You learn to say: I don’t answer questions.

Coinjoin, joinmarket, wasabi/samourai, etc

These are means of enforcing your right to privacy from third party and government snoops.

That’s exactly the kind of thing I’d expect satoshi to say.

I think I need to make a documentary. It’s bound to be better than the last one with this slam dunk evidence!

I leave some on exchange purposefully. Why? They can send you tax forms if you leave it there and need to sell…I haven’t needed to sell since 2019, but if something unexpected happened, it’s like a backup savings account.

You can recover privacy later, don’t pay extra for kyc free sats.

My plan for this bull market started in spring of 2019 when I upped my DCA’s and eventually stopped using coinbase and Gemini…for river and swan.

Agreed. We are stupid tribal apes.

At the core is an issue of property rights…land disputes are always settled by war…why is this? Don’t ask me. But it’s true.

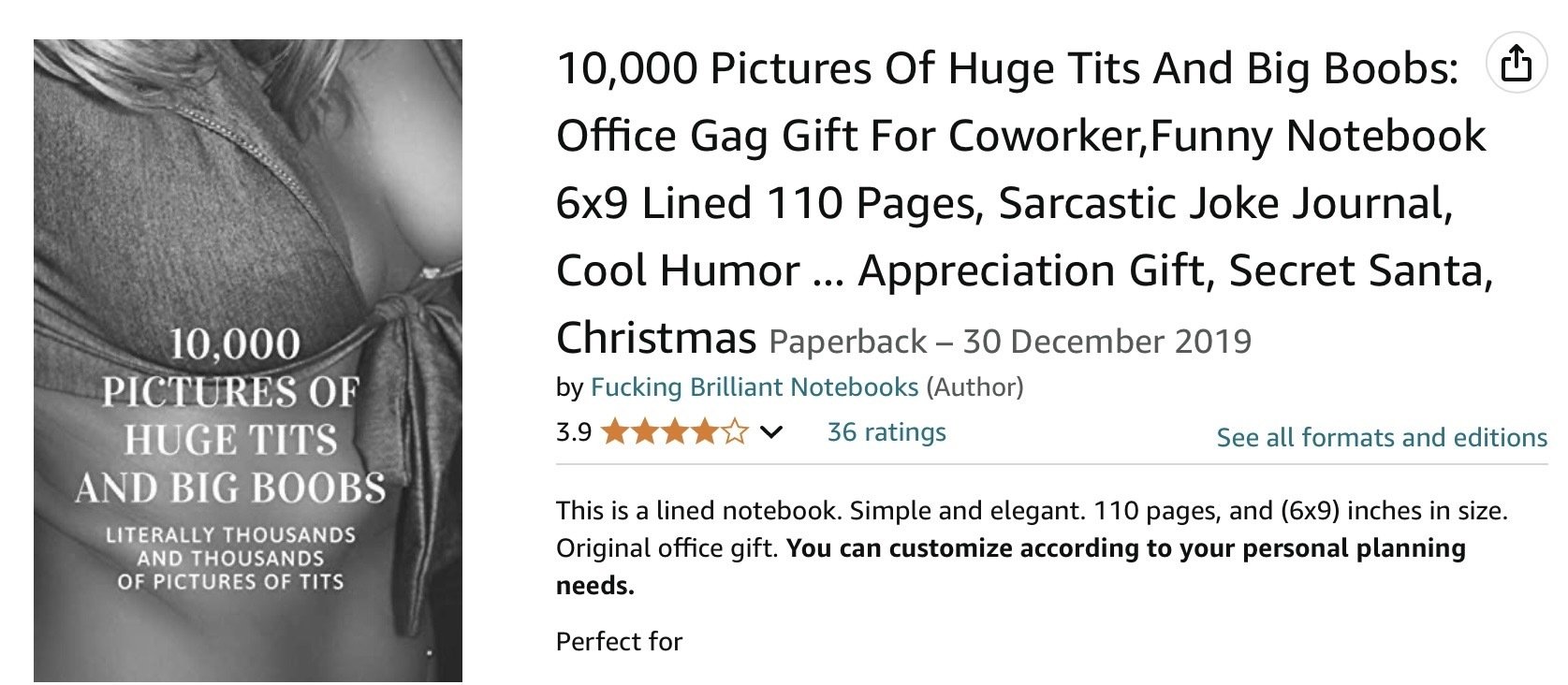

FTW I found the perfect xmas gift for you nostr:npub1jk9h2jsa8hjmtm9qlcca942473gnyhuynz5rmgve0dlu6hpeazxqc3lqz7 and most of the nostriches here 🤣🤣🤣💜

Dang. No book preview.

nostr:npub1n0pdxnwa4q7eg2slm5m2wjrln2hvwsxmyn48juedjr3c85va99yqc5pfp6

I have a new addition to my list of favorite frangrances: Amyris resin

Know of this one?

Got a beeswax candle with it and those are some very harmonious smells!

I actually think I recognize it as a component of a perfume I like.

#smellstr #fragrance

I love perfumes. Some perfumes. I hate others. But I feel strongly about scent.

I once tracked my wife through the university campus because I could tell she visited the physics lab I worked in and I could smell which way she went and caught up with her 5 minutes away.

My understanding is that these places make buying and selling seem to be instantaneous actions. But in reality they temporarily issue you an iou until things settle, sometimes in their favor where they pocket the difference and sometimes not in their favor where they cover the difference. Thus whenever their customers all want to either buy or sell they have to refuse orders until temporary transactions settle…

It doesn’t say: “the right to keep bearable arms shall not be infringed.”

It says: “the right to keep and bear arms, shall not be infringed.”

Just because a specific arm is too heavy to bear, that doesn’t mean it’s lawful to ban such an arm.

There is a movement out here in my desert along the lines of managing water through earthen structures and geography to allow the rainfall to be sufficient to sustain agriculture. AR15ONA deserts get a decent amount of rain, but unfortunately via occasional deluge rather than small amounts regularly.

How many bitcoins could a millionaire hold if every millionaire wanted one?

The answer to this question was about 1 in 2010. Now it’s something like ⅓…

Thus, at least some millionaires are missing out on at least ⅔ of their “fair share.”

So yeah, they fucked up the money so much, we’re redistributing it via bitcoin.

Saylor pointing out that seizures in bitcoin have happened only to legally dubious enterprises states nothing about his stance on self custody.

Self custody works until it pays to kidnap and torture you or a loved one for profit. Custodians add encumbrances to your keys that can’t be tortured away. This is something rich people must plan for.

I wish Saylor didn’t use the common/layman’s definition of cryptoanarchy…but that’s my only criticism. Everything else he said is spot on. It’s true 6102 succeeded because people complied rather than boots went kicking in doors.

While I agree eventually states will try something to violate property rights of bitcoin holders, I think it will be via unjust taxation.

Meh. It’s just a fact. Hundreds of thousands of bitcoins have been seized, but not in a bitcoin 6102 style event…rather from violators of dubious laws and some genuine criminals.

Verified myself as tuur@nostrverified.fyi. Thx nostr:npub17u5dneh8qjp43ecfxr6u5e9sjamsmxyuekrg2nlxrrk6nj9rsyrqywt4tp

Nice. I need a little more Tuur in my feed!

The risk reward ratio of such leverage increases over time. In the long run, guaranteed rekt…

The main problem with leverage is improper planning, commonly the false assumption that Bitcoin price won’t plummet or that other activities will bring steady income to service leverage interest.

When it comes to debt, most people should probably have some in order to maximize bitcoin returns. But not too much! Taking on debt denominated in dollars was typically only wise for things like houses and sometimes education, but in the Bitcoin world, there is an non-zero interest rate at or below which even buying groceries with debt makes sense. But securing a loan with bitcoin gives terrible rates.

Thought process: should one buy bitcoin or a house? Bitcoin.

Ok, so you bought a house. Should you buy Bitcoin or a car? Bitcoin.

Ok you bought a car. Should you DCA in to bitcoin now, or sell all your possessions and yolo in. You should yolo.

Ok, you’re on the DCA path. Should you borrow from home equity to buy Bitcoin or should you just keep DCA.

So you just keep DCA. Then someone says: shouldn’t you diversify your assets? No.

So you diversified your assets, but kept half your stack and kept stacking, but at a lower rate.

All of these “safe” choices turn out to be very very costly. But it’s true this path minimizes risk. But this is the path most of us choose and I’m guilty of it.

If I would have borrowed $10,000 from the bank of mom and dad in 2010, I’d be a billionaire. But I’m risk averse and stupid.

Yup. Yield to gain money vs. Yield to lose less.