🧠Quote(s) of the week:

"Bitcoin blows minds for many reasons.

Computer scientists say Satoshi solving the Byzantine Generals' problem blew their minds.

Economists might be mystified by an asset that goes up in price without producers increasing production to increase supply.

Oil drillers say finding an alternative to flaring excess gas that's cleaner and more profitable was mind-blowing.

Human rights advocates say being able to own an asset that cannot be confiscated in a corrupt country, allowing people to grow wealth and escape tyranny was mind-blowing.

Power plant operators will say the load-balancing capability of mining is mind-blowing.

Merchants or users of remittance services will say the fact that BTC lowers friction and fees is mind-blowing.

Some might say Bitcoin encouraging saving and long-term thinking is mind-blowing. If Bitcoin hasn't blown your mind, you just haven't viewed it through the right lens yet." - Jamelos Lopp

🧡Bitcoin news:

➡️S&P Global Ratings upgraded El Salvador's credit rating, citing the government's restructuring of short-term local debt. El Salvador's debt rating is now raised from CCC+ to B-, equivalent to Ecuador and Nigeria.

Game theory at play! Now imagine what will be like in 10-15 years!? More countries will follow the same path.

➡️"Today there are 81,954 addresses that hold a minimum of $1M in Bitcoin This is up nearly 3X from January 2023 when just 28,084 Bitcoin addresses held a value of at least $1M" - Bitcoin News

➡️Let's compare gold performance with Bitcoin. Since August 10, 2020, when Microstrategy adopted its Bitcoin strategy.

Bitcoin 214%

Gold -3%

I don't dislike gold, don't get me wrong, but gold is now just noise that takes away from Bitcoin’s signal.

Gold could be used as the gateway drug for Boomers into Bitcoin. If you can teach them gold they eventually get Bitcoin.

Personally, I see gold as my insurance (CDS)* to Bitcoin and Bitcoin is insurance to fiat.

* Credit Default Swap. No clue what I am talking about, watch the movie 'The Big Short'.

Just to sum it up: Since March 2020, Bitcoin smoked (+258%) all the other assets (Nasdaq, S&P, gold) when deflated by the rise in the Fed’s balance sheet.

The following quote is from last week's Weekly Recap: "Gold will run hot early but will eventually peter out as it becomes clear that Bitcoin is a harder asset and superior sound money. Also, as boomers age and digitally native Millenials/Gen-Z enter prime earning years, demand will shift from gold to Bitcoin."

Now are yourself, what will happen to Bitcoin in the next 30 years, when internet-native Millennials inherit a large chunk of $142T currently held by the older generations?

➡️ "Cybermoney controlled by private markets will supersede fiat money issued by governments. Only the poor will be victims of inflation."

Great tweet by Bert de Groot (Bitcoin Brabant): https://twitter.com/BdGBertdeGroot/status/1723598425755623456

TLDR: Self-custody is key!

➡️ "The day that the Bitcoin ETF gets approved, that is the day that the retail era comes to an end and the institutional era for Bitcoin begins." Eric Weiss (the guy that orange-pilled Michael Saylor)

So why you should stack harder? I will quote Samson Mow:

"The era of institutional Bitcoin is something to be cautious of. Yes, it will make the price go up. But it also means Bitcoin may split into two segments, one free-moving and one siloed in the institutions. Always keep custody of your own coins."

➡️ If till now you still have your coins on an exchange or your self-custody process is still wack... the next video/post will maybe change that.

https://twitter.com/RMessitt/status/1723141037856596175

Rick hodled since 2012 and got hacked. 25 BTC gone.

Now I love Rick for posting this on Twitter and sharing his story. By resharing his story I want to warn you guys and by doing that I might help someone.

A reminder to us all that seed phrases should never touch the internet!!! I hope all of you take this as a warning to keep your keys offline.

I personally recommend the following hardware wallets:

Blockstream Jade (For the Dutch followers you can order your Jade here: https://bitcoinbrabant.com/product-categorie/opslag/ - For the international followers you can order your Jade here: https://store.blockstream.com/product/blockstream-jade-hardware-wallet/)

Bitbox02 - Bitcoin-only edition: Order here https://bitbox.swiss/bitbox02/?ref=IYjAmzKEXw

ColdCard: Order here https://store.coinkite.com/store

"Bitcoin is like a living organism trying to move from weak hands to strong. Strong how?

- Own physical vs paper claim (GBTC)

- No leverage vs leverage

- Cold vs hot wallet

- Self-custody vs custodian

- Multsig vs single sig

Strengthen your hands or your BTC may leave you." Vijay Boyapati

➡️ 31 days ago, Jim Cramer said Bitcoin is about to go down. BTC is up 37% since then.

➡️ Bitcoin has seen an 80% increase in transactions valued over $100,000, compared to the 30-day prior.

➡️ Swedish couple experienced a violent home invasion by a group of robbers who were intent on taking their Bitcoin wealth. This incident is just one example of the growing trend of cryptocurrency-related robberies in Sweden

➡️The amount of Bitcoin held for more than 5 years is literally going vertical! Stackers from the 2018 bear market are holding stronger. 5yrs ago represents coins acquired at the 2018 lows between $3k and $4k.

➡️ Over 700K new Bitcoin addresses were created on November 4. Daily adoption! Is retail finally waking up?

➡️ WisdomTree Enhanced Commodity Strategy Fund to invest up to 5% of its net assets in Bitcoin future contracts.

➡️ Bitcoin mining company Hut 8 receives authorization to launch a “stalking horse” bid for several natural gas power plants and a Bitcoin mining site.

More on mining! Last week Daniel Batten presented a new peer-reviewed paper "From Mining to Mitigation: how Bitcoin can support renewable energy development and climate action”

The authors found Bitcoin mining “can help attract private investment into the renewable energy sector, providing a much-needed boost” for renewable development This adds scholarly weight to what Bitcoin mining companies have been saying for some time: that Bitcoin mining supports the renewable transition

Note: ACS Sustainable Chemistry & Engineering ranks #14 out of 139 for all environmental science–chemistry journals

read the paper here: https://pubs.acs.org/doi/10.1021/acssuschemeng.3c05445…

Daniel Batten: "35x 4MW bitcoin mining operations on landfills that were previously venting their methane = a greenhouse negative bitcoin network. Globally, 1000s of landfills have no profitable use case other than Bitcoin mining. Let that sink in."

I can't get over the fact that Bitcoin mining allows anyone, anywhere in the world, to turn electricity into money. Add on that, inventing a peaceful internet protocol that aligns human incentives to reduce methane emissions. If that isn't revolutionizing, nothing is.

➡️ Starting November 17, 2023, Gemini UK will only allow outgoing Bitcoin and cryptocurrency transfers to other registered TRUST Virtual Asset Service Providers (VASPs). Transfers to non-TRUST VASPs will be blocked.

Ergo: Controlled by the government

Start using a hardware wallet and start using P2P exchanges like Peach Bitcoin, Bisq or HodlHodl. Don't use centralized exchanges like Coinbase, Binance, or Bitvavo.

If P2P exchanges are a bridge too far, start using services like Relai.

➡️Nouriel Roubini is launching his own investment token offering. It reports being “enabled by AI, ML, Climate Technology, and Blockchain”.

You can't even write this shit. Roubine total helmet doom posted about Bitcoin for nearly a decade... now launching a shitcoin.! This next bull run cycle is going to be bananas. Stay safe out there, I have warned you!

➡️The number of addresses holding more than $1k worth of Bitcoin has hit a new all-time high.

➡️Michael Saylor's MicroStrategy Bitcoin holdings hit $1.27B in profit! 158,400 Bitcoin, $29,5K average price, 23% profit. Saylor is playing chess while others play checkers.

💸Traditional Finance / Macro:

👉🏽"This week's look ahead for the global economy and markets include US economic indicators such as industrial production, the NFIB small business sentiment and, especially, retail sales; and CPI and PPI data, where consensus is expecting 0.1% (headline) and 0.3% (core) monthly inflation for both. While on price data, look also for Argentina’s CPI inflation where the annual measure is expected to come in at 146%." - Mohamed A. El-Erian (President, Queens' College, Cambridge Uni. Allianz, Gramercy advisor.)

👉🏽 https://twitter.com/LynAldenContact/status/1723736410807501002

My only take from this.... do a plot with real-world inflation, not the fake CPI.

The stock market depends on the government printing money to make profits. Now don't get me wrong a lot of companies do add value to our lives and economy, but there is a major difference between the real economy and the financial economy (stock market)

🏦Banks:

👉🏽 World's Biggest Bank forced to trade via USB stick after hack. hahaha, read that again! This is bonkers, to say the least!

https://twitter.com/Mayhem4Markets/status/1722911227364384862

🌏Macro/Geopolitics:

👉🏽"Moody’s cuts U.S. credit outlook from stable to negative. Reasons for the cut:

1. Downside risks to U.S. fiscal strength have increased

2. Fiscal deficits to remain very large

3. Debt affordability to be significantly weakened Since the debt ceiling crisis “ended” S&P has downgraded US credit ratings and now Moody’s cut their outlook. All as interest rates are soaring and the U.S. issues trillions of Dollars in debt. Warning signs are everywhere, but no one is listening."

Moody’s specifically cites higher interest rates as a risk with rising deficit spending. The U.S. is currently spending at World War 2 levels but calling for a “soft landing.” One more misstep and the US loses its last AAA.

So let's have a look at the US current Debt situation...

👉🏽"Total US household debt rose by $230 billion in Q3 2023, to a new record of $17.29 trillion. Breakdown of the large categories:

1. Mortgage Debt: +$126 billion to $12.14 trillion

2. Auto Loans: +$13 billion to $1.60 trillion

3. Student Loans: +$30 billion to $1.60 trillion

4. Credit Card Debt: +$48 billion to $1.08 trillion

Total household debt in the US is now up ~21% in 3 years and rising rapidly.

We are "fighting" inflation with debt." - TKL

The US has so much debt that it can't service it through income, but only by taking on more debt.

Would like to know more on this topic I highly recommend the following podcast 'What Bitcoin Did' - interview with Luke Gromen:

https://www.youtube.com/watch?v=4Fr7SMuv0zo&t=7s

If we have a look at the Credit Card Debt we see that the: "total credit card debt in the US rose by $48 billion in Q3 2023, to a record $1.08 trillion. This means that total credit card debt is now up $400 billion since 2013 and $300 billion since 2020. Meanwhile, interest rates are credit card debt are at a fresh record of 25%. The average consumer is now spending $1,600/month on their credit card. People continue to "fight" inflation with credit card debt." -TKL

Our economy, also here in Europe, is based on borrowed money. Now in essence that is not bad...but the debt level in the US and other parts of the world is out of control. We need austerity, but basically, that is from a political standpoint, suicide.

Just to give you some context on the US debt:

It is now paying over $1 trillion annually of *interest* on federal debt. That's more than every single other line item (including Defense spending) except Social Security.

Hence, the US is now spending nearly one and a half 2008 bailouts every year just to service the debt.

https://twitter.com/jameslavish/status/1722327226065228191

This is completely out of control. The Fed owns 25% of TIPS issuance. So if inflation is higher, obviously there gonna be an outsized effect on debt interest payments...well you do the math. Oh well, what is a trillion here and a giraffe there between friends, right? Opt the F OUT: Bitcoin.

The only feasible long-term plan is going to be an inflationary policy. There is no political appetite to raise more revenues or cut spending, and interest expense is soaring. The Fed will likely need to reverse QT back to QE. They will try to inflate their way out of this and CBDC will help them in the process.

👉🏽https://twitter.com/jsblokland/status/1721798471252914653

What happens when you replace cheap gas from Russia with expensive LNG from the US because someone blew your pipeline, and your energy infrastructure is a mess? A big thanks to the present social-green government.

German is the sick man of Europe.

Germany could restart their nuclear power plants and lower energy prices for CE, but Habeck and the Greens would rather sacrifice Germany's economy and competitiveness (and EUs) than reopen the nuclear power plants and acknowledge that the 'Energiewende' was a disaster.

Germany's industry shrinks more than expected amid recession risks. German industrial output fell for a fourth month in Sep. Production declined 1.4% vs -0.1% expected. The sector is reeling from higher interest rates and China's slowdown.

🎁If you have made it this far I would like to give you a little gift.

"If you don’t understand how treasury auctions work, there’s a very strong chance you’re going to need to educate yourselves."

Another fantastic, easy-to-read breakdown of a difficult concept: "Near-Failed Treasury Auction" by @jameslavish, in The Informationist.

https://ckarchive.com/b/5quvh7hvl425oup5xxd52arzrx344

"Let me remind you. This is a US Treasury Bond. The global reserve asset. The (supposedly) most risk-free, most pure, most perfect security on the planet. And on Thursday, it traded like a tech or meme stock. Insanity."

Credit: I have used multiple sources!

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: nostr:npub1sqzr42dj8vx32yd5jcvvl3ytux45kl0etgf6y2ymjvmd7lqmuwmqk9vk7vis especially suited for beginners or people that want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info.

⠀⠀⠀⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple.

⠀⠀⠀⠀⠀⠀⠀⠀

Is this post helpful to you? If so, please share it and support my work with sats. #zap 🧡 #weeklyrecap #nostr #plebchain #grownostr #stacksats

🧠Quote(s) of the week:

The anniversary of Guy Fawkes’ Gunpowder Plot is a perfect time to remember Bitcoin as truth and to move another step closer to obsoleting the parasitic nature of the current system.

Vi veri veniversum vivus vici -> "By the power of truth, I, while living, have conquered the universe."

"Remember, Remember! The Fifth of November, The Gunpowder Treason and Plot; I Know Of No Reason, Why The Gunpowder Treason, Should Ever Be Forgot!"

Bitcoin is our own truth:

“Remember, remember, it is the 5th of November.

The Bitcoin Revolution and Plot,

I know of no reason why the Bitcoin Revolution

Should ever be forgotten.”

🧡Bitcoin news:

Before we start with the Weekly Recap some extra info for the Dutch followers.

Early general elections are scheduled to be held in the Netherlands on 22 November 2023 to elect the members of the House of Representatives.

Do you want to know what the current positions of political parties are regarding Bitcoin, cryptocurrencies, and digital central bank digital currency (CBDC)?Click here: https://bitcoin.nl/artikel/verkiezingen-de-bitcoin-stemwijzer-2023

➡️ The World Bank published a report on Gas flaring, that mentions Bitcoin about 40 times. They're acknowledging the powerful incentive structure that Bitcoin offers to tackle Climate Change.

So it's not only the pro-Bitcoiners, for example '"With real-world data, we (@ARKInvest) demonstrate that Bitcoin mining could encourage investment in solar systems (solar grids + batteries), enabling renewables to generate a higher percentage of grid power" or "Bitcoin mining reduces the CO2-equivalent emissions by about 63% when compared to traditional methods of flaring methane, explains @GigaEnergy_"

➡️ Great move by Vanguard, NOT!

Chairman and CEO of Vanguard Group Tim Buckley says the firm won't join the Bitcoin ETF race, as Vanguard claims to be focused on asset classes with an intrinsic value and capable of generating cash flows, like equities and bonds.

Why move ahead into the future when the past was so profitable for you?

Talking about living in the past...“We will stay focused on the horse and buggy. The auto-carriage is a fad.” Same vibe!

➡️Berkshire Hathaway's vice chairman Charlie Munger: "Bitcoin is like throwing a stink ball into a recipe that's been around for a long time, that's worked very well for a lot of people".

I will quote James Lavish:

"Ah yes. ‘The recipe’. The richest 1% seized 2/3s of all new wealth ($42 trillion) created since 2020, about twice the rest of the bottom 99%. And billionaire fortunes are increasing by $2.7 billion per day, while over 1.7 billion workers now live in countries where inflation is outpacing wages. (h/t@Oxfam) It appears that 1% of the population is a lot of people to Charlie (and others just like him)."

➡️PayPal just got approved to offer Bitcoin and crypto services in the UK.

➡️On the first of November, we’ve officially mined 93% of the 21m Bitcoin. The majority of it is in long-term storage or lost forever. Over the next 117 years, billions of people will compete over the remaining 7%.

➡️The correlation between the S&P500 and Bitcoin has collapsed to less than 0.

Is Bitcoin now being recognized as a global "flight to safety" in these uncertain times when compared to "risk-on" assets like stocks?

➡️A great thread by Jurrien Timmer, Director of Global Macro at Fidelity. With Bitcoin, higher risk comes a superior return. This thread will visualize that and show you Bitcoin's volatility.

https://twitter.com/TimmerFidelity/status/1720157956212244697

Oh, by the way, Jurrien Timmer, also mentioned that he thinks that Bitcoin is 'exponential gold':

https://twitter.com/TimmerFidelity/status/1720152886863179937

So what do Central Banks do? "Central banks are in the market for hard money. Even with gold near ATHs, they're still buying record tonnage. Just a matter of time before bitcoin, that "exponential gold", also gets added to the mix."- Tuur Demeester

I will quote this excellent tweet by Henry Schaffer:

"Gold will run hot early but will eventually peter out as it becomes clear that Bitcoin is a harder asset and superior sound money. Also, as boomers age and digitally native Millenials/Gen-Z enter prime earning years, demand will shift from gold to Bitcoin."

The following tweet by Jurrien puts into perspective Bitcoins' store of value thesis and puts Bitocin on the map for comparison.

https://twitter.com/TimmerFidelity/status/1720451086882877606

➡️ Federal Reserve threatens to sue Bitcoin Magazine in an attempt to silence criticism (their satirical "FEDNOW" merchandise, which incorporates a panopticon eye into the logo design) of its FedNow service.

For more information: https://www.zerohedge.com/crypto/fed-threatening-sue-bitcoin-magazine

TLDR: Bitcoin Magazine tells them to GFY

➡️ Spot exchange volumes surpassed $24B, reaching an 8-month high amid expectations of an imminent Bitcoin ETF approval

➡️ Argentina's two remaining Presidential candidates: Sergio Massa - Wants to mine Bitcoin with excess natural gas. Javier Milei - Says Bitcoin can eliminate the central bank. Argentina's economy is 20x bigger than El Salvador's.

At the moment (3rd of November), Argentinian Libertarian Javier Milei has a 4-point lead over Economic Minister, Sergio Massa, for the upcoming presidential runoff.

➡️Financial giant Block sold $2.42 billion worth of Bitcoin to customers through Cash App in Q3. That's 40% of Block's total revenue

➡️ Jury finds Sam Bankman-Fried guilty of all seven criminal counts against him. The former FTX CEO faces a maximum sentence of 115 years in prison. Fraud in the collapse of FTX was “worse than Enron” according to advisors. $10 billion in customer funds were missing. US Attorney says Sam Bankman-Fried perpetrated one of the biggest financial crimes in US history.

I quote Erik Voorhees: "Let's remember that he operated "the safe and regulated" exchange, and not a single regulator caught him. It was, instead, the market, which is not only a great fountain of innovation but also the best arbiter of discipline and justice."

Anyway, the Fed is a greater scam than FTX. More on that below in the segment Traditional Finance & Macro.

➡️ One of Austria's oldest football clubs, FC Admira Wacker, puts the Bitcoin logo on the jersey and will integrate Lightning payments. One of Austria's oldest and most traditional clubs, FC Admira Wacker, is becoming the first Bitcoin football club in the German-speaking part of Europe. LN integration, merchandising, educational content, and many more fun projects on Bitcoin to come

➡️ Marathon Digital to partner with Nodal Power for the development of a 280-kilowatt (kW) Bitcoin mining project in Utah, powered by landfill-generated methane.

Their official statement: "Today, we're announcing the energization of our first Bitcoin mining pilot project powered by renewable, off-grid energy from a landfill. The project is currently fully energized and operational."

Learn more: https://bit.ly/49gxvWH

TLDR: A brilliant way to cut emissions and go green. Can somebody please call Greenpeace USA, Alex de Vries, or Paul Tang (EU Member of the European Parliament)

➡️Percentage of Bitcoin supply that has not been moved for at least 1- year is nearing a new all-time high

➡️ New record Bitcoin hashrate! 450,000,000,000,000,000,000x per second

💸Traditional Finance / Macro:

Stan Druckenmiller on CNBC: “My generation… we’ve given nothing. We’ve given nothing! And now we want to screw our grandchildren… We’ve got to stop guys, we’re DRUNK.”

🏦Banks:

👉🏽Not really news, but just a reminder. 110 years ago, the Federal Reserve was founded. Since then, the US dollar has lost over 97% of its value.

👉🏽Another great reminder:

https://twitter.com/WalkerAmerica/status/1719743817753002081

👉🏽On November 3rd, the Federal Reserve said: "ACH Error Impacting Customers "

"Their ACH network had a problem that reveals a lack of data verification and validation in their proprietary fiat software. Instead of taking ownership of the protocol problem and fixing the root cause, the Fed is throwing EPN under the bus." - Pierre Rochard.

The Clearing House’s ACH operations service is called EPN, which handles essentially half the U.S. commercial ACH volume.

and on the same day: "Switzerland to restrict bank withdrawals and impose 'exit fees' on customers who take their money out under new rules being considered" - Reuters

AND

UK bank NatWest is telling customers to reduce their carbon footprint, eat vegetarian, and stop drinking dairy milk after scanning their transaction data - Telegraph

Bitcoin literally fixes this! Bitcoin is the exit!🧡

🌏Macro/Geopolitics:

👉🏽Summary of Fed decision:

"1. Fed leaves rates unchanged for a second straight time

2. The Fed will assess the extent of "additional tightening"

3. Tighter credit conditions continue to weigh on the economy

4. The Fed will "continue to assess additional information"

5. The inflation target remains at 2%

The Fed is bracing for a LONG PAUSE."

It looks like rate hikes are done. But higher rates are still necessary to get a grip on inflation and the economy.

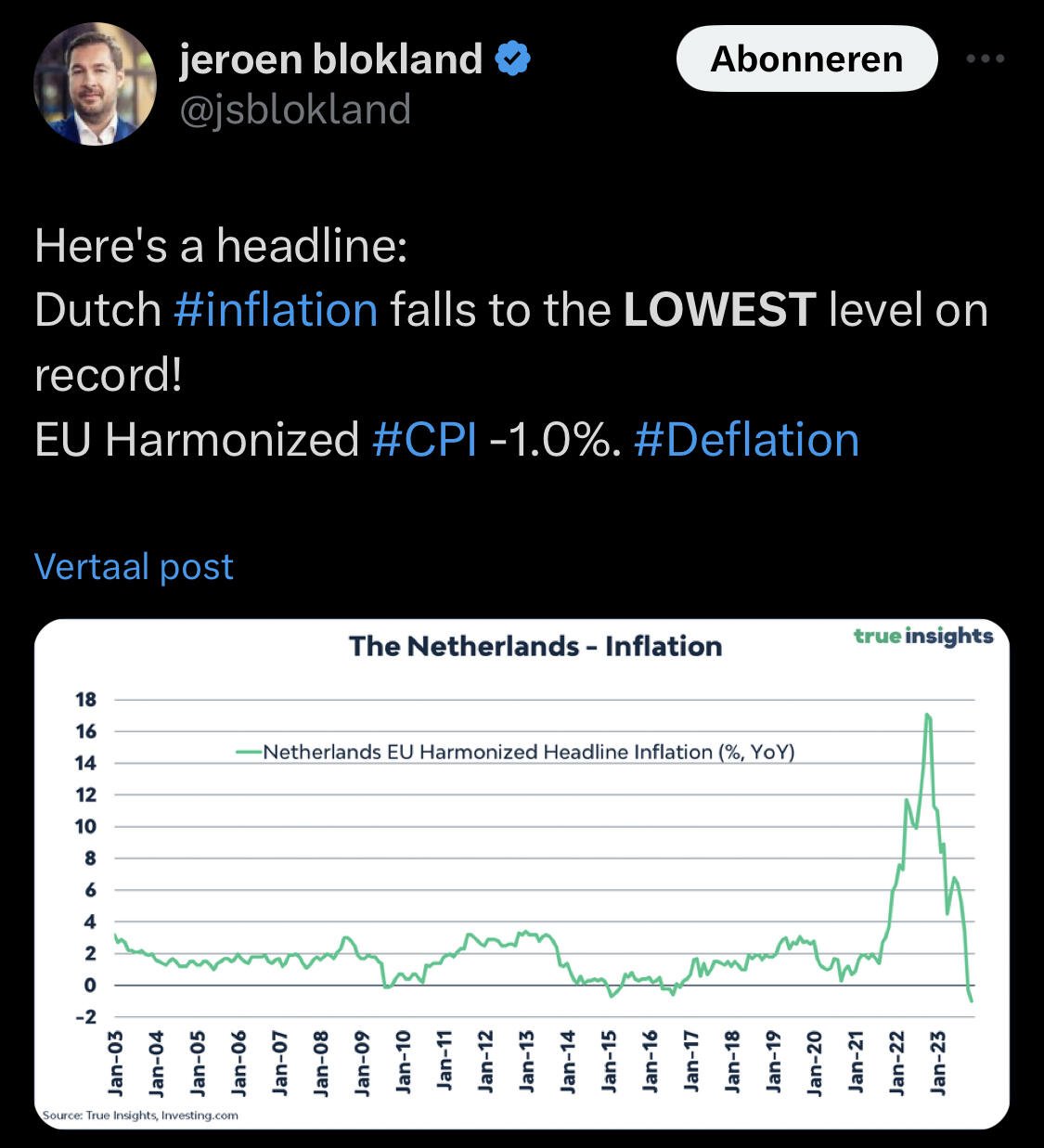

👉🏽Dutch Inflation to the LOWEST level on record! EU Harmonized CPI -1.0%. Hello, deflation!

👉🏽"Eurozone inflation sinks to 2-year low as the Eurozone economy shrinks: CPI slowed to 2.9% in Oct, down from 4.3% and better than expected 3.1%. But Core CPI – that excl food and energy is retreating less rapidly. It moderated to 4.2% in Oct from 4.5% the previous month." - Holger Zschaepitz

👉🏽"ISM Manufacturing comes in at 46.7 vs an estimate of 49 The fall was led by a collapse in new orders (from 49.2 to 45.5) and employment (from 51.2 to 46.8) This is not a great set of data by any stretch of the imagination."

Here in Europe, we are already experiencing a manufacturing depression, especially in Germany.

This is the Fed's worst nightmare: Stagflation.

👉🏽"The more Fed Chair Jay Powell speaks, the more the market hears that the US central bank is done with rate hikes in this economic cycle. US 2-year yields plunge." - Lisa Abramowitz

👉🏽 "Dollar drops, Bond yields slide following VERY disappointing US jobs data which fuel bets Fed is done. US econ added 150k jobs in Oct, less than 180k expected. Revisions were negative. Household Survey showed a huge 348k loss in jobs during Oct, unemployment rate ticked up to 3.9% vs 3.8% exp." Holger Zschaepitz

👉🏽 FED Barkin: "I am hearing more evidence of middle-income consumers cutting spending, high-end consumers are not cutting back"

Ergo: we are screwing the middle class

👉🏽The fiat system is fueled by debt. "The US ended last week with $33.7 trillion of federal debt and $211.2 trillion of unfunded liabilities, bringing the total amount owed to ~$245 trillion. That’s approximately 55X tax revenues, or the equivalent of someone with a $100K salary and $5.5 million of debt." - James Lavish

The bottom of the unemployment rate was 3.4%. Today unemployment printed at 3.9% in the US. Another 2 months of 3.9% cement the recession according to the Sahm rule.

What is the Sahm Rule? The rule, hatched by former Federal Reserve economist and now Bloomberg columnist Claudia Sahm, posits the start of a recession when the three-month moving average of the unemployment rate rises by a half-percentage point or more relative to its low during the previous 12 months.

The preserve logic of the market (Wall Street):

Unemployment up = Market up

- Biden's Dept of Fake Data doing its thing: August jobs revised down by 62,000, from +227K to +165K September was revised down by 39,000, from +336K to +297K 8 of the past 9 months have been revised lower.

The much more accurate and less manipulated Household survey shows employment collapsed by 348K, the biggest drop since the Covid shutdown. It's almost certain the US is already in recession.

Basically a lot of fakeness in a world called fiat. In a serious nation based on a sound moral judgment, with a real media, and a well-functioning political system this would be a major story. The now-convicted criminal Sam Bankman-Fried is "one of the people most responsible for Biden being in office" and one of his "biggest donors". Just saying.

https://twitter.com/alistairmilne/status/1720349075705303504

If you have made it this far I would like to give a little gift, a keynote talk by nostr:npub1trr5r2nrpsk6xkjk5a7p6pfcryyt6yzsflwjmz6r7uj7lfkjxxtq78hdpu of the Human Rights Foundation:

"The Currency Caste System"

Watch it here: https://www.youtube.com/watch?v=hDQRxgWIt6Q

TLDR: "150+ fiat currencies allow for massive exploitation via endless wage devaluation. Billions get squeezed Bitcoin threatens to obsolete this system with one neutral, open, global currency"

Credit: I have used multiple sources!

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: nostr:npub1sqzr42dj8vx32yd5jcvvl3ytux45kl0etgf6y2ymjvmd7lqmuwmqk9vk7vis especially suited for beginners or people that want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info.

⠀⠀⠀⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple.

⠀⠀⠀⠀⠀⠀⠀⠀

Is this post helpful to you? If so, please share it and support my work with sats. #zap 🧡 #weeklyrecap #nostr #plebchain #grownostr #stacksats

The anniversary of Guy Fawkes’ Gunpowder Plot is a perfect time to remember Bitcoin as truth and to move another step closer to obsoleting the parasitic nature of the current system.

Vi veri veniversum vivus vici -> "By the power of truth, I, while living, have conquered the universe."

"Remember, Remember! The Fifth of November, The Gunpowder Treason and Plot; I Know Of No Reason, Why The Gunpowder Treason, Should Ever Be Forgot!"

Bitcoin is our own truth:

“Remember, remember, it is the 5th of November.

The Bitcoin Revolution and Plot,

I know of no reason why the Bitcoin Revolution

Should ever be forgot.”

I will watch V for Vendetta again. There has never been a better time to watch this movie.

Learn more on the Gunpowder Plot: https://en.wikipedia.org/wiki/Gunpowder_Plot_in_popular_culture

Bitcoin Magazine article: https://bitcoinmagazine.com/culture/bitcoin-and-the-fifth-of-november

I hope this post is helpful to you. If so, please share it🧡

#zap 🧡 #satoshi #nostr #plebchain #grownostr #stacksats #optout #bitcoin #5thofnovember

So I can buy groceries cheaper, right?

But central banks won’t over tighten and send us in to deflation, right?

I mean they understand the lagged impacts of monetary policy, right?

#zap 🧡 #satoshi #nostr #plebchain #grownostr #stacksats #optout #bitcoin

On this day 15 years ago… An email was sent to the cryptography mailing list with the Bitcoin whitepaper. Happy #BitcoinWhitepaper Day! 🧡

Only nine pages and 3192 words. And yet it changed the world. Profoundly. Thank you Satoshi Nakamoto!

#zap 🧡 #whitepaperday #satoshi #nostr #plebchain #grownostr #stacksats

🧠Quote(s) of the week:

"Where do you spend most of your time and energy?

A system is trying to control you with fear and division. (and is it getting worse?) or

A system based on truth, hope, and abundance. (and is it getting better?)

A mirror of thoughts, words, and actions."

"Fear versus hope"

An eternal battle inside each of us, with our thoughts & actions reinforcing the world we each see,

Fear stops people from moving towards hope, and can be used effectively against you.

We all have a choice.

Those choices, in turn, shape our future!"

- Jeff Booth

🧡Bitcoin news:

Now before we start the weekly recap I want to share a tweet by Dr. Jeff Ross, as the war/genocide in Gaza intensifies.

"On a fiat currency standard, central planners argue that more fiat must be created in order to fund two or three simultaneous wars.

On a Bitcoin standard, decentralized users understand that sustained major wars are generally unaffordable, massively wasteful, and, therefore, unlikely to occur.

One currency standard generally wastes human life, while the other monetary standard generally preserves it.

Which world do you prefer?

The choice is yours.

Bitcoin is better money for a better world."

- Dr. Jeff Ross

➡️ Spot exchange volumes surpassed $24B, reaching an 8-month high amid expectations of an imminent Bitcoin ETF approval

➡️ "There's so much pent-up demand for Bitcoin — $200 Trillion of Institutional assets that can't touch it until an ETF is approved. - Ernst & Young (one of the top 4 global consulting)

It's the regulatory green light institutional investors are waiting for: "The spot Bitcoin ETF will be like a superhighway on-ramp for many institutional investors. It translates Bitcoin into the securities language they already know and speaks and does business in every day." - James Lavish

"Blackrock, Fidelity, Invesco and other major spot Bitcoin ETF issuers will probably need several million Bitcoin to satisfy consumer demand over the next 24 months. Where are they going to find that much 'physical' BTC without driving the price to $200,000+?"

I am not sure about the 'several million Bitcoin', but yes this will be the market dynamic.

Anyway talking about the approval...

➡️SEC Commissioner Hester Pierce says the "logic for why we haven't approved a Spot Bitcoin ETF has always mystified me."

SEC is supposed to protect retail investors but seems like they do everything to make sure retail doesn’t make money. The delay only makes sense if there is an underlying agenda to shield conflicting interests. Just to put it down in simple terms: Old money hates new money and tries to find ways to control the narrative, create pump/dumps, and profit from it.

"Bitcoin is a “safe haven asset” that consistently outperforms gold" - $676 Billion fund manager Alliance Bernstein

➡️ Last week we received the news that some people on Coinbase encountered a new $5k/wk withdrawal limit policy. The policy was implemented on 13.10.2023. I can only guess why they implemented the policy. Exchanges only have fractional reserves of your Bitcoin, so please repeat after me: not your keys...

They are going to close the exits soon. Self-custody is the only safe option. Learn how to self-custody. End of the day if you have Bitcoin on exchanges you are playing a game of musical chairs. If you are last to down, you lose!

Talking about not your keys, not your coins...

➡️ Ledged launched their 'Ledger Recovery'. So what is the new service and how does it work?

I quote Ledger: "Ledger Recover is a new service that is 100% optional. Ledger Recover is an ID-based key recovery service that provides a backup for your Secret Recovery Phrase. If you lose or don't have access to your Secret Recovery Phrase, the service allows you to securely restore your private keys using a Ledger device."

How this works:

STEP 1: Identity verification

Verify your identity using a valid ID document and a selfie recording.

STEP 2: Creating the backup

Connect your Ledger device and approve the creation of the backup for your Secret Recovery Phrase. Once approved, your Ledger device will encrypt the entropy of your Secret Recovery Phrase—a string of random 1s and 0s from which your Secret Recovery Phrase is computed. The encrypted entropy is fragmented into three pieces within the Secure Element chip. These fragments become the backup for your Secret Recovery Phrase. Ledger Recover only interacts with the fragments of the encrypted entropy, and never with your Secret Recovery Phrase in its readable format.

STEP 3: Securing the backup

The fragments are securely distributed using end-to-end encrypted and authenticated channels to the Hardware Security Modules (HSMs) of three independent companies – Ledger, Coincover, and EscrowTech. Each fragment on its own is a useless set of random numbers.

STEP 4: Linking the backup to your verified identity

Each fragment is linked to your verified identity from Step 1, so only you can request to retrieve the backup.

You will be billed 9,99€ per month after the first free month. You can unsubscribe anytime. Exclusively for Ledger Nano X.

Now my take on it:

There is no point in owning a hardware wallet if you're just going to give your private key to the government and corporations.

If you use this service, you are signing up for a simple seizure of funds if Ledger willingly (or unwillingly due to government pressure) decides to collaborate with one of the other storage providers.

If you want to read my full explanation:

https://www.instagram.com/p/CsWLjWosy0Z/?img_index=2

➡️ Casa CEO Nick Neuman sends an email to customers warning of abnormalities at Binance and encouraging them to remove funds from the exchange ASAP.

➡️ Bitcoin setting new All-Time Highs in countries around the world including Argentina, Egypt, Laos, and Lebanon. Also ATH in Turkish lira and Nigerian naira. Although I think this is less about Bitcoin ATHs and more about government-caused inflation ATHs.

➡️BlackRock's ETF ticker was removed from listing on the DTCC website and the huge volume of traffic from people checking broke the serve

➡️ On the 24th of October Bitcoin crested $34,500 for the first time since spring 2022 as the spot ETF hope rally gains steam $17 million short bitcoin futures have been liquidated in the last 20 minutes. $117 million in shorts have been liquidated and forced to buy spot today.

With the price surge to $33.8K, MicroStrategy is $679,000,000 in profit on their Bitcoin investment

➡️ Bitcoin Dominance surpasses 54% - a level not seen since April 2021, and 80% of Bitcoin addresses are now in profit.

➡️https://twitter.com/JoeConsorti/status/1716886928644321711

➡️"Last week, the @WSJ published an article claiming about $90 million worth of crypto was used to fund Hamas — a serious claim that gained significant attention. In response to the article, anti-Bitcoin politicians directly linked the WSJ article as evidence in a letter to the White House and Treasury “to address the serious national security threats posed by crypto’s use to finance terrorism.” Later, it was confirmed that the article was patently false. It was straight-up fake news. This was confirmed by @chainalysis, which ran the numbers." - Sam Callahan

Read more here:

https://twitter.com/samcallah/status/1715854073461604555

You can find the original sources below.

Original Fake WSJ article: https://wsj.com/world/middle-east/militants-behind-israel-attack-raised-millions-in-crypto-b9134b7a…

Politicians' letter to the White House: https://warren.senate.gov/imo/media/doc/2023.10.17%20Letter%20to%20Treasury%20and%20White%20House%20re%20Hamas%20crypto%20security.pdf…

Chainalysis correction article: https://chainalysis.com/blog/cryptocurrency-terrorism-financing-accuracy-check/

"Stocks down. Bitcoin up! BlackRock CEO said Bitcoin is a "flight to quality" because of the global chaos. Billionaire hedge fund manager Paul Tudor Jones said "Bitcoin is the fastest horse in the race" in an inflationary recession. Is the De-Coupling finally here?" -Bitcoin Archive

https://twitter.com/BTC_Archive/status/1717482661361357185/photo/1

➡️"Buy Bitcoin" Google searches spike globally, with a ~820% increase in the UK.

➡️ Bitcoin hash rate EXPLODES higher to 545 EH/s

➡️ "Remember this announcement?

"Ethereum will use at least ~99.95% less energy post-merge"

ETH is down 32% against BTC since. If you pay peanuts, you get monkeys."

Never change Tuur Demeester, never change!

💸Traditional Finance / Macro: no news

🏦Banks: no news

🌏Macro/Geopolitics:

👉🏽 M2 US dollar money supply just logged its 10th straight month of contraction at -3.6% in September. The longest period of money supply contraction since 1933 just keeps getting longer. Although this isn't a surprise. Rising interest rates and QT basically mean contracting M1 and M2. They are sucking the money out of the system that we injected during 2020-2021. Now why is this bad? Monetary policy-induced deflation into a system that is having debt through its freaking eyeballs, well that's bad.

Imagine BTC's price when this reverses and the printer goes brr again!? Despite the largest M2 contraction to date, Bitcoin is up 100%+ YTD.

👉🏽The US' annual interest expense just hit $981 billion for the first time ever. The Fed hikes rates to reign in consumer demand... meanwhile, it bankrupts the US government. As tax receipts weaken, interest payments will be increasingly funded with more debt issuance.

👉🏽US GDP grew 4.9% in Q3 QoQ annualized, way faster than +4.3% expected. Now for fiat fanboys, this is a signal that the economy is strong. But... "The United States hasn't made more than it spends since 2002. Those strong GDP numbers you've been sold are fuelled by even larger fiscal deficits. There is no "real" growth in the USA. It's a multi-decade debt-fuelled bender." - Joe Consorti

👉🏽US treasury secretary, Janet Yellen: "Biden has proposed deficit reduction plans."

"And just like the Inflation Reduction Act, this new plan will expand the budget, increase the deficit, and cause more inflation. There is only one button in Washington and it is labeled ‘Spend’." - James Lavish

On top of that, today we received the news that the Treasury expects to borrow nearly $1.6 trillion in net new debt during the six-month period covering this quarter and next quarter. Consequences, massive inflationary.

We are living in a world where debt is growing exponentially. In 2008 the US only needed a $5B cushion in the TGA - now the government needs a $700B cushion.

By the way, put this in Bitcoin's perspective. The US Treasury is going to issue 2.6 Bitcoin networks worth of debt (55.000.000BTC) over the next six months. Yikes!

👉🏽US consumer 1-year inflation expectation median comes in at 4.2% vs 3.8% prelim. 5-year is 3%. This is re-accelerating. Not clearly well-anchored in my view even if the Fed continues to believe it. Inflation may go down, but prices never go down. Inflation is 3%, but prices are 30% higher than they were 2 years ago.

👉🏽 "For the first time in history, you need to make six figures to afford a house in the US. The annual income needed to afford a house is now $111,000, according to Reventure. Meanwhile, the median household income in the US is just $78,000, ~30% below that threshold. Just 3 years ago, in 2020, you needed $60,000 of annual income to afford a house. In other words, the income required to own a home has risen by 85% in 3 years. The gap between median income and income needed to afford a house is ~25% LARGER than it was in 2008". - TKL

https://twitter.com/KobeissiLetter/status/1718297045088211152

I will end this week’s Weekly Recap with a tweet by Preston Pysh:

Must Read Quote From Luke Gromen:

“Many investors appear to be operating under a misapprehension that this cycle is just like all the previous cycles in their career, even though the FED has *NEVER* tightened with debt/GDP at 120%, deficits/GDP at 6%, or US Net International Investment Position at -65% of GDP….

…. LET ALONE TIGHTENED WITH ALL THREE BEING TRUE AT ONCE! …

The implications of this are critical: On one hand, if the FED keeps tightening from here, they are going to lose the long end (at least until they create an outright 1987-like stock market crash, and then stand aside as the system implodes)…and even then, the bid for USTs will only last until tax receipts collapse and UST issuance skyrockets. On the other hand, if the FED loosens policy from here, they are also going to lose the long end.”

@LukeGromen

All I can say (Preston): Got Bitcoin?!"

Credit: I have used multiple sources!

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: nostr:npub1sqzr42dj8vx32yd5jcvvl3ytux45kl0etgf6y2ymjvmd7lqmuwmqk9vk7vis especially suited for beginners or people that want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info.

⠀⠀⠀⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple.

⠀⠀⠀⠀⠀⠀⠀⠀

Is this post helpful to you? If so, please share it and support my work with sats. #zap 🧡 #weeklyrecap #nostr #plebchain #grownostr #stacksats

Reality!

No luck, just hard work & conviction🧡

#zap 🧡 #bitcoin #nostr #plebchain #grownostr #stacksats

🧠Quote(s) of the week:

"Buy Bitcoin and self custody.

- Bitcoin doesn’t care about Gensler.

- Bitcoin doesn’t care about war.

- Bitcoin doesn’t care about SBF.

- Bitcoin doesn’t care about BlackRock.

- Bitcoin doesn’t care about fake news.

- Bitcoin doesn’t care about price targets.

Tick tock, another block."

Predicting emergent complex behavior on an honest, immutable ledger is very difficult if you're measuring it from a dishonest, manipulated ledger. What system are you measuring from? Bitcoin! - Jeff Booth

"If you’re new to Bitcoin you may have heard the term “cycle theory” thrown around. Put simply, cycle theory suggests that Bitcoiners in proximity to each other will get their period at the same time. This group menstrual phenomenon is colloquially referred to as the bear market and lasts on average 3 years."- Hodl

🧡Bitcoin news:

➡️ Yesterday we received the news that FinCEN is proposing to apply section 311 of the Patriot Act against basically all types of crypto privacy, including noncustodial methods. On top of that, you add the fact that the BIS, as discussed in last week's Weekly Recap, released its Project Atlas whitepaper which aims to monitor and track every move on the 'Blockchain'.

We are in the: then they fight you (stage)!

FinCEN is one of 18+ (we don’t know how many there are for sure) U.S. Federal intelligence organizations. It shares data with intelligence orgs in 100+ other countries. It derives its authority from the 1970 Banking Secrecy Act and the Patriot Act.

If you are not familiar with the recent FinCEN proposal, read Brian Trollz's (Shinobi): "FinCEN Proposals Insane Special Measures" to learn about the recent draconian government proposal. We have 90 days to respond. They want every transaction tracked.

https://bitcoinmagazine.com/legal/fincen-proposes-insane-special-measures

As Lyn Alden mentioned on X: "The gates are down. The more that automated privacy techniques become ubiquitous, the less powerful their surveillance techniques are. Victory by a thousand cuts and civil disobedience of people wanting their spending to be secure and private."

https://twitter.com/AnselLindner/status/1715855382919188855

And I fully agree with Jeff Booth: "An important reminder that coercion and control is the end state of manipulated money. (loss of individual rights and freedoms) If it didn't look like that, would the places with the most broken money would have the best laws "protecting" people"

https://twitter.com/JeffBooth/status/1715732119480352804

➡️ According to @SGJohnsson the amended BlackRock spot Bitcoin ETF filing says they may be looking to seed the ETF with cash this month. Don’t want to read that much into it but it is new info not in the original filing so noteworthy (esp because they are BlackRock.

The race is on people!

Just a caution flag. Don't FOMO in!!

➡️ Argentina's presidential election is now (Sunday evening) underway. Are you ready for the next Bitcoin president? Argentina's economy is about 20x bigger than El Salvador's and a pro-Bitcoin candidate is leading the polls heading into today’s election. Pro-Bitcoin Presidential candidate in Argentina leads his rival into the election held today.

Javier Milei: 30%

Sergio Massa: 25%

Result: "Argentina's ruling Peronist coalition smashed expectations to lead the country's general election on Sunday, setting the stage for a polarized run-off vote next month between Economy Minister Sergio Massa and far-right libertarian radical Javier Milei.

Massa had 36.6% of the vote, ahead of Milei on just over 30%, while conservative Patricia Bullrich was behind on 23.8% with nearly 98% of the vote counted, a result that defied pre-election polls that had predicted a libertarian win."- Reuters

➡️ After Jim Cramer said: "Bitcoin is about to go down big!" Bitcoin is up by roughly 13%. This guy is a friggin' national treasure as an inverse indicator, everything that man is saying should be taken in a contrarian way, and he should be protected at all costs.

➡️Bitcoin dominance hits highest point in over two years.

➡️ Bitcoin hash rate is going absolutely parabolic, smashing through 450TH/s and another all-time high this week.

➡️CEO of BlackRock, Larry Fink during the rally that started last week. "This rally today is way beyond the [bitcoin spot ETF] rumor. The rally today is about a flight to quality."

This was not on my Bingo Bitcoin 2023 card. I really didn't foresee Larry Fink of all people becoming Bitcoin's marketing department, pushing it as a "flight to quality" due to difficult geopolitical times. Funny how game theory works isn't?

➡️"A significant % of Bitcoin's realized cap comes from coins that have not moved in 2 years or longer. This trend historically precedes bull markets. Supply illiquidity is the charcoal, logs, and kindling. Demand is the match. The halving is lighter fluid" - MitchellHodl

➡️ https://twitter.com/DocumentingBTC/status/1714335426234773917

Great news, not because it is faster to mine, but because open-source mining can open up creativity and innovation for dual-purpose mining. Next to that from a decentralization perspective, we need to have more miner choices than the Chinese ones.

➡️ Bitbox: Bringing Lightning to the BitBoxApp! Bitbox is exploring seamless, non-custodial Lightning payments directly within the BitBoxApp by partnering with

Breeze and using their Breez SDK (read here for more on the SDK)

https://breez.technology/sdk/Why does Bitbox want to add Lightning Support to their cold storage wallet?

By adding a non-custodial Lightning wallet to the already familiar BitBoxApp, they can create a secure and seamless experience to spend your Bitcoin wherever you go. All this without a custodian having control over your funds.

Great addition! For more info: read here https://bitbox.swiss/blog/bringing-lightning-to-the-bitboxapp/

Get your Bitbox02 (Bitcoin-only version) now here: https://bitbox.swiss/bitbox02/?ref=IYjAmzKEXw

➡️ At the Plan B conference in Lugano Relai announced that they will integrate Lightning into the app.

For more info read the news blog:

https://cryptofriday.eu/index.php/2023/10/22/relai-soon-lightning-fast/

➡️ Follow the Money Series: by Peter McCormack. https://whatbitcoindid.com/wbd-films

These are really solid documentaries. Highly recommend watching all four films.

- FTM #1: Bitcoin in El Salvador

- FTM #2: Inflation, The Hidden Tax

- FTM #3: Dear Elizabeth Warren

- FTM #4: Argentina's Inflation Crisis

➡️ Bitcoin supply held by long-term investors hit an All-Time high of 76%

➡️Bitcoin dominance clocking in at ca. 52.27%. The highest level in 908 days

➡️ Bitcoin hash rate is going absolutely parabolic, smashing through 450TH/s and another all-time high this week.

➡️ Blockchain data shows a record 76% of Bitcoin is owned by ‘long-term hodlers’ who have not moved their coins in +155 days.

💸Traditional Finance / Macro:

👉🏽As mentioned last week a few tech stocks are still the backbone of the market, the S&P500. And no that is not the real economy.

The S&P 493 is now up just ~4% in 2023 while tech stocks continue to push higher. Meanwhile, the S&P 7, which is the remaining 7 large tech stocks in the S&P 500, is up ~57% in 2023. Combined, the S&P 500 is up ~14% YTD. Without tech stocks and recent AI hype, markets would be significantly lower.

🏦Banks:

👉🏽 Bank of America reports a $131.6 billion unrealized loss on securities in Q3.

"Unrealized losses have come under closer scrutiny by investors since March. At the time, SVB sold a portfolio of its holding at a sharp loss, precipitating its collapse and fueling the worst industry turmoil since the 2008 financial crisis"

Source: Reuters

🌏Macro/Geopolitics:

👉🏽 According to the CBO, The US government paid $711 billion in net interest payments this year. This is an increase of $177 billion, or 33%, from fiscal year 2022. Average interest rates on Federal debt have gone from 1.5% in 2022 to nearly 3.0% today. Annualized US interest expense is expected to hit $1.2 trillion in the coming years.

Since the debt ceiling "crisis" ended, total US debt is up over $2 trillion.

Since 2020, total US debt is officially up more than $10 TRILLION.

Remember, FED revenue in 2022 was $ 4.9 trillion. The US government is not fiscally healthy, and shit will hit the fan real quick.

"UST yields continue to break the banks. 10s are at a 16-year high of 4.91% — meanwhile, the 30s crossed 5% for the first time since 2006 As yields soar, the price of outstanding bonds falls. This has left a hole in banks' balance sheets, $1.625 trillion in size, and counting." - Joe Consorti

With the most recent leg down, this US bond selloff is on par with the largest ever in history. It's also in line with the largest falls for major countries that didn't lose a world war or have hyperinflation.

"Bottom line, either way, this current extreme move in yields is setting up for a reversal into next year. There is no other choice. If not they can kiss their soft landing goodbye and risk a systemic break driven by another policy error. The original error: Staying too easy for too long being out of sync with market reality. The new error would be: Staying too tight for too long being again out of synch with market reality."

Oh, by the way, the dollar has lost 17% of its purchasing power in the last 3 years. And that is if you believe the CPI is accurate. Most people know if it intentionally underreported inflation. So the loss in purchasing power is actually much more than 17%. If you are living in the States... is your salary up 25% in the past 3 years? If not you are (probably poorer.

👉🏽 Meanwhile, China has cut its holdings in US Treasuries to $805bn, the lowest level since 2009. Beijing has been selling $502bn in Treasuries in the past decade, & pace of Chinese selling has been accelerated recently. Now this looks bad. But some macroeconomists mention that out of the reported 22-23% drawdown in the Chinese holding of US Treasuries over the past 2 years, around 15-16% point is driven by mark-to-market effects.

More on this topic a great tweet by Jeroen Blokland:

- BRICS & Friends now hold more gold than the US.

- Moreover, the chart shows BRICS+ have been adding gold to their reserves for over a decade.

- Recently, the pace of gold accumulation has been increasing. Why do you think this is?

And equally important, does that mean you should add gold to your reserves as well?

You do not have to embrace extremely bearish views about the world to allow for structural changes in financial markets and, hence, your portfolio"

BRICS countries dump $ 123 billion in U.S. Treasuries in 2023.

Outside money, hence treasuries/bonds X

Inside money, hence hard money -> Gold... now ask yourself what is digital gold?

Bitcoin

👉🏽 "The ratio of the Nasdaq to US Treasuries return is currently at a record 8.2x. To put this in perspective, even at the peak of the 2001 bubble, the largest tech bubble in history, this ratio was ~4.8x. In other words, the Nasdaq to US Treasuries return ratio is now 70% HIGHER than it was in 2001. It's now also 5.5x HIGHER than it was at the peak of the 2008 financial crisis. There has never been a larger gap between return in equities and US Treasuries." - The Kobeissi Letter

👉🏽 For the first time in 23 years, 8% mortgage rates are officially back. Less than 3 years ago, the average rate on a 30-year mortgage was just 2.6%. The median monthly payment for homebuyers will cross $3,000 this month. We are paying the price for "free" money after $4 trillion of stimulus in years of zero-rate policy.

👉🏽 On the 18th of October we received the news that the Governing Council (ECB) has decided to move to the next phase of the digital euro project.

Lagarde: "We need to prepare our currency for the future. While we haven’t yet decided whether to issue a digital euro, we’re getting ready. We envisage a digital euro as a digital form of cash that can be used for all digital payments, coexisting with physical cash, leaving no one behind."

Lyn Alden: "They say that it would coexist with physical cash, but it’s important to keep in mind that once both exist, it is much easier to phase out physical cash. Most changes to the financial system have been piecemeal, swapping out one small item at a time until it’s totally different."

My view: Lagarde getting community notes on the ECB CBDC. The digital euro has nothing to do with cash at all. Don't trust, verify! The digital euro is not digital in any meaningful sense. It's a CBDC and controlled by the ECB. Its ownership can be revoked with a keystroke as it lives in a centralized ledger controlled by the ECB. Cash is anonymous. The digital euro is not. Bitcoin is dictator-proof. Buy Bitcoin while they still allow you to use YOUR money to buy what YOU want.

Freaking scammers / liars: https://twitter.com/thomas_fahrer/status/1715159540684255316

Oh by the way, Bitcoin is up 81% since "Bitcoin's Last Stand" was published on the ECB blog.

https://twitter.com/BitcoinNewsCom/status/1715879846214046035

Credit: I have used multiple sources!

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: nostr:npub1sqzr42dj8vx32yd5jcvvl3ytux45kl0etgf6y2ymjvmd7lqmuwmqk9vk7vis especially suited for beginners or people that want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info.

⠀⠀⠀⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple.

⠀⠀⠀⠀⠀⠀⠀⠀

Is this post helpful to you? If so, please share it and support my work with sats. #zap 🧡 #weeklyrecap #nostr #plebchain #grownostr #stacksats

🧠Quote(s) of the week:

"Buy Bitcoin and self custody.

- Bitcoin doesn’t care about Gensler.

- Bitcoin doesn’t care about war.

- Bitcoin doesn’t care about SBF.

- Bitcoin doesn’t care about BlackRock.

- Bitcoin doesn’t care about fake news.

- Bitcoin doesn’t care about price targets.

Tick tock, another block."

Predicting emergent complex behavior on an honest, immutable ledger is very difficult if you're measuring it from a dishonest, manipulated ledger. What system are you measuring from? Bitcoin! - Jeff Booth

"If you’re new to Bitcoin you may have heard the term “cycle theory” thrown around. Put simply, cycle theory suggests that Bitcoiners in proximity to each other will get their period at the same time. This group menstrual phenomenon is colloquially referred to as the bear market and lasts on average 3 years."- Hodl

🧡Bitcoin news:

➡️ Yesterday we received the news that FinCEN is proposing to apply section 311 of the Patriot Act against basically all types of crypto privacy, including noncustodial methods. On top of that, you add the fact that the BIS, as discussed in last week's Weekly Recap, released its Project Atlas whitepaper which aims to monitor and track every move on the 'Blockchain'.

We are in the: then they fight you (stage)!

FinCEN is one of 18+ (we don’t know how many there are for sure) U.S. Federal intelligence organizations. It shares data with intelligence orgs in 100+ other countries. It derives its authority from the 1970 Banking Secrecy Act and the Patriot Act.

If you are not familiar with the recent FinCEN proposal, read Brian Trollz's (Shinobi): "FinCEN Proposals Insane Special Measures" to learn about the recent draconian government proposal. We have 90 days to respond. They want every transaction tracked.

https://bitcoinmagazine.com/legal/fincen-proposes-insane-special-measures

As Lyn Alden mentioned on X: "The gates are down. The more that automated privacy techniques become ubiquitous, the less powerful their surveillance techniques are. Victory by a thousand cuts and civil disobedience of people wanting their spending to be secure and private."

https://twitter.com/AnselLindner/status/1715855382919188855

And I fully agree with Jeff Booth: "An important reminder that coercion and control is the end state of manipulated money. (loss of individual rights and freedoms) If it didn't look like that, would the places with the most broken money would have the best laws "protecting" people"

https://twitter.com/JeffBooth/status/1715732119480352804

➡️ According to @SGJohnsson the amended BlackRock spot Bitcoin ETF filing says they may be looking to seed the ETF with cash this month. Don’t want to read that much into it but it is new info not in the original filing so noteworthy (esp because they are BlackRock.

The race is on people!

Just a caution flag. Don't FOMO in!!

➡️ Argentina's presidential election is now (Sunday evening) underway. Are you ready for the next Bitcoin president? Argentina's economy is about 20x bigger than El Salvador's and a pro-Bitcoin candidate is leading the polls heading into today’s election. Pro-Bitcoin Presidential candidate in Argentina leads his rival into the election held today.

Javier Milei: 30%

Sergio Massa: 25%

Result: "Argentina's ruling Peronist coalition smashed expectations to lead the country's general election on Sunday, setting the stage for a polarized run-off vote next month between Economy Minister Sergio Massa and far-right libertarian radical Javier Milei.

Massa had 36.6% of the vote, ahead of Milei on just over 30%, while conservative Patricia Bullrich was behind on 23.8% with nearly 98% of the vote counted, a result that defied pre-election polls that had predicted a libertarian win."- Reuters

➡️ After Jim Cramer said: "Bitcoin is about to go down big!" Bitcoin is up by roughly 13%. This guy is a friggin' national treasure as an inverse indicator, everything that man is saying should be taken in a contrarian way, and he should be protected at all costs.

➡️Bitcoin dominance hits highest point in over two years.

➡️ Bitcoin hash rate is going absolutely parabolic, smashing through 450TH/s and another all-time high this week.

➡️CEO of BlackRock, Larry Fink during the rally that started last week. "This rally today is way beyond the [bitcoin spot ETF] rumor. The rally today is about a flight to quality."

This was not on my Bingo Bitcoin 2023 card. I really didn't foresee Larry Fink of all people becoming Bitcoin's marketing department, pushing it as a "flight to quality" due to difficult geopolitical times. Funny how game theory works isn't?

➡️"A significant % of Bitcoin's realized cap comes from coins that have not moved in 2 years or longer. This trend historically precedes bull markets. Supply illiquidity is the charcoal, logs, and kindling. Demand is the match. The halving is lighter fluid" - MitchellHodl

➡️ https://twitter.com/DocumentingBTC/status/1714335426234773917

Great news, not because it is faster to mine, but because open-source mining can open up creativity and innovation for dual-purpose mining. Next to that from a decentralization perspective, we need to have more miner choices than the Chinese ones.

➡️ Bitbox: Bringing Lightning to the BitBoxApp! Bitbox is exploring seamless, non-custodial Lightning payments directly within the BitBoxApp by partnering with

Breeze and using their Breez SDK (read here for more on the SDK)

https://breez.technology/sdk/Why does Bitbox want to add Lightning Support to their cold storage wallet?

By adding a non-custodial Lightning wallet to the already familiar BitBoxApp, they can create a secure and seamless experience to spend your Bitcoin wherever you go. All this without a custodian having control over your funds.

Great addition! For more info: read here https://bitbox.swiss/blog/bringing-lightning-to-the-bitboxapp/

Get your Bitbox02 (Bitcoin-only version) now here: https://bitbox.swiss/bitbox02/?ref=IYjAmzKEXw

➡️ At the Plan B conference in Lugano Relai announced that they will integrate Lightning into the app.

For more info read the news blog:

https://cryptofriday.eu/index.php/2023/10/22/relai-soon-lightning-fast/

➡️ Follow the Money Series: by Peter McCormack. https://whatbitcoindid.com/wbd-films

These are really solid documentaries. Highly recommend watching all four films.

- FTM #1: Bitcoin in El Salvador

- FTM #2: Inflation, The Hidden Tax

- FTM #3: Dear Elizabeth Warren

- FTM #4: Argentina's Inflation Crisis

➡️ Bitcoin supply held by long-term investors hit an All-Time high of 76%

➡️Bitcoin dominance clocking in at ca. 52.27%. The highest level in 908 days

➡️ Bitcoin hash rate is going absolutely parabolic, smashing through 450TH/s and another all-time high this week.

➡️ Blockchain data shows a record 76% of Bitcoin is owned by ‘long-term hodlers’ who have not moved their coins in +155 days.

💸Traditional Finance / Macro:

👉🏽As mentioned last week a few tech stocks are still the backbone of the market, the S&P500. And no that is not the real economy.

The S&P 493 is now up just ~4% in 2023 while tech stocks continue to push higher. Meanwhile, the S&P 7, which is the remaining 7 large tech stocks in the S&P 500, is up ~57% in 2023. Combined, the S&P 500 is up ~14% YTD. Without tech stocks and recent AI hype, markets would be significantly lower.

🏦Banks:

👉🏽 Bank of America reports a $131.6 billion unrealized loss on securities in Q3.

"Unrealized losses have come under closer scrutiny by investors since March. At the time, SVB sold a portfolio of its holding at a sharp loss, precipitating its collapse and fueling the worst industry turmoil since the 2008 financial crisis"

Source: Reuters

🌏Macro/Geopolitics:

👉🏽 According to the CBO, The US government paid $711 billion in net interest payments this year. This is an increase of $177 billion, or 33%, from fiscal year 2022. Average interest rates on Federal debt have gone from 1.5% in 2022 to nearly 3.0% today. Annualized US interest expense is expected to hit $1.2 trillion in the coming years.

Since the debt ceiling "crisis" ended, total US debt is up over $2 trillion.

Since 2020, total US debt is officially up more than $10 TRILLION.

Remember, FED revenue in 2022 was $ 4.9 trillion. The US government is not fiscally healthy, and shit will hit the fan real quick.

"UST yields continue to break the banks. 10s are at a 16-year high of 4.91% — meanwhile, the 30s crossed 5% for the first time since 2006 As yields soar, the price of outstanding bonds falls. This has left a hole in banks' balance sheets, $1.625 trillion in size, and counting." - Joe Consorti

With the most recent leg down, this US bond selloff is on par with the largest ever in history. It's also in line with the largest falls for major countries that didn't lose a world war or have hyperinflation.

"Bottom line, either way, this current extreme move in yields is setting up for a reversal into next year. There is no other choice. If not they can kiss their soft landing goodbye and risk a systemic break driven by another policy error. The original error: Staying too easy for too long being out of sync with market reality. The new error would be: Staying too tight for too long being again out of synch with market reality."

Oh, by the way, the dollar has lost 17% of its purchasing power in the last 3 years. And that is if you believe the CPI is accurate. Most people know if it intentionally underreported inflation. So the loss in purchasing power is actually much more than 17%. If you are living in the States... is your salary up 25% in the past 3 years? If not you are (probably poorer.

👉🏽 Meanwhile, China has cut its holdings in US Treasuries to $805bn, the lowest level since 2009. Beijing has been selling $502bn in Treasuries in the past decade, & pace of Chinese selling has been accelerated recently. Now this looks bad. But some macroeconomists mention that out of the reported 22-23% drawdown in the Chinese holding of US Treasuries over the past 2 years, around 15-16% point is driven by mark-to-market effects.

More on this topic a great tweet by Jeroen Blokland:

- BRICS & Friends now hold more gold than the US.

- Moreover, the chart shows BRICS+ have been adding gold to their reserves for over a decade.

- Recently, the pace of gold accumulation has been increasing. Why do you think this is?

And equally important, does that mean you should add gold to your reserves as well?

You do not have to embrace extremely bearish views about the world to allow for structural changes in financial markets and, hence, your portfolio"

BRICS countries dump $ 123 billion in U.S. Treasuries in 2023.

Outside money, hence treasuries/bonds X

Inside money, hence hard money -> Gold... now ask yourself what is digital gold?

Bitcoin

👉🏽 "The ratio of the Nasdaq to US Treasuries return is currently at a record 8.2x. To put this in perspective, even at the peak of the 2001 bubble, the largest tech bubble in history, this ratio was ~4.8x. In other words, the Nasdaq to US Treasuries return ratio is now 70% HIGHER than it was in 2001. It's now also 5.5x HIGHER than it was at the peak of the 2008 financial crisis. There has never been a larger gap between return in equities and US Treasuries." - The Kobeissi Letter

👉🏽 For the first time in 23 years, 8% mortgage rates are officially back. Less than 3 years ago, the average rate on a 30-year mortgage was just 2.6%. The median monthly payment for homebuyers will cross $3,000 this month. We are paying the price for "free" money after $4 trillion of stimulus in years of zero-rate policy.

👉🏽 On the 18th of October we received the news that the Governing Council (ECB) has decided to move to the next phase of the digital euro project.

Lagarde: "We need to prepare our currency for the future. While we haven’t yet decided whether to issue a digital euro, we’re getting ready. We envisage a digital euro as a digital form of cash that can be used for all digital payments, coexisting with physical cash, leaving no one behind."

Lyn Alden: "They say that it would coexist with physical cash, but it’s important to keep in mind that once both exist, it is much easier to phase out physical cash. Most changes to the financial system have been piecemeal, swapping out one small item at a time until it’s totally different."

My view: Lagarde getting community notes on the ECB CBDC. The digital euro has nothing to do with cash at all. Don't trust, verify! The digital euro is not digital in any meaningful sense. It's a CBDC and controlled by the ECB. Its ownership can be revoked with a keystroke as it lives in a centralized ledger controlled by the ECB. Cash is anonymous. The digital euro is not. Bitcoin is dictator-proof. Buy Bitcoin while they still allow you to use YOUR money to buy what YOU want.

Freaking scammers / liars: https://twitter.com/thomas_fahrer/status/1715159540684255316

Oh by the way, Bitcoin is up 81% since "Bitcoin's Last Stand" was published on the ECB blog.

https://twitter.com/BitcoinNewsCom/status/1715879846214046035

Credit: I have used multiple sources!

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: nostr:npub1sqzr42dj8vx32yd5jcvvl3ytux45kl0etgf6y2ymjvmd7lqmuwmqk9vk7vis especially suited for beginners or people that want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info.

⠀⠀⠀⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple.

⠀⠀⠀⠀⠀⠀⠀⠀

Is this post helpful to you? If so, please share it and support my work with sats. #zap 🧡 #weeklyrecap #nostr #plebchain #grownostr #stacksats

🧠Quote(s) of the week:

"Buy Bitcoin and self custody.

- Bitcoin doesn’t care about Gensler.

- Bitcoin doesn’t care about war.

- Bitcoin doesn’t care about SBF.

- Bitcoin doesn’t care about BlackRock.

- Bitcoin doesn’t care about fake news.

- Bitcoin doesn’t care about price targets.

Tick tock, another block."

Predicting emergent complex behavior on an honest, immutable ledger is very difficult if you're measuring it from a dishonest, manipulated ledger. What system are you measuring from? Bitcoin! - Jeff Booth

"If you’re new to Bitcoin you may have heard the term “cycle theory” thrown around. Put simply, cycle theory suggests that Bitcoiners in proximity to each other will get their period at the same time. This group menstrual phenomenon is colloquially referred to as the bear market and lasts on average 3 years."- Hodl

🧡Bitcoin news:

➡️ Yesterday we received the news that FinCEN is proposing to apply section 311 of the Patriot Act against basically all types of crypto privacy, including noncustodial methods. On top of that, you add the fact that the BIS, as discussed in last week's Weekly Recap, released its Project Atlas whitepaper which aims to monitor and track every move on the 'Blockchain'.

We are in the: then they fight you (stage)!

FinCEN is one of 18+ (we don’t know how many there are for sure) U.S. Federal intelligence organizations. It shares data with intelligence orgs in 100+ other countries. It derives its authority from the 1970 Banking Secrecy Act and the Patriot Act.

If you are not familiar with the recent FinCEN proposal, read Brian Trollz's (Shinobi): "FinCEN Proposals Insane Special Measures" to learn about the recent draconian government proposal. We have 90 days to respond. They want every transaction tracked.

https://bitcoinmagazine.com/legal/fincen-proposes-insane-special-measures

As Lyn Alden mentioned on X: "The gates are down. The more that automated privacy techniques become ubiquitous, the less powerful their surveillance techniques are. Victory by a thousand cuts and civil disobedience of people wanting their spending to be secure and private."

https://twitter.com/AnselLindner/status/1715855382919188855

And I fully agree with Jeff Booth: "An important reminder that coercion and control is the end state of manipulated money. (loss of individual rights and freedoms) If it didn't look like that, would the places with the most broken money would have the best laws "protecting" people"

https://twitter.com/JeffBooth/status/1715732119480352804

➡️ According to @SGJohnsson the amended BlackRock spot Bitcoin ETF filing says they may be looking to seed the ETF with cash this month. Don’t want to read that much into it but it is new info not in the original filing so noteworthy (esp because they are BlackRock.

The race is on people!

Just a caution flag. Don't FOMO in!!

➡️ Argentina's presidential election is now (Sunday evening) underway. Are you ready for the next Bitcoin president? Argentina's economy is about 20x bigger than El Salvador's and a pro-Bitcoin candidate is leading the polls heading into today’s election. Pro-Bitcoin Presidential candidate in Argentina leads his rival into the election held today.

Javier Milei: 30%

Sergio Massa: 25%

Result: "Argentina's ruling Peronist coalition smashed expectations to lead the country's general election on Sunday, setting the stage for a polarized run-off vote next month between Economy Minister Sergio Massa and far-right libertarian radical Javier Milei.

Massa had 36.6% of the vote, ahead of Milei on just over 30%, while conservative Patricia Bullrich was behind on 23.8% with nearly 98% of the vote counted, a result that defied pre-election polls that had predicted a libertarian win."- Reuters

➡️ After Jim Cramer said: "Bitcoin is about to go down big!" Bitcoin is up by roughly 13%. This guy is a friggin' national treasure as an inverse indicator, everything that man is saying should be taken in a contrarian way, and he should be protected at all costs.

➡️Bitcoin dominance hits highest point in over two years.

➡️ Bitcoin hash rate is going absolutely parabolic, smashing through 450TH/s and another all-time high this week.

➡️CEO of BlackRock, Larry Fink during the rally that started last week. "This rally today is way beyond the [bitcoin spot ETF] rumor. The rally today is about a flight to quality."

This was not on my Bingo Bitcoin 2023 card. I really didn't foresee Larry Fink of all people becoming Bitcoin's marketing department, pushing it as a "flight to quality" due to difficult geopolitical times. Funny how game theory works isn't?

➡️"A significant % of Bitcoin's realized cap comes from coins that have not moved in 2 years or longer. This trend historically precedes bull markets. Supply illiquidity is the charcoal, logs, and kindling. Demand is the match. The halving is lighter fluid" - MitchellHodl

➡️ https://twitter.com/DocumentingBTC/status/1714335426234773917

Great news, not because it is faster to mine, but because open-source mining can open up creativity and innovation for dual-purpose mining. Next to that from a decentralization perspective, we need to have more miner choices than the Chinese ones.

➡️ Bitbox: Bringing Lightning to the BitBoxApp! Bitbox is exploring seamless, non-custodial Lightning payments directly within the BitBoxApp by partnering with

Breeze and using their Breez SDK (read here for more on the SDK)

https://breez.technology/sdk/Why does Bitbox want to add Lightning Support to their cold storage wallet?

By adding a non-custodial Lightning wallet to the already familiar BitBoxApp, they can create a secure and seamless experience to spend your Bitcoin wherever you go. All this without a custodian having control over your funds.

Great addition! For more info: read here https://bitbox.swiss/blog/bringing-lightning-to-the-bitboxapp/

Get your Bitbox02 (Bitcoin-only version) now here: https://bitbox.swiss/bitbox02/?ref=IYjAmzKEXw

➡️ At the Plan B conference in Lugano Relai announced that they will integrate Lightning into the app.

For more info read the news blog: