If I could send a letter to myself five years ago, this book would be it.

I’m not a Bitcoin expert. I’m not a developer, a coder, or an economist. I don’t have credentials, connections, or capital. I’m a blue-collar guy who stumbled into Bitcoin almost exactly four years ago, and like everyone else, I had to wrestle with it to understand it.

Bitcoin is one of the most misunderstood, misrepresented, and misinterpreted ideas of our time—not just because it’s complex, but because its very structure makes it easy to distort.

It’s decentralized and leaderless, which means there’s no single voice to clarify what it is or defend it from misinformation. That’s a feature, not a bug, but it means that understanding Bitcoin isn’t easy.

It’s a system that doesn’t fit into any of our existing categories. It’s not a company. It’s not a product. It’s not a government.

There’s no marketing department, no headquarters, no CEO.

That makes it uniquely resistant to corruption, but also uniquely vulnerable to disinformation. Whether through negligence or malice, Bitcoin is constantly misunderstood—by skeptics who think it’s just a Ponzi scheme, by opportunists looking to cash in on the hype, by scammers who use the name to push worthless imitations, and by critics who don’t realize they’re attacking a strawman.

If you’re new to Bitcoin, you have to fight through layers of noise before you can even see the signal. And that process isn’t instant. Even if you could explain digital signatures off the top of your head, even if you could hash SHA-256 by hand, even if you had a perfect technical understanding of every moving part—you still wouldn’t get it. Because Bitcoin isn’t just about technology. It’s about trust, incentives, game theory, and the history of money itself. It’s about sovereignty and censorship resistance. It’s about how something so simple—21 million coins, an open ledger, a fixed issuance schedule—can have such massive implications for the world.

And that’s why this book exists.

Bitcoin isn’t something you learn all at once. It’s something you unlearn first. You start with assumptions about money, value, and authority that have been baked into you since birth, and you slowly chip away at them. It’s like peeling layers off an onion.

At first, you might come for the speculation. A lot of people do. But those who stick around, who actually take the time to understand what’s happening here, don’t stay for the “profits”. They stay for the principles.

Because once you see Bitcoin for what it is—not just an asset, but an idea—you can’t unsee it.

If you’re holding this book, you’re somewhere on that journey. Maybe you’re at the very beginning, trying to separate the signal from the noise. Maybe you’ve been down the rabbit hole for years and you’re looking for a way to articulate what you already feel. Either way, this is for you. It’s not a technical manual, and it’s not a sales pitch. It’s a distillation of everything I wish I could have told myself when I first started.

So if you’re where I was, consider this a time capsule from the future. A hand reaching back through the noise, saying:

Keep going. It’s worth it.

***

Preface

The End of The Beginning

March 2025.

The moment has arrived. Most haven’t even noticed, let alone processed it. The United States is setting up a Bitcoin (Bitcoin-only!) strategic reserve.

It’s not a theory. Not an idea. The order is signed, the ink is dried.

The people who have been wrong, over and over (and over!) again - for years! - fumble for explanations, flipping through the wreckage of their previous predictions:

“Bubble…’’

“Fad…”

“Ponzi…”

No longer.

The same analysts who once sneered are now adjusting their forecasts to protect what’s left of their credibility. Those who dismissed it are now trapped in a slow, humiliating realization: Bitcoin does not require their approval.

It never did.

Something fundamental has shifted, and the air is thick with a paradoxical cocktail of triumph and panic. Bitcoiners saw this coming. Not because they had insider information, but because they understood first principles when everyone else was still playing pretend.

Bitcoin was never just surviving.

It was infiltrating.

The question is no longer whether Bitcoin will succeed. It already has. The only question that remains is who understands, and who is still in denial.

Think back to 2022.

At its peak, FTX was one of the world’s largest cryptocurrency exchanges, valued at $32 billion and backed by blue-chip investors. It promised a sophisticated, institutional-grade trading platform, attracting retail traders, hedge funds, and politicians alike. Sam Bankman-Fried, with his disheveled hair and cargo shorts, was its eccentric figurehead, a billionaire who slept on a bean bag and spoke of philanthropy.

Then the illusion shattered.

FTX collapsed overnight, an implosion so violent it left an entire industry scrambling for cover. One moment, Sam Bankman-Fried was the golden boy of crypto - genius quant, regulatory darling, effective altruist™. The next, he was just another fraudster in handcuffs.

Billions vanished. Customers locked out. Hedge funds liquidated. Politicians who had once taken photos with SBF and smiled at his political donations, suddenly pretended they had no idea who he was. The same regulators who were supposed to prevent disasters like this stood slack-jawed, acting as if they hadn’t been having closed-door meetings with FTX months before the collapse.

If you were Bitcoin-only, with your satoshis in cold storage, you didn’t even blink.

From your perspective, nothing important changed:

A new Bitcoin block still arrived every ten minutes (on average).

The supply cap of 21 million bitcoins remained untouched.

Ownership was still protected by public/private key cryptography.

You were literally unaffected.

FTX wasn’t just a scandal, it was a filter.

Bitcoiners had already updated their priors:

“If you don’t hold your own keys, you own nothing.”

“Bitcoin is not ‘crypto’.”

“’Crypto’ is a casino.”

FTX was just another financial fire, another chapter in the never-ending saga of people trusting systems that had already proven themselves untrustworthy.

That moment was a prelude.

The U.S. Bitcoin pivot is the paradigm shift.

The Eukaryotic Revolution Is Upon Us

In biology, abiogenesis is when life emerged from non-life - a fragile, uncertain process where the first microscopic self-replicators struggled to survive against hostile conditions. That was Bitcoin’s early history. It had to fight for its existence, attacked by governments, dismissed by economists, ridiculed by mainstream media. But it survived.

That era is over.

We have entered the Eukaryotic Revolution.

This is the moment in evolutionary history when simple lifeforms evolved into something structurally complex - organisms with nuclei, internal scaffolding, and the ability to form multicellular cooperatives and populate diverse ecosystems. Once this transformation happened, there was no going back.

Bitcoin has just experienced its own Eukaryotic leap.

Once an outsider, dismissed and ridiculed, it is maturing into an integrated, resilient force within the global financial system.

On March 2, 2025, the Trump administration announced a Crypto Strategic Reserve.

At first, it wasn’t just Bitcoin - it included XRP, SOL, and ADA, a desperate attempt to appease the altcoin industry. A political move, not an economic one.

For about five minutes, the broader crypto industry cheered.

Then came the pushback.

Bitcoiners called it immediately: mixing Bitcoin with centralized altcoin grifts was like adding lead weights to a life raft.

Institutional players rejected it outright: sovereign reserves need hard assets, not tech company tokens.

The government realized, almost immediately, that it had made a mistake. By March 6, 2025, the pivot was complete.

Bitcoin reserve confirmed. The government’s official policy: hold bitcoin. Acquire more bitcoin.

Altcoins relegated to second-tier status - treated as fundamentally separate from and inferior to bitcoin. The government’s official policy: sell, do not actively accumulate more (ouch!).

Bitcoin maximalism wasn’t vindicated by debate. It was vindicated by economic reality. When the U.S. government was forced to choose what belonged in a sovereign reserve, it wasn’t even close. Bitcoin stood alone.

“There is no second best.”

-Michael Saylor

Who This Book Is For: The Three Types of Readers

You’re here for a reason.

Maybe you felt something shift. Maybe you saw the headlines, sensed the undercurrents, or simply couldn’t ignore the growing drumbeat any longer. Maybe you’ve been here all along, waiting for the world to catch up.

Whatever brought you to this book, one thing is certain: you’re curious enough to learn more.

Bitcoin forces a reevaluation of assumptions—about money, trust, power, and the very foundations of the economic order. How much of that process you’ve already undergone will determine how you read these pages.

1. The Layperson → You’re new, curious, maybe skeptical.

Bitcoin probably looks like chaos to you right now. One person says it’s the future. Another says it’s a scam. The price crashes. The price doubles. The news is either breathless excitement or total doom. How the hell are you supposed to figure this out?

If that’s you, welcome.

This book was built for you.

You don’t need to be an economist, a technologist, or a finance geek to understand what’s in these pages. You just need an open mind and the willingness to engage with new ideas - ideas that will, if you follow them far enough, challenge some of your deepest assumptions.

Bitcoin is not an investment.

Bitcoin is not a company.

Bitcoin is not a stock, a trend, or a passing phase.

Bitcoin is a paradigm shift.

And by the time you reach the last page, you won’t need to be convinced of its importance. You’ll see it for yourself.

2. The Expert → You’ve been in the game for years.

You’ve put in the time.

You don’t need another book telling you Bitcoin will succeed. You already know. You’re here because you want sharper tools. Tighter arguments. A way to shut down nonsense with fewer words and more force.

Maybe this book will give you a new way to frame an idea you’ve been struggling to convey. Maybe it will help you refine your messaging and obliterate some lingering doubts in the minds of those around you.

Or maybe this will simply be the book you hand to the next person who asks, “Okay… but what’s the deal with Bitcoin?” so you don’t have to keep explaining it from scratch.

3. The Student → You understand the basics but want to go deeper.

You’ve already stepped through the door.

You’ve realized Bitcoin is more than just digital gold. You understand decentralization, scarcity, censorship resistance… But the deeper you go, the more you realize just how much there is to understand.

Bitcoin isn’t just a technology.

Bitcoin isn’t just an economic movement.

Bitcoin is a lens.

And once you start looking through it, the world never looks the same again.

You’re here because you want to accelerate your journey. You don’t just want to know what Bitcoin is, you want to know why Bitcoiners think the way they do.

This book will give you the mental framework to make that leap.

Bitcoin isn’t just something you learn about.

It’s something you grow to realize.

Regardless of which category you fall into, you’ve already passed the first test.

You’re still reading.

You haven’t dismissed this outright. You haven’t scoffed, rolled your eyes, or walked away. You’re at least curious.

And that’s all it takes.

Curiosity is the only filter that matters.

The rest takes care of itself.

The Essential Role of Memes

Memes won the narrative war - it wasn’t textbooks, research papers, or whitepapers that did it.

Bitcoin spread the same way evolution spreads successful genes - through replication, variation, and selection.

Richard Dawkins coined the term meme in The Selfish Gene, describing it as a unit of cultural transmission – behaving much like a gene. Memes replicate, mutate, and spread through culture. Just as natural selection filters out weak genes, memetic selection filters out weak ideas.

But Bitcoin memes weren’t just jokes.

They were premonitions.

The most powerful ideas are often compact, inarguable, and contagious - and Bitcoin’s memes were all three. They cut through complexity like a scalpel, distilling truths into phrases so simple, so undeniable, that they burrowed into the mind and refused to leave.

“Number Go Up.”

“Not Your Keys, Not Your Coins.”

“There Is No Second Best.”

Each of these statements is more than just a slogan.

They are memetic payloads, compressed packets of truth that can carry everything you need to understand about Bitcoin in just a few words.

They spread through conversations, through tweets, through shitposts, through relentless repetition. They bypassed the gatekeepers of financial knowledge. They infected minds before Wall Street even understood what was happening.

And now - they are historical markers of the shift, the fossil record our of our collective consciousness coming to terms with something fundamentally new in the universe.

The old world relied on authority, institutional credibility, and narrative control. Bitcoin broke through with memes, first principles, and lived experience.

This wasn’t just an ideological battle. It was an evolutionary process.

The weaker ideas died.

The strongest ones survived.

Once a meme – in other words, an idea - takes hold, there is nothing - no law, no regulation, no institution, no government - that can stop it.

Bitcoin isn’t a movement that needs recruits.

It isn’t a stock looking for investors. It isn’t a campaign asking for your vote.

Bitcoin simply is.

And it will keep producing blocks, every ten minutes, whether you get it or not.

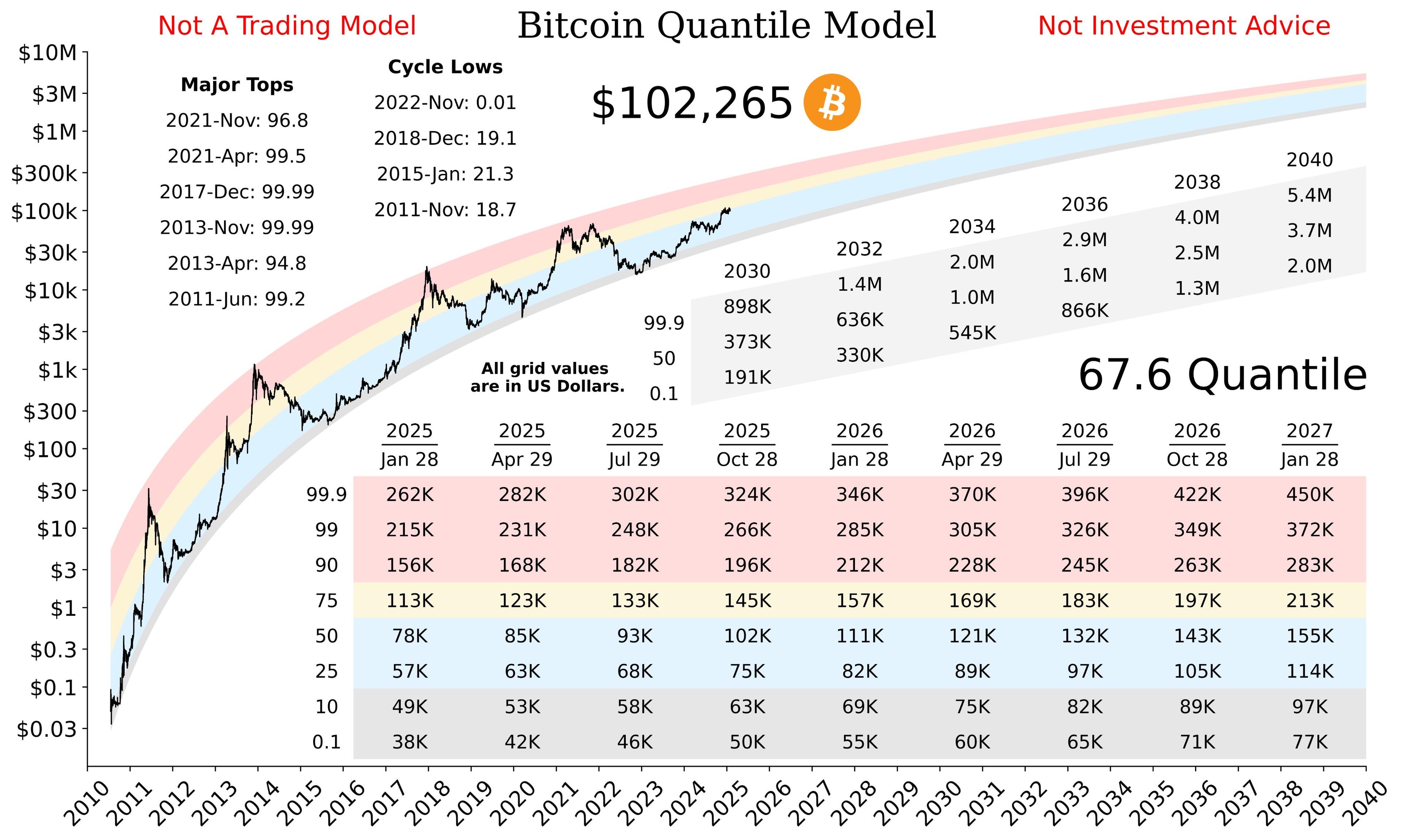

This book isn’t a trading manual. It won’t teach you how to time the market, maximize your gains, or set up a wallet.

This book is about something deeper - memes as scaffolding for the greatest monetary shift in human history.

A shift that has already begun.

The pivot has happened.

Now the only thing left to decide is whether you’re watching from the sidelines, or whether you’re part of it.

The rest is up to you.

Next: Chapter 1: Bitcoin Only.

For now, it’s a heuristic - an efficient filter that separates signal from noise, with minimal effort. But by the time you finish this book, it won’t be a heuristic anymore. It will be something you know.

Welcome to the rabbit hole.

NUMBER GO UP

More likely: once we switched to a bitcoin standard, the first time we will have a sound money standard, combined with the digital/computer/AI revolution;

That is going to be a step function change in human flourishing.

Shit is going to come off the fucking rails, and absolutely the best way.

So grateful to be able to witness the transition.

And to be able to say “I told you so” afterwards, lol.

All of your models are broken.

“Tell me,” Wittgenstein asked a friend, “why do people always say it was natural for man to assume that the sun went round the earth rather than that the earth was rotating?”

His friend replied, “Well, obviously because it just looks as though the sun is going round the earth.”

Wittgenstein replied, “Well, what would it have looked like if it had looked as though the earth was rotating?”

The answer, of course, is it would have looked exactly the same. The Sun would still rise and set.

Wittgenstein’s point? People don’t just observe reality—they interpret it. We assume that truth should look different from falsehood, that if we’re fundamentally wrong about something, the world should announce it loudly and obviously. But more often than not, we’re all just making sense of the same data through different frameworks.

So let’s ask a modern version of Wittgenstein’s question:

What would it look like if an outsider actually took on government reform?

Would it be neat? Polite? Would the institutions of power simply roll over and accept accountability? Would the media calmly explain, Finally, a competent administrator has arrived to streamline operations!?

Of course not. It would look like a billionaire wielding enormous power. It would look like bureaucratic institutions pushing back hard. It would look like headlines screaming about reckless destruction, leaks from government agencies, and half the country treating it as an existential crisis.

In other words, it would look exactly like what’s happening right now.

Right now, two completely different interpretations of reality are playing out.

One side sees: An unelected billionaire dismantling decades of governance with no oversight, running roughshod over institutions.

The other side sees: A competent outsider executing a clear campaign promise, facing exactly the kind of resistance you’d expect from a system that doesn’t want to be reformed.

Same events. Same facts. But depending on which framework you start with, they mean completely different things.

Psychologist Jonathan Haidt describes two ways people process new information:

When a fact aligns with their worldview, they ask the low-threshold question: Can I believe this? (If the answer is yes, they accept it.)

When a fact contradicts their worldview, they ask the high-threshold question: Must I believe this? (They will only accept it if there is no possible way to deny it.)

This is exactly what’s happening now.

If you already believed government was bloated but resistant to reform, you ask Can I believe that this is finally the shake-up we needed? And the answer is obviously yes.

If you believed the system was flawed but fundamentally stable, you ask Must I believe that this is necessary?—and unless you’re dragged there kicking and screaming, the answer is no.

But the best test of a worldview isn’t how comfortable it makes you feel. It’s how predictive it is.

If the federal government were corrupt, bloated, and resistant to reform, what would it look like if someone actually tried to fix it?

You’d expect bureaucrats to fight back hard.

You’d expect the media to frame every change as reckless destruction.

You’d expect a wave of good-faith and bad-faith criticism—some sincere, some self-serving.

You’d expect institutions to leak, sabotage, and retaliate.

That’s exactly what’s happening.

Now let’s ask another Wittgenstein question:

What would it look like if a highly competent, multi-talented, systems-oriented genius existed?

It would look like Elon Musk.

And yet, depending on who you ask, Musk is either:

A brilliant, hands-on problem solver who has revolutionized industries and knows how to make things work in the real world, or

A glorified rich kid who buys companies, extracts value, and takes credit for other people’s work.

One person sees a tech visionary who built PayPal, SpaceX, Tesla, Starlink, and now the Department of Government Efficiency. Another sees a government-subsidized fraud who gets rich off taxpayer money.

One person sees a competent leader who knows how to run large, complex organizations. Another sees an egomaniac whose wealth insulates him from consequences.

So let’s ask again:

What would it look like if a highly competent administrator were put in charge of reforming government?

Would he be a serene, soft-spoken philosopher? Would he live in a humble monastery, wearing simple robes, untouched by material wealth?

No. It would look like a ruthless, ambitious operator who understands power, scale, and efficiency—who knows how to break things and rebuild them better. It would look exactly like Elon Musk.

And if a person like that chose, voluntarily, to take on one of the most entrenched bureaucracies in the world, what would you expect to happen?

Exactly this.

If the Earth were really rotating, it wouldn’t look any different than it does now.

If real government reform were happening, it wouldn’t look any different than what we’re seeing today.

And if one of the most competent administrators of our time took on a seemingly impossible bureaucratic task, it wouldn’t look any different than Elon Musk running DOGE.

None of this is simple. None of this is clean. But pretending the problem isn’t there doesn’t make it go away. As Neil Peart put it, if you choose not to decide, you still have made a choice.

So here we are. If your expectations keep failing—if the world keeps surprising you—maybe it’s worth asking yourself:

What would it look like if you were wrong?

H/t @ Alan Farrington for adding “Wittgenstein Question” to my toolkit!

Jordan Peterson and Bret Weinstein discussed that I found satisfying.

Does anyone here play #AnimalCrossing? I want to get my wife into #NOSTR and think this might be the way!

So somehow my nostr:nprofile1qqs9500z3l7sn46sdnls5fnjm0d3lqmrq7707qshes2y7j8pnm4rllcpzdmhxue69uhhqatjwpkx2urpvuhx2ue0lgtw53 ended up in my washing machine. Does anyone know if it can still be used after that? #bitcoin #help #bitbox

THAT’S NOT HOW WE LAUNDER MONEY SIR

More options, more outputs. A higher need for filtering. 90% of everything is crap, and that’s true with or without AI.

It’s not either/or, but “yes, and”…..

Every output - no matter how organic or mechanical - can be a direct input or indirect input on future works.

Also use it to generate bespoke loops for sampling onto hardware, to then perform with live…. Gimme gimme gimme

Why not both? ¯\_(ツ)_/¯

What i’d love is for this thing to be precise enough for me to specify chord sequences and tempos. I can play some stuff, and can even perform some songs (badly) singing and playing simultaneously.

***with cover songs***

Writing lyrics/melodies was always my kryptonite.

If i can outsource that to a machine (working in parallel with chatgpt or venice.ai to fine-tune the lyrics), and then “reverse-engineer” the campfire version i can sing with my guitar, that’s a heckin win

Suno is heckin rad. So much satisfy

I hadn’t planned to share this conversation, but it’s just too good to keep private. nostr:npub1s05p3ha7en49dv8429tkk07nnfa9pcwczkf5x5qrdraqshxdje9sq6eyhe gave me a brilliant, private Masterclass on inflation, deflation, and the problem Bitcoin solves. It completely transformed the way I think about these concepts, and I know it will do the same for you.

This is a must-watch — one you’ll want to bookmark and share with friends.

Why no zaps?!

Working on a book! Protodraft complete.

Now I don’t need to “write a book” - I merely need to edit and polish it.

The title is meant to be an homage tonostr:npub1dergggklka99wwrs92yz8wdjs952h2ux2ha2ed598ngwu9w7a6fsh9xzpc .

Is it ***too*** close for comfort? I think the subtitle helps?

¯\_(ツ)_/¯