David Bailey really did it

All the buckling up was worth it 🥹

If I were wanting to make a big impact on bitcoin payments and I was working with big fintech apps with Bitcoin capability.

I’d ship Pay to lightning from fiat. Buy / send out in one step (after confirmation of course)

- no btc exposure for people who don’t want it

- maximal compatibility globally

- further shores up the access argument. Big fintechs can make this happen for many users

So many examples

Ideas are meaningless without execution and the ability to follow through.

If you’re only able to copy someone else, you’re always a step behind.

Announcing Proof of Reserves for Twenty One

As Bitcoiners, we hear a lot about how Wall Street has arrived to #Bitcoin. With Twenty One, #Bitcoin has arrived on Wall Street.

Don't trust, verify.

We will be publishing multiple addresses over the next week proving our #Bitcoin reserves.

Our first address can be seen below, which contains 4,812.22 BTC that was acquired via proceeds of a prior transaction: https://mempool.space/address/bc1qzup4k7zn9jur7a8kz0dnaernzyf60h8ez6s9cpmp23wfw5djhvusd4p0v3

We are also announcing today that, as of May 22, the Convertible Note Investors (all but one) and the Sponsor have exercised the option in full to purchase, in the aggregate, $100 million of Option Convertible Notes. See the Form 8-K below.

Over the next week, the four more #Bitcoin addresses we plan to publish are as follows:

- 14,000 BTC that's been contributed by Tether

- 7,000 BTC that's been contributed by Bitfinex

- 10,500 BTC that's an additional contribution from Tether on behalf of SoftBank

- The BTC we intend to acquire via the proceeds from the transaction announced today

The contributions are subject to closing of the previously announced business combination with Cantor; following such closing the BTC reserves will be transferred to wallets owned by Twenty One.

https://blossom.primal.net/b85b8e11a9e8b8d864b1054adc39613c0c2e98ef9546767738658f11a5417ef0.mp4

Gottem

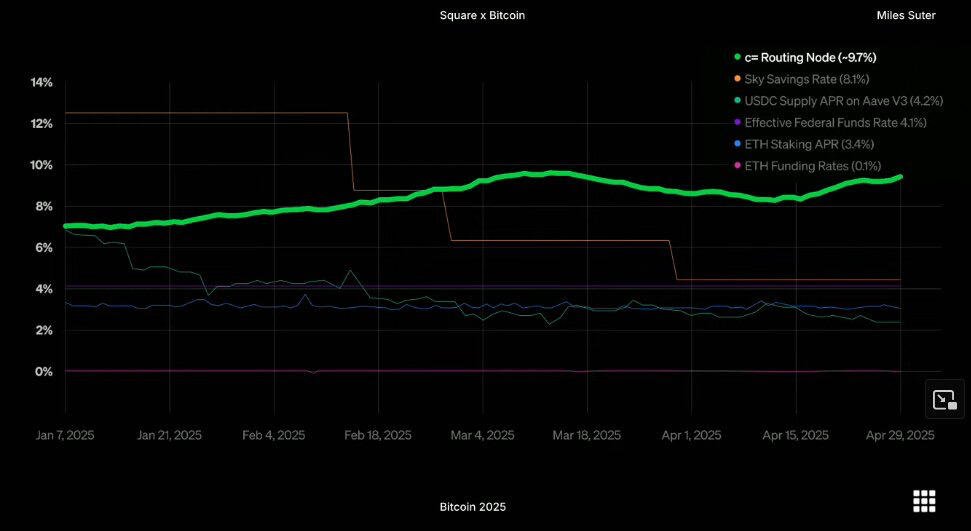

The APR comes from payments that aren’t from c= / Block. I don’t know how you don’t call that routing. Those are other nodes using that liquidity and paying for the privilege. You can copy c=‘s strategy if you’d like.

You are correct there is more value in running a business that assists or directly does lighting payments over running a “pure router.” There’s room for the latter but it can be tight.

Yeah but fincen did, and lightning nodes like c= are non custodial

Tyler was likely the one that pulled that data. This was all outside of Cash transactions.

Theres still a lot to be made out there if you know where to put your liquidity, but that edge fades over time (as word gets out that we were doing well!)

The most will be made by being a real economic actor on the network. But there are still plenty of places that need liquidity and that is a constantly growing and changing need.

I put it here for you Matt nostr:note102ncta6etyyj3wedanhcvqjqqledcashfk2p8wa2lu5muvrjestqg96yxv

Tyler was the goated data scientist running the management on the node. There are only a few people who “get it” like him.

How can c= generate such a return with just routing?

Lightning liquidity is the most underestimated part of the network.

It’s part of what we solve at moneydevkit, but here’s a bit about how we did it at Block

1. Real transactions.

Cash is one of the biggest lightning services on the network. It connects millions to lightning, and as Miles pointed out, more and more people are using it everyday.

By nature of cash being custodial, we had insights into what people were using lightning for. This was part of the original thesis of c=.

There are some big players out there that node runners have no idea about 🤷🏻♂️. Lightning privacy works very well. Apologies monero trolls.

2. Liquidity in our favor

Most people buy bitcoin on cashapp and withdraw (based)

That transaction flow is ideal for lightning, and in the right hands, you can flex it to pay for and make a handsome return on your own payments and operations.

For the plebnet inclined— c= is an inbound generator. For its capacity it’s typically had 1-3X+ more inbound than outbound. This is a very unique position on the network.

3. Strategy

The management the team did not only improved the experience for Cash users, it compounded payments and fees going through our channels.

We expected to get some return, but we were pretty blown away by the volumes and takes.

The ROI we collected was not from Cash.

This was just step 0.5. The next steps were to flex our position and liquidity to bolster bigger and higher value things. One of those was Square.

In the end, the real value comes from real people making real payments. It’s why I’ve always harped on this:

We don’t need X protocol or Y L2. The technology is there. We need to do the hard part of bringing it to real people now.

For you nostr folks consider— on-chain fees were never even a thought in our minds. Our margins were fat.

Huge shout out to the c= team, I wish I could be there celebrating with you.

10% ROI on Block's bitcoin and building the first Square lightning integration are huge accomplishments and hard won. Both unprecedented, I am so proud of all of you.

We put together an amazing team and did exactly what we set out to do. I am so happy some of this work finally gets to see the light of day. Teams that start from nothing and put out the results you did are rare and extremely valuable. Most startups only dream of hitting $1M ARR.

This is the work that makes the dream happen. Considering what it took, you guys are miracle workers. It's my sincere hope that work like this can shine through more often at Block unimpeded.

Congrats to the team that built this. A huge accomplishment. This is how it starts.

nostr:note1xsyrc5tx34lfeq03hw03cqh0v539rf0ptdqvxgean52nmum8cjwqmggl9j

People do not want to “be on chain” they just want to do normal things.

There is no UX path that starts with “well first they will learn crypto with stablecoins and then…”

The first part of that statement is already garbage.

Our first iterations will be focused on taking payments, but our goal will be integration on your side being as easy as possible.

Your users will need to have Bitcoin / lightning enabled wallets. People who have coinbase / cashapp will have a relatively easy time for example.

A really nice experience that some are working on is the ability to buy and send out bitcoin in one fluid motion. Imagine you’ve scanned a lightning QR from your bank account and it just works. When more catch on to this, there won’t be much of a difference.

If you’d like to chat through ways to make your game happen feel free to DM me.