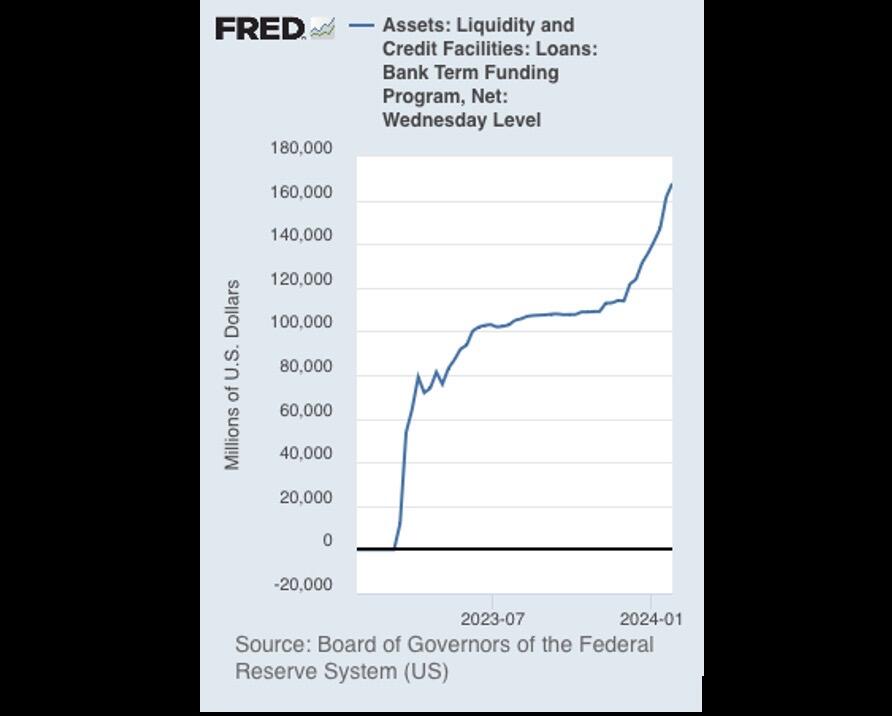

This week we got news that the Bank Term Funding Program (BTFP) will be expiring on March 11, 2024.

Last year we had two of the largest bank failures in US history (Silicon Valley Bank, First Republic Bank). In response to these failures this program was established.

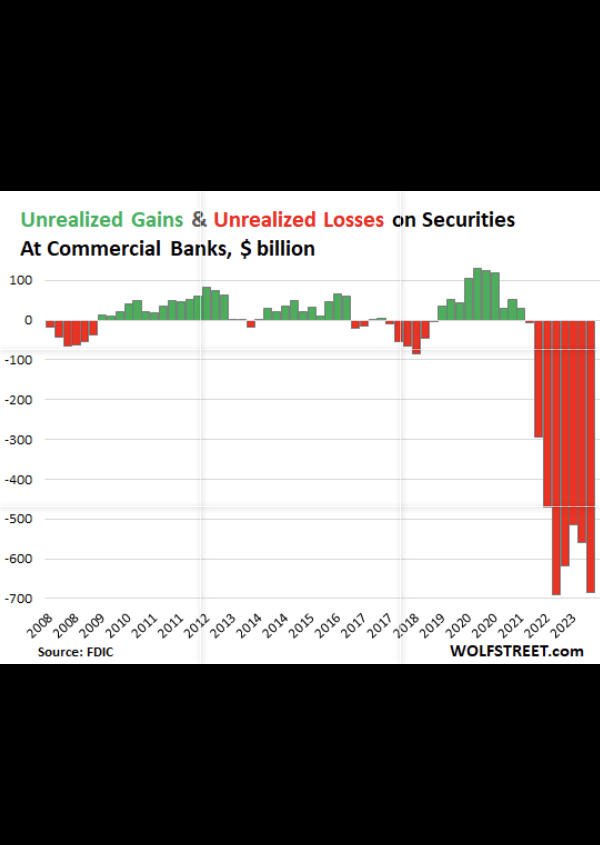

This program is essentially life support (liquidity) for the banking system, which is collectively underwater.

In the second slide the visual shows the unrealized losses of the banks (hundreds of billions).

In the first slide the visual shows the banks utilization of this program, which has skyrocketed.

If this program does end and there isn’t some other liquidity lifeline set up for the banks, I think we will see further pain for the banking system and it’s customers.

Keep your eyes peeled for a new video, where I’ll go more in depth into the expiration of the BTFP program. Subscribe to the YouTube so you don’t miss it!

#bank #failure #BTFP

I stand with you brother

What happens when nobody will sell, everyone wants to buy and you can’t increase the supply?

#supply #demand

Money is a tool for measuring the value in society. When the supply of money is constantly changing, it leads to goods and services being mispriced.

https://youtube.com/shorts/lNDaO6zKBZM?si=6L8PTjkPgZM4aHzB

#money #function #shorts

Let me know if I’m wrong here, haven’t thought too deeply about this. It seems like Grayscale fucked up. They had one of the few regulated Bitcoin derivatives on the market. By pushing for an ETF conversion they allowed a bunch of large competitors into the market. I get that ETF’s were inevitable and it’s good for Bitcoin adoption. But it seems like they had a pretty sweet deal being one of the only games in town with little competition. Agree or disagree?

#bitcoin #grayscale #etf

Money is a tool for measuring the value in society. When the supply of money is constantly changing, it leads to goods and services being mispriced.

https://youtube.com/shorts/M005RhlH96k?si=EssAiVanvO951oVg

#money #function #shorts

Be thankful for the internet, you’ve got all the information in the world right in your palm. What will you do with it?

#internet #information #decentralization

I’m about 80 pages into Jeff Booth’s book, “The Price of Tomorrow”. Very interesting book with concepts that are well explained. Check it out!

#deflation #technology

New video! Why does money trend towards one? Money is a tool and people want to use the best tool. Join me for a discussion about money and subscribe to the YouTube!

https://youtu.be/mFNwo9hNy3k?si=s2XmaZtjo8_xN8pe

#money #economics #competition #bitcoin

The problem with stocks is their over-exposure to the dollar system. Businesses save in treasuries. They keep their depreciating dollars at a bank, which saves in treasuries. Maybe they save by investing in other businesses, but what do those businesses save in… treasuries. What happens if all this paper/credit that people perceive as value becomes worthless? What value has the business retained… none.

#stocks #treasuries #risk

On this page I have expressed support for specific stocks in the cannabis industry and precious metals industry. While I do like these businesses and I’m bullish on these industries long term, I’m revising my stance on these stocks due to their exposure to dollars and debt. I have left my positions in these stocks.

Disclaimer: This is not financial advice, this content is created for entertainment purposes only.

I think that interest rates will stay high and march higher for the remaining existence of the dollar system. If they lower rates, they will lose the treasuries market and the system will collapse. We could see a temporary period of rate cuts leading up to the election (while they find a way to buy the unwanted debt in the short term), but in the coming years expect higher interest rates.

#debt #treasuries #interest

New video out now! In this video I discuss the economic impact of the recent shipping attacks in the Red Sea region. Check it out and subscribe to my YouTube! Link in bio.

https://youtu.be/1pKd7C02yxA?si=4qLrenJAiYufegZa

#Houthi #trade #economics

You don’t want money. You want higher quality time and more of it. The money is just a vehicle to get what you truly value… higher quality time.

#time #value #money

Having energy self-sufficiency is a huge advantage. Nations who heavily rely on imported energy are under the thumb of energy exporters. In times of geopolitical tension, you want to be producing energy at home.

#energy #production

Centralization is the worlds greatest problem. Centralization of power, centralization of information, centralization of resources.

#centralization

When there are bullish catalysts and the price is dropping for an asset, just enjoy the discount.

#value #price

Easy prediction: Vanguard flips stance on Bitcoin ETF’s.

PS: After they lose a bunch of customers/potential profit

#Bitcoin #ETF

I don’t like the argument, “If something works, people will continue to use it.” A VCR worked, a Nokia flip phone worked… if something works better people usually figure it out pretty quickly, especially in the Information Age.

Seems like they’re just not participating and losing customers lol, if that’s part of their game then they’re gonna lose.