Don't ask me why; I can't explain it either. I learned it in flight school a looong time ago, and it just stuck as a fact. Might ask Grok one day.

The most important part to understand about "alternative" energies, or fuel-free energies, is that there is a vast abundance of energy, which means it's basically worthless. The value is not in capturing the energy, but in funneling it at the right time to the right place. That may include storing it. And fuel is stored energy, which is why uranium, oil & gas are expensive.

Because what you need isn't energy, it's power (energy/time). And matching power production to power need is really hard when you base it on something that you don't control (like the weather).

Correct. Coriolis. What's interesting is that it's "right" anywhere on earth, so in both hemispheres.

Is it over? Can I unmute him now?

Don't feed the trolls. Just sayin'…

(I know, I'm guilty of it, too. It IS fun after all.)

Not same speed. Air and other gases behave like a liquid of very low viscosity. So the air ON the ground has a speed of zero, while the speed rises with every incremental unit (cm, inch, foot, whatever). The higher you are, the greater the wind speed. (And also, the more it comes from the right, but that is much harder to understand and explain).

Easy. When the rotor blade passes in front of the pole, there's a sudden reduction in pressure on the blade, causing a low frequency vibration in the whole mechanical system. This would be exacerbated, if at the same time, another blade would receive maximum pressure (being at the top).

I'll let the public be the judge.

So, what happened to you afterwards? Cause you're certainly not smart now.

As I said: behaving like a kid ¯\_(ツ)_/¯

Nah. You know. I know. And the guy who wants to know, behaves like a kid. Have a nice day, sir.

Aaaand that's where you lose my engagement. x92vbb was actually giving you a perfectly good explanation for why metal isn't a good material, and why glass (or carbon) fiber are the way to go, and you call it bullshit. GFY

Big ones need all sorts of approvals from the regulators. We DID roll out a huge bunch of large wind turbines in Germany recently. A lot of drawbacks: the landscape looks awful, it's a noisy mess, downstream the windmills the ground dries out, overproduction and reserve capacity make energy hideously expensive to the end user., and so on.

They need to be as high up as possible, because wind speed near the ground are relatively slow. That's why they get bigger every year. I'm sure they could efficiently be mass produced, even if they're hard to deploy because of said foundation (a huge heavy concrete slab to weigh the thing down), but I suspect the whole enchillada won't be as energy efficient overall.

1) they need a firm grounding so as not to be ripped out of the ground

2) they make a lot of noise, especially the small ones

3) the smaller the less efficient

....

Rsync isn't always a good solution. It requires setup on both ends, which is a lot of overhead for a one-off situation, it can't copy to some random share, etc. But of course you can use rsync on macOS as well, for cases where rsync makes sense.

I prefer drag-to-copy, knowing it'll Just Work™

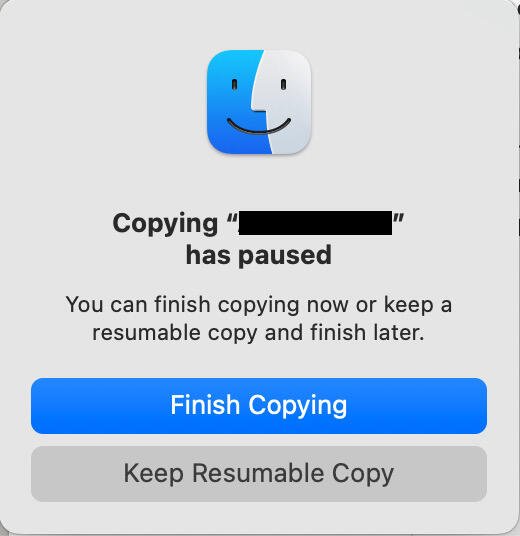

GM! Last night I started copying a bunch of huge folders (with lots of funny characters in file names) across a WAN tunnel. The tunnel broke down overnight, so the copy was interrupted in mid-flight.

Windows: clean up destination, restart from scratch

Linux: Might have a chance if you're REALLY REALLY good at shell, especially at quoting (spaces and special characters in file names are hell on steroids), but it'll take a long time to get it right-

macOS: "Wanna continue right now, or prefer later?"

I LOVE this system.

nostr:note1tf7k60hmgyc56kurhduzq9rnejrhc2urxhktch07ygszh26ute6semg2s6

Compied from X:

Today, I submitted a new BIP proposal for public review:

Redefinition of the Bitcoin Unit to the Base Denomination

Abstract

This BIP proposes redefining the commonly recognized "bitcoin" unit so that what was previously known as the smallest indivisible unit becomes the primary reference unit. Under this proposal, one bitcoin is defined as that smallest unit, eliminating the need for decimal places. By making the integral unit the standard measure, this BIP aims to simplify user comprehension, reduce confusion, and align on-chain values directly with their displayed representation.

Motivation

The current convention defines one BTC as 100,000,000 of the smallest indivisible units. This representation requires dealing with eight decimal places, which can be confusing and foster the misconception that bitcoin is inherently decimal-based. In reality, Bitcoin’s ledger represents values as integers of a smallest unit, and the decimal point is merely a human-imposed abstraction.

By redefining the smallest unit as "one bitcoin," this BIP aligns user perception with the protocol’s true nature. It reduces cognitive overhead, ensures users understand Bitcoin as counting discrete units, and ultimately improves educational clarity and user experience.

Specification

Redefinition of the Unit:

Internally, the smallest indivisible unit remains unchanged.

Historically, 1 BTC = 100,000,000 base units. Under this proposal, "1 bitcoin" equals that smallest unit.

What was previously referred to as "1 BTC" now corresponds to 100 million bitcoins under the new definition.

Terminology:

The informal terms "satoshi" or "sat" are deprecated.

All references, interfaces, and documentation SHOULD refer to the base integer unit simply as "bitcoin."

Display and Formatting:

Applications SHOULD present values as whole integers without decimals.

Example:

Old display: 0.00010000 BTC

New display: 10000 BTC (or ₿10000)

Conversion:

Ledger and consensus rules remain unchanged.

Implementations adopting this standard MUST multiply previously displayed BTC amounts by 100,000,000 to determine the new integer representation.

Rationale

Usability:

Integer-only displays simplify mental arithmetic and reduce potential confusion or user error.

Protocol Alignment:

The Bitcoin protocol inherently counts discrete units. Removing the artificial decimal format aligns user perception with Bitcoin’s actual integral design.

Educational Clarity:

Presenting integers ensures newcomers do not mistakenly assume that Bitcoin’s nature is decimal-based. It conveys Bitcoin’s true design from the start.

Future-Proofing:

Adopting the smallest unit as the primary measure ensures a consistent standard that can scale smoothly as Bitcoin adoption grows.

Addressing Alternative Approaches

Refuting the "Bits" Proposal (BIP 176)

An alternative suggestion (BIP 176) proposes using "bits" to represent one-millionth of a bitcoin (100 satoshis). While this reduces the number of decimal places in certain contexts, it fails to fully address the core issues our BIP aims to solve:

Persistent Decimal Mindset:

Using "bits" still retains a layered decimal approach, requiring users to think in terms of multiple denominations (BTC and bits). This shifts complexity rather than eliminating it.

Inconsistent User Experience:

Users must learn to toggle between BTC for large amounts and bits for small amounts. Instead of providing a unified view of value, it fragments the user experience.

Incomplete Alignment with the Protocol’s Nature:

The "bits" proposal does not realign the displayed value with the integral nature of Bitcoin’s ledger. It continues to rely on fractional units, masking the fundamental integer-based accounting that Bitcoin employs.

Not Permanently Future-Proof:

Though "bits" may simplify certain price ranges, future circumstances could demand additional denominations or scaling adjustments. Our integral approach resolves this problem entirely by making the smallest unit the standard measure, avoiding future fragmentation.

In essence, while BIP 176 attempts to simplify small amount representations, it only replaces one decimal representation with another. By redefining "bitcoin" as the smallest indivisible unit, this BIP eliminates reliance on decimal fractions and separate denominations entirely, offering a clearer, more intuitive, and ultimately more durable solution.

Backward Compatibility

No consensus rules are altered, and on-chain data remains unchanged. Differences arise solely in display formats:

For Developers:

Update GUIs, APIs, and documentation to present values as integers. Remove references to fractional BTC.

For Users:

The actual value of holdings does not change. Transitional measures, such as dual displays or explanatory tooltips, can ease the adjustment period.

Security Considerations

A short-term risk of confusion exists as users adapt to the new representation. Users accustomed to decimals may misinterpret initial displays. To mitigate this:

Offer dual displays and tooltips during the transition.

Provide clear educational materials and coordinated messaging.

Use alerts or confirmations in applications if input values appear unexpectedly large or small.

Over time, confusion will subside, leaving a simpler, more intuitive understanding of Bitcoin’s integral values.

Reference Implementation

Some wallets, such as Bitkit, have successfully adopted integer-only displays, demonstrating the feasibility of this approach. Transitional features—like showing both old and new formats side-by-side—can help smooth the transition.

Test Vectors

Old: 1.00000000 BTC → New: 100000000 BTC (or ₿100000000)

Old: 0.00010000 BTC → New: 10000 BTC (or ₿10000)

Old: 0.00500000 BTC → New: 500000 BTC (or ₿500000)

All formerly fractional representations now directly correspond to whole-number multiples of the smallest unit.

Implementation Timeline

Phase 1 (3-6 months): Introduce the concept, provide dual displays and educational materials.

Phase 2 (6-12 months): Prominent services adopt integer-only displays by default.

Phase 3 (12+ months): Integer representation becomes standard. Documentation and user guides no longer reference decimal-based formats.

Conclusion

Redefining the "bitcoin" unit as the smallest indivisible unit and removing decimal-based representations simplifies comprehension and aligns displayed values with the protocol’s integral accounting. While a transition period may be necessary, the long-term benefits include clearer communication, reduced confusion, and a more accurate understanding of Bitcoin’s fundamental design.

Copyright

This BIP is licensed under CC0-1.0.

github.com/BitcoinAndLigh…