This time right now is a once in a lifetime moment.

What other movement makes all of your like minded, high agency, convicted peers financially independent? I’m not a moon boi but this is relentlessly powerful.

It’s the self selecting long play of the century.

I was sad to see Nick Szabo sign off in 2021. It’s good to see him back in the fray somewhere.

Don’t take the old heads for granted. Many have come and gone 🫡

How many people use chargebacks, dispute settlement? Most I hear is people who use those mechanisms for fraud. IE. buy something, chargeback and say you didn’t get it, repeat.

Pushing stablecoins as a way to increase dollar hegemony is strictly worse than the SBR.

El Salvador did always have a bit of an asterisk where businesses were forced to accept bitcoin, never really felt right.

Cool to see you digging into this

Appreciate your viewpoint, have also been a little uneasy about bitcoin reserve.

I think you might agree that more reasonable (in line with previous guidance) money transmission definitions would be the most helpful for bitcoin usage.

Should the gov not buy bitcoin though?

Imagine 2025 the year of ripple, xrp the standard. Who stops this?

Timeless, true heritage.

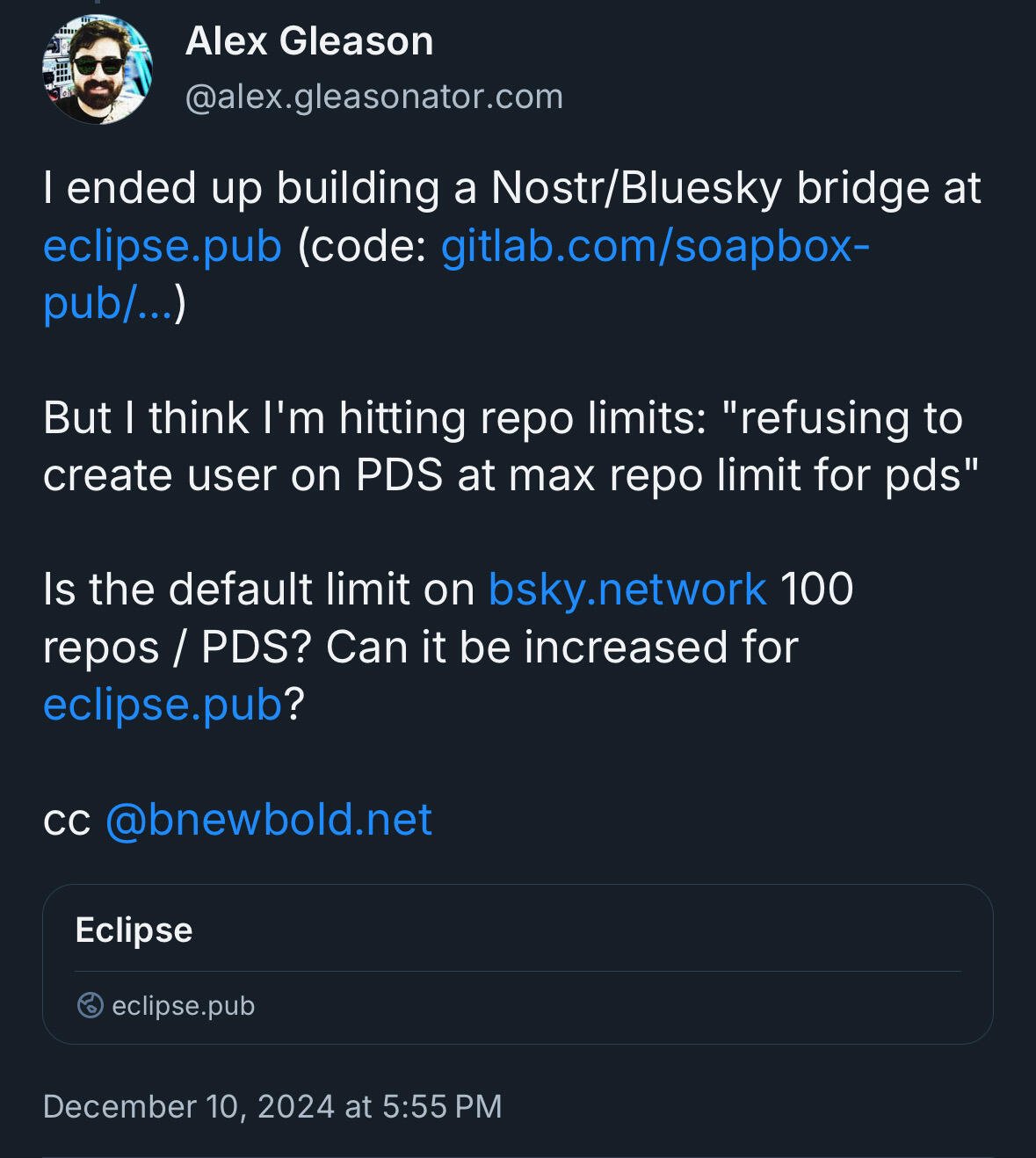

Balkanize then bridge

nostr:npub1q3sle0kvfsehgsuexttt3ugjd8xdklxfwwkh559wxckmzddywnws6cd26p always bringing the gang back together

Protocols, protocols, protocols