Builders build baby.

Mutiny net coming tonnostr:npub15klkdfx9sh3y096a5jf895rcvkmkzvly2fm9dgxq6huqhp9576jsav4m73

Hydro by nostr:npub19tcpurtt6xulhw0r6sc404j9jraj0h8me2lzs7z2tqewz7l0hpas59nlea coming to nostr:npub15klkdfx9sh3y096a5jf895rcvkmkzvly2fm9dgxq6huqhp9576jsav4m73

We're so excited to open up the LSP market to anyone. Plebs, institutions, and everyone in between can become an LSP.

Hydro handles all the automation!

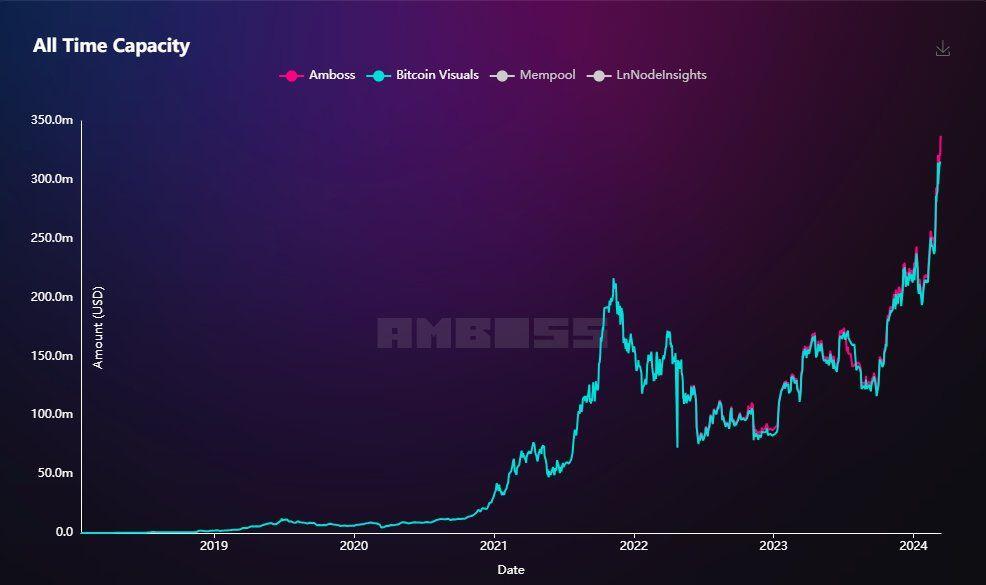

Actual settlement is private. Settlement size is limited by the lightning capacity in each channel. The total capacity of all channels is public information, reported as network capacity or settlement capacity.

It's basically how much value could theoretically be settled at once within the network as a whole.

If you're not bullish on the Lightning Network, I don't know what to tell you.

New ATH in Settlement Capacity!

amboss.space/stats

Payment processing on lightning is cheaper and faster than VISA.

💳 = ~3.00% fee

⚡ = ~0.67% fee

Using the LINER Cost index, you can calculate the cost of network infra (liquidity) for receiving payments.

0.08% LINER / 12 months = 0.67%

If you send payments, you save more!

There's no way it could be possible!!

...Except we've been doing it for nearly two years

ICYMI:

nostr:npub15klkdfx9sh3y096a5jf895rcvkmkzvly2fm9dgxq6huqhp9576jsav4m73 announced plans to integrate HYDRO to automate lightning node liquidity on nostr:npub19tcpurtt6xulhw0r6sc404j9jraj0h8me2lzs7z2tqewz7l0hpas59nlea.

https://www.youtube.com/live/lL5M5QLBA-4?feature=shared&t=1428

Start selling channels here to provide for this upcoming demand:

Bitcoin is not just an investment; it's critical payments infra with a native yield.

Yield from BTC in self-custody is made possible by the lightning network and Hydro, our liquidity automation service.

nostr:npub15klkdfx9sh3y096a5jf895rcvkmkzvly2fm9dgxq6huqhp9576jsav4m73 nodes will have easy access to liquidity, driving yields higher.

ICYMI:

nostr:npub15klkdfx9sh3y096a5jf895rcvkmkzvly2fm9dgxq6huqhp9576jsav4m73 announced plans to integrate HYDRO to automate lightning node liquidity on nostr:npub19tcpurtt6xulhw0r6sc404j9jraj0h8me2lzs7z2tqewz7l0hpas59nlea.

https://www.youtube.com/live/lL5M5QLBA-4?feature=shared&t=1428

Start selling channels here to provide for this upcoming demand:

Too many names you say?

MAGMA = Farmer's Market for liquidity

HYDRO = Instacart for liquidity

Wait you did what!?

Did anyone catch the last nostr:npub13v40ge89cgqrnr06rhk22vyca8yz3dve53vr9drwfjz7ww88xsnsstdjed?

https://www.youtube.com/live/lL5M5QLBA-4?feature=shared&t=1121

Shout-out to the nostr:npub15klkdfx9sh3y096a5jf895rcvkmkzvly2fm9dgxq6huqhp9576jsav4m73 team making the Lightning Network easy, accessible, and shipping relentlessly to make it the instant payment rails of the globe.

Great to see the incredible work they do first-hand, even during their company off-site at nostr:npub1e83qqgcelmcqp08290kvjgjpnd5w9jn3j4vvrs0ympun998smfqqg7klzd.

Hydro now automates liquidity operations for 46 lightning nodes on the network.

We heard you when you said managing channels takes too much time! So, we made it fully automated.

Getting set up with Hydro is easy and can be completed in 90 seconds.

This is a step in the right direction for the companies that need to take precautions against terrorist financing, but this isn't the complete solution.

Most regulated businesses have had to create their own versions of this one by one. As many of them have realized, this isn't something that they've wanted to spend time building or maintaining.

When it comes to a lawyer diving into the individual product decisions that were made, larger enterprises have chosen to outsource the maintenance to dedicated providers to reduce their liability when they can elect to use a professional, dedicated provider.

This is what we've created as the first feature of Reflex. We've operationalized the maintenance of relevant OFAC and Ransomware alerts as well as helped business prepare documentation that supports the consistent application of their business policies.

If building your own OFAC tool for lightning is a good use of your time, use this!

Otherwise, try out Reflex at rpo.dev

Regulated Chaumian Ecash

While the custodian of the Ecash won't know who initiates a transaction, the custodian is responsible for making the transaction happen.

What's the right risk policy for the custodian to implement?

Customize it with Reflex 🏹

rpo.dev

Not everyone will take a regulated path with their lightning nodes and that's a good thing!

The lightning network is constructed with bountiful redundancy in many jurisdictions if one node becomes more restricted because of regulation.

What Reflex enables is translating a business policy into operations to simplify working within the shifting regulatory landscape and an organic payment network. This works not by imposing a policy on others, but by self-governance.

nostr:npub19tcpurtt6xulhw0r6sc404j9jraj0h8me2lzs7z2tqewz7l0hpas59nlea

What happens on your website when an alias is being recycled with a completely new node? Assuming the previous one never comes back on the network, of course…

Could this bring confusion in search results?

It can be a bit confusing at times, but it's usually obvious when looking at the capacity and number of channel of the node in the search results.

"Satbase" for example has been used as an alias in the past on a now-defunct node and it is also in use by an active node.

Excellent newsletter from the nostr:npub1lnm0ac8ft8r3jhddchekledgwvqrkwy7wqejjwcxq47gy87te8zs6utnnn team diving into key nuances of what regulatory interpretations mean for the lightning network.

As we'll share in upcoming Reflex updates, there are potentially severe operational impacts to adopting restrictive "bubbleboy" peer policies.

https://blog.lnmarkets.com/latest-strikes-72-february-19th/

https://twitter.com/LNMarkets/status/1763275976027291991?t=z30t5nroOf6EZzzTLDeH0w&s=19

Oops I guess we just need to wait for Bitcoin to go up by another 1%... So please wait another couple of minutes.