As much as I am a fan of #Stacks, I am exercising caution at these price levels.

$STX is still within a major order block, and there is an RSI divergence, typically meaning that the strength of the upward momentum is exhausting.

If #STX can pull above the order block with strength, then buckle up, because this rocket is going to the moon.

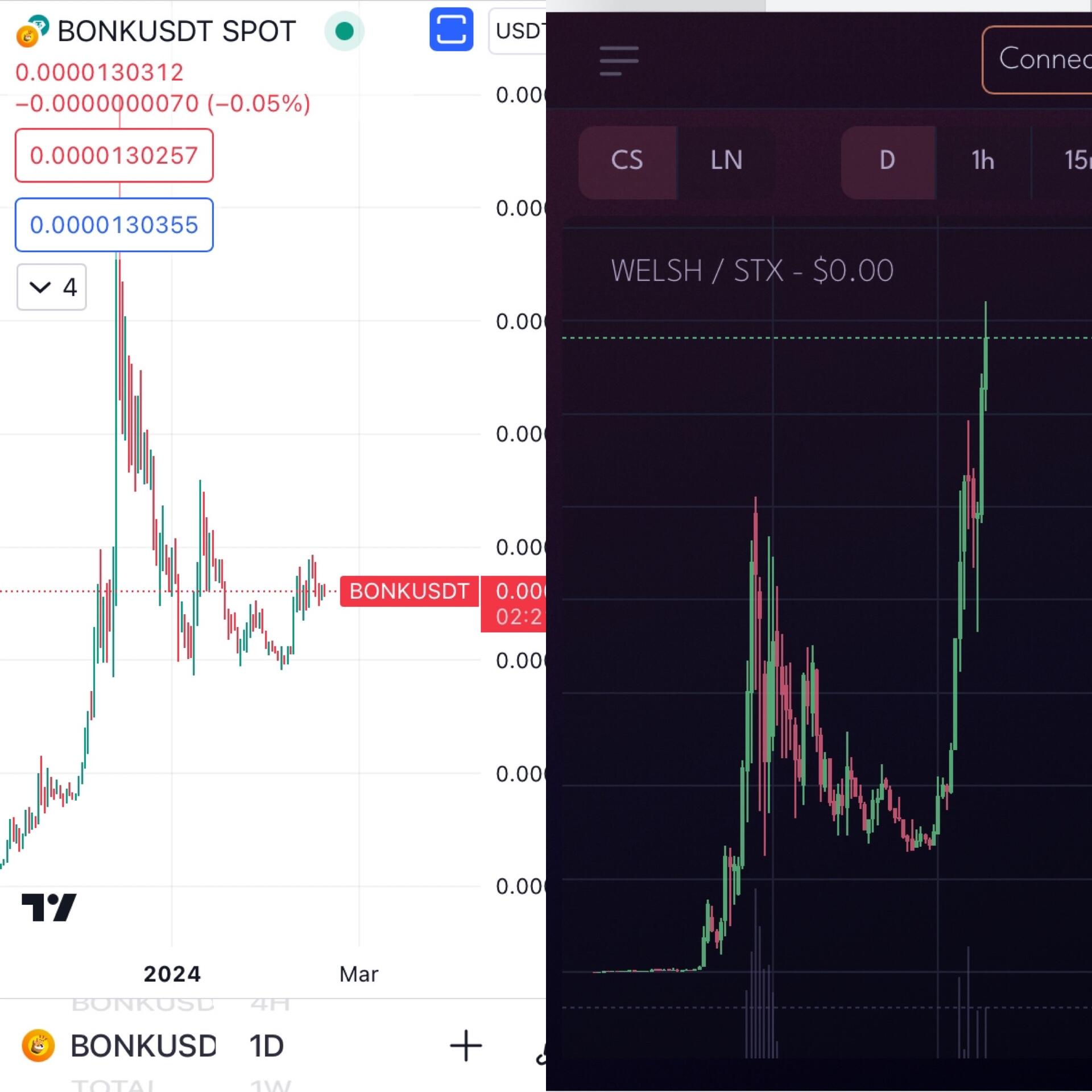

Interestingly enough, $BONK and $WELSH have created the same pattern.

Makes me wonder the rest of these $DOGE spin-offs perform similarly. #BONK #WELSH #DOGE

$STX has reached the final order block, created back in November 2021.

If #STX can manage to pull above this level, then I can see it going into price discovery. #Stacks #Blockstacks

$CKB down 20% today, but still up 125% for the week.

This price action is considered a healthy pull back, before continuing to the upside.

Two scenarios: (1) #CKB retraces to the FVG or (2) it retraces to the order block, then marches upwards.

In both scenarios, #NervosNetwork will still be considered making higher highs and higher lows. Going below these levels would make me less bullish.

$CKB has been on a tear, up 200%+, this past week.

#CKB is currently at resistance. If #NervosNetwork can break through, then I can see it reaching the 0.5 Fibonacci level… which also happens to be where the next major order block is located!

Now that #Bitcoin has reached $52k, what’s next?

$BTC is in a bullish momentum, so I can see it mitigating the next FVG at $60k first, before considering retesting the FVG at $30k. #BTC

$SHOP down a staggering 13%+ on earnings and CPI data.

Zoom out, and you’ll see that #SHOP is retesting a peak made in March 2022.

Keep an eye if #Shopify breaks or bounces off that support.

I can see $IMX reaching at least $4.15 this cycle.

#IMX is busting through a breaker block, will likely retest, and move higher. #ImmutableX

I can see $LINK reaching to at least $32 during this bull run.

Of course, that doesn’t mean that #LINK won’t retest some demand zones along the way.

$BCH up 13%+ today already. Zoom out, and you’ll find that we’re still in a range, soon to hit resistance at $304.

In order to be bullish, I want to see #BCH break through the range with strength, retest, and then climb higher. #BitcoinCash

$FLR has reached a resistance zone.

I expect #FLR to bounce around in this zone, before deciding either to pierce through it or reject.

IMO, it’s a good sign that #Flare has mitigated all of its weekly FVG’s.

$BONK price action has slightly diverged from $DOGE price action from April 2021.

#BONK recent break of structure is a good sign, but what I’d like to see is a retest and bounce off $0.000012 to continue to be bullish towards the upside.

#Monero has been ranging since June 2022.

I wouldn’t be surprised if the price action of $XMR decided to play around between $80-$100, before coming back to the top of the range.

In a bull scenario, I’d like #XMR to break the top of the range, retest, and break out.

$BTC is holding support, after forming a cup and handle.

Waiting on #BTC to slowly grind up, or break to the downside.

$FLR is up 16%+ so far today, and has been on a bullish uptrend, up 300%, since October 2023.

#FLR is about to hit resistance soon though. It’ll likely retrace, then retest this top again.

If #Flare can turn this resistance into support, then it’s possible it can enter into price discovery.

$LUNC up 14%+ today, after bouncing off support.

Expect resistance soon. If #LUNC can plow through resistance, then it’s possible will attempt to reach back to December highs.

$XRP has now mitigated every FVG (yellow circles) made since it’s low on June 13, 2022.

My only concern is that #XRP has equal lows at $0.3004, which means there is likely liquidity leftover.

It’s possible XRP may take out those lows, before being given the permission to explode to the upside.

The #FOMC is meeting today in 4.5 hours. Expect volatility in the markets.

The #CME FedWatch tool is expecting that we hold, and continue to pause. Therefore, no rate hikes or rate cuts.

If you were planning on going long on $BTC, then we’re technically still in a discount zone.

Although, #BTC hitting the 0.5 Fib retracement could also reverse from here…. Hopefully, just for a retest of previous levels.

#Bitcoin has been ranging since December.

$BTC took out the top of the range, then took out the bottom of the range. This pattern typically sets us up to break to the upside. LFG, #BTC !