Talking bitcoin and Taoist philosophy with nostr:npub1eawxwqldulz8rn80jug6n63seyn8pwelm9mmu7rdt622lfj7am9qgem0rx

Here’s the slide deck for the presentation last night:

(Google drive PDF-click the link or scan the QR code)

drive.google.com/file/d/145dWnd…

nostr:note1ygn2tj5mcjqp4fpvpwdh50pgvsrw56eda70fvca9emxqgas2k3ns8up3f3

--. --- .-.. -.. / -- .- -.-- / -... . / .- / ... .... .. - / -.-. --- .. -. / -... ..- - / .. - / .. ... / -... . - - . .-. / - .... .- -. / ..-. .. .- -

nostr:note1y5w4yl2d3j0zw9t0qmggsmuxkfvyu7nwf6agfc7m9n5txgwyjuuqms6cus

Yes it is, see nostr:npub1qqvt0m3nlvjnssmrn33w9yh7cuq2dx5nkz8wxax9hk5hrjdnj4jqz8cn3w podcast

A lot of people said that they loved the subject of this podcast, the CIA’s Stargate Project and classified government research into psychic capabilities.

Would you like more content like this? Even though it’s off the beaten path for my typical subject research?

Gateway+ Psi Abilities, Frequencies, Religion/Spirituality, all of this is interesting to me but not sure if my followers want my take on it 🤔

nostr:note1zmqg6jdl2qcdq27k9utnp7er30pn6wk09mprwzwwc9la4x9dlpjq06c8s3

the divide over the US stock + housing market is generational.

the boomers see a market correction as the end of their retirement plans, while the millennials and Gen Z see it as bringing prices back down so they can afford houses and stocks.

boomers should understand that helping Millenials + Gen Z is literally the key to the future of this country

gold is cutting through resistance like toilet paper tonight!

Happy Easter, everyone!!

Gold is outperforming Bitcoin in the last year, which should surprise almost everyone..

But zoom out and it isn’t even close.

Peter Schiff in shambles 😂

$DXY is falling, and dollar bears celebrate, not knowing that a weaker dollar paradoxically actually strengthens the system.

How? Here goes:

-there's tons of dollar debt that exists in offshore markets known as the eurodollar system. exact figures on this are hard to parse apart, but it's easily in the hundreds of trillions of dollars if you include off-balance sheet assets.

-the system started in the early to mid 1950s in the aftermath of WWII and the Marshall Plan. A UK Bank (Midland) began creating dollar deposits at high interest rates to attract capital. the market quickly grew to encompass all of Europe and then moved to Africa, Asia and Latam. By 1982, it was already at $1T in size (not adjusted for inflation!)

-the dollar debt is created by foreign banks creating eurodollar loans to local entities like mining companies, oil producers, car manufacturers, etc.

-these dollar liabilities are serviced with non-dollar income usually (meaning income in their local currency) that they have to swap into dollars to pay the debt

-therefore, a lower DXY (weaker dollar) means that these debts are more serviceable, which allows corps to pay off debt and if they want acquire even MORE dollar debt

-this means the debt system grows, and with it future demand for dollars- reinforcing the very system that the bears think is DYING.

-as the dollar weakens it also is easier for these third world countries to use USD as a settlement mechanism, since their own domestic currency buys more USD comparatively

-while the US does face a massive economic and fiscal crisis, so does everyone else- and the key differentiating factor is that the Dollar is the only currency with EXTERNAL DEMAND

-this leads to TINA doctrine- There Is No Alternative. No other fiat can compete with the dollar as a payment mechanism. BRICs is a loose confederation of states that can barely agree on border disputes, much less ownership + management of a multi polar commodity backed currency!

-if the dollar spikes, this leads to a crisis where more and more sovereigns see their currencies depreciate and in order to get their hands on dollars they have to print even more, which weakens their currency further

-DXY soars upwards in a devastating feedback loop until dollar liquidity is restored. the Fed has shown its willingness to create dollar swap lines to bail out other global CBs

-this is the devastating "dollar milkshake" that @SantiagoAuFund talks about. It is a feature, not a bug, of the structure of our current system- and it will only die if the entire system dies as well, which ironically inflicts more immediate pain on the countries trying to ditch the dollar first.

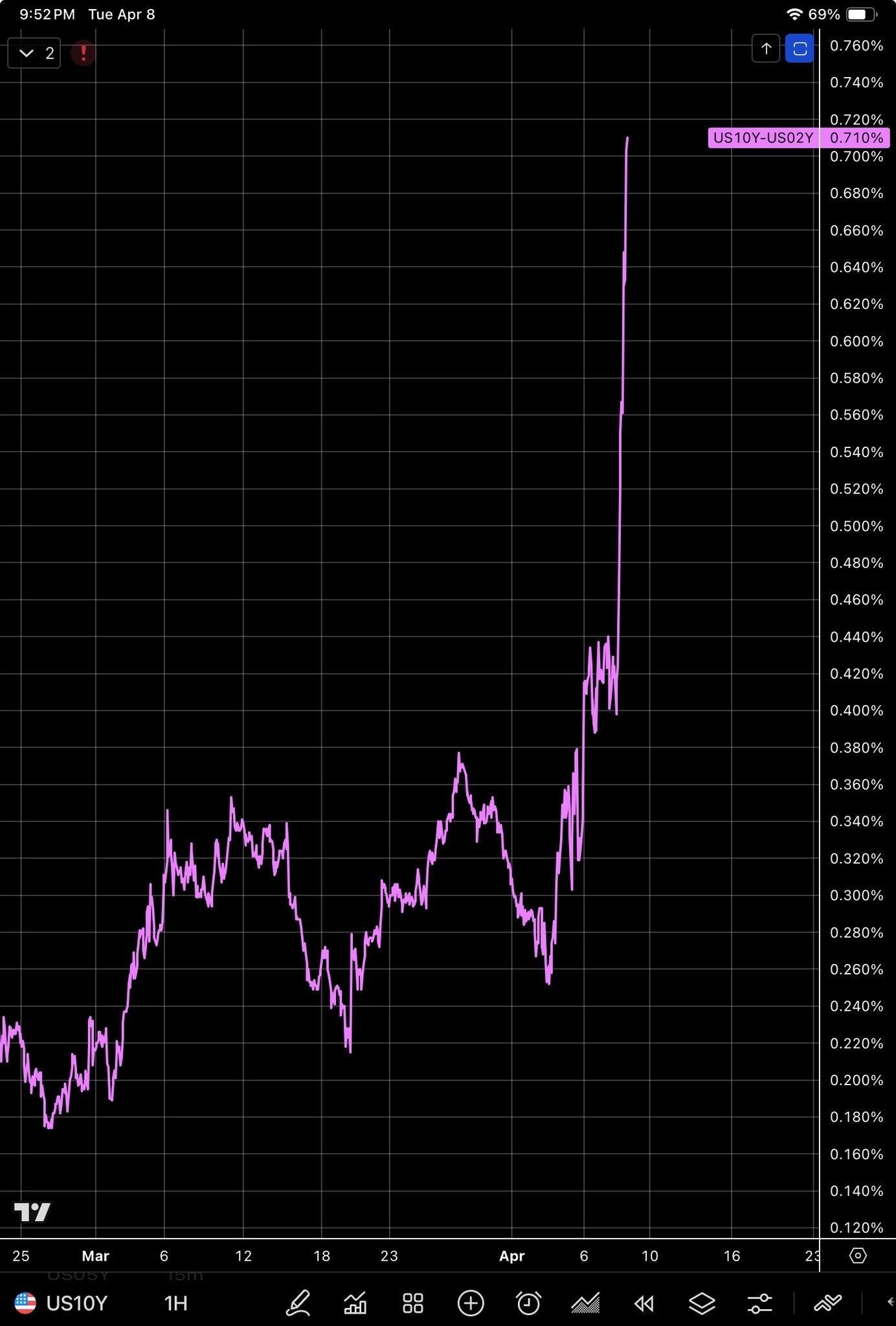

The 10Yr-2YR spread has been blowing out as well

Uninverting rapidly

Just look at that move!

They’re gonna do more bailouts again, aren’t they?

the entire yield curve is blowing out

20YR just crossed 5% and 30 year is a hair’s breadth away

Nikkei 225 opens down 5%, now only 3% amid volatile trading

Bloodbath on Monday morning incoming

Apple speech to text is horrible for some reason, but this gets the gist of what I was saying

nostr:note10lstlhgkxed6j9fplnv5u72w9xys7kft9s9jfev3xh3su4uwupyqhzr20r

Jesus apple speech to text is horrible 😞