Just wait until we can get one of these SMR vendors to reject fiat financing and chart their own course with a Bitcoin strategy.

It's great to see the World Bank get their boot of the sector. But after reading Gladstein's work, I'd prefer that they just stay out of the way.

💡 Two Men, Two Models, One Pattern of Institutional Capture

Hermann Muller and John Maynard Keynes — two men who reshaped their fields by offering simple models during moments of crisis. LNT and Keynesianism became dogma, not because they were scientifically airtight, but because they handed policymakers tools they wanted to use.

Muller ignored data on radiation thresholds to push the Linear No-Threshold theory, which locked us into overregulation and radiophobia. Keynes sidelined classical economics to justify permanent deficit spending and monetary manipulation.

Both instantiated perverse incentives:

— Fear over nuance.

— Control over liberty.

— Political wins over robust science.

Their models weren’t just wrong — they were useful, and that made them dangerous.

It’s time to re-evaluate the structures built atop these flawed foundations. Sound science. Sound money.

#Bitcoin #Radiation #AustrianEconomics #Energy #Nuclear #SoundPolicy #NOSTR

Gracias. Nobody else is posting nuclear power content over here. I keep wanting to post more.

Nuclear power is so hot right now.

I'm not sure, it's just my coinos paynym. I just tested it and it seems fine.

Since the 1970s the fiat system slowly strangled the nuclear industry.

Nuclear energy requires a low time preference — decades of planning, patient capital, long-term trust. Fiat incentives reward short-term wins, not century-scale stewardship.

Instead of building reactors, we built debt.

#Bitcoin #Nuclear #TimePreference #Fiatruinseverything

#SoundEnergy #EnergySovereignty

#SoundEnergy #EnergySovereignty

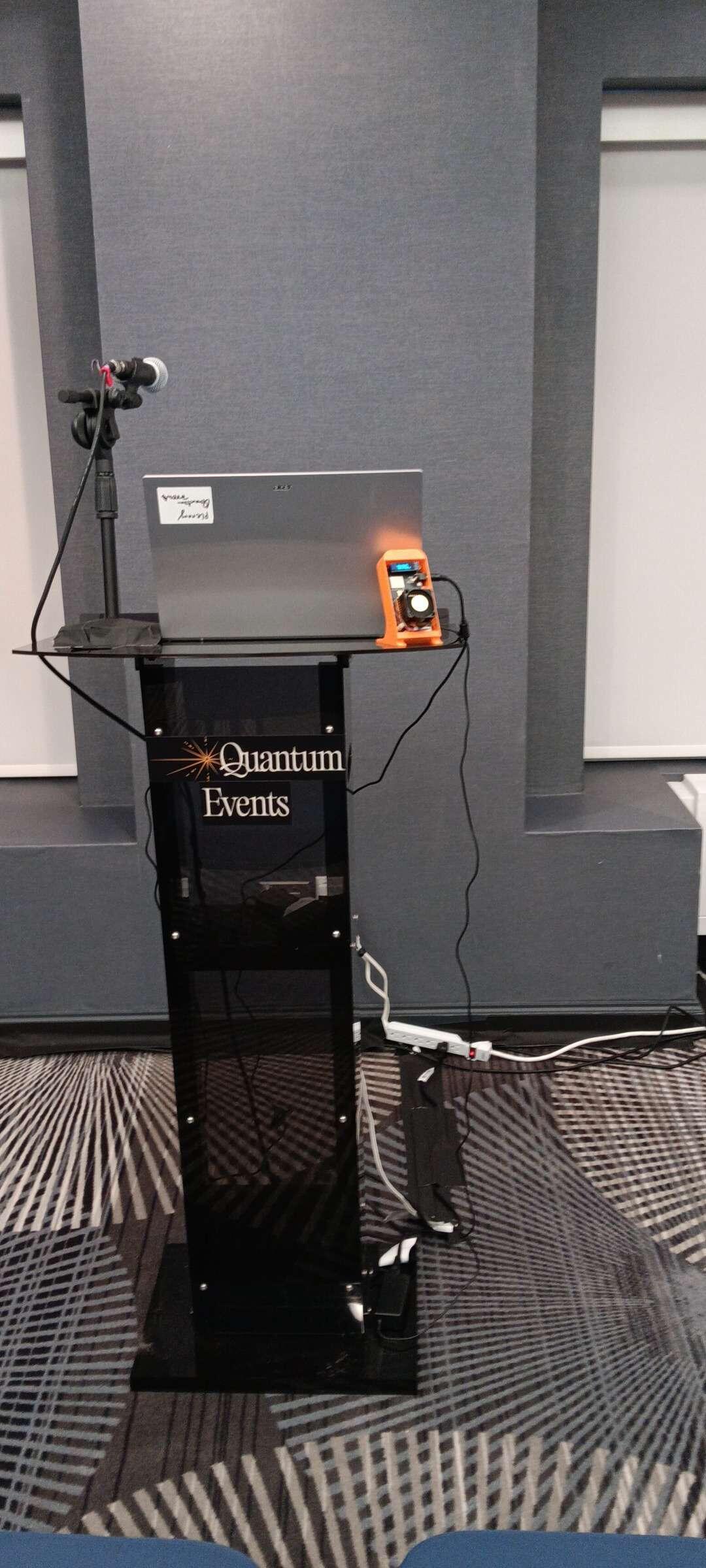

Mining Bitcoin while talking about Bitcoin mining.

For the most part everyone was very receptive to the idea. Typical stuff like why not other cryptos, what about when issuance runs it's course, how do I get my hands on some of these ASICs, why not just a traditional datacenter...Margot and Troy's Locust and Dung Beetle paper was very helpful for that one

There was crazy smart Russian fella though that had some good challenges though. Mostly he was stuck in the old framework of why not just use diesel or gas for peaking because intentionally installing excess nuclear capacity, especially at first when SMRs are still very costly per MW projects, which is kind of true if the miner is buying power and not the asset owner. He was also hung up on how running ASICs at <95% load factor would have long payback. But as I explained that you can use different efficiency tiers to cover a range of load factors he seemed to be more open to the idea.

More than anything I spent most of the week educating folks on the history of monetary technologies, and ranting about negative societal impacts of inflationary money. For a highly educated bunch, they were sorely lacking in this area, unless they came from a nation where inflation is brutal.

I sure am, and I should be using it way more. Nostr needs more nuclear power content.

Lookie what I found on an endless loop of ads while attending the International Youth Nuclear Congress conference in Abu Dhabi.

Needless to say, having this in the background made for some interesting conversations. Especially when one is in attendance to extoll the awesome synergies of integrating Bitcoin mining with off-grid Nuclear assets.

probably. game theory though. cool to observe

I agree 7 or 8 seem realistic, if the will exiats. Despite most of these being too far gone to recover. That doesn't stop new reactors from being built on their sites and reusing much of the electrical infrastructure.

Dare to dream my friend.

Miners should building relationships with all the SMR startups and the national labs where the research hybrid energy system models anchored by SMRs. That's where we can have an impact this early in the game. As the tech matures they are far more familiar to each other.

Maybe. But all bets are off now that we know that big Data wants big power.

Maybe this is a lever we can use to untangle the bureaucratic inertia that has built up around the sector.

How about the farmstead, powered by a Small nuclear reactor, inside of a biodome, on Mars?

Any reactor that has been shut down in the last 15 years citing economic reasons is potentially in play.

Oh no, gas got cheap for a few years so let's just retire GWs of capacity, assuming it won't be needed later.

San Onofre, Vermont Yankee, Fort Calhoun, Oyster Creek, Pilgrim, Duane Arnold, Indian Point. Any one of these can be brought back to life, Palisades, and now TMI are already underway.

We have the momentum on our side now. Just a few legacy hangups like the the Linear No Threshold theory that lacks evidence, yet underpins all nuclear safety policy, to re-evaluate and we can shed some dead weight that has been a massive burden on the advancement of nuclear technology.

Gradually, then Suddenly, the nuclear renaissance is upon us.

This is just getting started. Big Data needs a dense power supply to support their dense computing loads.

Wind and Solar have a supplementary role to play in future energy systems, but powering a high tech society is not one of them.

Nuclear Power is the star of this show.

Three Mile Island Unit 2 Revival!

Demand for power from big data is about to grow at an unprecedented rate.

20 year deal, $100/MWh, Microsoft wants every watt.

I wonder what happens when nuclear power plant owners and Small Modular Reactor vendors realize that they don't need a relationship with a counterparty if they mine Bitcoin?

A fleet of new S21Pro Hydro ASICs will net their owner $150/MWh, at current hashprice.