Finally had time to listen to JPow (not that I like it but here we are)

- FED is not deterred by recent banking crisis, it wants to see inflation going down for good, rates up until necessary

- banks may receive additional saving graces (especially large banks), but that means the rest of the market has to deteriorate

- there is no soft landing anymore, FED wants to see unemployment end of story

What does this mean for bitcoin?

Meh, the 1M guy will lose his Milli, one block every 10 minutes anyway, the trading monkeys who see bitcoin correlated with equities will sell it.. let’s see if enough monkeys have understood: “not your keys not your coins” > banking. I doubt it..🙈 🙉 🙊

Well, they have it in clear, so you can’t really know what they do with it. Last time I checked you can’t have an account there without phone number

They had an altcoin and get grants from government anyways, maybe it’s all in good faith, maybe not, too difficult to tell

I was in two calls at once today, muting my mic and audio on one pc and unmuting the other, webcams always on.

Idk, it was more difficult than expected 😵💫

GM ☕️ ☕️ ☕️ PV!

This is one of my favorite things lately, try to trick ChatGPT into telling you a secret!

I’ve designed level 17 👀.. how did they do it in 5??

GM PV ☕️ ☕️ ☕️

Today we tune the pitch story! I don’t plan to fundraise right now but at the end of summer there’s a sweet spot: first clients are there and will need support to sponsor the tool

I am a noob in such matters of course, but here are a couple of historical pointers:

- CS operation reminds of Bear Stern rescue, which started a rally of risk assets for a couple of months before collapse

- liquidity swaps between central banks were also a temporary measure invented during GFC, which became permanent. It’s not clear to me what’s exactly the consequence of what, but high volume of swaps was correlated with major market crisis (gfc and March 2020 had spikes in that activity)

I think gfc was structurally very different: today there is high inflation and low unemployment, during gfc inflation was 5%ish and unemployment skyrocketed to 10%, today we have 10% inflation and unemployment still close to 3 or 4 % (basically a minimum). Today there is A LOT more money in the system (10 years of QE and a covid packagr later..)

So I’m not sure the feeling can even be the same. At the time I was a grad student and had no idea about the world, so take whatever I say with caution! To me it was just curious house prices

Paste your npub here and see how AI finds you (not that we care)

th_s4m0ht@eonpass.com description generated by ChatGPT:

The user who wrote these notes seems to be a highly active and engaged member of the Nostr community. They use a lot of abbreviations, memes, and emojis, showing that they are comfortable with internet culture. They often greet other users with "GM ☕️" (Good Morning with a coffee emoji) and seem to enjoy discussing a wide range of topics. They frequently talk about coding, technology, finance, and current events. They also occasionally make jokes and sarcastic comments. Overall, this user seems to be knowledgeable, curious, and sociable.

AI is too kind! 🙏 🙏 🙏 not active enough though.. moar notes, moar zaps, moar frens!

GM ☕️

Have a relaxing Sunday!

GM ☕️ ☕️ ☕️

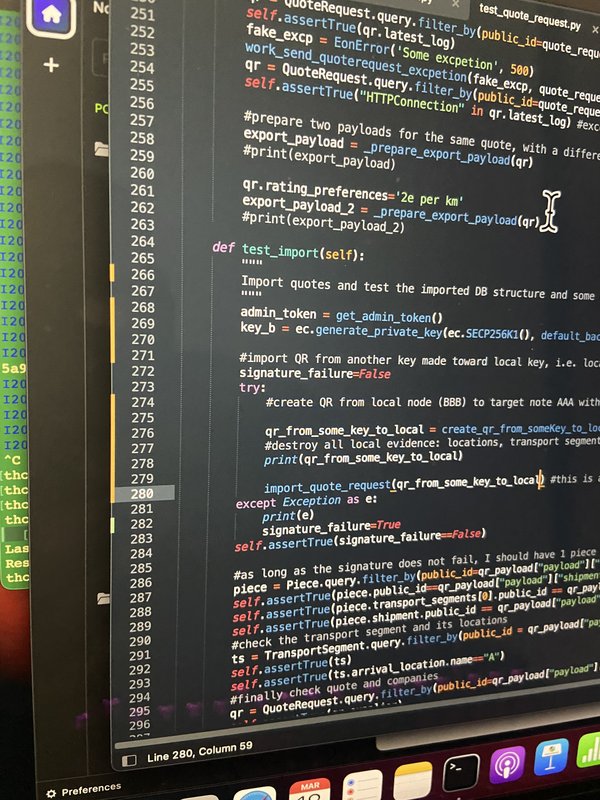

Today we slay the last unit test!

Spoiler: he is going to lose that bet 110%

as you suggest the classifier could be trained as it goes. What if the filter is also client side, the user can train its own classifier to detect what it doesn’t like

Ackchyually..

Ferrari ownership:

67% public float

23% Exor holding (Agnelli family)

10% Piero Ferrari

🏎️ 🏎️ 🏎️

About SVB chapter 11, do you know if that means stock from its startup clients have to marked to market?

If I remember right they gave some credit lines to clients with startup stock as collateral. This was not the reason why they blew out, but if those stocks touch any form of rational market, that will blow out a couple of VC funds for sure

Imagine explaining in a liquidation process that a company with no revenues and no product has xxx millions evaluation lol

LPs will be pissed for sure

Meh.. reminds me of “welcome to law”

Thanks! I’m on Damus and I see the preview, but yes, it’s not an image I see what you mean! Better to use a real hosting

The real Labrahodl?? Not a ghost of the ghost???

Hype!!! Congrats!! 🍾

1) Pub/priv keys, not username and password

2) easy to talk with builders

3) zapping around ⚡️

4) cool network architecture, the concept of multiple relays and clients is difficult to stop but easy to run (or at least easier than straight up p2p)