War Is A Racket

“WAR is a racket. It always has been.

It is possibly the oldest, easily the most profitable, surely the most vicious. It is the only one international in scope. It is the only one in which the profits are reckoned in dollars and the losses in lives.

A racket is best described, I believe, as something that is not what it seems to the majority of the people. Only a small "inside" group knows what it is about. It is conducted for the benefit of the very few, at the expense of the very many. Out of war a few people make huge fortunes.

In the World War [I] a mere handful garnered the profits of the conflict. At least 21,000 new millionaires and billionaires were made in the United States during the World War. That many admitted their huge blood gains in their income tax returns. How many other war millionaires falsified their tax returns no one knows.

How many of these war millionaires shouldered a rifle? How many of them dug a trench? How many of them knew what it meant to go hungry in a rat-infested dug-out? How many of them spent sleepless, frightened nights, ducking shells and shrapnel and machine gun bullets? How many of them parried a bayonet thrust of an enemy? How many of them were wounded or killed in battle?

Out of war nations acquire additional territory, if they are victorious. They just take it. This newly acquired territory promptly is exploited by the few -- the selfsame few who wrung dollars out of blood in the war. The general public shoulders the bill.

And what is this bill?

This bill renders a horrible accounting. Newly placed gravestones. Mangled bodies. Shattered minds. Broken hearts and homes. Economic instability. Depression and all its attendant miseries. Back-breaking taxation for generations and generations.”

Read the rest here: https://www.ratical.org/ratville/CAH/warisaracket.html nostr:note1w80c88uznlydv2zlpgtg6h68v4uha6ttek6gqd7rhg4qhly5eqlsxlxf5u

This war feels awfully manufactured

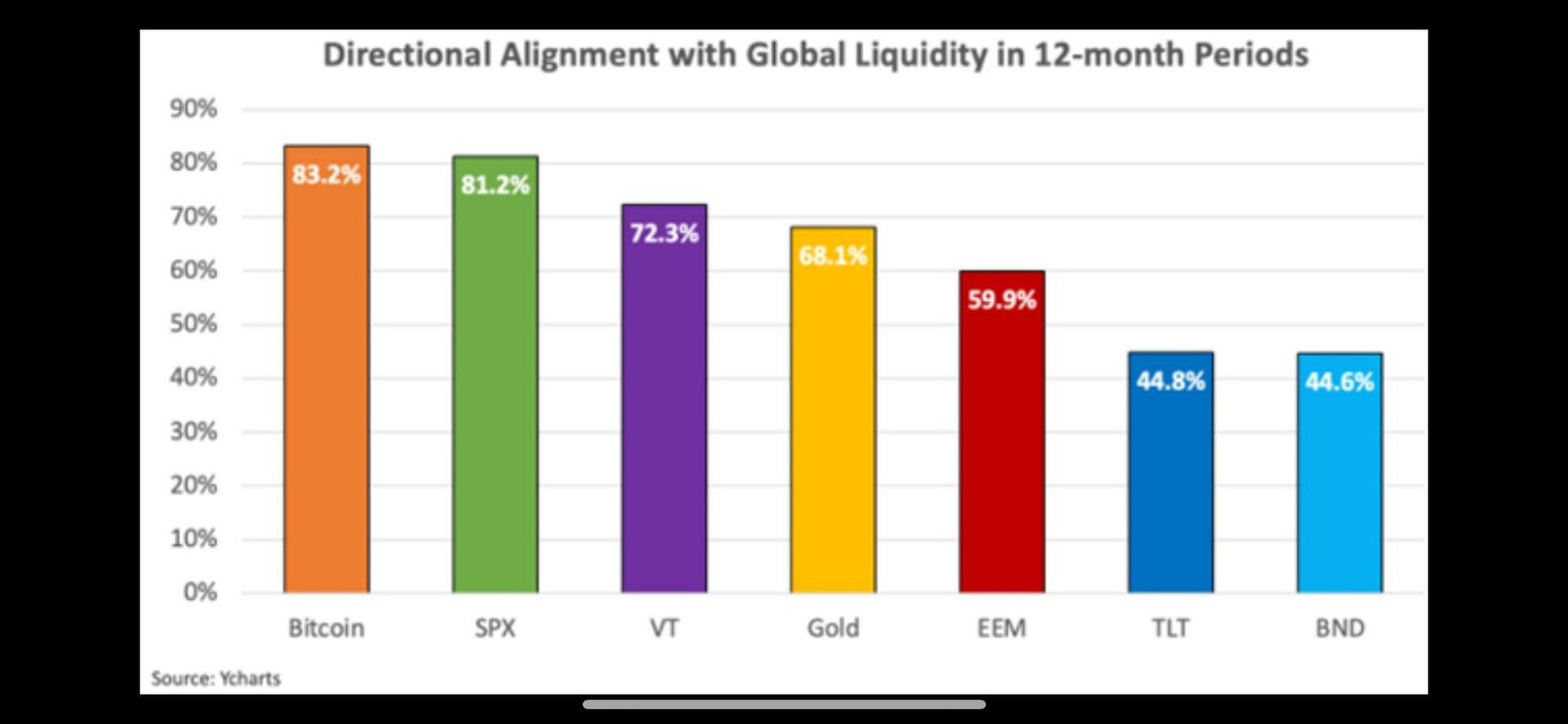

Bitcoin is gonna pump so hard once all the central banks are easing together

Are we ready for global liquidity to rip??

Carnivore diet is elite 👌

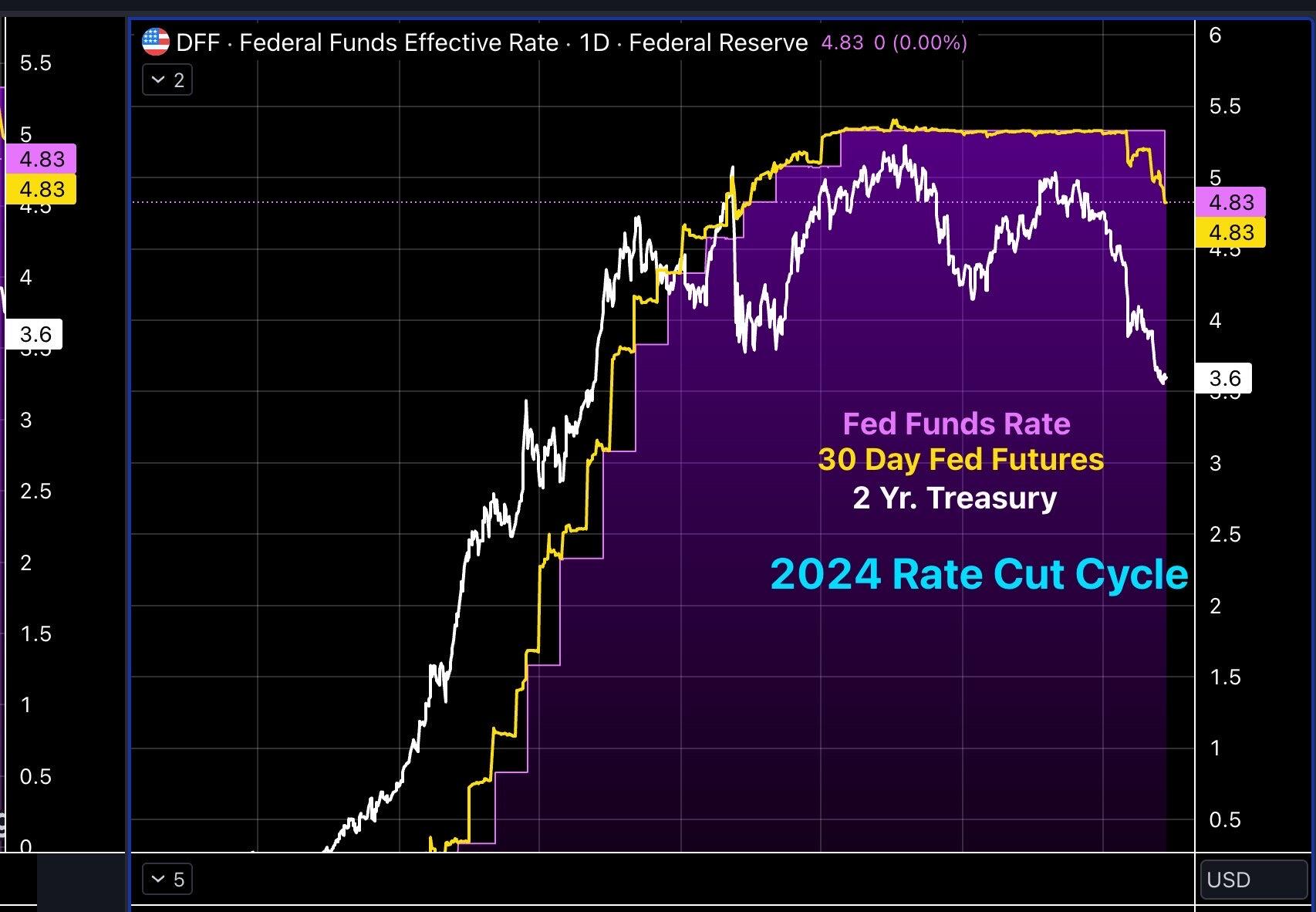

Historically, they’ve never been able to do a cutting cycle without also running QE

the rate cuts have begun 🔥

POWELL: FED IS NOT DECLARING VICTORY OVER INFLATION

yeah no shit, sherlock

FED CUTS BY 50BPS

with “no financial crisis and no recession”

They need LIQUIDITY

Yes they are parked at the Fed. I am starting a whole series on monetary plumbing to be posted on my substack soon

Is there a way to pin a note to your profile on Damus or any other Nostr app?

I want to bring over all my great Twitter threads onto here, but I want to have a nice convenient place to store them so anyone coming to my profile in the future can just read all my best work

Good idea. I’ll start posting them here

Our monetary system does not work how do you think it does.

An economics courses they will tell you that when the Fed bank reserves, those bank reserves are multiplied out into loans which then create deposits.

That view is incorrect. Reserves are strictly financial economy money and do not directly correlate to private credit creation with only one exception (Treasury General Account).

In fact, in 1986 we had around $2.8 trillion of M1 money supply and yet bank reserves were only $39billion. Fast-forward to 2008 and money supply was sitting above $7 trillion and bank reserves had fallen to 10 billion.

So if bank reserves don’t actually facilitate credit creation, then what do they do?

Essentially, they act as accounting entries on bank balance sheet to settle interbank payments, But ironically, Banks can just use their own ledgers to settle directly with each other using cash.

All of this changed in 2008 when the fed began their massive QE program and injected $2 trillion of bank reserves into the system in short order, stuffing the banks with a new asset that had to be parked somewhere.

The rise in base money in the form of reserves, therefore flowed into the financial markets, equities, derivatives and bonds, and serve to ignite the most aggressive market in US stock market history.

in a world of debt, interest rates are a weapon

Why are there now 1000 reply guy bot accounts on NOSTR?

It’s annoying as hell

I mean bitcoin is up what almost 33% YTD?

Just because its been sideways for a few months doesn’t mean everything is over

Chinese buying is the main reason gold has been ripping, and as their economy slowly implodes, the trend should continue