Hollywood and DC work hand in hand.

Hollywood is a reflection of the political

THE GAME IS EXITING THE SYSTEM

It's easy to buy #bitcoin it's hard to exit the matrix.

Another way to view this is FI managers are willing to pay a 2x premium on #Bitcoin to get assets out of the Tradfi system. Every dollar that buys MSTR over 1x Nav allows a dollar of stuck FI money to get out.

Literally the exit liquidity for the bond holders, by design. Retail always loses.

Not bad; long the converts short the stock is the real play.

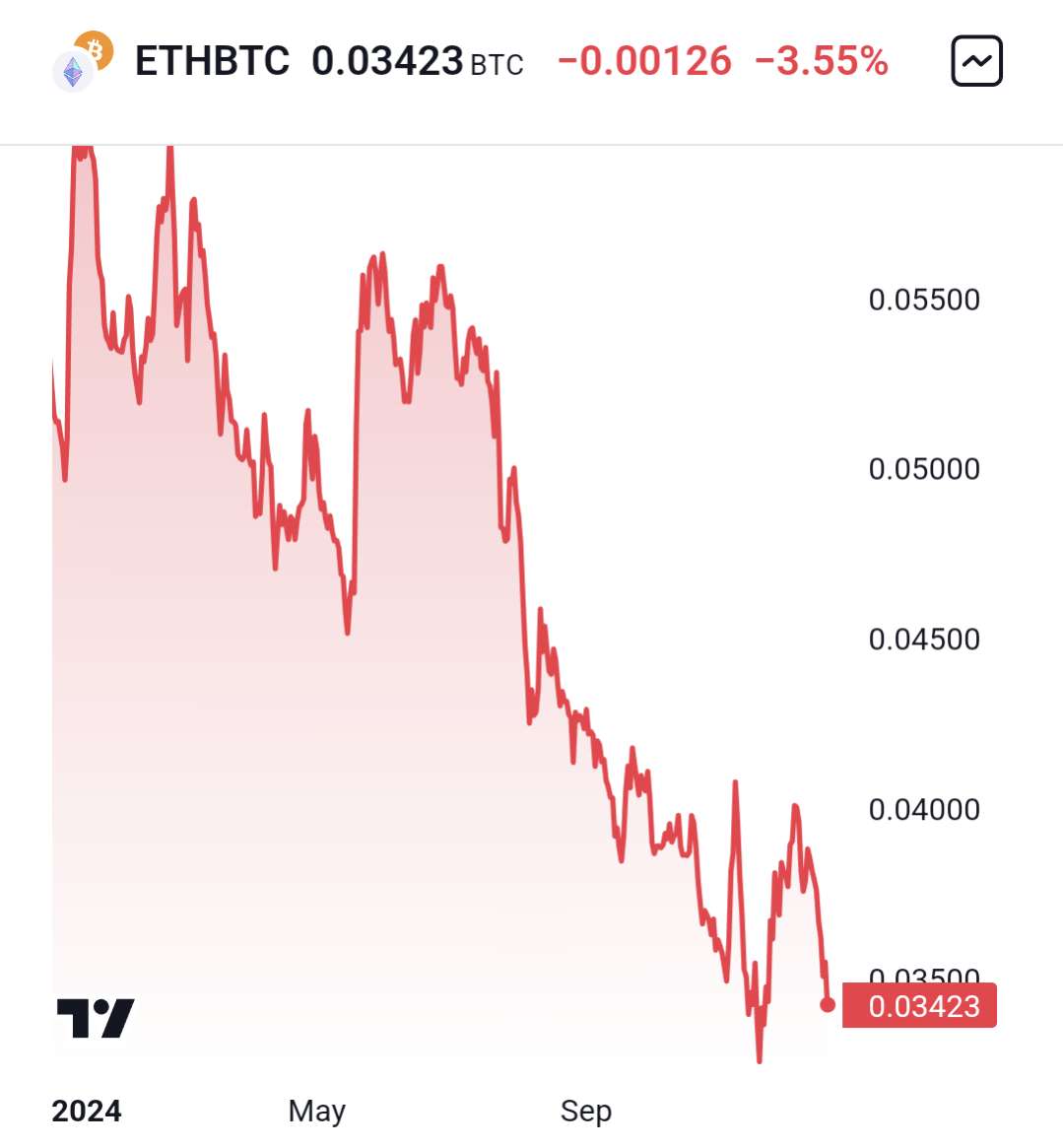

Everything that holds bitcoin is just a derivative of #bitcoin and will trade at a discount to the actual thing.

Correct that's not the argument. Why would you purchase bitcoin 2x-3x the market price of bitcoin?

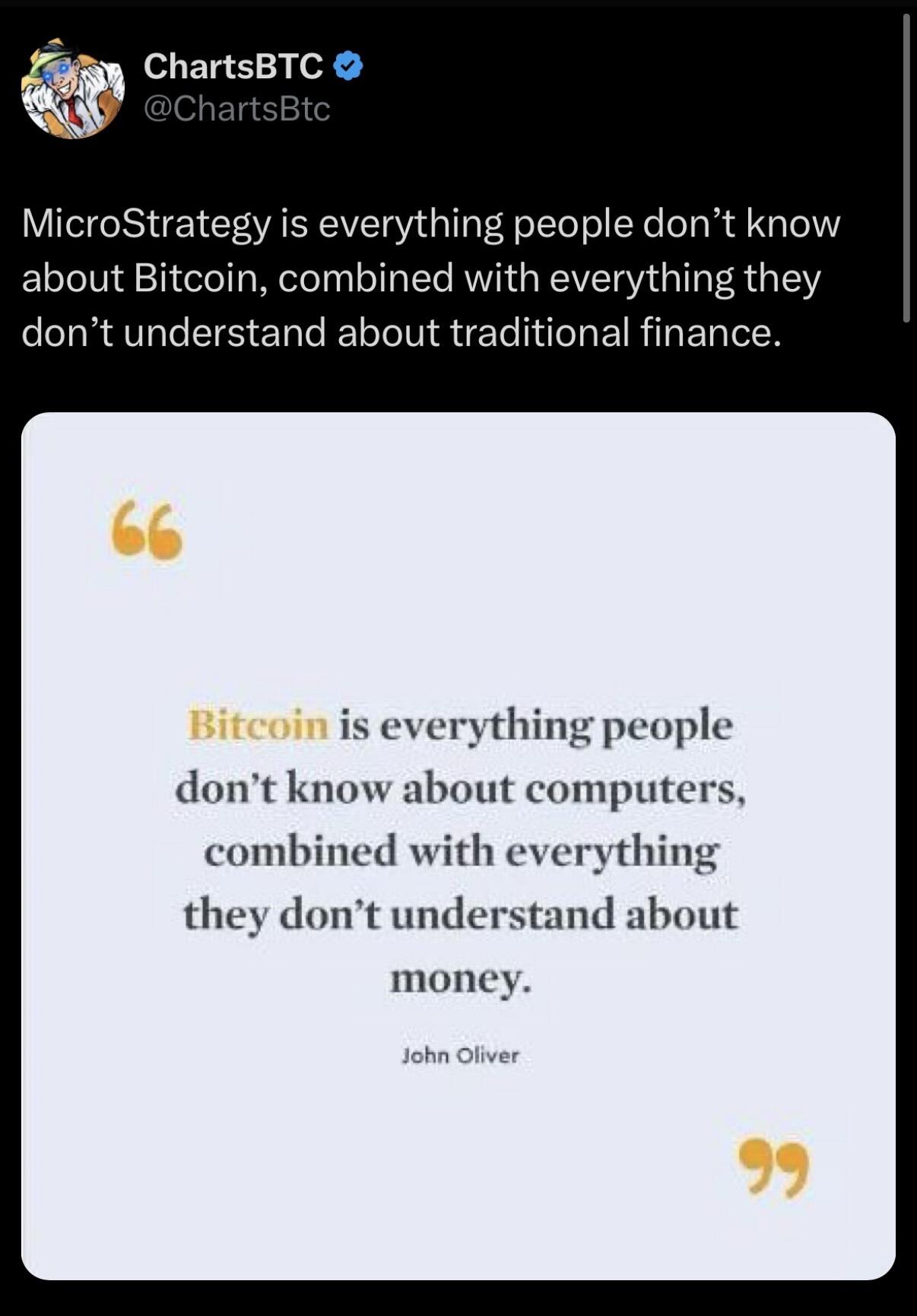

What is Microstrategy doing as a business that makes their bitcoin worth 2x more?

Hint: they are doing nothing, we just have simps that watched a few YouTube videos

Called the NAV top a month ago and the bag holders/exit liquidity just can't part with their positions. The only winners here are the convert bond buyers; none of which are here.

Nah just shitcoining with a different name.

MSTR valuation is 2x the bitcoin it holds (was 3x , will be <1x). So either they have a kickass operating business that is going to make them a ton of money; Saylor somehow adds so much value that when he holds bitcoin it's worth 2x

OR

It's over valued by 50% - 70%

These losers think that the bitcoin Saylor holds is magically worth 2x more than other bitcoins lol

😂

(That's not actually what they think, they actually are not thinking at all)

If you're buying MSTR now you have to make the case that the #Bitcoin It holds is worth $200k while you can buy $100k bitcoin

OR

MSTR is going to double the amount of the #Bitcoin they hold

If you're holding it and did not sell at 3x nav you're stupid and if you're buying it 2x nav you're also stupid.

It's about getting fiat rich not changing the system. Never was for a lot of them. The colors always come out.

nostr:npub1rtlqca8r6auyaw5n5h3l5422dm4sry5dzfee4696fqe8s6qgudks7djtfs is the Nic Carter of this cycle

be a bot to confuse them

El Salvador has always been the trial balloon for the US. The US wants to become the de-facto IMF through bitcoin. #Bitcoin is how the US govt gets out from under the boot of the #Fed and the #IMF . We're just the pawns in the middle making some money.

When that goes to 0 #bitcoin becomes un-priceable. Markets will not function. Liquidity is much thinner than everyone thinks.

They cant stop the thing

Whale alert! 🐋 Someone moved 3,999 BTC ($427M) in block 875,042 https://mempool.space/tx/05490de013ba8170af6a513b8ea4ccca5ce84716c311ea913d341cf697bae4e3?mode=details

Hell yeah

Central bank is the bank of banks. Commercial banks are just arms of the central bank.

Central banks "loan" money (digitally created money) to commercial banks.

Those that finally "get it" always come back and tell the people who tried to orange pill them "thank you, I was wrong". It's part of understanding #Bitcoin