When you tell a doctor you don’t take any medication and they try to tell you how lucky you are -

The scam is revealed. They don’t even know. They think it’s luck. This disqualifies them from diagnosing anything I care about.

Launching a “bitcoin-only” “trust company” is like launching a rehab that’s also a crack house. Bitcoin-only cannot live in the world of fiat- compliance trust.

Bitcoin only requires opting out of Fiat not joining it. Swan doesn’t get this and they never will it seems.

You’re really just benefiting the crack house unless the purpose is to increase customers of the rehab.

https://fountain.fm/episode/jbuPPbl1Ld8WY4WsQ0jE

Shane Gillis, Star Trek, Phish (of course), Oliver Anthony, and the fairest and most rigorous pleb breakdown of Swan’s situation you will hear anywhere

Incentives drive outcomes.

This is especially true when leaders are mediocre because their only incentive is to not be found out.

I get that it’s not needed but I feel like people can be conVinced that it is needed. More about getting gaslit.

F2Pool to Return 20 BTC Tx Fee to Owner if It's Claimed Within 3 Days

An unknown Bitcoin network entity paid 19.82 BTC (~$500k) transaction fee to send 0.074 BTC (~$200) - one of the highest fees to date when measured in fiat.

https://www.nobsbitcoin.com/f2pool-to-return-20-btc-to-sender/

My adversarial brain is wary that this will be a case for more KYC on mining pools

If we go back to 2008 and do a checklist:

Bank failures (SVB, Signature, Silvergate, Credit Suisse)

Bad returns (historical worst 1yr returns for 60/40 portfolio)

Credit rating bubble (Sovereigns, Corporates)

But now we also have the US over 100% debt/GDP and an inflation problem.

Everything the Fed did in the last 18 months just got us back to the rate levels we were at in 2008.

Buckle up.

The Normal probability distribution (bell curve) is a psy-op.

It exists because it has beautiful mathematical properties and if we can imagine such a world where we can see 99% of results in 3 standard deviations around a mean - then we have an extraordinary tool.

1) we get to assume the Law of Large Numbers without any validation. Every system and sample set should be thoroughly validated before making this assumption and even if we get there, you can’t exptrapolate out of that sample to the next observation.

The Normal distribution gives the false narrative that the Law of Large numbers can have predictive power.

2) we get to add the random variables at will and still maintain mathematical equivalence if we assume everything continues to conform to the “bell curve”

This puts the problem stated in 1 on steroids. It also gives midwits a framework to publish endless studies without a rubric for proof, providing the “knowledge system” that doesn’t know any better a basis for “data-driven” decision making. Not good.

3) The map becomes the territory and we lose all sense of “tail risk” in systems were trying to understand. When we underestimate the tail risk, we get REKT.

TLDR

Normal distribution:

1. Gives a false sense of predictive power

2. Gives midwits a framework to provide data to abuse the false predictive power

3. Systematically reduces the aperture to understand tail risk.

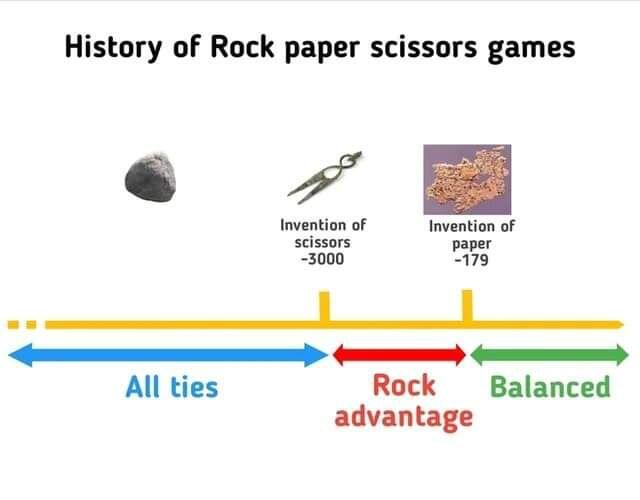

In 2023 Rock Paper Bitcoin is invented transcending all prior versions of Rock Paper Scissors.

Paper:

https://risk-fundamentals.ghost.io/rock-paper-bitcoin/

Podcast:

Monetizing influence is the Schrödinger effect from which influence is permanently altered.

The internet was an awesome place before “monetize” was ever verbified but the line was crossed and we can’t ever go back.

https://fountain.fm/episode/oP1HkfvAU5ULcj8BcElp

Phish invented a secret language - I get into it.

Bitcoiners also have secret language. Highly regarded is my favorite because it hides in plain sight.

I read this mathemativally and thought about the Galois Fields that enable Elliptic Curve Cryptography.

Most properties translate to humans.

Swan’s troubles, stemming (in my opinion) from a desire to go public and grow on Fiat capital, demonstrates yet again that institutions can never have the time preference of individuals.

https://risk-fundamentals.ghost.io/hodling-is-a-human-action/

Swan is dead to me, and Strike is on the road to recovery. Frankly, nostr:npub1xkere5pd94672h8w8r77uf4ustcazhfujkqgqzcykrdzakm4zl4qeud0en is the big winner in all of this. While others took shortcuts, they built. We were blind to this issue, and following Cory like he was some sort of God that had the power to see the future. Meanwhile, he built his house and quicksand.

I’m honestly a bit pissed at myself for being duped, again. I didn’t get hurt in any of this, but still, I looked up to these guys.

Swan will do good in the world again but they won’t recover the standing they had.

This was a banger and everyone should listen to this episode. Phish might not matter to most but they might matter to Bitcoin and you won’t hear about it anywhere else.

Most importantly, I feel a brotherhood with these guys and look forward to building the world with them.

Come on board and join us. nostr:note1u8uk7uqhkuypzt682xkltxy93h8hx00pjpt45stc5wjr4tngm6rq7j0dzw

Swan’s relationship with PrimeTrust as the lead sponsor of Pacific Bitcoin 2022 was far deeper and more meaningful than the Strikes, Folds, Coinbits, etc of the world.

They only saw dollar signs with them and never saw this coming. Now their customers freedom money is in the benevolent hands of Ripple of all places.

Swan will never recover the influential position they had - ever. Sometimes fessing up to your mistakes is just about seeing them and not making them worse.

It’s gonna be super weird at that conference this year.

Keep curating your Nostr signal. Things are gonna get even crazier in this world and people on other platforms are gonna flock here to avoid censorship.

The time is now to determine who gives you signal here.

Another central planning mindset exposed. They can all get fucked.

Last weeks Covid convo had consequences. BusinessKitten is born and BusinessCat finally capitulates to some #Phish signal

Not today. I don’t think they know what a fork is. They just think that they can control their risk outcomes. If it comes to a fork then they’ll look there.