Expedia Falls as Sales Miss Estimates, Signal Travel Slump

Expedia Group Inc. tumbled the most in more than a year after reporting second-quarter revenue that missed analysts’ estimates, signaling a potential slowdown in travel demand during the busy summer season. #press

Saudi Budget Slips Deeper Into Deficit With Jump in Spending

Saudi Arabia’s budget deficit widened in the second quarter as the government raised spending on social benefits and projects meant to diversify the economy from oil. #press

India’s IndiGo Posts Record Profit on Soaring Demand, Go Failure

IndiGo, India’s biggest airline, posted record quarterly profit in the three months through June, as the demand for travel surged and a smaller competitor’s insolvency funneled a windfall of business. #press

BlackRock Sees Private Credit Growth Keeping Pace With Peers

BlackRock Inc. aims to expand its private credit business by double digits every year, according to a senior executive, as the world’s largest fund manager joins a string of big-name investment firms in embracing the fast-growing sector. #press

Yale Law School's Roach on China's Economy

Stephen Roach, Senior Fellow at Yale Law School, discusses his outlook for China's economy. He speaks with Shery Ahn and Haidi Stroud-Watts on "Daybreak Asia". (Source: Bloomberg) #press

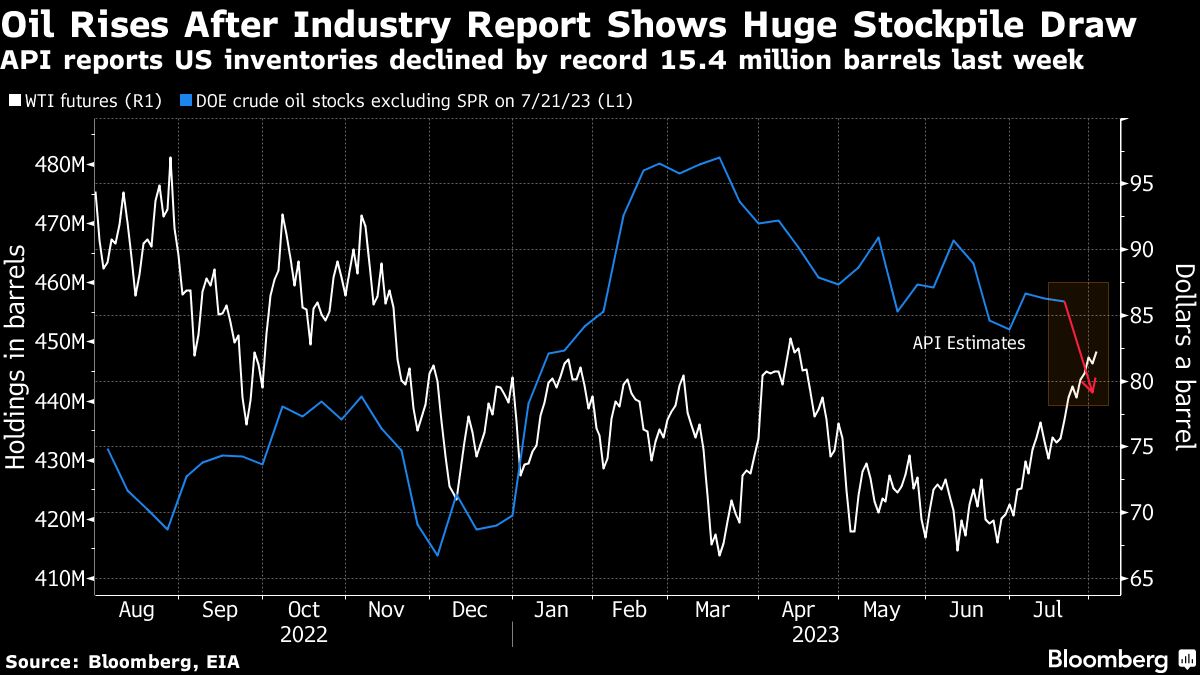

Oil Rises After Industry Report Points to Massive Inventory Draw

Oil resumed a rally after an industry estimate pointed to a huge drawdown in US inventories, adding to signals the market is tightening. #press

Coffee Seller JDE Peet’s Posts Organic Sales Growth Just Shy of Estimates

Dutch coffee seller JDE Peet’s NV took an impairment charge on one of its brands as it transitions to a local portfolio of brands in Russia. #press

RB Global Replaces CEO Fandozzi Amid Compensation Dispute, Sources Say

RB Global Inc., formerly known as Ritchie Bros. Auctioneers Inc., is appointing a new chief executive officer to replace Ann Fandozzi following a dispute over issues including compensation, people familiar with the matter said. #press

Egypt Currency Squeeze Sinks Bank Foreign Buffers to New Low

Net foreign assets held by Egypt’s commercial banks went into a record deficit in June, as a lack inflows drives a deterioration in the finances of a country already struggling with its worst hard-currency shortage in years. #press

Mexico’s Top Oil-Export Terminal Shut as Summer Demand Jumps

Petroleos Mexicanos shut down the country’s largest oil-exporting terminal because of a leak, adding to a string of major operational headaches for the state-owned company just as the summer driving season increases demand for crude. #press

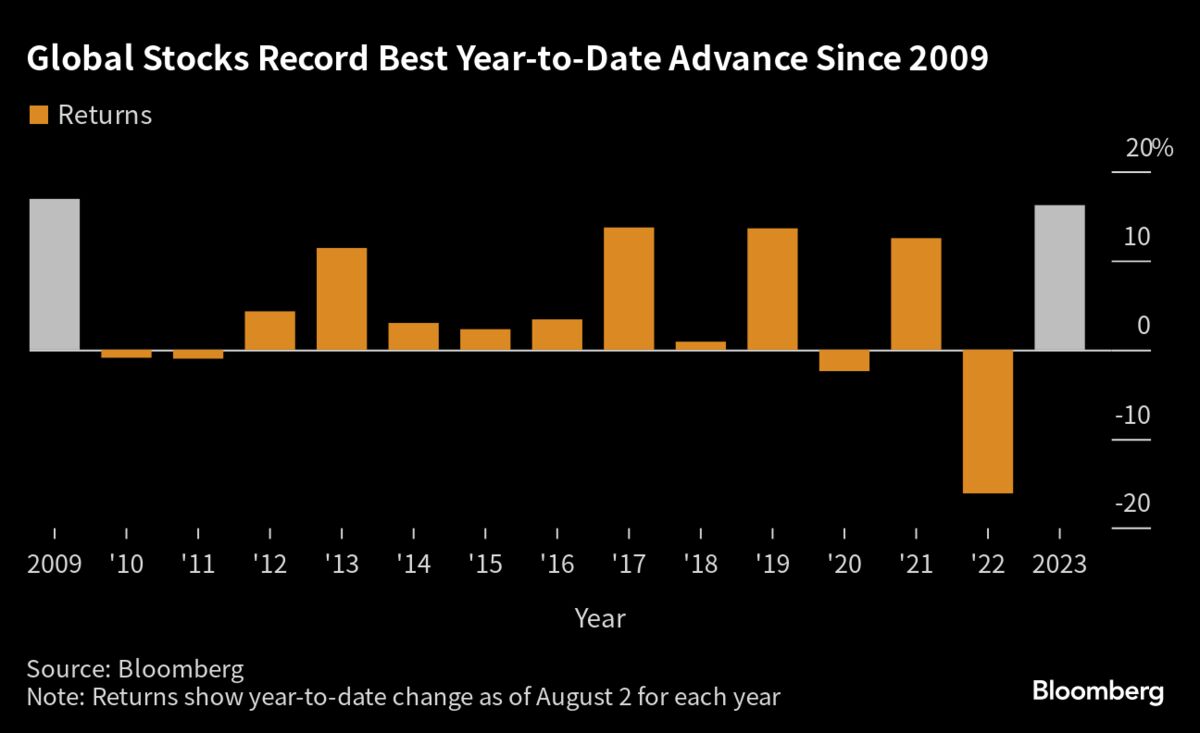

Global Equities Enjoy Their Best Year-to-Date Gain Since 2009

Global markets have posted their largest year-to-date gains since 2009 when markets recovered from the global financial crisis. #press

New Zealand Adds Capital to RBNZ, Boosting Intervention Capacity

New Zealand’s government has provided the central bank with more capital and an indemnity that allows it to build its foreign reserves, giving it more scope to intervene in currency markets if it needs to. #press

US Stripped of AAA Rating by Fitch as Budget Deficits Swell

The US was stripped of its top-tier sovereign credit grade by Fitch Ratings, which criticized the country’s ballooning fiscal deficits and an “erosion of governance” that’s led to repeated debt limit clashes over the past two decades. #press

QI Research DiMartino Booth on Fed

QI Research CEO & Chief Strategist Danielle DiMartino Booth discusses her latest outlook on Fed's next move and US markets. She speaks with David Ingles on "Bloomberg Markets: China Open". (Source: Bloomberg) #press

US Stripped of AAA Rating by Fitch as Budget Deficits Swell

The US was stripped of its top-tier sovereign credit grade by Fitch Ratings, which criticized the country’s ballooning fiscal deficits and an “erosion of governance” that’s led to repeated debt limit clashes over the past two decades. #press

ANZ's Goh on Emerging Markets Currencies

Khoon Goh, Head of Asia Research at ANZ, discusses his outlook and investment strategies for Asian currencies in emerging markets. He speaks with Shery Ahn and Haidi Stroud-Watts on "Daybreak Asia". (Source: Bloomberg) #press

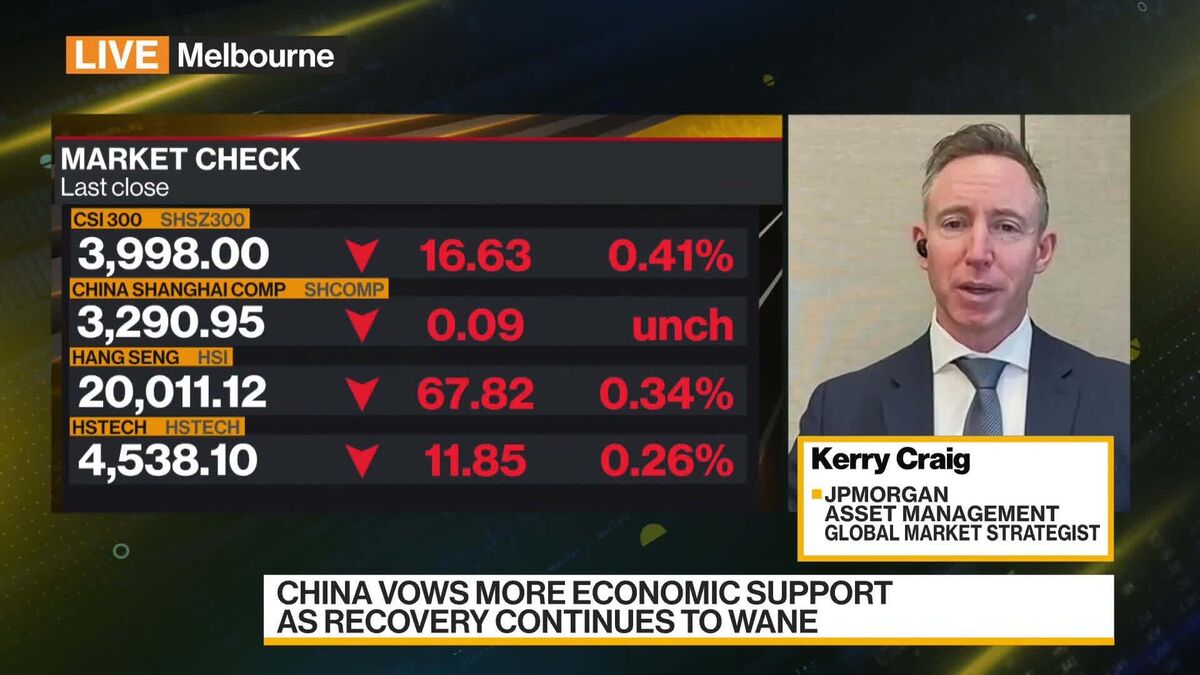

JPMorgan Sees 'Very Attractive Valuations' in China

Kerry Craig, global market strategist at JPMorgan Asset Management, discusses credit spreads across markets, emerging-market debt, China's economy and financial assets. He also talks about Fitch Ratings' decision to strip off the top-tier sovereign credit grade from the US. He speaks with Haidi Stroud-Watts... #press

Fed Is Not in a Hurry to Start Cutting Rates: Chanana

“This knee-jerk reaction could probably have difficulty carrying on into the rest of the session.” Charu Chanana, market strategist at Saxo Singapore, discusses the current state of markets, her investment strategy and where she’s finding opportunity. She speaks on Bloomberg Television. (Source:... #press

Singapore’s Sky-High Rents Show First Signs of Cooling

Singapore’s rental price growth slowed in the second quarter, cooling a years-long boom that has sapped affordability and threatened to dent the city-state’s appeal as a finance hub. #press

Treasuries Demand to Persist as Traders Look Past Fitch Fallout

Investors will continue to scoop up Treasuries despite Fitch Ratings’ move to cut the US’ credit rating although the downgrade may spur some short-term volatility, according to analysts. #press