Anyone else enjoy cigars from time to time?

This one is treating me just right

#cigarstr #bitcoin

You will own nothing and be happy

This is why you DCA and buy every dip and FOMO every 2% pump and empty your 401k and skip breakfast and sell your chairs

Today I learned RBF does not mean resting bitch face

Bitcoin mining water critics are not doing the math right when it comes to water use for 3 reasons, a🧵👇🏼

For context, critics assume the following:

1. Identify the electricity grid mix for each mining jurisdiction

2. Apply the water impact of each energy source (eg nuclear, hydro)

3. Apply 👆🏼 proportionally to how much ⚡️ bitcoin consumes

4. Estimate a per tx water use

Let's examine why their assumptions are problematic...

1. Direct vs indirect water use

The biggest issue is they assume direct water use by miners when it's indirect (ie electricity generator water use). This is an important distinction so let's look at an analogy:

When we look at carbon, we estimate direct (scope 1) & indirect (scope 2 & 3) CO2 emissions. Steel, cement, pulp mills report direct carbon emissions under cap & trade. The ⚡️ generator does too so there's no double counting. But mining critics attribute power emissions to miners!

It's the same wrt direct vs indirect water use: think farms, pulp mills, textile mills using water directly, vs power plants that make the power they use

A miner w/ *direct* water use would employ:

- Evaporative cooling

- Hydro cooling

Thus 👆🏼 direct use is what the critics should estimate (note, these water cooling methods are not prevalent vs air cooled or immersion)

The water use from a power plant powering miners is not the same as the water used directly at a mining facility, in the same way that the water used by a Nestle bottle plant does not have the same indirect water impact from Nestles electrical consumption!

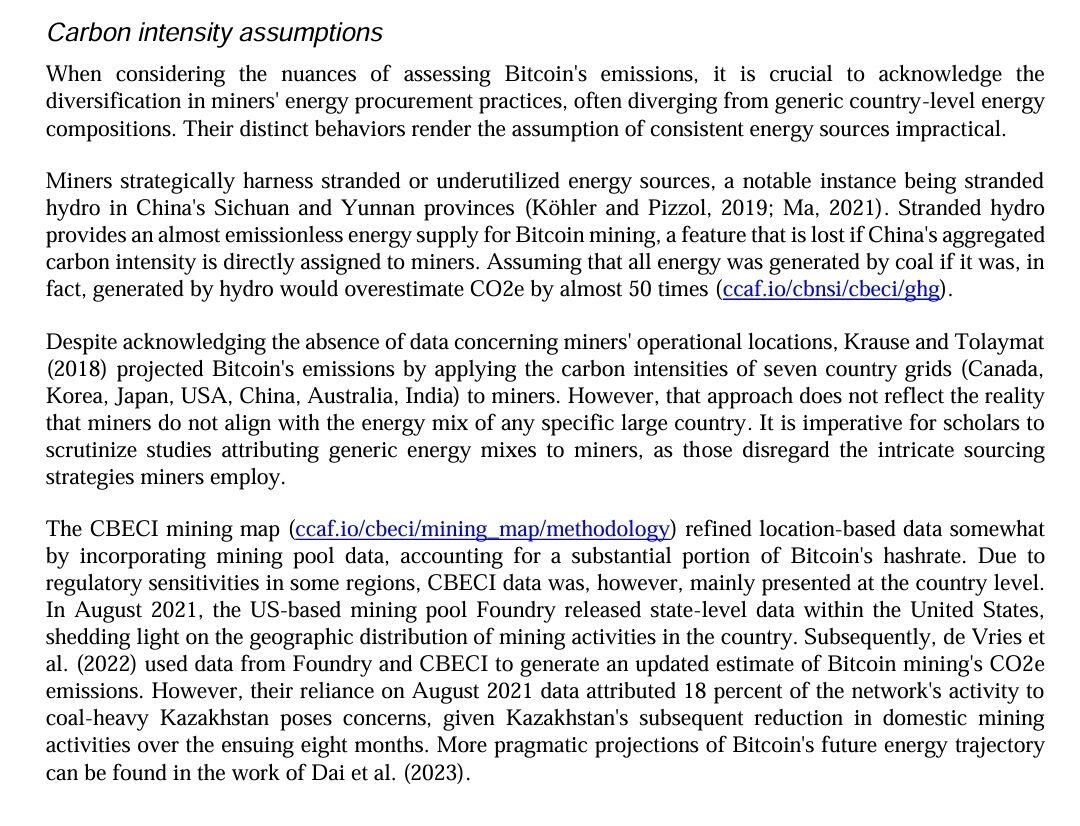

2. Inaccurate grid & country mix

Water critics assume miners are representative of the grid mix in their jurisdiction. But we know miners employ energy strategies to lower power costs - ie many projects co-locate w/ renewables or use stranded power. Further, the country mining stats critics use are out of date. Mining is extremely mobile & China & Kazakhstan play a much lower role than before.

Read more in the recent study from mining experts: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4634256

ALSO, let's say critics stick to ⚡️related water use. If they were fair, they'd consider the water use that's OFFSET from heat recovery applications in district, industrial & farm heating bc the heat energy offset would have had a water impact too! But they don't

3. Per transaction water use

Water critics assume the same fallacy when they say 1 tx uses the equiv amount of energy as a swimming pool, as when they assume 1 tx consumes a month's worth of household electricity use. "Per tx" is the wrong model & industry experts wrote great rebuttals wrt energy that are applicable to water:

2. https://bitcoinmagazine.com/business/bitcoin-energy-per-transaction-metric-is-misleading

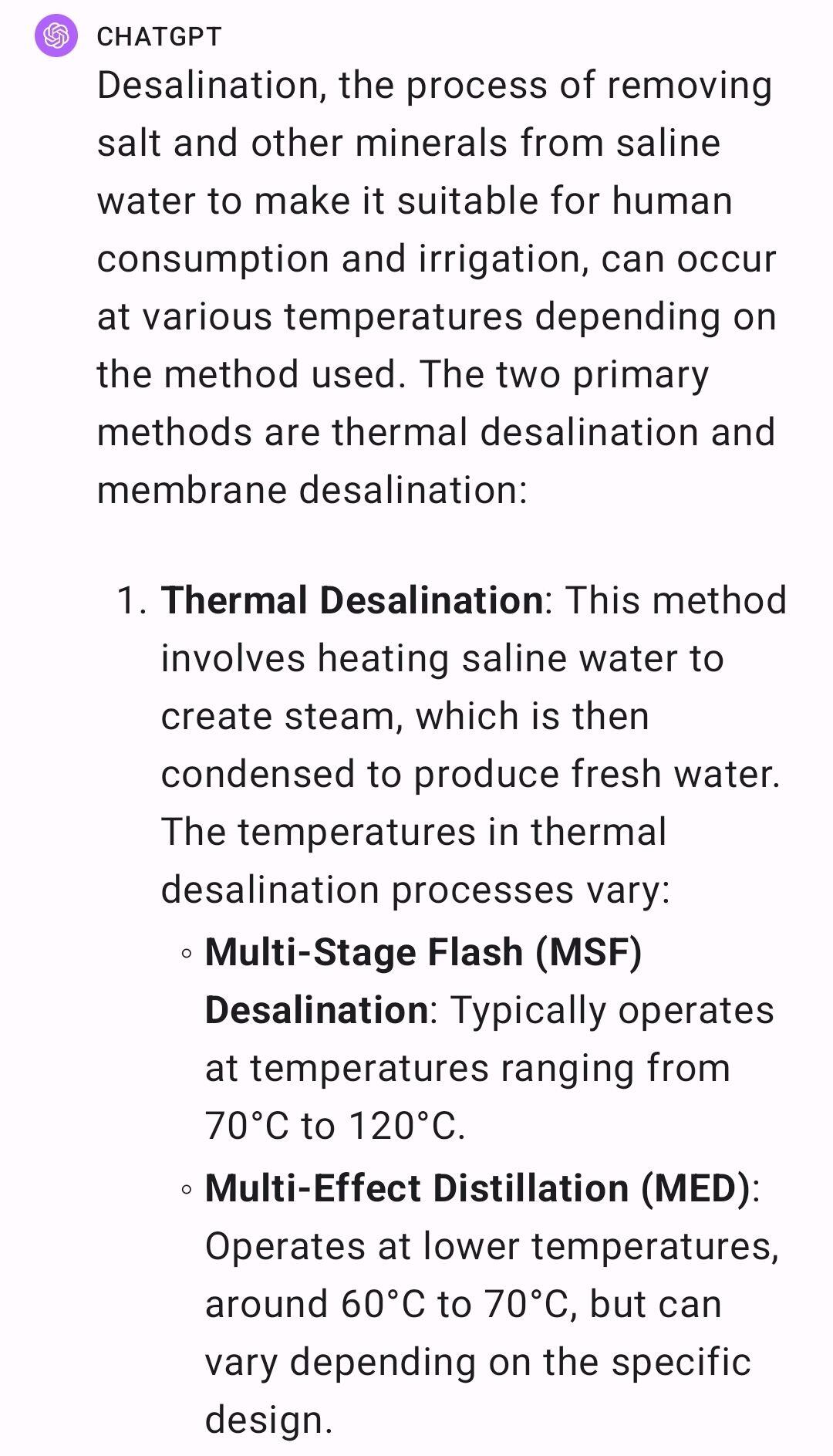

Overall, critics aren't playing fair w/ the numbers & their math is off. A final thought to leave you with: Bitcoin miner heat recovery desalination projects are feasible - what will water critics say when they go live?

All your models are destroyed

Somewhere with good waves

That’s a question for my great great great grandkids. My guess would be some side chain that settles over longer block times though

Can’t fault that. Head down, stack up.

Everyone is on their own heroes journey. It just so happens we’re all walking towards the same eventuality. What you bring with you can either weigh you down or make your trip easier - you decide though.

It’s wild to me how much hypocrisy exists even among highly principled maximalists. We turn a blind eye to what suits our world view as long as it’s convenient to us.

If anyone is thinking about building a pool to offset their bitcoin consumption please let me know. I’m happy to draw one up for you.

Ask yourself; what would satoshi do?

What she doesn’t tell you is that 95% of people can’t trade and lose a lot more money trying to trade instead of following a simple buy and hold approach. Influencers would sell their soul to shill you their reflink.

https://x.com/layahheilpern/status/1729503380123291856?s=46&

Simps keep falling for it

Only invest in fiat what you can afford to lose

By now you shouldn’t be reliant on muh App Store™️

You’re better than this anon

You’re keys were never safe from 4th dimensional attacks. If time travel ever exists in the future there’s no defending against it. It’s already gone.

Wish it was from pulling into a big close out but I just tweaked it playing pickle ball haha

Torn rotator cuff. I’m falling apart!

If your checking is -$2.79 you’re a real one

Become unwrenchable

Needs to be bag wine

This one’s been in my cart for a few weeks. How are you liking it?