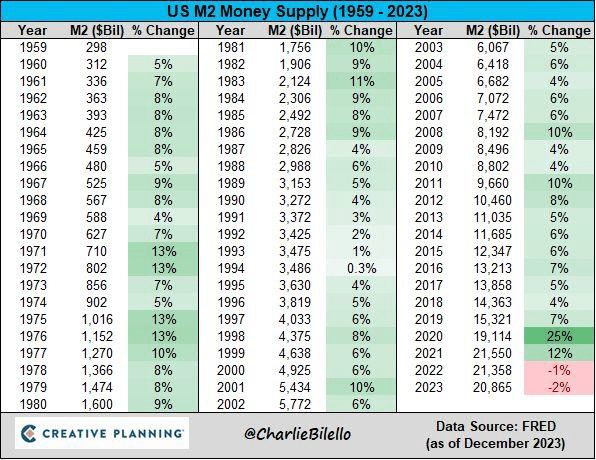

not hard to have a decline when the money supply grew in just one year 2019-2020 by the same amount as what the TOTAL money supply had reached by 1996

Yup it’s nonsense, such tools are inevitable. We just have to get used to the fact that no audio or video online can be trusted as being real anymore - only face-to-face or content from people you trust, signed with a trusted signature. It’s a bit like the idea of ‘fighting’ climate change - the focus should be on adapting and on tangible improvements to efficiency and pollution reduction rather than attacking the whole complex climate system as if it’s some sort of monster

By Bitcoin Content Industrial Complex are you referring to the shitcoin invasion that thrives on the attention it gets from the drama talk within Bitcoin community, or just in general that there’s too much talk and not enough action?

I did most of that (although using default enuts mint) and sent you a few sats in less than 10 mins! Thanks for your help

thank you Klaus for spelling out what needs to be done 😂. And by the way, just because the word sounds like tear-ee-a-nism, doesn't mean it's actually about tearing things down, it's more like just trimming off the fat!

Encourage ppl to look into RGB (Really Good Bitcoin!), Prime and Abraxas, which use client-side validation which will negate the need for the blockchain to store all transactions, instead requiring only the parties to the specific transaction histories to validate their part of the timechain using merkle trees and storing the bulk of data off-chain. This is great for both privacy and scaling on Bitcoin

nostr:note1vwg3668ryxzy5gz8ed5nzz0m4ladrvszz0xa6d0323hdlfqqz9yqu2z2qd

Encourage ppl to look into RGB (Really Good Bitcoin!), Prime and Abraxas, which use client-side validation which will negate the need for the blockchain to store all transactions, instead requiring only the parties to the specific transaction histories to validate their part of the timechain using merkle trees and storing the bulk of data off-chain. This is great for both privacy and scaling on Bitcoin

nostr:note1quhgzrut4eh2z0wf5cq2k6xq5axuwhqrnlz50qzwsrg3wkn8r5nq7j0z45

Sticking it to the WEF! Klaus must be squirming. Pretty cool AI conversion of the original speech in Spanish, made to look like he’s speaking in English and with his own accent

dog owners too busy having to walk their dogs

it's all relative

https://www.reddit.com/r/Bitcoin/s/B1AmthGXNM

Here's a list of all the dumb things Dipstick Dimon fits into this 2-minute video:-

"This is the last time I’ll tell this to CNBC" - highly unlikely unless he gains a few braincells

"Blockchain is real, it’s a technology" - no shit Sherlock, it stores the Bitcoin ledger

"We use it, it’s going to move money, it’s going to move data, it’s efficient" - it's not "going" to move money, Bitcoin is a form of money and is already being moved from wallet to wallet within the blockchain, secured by mining work. It's NOT efficient when compared with a centralised ledger so there's no point using a blockchain for anything unless it requires decentralisation and high security.

"We’ve been talking about that for 12 years too and it’s very small, we’ve wasted too many words on that" - he's describing his long journey leading to little understanding of Bitcoin

"Cryptocurrencies, there are two types – those that might actually do something (smart contracts to buy and sell real estate, that may have value). Tokenising things that you do something with." - last I checked there've been 23,000+ crytpocurrencies or tokens. There are also smart contracts on Bitcoin.

"Then there’s one that does nothing, I call it the pet rock, the Bitcoin or something like that" - feigning ignorance of its name! One of Bitcoin's most important features IS that it is pure money and its supply and demand will not be affected by the ebb-and-flow and unpredictability of industrial, commercial or decorative uses.

"On the Bitcoin there are use-cases – AML, fraud, anti-money laundering, tax avoidance, sex trafficking – and you see it being used $50-100b a year for that" - On the Bitcoin?! First, he mentions anti-money laundering twice and lumps it together with fraud and sex trafficking as if it's an evil thing - not the first time, as he also said this to congress. Perhaps he's so fed up of those AML people bugging him all the time that he's forgotten they're supposed to be the good guys! As for the amounts he quotes, each year about $500b is lost in tax avoidance, $150b spent of sex trafficking and up to $2 trillion in fraud. This amounts to over $2.5T. If the global money supply is about $50T, that means 5% is spent on these illicit activities. Bitcoin pails in comparison, with less than 0.3% of Bitcoin used for illicit activities

"Everything else is people trading among themselves (speculating?)" - er... why would people trade Bitcoin among themselves, 1BTC = 1BTC. There's arbitrage, yes, but any speculation involves fiat and other cryptos as well. There are plenty of people trading their Bitcoin for goods and servces.

“I don’t care what Larry Fink finks so please stop talking about this shit" - ooh getting lairy, but JPM's happy to support Larry's ETF nonetheless.

"I don’t know what [Larry] would say about blockchain vs currencies that do something and Bitcoin that does nothing" - why does he think that a currency has to DO something other than be a currency?!?1

Eye-opening talk with Hal Finney’s wife Fran and Peter McCormack. It’s admirable how well Hal seemed to adapt to his condition with ALS but also shocking what the family had to go through on top of all that

I’m curious why it’s necessary to put personal info inc. email in to activate the wallet? Is there an alternative way to zap ⚡️ like using zapplepay with alby on Damus?

nostr:npub16c0nh3dnadzqpm76uctf5hqhe2lny344zsmpm6feee9p5rdxaa9q586nvr Why does #primal ask for personal info when setting up the wallet? Isn’t this against the ethos of #nostr ?

What I got from this is that arbitrage between the cost of input resources for producing something of value, and the revenue of the output is a key driving force in an economy (not simply corrections of minor imperfections tending towards a perfect equilibrium, as Weinstein apparently wants to believe for Gauge Theory). The economy can never be mathematized when its variables comprise a myriad of conscious beings with subjective intent, and far less so in an environment where the would-be yardstick ($) is itself floating in an unpredictable sea of the futile ambitions of a tiny subset of those conscious beings with their own subjective intent (Fed)

Card machine modified to accept lightning?

Talk by Maxim Orlovsky on Prime, alternative Layer 1 for Bitcoin. Seems promising for privacy and scalability but I’m having difficulty conceptualizing how individuals would maintain only the histories related to their own transactions for client-side validation of the Prime chain, without many of those getting irretrievably lost or corrupted and it ending up in a mess. Validation is one thing but if you don’t have the transaction data to validate it wouldn’t be much good. Appreciate if someone can explain how this part works?