Zaps for #bitcoin mining block party

Now you can direct buy 8 TH/s for this Saturday's mining party

Just 120 sats to potentially win (via mining) 21x that

Great price!

I'll zap 121 sats to everyone who reposts in the next 21 minutes

100% this. nostr:note1guw7g4790e3pt0zlhqdtvalnak5g28mtgusd7fkddkw7znhj5t6syd48r3

Morning Nostr.

ROUND 2 🔥🔥🔥

Nostr is fucking amazing.

Interact with this post to win sats!

nostr:npub1e85mms9s8ssm6vm6ztw0tdrr6j0a4l5gf2sjhw2scxpwnexmaxuqcev9em 21000

hello

Morning Nostr

Meditation on Moloch is the best essay you'll read on bitcoin mining.

https://slatestarcodex.com/2014/07/30/meditations-on-moloch/

I'm gaining on him 😂

yes, we're a team so we all get shares if we find a block, so his share is bigger than mine since I'm trailing him...but the incentive also is that we're pumping up the hashrate with our ridiculousness. And nostr:nprofile1qyxhwumn8ghj7mn0wvhxcmmvqys8wumn8ghj7mn0wd68yttjv4kxz7fww3jhsctndpjkgem99eu8j7sqyq7jezkg8zyrx784ncdupq8p76wv8ssjcyymn8jpess7etzulu0lqs07j7q does a 21% hashrate match.

Then whoever amongst the group has nostr:nprofile1qyv8wumn8ghj7urjv4kkjatd9ec8y6tdv9kzumn9wsqzpv0prpvgffk3fwluuwyeedf7sxp6mhny9uny6rl57969xu0qvy6vhuwgqp fleets (or other solo miners) can point them to our pool (we use CKPool) during the block party (which is 6 hours).

And then I'm also out there seeking extra hash because I'm competitive 🤣 but that's another story! tell ya if we hit a block on the 26th 😉

🔥🔥🔥

Morning Nostr 👋

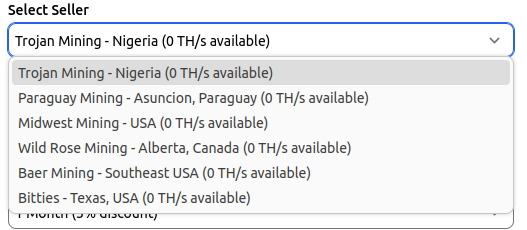

Sold everything in 4 hours on Friday

Working on more supply from our mining farm partners

Stay tuned

Watching the world transform

Just posted a new round of block party auctions

Opening bid is 100 sats

Good price

I'll zap the next 3 people who want to try solo mining w/ our crew

Morning

bitcon....

Background on the Upendo block party:

I first saw the idea of a block party on bitcointalk [below]

Willi on bitcointalk organized the party, a bunch of folks sent him bitcoin, and he rented a bunch of hashrate and they all solo mined together - they found several blocks back in the day.

nostr:npub1t6el40knsq8hmrpr0m6tt3t0tr4pdeyhlt2qelwhgtwawddqx0xsv03scu was built to sell hashrate at auction - and so, I figured, let's try a block party auction.

What happened next was interesting

- To start, bids were low (way under the cost of hashrate)

- As hashrate went up, so did the bids

Once the party was mining, bids to join were 3x over the cost of hashrate - totally nuts.

Thus the idea of bonus hashrate...

Putting on my Systems Thinking Hat, I saw there was a feedback loop between bidders and block party size...the more bidders, the more hashrate, which attracted more bidders.

And so, to amplify the feedback loop, the bid amount *over* the cost of hashrate pays for "bonus" hashrate - extra hashrate that increases the odds for the whole party.

The idea is to leverage the FOMO Energy of block party'ers to biggify the party.

This bonus hashrate feedback loop has played out in every block party since then.

It's like a flywheel.

Or maybe a plebwheel?

The block party is a way to grab some hashrate (otherwise pointed to centralized pools) and solo mine with it, as a group.

Next up is to figure out a feedback loop to incentivize people telling friends (and their friends, and their friends) about Upendo 📈

And then we may finally get enough hash to mine a block..

Happy Friday, thanks for reading.

- Background: https://bitcointalk.org/index.php?topic=5364375.0

- Upendo: https://upendo.rigly.io

how quickly we get used to things

Gm nostr

It's a good day to have a good day

Gm nostr