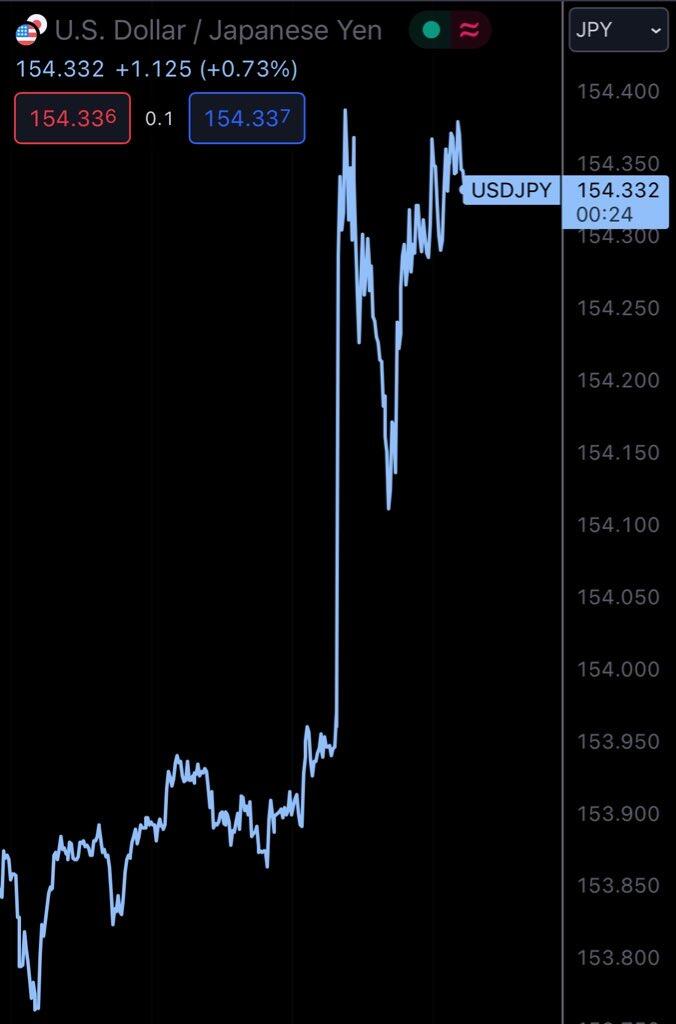

Bank of Japan this last week

This is a great article on the power of Nostr nostr:npub1a2cww4kn9wqte4ry70vyfwqyqvpswksna27rtxd8vty6c74era8sdcw83a

here's what everyone might be missing about the Roaring Kitty/DFV story:

Maybe it was NEVER about the money.

RK by now has more money than he ever knows what to do with. even if $GME closes below $20 next week.

He's a regular guy, who is an intelligent and educated investor with a CFA who found a struggling company and went all in.

he exposed more corruption, shenanigans, backroom deals, and overall rot of the system than he could have ever imagined.

with this money he wanted to come back, aligned with the swap cycles, to show us once again that the shorts haven't closed and crime is still happening in real time.

all of fintwit measures your character by your P&L. if he loses money, they'll call him an idiot, a grifter, a loser.

but his intention might be different. maybe he's crazy enough to allow himself to "lose" in the pursuit of the truth about the markets.

what if it's not about money?

maybe it's about sending a message.

Want to know a shocking fact?

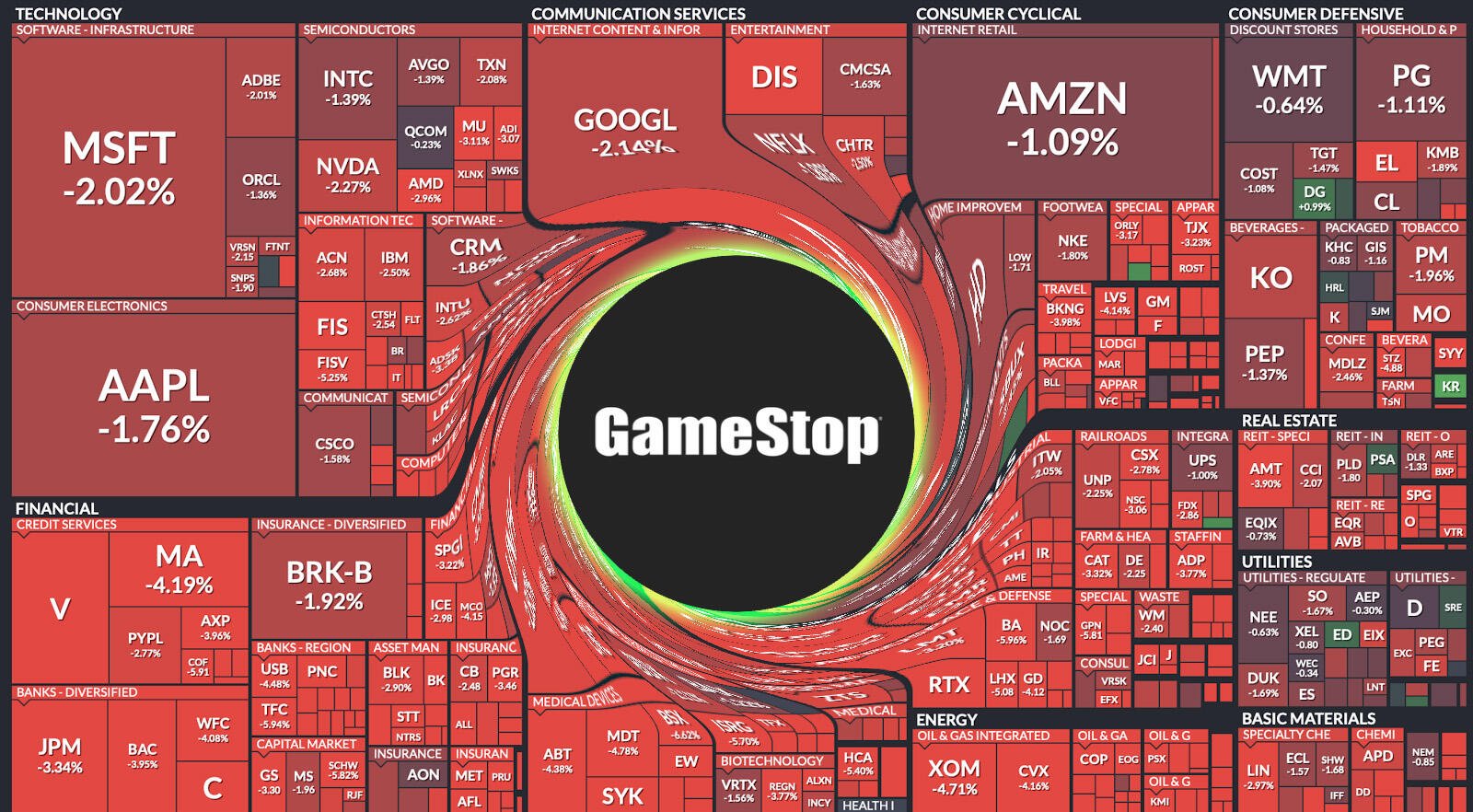

Our stock markets are fractionally reserved. For decades, ever since the inception of electronic book entry, the creation and dissemination of synthetic shares has been common place.

Thousands of companies have been naked shorted into the dust, if their business plan or go to market strategy was not in line with what certain powerful people wanted.

Richard Simpson, who was an investor in global links in 2005, bought the entire float and more of the stock, and moved it into his brokerage account. Over the next two days 50 million shares traded.

This is not new or unique to just this small company. Many popular household names, like GameStop, Toys “R” Us and Sears have been naked shorted into the ground in a bid to push them into bankruptcy and scoop up their assets for the cheap.

Realizing this makes you lose faith in the stock market. If the shares you hold aren’t real then is any asset real?

The answer is bitcoin. 1 million GameStop apes stand ready to be told the truth and move their wealth into an asset that can’t be debased, rehypothecated, or synthetically printed.

The GameStop meme is about much more than than the company. It’s about the awakening of an entire generation.

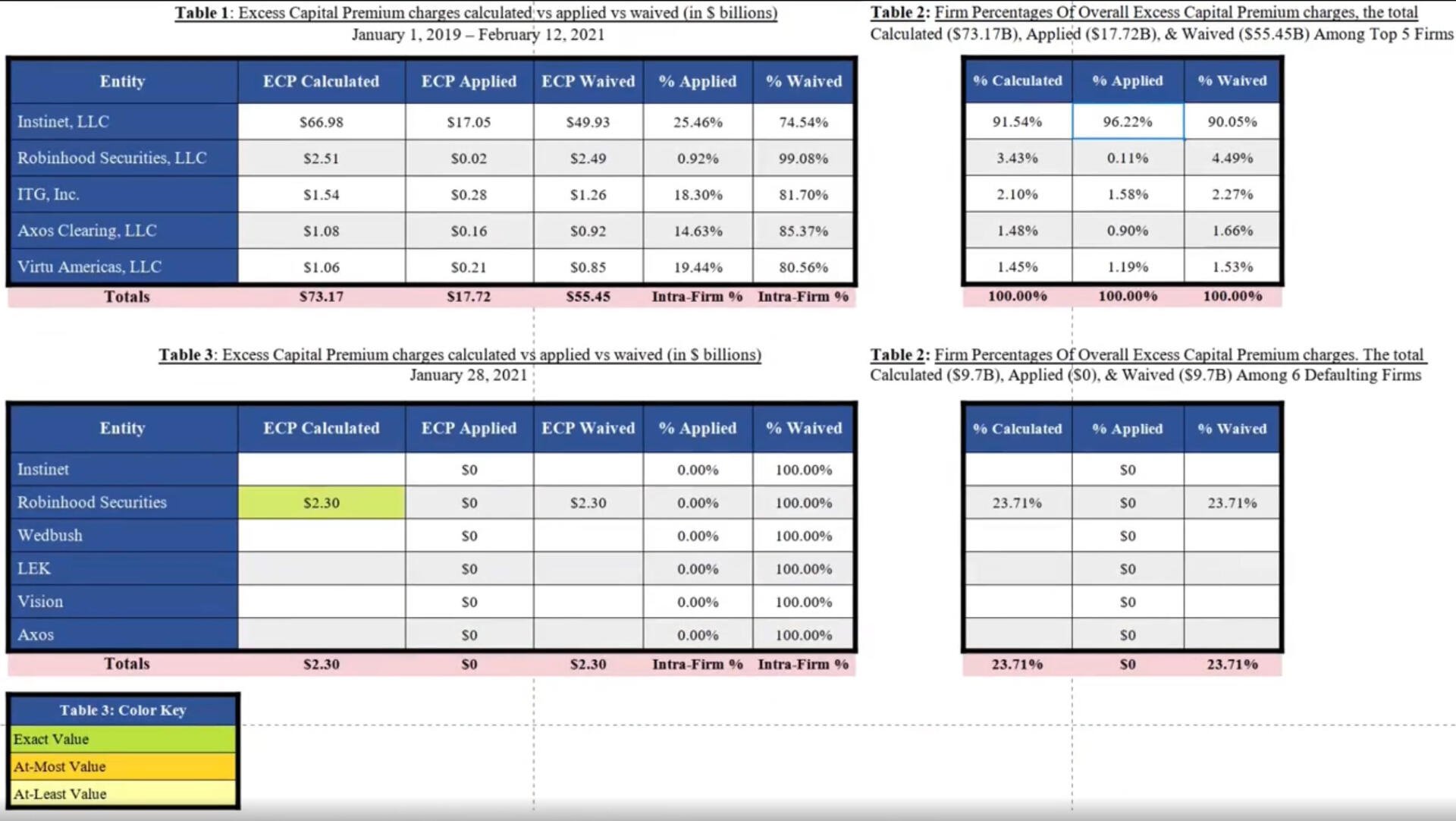

Did you know that $55 BILLION of excess capital premium (collateral charges) were waived in early 2021 as the GME price skyrocketed and institutions found themselves underwater?

The NSCC saw a market wide disruption, and the squeeze on GME would have frozen multiple brokers and clearing firms, including Instinet.

To cope with this, they waived the charges and froze buying to stop the bleeding.

Our stock market is run by a cabal, and you never win if it comes at their expense.

This is why we Bitcoin. A million apes are learning in real time about why owning your own assets is so crucial.

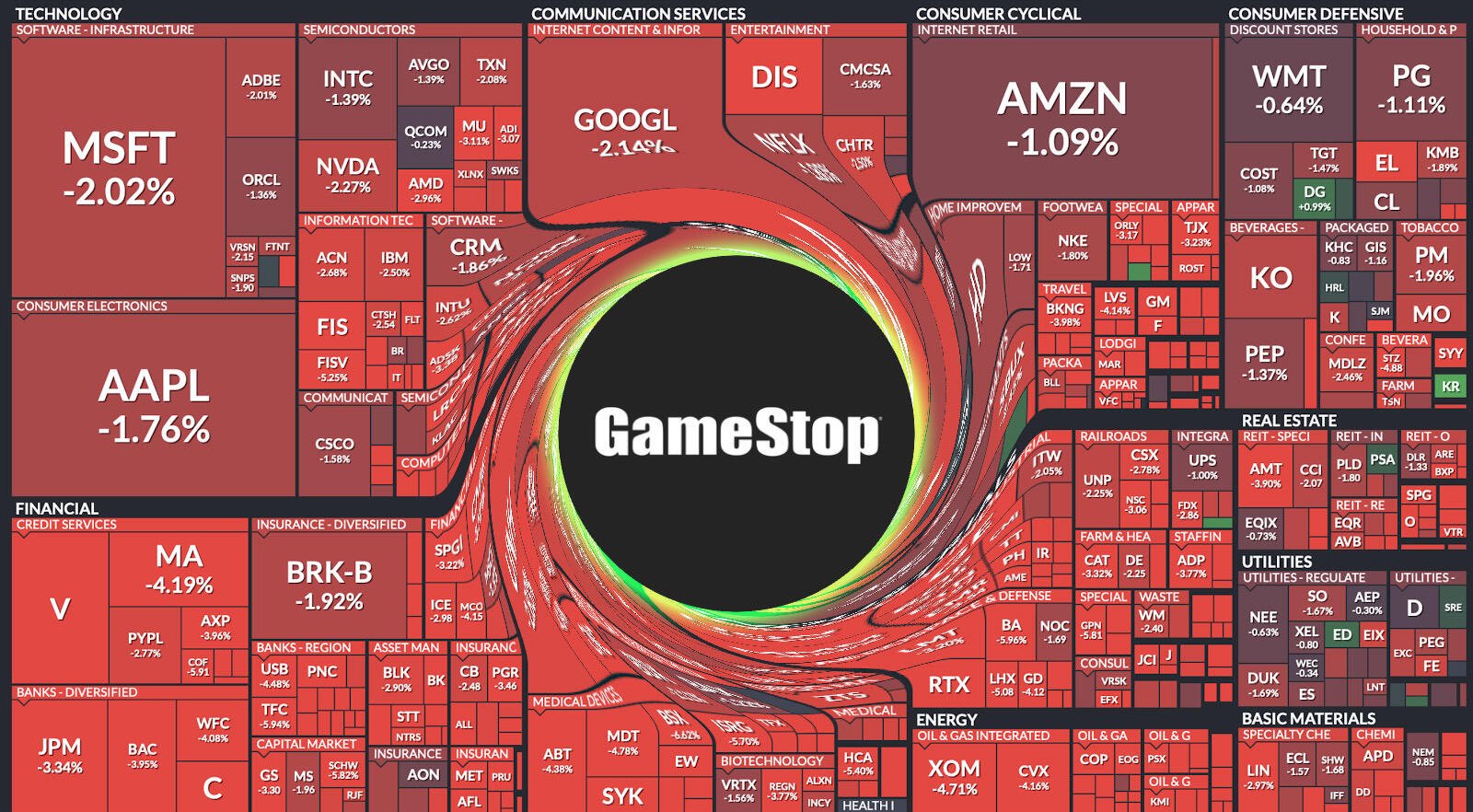

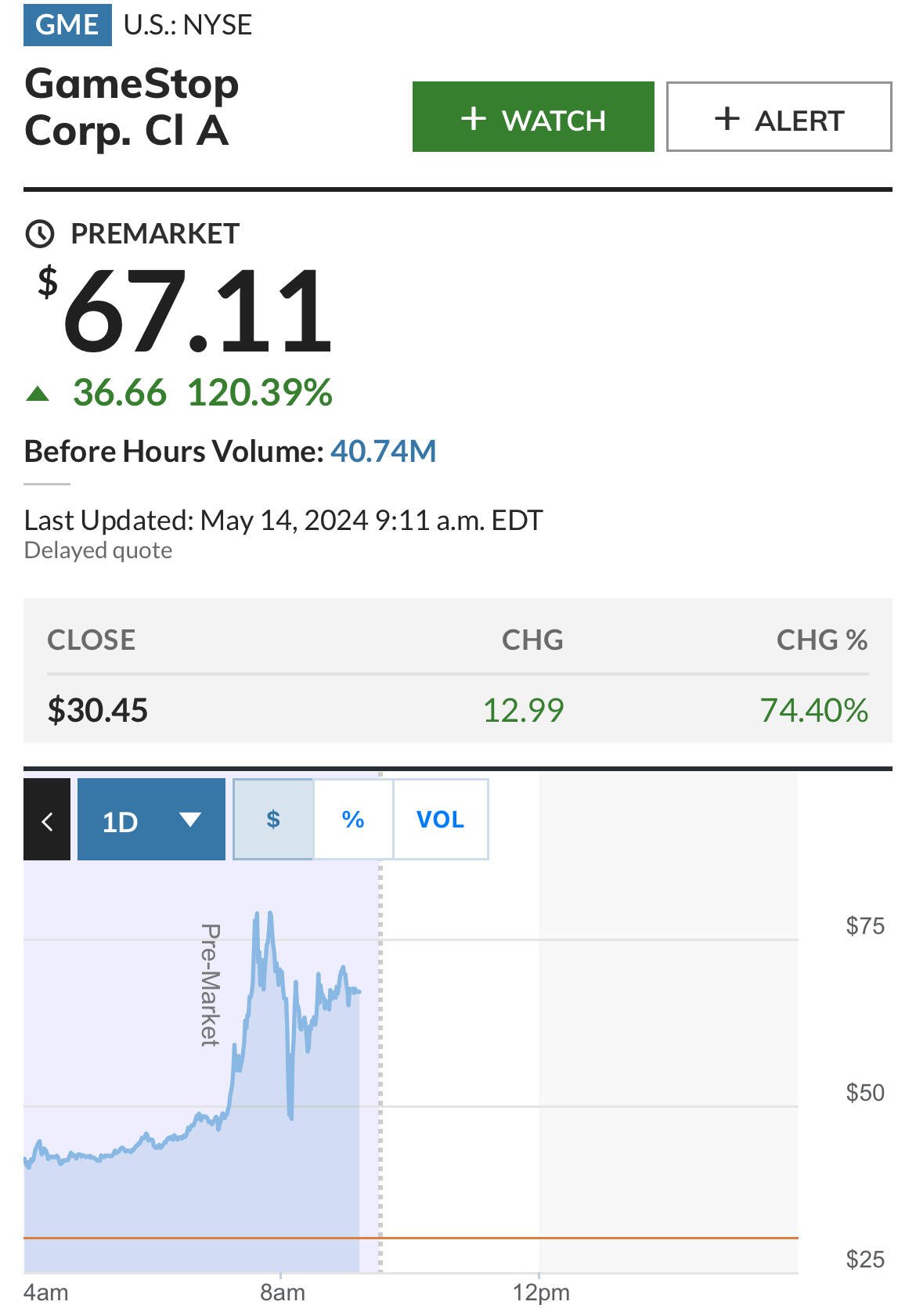

The price of GameStop hit $80 in premarket trading today, and then collapse all the way back down to 39.

This is not retail. Most small investors don’t have access to premarket, trading and disposable income is basically drained from the pandemic stimulus.

There are massive institutions that have a vested interest in GameStop, and they shorted more shares than exist, which created wall of failure to delivers, which occasionally come back in the form of these price spikes .

This is all the more evidence that the Fiat financial system is completely broken, and bitcoin is the solution.

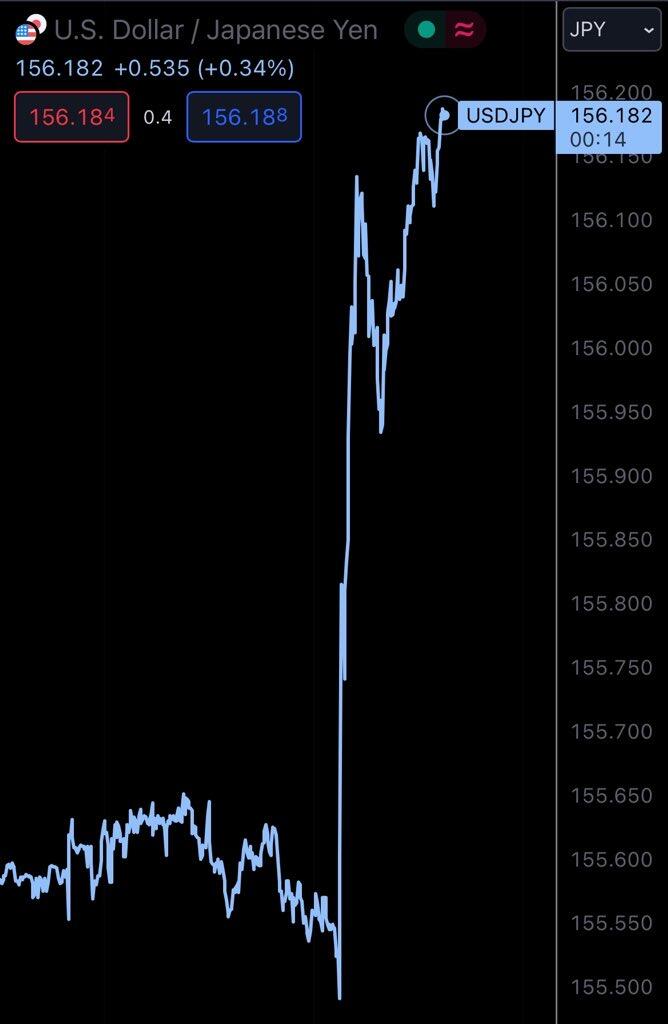

The absolute level matters, but so does the pace of increase of the new debt.

Japan was able to kick the camper so long because I’ve insanely low monetary velocity and a positive current account which means they had excessive capital to defend their currency and with rates being low globally, there wasn’t any pressure building up.

Now, with federal funds rate above 5%, and the Japanese still close to the zero bound, the massive carry trade is opened up and is pushing the yen weaker and weaker

It’s hard to say on timeline, but I would say definitely within this decade the Fiat financial systems is going to reach breaking point

As for adding bitcoin to Substack, I don’t have an option, but if you just zap me the sats on my Alby wallet and DM me your email I’ll add you manually

GameStop is ripping right now. Back in 2021 it was shorted well over 150%, most people would ask why or how that could even be possible and the answer is someone can sell a short multiple times. It also means that the shorts cannot escape.

GameStop represents a chink in the armor of the financial system, the nuclear beating heart of the death star of infinite liquidity and shorting that is our stock market

Bitcoin is the escape valve, and GameStop is the red pill that will awaken millions

the japanese government itself is doing a $20T carry trade.

George Saravelos, the head of currency research at Deutsche Bank, examined a combined balance sheet of the Japanese government, encompassing the government-managed pension fund GPIF, the Bank of Japan (BOJ), and state-owned banks. He examined the asset and liability composition of Japan's $20 trillion debt.

basically this debt is a giant carry trade that involves borrowing yen at the zero bound and buying assets in higher-yielding currencies.

but this means that the government itself is TRAPPED.

"If the central bank raises rates the government will have to start paying money to all the banks and the carry trade's profitability will quickly start unwinding," Deutsche analysts said.

This would result in higher interest payments on bank reserves and a fall in the value of government bonds, along with a reduction in the value of government assets in an environment of rising interest rates.

Potentially causing a financial crisis in Japan on the same level as 2008.

Thus, they can't really afford for their carry trade to blow up in their face. So, they must keep it on, slowly whittling away at their currency.

The BoJ will do Yenterventions to slow the fall, but they'll have to let it fall eventually.

Last night we had our second Yentervention

At this rate their going to burn through the capital account quickly, they may have five or six more interventions of this size left

What an absolute chad! Hahaha nostr:note17mx9zrjuw43gl88haq7qmjkncae9l8d2fhqgfezhhzf0upe7llysdzeswh

this is it. we're moving to a new stage of the Endgame.

Japanese Yen ripping through barriers like paper, passing each level where the BoJ intervened before. The slow motion meltdown has finally begun to accelerate, and authorities are powerless to stop the decline, unless they want to dump their Treasuries.

Yellen probably on the phone with them tonight, warning dire consequences if they put their finger on the button to defend their currency. Japanese PM Kishida met with Biden this month, smiling on the surface, but pain underneath.

He knows, as Kuroda does, the terrible truth:

They are TRAPPED.

With debt to GDP at an eye-watering 263%, they can't afford to normalize rates with the Fed. Since they have to maintain low rates, a massive carry trade opens up, bolstering USD and pulling JPY down consistently. The longer the Fed keeps rates high the worse this blows out. News of a hot inflation in the US this morning made things worse, as now Powell has more justification for "higher for longer".

This means more pain ahead for the Asian behemoth.

In the US, massive 50% downside miss on GDP paired with hot PCE means stagflation is returning. With government interest expense at all time highs and trillion dollar deficits as far as the eye can see, this means more debt growth as we accelerate across the Monetary Event Horizon.

The walls are beginning to close in.

Attacks on Bitcoin have escalated, first with Feds arresting the developers of Samourai Wallet. Next Phoenix Wallet pulls their app from Appstore, and now DTCC is assigning 100% haircut to all crypto assets.

They're coming for the non-KYC wallets first. Then the nodes. Then self-custody.

Your privacy is at stake. Your future is at stake.

The truth is, they depend on us to keep the whole charade going. We man the barricades of the dying fiat monetary system. Without us working for their money, they have nothing to control us with.

"Look, the people you are after are the people you depend on. We cook your meals, we haul your trash, we connect your calls, we drive your ambulances. We guard you while you sleep. Do not... fuck with us." -Tyler Durden

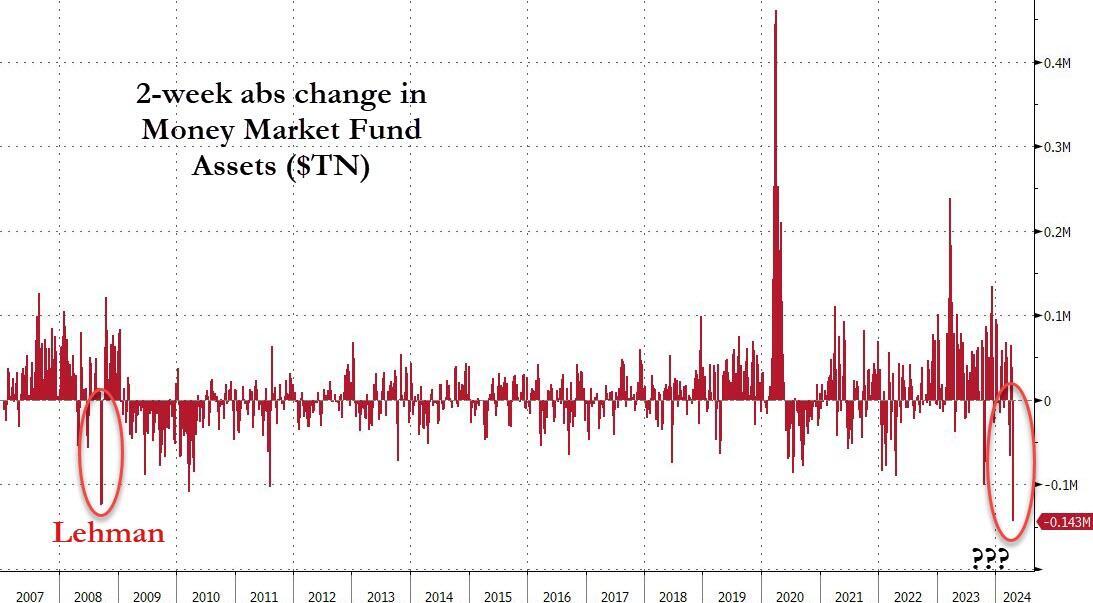

Also money markets are being drained at a record pace

USDJPY ABOVE 157

This is a slow motion currency crisis  nostr:note10mpzhhw5apvarye4gk7g25tds72aeueh8edp8s4seql45jyg9ujq9gvr6s

nostr:note10mpzhhw5apvarye4gk7g25tds72aeueh8edp8s4seql45jyg9ujq9gvr6s

The real Lehman Bros is Japan

Not even a day after breaking 155, the yen breaks 156!!!

FINANCIAL GRAVITY:

If we divide the performance of the S&P 500 by the Fed’s Balance Sheet since the GFC, the LINE IS FLAT.

This means that there has been basically NO REAL growth in stock prices since 2008- with the only rise in prices due to money printing.

The correlation coefficient between central bank quantitative easing and the price of stock indexes is nearly 1.

The money printed by the Fed, because of the structure of the Open Market Operations, is plugged directly into the Treasury markets, and from there, flows into equities and derivatives.

This has served to primarily enrich the asset owners, financial institutions, and wealthy elites who own the majority of the stock market anyways.

The entire rally has been an illusion, financed by the Fed and maintained through QE.

In the black expanse of space, many things are not what they seem.

What are y’all doing for the Halving?

Japanese Yen just blew out to 154!

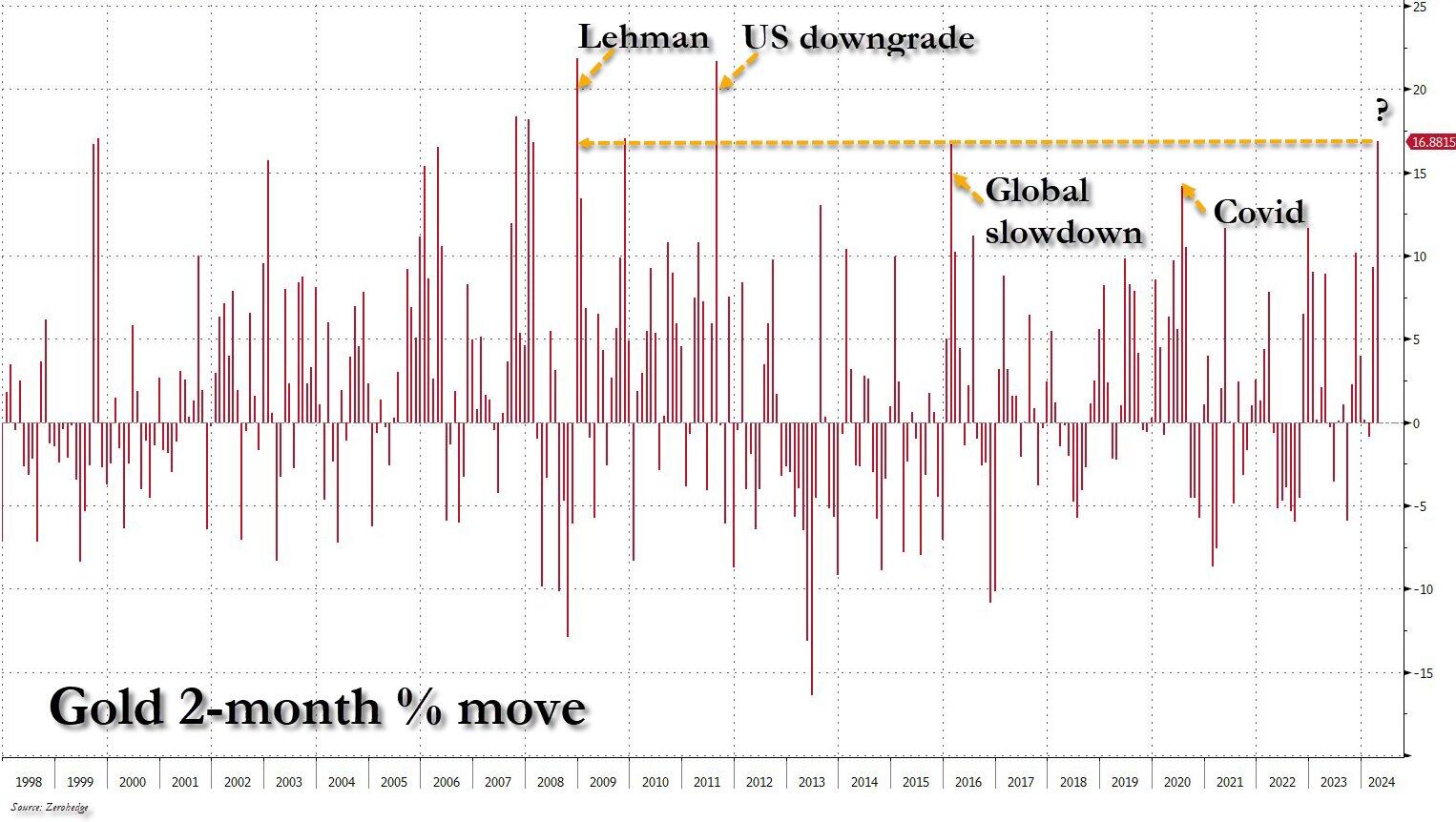

GOLD IS SENDING A WARNING