The Latest Bitcoin & Macro news: Weekly Recap 01.12.2025

If you would rather read the long format, enriched with detailed charts, illustrative images, and comprehensive macroeconomic news to provide context and clarity. (outside of Nostr) Click here:

Do you think this post is helpful? If so, please share it with your friends, family co-workers, and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐️ Many thanks⭐️

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

On Nostr, I will exclusively share the most significant Bitcoin news. (this note)

For those (still) beyond Nostr—friends, family, and colleagues—the complete Weekly Recap will be accessible on my Bitcoin Friday page on Yakihonne. (next note)

Enriched with detailed charts, illustrative images, and comprehensive macroeconomic news to provide context and clarity.

Happy reading!

The Latest Bitcoin & Macro news: Weekly Recap 01.12.2025

## 🧠Quote(s) of the week:

'I didn't choose the dollar.

I didn't choose the euro.

I didn't choose the pound.

I didn't choose the yen.

I didn't choose the ruble.

I didn't choose fractional reserve banking.

I didn't choose central banks.

I didn't choose quantitative easing.

I choose Bitcoin.' - Bitcoin Teddy

## 🧡Bitcoin news🧡

People want desperately to see Bitcoin fail because watching it succeed would mean admitting their entire worldview was wrong. It’s the same psychology that resisted the shift from geocentric to heliocentric. From “the state defines value” to “reality defines value”. - Bitmund Freud

https://cdn.azzamo.net/268e40fd299df6ad3344729b3edf07d6121b3b45e3fa84c4609a6d14f6a1cf38.webp

Photos hosted by Azzamo (https://azzamo.net/)

On the 21st of November:

➡️"Tokenization is a megatrend." - Robin Vince, Bank of New York Mellon CEO

- the oldest bank in America

- the largest custody bank in the world ($53T)

- one of the most widely used service providers in tradfi

Now you think this is positive. Right!? Nope!

Tokenization is just a more complicated form of ownership.

Remember, Bitcoin, not Crypto.

➡️Joe Consorti: 'Bitcoin is increasingly beholden to the macro backdrop with each passing cycle.

Looking at the NFCI financial conditions index, BTC surges as financial conditions loosen and drops as financial conditions tighten/stagnate → this has happened reliably with a 4-6 week lead/lag. The Fed ends QT in early December. A resumption of asset purchases is likely soon after.

With financial conditions set to ease further, we will probably fully set the local bottom and begin making higher highs mid-late December.

Not to mention how oversold BTC is across all timeframes.'

https://cdn.azzamo.net/ea6da4264bc5a6eaf1a660986bb06e1829f53492be78cf11f0ea932253bb5eae.webp

On the 22nd of November:

➡️Bitcoin fell below the average Bitcoin ETFs purchase price.-Quinten

https://cdn.azzamo.net/b36328559de918a4cd7e98b8f7f0debbc69be0106a5d07ad234828135b60b48b.webp

➡️Sales of Strategy’s Bitcoin-backed credit products jumped 50 percent week over week. Despite the unprecedented FUD aimed at the company this week, the numbers tell a very different story. - Bitcoin News

https://cdn.azzamo.net/ad16517567d04aaee5b4959ca6c8b45c2456abc25fa17631d82751d4b7b2229d.webp

➡️'Bitcoin: It's not complicated. **Not Financial Advice**

My odds of knowing where the bottom is.

85% = $70,000 to $80,000

10% = $60,000 to $70,000

4.9% = $50,000 to $60,000

0.1% = $50,000 or less.' - Plan C

Luke Broyles put it out perfectly:

'Anyway, Bitcoin going to $150,000 after buying Bitcoin at $126,000 is a 19% gain. Bitcoin going to $150,000 after buying Bitcoin at $85,000 is a 76% gain.

Your % return is now 4x better.

This is a bummer, but only for the over-leveraged.'

Honey Badger DGAF!

https://cdn.azzamo.net/988c22a941f1831ae9e84ea7dde1d3d6980b344e9f27efee061aec626b2ac836.webp

➡️Bitcoin flashed the most oversold signal since $25,000.

➡️'Only the 6th time in Bitcoin history that it has been this oversold. Historic major bounces have occurred between 25 and 35—we are currently at 35.' -PlanC

Could this be the end of the bear market?

➡️Fed Chair Jerome Powell claims that Bitcoin is “just like digital gold”.

Bitcoin is not a competitor with the dollar but is a competitor with gold misses the overarching point that both gold and Bitcoin are serious competitors with the dollar. The dollar and all fiat currencies are doomed.

➡️Bitcoin News: A Bitcoin whale who had held since 2011 just cashed out their entire position, walking away with $1.3 billion in profits and zero BTC.

On the 23rd of November:

➡️Forum user asks Satoshi Nakamoto on November 22nd, 2009, “Are there any plans to make this service anonymous?” Satoshi responds, “There will be proxy settings in version 0.2 so you can connect through TOR.”

➡️Bitcoin News: JP Morgan dumped 25% of their MSTR position right before MSCI announced Bitcoin companies can’t enter major indexes. Totally normal timing, right?

https://cdn.azzamo.net/7a5cc4a0396eafbe766418f81f89fafbda570d52470f1bdb788e4f38f6ddcff6.webp

Just a giant bank with perfect timing, selling right before a decision they definitely didn’t know about in advance. Pure coincidence. Nothing to see here.

➡️A major academic study on Bitcoin bans finds that Bitcoin bans can't stop BTC. Researchers analyzed 19 countries from 2013 to 2024 and discovered that Bitcoin’s decentralized network keeps markets integrated even under strict bans. China and Russia showed only partial segmentation, while smaller markets saw counterintuitive increases in integration after bans. The study concludes that unilateral restrictions are largely ineffective.

➡️Bitcoin Archive: SAYLOR ON POTENTIAL LIQUIDATION:

"As long as Bitcoin goes up 1.25% a year, we can pay the dividend forever." "If Bitcoin stops going up, we've got 80 years to figure out what we're going to do about that." I think they'll be alright.

➡️Overnight, 630,000 Bitcoin were removed from exchanges.

➡️'Rising difficulty. Shrinking target. Same result: tick tock, next block.

Assuming a network efficiency of 12–18 J/TH and a hashrate of 1.09 ZH/s, Bitcoin is consuming roughly 13–20 GW of power right now.

https://cdn.azzamo.net/9833f37b9277283ddf295463c6c4a845209d56b3cd4c56154003992e9297cd99.webp

I don't think people understand just how ridiculously large a zettahash is...1,000,000,000,000,000,000,000, and that's per second! Bitcoin's proof of work is uncontested.' - Wicked

People who have no idea what this is, or what it means, will tell you Bitcoin doesn’t work. This is the largest distributed computer in existence. Gets bigger every day. Gets more efficient every day. The network is alive and thriving.

Oliver L. Velez: The three tools that have historically kept the masses blind, poor, and away from winning:

1) Fear campaigns of a pending threat. "Stay away!" (quantum);

2) Distraction with temporarily shinier-seeming alternatives to the clear winner (Zcash); If these aren't working so well...

3) Divide and conquer from within (Core Knots).

Bitcoin won't succumb to these age-old tactics, though. Its anti-fragility will only lead to these things making it stronger. BTC solved the Byzantine Generals' Dilemma. Look it up. The future is very bright, and we're stronger and stronger than ever.

➡️A SOLO MINER JUST HIT THE JACKPOT! A miner with a tiny setup running only 6 terahashes per second, so small it barely even registers on the Bitcoin network, managed to mine a full block and earn 3.146 BTC plus fees worth about $265,000.

➡️Bitcoin is Simple:

'1) DCA. 1A) Lump-Sum once Fear and Greed hit “Extreme Fear”. 2) Move Coins to Cold Storage. 3) Never sell. Rinse and Repeat. Your entire bloodline will be forever grateful.' - CarlBMenger

➡️Not really Bitcoin related, but in the end, yeah, Bitcoin related:

JPMorgan Chase, Citibank, and Morgan Stanley are among those that have been notified by Situsamc that their client data may have been taken- The New York Times

KYC = kill your customer

➡️Bitcoin News: Anchorage Digital has added support for Mezo, an EVM-compatible Bitcoin DeFi chain, giving institutions new ways to earn rewards and access liquidity without selling BTC. Clients can now use Anchorage’s self-custody wallet, Porto, to borrow against their BTC at fixed rates starting at 1%.

➡️The number of Bitcoin addresses holding at least 10K BTC hits a 5-month high of 90.

➡️Percentage Decline From Record High:

1. Oracle: -44%

2. Palantir: -30%

3. Meta: -27%

4. AMD: -27%

5. Tesla: -22%

And you think Bitcoin is dead because it's down 30% from its all-time high? - Bitcoin News

On the 24th of November:

➡️165,000 Bitcoin taken off Coinbase over the weekend! Cause TBD. But the last comparable plunge was just after FTX collapsed. Bitcoin was $16K' - Charles Edwards

➡️'China Discovers One of the Largest Gold Deposits in History, about 1,444 Tonnes of pure Gold. You can find more Gold, but you can’t mine more Bitcoin 21 million forever.' - CarlBMenger

➡️Sminston With:

I talk about Bitcoin's power law support line a lot, so... - - -

I finally ran a test everyone (probably) wonders about: How much does “buying the power law support” actually beat random timing in Bitcoin? It’s not even close. Comparing the two strategies from Jan 2015 → Nov 2025 (current ~$87k BTC.

Support strategy: (Buy $100 every single time BTC dips below the long-term power law floor):

→ 236 buys

→ Total cash invested: $23,600

→ BTC accumulated: 34.56 BTC

→ Final portfolio value today: $3,001,941. Yes, 3 mill from 23 G's.

Random timing strategy (1,000 simulations):

→ 236 buys (same as other strategy)

→ Total cash invested ($23,600) (also the same)

→ Average outcome: $1.26M → 3 std deviations (top ~0.15%): $1.71M

Even the luckiest bastard in this pile is not even half as well off as the support strategist.

The support buyer crushed every single random-timing simulation. Not 90%. Not 99%. 100% of the 1,000 random paths lost to buying the power law support. NOW CONSIDER: I believe understanding where the support line is is WAY easier than trying to understand where the tops are.

The peaks/bubbles are noise. Find the orange line. Mind the orange line.'

https://cdn.azzamo.net/8e76123ff749332f0378e7ff12508dda3652406b177014c940d452ac42009bfd.webp

➡️Another Smintson With banger:

Bitcoin has a way of getting away from you. Lines represent how long it takes to stack 1 Bitcoin if you start that year.

If you start now, stacking $500/week can get you to 1 Bitcoin in 5 years.

If you wait 4 more years to begin, it will take you 22 years. Stack. Early. Stack. Hard.

https://cdn.azzamo.net/76fad15a508ee0419eabe7b421becf034fbf7e779d544ab544a3474e7875b91b.webp

➡️'More than 8% of all Bitcoin moved in the last 7 days. The last two times this happened?

1. March 2020 - $5,000 BTC

2. December 2018 - $3,500 BTC

This makes the latest drawdown one of the most significant on-chain events in Bitcoin’s history.' - Joe Burnett

https://cdn.azzamo.net/46a19984356bf1f566f98c62dcded8d29485fd17667918d8f9bd5e1aea79c8cb.webp

On the 26th of November:

➡️'Have fun with all your Bitcoin Thanksgiving conversations.... Every year (except 24'), Bitcoins have been way off the annual high, and 2025 is no exception. Average drawdown: 37.16% from the year high. Median drawdown: 32.92% from the year high. Fun Fact: Bitcoin's epic bull run in 2017 still saw BTC price down -58.96% ($8,118) on Thanksgiving, and was only just weeks away from its December peak of $19,783. - Mark Moss

https://cdn.azzamo.net/6eba4217daa906424fdc787c552b3ec6517903df013aed3ef9382dd0604d571f.webp

➡️'HOW JPMORGAN’S NEW BITCOIN PRODUCT WORKS.

The product is linked to BlackRock’s Bitcoin ETF (IBIT). If IBIT is at or above a target price in one year, investors automatically get a guaranteed 16 percent gain.

If IBIT is below that target, the investment continues until 2028. If IBIT rises by then, investors can make up to 1.5 times their money with no cap. If IBIT is down in 2028 but not more than 30 percent, investors get all their money back.

If it’s down more than 30 percent, investors take the loss past that point.' -Bitcoin News

On the 27th of November:

➡️Bitcoin extends gains and rises above $91,500, now up +14% since the November 21st low.

➡️'Compounding inflation is a global crisis:

Since January 2021, the UK gas experienced the largest surge in prices among major economies, at +28.2%.

The US saw cumulative inflation of +23.8%, followed by the Euro Area at +23.1% and Germany at +21.2%. France’s cumulative inflation reached +15.1%, while Japan recorded +12.4% over the same period.

On the other hand, China saw only a +2.8% cumulative CPI increase, as the country has been struggling with weak domestic demand and a real estate downturn.

Put simply, consumers in major economies have lost 21% to 28% of their purchasing power since January 2021. Own assets or be left behind.'- TKL

https://cdn.azzamo.net/66ebd46312158cc42c414564c255bc68fec957574053b52c59af4d8bb24dcbde.webp

Anyway, people, study Bitcoin.

➡️Highest amount of unrealized Bitcoin losses since the 2022 bear market.

https://cdn.azzamo.net/3fe0aebb6a4789a7d25fbcfbe7f9d0f9083cb1b66a256192baaa7150749804e6.webp

➡️TFTC: The number of wallets holding 0.1 BTC went DOWN during the dip. Wallets with 1000+ BTC? Up. Newcomers are selling into weakness. Veterans accumulating. This is why most people don't make it. You know the game, freaks. Stay humble, stack sats.

On the 28th of November:

➡️Bitcoin extends gains and rises above $92.500, now up +15% since the November 21st low.

➡️VANECK: “By 2050, Bitcoin becomes a reserve asset that's used in global trade and held by global central banks at a 2% weight. In that model, we arrive at a $3,000,000 price target for Bitcoin.” "Into the MILLIONS over the medium term is a HIGH conviction call."

I always think it is funny to hear those kinds of predictions. I have always learned that you can only predict one thing, either price or time, not both.

And VanEck is into CrYpTo, and it's a speculative model—actual outcomes depend on adoption and global factors.

Meanwhile, BlackRock CEO Larry Fink says he changed his mind on Bitcoin. After years of calling it “the domain of money launderers and thieves,” he tells 60 Minutes, “there is a role for crypto in the same way there is a role for gold,” and says markets made him “relook at assumptions”.

Anyway:

https://cdn.azzamo.net/cc80f3284f3e5d589e04f1af24692c2c3c3062aa31ea9f93078dfa405a3a6b5a.webp

➡️“70% of Bitcoin’s wealth sits ABOVE $85K.” – Checkmate

The ancient-history charts—$30K, $10K, $5K—don’t reflect today’s reality. This is now a game of sovereigns, banks, and price-insensitive allocators.

➡️IBIT shenanigans. 'At last, IBIT options are finally getting the treatment they deserve— Nasdaq just filed to increase options limit to 1 MILLION (from 25k a year ago). Institutional vol is finally here.

The rule filing literally says they’re doing this because IBIT has reached the same level of market cap, liquidity, and trading frequency as the biggest stocks. This is the category reserved for: AAPL, NVDA, MSFT, SPY, QQQ. That’s the club Bitcoin is now in.

It’s a simple story: Bigger limits → institutional size selling options(short vol. for structured product) → more market makers → easy to buy options → more retail.'

But remember >>>

https://cdn.azzamo.net/19fae59e9304e2a7d15cc5a31df777854016e58753dc9dfe334d347bcebf9fd4.webp

➡️Quinten:

> 'Bitcoin dips -30%

> People’s reaction: extreme fear

> Black Friday -30% sale on junk

> People’s reaction: take my money

> This is why most people stay poor.

> They buy liabilities on sale and sell assets on fear, the exact opposite of how wealth is built.'

➡️Bitcoin falls below STH cost basis. Another buy-the-dip indicator flashes on Black Friday.

➡️Daniel Batten: All 12 Sustainability Media Outlets that cover Bitcoin Mining are now covering its environmental benefits!

1. Renewables Now: Bitcoin helps green energy adoption and grid stabilization. https://renewablesnow.com/news/bitcoin-miner-mara-buying-114-mw-wind-farm-in-texas-1267551/

2. Renewable Energy Magazine: Bitcoin Mining is enabling Landfill Gas methane mitigation. https://renewableenergymagazine.com/biogas/companies-launch-pilot-using-landfill-methane-emissions-20230502

3. Anthropocene Magazine: Bitcoin mining could help wind and solar development. https://anthropocenemagazine.org/2023/12/wind-and-solar-projects-struggle-financially-in-their-early-phases-could-bitcoin-mining-change-that/

4. One Green Planet: Bitcoin mining is more sustainable than previously thought. https://onegreenplanet.org/environment/shining-light-on-the-sustainable-side-of-bitcoin-mining/

5. Microgrid Media: Bitcoin mining increases grid stability and helps make the grid "more efficient and less wasteful." https://microgridmedia.com/green-energys-impact-on-bitcoin-mining/ 6. The Africa Report: Bitcoin mining in Ethiopia has helped grow green energy and expand Ethiopia's grid. https://theafricareport.com/366515/ethiopia-turns-to-bitcoin-miners-to-power-growth-and-renewable-energy/

7. Recharge Magazine: Bitcoin is aiding the renewable transition. https://rechargenews.com/energy-transition/why-crypto-could-be-green-powers-unlikely-new-best-friend/2-1-1613383

8. The Cooldown: Bitcoin mining is helping to ease geopolitical tensions, stabilize grids, reduce electricity prices, and monetize wasted renewable energy. https://thecooldown.com/green-business/bitcoin-mining-european-energy-grid-stability/

9. http://Carboncredits.com: Bitcoin mining has emerged as a promising solution for enabling the EU to meet its green energy transition and energy security goals. https://carboncredits.com/is-bitcoin-mining-the-unexpected-solution-to-europes-energy-challenges/%e2%80%a6/

10. Northern Forum: Bitcoin mining is "transforming the energy production game" by absorbing excess renewables. https://northernforum.net/how-bitcoin-mining-is-transforming-the-energy-production-game/

11. EnergyTech: 2 Bitcoin mining companies expanding the network's renewable footprint, using wind-based power in Texas. https://energytech.com/data-center-power/news/55320690/canaan-and-soluna-partner-to-power-bitcoin-mining-with-renewable-wind-energy-in-texas

12. Sustainability Magazine: How Bitcoin mining can utilize "what might otherwise be wasted renewable energy" https://sustainabilitymag.com/news/soluna-and-canaan-partner-on-20mw-wind-powered-texas-project

➡️Turkmenistan President signs bill to legalize Bitcoin and crypto starting in 2026

➡️Julius: Bitcoin’s valuation is at its lowest level against gold since 2013. This is the longest consolidation in its history. Currently, it is even back down at bear-market levels.

https://cdn.azzamo.net/0998a8c97d2bbe4bfb4f73b4013404a3634ab61d13cd44dfcc9076f126ea6037.webp

➡️You mathematically can't compound your way to wealth anymore... 20 years, 7% returns, 3% inflation, 40% taxes -- best case you 1.5x your investment. That is why the kids YOLO it... plain and simple.' -Sam Lessin.

Now the post is a bit of clickbait, and it is applicable to the U.S.; the moral of the story is the same, though.

https://cdn.azzamo.net/6f28155d155513882be2f4b7ea11eebc0b81c0d02adf69af7d47134faf1dd0f0.webp

And oh yeah, if only inflation were just 3%...anyway:

This is the hard truth people do not want to say out loud: You cannot compound when the system is subtracting faster than you can add. When inflation eats the base, taxes skim the flow, and real yields stay negative, the old compounding model becomes a museum artifact. That is why the young do not invest in “prudence.” They invest in convexity. When linear paths die, people reach for asymmetric ones. It is not irrational. It is adaptive. The math changed. The behavior followed.

Study Bitcoin!

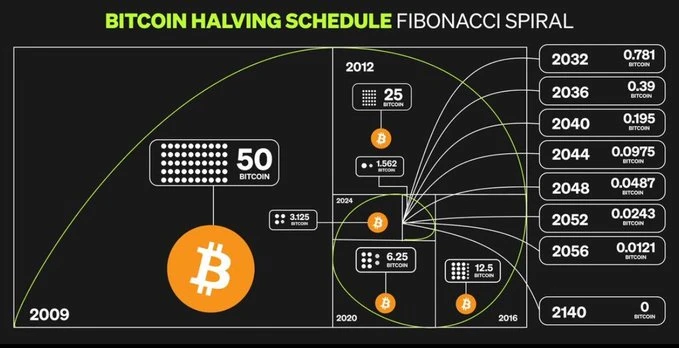

➡️'Thirteen years ago today, Bitcoin’s first ‘halving’ program reduced the new mining block reward in half from 50 coins to 25 coins. This event marked the first time in history a decentralized monetary system automatically maintained new issuance on an open-source schedule of code.' - Documenting Bitcoin

(https://cdn.azzamo.net/6cdf6ddbfe39b834b9fc8185e6df09489e1ef0e4bbc3644504dc322588852e02.webp)

## 🎁If you have made it this far, I would like to give you a little gift:

Lyn Alden: The So-Called “Debasement Trade”

My December macro newsletter is now available.

It discusses the debasement trade, changing macro conditions, and the large dislocation between the economy and markets.

https://www.lynalden.com/december-2025-newsletter/

Credit: I have used multiple sources!

My savings account:Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: **PocketBitcoin **, especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. (from now on, full KYC, so be aware)

> Use the code SE3997

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple. ⠀ ⠀

⠀⠀ ⠀ ⠀⠀⠀

Do you think this post is helpful to you?

If so, please share it and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐ Many thanks⭐

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

https://blossom.primal.net/cc2dcec361355d89c2a97e9b1f20957447063920d68f3009007b267ead96af50.webp

The Latest Bitcoin & Macro news: Weekly Recap 22.11.2025

If you would rather read the long format, enriched with detailed charts, illustrative images, and comprehensive macroeconomic news to provide context and clarity. (outside of Nostr) Click here:

Do you think this post is helpful? If so, please share it with your friends, family co-workers, and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐️ Many thanks⭐️

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

On Nostr, I will exclusively share the most significant Bitcoin news. (this note)

For those (still) beyond Nostr—friends, family, and colleagues—the complete Weekly Recap will be accessible on my Bitcoin Friday page on Yakihonne. (next note)

Enriched with detailed charts, illustrative images, and comprehensive macroeconomic news to provide context and clarity.

Happy reading!

The Latest Bitcoin & Macro news: Weekly Recap 22.11.2025

🧠Quote(s) of the week:

> 'What’s the common denominator with all of these issues?

> High rent — Money

> Can’t buy homes — Money

> Groceries too damn high — Money

> Student debt — Money

> Credit card debt — Money

> Health insurance — Money

> Saving to invest — Money

> Dating and marriage — Money (heavy burden because of monetary costs), Trust in institutions — shattered because of broken money

>

> Belief in the future — not possible when your money is GUARANTEED to lose value in the future BY DESIGN

> No meaning — heavy time and energy pressure because your time and energy decline when your money, which is a representation of your time and energy, declines in value

>

> Maybe the money is the problem??

> Spoiler alert: it is.

>

> A socialist mayor or leader of your country isn’t going to fix it.

> Broken money breaks the world.

> All of these issues, including one of the biggest cities in the world electing a socialist, stem from the money being broken.

> The world will not be fixed until the money is fixed.

> The solution is here. All that remains is understanding.

> Study Bitcoin.' - Cole Walmsley

https://cdn.azzamo.net/ad2d863d22bb690bd624728049c6c3d5444d0ed98f41cd3805e4701395835310.webp

## 🧡Bitcoin news🧡

Just want to start with the following...

What produces inflation? Milton Friedman had the answer decades ago: “Too much government spending and too much government creation of money - and nothing else.”

Study Bitcoin!

Photos hosted by Azzamo (https://azzamo.net/)

On the 16th of November:

➡️I’m a buyer of standard deviation moves to the downside; they don’t come often, but they tend to be excellent opportunities.

https://cdn.azzamo.net/3ac263f594b5f360f081edbcebc6817218ca642fe81ea47cac96224ab6e9e800.webp

➡️Bitcoin News: Bitcoin just hit its 4th “death cross” of this cycle. The last three marked excellent buying opportunities. Historically, one year after a death cross, Bitcoin has been higher 50% of the time, with an average return of 85%.

https://cdn.azzamo.net/b330f170fc2a8f988498a95ab4260be8a54d818dc75ea75ff9d1cea91f258076.webp

On the 17th of November:

➡️

> 'IBIT alone is buying 1,200 BTC / day (all day average). All ETFs + MSTR 2,000 BTC / day = 1 MM BTC+ every 2 Years. (R2 = 93%).

> Most of the freely tradable supply will be bought in the next decade.' - Fred Krueger

https://cdn.azzamo.net/9954ed7595da297b8064e052fa75b0079eefd0b9bdcb5b37bb26eba9ddc15827.webp

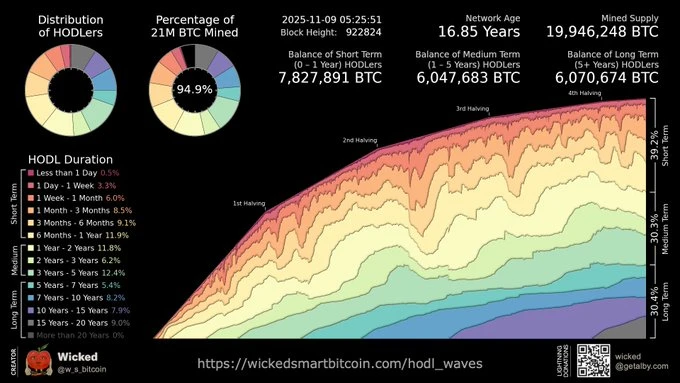

➡️95% of the total Bitcoin supply has now been mined.

➡️Jeff Swanson: Bitcoin continues its collapse, ultimately going to zero. You can really see it here on this chart.

*On the 18th of November:*

➡️Bitcoin whales bought the dip below $100k

https://cdn.azzamo.net/476e49de1e572b7a684e001154253a9307db8bfc7854103d75b6cd590e6bc32e.webp

➡️The last time Bitcoin was here, global liquidity was $7 trillion lower.

➡️BTCosmonaut: 'This is without a doubt one of the most dangerous bear traps in Bitcoin history. Plebs are losing the plot and selling to Blackrock, Harvard, UAE, Czech, etc., because their WATCH is telling them to. Unfortunately, they will never see that Bitcoin again.'

➡️Joe Consorti: 'Bitcoin may be at its lowest price since April, but the assets held by spot ETFs are ~200,000 BTC higher. Don't let Goldman Sachs be more bullish than you.'

https://cdn.azzamo.net/91531afc3169deef2f79c9fdef272af47db7d44b40776fbf8dcef416f223ba55.webp

➡️Pre Black Friday deal: Bitcoin's on sale. 30% discount.

➡️El Salvador just bought $100 MILLION Bitcoin during the dip.

➡️'95% of the 21 million Bitcoins have officially been mined. Only 5% of BTC supply left to be mined over the next 114 years!' - Wicked

https://cdn.azzamo.net/85a1bba1eb05c57d4d553a8e01c9a4bcdec513cbd436da044640fedeafdb385c.webp

> Chapo:

> '21M total BTC

> 3M lost = 18M

> 75% owned by institutions, govts, funds

> Only ~4M BTC available for individuals globally to own.

> Individual average ownership = 1/2000 (0.0005) Bitcoin

> If you own anywhere close to a whole Bitcoin, you are rich AF.'

*On the 19th of November:*

➡️Bitcoin has broken below the 0.75 cost-basis quantile, a level that has historically marked bear-market territory. Across cycles, reclaiming and holding above it has been key to restoring bullish structure. Bulls will want to see this level regained. -Glassnode

➡️New Hampshire launches First Bitcoin-backed municipal bond.

*On the 20th of November:*

➡️'Short-term holders underwater:

• 2020 COVID crash 92% in a loss of $3,850

• 2022 FTX collapse 94% in a loss of $16,000

• Today: 99% in a loss at $89,000

This is the highest short-term holder capitulation ever recorded.'

➡️Charlie Bilello: At $86,000, Bitcoin is now down around 32% from its all-time high of $126,000 in early October. That's the biggest drawdown since April, but not unusual at all given its historical volatility.

https://cdn.azzamo.net/87a29ae4ae7abc87df15bf7c73a1e6d783f8ce1f96b3d3fdaacced09220785fe.webp

➡️ Bitcoin's weekly RSI is at a level historically reserved for the bottom of bear market cycles, yet we're only 30% off the highs. It might be the fastest washout in Bitcoin history.

➡️Strategy: 'At current $BTC levels, we have 71 years of dividend coverage assuming the price stays flat. And any $BTC appreciation beyond 1.41% a year fully offsets our annual dividend obligations.'

Market: "We're gonna take Bitcoin down and force liquidate Saylor." Strategy: "Okay, sure. Assuming we do nothing else, you know that we have 71 years of dividends at this current Bitcoin price, right?"

Market: "Oh...um...well..."

On the 21st of November:

➡️At $80,600, Bitcoin is now down around 36% from its all-time high of $126,300 in early October. That's the biggest correction off an all-time high since 2022. Is this unusual volatility for Bitcoin? Not at all. We've seen similar or bigger drawdowns every year.

https://cdn.azzamo.net/5b30d5f475b04cc8075f77ebeec294d75db17d2a40c6c8a0fcb249b941457fa0.webp

I saw Bitcoin crash from $20k to $3k, from $69k to $16k, and from $126k to $80k. Every dip was said to be Bitcoin's death, while in reality, every single one was a once-in-a-lifetime buying opportunity. Zoom out, chill, and HODL. Bitcoin will recover.

https://cdn.azzamo.net/1b222a2680f2d99f8087d3f079e15fb6b944e3dd66ac28eccb3460b55af26ac6.webp

Aged like fine red wine.

➡️Bitcoin News: Bitcoin's Mean Reversion Oscillator just printed its first green (oversold) bar since April this year.

https://cdn.azzamo.net/6b9d831890b364277b1aff51b25f22ada3feb8fe887e8cb4d980ed26924abaea.webp

➡️The number of Bitcoin addresses worth over $100K has dropped 30% over the last two weeks.

➡️Bitcoin realized losses surge to levels last seen during the FTX collapse (Glassnode)

➡️'Binance spot orderbook just printed the single largest positive Depth Delta spike on record (deepest depth). Buy orders now massively outnumber sell orders below price, the strongest absorption signal we’ve seen all cycle. Previous extremes like this marked local lows within hours/days.' - ExitpumpBTC

➡️Bitcoin realized losses have surged to levels last seen during the FTX collapse, with short-term holders driving the bulk of the capitulation. The scale and speed of these losses reflect a meaningful washout of marginal demand as recent buyers unwind into the drawdown. - Glassnode

➡️Bit Paine: If this dip is truly being caused by a liquidity contraction before a wave of stimulus, then the only real historical comparison we have is the 2019 COVID crash, like the ocean going out before a tidal wave.

https://cdn.azzamo.net/ef2f0afdd8d482450e91c8a5c36a3edcc98fe90714689a217b37797c6025d4de.webp

➡️Parker Lewis: "The most important learning from bitcoin's volatility is that bitcoin doesn't die. No central coordination, no bailouts, no moral hazard. On March 12th, 2020, Bitcoin crashed by 50% in a single day to $4,000. Did Bitcoin die? No. Is this good for Bitcoin? Yes. Same story."

https://cdn.azzamo.net/6a6adc9544d3168272e62116b18cb8f8bbeb88263a7d6aa3e6c306904cee626a.webp

➡️SOLO BLOCK FOUND A home miner with only ~6.73TH/s of total hashrate just mined a block for 3.146 BTC, totaling $264,558. The device that mined block 924569 appears to be a Bitaxe Gamma at 1.2TH/s.

*On the 22nd of November:*

➡️Bitcoin's weekly RSI has only been this low twice before:

1. 2019 bear market

2. 2022 bear market.

➡️Even if Bitcoin adoption completely froze today, its price could still track M2 money supply growth at about 8% per year. ~8% more USD. ~0% more BTC. Each year. But adoption is accelerating, not stopping, so a CAGR of 30% - 50%+ is more realistic.

➡️Billy Boone: 'If Bitcoin closes in the red in 2025, it will break the pattern, and everything you've ever thought to be predictable about the asset is over. In uncharted territory, macro makes the rules. And macro is ALWAYS forced to appreciate scarce assets eventually. Remember, we live in a world denominated in pieces of paper represented by numbers on a screen.'

https://cdn.azzamo.net/4828bb142c805406f6c4b4bb5cb6d8c4f370164b068c28f4c149da928bd50083.webp

➡️SwanDesk: 'Bitcoin Hashprice COLLAPSES to all-time low of $34.49/PH/s, down over -50% in weeks and the lowest in BTC’s entire history. This is much worse than even the 2021 China ban or the 2022 bear market. Miners are now hemorrhaging cash, which means forced selling and shutdowns are imminent.'

https://cdn.azzamo.net/e3e1c839d6d9470d8e1a08e623d2aea58b77e543fc01ee72ab38cc79f7ab2e37.webp

Miners capitulating at historic lows isn't a crisis; it's the reset Bitcoin needed. Weak hands exit, difficulty adjusts down, survivors mine profitably again. This is how BTC self-heals.

Anyway, people, just calm your tits and behold,

The Great Bitcoin Collapse:

https://cdn.azzamo.net/03ecf3ecdd794361af72b2d78fd81bb47353996675f6678e3d6e95f312ab218c.webp

🎁If you have made it this far, I would like to give you a little gift:

What Bitcoin Did: Bitcoin, AI & The Fourth Turning | George Bodine**

George Bodine joins the show for a wild conversation about the fourth turning, AI, quantum, and why he believes the next 3–5 years will be the most volatile period in Bitcoin history. We get into his insane life story — from trailer parks to flying F-18s at Top Gun, ejecting from a crashing jet, working underground as a miner, becoming a pro artist, and eventually going all-in on Bitcoin. George breaks down why he thinks the financial crisis never ended, how AI and robotics will erase millions of jobs, the global arms race for compute and energy, and why quantum could hit faster than people expect. We dig into Bitcoin’s real threats — mining centralisation, quantum-vulnerable coins, BIP444, and the Core vs Knots fight dividing the community.

Click here: https://youtu.be/mn-saa_p7r8

Credit: I have used multiple sources!

My savings account:

Bitcoin The tool I recommend for setting up a Bitcoin savings plan: **PocketBitcoin **, especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. (from now on, full KYC, so be aware)

> Use the code SE3997

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple. ⠀ ⠀

⠀⠀ ⠀ ⠀⠀⠀

Do you think this post is helpful to you?

If so, please share it and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐ Many thanks⭐

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

https://blossom.primal.net/cc2dcec361355d89c2a97e9b1f20957447063920d68f3009007b267ead96af50.webp

On Nostr, I will exclusively share the most significant Bitcoin news. (this note)

For those (still) beyond Nostr—friends, family, and colleagues—the complete Weekly Recap will be accessible on my Bitcoin Friday page on Habla. (next note)

Enriched with detailed charts, illustrative images, and comprehensive macroeconomic news to provide context and clarity.

Happy reading!

The Latest Bitcoin & Macro news: Weekly Recap 10.11.2025

## 🧠Quote(s) of the week:

> If we don't diagnose and treat the core of the problem, people are only going to continue moving closer to the polar ends of the political spectrum. Broken money is at the core of today's issues. Until that is widely acknowledged, nothing will get fixed. - Marty Bend

## 🧡Bitcoin news🧡

Before we start. Over the past few weeks, I stepped away for a moment — no weekly recaps, no updates. Life had its way of asking me to slow down, reset, and catch my breath. It was necessary, and honestly, it felt good to disconnect for a bit.

But I’m back now, fully recharged and ready to dive in again. Thanks for sticking around — let’s pick up where we left off.

Photos hosted by Azzamo (https://azzamo.net/)

**On the 3rd of November:**

➡️'Bitcoin has averaged over 40% gains in November since 2013.

➡️Norway reports a 30% rise in taxpayers declaring digital assets in 2024, with holdings exceeding US$4B.

**On the 4th of November:**

➡️Wicked: 'Everyone who first started daily DCA'ing bitcoin anytime over the past year is now at a loss on their investment, price lower than cost basis. If bitcoin were to drop down to $83k, then everyone who started as early as the last halving, on April 20, 2024, would also be at a loss.'

➡️'Bitcoin officially enters bear market territory, now down -20% since its record high seen on October 6th. We are living in the most exciting market in history.' -TKL

➡️Joe Consorti: 'Bitcoin is now down 20% from its all-time high—in equity terms, this would be considered the start of a bear market. We've already seen two 30%+ drawdowns this cycle. Nothing new under the sun. This is just capitulation from spot Bitcoin holders.' -Joe Consorti

➡️Largest re-accumulation event in the history of the asset class 300-500k.

➡️Pierre Rochard: We need more Bitcoin education. The mispricing is a result of growing information asymmetry. Check out and share:

https://nakamotoinstitute.org/

➡️This is bitcoin's 2nd-worst day of the year, down over 6%, now officially a bigger drawdown than last month's liquidation event.

➡️'Sequans becomes the first Bitcoin Treasury Company to officially sell part of its Bitcoin holdings. The firm announced it had sold 970 BTC to redeem 50% of its convertible debt from its July 7, 2025, offering. This move reduces Sequans’ total outstanding debt from $189M to $94.5M. Its Bitcoin holdings now stand at 2,264 BTC, down from 3,234 BTC. CEO Georges Karam called the sale a “tactical decision aimed at unlocking shareholder value” amid current market conditions.' -Bitcoin News

**On the 5th of November:**

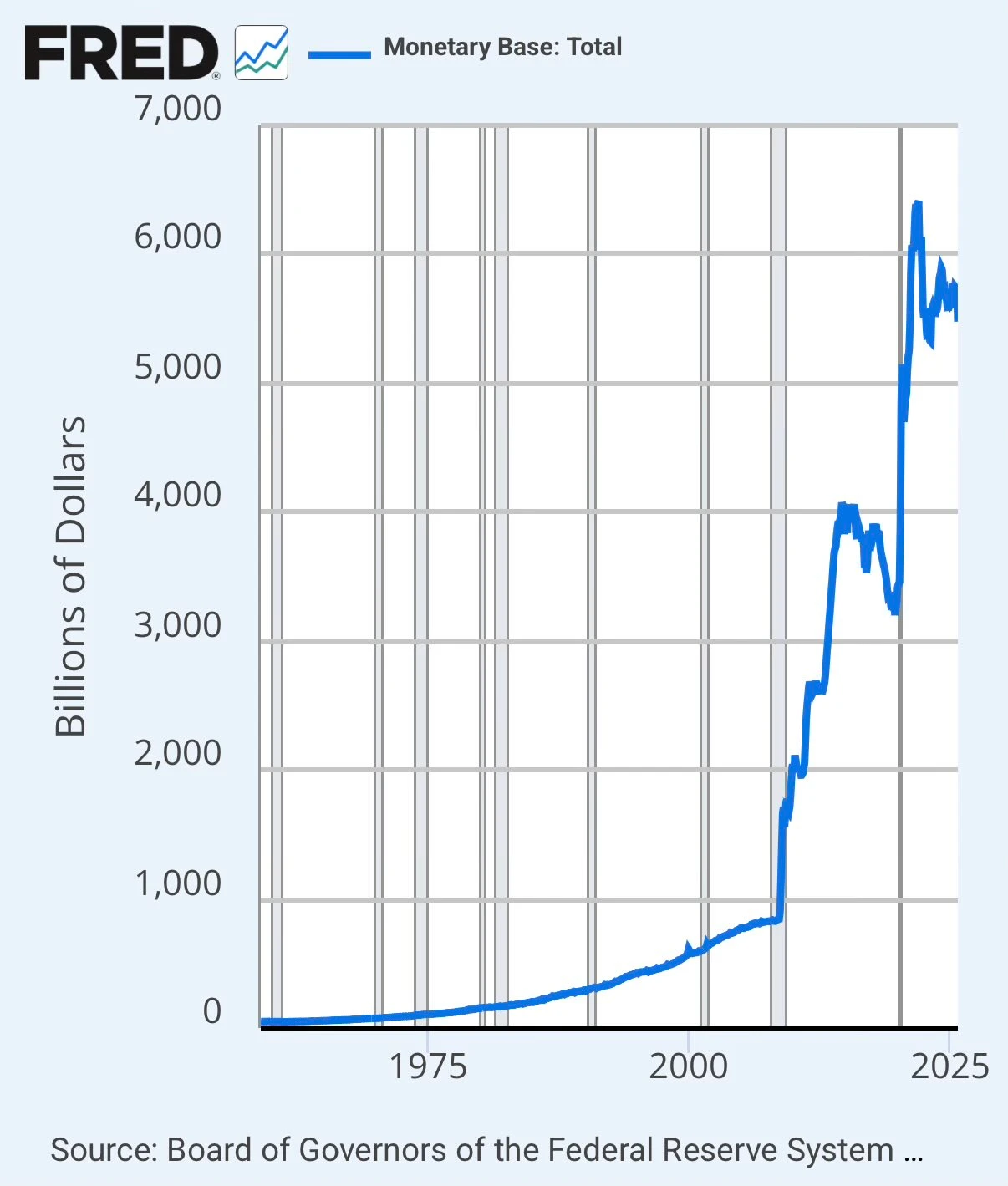

➡️DenverBitcoin: "78% of all US Dollars in existence were created after 2019.

When people say “Capitalism doesn’t work.”

What they really mean is, “The limitless + costless creation of money doesn’t work.”

Your money is broke. Opt out."

Study Bitcoin

➡️Pullbacks in Bitcoin price are a feature of bull runs, not a bug. The recent drawdown of -21% from the all-time high doesn’t even make this list.

**On the 6th of November:**

➡️BITCOIN MIMICS APRIL CRASH

Bitcoin Archive:

In April, Bitcoin fell 30% to $74K before rallying 70% to $126K Several indicators marked the low in hindsight, including MVRV, Supply in Loss %, 365DMA, and RSI. Today, those same indicators are signaling a potential reversal.

Structurally, it all looks the same. My theory is that people are just down and tired of being chopped up throughout the year.

➡️Wicked: "In dollars, prices of houses have more than doubled. In Bitcoin, they continue to collapse, trending toward zero. Wake me up when the average new house costs less than 1 BTC."

➡️Institute of Technology and Renewable Energies to sell 97 Bitcoin ($10M), originally bought for $10,000 in 2012 during a blockchain research project.

➡️Normally, the following I would place the following in the segment Macro/geopolitics.

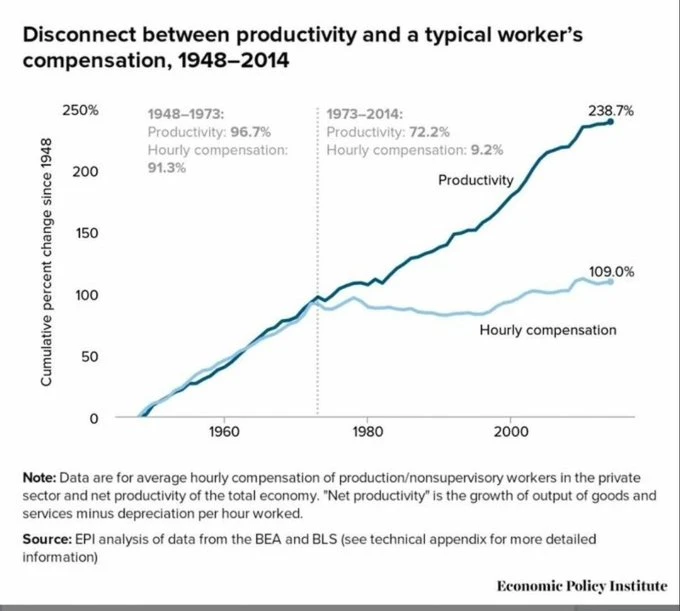

Mark Mitchell: 'This chart is damning. The death of true capitalism.'

The chart is real. The conclusion is not.

Great response by Rock Chartrand: 'What you’re calling “the death of true capitalism” is actually the triumph of government-managed markets. When the state rigs the rules, prices signal politics instead of value. Capitalism didn’t fail. It was replaced. If productivity rises but your paycheck doesn’t, the first question is: Who inserted themselves between you and the value you produce? The answer is never “capitalism.” It’s always “the people who claim to be protecting you.”

Opt out, study Bitcoin.

https://wtfhappenedin1971.com/

➡️JPMorgan analysts see Bitcoin reaching about $170,000 within the next 6 to 12 months. They cite leverage resets, improving volatility relative to gold, and a market correction of nearly 20 percent from recent highs. Analysts also noted record futures liquidations on Oct. 10 and renewed security concerns after the $120 million Balancer exploit as reasons for recent concern.

'OG bitcoin whales are dumping, and sentiment is horrible. Meanwhile, JPMorgan has a $170k price target, and 99.5% of funds in the spot bitcoin ETFs haven't sold in this 20% drawdown. A complete inversion of pre-2024 norms. This is a totally different market now.' - Joe Consorti

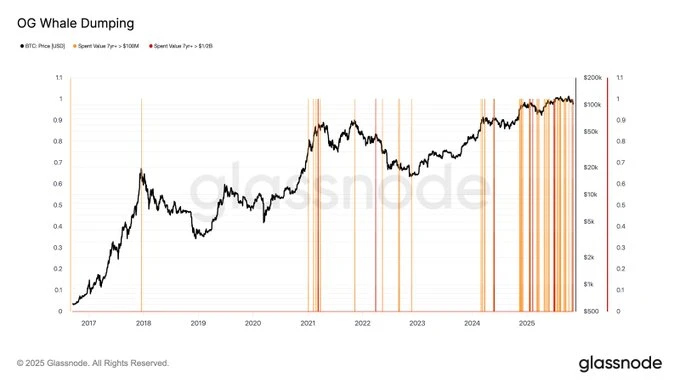

➡️Checkmate: '2025 has been the year when the most old coin $ value has come back to life.

$13.3B worth of coins aged 10yrs+ (with ~$9.5B from that one guy with 80k BTC).

$16.2B from 7 to 10-year coins

$22.7B From 5y to 7y (1-2 cycle holders)

Total 5y+ revived supply in 2025 is $52.2B

➡️With an average purchase price of $107,911, Metaplanet (#4 largest Bitcoin Treasury Company) is now down over $30 million on their Bitcoin holdings.

➡️BlackRock just sold $478 million worth of Bitcoin through Coinbase Prime.

➡️Ark Invest CEO Cathie Wood reduces her 2030 Bitcoin target from $1.5M to $1.2M.

➡️Bitcoin accumulator addresses doubled to 262,000 in just two months, 375,000 BTC added in 30 days.

**On the 7th of November:**

➡️Charles Edwards:

OG Bitcoin whales are dumping.

'This chart gives a good visual of how many super whales are cashing out of Bitcoin. All lines here are 7+ year on-chain spends from pre-2018 era OG Bitcoin Hodlers.

Orange = $100M OG dumps.

Red = $500M OG dumps.

The chart is VERY colorful in 2025. OGs are cashing out.'

➡️'Largest business cycle bull div yet. Reversal = Parabolic market' - TechDev

'The US Government seeks a maximum 5-year sentence for Samourai Wallet developers. In its sentencing memo, prosecutors barely mention the actual charge of operating an unlicensed money transmitter. Instead, they focus on dropped allegations of money laundering and sanctions evasion.' - Bitcoin News

➡️Blackrock bought 921 BTC today. Has sold 5,300 this week. Still holds 798,000 BTC.

➡️Japan's Financial Services Agency to support the country's three largest banks in developing a stablecoin. More liquidity for Bitcoin.

➡️Smart money isn’t selling 99.5% of spot bitcoin ETF investors held through the 20% drawdown.

➡️'What's different this time about Bitcoin Long-term holder (LTH) selling? Bitcoin Long-term holders selling is a normal occurrence in bull markets. LTH takes profits as prices reach new highs.

What's important to analyze each time is whether there's growing Bitcoin demand that can absorb the LTH selling at higher prices. For example, in Jan-March and Nov-Dec 2024, increasing LTH sales occurred as demand was growing (green areas), so the price reached new ATHs.

However, since October, LTH sales have increased (nothing new here), but demand is contracting (red areas), unable to absorb LTH supply at higher prices.' -Julio Moreno

➡️U.S. Bitcoin ETFs bought $240 MILLION BTC yesterday, ending six days of outflows.

➡️Joe Consorti: 'Bitcoin is now in "extreme fear" with its price now 20% off the all-time high and falling. The market has been more fearful twice this cycle:

1. After 8 months of consolidation in 2024,

2. This April, near the bottom of a 32% drawdown

If we're still in a bull, this means we're nearing the local bottom.

If we're moving into a bear (I don't think so), then look out down below.'

➡️'Since 1987, every major bottom in the University of Michigan Consumer Sentiment Index has aligned with a bottom in the Russell 2000. And over the past 15 years, every parabolic bitcoin bull market has coincided with a Russell 2000 breakout, which may be forming again now.'- Joe Burnett

➡️'They print the money, fund the crimes, and walk free, but the dev who built a privacy wallet gets 5 years.' - TFTC

➡️71% of traditional hedge funds plan to increase Bitcoin and crypto exposure over the next year - AIMA

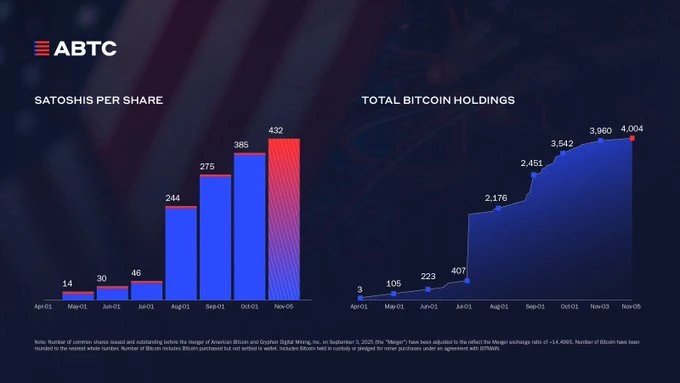

➡️The Trump family’s American Bitcoin continues stacking, adding ~₿139 since the October 24, 2025 announcement. Total holdings now stand at ₿4,004, with Satoshis per Share (SPS) rising to 432.

**On the 8th of November:**

➡️Satoshi Nakamoto Explains ‘Difficulty Adjustment’ “As computers get faster and the total computing power applied to creating bitcoins increases, the difficulty increases proportionally to keep the total new production constant. Thus, it is known in advance how many new Bitcoins.”

➡️Wicked: The NASDAQ 100 just edged out Bitcoin, comparing their 4-year CAGR.

➡️A Ledger blog article explaining multi-sig is restricted to citizens in the UK “due to new rules.”

➡️Bitcoin News: 'On Friday, Nov. 7, with the price of Bitcoin hovering just above $100,000, a 2016-era whale moved 216.95 BTC worth $22.47 million after 9 years and 4 months of dormancy.'

➡️Bitcoin miners are under renewed pressure as the hash price, a key profitability metric measuring daily revenue per petahash per second, falls to around $42, nearing the $40 “survival” threshold that could push smaller operators offline.

**On the 9th of November:**

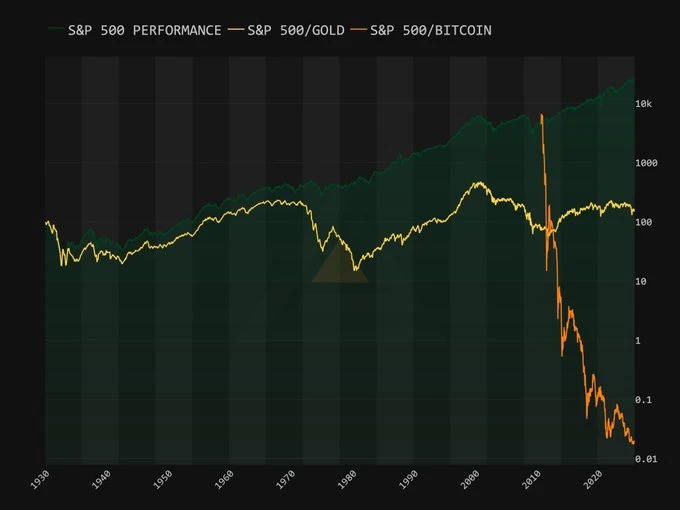

➡️The S&P 500 is up in nominal terms, flat in gold terms, and down in Bitcoin terms.

➡️Josh Mandell reports losing over $1.2 million on IBIT call options, which he bought after predicting Bitcoin would reach $444,000 by November 8.

➡️The Winklevoss twins send 250 BTC to Gemini hot wallets.

➡️Wicked: 'Block by block, sat by sat...save and HODL bitcoin for a better future.'

➡️$1,200 Covid stimulus check is now worth $21,270 if you bought bitcoin with it, 1,672% return.

**On the 10th of November:**

➡️Retail is selling Bitcoin while large investors are buying.

➡️"On October 15, as gold was hitting a blow-off top, people in Australia were lining up for hours to buy it. Today, after an 11% correction over the past couple of weeks, those lines have vanished, even though gold has already bounced 5% off the lows." -Bitcoin News

Fascinating how market psychology works; you can apply that to Bitcoin as well.

➡️APPLE CO-FOUNDER STEVE WOZNIAK: "Bitcoin is mathematical purity"

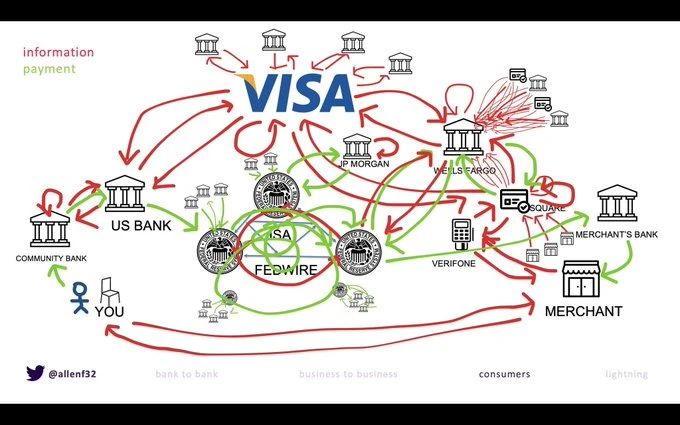

➡️4 million Square merchants can now accept Bitcoin with no fees starting today. Square just announced Bitcoin payments live via Lightning. Instant settlement. No banks. The rails of fiat are breaking. The rails of Bitcoin are being built. Their sellers can now receive Bitcoin to Bitcoin, Bitcoin to fiat, fiat to Bitcoin, or fiat to fiat.

Allen Farrington: But why would Square want merchants to accept bitcoin?

➡️Ethiopia's Bitcoin mining operation has made $82 MILLION in just 3 months.

➡️Strategy has acquired 487 BTC for ~$49.9 million at ~$102,557 per bitcoin and has achieved BTC Yield of 26.1% YTD 2025. As of 11/9/2025, they hodl 641,692 Bitcoin acquired for ~$47.54 billion at ~$74,079 per Bitcoin.

➡️'Bank of England proposes £20k cap on retail stablecoin holdings. They can only control you because you are using their money. Opt out, study Bitcoin. HODL it in self-custody. F*CK THEM!' - CarlBMenger

➡️'HIVE just reached 24 EH/s, up 147% YoY, and completed its 300 MW Paraguay site. Now it’s turning Bitcoin mining profits into AI data centers across Canada!' - Simply Bitcoin

➡️No, the EU will not require ID for every Bitcoin transaction.

But the AMLR is still a massive pile of trash.

Now let's break it down...

"Lots of fake news about the EU’s Anti-Money Laundering Package flooded the timeline last weekend, so here’s a quick breakdown of what these new regulations actually mean.

First, the EU *is not* requiring an ID for every bitcoin transaction, as widely misreported. The EU’s AMLR only applies to so-called CASPs, or Crypto Asset Service Providers, which are defined custodians under the Markets in Crypto Assets Regulation (MiCAR) and was adopted 1.5 years ago.

This is bad because it effectively requires most custodians to KYC their users, which is a major blow to small software firms trying to innovate.

Second, the AMLR requires CASPs to conduct due diligence on any funds that are sent to and from non-custodial wallets below 1000 EUR, and requires proof of proof-of-ownership of the non-custodial addresses when payments exceed 1000 EUR.

This also isn’t great because it effectively hinders the use of bitcoin as money, but it also isn’t KYC – due diligence is defined as a risk-based approach, which CASPs have some room to define, e.g., via the use of chain analysis firms. For transactions above 1000 EUR, most CASPs require something called the Satoshi Test, where you make a small transaction to the CASP to prove that the address belongs to you.

Again, this isn’t news and was implemented at the beginning of this year via the Travel Rule.

Third, the EU bans cash transactions over 10k EUR for business transactions, but this too is already in effect in most countries, which have bans on cash transactions as low as 1000 EUR, e.g., France or Spain. What *is* new is that the AMLR bans CASPs from offering privacy coins – but some exchanges, such as Kraken EU, have already delisted coins like Monero as the EU considers them to be risk-carrying assets.

I hope this helps clear up some of the misconceptions and reminds you to read primary news sources yourself instead of relying on AI-fueled news aggregators feeding a frenzy for monetized clicks.

The AMLR is an absolute disaster, and there’s no need to make it worse than it sounds, because things are already pretty bad in the EU for Bitcoin.' -Independent Journalist L0laL33tz

Here's what the new regulations mean. Full story:

https://www.therage.co/eu-bitcoin-kyc/

Now, why am I writing the recaps? The main reason to share information and knowledge. Bring more people into Bitcoin and teach them how to use freedom tech.

People should learn how to use Bitcoin, try many wallets, Lightning Network, and VPN's to evade censorship.

But let me make one thing very clear. You can clearly see the trend here. They are closing the gates to escape. They will soon start to confiscate or regulate YOU out of the equation.

🎁If you have made it this far, I would like to give you a little gift:

What Bitcoin Did - Bitcoin Power Law: The End of Exponential Growth | Matthew Mezinskis

Matthew Mezinskis is a macroeconomic researcher, host of Crypto Voices, and creator of Porkopolis Economics. In this episode, Matthew breaks down why Bitcoin doesn’t grow exponentially like traditional finance; it grows on a power curve. He explains why this difference matters for sustainability, how it challenges credit-based systems, and what it means for the long-term coexistence of Bitcoin and fiat money. They discuss how the power law reveals Bitcoin’s proportional and sustainable growth, why exponential systems like debt-driven markets inevitably face booms and busts, and how Bitcoin could eventually pull TradFi into a Bitcoin world rather than be absorbed by it. Matthew also explores Bitcoin’s growing dominance as base money, comparing its scale to global cash and reserves, and why its next major milestone is surpassing U.S. cash in circulation.

Click here: https://youtu.be/NaC3zGp6BSo

Credit: I have used multiple sources!

My savings account:

Bitcoin The tool I recommend for setting up a Bitcoin savings plan: **PocketBitcoin **, especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly.

Use the code SE3997

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple. ⠀ ⠀

⠀⠀ ⠀ ⠀⠀⠀

Do you think this post is helpful to you?

If so, please share it and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐ Many thanks⭐

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

https://blossom.primal.net/cc2dcec361355d89c2a97e9b1f20957447063920d68f3009007b267ead96af50.webp

On Nostr, I will exclusively share the most significant Bitcoin news. (this note)

For those (still) beyond Nostr—friends, family, and colleagues—the complete Weekly Recap will be accessible on my Bitcoin Friday page on Habla. (next note)

Enriched with detailed charts, illustrative images, and comprehensive macroeconomic news to provide context and clarity.

Happy reading!

The Latest Bitcoin & Macro news: Weekly Recap 08.09.2025

🧠Quote(s) of the week:

“The Roman state was daily growing poorer, while the taxes were constantly increasing, because the coinage was debased.” - Zosimus, 6th century.

https://cdn.azzamo.net/959aa7148c19520d7742bf5e4b27d40fda5aa66bfc8cd2ea30256266494dab7c.webp

SAIFEDEAN AMMOUS: "The biggest problem with Bitcoin is that it didn't exist before 2009."

🧡Bitcoin news🧡

On the 1st of September:

➡️'Bitcoin supply shock is imminent!' - Trending Bitcoin

https://cdn.azzamo.net/a01a842ff28b83f126873dee175fed6e8e01139671d8cf5f682be2f6a5a8786f.webp

On the 2nd of September:

➡️Wicked: 'Saving in dollars vs gold vs bitcoin: After 400 weeks of $50 DCA, you’d have $20,000 had you saved in dollars, 11.322 ounces of gold (worth $38,864) had you saved in gold, or 1.3719 BTC (worth $148,707) had you saved in bitcoin.'

https://cdn.azzamo.net/47e7de8bb3ceede86bd74d90e01fa8c103c0003c5192ef4e580150fd8be0ff56.webp

Quick reminder: Gold officially hits $3,600/oz for the first time in history. Gold is now up +33% YTD, more than 3.5 TIMES the S&P 500’s return. Meanwhile, the US Dollar to Gold ratio is falling off a cliff.

https://cdn.azzamo.net/70e520c84f95b6dc72d53757fdeb31b3f625ae05d8d187944a521960c713d87f.webp

What does that tell us?

Oh wait.... 'US M2 Money Supply is now growing at a +5.1% annualized rate of change. It should be no surprise that Core CPI inflation is back above 3.0%, AND rate cuts are on the way. After 10 years of 3% inflation, the US Dollar loses 25%+ of its purchasing power. This is on top of the ~20% in value that the US Dollar has lost since 2020. Own assets or you will be left behind.' - TKL

Anyway, got Bitcoin?

https://cdn.azzamo.net/76adfe915db5f4288c3969e38b0890de77229174503103b5a72393f23c5f80a3.webp

➡️Strategy has acquired 4,048 BTC for ~$449.3 million at ~$110,981 per bitcoin and has achieved BTC Yield of 25.7% YTD 2025. As of 9/1/2025, we hodl 636,505 Bitcoin acquired for ~$46.95 billion at ~$73,765 per Bitcoin.

➡️https://cdn.azzamo.net/e3ec32936e8b845ad6b969cbcba9da97c7982081ed2ab609e2217063fe602991.webp

Robin Seyr: 'They know it's a race between private sound money and state surveillance money. ⇒ Bitcoin vs. CBDC!"

➡️Parker Lewis: "Not changing your software or running new code is being framed as the heretical position, which feels like gaslighting. 2009-2024: run full nodes, verify, don't trust, default position is no. 2025: run light clients, trust the experts, if you don't change code, you're a retard."

➡️'Cango Inc. reports 663.7 Bitcoin produced in August, up from 650.5 in July, with 5,193.4 BTC held by month-end. Deployed hashrate stayed at 50 EH/s, while average operating hashrate rose to 43.74 EH/s from 40.91 EH/s.' - Bitcoin News

➡️Billionaire Ray Dalio warns of a "debt-induced heart attack in the near future." "I'd say three years, give or take a year or two." Dalio has warned Donald Trump’s America is drifting into 1930s-style autocratic politics — and said other investors are too scared of the president to speak up. https://archive.ph/GdvIb

Buy Bitcoin.

➡️Daniel Batten: New article: The new (data-backed) story about Bitcoin mining: TL;DR

22 peer-reviewed studies

19 mainstream media outlets

10 sustainability media outlets

8 independent reports say Bitcoin mining has strong, scalable environmental benefits: https://batcoinz.com/the-changing-narrative-on-bitcoin-mining/

On the 3rd September:

➡️'Google Cloud just launched an AI that explains Bitcoin, analyzes wallets, and interacts with blockchain transactions.' - TFTC

➡️As I will explain down below in the Macro/Geopolitics section regarding the collapse of the G7 bond market... The best explanation why you should hold some Bitcoin. Adam Kobeissi: 'At some point, you have to ask yourself: What is going on? Gold is hitting daily record highs, yields are rising to 20+ year highs with rate cuts, and the S&P 500 is setting up for 7,000. Markets know that G7 Countries will see 3%+ inflation for years, and deficit spending is soaring. Own assets or be left behind.

➡️Global M2 is at an all-time high. Historically, the Bitcoin price follows. - Bitcoin Magazine

➡️River: "Business owners are investing 22% of their profits into Bitcoin. Our new report shows how, in 2025, businesses are adopting bitcoin faster than ever."

https://cdn.azzamo.net/37029322d389c6e2a91a11b30b8276a44ff4af1b8410a951367e1caa717f7f68.webp

In this report:

Why 2025 is a breakout year for business adoption

Bitcoin adoption across every industry

The Bitcoin Treasury Company Megatrend

How bitcoin goes mainstream for businesses https://river.com/learn/files/river-business-report-2025.pdf

➡️Bitcoin Archive: 'Whales are selling Bitcoin. Average holdings for entities with 100–10K BTC just dropped to 488 BTC, the lowest since 2018. Once whales finish taking profits, the melt-up can resume."

https://cdn.azzamo.net/c7b92414d96c261c7c90194e76af6003b6571add625d7b9cfa9737b3c69d9688.webp

➡️'Bitcoin smashes through $112K as Fed Governor Waller signals support for "multiple rate cuts" in the coming months.' - Bitcoin News

➡️River: 'You should be able to verify that your exchange is not selling paper bitcoin. It's a requirement to build a better financial system. All Bitcoin held on River is in proven full-reserve custody.'

https://cdn.azzamo.net/589eaaf534b2fe293e9e0176f8e1c161a1f15748bf7e7e209e3c2dc017f00ab0.webp

We need that all over the space, and worldwide in each country.

➡️One month later, and MSTY's down another 10% in terms of Bitcoin. nostr:npub14uhkst639zvc2trx2nlsvk4yqkjp690zk89keytnzgmq2az0qmnq58ez89

https://cdn.azzamo.net/b2733a088d43cc16604f6c095f9eb555fe481532345e83bbe2843fea40be55da.webp

Even if a 'product' comes out of the Saylor fabric, paper Bitcoin is not Bitcoin... and it will go to 0, given enough time.

➡️'Simple way to see if we have juice left in this cycle: Track the Z-score of Bitcoin's (daily price - 200WMA), and we see that the resulting standard deviation has a history of creeping up to ~2-3σ, and somewhere around that 2-3σ crest there tends to be a BLOW-OFF to the 6-8σ range. We haven't seen that blow-off yet this cycle. Get your popcorn ready for Q4 - Sminston With

https://cdn.azzamo.net/449909cf3d2c958540d555c19cb750eeece5712cfb5739c065b124df341a6849.webp

➡️West Main Self Storage buys an additional 0.089 Bitcoin and now holds a total of 0.52 BTC.

➡️Bloomberg reports Michael Saylor's Strategy "has met all the criteria — and more" to be added into the S&P 500

On the 5th of September:

➡️ nostr:npub1xkere5pd94672h8w8r77uf4ustcazhfujkqgqzcykrdzakm4zl4qeud0en Every business will hold bitcoin on its balance sheet. There’s an industry emerging to make this possible:

https://cdn.azzamo.net/60f5ff1cfcecbaf6c6b311a23ef9d5259ba223078dec6c9a23bb8a5a1a17334a.webp

➡️Bitcoin Archive: "$120 million Bitcoin and crypto longs liquidated in the past hour. Bitcoin fell -$2,500 in a few minutes."

➡️A solo Bitcoin miner has mined on this day a block worth $353,000.

➡️MARA mined 705 Bitcoin worth $77.7 MILLION in August. MARA now holds 52,477 BTC worth $5.9 BILLION. Second-largest public holder behind Strategy.

➡️El Salvador buys $50,000,000 worth of Gold. https://es-us.noticias.yahoo.com/salvador-eleva-31-reservas-oro-215307198.html According to the Yahoo article, they have $207M of gold in total and more than $700M in Bitcoin. As Pledditor mentioned: 'El Salvador just spent more money buying Gold yesterday than they have spent over the last 2 years buying bitcoin.' Let's see how this will work out.

➡️Paraguay to hold a meeting in September on creating a strategic Bitcoin reserve.

➡️RhinoBitcoin: 'AI researcher Dr. Roman Yampolskiy just told millions of viewers on Diary of a CEO that Bitcoin is the best investment for the age of AI. It's because “it’s the only scarce resource, the only thing we know the exact supply of in the universe.” Great quote on this topic by Bitcoin News: "If AI makes everything from knowledge to labor infinitely abundant, then Bitcoin’s absolute scarcity will become priceless."

➡️Bitcoin Archive: An SEC report reveals nearly a year of texts from former Chair Gensler were lost due to “avoidable” tech failures at the agency. Dates range from October 18, 2022, to September 6, 2023, when Bitcoin was $15k.

On the 6th of September:

➡️2.3M - 3.7M Bitcoin is permanently lost, according to Ledger. This means at least 11% of the total supply is gone forever.

➡️It took the U.S. 220 years to reach $1 TRILLION in debt. Today, we add that every 5 months.' - CarlBMenger

https://cdn.azzamo.net/5c68e0a3334bcbc1e569b05e07493c69f618ecc295c4efe4f8fe35b7c2c80d92.webp

Anyway, got Bitcoin?

On the 7th of September:

➡️Companies are buying 1,755 BTC per day. That’s 4x the daily mining issuance of just 450 BTC.

➡️Next ₿itcoin Halving Progress ▓▓▓▓▓░░░░░░░░░░░░░░░░ 35% Current Block: 913,519 Halving Block: 1,050,000 Blocks Remaining: 136,481 Days Remaining: ~948 days It is projected to occur in 2 years and 217 days on 4/11/2028.

➡️Bitcoin mining difficulty sets a new all-time high above $136 TRILLION. Network is stronger than ever.

https://cdn.azzamo.net/7a0eda9dfef04e8d0bc74d11f466aadca8cddfa6166bf3d2da6fd800e98f1b76.webp

➡️Bitcoin illiquid supply hits a record 14.3M BTC. 72% of the total supply is locked up by long-term holders.

On the 8th of September:

➡️Bitcoin Archive: Massive crypto supply chain attack. Ledger CTO warns: Hardware wallet users must verify every transaction. Others should avoid on-chain activity until patched.

https://cdn.azzamo.net/ba8bbd63105670b302d3295080ab6d79beb96111bf900ccdd9f1cef841a02952.webp

The drama here isn’t that a vulnerability exists — every system eventually reveals cracks. The drama is that 'crypto' has lulled people into forgetting the first principle of sovereignty: trust nothing blindly, not even your tools. And because no one bothers to listen, the majority of the people will continue to suffer. Do you know why Satoshi designed Bitcoin to be used "p2p"? It's because "3RD PARTIES ARE SECURITY HOLES...ALL OF THEM!". And for the love of god! When are people going to learn that Ledger is just crap and not air gapped? Just don't do shitcoins!

🎁If you have made it this far, I would like to give you a little gift:

'Lyn Alden just dropped a 2-hour masterclass with Tom Bilyeu to his 4.5M+ subscribers. If you don’t understand what’s happening to money right now, you’ll wake up on the wrong side of history. A 2-hour macro deep dive, compressed for signal. Which insight hit hardest for you? Watch the full conversation here:' - Swan

Credit: I have used multiple sources!

My savings account:

Bitcoin The tool I recommend for setting up a Bitcoin savings plan: PocketBitcoin especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly.

Use the code SE3997

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple. ⠀ ⠀

Do you think this post is helpful to you?

If so, please share it and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐ Many thanks⭐

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

https://blossom.primal.net/cc2dcec361355d89c2a97e9b1f20957447063920d68f3009007b267ead96af50.webp

The Latest Bitcoin & Macro news: Weekly Recap 08.09.2025

If you would rather read the long format, enriched with detailed charts, illustrative images, and comprehensive macroeconomic news to provide context and clarity. (outside of Nostr) Click here:

Do you think this post is helpful? If so, please share it with your friends, family co-workers, and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐️ Many thanks⭐️

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

https://blossom.primal.net/cc2dcec361355d89c2a97e9b1f20957447063920d68f3009007b267ead96af50.webp

The Latest Bitcoin & Macro news: Weekly Recap 01.09.2025

If you would rather read the long format, enriched with detailed charts, illustrative images, and comprehensive macroeconomic news to provide context and clarity. (outside of Nostr) Click here:

Do you think this post is helpful? If so, please share it with your friends, family co-workers, and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐️ Many thanks⭐️

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

https://blossom.primal.net/cc2dcec361355d89c2a97e9b1f20957447063920d68f3009007b267ead96af50.webp

On Nostr, I will exclusively share the most significant Bitcoin news. (this note)

For those (still) beyond Nostr—friends, family, and colleagues—the complete Weekly Recap will be accessible on my Bitcoin Friday page on Habla. (next note)

Enriched with detailed charts, illustrative images, and comprehensive macroeconomic news to provide context and clarity.

Happy reading!

The Latest Bitcoin & Macro news: Weekly Recap 01.09.2025

🧠Quote(s) of the week:

James Lavish: "If you want to protest anything, protest central bank monetary manipulation that steals purchasing power from you daily. And the way to do that is by buying Bitcoin." nostr:npub1cj94enk44kn5mvrcma4sp7jnlsgnn4em7rk3dh3jt4fzyqs3m02s560efa

The great promise of Bitcoin—its great and noble ambition—is that, some years from now, it will perhaps have healed the institution of money in our civilization.

🧡Bitcoin news🧡

On the 25th of August:

➡️The Bitcoin Fear and Greed Index is now almost back at "Fear" - Bitcoin Magazine Pro

https://cdn.azzamo.net/5e56cbc601a40ee1a8e57dc35ff630c248f75bfb70f69d28112cd2a5d1296cba.webp

On the 26th of August:

➡️Semiconductor firm Sequans to raise $200 MILLION to buy Bitcoin for its treasury.

➡️By opening 401ks to alternative investments, the Trump administration just unlocked a $7 trillion market for Bitcoin. "This isn't regulatory capture, it's almost regulatory surrender."

Bitcoin News: "Did you know that new SEC Chair, Paul Atkins, has disclosed owning $6 million in crypto?'

➡️86% of Strategy’s 3,081 BTC purchase this week came from tapping the ATM and selling common MSTR shares.' -Bitcoin News

➡️Bitcoin News: "In its inaugural 'Bitcoin Long-Term Capital Market Assumptions, Bitwise lays out its bull case. Bitwise predicts Bitcoin could hit nearly $3 MILLION by 2035. Base case: $1.3M Bear case: $88K Bull case: $2.97M Too bullish or too bearish?"

➡️As shared last week, but a great reminder: If you hold Bitcoin for 3+ years, your odds of losing money are basically 0%.

On the 27th of August:

➡️A Bitcoin whale sent 750 BTC worth approximately $83 million to Binance, according to Nansen. They bought it 12 years ago for $322. Many whales have been selling recently. Once the market absorbs this supply, Bitcoin is likely to move higher.

➡️Bitcoin Archive: "Bitcoin total hash rate reaches a new all-time high. Hash precedes price."

https://cdn.azzamo.net/ebbd11a3f19629788292ee0f68c49caa64e595fc3f84186234f11d12550c0bdc.webp

➡️Priced in Bitcoin: "The Big Mac Index, Priced in BTC.

2015: ₿0.0099

2020: ₿0.000166

2025: ₿0.0000609

In 10 years: -99% in BTC, while USD +33%. Everything priced in bitcoin tends to zero.

https://cdn.azzamo.net/bc453d24cd520470f68be7ff0198a856ce4e7606586beb05cb04b50737946f6e.webp

On the 29th of August:

➡️River: Every Bitcoiner started as a critic. But as we pay attention and dig deeper, one by one, we change our minds. And all of them end up capitulating! nostr:npub1xkere5pd94672h8w8r77uf4ustcazhfujkqgqzcykrdzakm4zl4qeud0en

➡️Lyn Alden: "There's so much drama/chatter about bitcoin's boring price action. Just grinding generally upward with higher highs and lows. Since this has roughly been my base case (bullish but boring), I went and wrote a sci-fi book during this time. You can just kind of skip boring things."

https://cdn.azzamo.net/cc449f379a1f1b7e50f1878edba11b7fa5e9b92a952a20cd4027fc6bcbfcb9b4.webp

➡️How can this be…I was told they only use Bitcoin to launder money.

https://cdn.azzamo.net/f9e5b01f7593d0e6e904afde07ceb332de820ec2017d7f9315ca51913f8a1aba.webp

On the 30th of August:

➡️Reminder: Bitcoin's volatility has been trending down since its inception. The trend also follows price, which Bitcoin has scaled by 7 orders of magnitude. Moving toward $1M Bitcoin will represent moving into a fully mature asset class, from which the early investors (you) will have greatly benefited, especially while enduring the stormy seas. Showing: Bitcoin's annualized 30-day volatility as a % (along with the rolling median). Bitcoin’s volatility: the ultimate chart.

https://cdn.azzamo.net/1ffa05d2855041d39e38992f4247d54418e5c640c99ca468a1b45d8c8de6ace3.webp

Both Bitcoin volatility and returns have unquestionably followed a clear, diminishing pattern, which is logical and expected for a financial asset and network undergoing a stabilization process.

➡️ Institutions bought 690,710 BTC this year vs only 109,072 BTC mined. – Bitwise: That’s 6x more demand than supply.

https://cdn.azzamo.net/620fb577671c76f1f87a4cca33526865cba2677143bf035c55143384b18061e8.webp

➡️'New York’s Bitcoin bar @PubKey is rolling out a new deal: all payments made in Bitcoin get 21% off. That’s beers, burgers, dogs, and merch, everything on the menu.' -Bitcoin News

➡️West Main Self Storage buys an additional 0.088 #Bitcoin and now holds a total of 0.43 BTC.

On the 30th of August:

➡️Bitcoin Archive: "Bitcoin whale who sold 24,000 BTC last week just sent another 2,000 BTC to an exchange. Watch out for volatility again this weekend."

➡️"El Salvador has begun redistributing its National Strategic Bitcoin Reserve into multiple unused addresses, each capped at 500 BTC. The move enhances long-term security and reduces exposure to quantum threats by keeping public keys hashed and unused." -Bitcoin News

On the 31st of August:

➡️BLACKROCK: "If every millionaire in the U.S. asked their financial advisor to get them 1 Bitcoin, there wouldn’t be enough."

On the 1st of September:

➡️Michael Saylor's STRATEGY could join the S&P500 as early as this Friday. Passive index funds would be forced to buy billions in Bitcoin exposure.

➡️Solo miner mines an entire Bitcoin block worth $340,000. They won the Bitcoin lottery.

https://cdn.azzamo.net/c06ffcffcf7113446e26a6775e9bbb39d34153d37a86ce95acdb801a7c9878e1.webp

➡️The world's third-largest hydroelectric power plant in Paraguay turns renewable hydropower into Bitcoin.

➡️'Bitcoin closed August in the red for the 4th consecutive year. September is historically Bitcoin’s weakest month. Watch for a bottom this month before a surge in Q4.' - Bitcoin Archive

https://cdn.azzamo.net/d84d3b29abe667c024ed430da1dd268f333d5c32a937f3be7dfaa31f214ebd13.webp

➡️The dollar is losing reserve currency status. It’s down to 42% of global reserves, and gold is rapidly rising. - Balaji

Some context: Gold's share of global international reserves rose 3 percentage points in Q1 2025, to 24%, the highest in 30 years. This marks the 3rd consecutive annual increase. Meanwhile, the US Dollar's share declined ~2 percentage points, to 42%, the lowest since the mid-1990s. The Euro share remained roughly unchanged at ~15%. Gold is now the world’s second-largest reserve asset after surpassing the Euro in 2024. Gold is seeing historic levels of demand.

https://cdn.azzamo.net/2e8b9dca2e0d54af01947521115477ae8435cb6159842cce7aafefe16af28d65.webp

Something Bitcoin flavour to add on.

https://cdn.azzamo.net/ffbf72ec342f7f50ec2ae82cb57dbbca373d19714cb6c51387d78536756bad1b.webp

What do you need besides this table, really? More Bitcoin! All aside, Bitcoin % will be max 20-30% in the next decade. Considering the alternatives, still the best.

Show this to your co-workers, friends, or family members if they ask you how to get started with investing. There is only one answer...

🎁If you have made it this far, I would like to give you a little gift:

For those who haven't gotten a chance to read Broken Money, remember that nostr:npub1a2cww4kn9wqte4ry70vyfwqyqvpswksna27rtxd8vty6c74era8sdcw83a has a 30-minute animated video of it as well:

Credit: I have used multiple sources!

My savings account:

Bitcoin The tool I recommend for setting up a Bitcoin savings plan: PocketBitcoin especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly.

Use the code SE3997

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple. ⠀ ⠀

⠀⠀ ⠀ ⠀⠀⠀

Do you think this post is helpful to you?

If so, please share it and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐ Many thanks⭐

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

The Latest Bitcoin & Macro news: Weekly Recap 25.08.2025

If you would rather read the long format, enriched with detailed charts, illustrative images, and comprehensive macroeconomic news to provide context and clarity. (outside of Nostr) Click here:

Do you think this post is helpful? If so, please share it with your friends, family co-workers, and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐️ Many thanks⭐️

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

https://blossom.primal.net/cc2dcec361355d89c2a97e9b1f20957447063920d68f3009007b267ead96af50.webp

On Nostr, I will exclusively share the most significant Bitcoin news. (this note)

For those (still) beyond Nostr—friends, family, and colleagues—the complete Weekly Recap will be accessible on my Bitcoin Friday page on Habla. (next note)

Enriched with detailed charts, illustrative images, and comprehensive macroeconomic news to provide context and clarity.

Happy reading!

The Latest Bitcoin & Macro news: Weekly Recap 25.08.2025

🧠Quote(s) of the week:

"People don't realize that Bitcoin can conquer a $100+ trillion market simply because of multisig and the unbreakable reliability of its settlement. No collateral can even come close to any of the 5 most important traits you want in a perfect collateral. Bitcoin destroys all of it. - quick to exchange - easy to verify - easy & quick to liquidate at any time on any day - can't be damaged, perfectly portable - completely unmatched in mitigating trust and custody concerns Literally nothing is even in the same ballpark." - Guy Swann

Photos hosted by Azzamo (https://azzamo.net/)

🧡Bitcoin news🧡

https://cdn.azzamo.net/b5da19c57bc81cfd8487a7560a0962422ca5ac14c57fe7beaf440037342eb53e.webp

On the 18th of August:

➡️Thailand launches a program to allow foreign visitors to convert Bitcoin and crypto into local currency.

➡️I hate dumbducks like Jacob King:

https://cdn.azzamo.net/9afe7877c9fb692d461e29cf7d3dd7b5c56dc3445be520f66564797aed6ef8c4.webp

Ah, the great panic of the faithful—Foundry burps out eight blocks in a row and suddenly the sky is falling. Eight in a row with ~40% of the hash? That’s not black magic, that’s probability yawning and stretching. The White Paper told you plainly in Section 5: miners and nodes are the same, and there have never been more than a dozen or two in operation at any given time. Right now, you’re looking at about 13. So the spectacle here isn’t proof of decentralisation’s corpse; it’s just mathematics paying its rent on time.

Shanaka Anslem Perera: "Everyone screaming 'centralization' at 8 Foundry blocks in a row is missing the actual signal. Bitcoin is not a stock you hold; it is a thermodynamic truth encoded in math. Mining is probabilistic … streaks happen. Fees collapsing and empty blocks don’t mean “Bitcoin is dead,” they mean the network is clearing, like the ocean at low tide before the next wave. The real centralization risk isn’t Foundry or Antpool. It’s the fiat system you’re still trapped in. Bitcoin is the only network where power is checked by physics itself: SHA-256, difficulty adjustment, and block time. No CEO, no government, no central bank can override it. Eight blocks in a row isn’t a death knell. It’s a reminder. Bitcoin doesn’t care about your fear. It runs on a clock deeper than nation-states, deeper than empires. The longest chain always wins."

Spot on!

On the 19th of August:

➡️Royal Bank of Canada increased its MSTR stake by nearly 16% in Q2 2025, per new SEC filing.

➡️Bitcoin is dead, again!

https://cdn.azzamo.net/42ac87713c26dc9bbc29601df59f91bead71f114b0d751ff0fe1725bf3b6b30d.webp

Joe Consorti: Bitcoin has spent 131 days above $100k since it first broke it, with 43 days spent above $110k. Last cycle, BTC only spent 39 days above $60k. This consolidation above $100k is extremely healthy relative to prior cycles. Zoom out, and relax.

➡️On-Chain Collega: Let me be clear: This is not what Bitcoin cycle tops look like.

https://cdn.azzamo.net/06c2427d44a81e94e36c6de30bade9b056f1e0430e0e72fd56c52884949e1abc.webp

➡️Air Canada pension fund reveals $161 MILLION Bitcoin allocation. This is Canada's first large pension fund with a Bitcoin allocation.

➡️David Bailey’s KindlyMD acquires 5,744 Bitcoin for $678.9 MILLION.

➡️Tether appoints former white house crypto council executive director Bo Hines as strategic advisor for digital assets and U.S. strategy

➡️Tech Giant Google increases stake in Bitcoin miner TeraWulf to 14%.

➡️Bhutan government transfers 800 BTC ($92M). Bhutan holds 9,969 BTC ($1.15B).

https://cdn.azzamo.net/699d3b6edb3ddd50d95c6c78df3bcd5387fd582d9774e4518f41ccc0d58342c5.webp

➡️Ark 21Shares sells 559.85 Bitcoin worth $64.4 million.