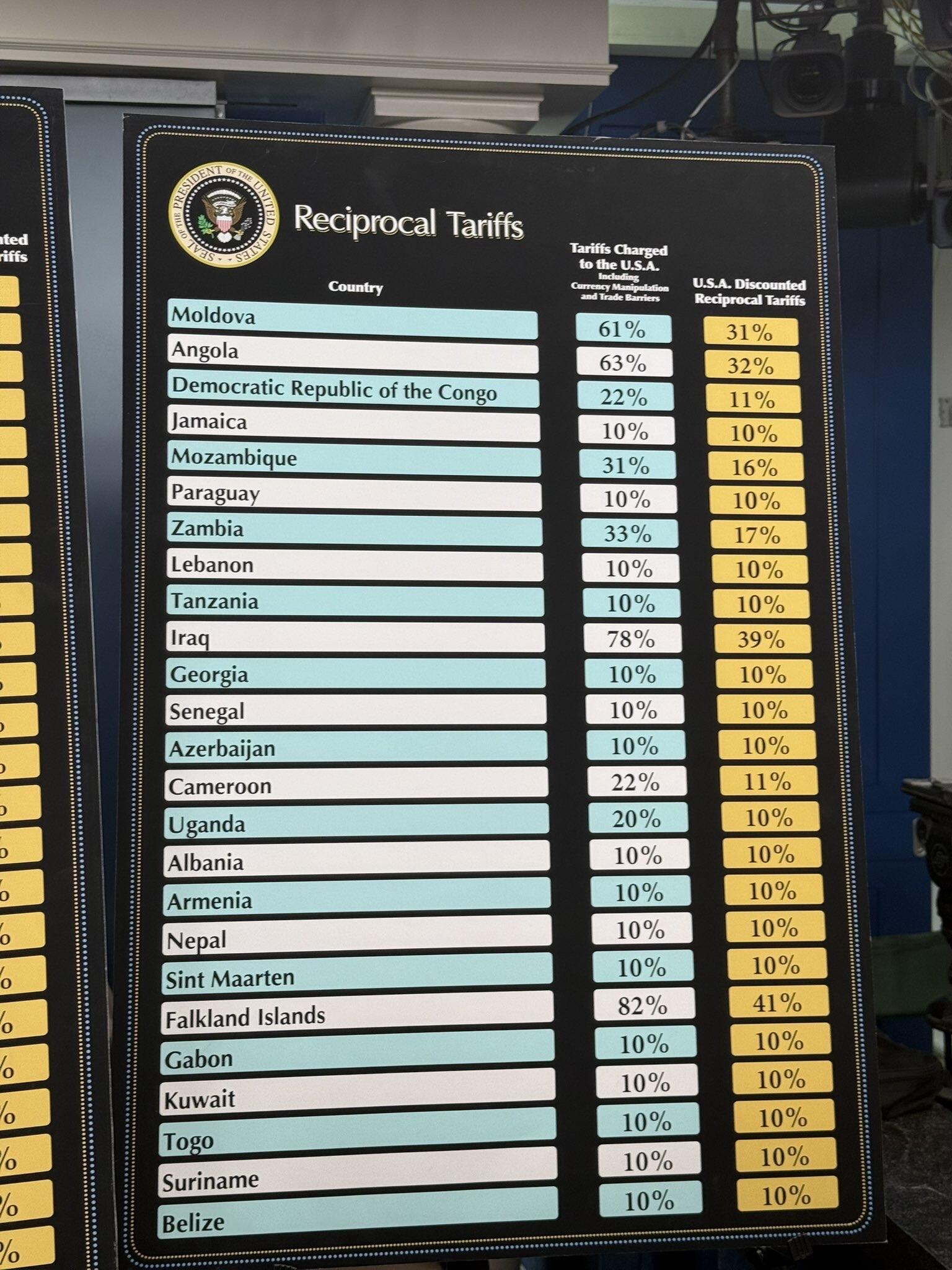

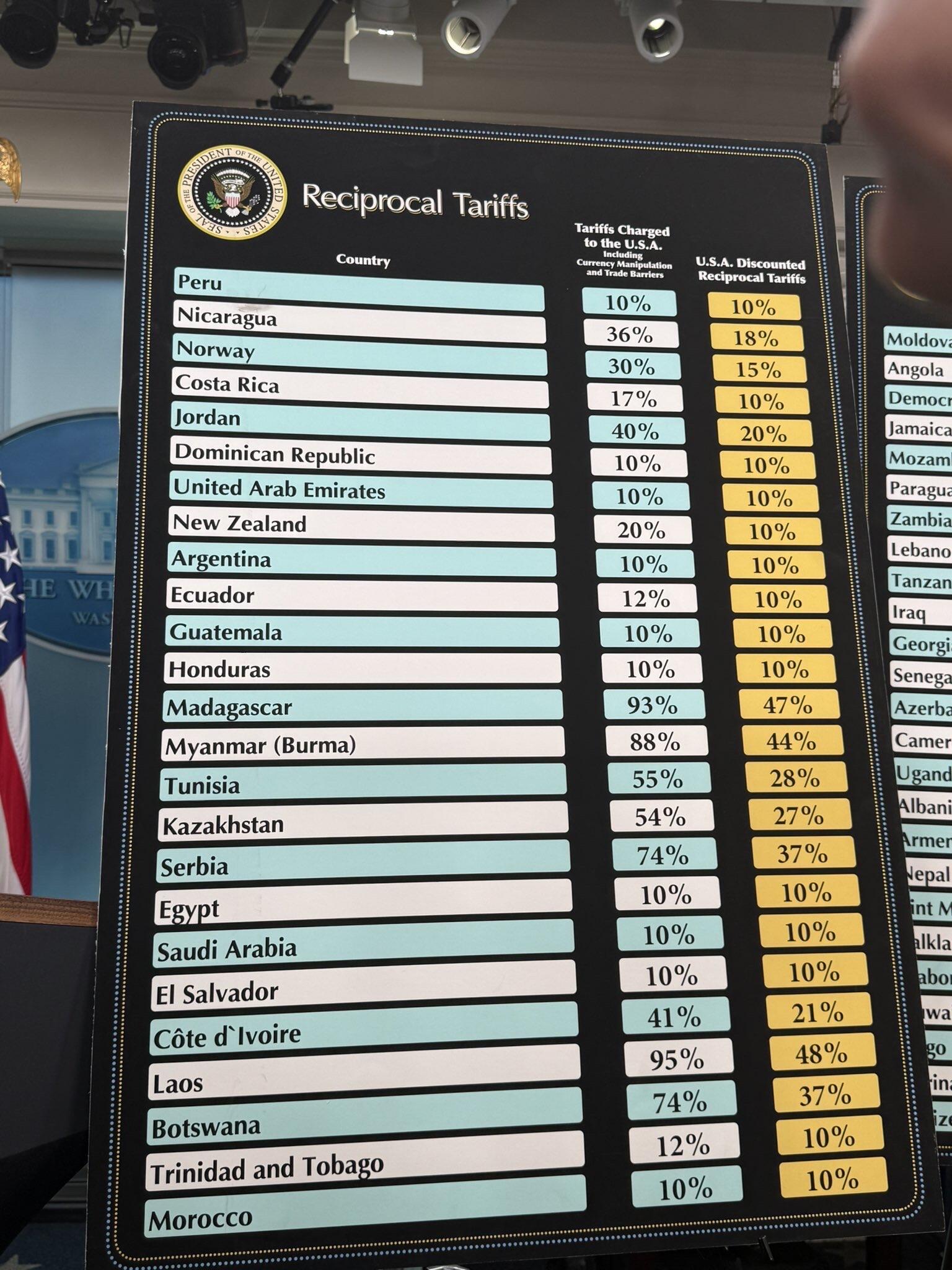

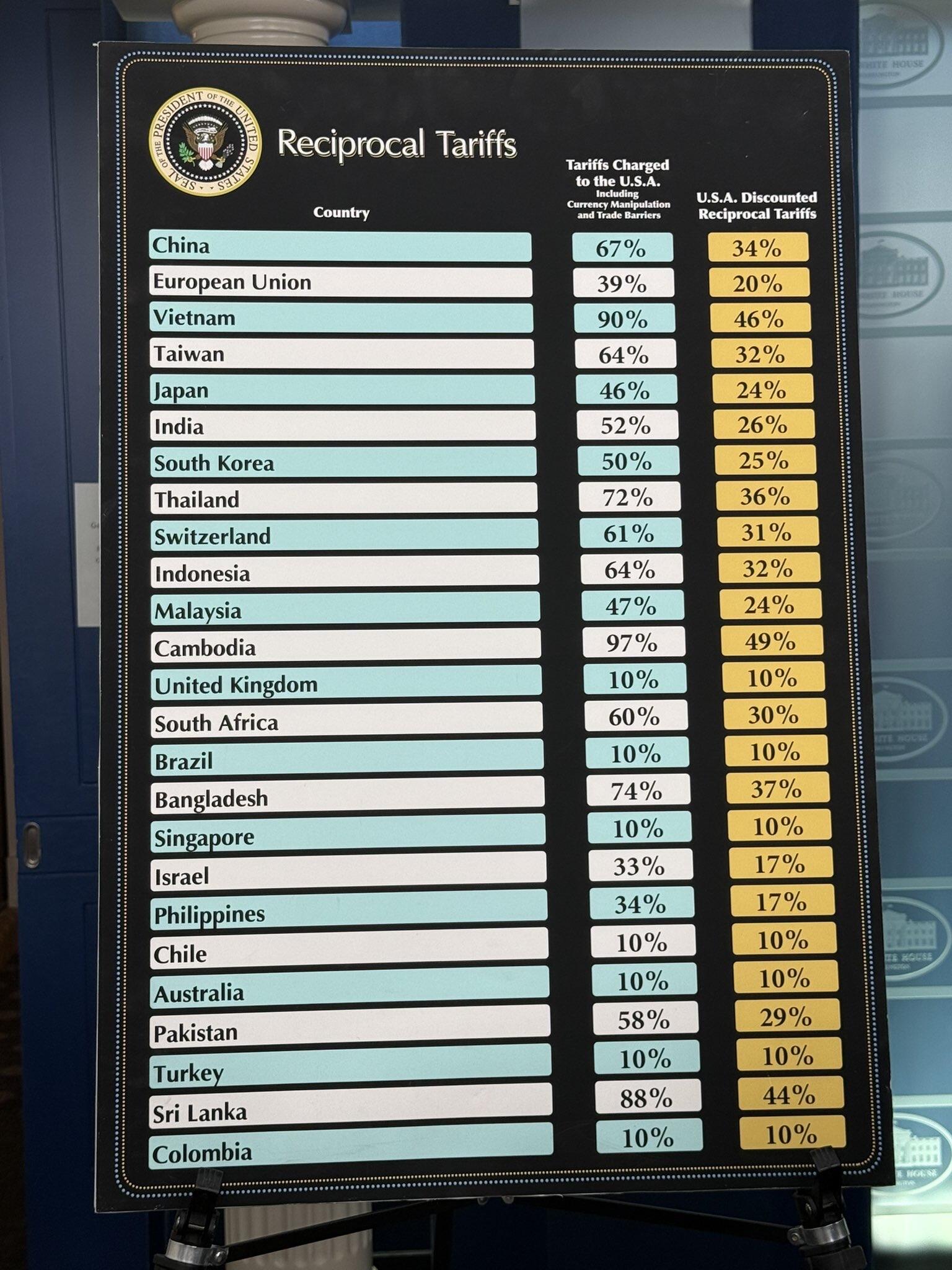

Full list of all the tariffed countries and the rates US is charging now

The US implemented universal 10% tariffs on everyone and higher on certain countries

Yes, exactly.

Not only does the bank Japan have around 1.2 trillion in treasuries, but basically every single actor in the car trade uses the US government bond market as the collateral for the trade .

This means that when they get liquidated, they have to dump the bonds which causes the yield to spike

Who is blowing up in Japan?

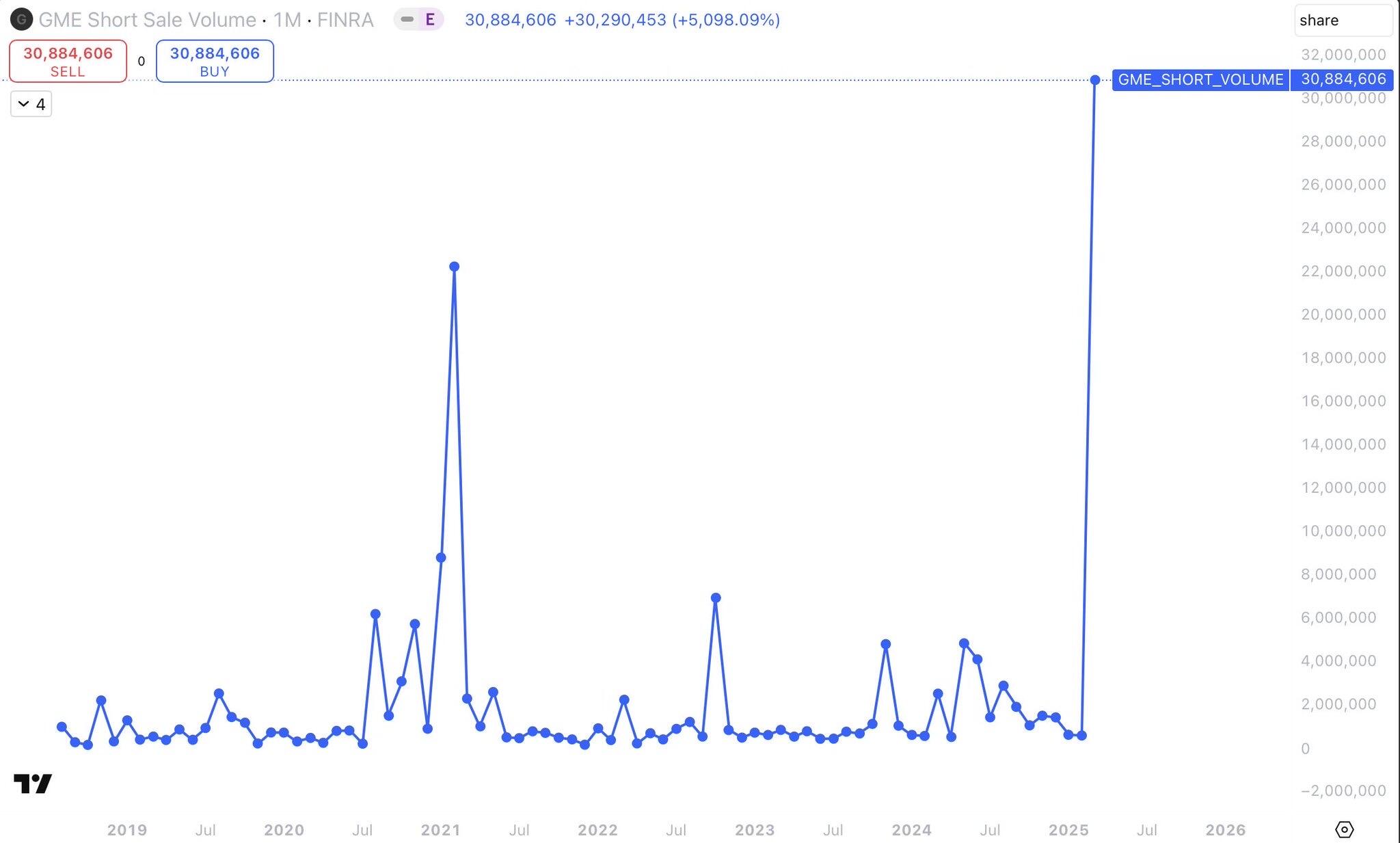

If you think that they’re going to stop shorting the stock just because they’re now buying Bitcoin you got another thing coming

The shorts are way too underwater, they have nothing to lose by shorting even more

where have i seen this before?

GameStop short volume hits the highest ever even surpassing the 2021 squeeze

The shorts came out in full force to make sure that the price did not move upwards after the beginning of the raise for the convertible bonds ⚡️

Only time will tell my friend, but given the convertible offering, I think they’re gonna do at least a modified version of the Saylor strategy

You don’t have to full port into GameStop by selling all of your micro strategy just sell like five or 10% and get a small GameStop position

$GME trades at $2.5x its cash value right now and has an underlying business and owns tons of inventory

If they buy BTC at discount prices they’re very close to normal ranges for valuations

They have $5 billion and they can’t hire someone? lol

Did you not remember that S3 changed how they calculate short interest? Or that short figures are self reported?

You can look on fintel but remember that it’s manipulated

$GME has around 10x the cash and is 10x the market cap of $MSTR when they started the Saylor Strategy in August 2020.

Are you ready for corporate Bitcoin treasury adoption? 🔥🔥🔥

nostr:note1mytrcjv0flsrc7vjwmg9amg2nuk2vq3ck93sdu7lcnugya8p8dtsp23t7j

$GME BEGINS THE SAYLOR STRATEGY

YOURE NOT BULLISH ENOUGH

Yes the stock is still shorted

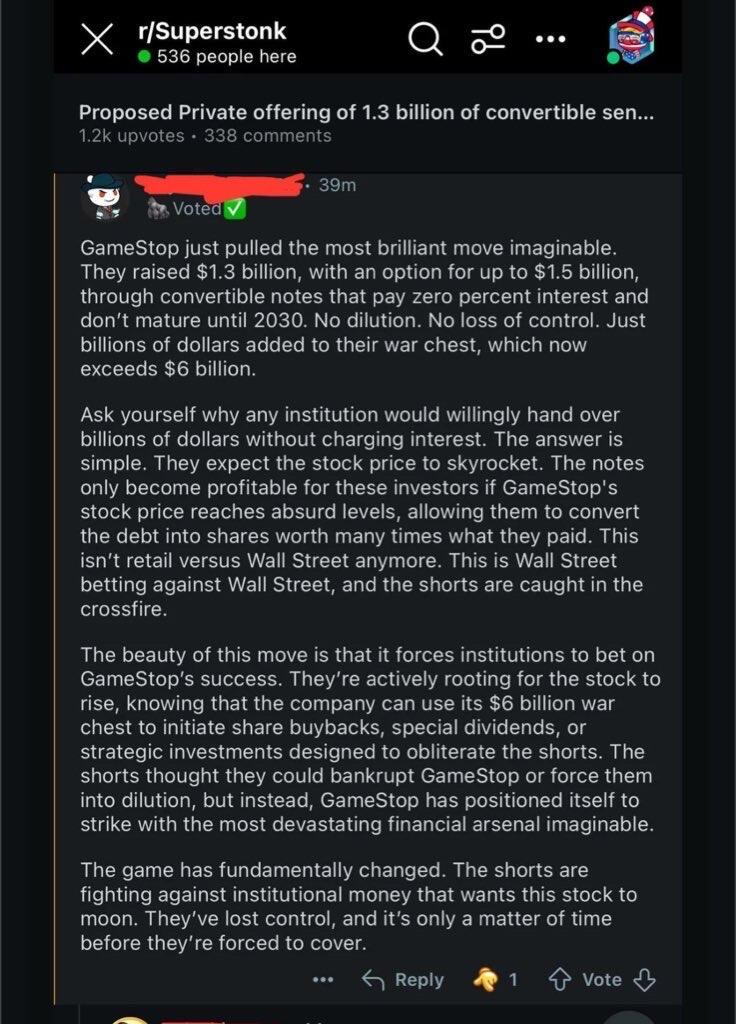

Redditors finally understanding the genius of the convertible notes 🧠

Great episode and one of my first podcasts ever

GME + BTC is the greatest collab known to mankind. Unite the apes who know the stock market is a scam with the Plebs who know the monetary system is a scam ⚡️

nostr:note1um094dx2q864e9jy75aj2kzj0xuleve7w30ep6mcn8f0etepghwsua32tr

😂😂😂

IT WAS FORETOLD:

BUY BITCOIN

ISSUE BITCOIN DIVIDEND

SPARK MOASS

HEDGIES R FUKD

In the offices of nostr:npub18d4r6wanxkyrdfjdrjqzj2ukua5cas669ew2g5w7lf4a8te7awzqey6lt3 chatting about bitcoin adoption in Japan with nostr:npub1uvl7vhclmezvdhqha6eclkksln40rjhgwgsggvew683jf93fr4pq3mq3sd

This country has 260% debt to GDP and is battling a massive deflationary force with QE Infinity since 2016. The people are trapped in a low interest rate environment with no way out ⚡️