Wintermute’s Election Prediction Market to Use Trump and Harris Tokens on Ethereum

Wintermute is launching OutcomeMarket, a decentralized prediction market platform focused on the 2024 U.S. presidential election. The platform will feature tokens tied to candidates like Donald Trump and Kamala Harris, and will operate across Ethereum and its layer-2 scaling networks, Base and Arbitrum. OutcomeMarket aims to reduce barriers by using permissionless smart contracts, enabling trading venues to list tokens without minting or transaction fees. Users can participate in prediction markets, trading on candidates' performance while also using these tokens in DeFi applications. Multiple exchanges, including Bebop and WOO X, plan to list these tokens.

Source: Decrypt

dYdX to Launch Futures Trading on Prediction Markets

dYdX, a DEX, is set to launch prediction markets, allowing users to place leveraged bets on binary event outcomes, such as sports or financial markets. This move is part of the dYdX Unlimited upgrade, which will also introduce permissionless market listings and a liquidity pool called MegaVault. Users can deposit USDC into the vault for passive income, as it provides liquidity to various markets. The initiative aims to offer something unique in DeFi, distinguishing it from centralized exchanges.

Source: Coindesk

DBS Bank Introduces BTC & ETH Options Trading for Institutional Clients

Singapore’s DBS Bank will introduce over-the-counter (OTC) crypto options and structured notes for institutional clients starting in Q4 2024, focusing on Bitcoin and Ethereum. These products will allow clients to hedge against crypto volatility and manage their digital asset portfolios with advanced strategies. DBS aims to provide trusted, institutional-grade access to digital assets and is expanding its Web3 infrastructure with initiatives like DBS Treasury Tokens and blockchain-based government grants.

Source: Cointelegraph

Circle Plants Flag in Wall Street with New NYC Headquarters

Circle, the company behind the USDC stablecoin, announced it will relocate its global headquarters to New York City's One World Trade Center, signaling a commitment to the U.S. despite regulatory challenges. CEO Jeremy Allaire expressed hopes that the new headquarters will bridge web3 and traditional finance. While some praised the move, including Anthony Scaramucci, others like Step Finance's George Harrap criticized the decision to "double down" on a country perceived as hostile to crypto. On-chain researcher ZachXBT accused Circle of profiting from web3 while failing to act against DeFi hacks.

Source: The Defiant

U.S. Federal Debt Interest Costs Hit $1.1 Trillion as Daily Payments Reach $3 Billion

The U.S. Federal debt’s annual interest costs have surpassed $1.1 trillion, with the government now paying a record $3 billion per day in interest. This expense is triple what it was a decade ago and has doubled in the past 2.5 years, according to the Kobeissi Letter. Even if the Federal Reserve cuts interest rates by 1%, the daily interest cost would still be $2.5 billion, more than double the average from 2009-2019. The rising debt, now over $35.3 trillion, combined with high interest rates, has made interest payments one of the country’s largest expenses.

Source: Crypto Globe

Agile Energy X eyes $2.5 Billion BTC Earnings From Excess Green Energy

Agile Energy X, a subsidiary of Tokyo Electric Power Grid, is exploring the use of surplus renewable energy for Bitcoin mining by installing mining machines near solar farms in Japan's Gunma and Tochigi prefectures. Tests indicate that if Japan meets its goal of 50% renewable energy by 2050, utilizing just 10% of the projected 240,000 gigawatt-hours surplus could generate $2.5 billion in Bitcoin annually.

Source: Beincrypto

It’s 2030. Bitcoin is a million dollars. You look back and think, holy shit, I was a fucking dumbass for worrying about the move from 57k to 54k in the summer 2024 and selling to “buy lower.”

Vitalik’s 10-Year Vision For Ethereum

Vitalik shared his optimistic vision for Ethereum’s future on the Bankless podcast, outlining significant advancements he expects over the next decade. He sees a future where Ethereum nodes can be run on mobile phones, allowing anyone to participate in the network with seamless, light computations. He believes breakthroughs in tech will make node verification quick and efficient, despite the challenge posed by heavy data.

Source: U Today

WisdomTree Drops Ethereum ETF Plans

WisdomTree has withdrawn its Ethereum Trust S-1 filing with the U.S. SEC, more than three years after its initial submission in May 2021, confirming that no securities were issued or sold. The filing had aimed to list Ethereum ETF shares on the Chicago Board Options Exchange’s BZX Exchange.

Source: Cointelegraph

Friday night football in Brazil that isn’t on actual TV.

The simulation is really glitching.

VanEck Winds Down ETH Futures ETF

VanEck will close its Ethereum Strategy ETF (EFUT), which launched in October 2023 and held ETH futures contracts, due to insufficient asset growth compared to its spot ether ETF, ETHV. EFUT, managing only $21 million in assets, struggled as investors preferred spot Ethereum ETFs, which received SEC approval in July. VanEck’s decision, effective September 16 when shares will be delisted from the Cboe exchange, reflects ongoing challenges with futures ETFs, including roll costs and contango. This move follows Grayscale's withdrawal of its ether futures ETF application and VanEck's earlier plan to close its bitcoin futures ETF after launching a spot bitcoin ETF.

Source: Blockworks

The US Treasury Department is intensifying its efforts to regulate crypto transactions linked to terrorist organizations, notably Hamas, as it seeks to address national security risks associated with virtual assets.

According to a recent Bloomberg report, Treasury officials revealed they are investigating approximately $165 million in cryptocurrency transactions believed to support Hamas, a group designated as a terrorist organization by the US government.

Source: Bitcoinist

Ripple Co-Founder Backs Kamala Harris in 2024 Presidential Race

Ripple co-founder and executive chairman Chris Larsen has publicly endorsed Kamala Harris for president, joining 87 other corporate leaders in signing a letter of support.

Former Ripple board member Gene Sperling recently joined Harris' campaign, further solidifying Ripple's connection to her candidacy.

Source: Cointelegraph

August Jobs Report

U.S. job growth in August fell short of expectations with 142,000 new jobs added, compared to the forecast of 160,000, and July's job growth was revised down to 89,000. The unemployment rate decreased to 4.2% from 4.3% in July. Average hourly earnings rose 0.4%, surpassing expectations.

Coindesk said that the data suggests the Fed is more likely to implement a 25 basis point rate cut rather than a 50 basis point cut at its upcoming meeting.

Source: Coindesk

"Never complain, never explain.”

Move in silence, do things your way, and let the results speak for themselves. Energy wasted on excuses is better spent building solutions. You owe no one a justification for your path.

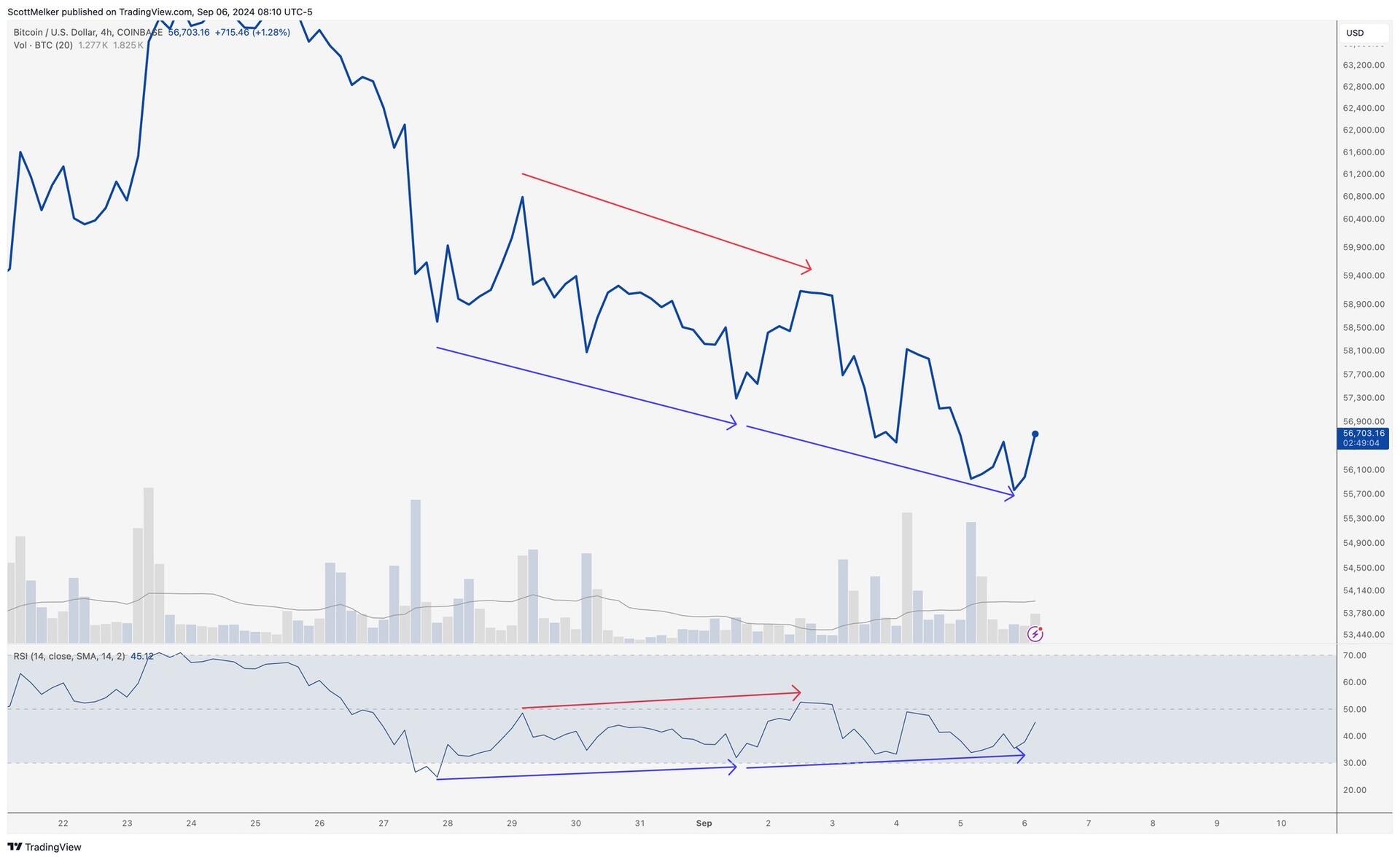

Bottoming signals everywhere.

$BTC 4-HOUR

So much bullish divergence.

You only need one chair. #Bitcoin

Do you hold more #Bitcoin today than you did a year ago?

Learn to think in #Bitcoin.