“He felt closer to dust, he said, than to light, air or water”

WG Sebald, The Emigrants 1992

Frank Auerbach, Head of EOW 1960 (snap by me in 2023)

Great film.

Now do the scene with Peter Kay and the transit van.

Like Bitcoin, gold hasn’t made an all-time high this year against the inflation-adjusted dollar.

Congratulations. Keep up the great work.

Craig Wright, discredited as Satoshi in UK courts, launches a £911B legal battle against Bitcoin Core developers.

My latest piece in Forbes featuring COPA & nostr:npub1cjw49ftnxene9wdxujz3tp7zspp0kf862cjud4nm3j2usag6eg2smwj2rh #Bitcoin

Great piece. Beautifully structured and well explained.

GM

BITCOIN IS 'GREEN'

Many wrongly believe Bitcoin miners are devouring all the world’s energy and destroying the planet. This is due to erroneous ‘green’ anti-Bitcoin propaganda peddled by those who see Bitcoin as a threat, or (misguidedly) believe they are competing with it, or are simply poorly informed and parroting mainstream disinformation.

Bitcoin consumes a lot of energy annually, but in world terms this is tiny: even a probable overestimate of low hundreds of terrawat hours per year is a tiny fraction of a single percent of global energy use. But unlike most activities, which use mostly carbon-based power, Bitcoin runs primarily on sustainable energy, making it far ‘greener’ than other industries in terms of carbon emissions.

Worse, those advocating against Bitcoin from a carbon perspective have it backwards, because they fail to grasp the network’s revolutionary utility and efficiency: they should instead campaign to have energy-guzzling classical payments systems replaced by Bitcoin, as this would result in vastly reduced energy use, as well as a consequentially far lower 'carbon footprint'.

And what about methane, which is widely considered orders of magnitude worse for atmospheric warming than carbon dioxide? Bitcoin is already eliminating methane emitted by natural gas flaring, landfill sites and animal farms. At scale, this could contribute significantly to achieving emission reduction targets.

Agile and mobile, Bitcoin miners are also happy to be intermittent power consumers, helping to balance grids by using off-peak excess generation, improving overall system efficiency and thereby reducing consumption and emissions.

None of this is because Bitcoin desires to be ‘green’. It’s just that Bitcoin miners' incentives – to use the cheapest electricity they can find – aligns with using otherwise wasted energy which doesn’t have rival consumers. Because renewable electricity generation is often inefficient and wasteful, and many energy sources are not exploitable by grids, Bitcoin gravitates towards their cheap, otherwise stranded power.

Bitcoin is ‘green’.

Many thanks Vlada.

UK soon to follow I’d wager, with >130 already rebranded ‘pre high’.

GM

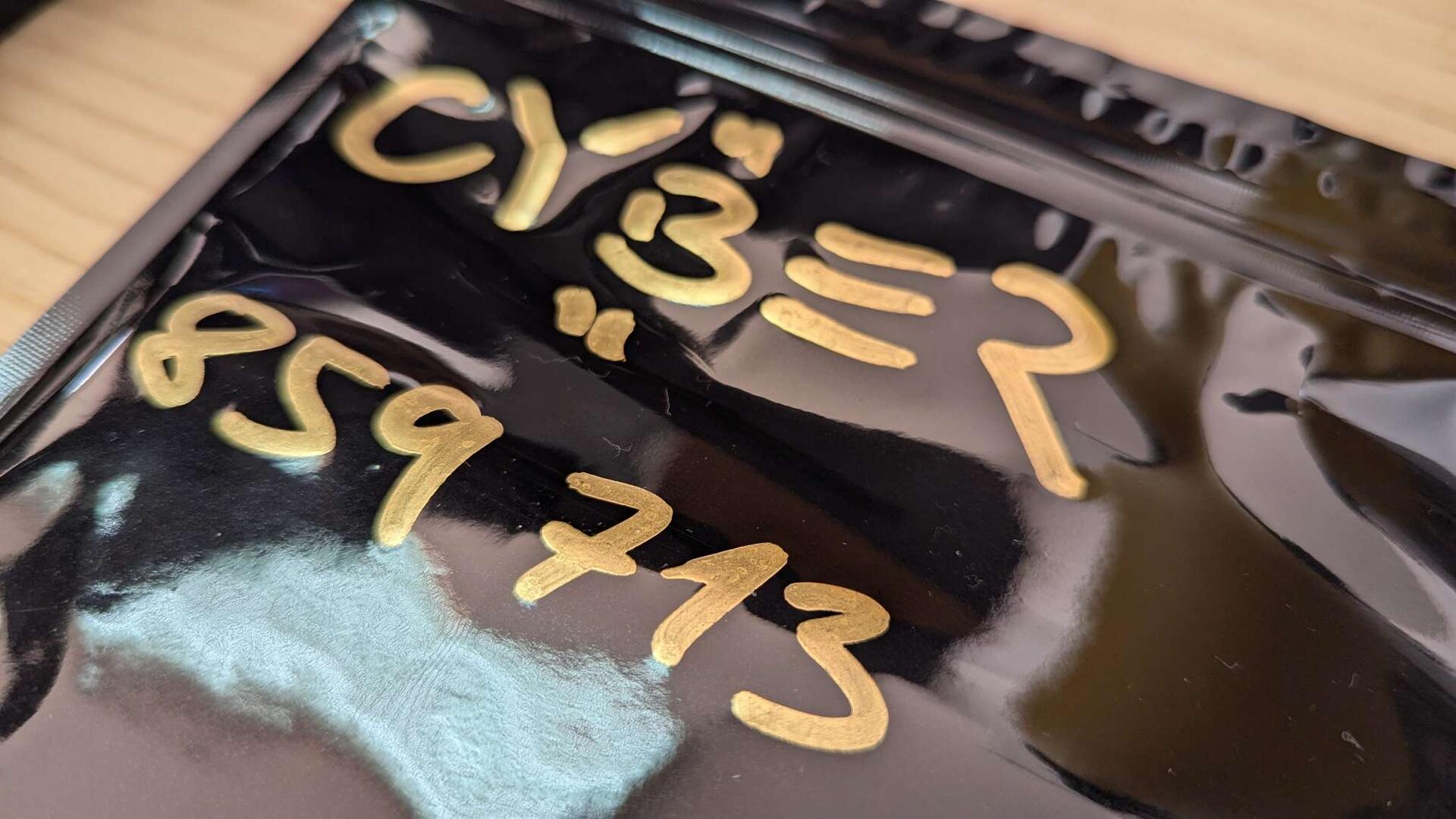

(Skit Note, Banksy, 2004)

BITCOIN IS NOT A PONZI

“A Ponzi scheme is an investment fraud that pays existing investors with funds collected from new investors… Ponzi scheme organizers often promise high returns with little or no risk. Instead, they use money from new investors to pay earlier investors and may steal some of the money for themselves.” - US Securities and Exchange Commission

Many governments such as the UK and US have large debts and spend more than they earn. They repay existing debts by taking on new debt. They pay returns and portray themselves as ‘risk free’. And by continuing to run spending deficits, the governments always take some of the money for themselves. Given this, government debt schemes such as US Treasuries and UK Gilts look very much like Ponzi schemes.

With only a small percentage of cash reserves compared with customer deposits, fractionally-reserved commercial banks can often only repay existing customers with new cash deposits. They also promise returns in the form of interest with little or no risk. And by charging fees and paying out less interest than they earn from depositors’ funds, they always take some money for themselves. Therefore commercial banks also resemble Ponzi schemes.

Cryptos (as distinct from Bitcoin) typically have Ponzi-like features. Insiders often receive a large proportion of the coins ‘pre-mine’, generate hype around the retail launch and drive up (‘pump’) the price. They then sell (‘dump’) their large stake to new investors, crashing the price and leaving outsiders holding all the coins. They often entice victims by promising high returns in the form of ‘yield’, normally above prevailing market interest rates.

By contrast, bitcoin holders are promised no repayment, returns, interest or yield. The only payments Bitcoin makes are to nodes called ‘miners’ (which need not already hold any bitcoin) for providing transaction processing and security services. Bitcoin makes no claims about risk, and does not receive or steal any money. Bitcoin isn’t even an investment scheme – it’s simply a monetary good.

Unlike government bonds, commercial banks and many cryptocurrencies, Bitcoin exhibits no Ponzi-like characteristics.

Bitcoin is not a Ponzi.

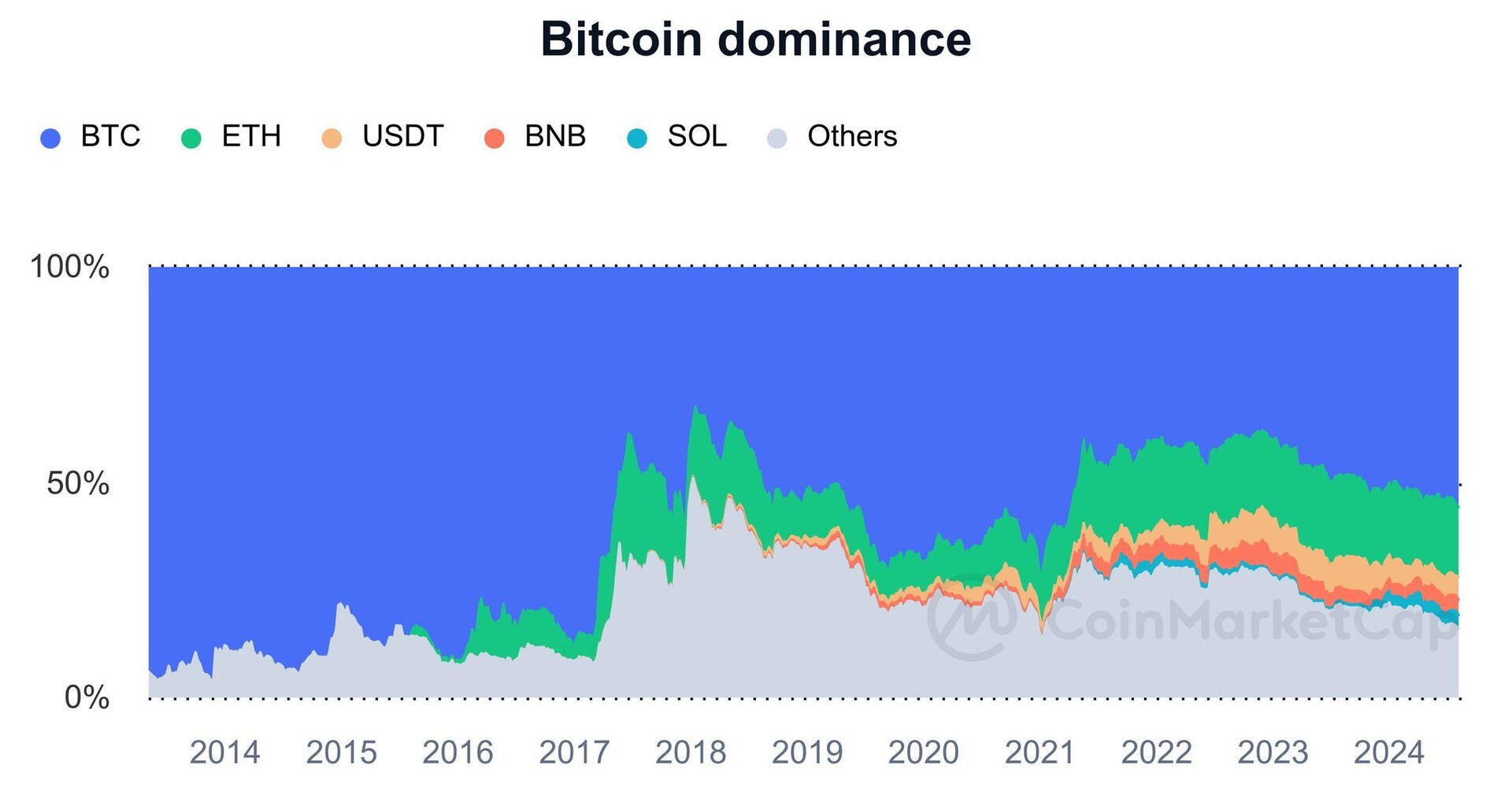

I don’t see a crypto challenging Bitcoin in the first chart. Even all of them put together look to be in the minority and declining.

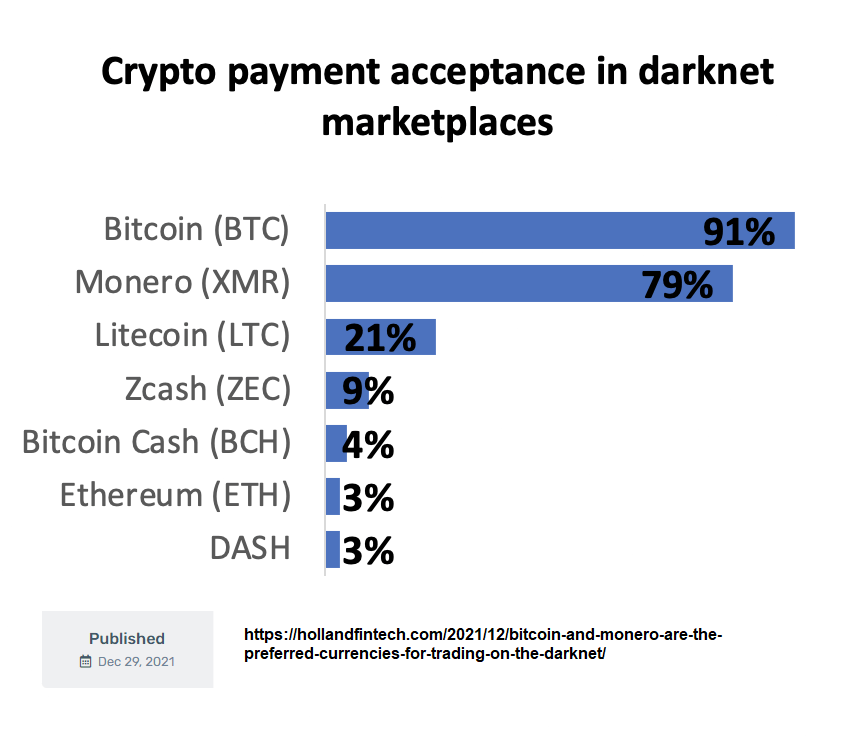

With its transparent public ledger, Bitcoin is the antithesis of privacy, and can’t even try and compete with opaque systems such as Monero and the fiat system. So Bitcoin being the most accepted currency on the ‘darknet’ is surprising: even where secrecy is most prized, Bitcoin is still leading. If anything, that seems to demonstrate Bitcoin’s supremacy.

Can you point me at any resources on Monero? Genuinely interested to find out more, particularly its levels of use and decentralisation.

Can you tell me more about why Bitcoin is not fungible?

Before Bitcoin, you could argue that nothing was functionally finite except time. However, gold comes closer than most things: it is scarce and hard to produce, qualities which help make it a good money.

Whether we like it or not, large finance houses promoting Bitcoin means one thing above all: adoption.

How decentralised is Monero? How many people likely hold it? Can you post me at any resources (genuinely interested to know)?

BITCOIN IS NOT CRYPTO

Bitcoin is the best digital monetary system due to its rock-solid core properties, its fairness to all participants and – crucially – because it eliminates trust.

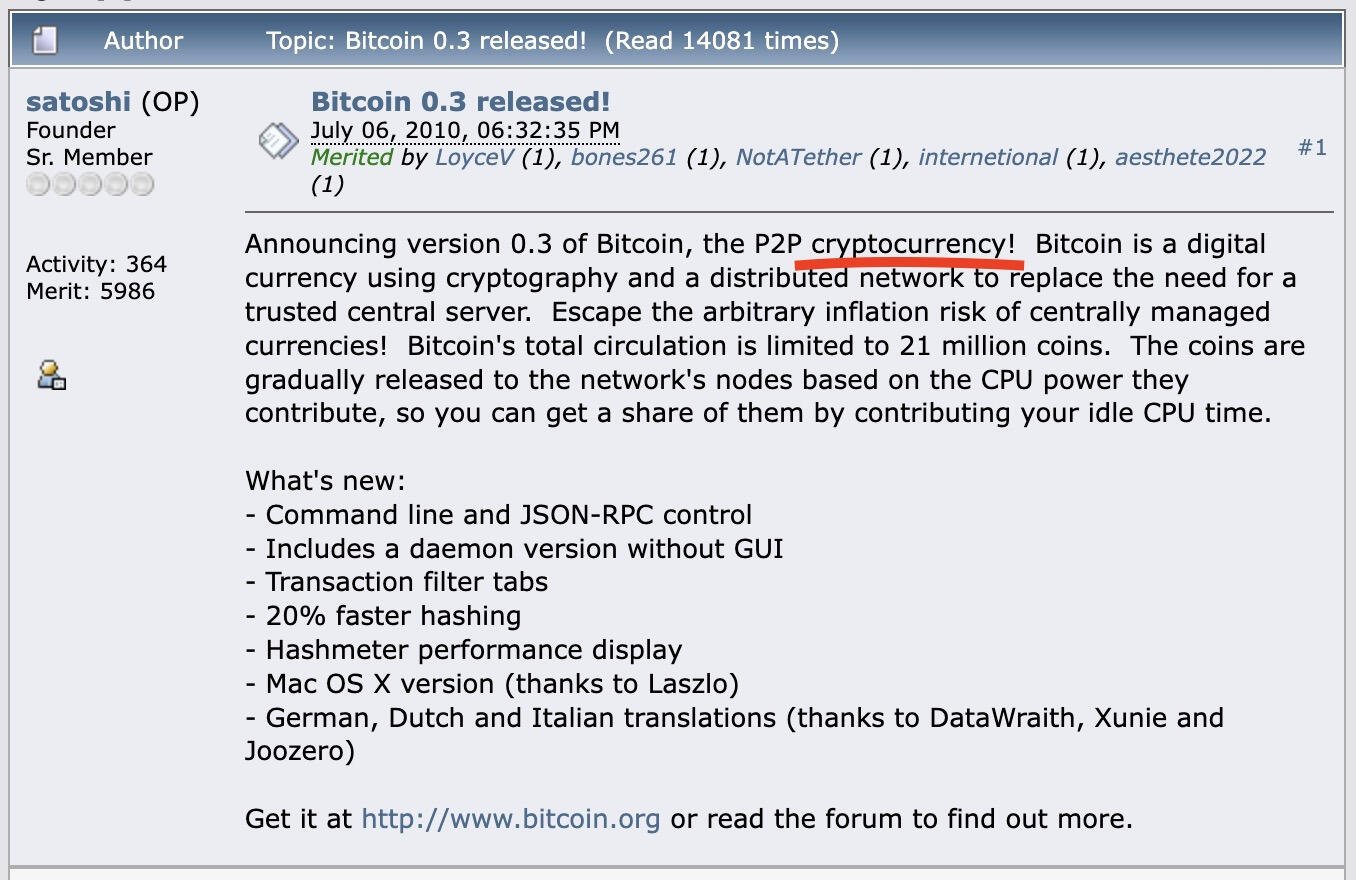

Despite publicly being declared dead hundreds of times every year since its birth, Bitcoin is now the world’s most secure large computer network with millions of users worldwide. Robust in design, it continues to grow, with the Lindy Effect already suggesting that it has a very long future indeed.

Since Bitcoin’s inception in 2009, many thousands of imitators have been created – ‘crypto’ as distinct from Bitcoin. But because Bitcoin is the first successful digital money, any crypto trying to be money, irrespective of its characteristics, cannot compete with Bitcoin’s established network effects. Even near-identical copies ‘hard-forked’ from Bitcoin itself have all diminished in value, participation and security relative to Bitcoin over time. As time passes, this network effect is getting stronger. It is a key reason why no crypto network comes close to Bitcoin’s value, and – due to Metcalfe’s Law – is unlikely to do so in the future.

Some cryptos are better than Bitcoin at various non-monetary things, e.g. using less power, being more private, and acting as a platform for other cryptos and so-called ‘smart contracts’. But all cryptos are inferior to Bitcoin at being money. This isn’t just due to Bitcoin’s network effect: it is also because almost all cryptos suffer from one or more of four critical shortcomings.

First, most cryptos rely on trust because they eschew Bitcoin’s proof-of-work consensus mechanism for the misleadingly named ‘proof of stake’. In reality, this is proof of nothing because it trusts subjective abstract power (the opinion of the privileged), rather than verifying objective physical power (via computational work irrefutably done). By design, proof of stake also increases centralisation, ensuring the rich and powerful get richer and more powerful: in proof of work, work begets wealth, but in proof of stake, wealth begets wealth.

Second, most cryptos are less censorship resistant than Bitcoin because, instead of being controlled by a large number of ordinary users, they are instead effectively controlled by a small number of privileged users. Even though they cloak themselves in the verbiage of decentralisation, they are in reality decentralised in name only.

Third, far from being sound and fair monetary systems, many cryptos are scams with sizeable ‘pre-mines’, where before launch insiders take a large proportion (or even most of) the coins which will be created. This exacerbates the problems of proof of stake, with the insiders accruing even more profit and control at the expense of the outsiders.

Fourth, many cryptos do not have a hard monetary limit, or that limit is not clearly defined. This makes them vulnerable to inflation, where the privileged participants can be enriched at the expense of the others.

Some crypto creators have genuinely noble intentions, and are trying to improve on Bitcoin: it may be the most secure and decentralised computer network in history, but its limited transaction throughput means it is not particularly scalable. Unfortunately, these attempts all fail due to the so-called ‘blockchain trilemma’, which states that security, scalability and decentralisation cannot all be achieved together. Bitcoin wins by not trying to resolve this trilemma at all on the ledger itself, instead incentivising large-volume small-value transactions to move to second-layer networks with far higher capacity than any crypto's blockchain.

Note that Bitcoin’s superiority as money isn’t only the opinion of individual Bitcoiners. It’s also the view of large financial institutions.

“Bitcoin is fundamentally different from any other digital asset. No other digital asset is likely to improve upon bitcoin as a monetary good because bitcoin is the most (relative to other digital assets) secure, decentralized, sound digital money and any ‘improvement’ will necessarily face tradeoffs.”

– Fidelity Research Study 'Bitcoin First: Why Investors Need to Consider Bitcoin Separately from Other Digital Assets, 2022

Bitcoin is not crypto.

So here’s me all smug with my lower-numbered edition.

Then realizing you have bagged number 21, surely the most prized.

https://primal.net/e/note12heydh3v5w3tulc9duj0kqnudys6an290m5hdn63t66mgrwsl25q4x26dm

GM

Keeping things rational.

GM

GN

Source: BlackRock “Bitcoin: A Unique Diversifier”

?format=1500w

?format=1500w