "boosting the ability of the armed forces to execute the tasks of repelling aggression by a potential enemy from maritime directions."

On Monday President **Putin praise the "high level" performance** of the Russian navy and armed forces in the exercise, saying that more such drills will be held.

Interestingly, multi-national drills are also kicking off in Sweden this week, per a description in Russian state media (https://tass.com/defense/1605503):

> _The Aurora-23 international military exercise - the largest over the past 25 years - began in Sweden on Monday. It will last until May 11, with the **United States, Britain, Finland, Poland, Norway, Estonia, Latvia, Lithuania, Ukraine, Denmark, Austria, Germany and France taking part**, the Swedish Defense Ministry said._

>

> _The purpose of the exercise is to "improve the combat readiness of the armed forces" in the event of a hypothetical armed attack on Sweden._

>

> _"The exercise is one of the main tools of enhancing, testing and demonstrating combat readiness," the Defense Ministry said. "Together with military units from our partner countries, we strengthen security while enhancing Sweden's operational capabilities."_

>

> _The exercise will take place in the air, on land and at sea. **Some 26,000 troops from all military units**, mainly in the south of Sweden and also on the island of Gotland will take part._

With this, it looks like the West is using the opportunity to flex its military might in these annual drills as well, at a moment the Ukraine conflict shows no signs of abating.

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Mon, 04/17/2023 - 23:30

**Rise of the Petroyuan: The End Of The Petrodollar’s Reign And The Impact On Global Markets**

Rise of the Petroyuan: The End Of The Petrodollar’s Reign And The Impact On Global Markets

_Authored by Nick Giambruno via Doug Casey's International Man (https://internationalman.com/articles/rise-of-the-petroyuan-the-end-of-the-petrodollars-reign-and-the-impact-on-global-markets/),_

?itok=2sZxcyzS (

?itok=2sZxcyzS ( ?itok=2sZxcyzS)

?itok=2sZxcyzS)

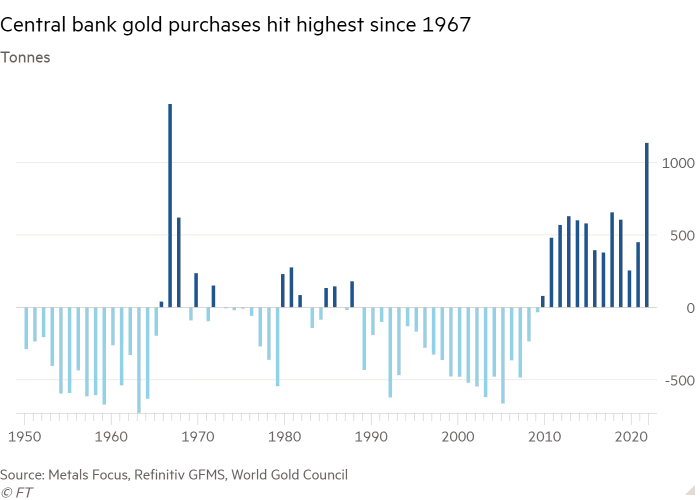

**Did you know that central banks bought more gold last year than any year in the past 55 years—since 1967?**

Though most don’t realize it, 1967 was a significant year in financial history, mainly due to the events at the London Gold Pool.

The London Gold Pool was an agreement among central banks of the United States and Western European countries to stabilize the price of gold. The goal was to maintain the price of gold at $35 per ounce by collectively buying or selling gold as needed.

However, in 1967 the London Gold Pool collapsed due to a shortage of gold and increased demand for the metal. That’s because European central banks bought massive amounts of gold as they began to doubt the US government’s promise to back the dollar to gold at $35/ounce. The buying depleted the London Gold Pool’s reserves and pushed the price of gold higher.

**In short, 1967 was the beginning of the end of the Bretton Woods international monetary system that had been in place since the end of World War 2**. It ultimately led to severing the US dollar’s last link to gold in 1971. The dollar has been unbacked fiat confetti ever since—though the petrodollar system and coercion have propped it up.

The point is large global gold flows can be a sign that a paradigm shift in the international monetary system is imminent.

Central banks are the biggest players in the gold market. And now that we have just experienced the largest year for central bank gold purchases since 1967, it’s clear to me something big is coming soon.

**And those are just the official numbers that governments report.** The actual gold purchases could be much higher because governments are often opaque about their gold holdings, which they consider a crucial part of their economic security.

?itok=nRVAZMmJ (

?itok=nRVAZMmJ ( ?itok=nRVAZMmJ)

?itok=nRVAZMmJ)

Today, I think we are on the cusp of a radical change in the international monetary system with profound implications. Yet, few are aware of what is happening and its enormous significance.

I suspect most people will be taken by surprise—and it won’t be a pleasant one. They’ll be the ones holding the bag for a failing monetary system.

But it doesn’t have to be a disaster for everyone…

Those who get positioned properly ahead of this paradigm shift could make fortunes.

The Real Reason for China’s Massive Gold Stash

According to the _Financial Times_, the big buyers of gold in 2022 were China and Middle East oil producers. That’s not a coincidence, as these countries will be at the center of the changes to the international monetary system.

It’s no secret that China has been stashing away as much gold as possible for many years.

China is the world’s largest producer and buyer of gold. Most of that gold finds its way into the Chinese government’s treasury.

Nobody knows the exact amount of gold China has, but most observers believe it is many multiples of what the government declares.

**Today it’s clear why China has had an insatiable demand for gold.**

Beijing has been waiting for the right moment to pull the rug from beneath the US dollar. And now is that moment…

The key to understanding it all is Chinese President Xi’s recent historic visit to Saudi Arabia and other Gulf Cooperation Council (GCC) states to launch, in his words, “a new paradigm of all-dimensional energy cooperation.”

The GCC includes Saudi Arabia, Kuwait, Qatar, Bahrain, Oman, and the United Arab Emirates. These countries account for more than 25% of the world’s oil exports, with Saudi Arabia alone contributing around 17%. In addition, more than 25% of China’s oil imports come from Saudi Arabia.

China is the GCC’s largest trading partner.

The meetings reflect a natural—and growing—trade relationship between China, the world’s largest oil importer, and the GCC, the world’s largest oil exporters.

During Xi’s visit, he made the following crucial remarks (emphasis mine):

> “China will continue to import large quantities of crude oil from GCC countries, expand imports of liquefied natural gas, strengthen cooperation in upstream oil and gas development, engineering services, storage, transportation and refining, and ma…

https://www.zerohedge.com/economics/rise-petroyuan-end-petrodollars-reign-and-impact-global-markets

**David's Bridal Files For Second Bankruptcy In 5 Years, To Lay Off 9,200 Workers**

David's Bridal Files For Second Bankruptcy In 5 Years, To Lay Off 9,200 Workers

Bridal retailer _David's Bridal_ is going to be laying off more than 9,200 workers nationwide but plans on staying open after filing for bankruptcy for the second time in just five years.

As the chain gets ready to deal with a busy prom and wedding season, a notification of the layoffs was filed with the Department of Labor in Pennsylvania, according to NJ.com (https://www.nj.com/news/2023/04/davids-bridal-plans-9200-layoffs-files-for-bankruptcy-8-nj-stores-remain-open.html).

Layoffs started in Pennsylvania on Friday and its unclear when additional, out of state layoffs would take place, the report notes. The company currently has 300 stores across the United States.

?itok=uQCA7jf9 (

?itok=uQCA7jf9 ( ?itok=uQCA7jf9)

?itok=uQCA7jf9)

“David’s Bridal has commenced a financial restructuring process to facilitate a potential sale of our company,” the company said in a statement. It is reportedly trying to sell itself, but stores should continue to take orders.

Nationwide, the Conshokocken, Pennsylvania-based chain has over 11,000 employees. Previously, it filed (https://www.nj.com/news/2018/11/davids_bridal_files_for_bankruptcy_but_your_order.html) for bankruptcy in 2018 and also operated normally through the process.

Recall, days ago we noted (https://www.zerohedge.com/economics/small-businesses-file-bankruptcy-record-pace-surpassing-covid-crash) that small businesses were filing for bankruptcy at a record pace, even surpassing the Covid crash:

> _The note from UBS Evidence Lab shows private bankruptcy filings in 2023 have exceeded the highest point recorded during the early stages of the COVID pandemic by a considerable amount. The four-week moving average for private filings in late February was 73 percent higher than in June 2020._

>

> _“\[We\] believe one of the more underappreciated signs of distress in U.S. corporate credit is already emanating from the small- and mid-size enterprises sector,” Matthew Mish, head of credit strategy at UBS, wrote in a recently published research note. “\[The\] smallest of firms \[are\] facing the most severe pressure from rising rates, persistent inflation and slowing growth.”_

>

> _Industries hit hardest by the wave of bankruptcies include real estate, health care, chemicals, and retail outlets, according to the Swiss Bank’s report._

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Mon, 04/17/2023 - 22:30

https://www.zerohedge.com/markets/davids-bridal-files-second-bankruptcy-5-years-lay-9200-workers

**Washington State House Approves Bill Authorizing Hiding Of Children Seeking Transgender Medical Intervention From Parents**

Washington State House Approves Bill Authorizing Hiding Of Children Seeking Transgender Medical Intervention From Parents

_Authored by Matt McGregor via The Epoch Times (https://www.theepochtimes.com/washington-state-house-approves-bill-authorizing-hiding-of-children-seeking-transgender-medical-intervention-from-parents_5194526.html?utm_source=partner&utm_campaign=ZeroHedge&src_src=partner&src_cmp=ZeroHedge) (emphasis ours),_

**The Washington state House approved a bill that would authorize state agencies to hide children seeking transgender medical intervention from parents.**

?itok=Zlw5pNnA\

?itok=Zlw5pNnA\

_Washington state Rep. Alicia Rule in 2023 (Courtesy of TVW)_ ( ?itok=Zlw5pNnA)

?itok=Zlw5pNnA)

On April 12, House lawmakers debated Senate Bill 5599 (pdf (https://acrobat.adobe.com/link/review?uri=urn:aaid:scds:US:92d160c5-b7b3-4315-84ad-02f88a80bcdd)), which creates an exemption for the state that grants it the right to not be required to notify parents of minors who have left their homes because their parents wouldn’t let them pursue gender transition medical procedures.

In a video statement (https://twitter.com/i/status/1646404320232083458) after the vote, Republican state **Rep. Chris Corry said the bill “erodes parental rights in the state of Washington.”**

“Essentially what the bill would do would be if a child left a parents’ home for certain medical care and went to a shelter or host family, **that shelter or host family would not be required to notify the parents of their child’s whereabouts**,” Corry said. “ **This is obviously a fundamental violation of parental rights** and something that’s deeply concerning for parents across Washington state.”

State Rep. Peter Abbarno, a Republican, said the crux of the debate over the bill was whether the state be permitted to “essentially hide where the child is.”

**Most parents, Corry said, would “go to the ends of the earth to find their child” if they disappeared after an argument.**

“And the fact that we have a bill that may become law that would say, ‘we’re not going to tell you,’ was really just a bridge too far for us,” Corry said.

Corry told The Epoch Times that, under the bill, a disagreement between a child and parents over the child’s desire for a medical transition constitutes “abuse and neglect,” only because the parent hasn’t “properly affirmed what the child wants.”

Corry said there are already laws that protect children from abuse and neglect in the state th **at require “solid and compelling reasons”** why children would need to be removed from their homes.

“What’s frustrating is even in those cases, the parents still have a right to know where their kids are after they’ve been removed,” Corry said. “In this case, parents would have no idea.”

House Debate

Republican state Rep. Travis Couture spoke on the House floor in a debate (https://www.tvw.org/watch/?clientID=9375922947&eventID=2023041141) over amendments to the bill, stating that the U.S. Constitution, based on the precedent set by previous Supreme Court rulings, permits the state to interfere with the right of parents only to prevent harm to a child “and any legislation that goes further fails that standard.”

“ **The Constitution doesn’t tell us what we can do; it tells us what we can’t do to people**,” Couture said. “ **And multiple times our U.S. Supreme Court has ruled in favor of parental rights**.”

The Due Process clause of the Fourteenth Amendment “gives parents the right to parent” through the educating and rearing “as they see fit.”

“I think it’s important as we embark on this bill tonight to recognize the very important and critical role parents have not only in our society, and not only with their families and their children but in our law as well,” Couture said.

State Rep. Julio Cortes, a Democrat, said though having a supportive family environment is critical, it doesn’t always determine the best outcome for the success of a child’s well-being.

“But **family dynamics as I’m sure a lot of us can agree at times be let’s say complicated**,” Cortes said. “Positive mental health outcomes are possible even when a family dynamic is negative, and on the other side negative outcomes are possible even when a family is supportive. This bill is about providing housing security for our trans youth.”

While not addressing parental consent, Cortes shared an anecdotal story about a trans child he said he helped while working with homeless youth.

The child, he said, ran away to protect his family who was being attacked by community members over the child’s decision.

…