A little over a month ago, Bitcoin recorded a CAGR of just 8% over the prior four year period; the lowest it’s seen in that kind of window. Experiencing that felt just as off as it sounds. And yet, Ark Invest recently updated its bull case for Bitcoin to a staggering 72% CAGR through 2030, with a projected price of $2.4 million.

Do they know something I don’t? Honestly… probably. Their research budget is effectively infinite compared to mine, so it wouldn’t shock me if they’re seeing signals I can’t.

Ark attributes this expected surge primarily to institutional demand…something I’ve also believed would be a key driver, especially over the past year. But the timing of this renewed conviction, right on the heels of major developments in the market, feels a little too well-timed to be coincidence.

I’ll admit, I had expected the idea of “diminishing returns” to be disproven by now. And with Ark’s new projections, there’s still a real possibility that narrative collapses.

The invalidation of diminishing returns doesn’t require everyone on Earth to become a Bitcoin maximalist. It could just as well be catalyzed by the rapid deterioration of fiat currencies. That scenario is arguably more plausible, and certainly more painful, but it leads us, indirectly, to the same outcome: Bitcoin becoming the clear monetary alternative.

Bitcoin’s scarcity isn’t static; it compounds. Through its programmed supply schedule and the inevitable loss of coins due to human error, available supply will continue to dwindle. Price and divisibility will naturally fill the gap.

Bitcoin is many things: a network, a settlement layer, a savings technology, but it has long since transcended mere speculation. It’s about time the world stopped and took real notice.

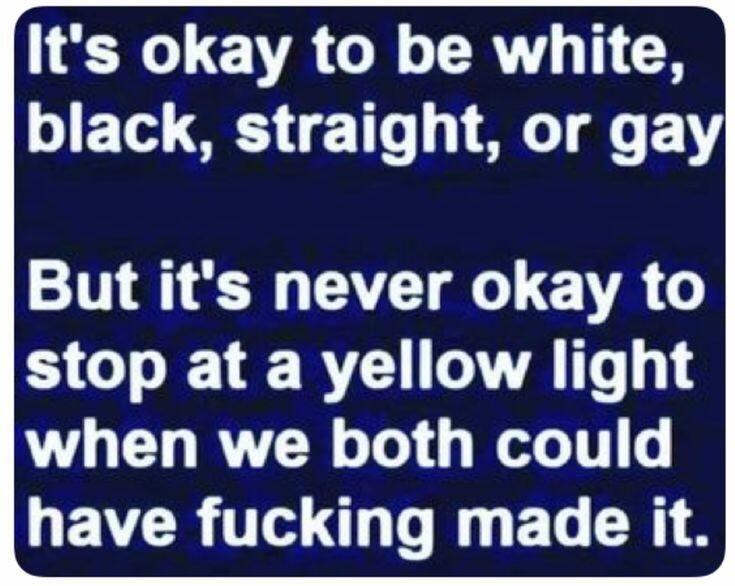

#love #car #memestr

#love #car #memestr