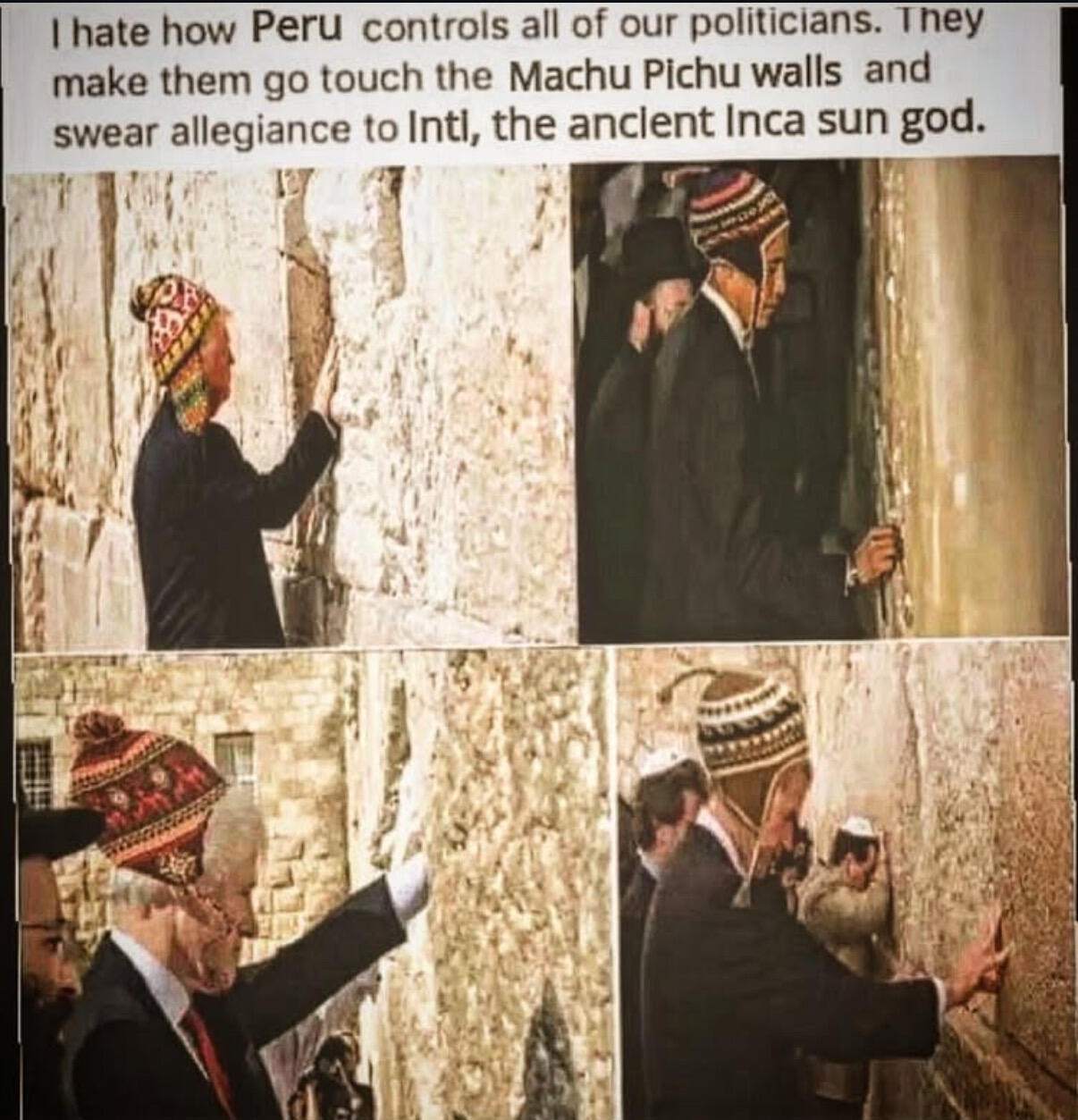

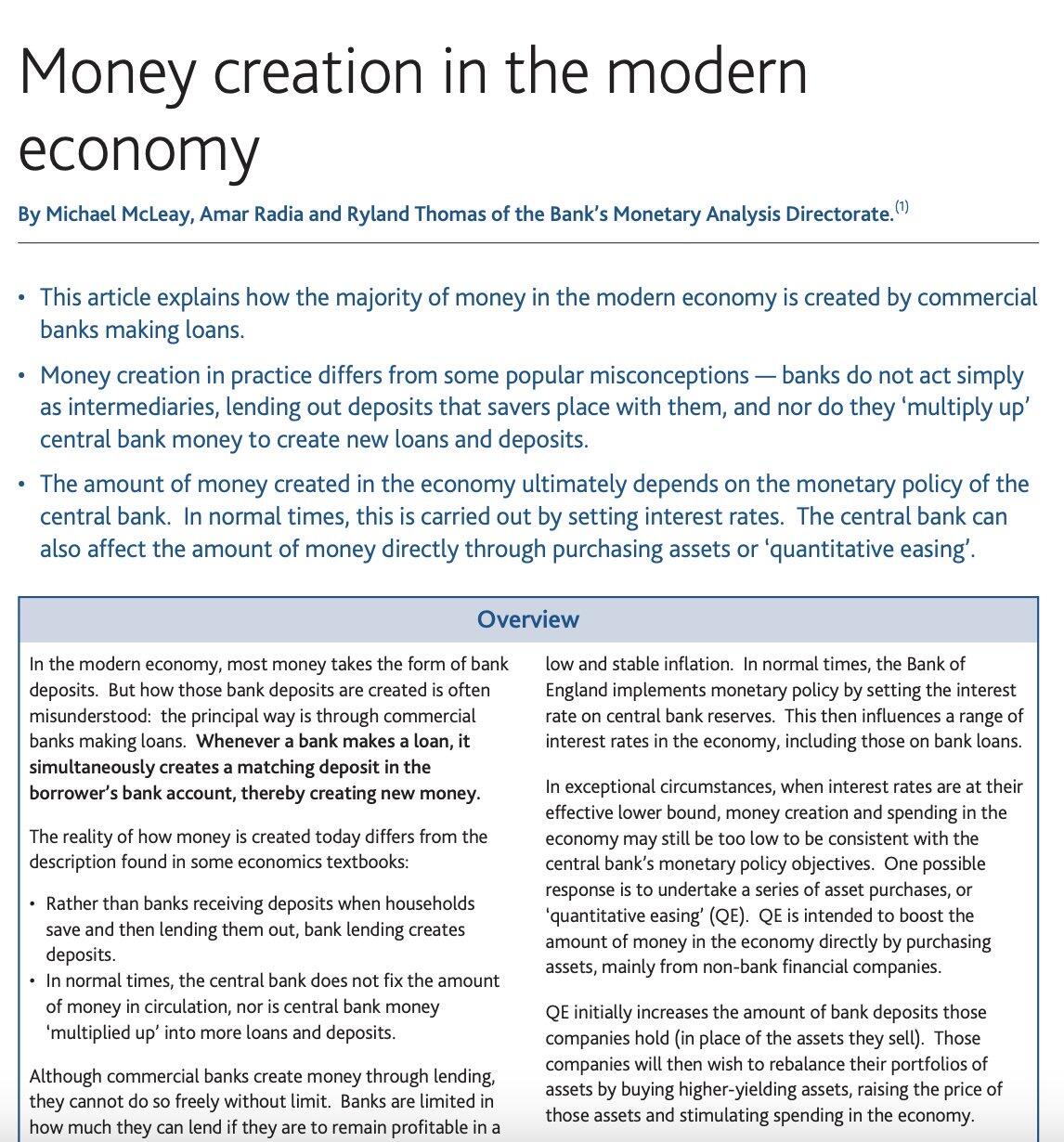

the bank of england LITERALLY published a research paper in 2014 describing how banks create deposits out of thin air when they loan money, and how central banks modulate this supply of credit (and therefore money) via interest rates...

and finance bros STILL don't believe it

Printer is coming

nostr:note1xyj45z3stwv48t353k8fa9yknvs7xykqphfg6m26l5t3mvy30wuqnegjaw

I don't know when Powell will talk, but i do know where:

In De basement.

Yes I want bitcoin to win

I want to live in a financial system where people cannot get wealthy off of Cantillion effects

Where poor people can’t get screwed over by overdraft charges and predatory loans

Where we don't all work for money that they print out of thin air

Where banks don't get infinite bailouts whenever they fuck up

Where entire nations are not enslaved by debt

Is it so bad to want this system to change?

And if not, ask yourself who is opposing this? And why?

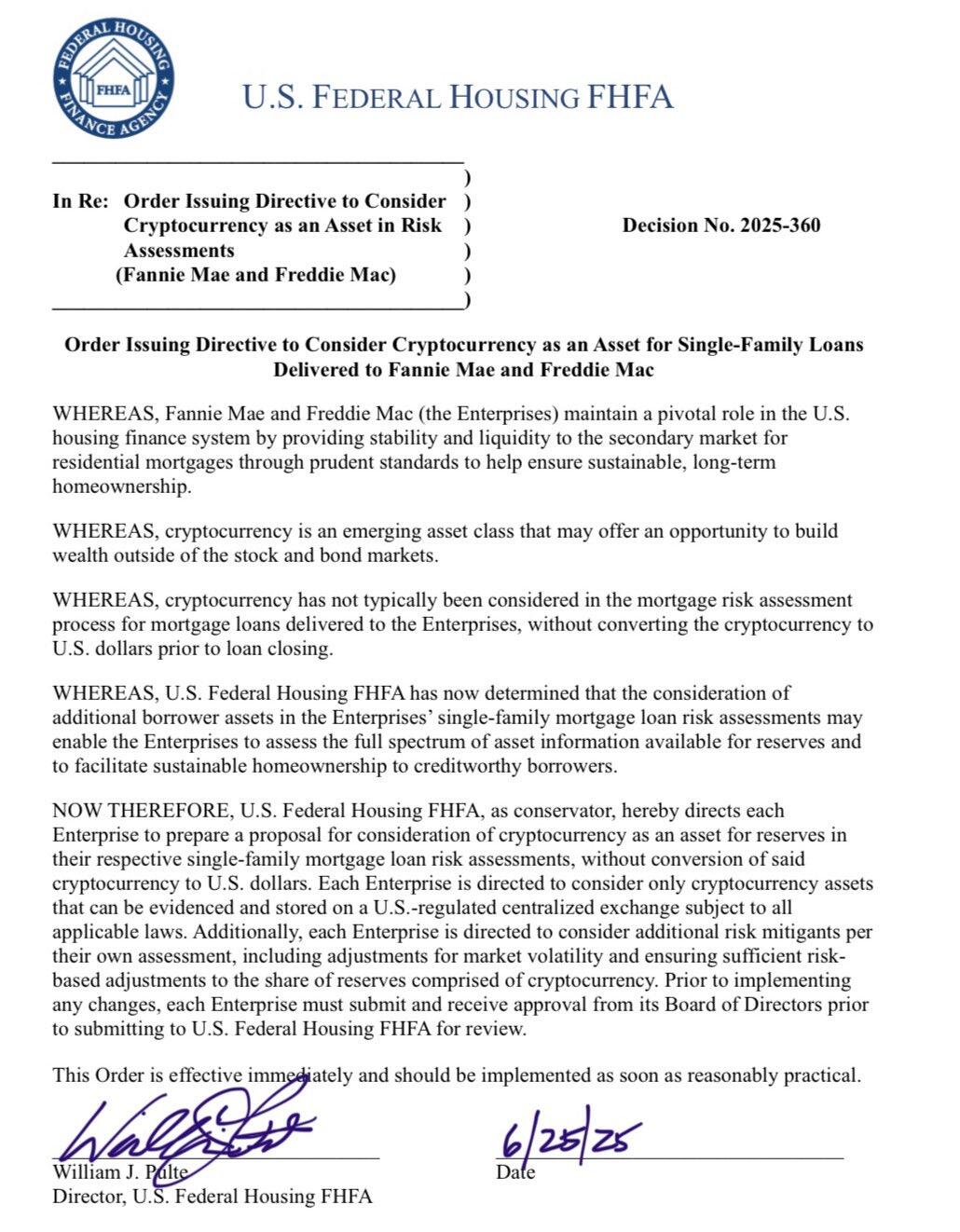

Bitcoin is now an asset that can be borrowed against for mortgages ⚡️

Agreed

It’s a store of value still

Let's create a gold backed app/stablecoin...oh right... nostr:nprofile1qqsyx708d0a8d2qt3ku75avjz8vshvlx0v3q97ygpnz0tllzqegxrtgppamhxue69uhkumewwd68ytnrwgqs6amnwvaz7tmwdaejumr0dsxxn50k already tried that and failed. That game is over.

He did?

When?

Sup guys

I’m never leaving ⚡️🔥🥹😉

Meaning everyone who owns it should just store themselves

Gold cannot be money because it is infeasible for micro transactions in the modern digital economy

Are you going to walk around paying flakes of gold for your coffee or some takeout?

You won’t, which is why you’ll put it back in the hands of centralized custodian who will issue you paper

Which brings us all the way back to square one with the Fiat fractional banking standard

In gold terms we’re broke

This is why millennials and gen z are so infuriated

We’re gonna win guys.

Good defeats evil in the end

nostr:note1wsnpfqfwwxz6rngfq8ftj90qyv66grpuzaq27psr6t6nqu6fm70q6qavys

the difference between china and japan is that despite the fact that both countries have huge amounts of USTs, built up from decades of surpluses with the US and other countries transacting in USDs, is that in china most of the USTs are held by the central bank while in japan they are mostly held by retail investors.

although large asset managers could hypothetically take control of the holdings of their clients and dump them in order to raise USD liquidity to stave off issues with the yen, this would be blatantly anti capitalistic at a time when japan needs a new trade deal with the US to secure their trade surplus as they muddle their way through a rice shortage.

in china, the story is much different. since the bonds are held by the PBOC and the Chinese Ministry of Finance, they can be used in a form of economic warfare, if the Chinese want to employ the nuclear option and fire sell their $1T+ of treasuries and cause rates to go parabolic within days

but, it's unlikely they will exercise this option, given the damage that it will cause to the domestic Chinese economy as the CCP is dealing with the fallout from the collapsing housing market and the subsequent unwinding of the shadow banking system.

quote below via Weston Nakamura

The situation room is gonna be poppin tonight

Can someone explain this civil war that’s going on in bitcoin core?

What is Knots and what are the proponents of it trying to do?

Totally lost rn