Notifications changed in a recent update. I don't like it either.

Forgot to add Qubic was definitely intentional reorgs though. They did it for brief periods with significantly less than 51% of hash power. Same selfish mining attacks can be done with just about any PoW coin. It's an economic attack. Miners are incentivized to switch because they will get the the reward from the native coin + the attacking coin reward. It will always be worth more to do that than mining natively. There are several ways to greatly mitigate this though. Like variations of workshare schemes for example which is what Monero is in the process of implementing.

It's a side effect of PoW which is probabilistic thats why you have to wait for confirmations. They can happen unintentionally. You don't need a majority of hash power for a reorg to happen either. Though the more hash power an entity has the more likely it happens.

Why You Should Own Bitcoin, Not Monero

If you want a more objective analysis from a former multi Billion $ hedge fund manager, here are several10 min. videos from the past several years addressing various aspects of the differences between Bitcoin & Mpnero.:

https://www.youtube.com/playlist?list=PL7w04GVKPitHbogpG3bxuvZIRxSklZVJf

https://x.com/i/grok/share/UxjRNJe8gER3dKI3XOVRowxlT

nostr:nprofile1qywhwumn8ghj76r0w3exjemgw3hx7aewdehhxarjxyhxxmmd9uqjqamnwvaz7tmvd938yetjv4kxz7fwv9shymmwd96k66tf9e3k7mf0qqsggcc8dz9qnmq399n7kp2yu79fazxy3ag8ztpea4y3lu4klgqe46qpqyc8n

In that first video he also says:

"Your average Monero person is much more likely than your average Bitcoiner to value: privacy, freedom, cypherpunk values, not bootlicking politicians, etc"

You can also still hold Bitcoin and have a small stack of Monero for spending privately. It's very likely you still use fiat or have other assets that aren't Bitcoin. Same concept but for Monero.

Easiest way is probably swapping some Bitcoin for Monero using an aggregator like trocador.app

Or p2p using Retoswap, Bisq, Robosats, or Eigen wallet (atomic swaps)

You can have NGU in IOUs completely beholden and surveilled by custodians. But the ideal would definitely be both NGU and FGU. I think you and Hanshan would probably agree with that.

I don't get why people freak out over something with less annual inflation than gold (and currently less inflation and circulating supply than Bitcoin for that matter)

They talk about that conversation we had a few weeks ago around 19:15 nostr:npub150q6tnk63wrt0jmy6ht27k8u0pa6gq8jjy4eq7tf6f6507t9ghgqnnen2h

nostr:note1x27ezn2z8383ckr8h2qnh6eqfqygpg0jx532mlhwgyrrahwjffvsylw5lg

Signal would be Monero in that example though. It's built in by default and users don't even have to think about it.

Manual PGP over texts would be coinjoining or using lightning privately

You're right a lot of people don't care maybe even most. But there is a subsection that care but can't get over the technical hurdles (or can but still shoot themself in the foot by making mistakes that wouldn't otherwise be possible to make)

All government has to do is threaten you or your family legally or physically. I'm sure most would give up their coin if they were facing down decades behind bars or worse.

If privacy isn't built in by default very few will use it privately. Too much friction and potential pitfalls.

Who uses PGP over email or texts? Vanishingly few.

Transparency might be a strength in one way, but on the other hand it is also a major gift to it's adversaries

Cada nó em uma rota de pagamento sabe o valor que está sendo transferido. Com o Monero, os nós não conseguem ver os valores. Boa tentativa, porém.

Bisq, Retoswap, and Robosats are probably the most popular ways to get Bitcoin/Monero using fiat without KYC

If you already have Bitcoin and want some no-KYC Monero you can use the above three too. Or for a quick swap you can use an aggregator like Trocador.app

A third way is selling good and services on https://xmrbazaar.com/

Heres a few more:

Bisq, Retoswap, and Robosats are probably the most popular ways to get Bitcoin/Monero using fiat without KYC

If you already have Bitcoin and want some no-KYC Monero you can use the above three too. Or for a quick swap you can use an aggregator like Trocador.app

A third way is selling good and services on https://xmrbazaar.com/

Another option is buying from crypto ATMs, but they're usually quite expensive and have limits on how much you can buy without KYC

Bisq, Retoswap, and Robosats are probably the most popular ways to get Bitcoin/Monero using fiat without KYC

If you already have Bitcoin and want some no-KYC Monero you can use the above three too. Or for a quick swap you can use an aggregator like Trocador.app

A third way is selling good and services on https://xmrbazaar.com/

I'm not sure it's true most Bitcoiners hate Monero. Many explicitly say they use it, or at least appreciate it even if they don't use it. I'm sure there are plenty of Bitcoiners that are closet Monero users too and just aren't public about it.

nostr:note1sj2m26v2cqnncdzyqe8966jhr297k4exvwjxmhsg33gruh8kh45smkn5vl

Não tenho certeza se nunca tentei isso com um pi5. Depois de dar uma olhada rápida nas especificações, a sincronização pode ser um pouco mais lenta do que em um computador normal, mas não vejo por que não.

Can't use future promises and vaporware today. Even if it's assumed that Bitcoin will eventually make them obsolete they still fit legit use cases right now that Bitcoin doesn't cover yet.

And like everything, the way Bitcoin will do it, using layers, has completely different trade-offs so not even sure if they will ever be obsolete.

I like Session but it has it's own problems

Even the way you get some shred of privacy on Bitcoin is super sus

You have to get together with a bunch of other Bitcoin users and have a big "coinjoin"

Sounds like a massive gay orgy

Gaaaaaaaaay!

If it's not default 99% of transactions won't use those tools. Look at normal transactions vs coinjoin transactions. Ratio is abysmal.

Now your allegedly massive anonset is comparable to Monero, and for technical and practical reasons, likely worse.

Depends what you care about more. Non-custodial vs instant/free transactions.

There are also privacy nuances. Larger transactions are less anonymous on ecash because the mint can see denominations being spent (there are less people using higher denominations = smaller anonymity pool and at some point no anonymity pool). On Monero amounts are completely hidden from the public. But ecash also has no public blockchain if you look at it from that angle.

I would say if you want privacy, and don't care about custody for smaller amounts, use ecash. For larger amounts you would care about losing use Monero or self-custodial Lightning.

Better at what? Cashu is faster and feeless if you trade ecash directly, but it's custodial.

A wise man once told me "It’s not name calling, it’s labeling you accurately."

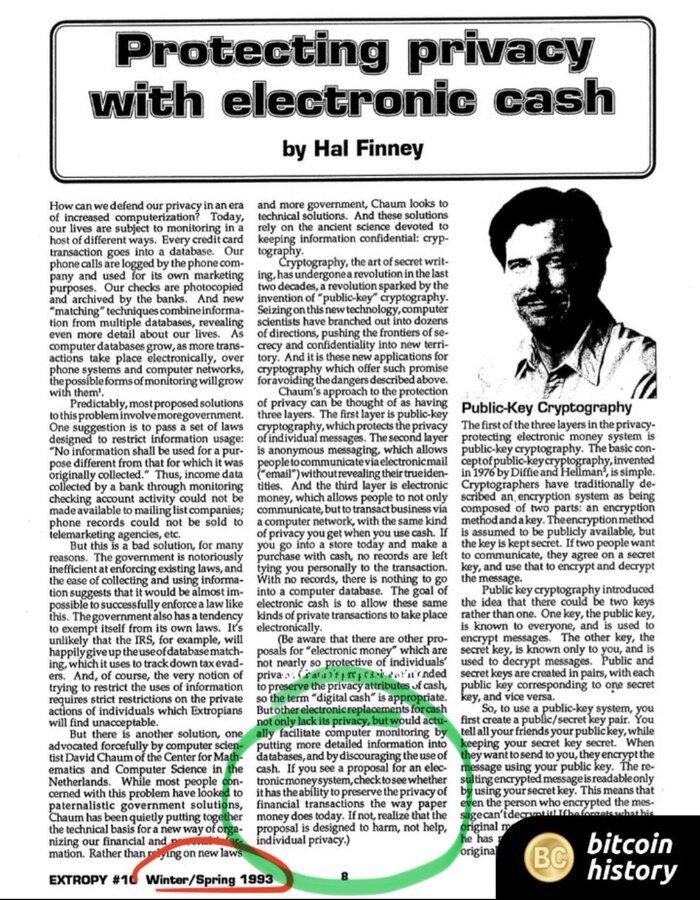

>"There have already been large improvements in this area since the days of Hal’s tweet, more to come."

Lol. Lmao even.

Alright you're a dumbass. Just labeling you accurately bro.

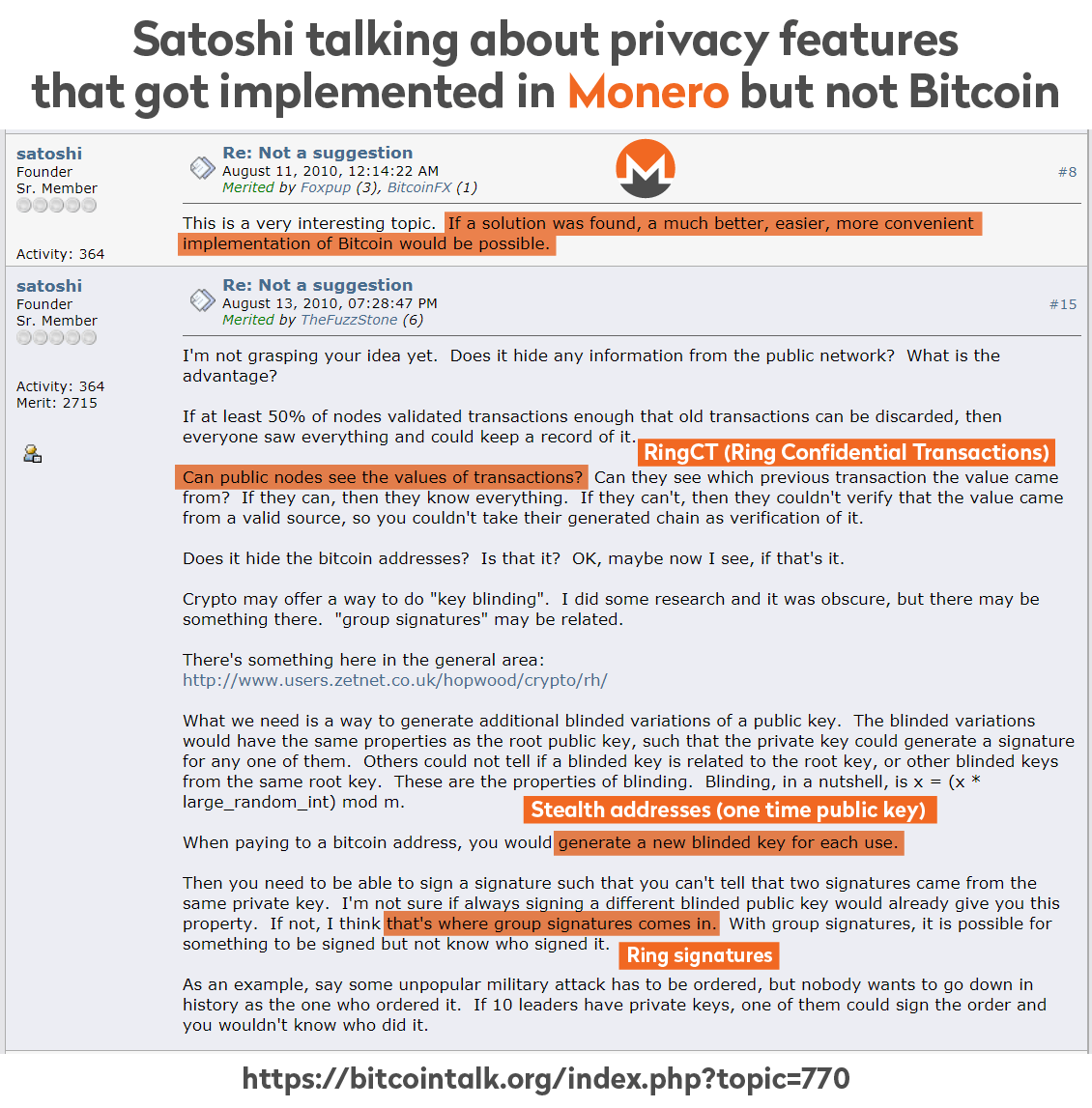

Here are a few more "delusional" people

Yep happens sometimes by sheer luck

"Thinking adversarially is much different than pretending everyone who uses a bank account will be censored or frozen. That’s an anxious delusional that will never play out."

Probably also what someone told Satoshi about Bitcoin at some point

Apparently someone hasn't heard of the Samourai, Roman Sterlingov, and Tornado Cash trials going on right now. They don't want you to have privacy bro, that's for a reason that isn't difficult to figure out, it's too late in the game already for you not to understand this.

Youre right a private Bitcoin would be more censorship-resistant than both Bitcoin and Monero.

Great. It's more difficult for the Bitcoin the network to be 51% attacked, but goons with guns can kick down the doors of individual users and coerce them into relinquishing their keys just like the Canadian truckers and BTCSessions friend.

"Implement Detective Mining (Pool Software Change, No Protocol Change Required)"